Original author: Rui , Investor at SevenX Ventures

Compiled by Odaily Planet Daily ( @OdailyChina )

Translator: CryptoLeo ( @LeoAndCrypto )

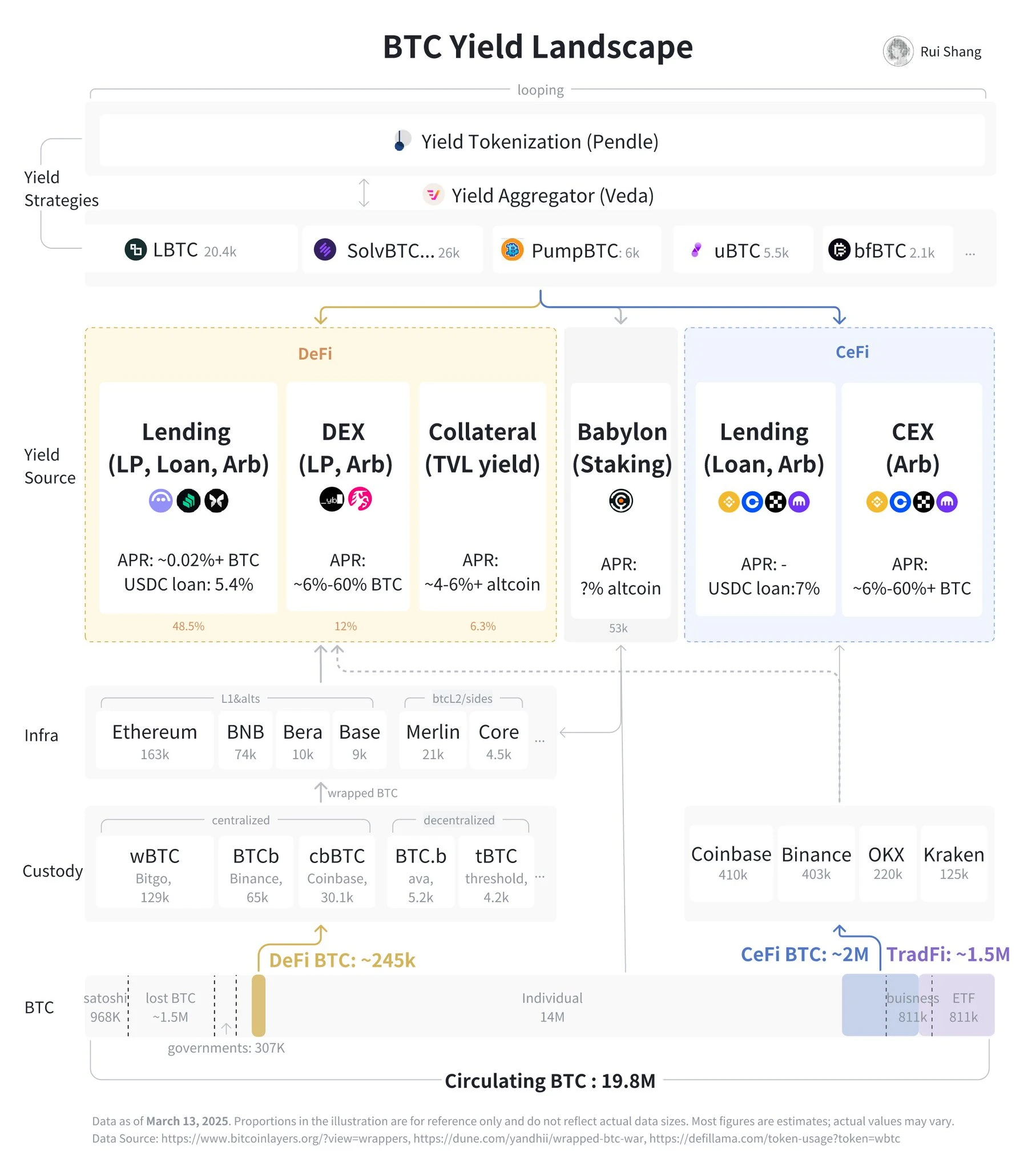

Editors note: Curve Finance founder Michael Egorov launched a new project Yield Basis in February, which raised $5 million with a token valuation of $50 million. SevenX Ventures investors wrote about the current status of BTC revenue sources and analyzed the Yield Basis protocol operation process and potential opportunities for BTC revenue layers in the future. The following is the original content, compiled by Odaily Planet Daily:

BTC APR sounds tempting, but it could be a house of cards built on layers of altcoin incentives that could collapse at any moment.

When it comes to BTC APR, people usually ask some questions: Is the return settled in BTC or altcoins? What are the risks? What is the potential loss of principal? Is this return sustainable? Will it be diluted as TVL grows?

This article focuses on sustainable BTC settlement returns in CeFi and DeFi, and is divided into three parts:

1. Original BTC income sources: quantitative trading, DEX LP, lending, staking, collateral, LST and Pendle;

2. A new place for BTC earnings: Yield Basis Protocol;

3. Outlook: Minor mistakes may lead to catastrophic failures; the scarcity of elite quantitative teams; the integration of TradFi, CeFi and DeFi and IPO opportunities.

Original BTC income source

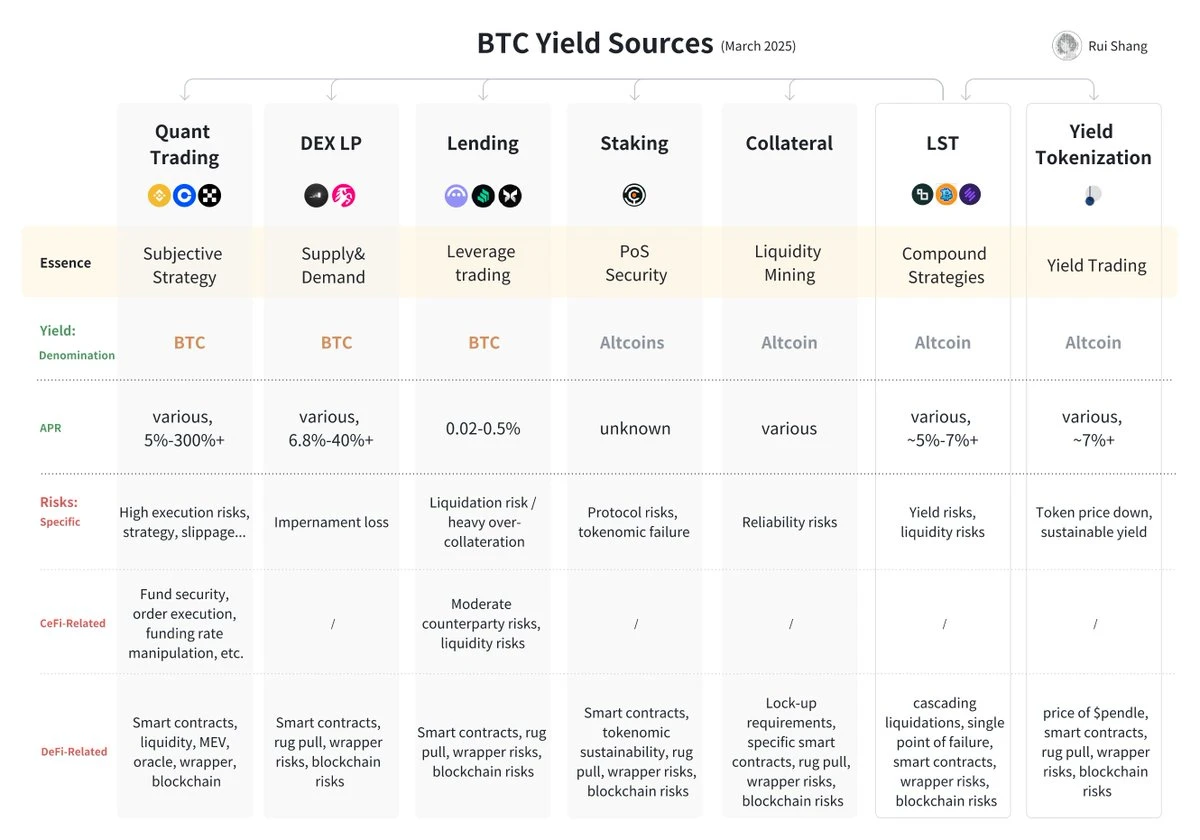

Although there are many ways to cycle and compound interest, we can divide the original income into five categories: quantitative trading, DEX LP, lending, staking and collateral. (The figure below is a comparison of income and risk)

1. Quantitative trading strategy: a zero-sum game

Ensure your Alpha strategy is net profitable. Arbitrage strategies include funding rates, spot futures basis, cross-exchange and lending arbitrage, or involve event-driven trading. Quantitative trading requires deep liquidity - currently mainly on TradFi and CeFi. In addition, TradFi to DeFi arbitrage lacks cross-domain infrastructure.

BTC yield: Varies based on asset size, risk profile, and execution. A market neutral strategy might target a 4-8% annualized rate based on Bitcoin and a stop loss of about 1%. The best performing quantitative teams even pursue 200-300%+ annualized rates and perform complex risk control at a stop loss of around 10-30%.

Risks: Highly subjective, subject to model, judgment and execution risk - even neutral strategies can fall into directional bets. Requires real-time monitoring, robust infrastructure (e.g. latency, custody and delivery protocols), loss insurance and venue risk controls.

2. DEX LP: Limited by supply and demand

In addition to arbitrage, DEXs also facilitate real trading volume. Due to limited supply and demand, only about 3% of wrapped BTC is currently in DEX. In volatile LPing pairs such as WBTC-USDC, supply is limited by impermanent loss, while demand faces wear and tear on wrapped BTC and limited utility in DeFi.

BTC yield: High volatility, Uniswap’s current annual interest rate is 6.88%, which can be as high as double digits.

Risk: Due to impermanent loss, simply holding BTC is usually better than providing liquidity. However, new LPs are often misled, which reflects a common psychological bias: fee income and APR are obvious indicators that induce LPs to maximize short-term returns and ignore less obvious long-term capital losses. DeFi risks also apply here.

3. Lending: BTC lending

BTC is mainly used as lending collateral for USD or stablecoins for revolving or leveraged trading, rather than focusing on the APR for lending BTC - as the current lending demand is low.

BTC yield: CeFi and DeFi loan rates are generally low, around 0.02%-0.5% annual interest rate. The LTV ratios of loans vary: TradFi 60-75% LTV, the current preferential rate is 2-3%, CeFi 33-50% LTV, the current USDC interest rate is 7%; DeFi LTV is 33-67%, the current USDC interest rate is 5.2%.

Risks: Liquidation risk, although low LTV ratios help reduce capital efficiency and hedging strategies can provide additional protection, there will be CeFi and DeFi risks.

4. Staking: Earn altcoin rewards

Babylon is in a unique position where staking contributes to the security of the associated PoS chain.

Altcoin Returns: Denominated in altcoins, APR unknown.

Risks: The Babylon protocol should undergo multiple security audits and disclose the expected staking returns after the system goes live. If the Babylon token issuance is unsuccessful, the sustainability of the ecosystem will be at risk.

5. Collateral: Liquidity Mining

When you provide BTC to DeFi, BTC L2 and other protocols as TVL to earn altcoins.

Altcoin yields: Varies, around 5-7%, but whales always get better rates.

Risk: Protocols vary in their reliability and verifiable track record, and each has different lock-up periods and capital requirements.

6. Liquidity Staking Tokens: Compound Returns

BTC LST is similar to Lombard, PumpBTC, Solv Protocol, BitFi, these LST protocols originated from the Babylon ecosystem, and now are cross-chain BTC with complex profit strategies. Veda is like an aggregator.

The income is mainly presented in the form of altcoins: combining Babylon staking rewards, points from different chains, Pendle, and some introduce quantitative strategies through third parties. In addition, it also provides its own tokens as incentives.

Risks: LST has low liquidity and is subject to chain liquidation risk. There are single points of failure in the minting, redemption, staking, and bridging processes. Heavy reliance on own and other peoples altcoin returns indicates that returns are highly volatile.

7. Revenue Tokenization: Revenue Trading

Pendle is the main platform for LST to earn more income, currently managing $444.17 million BTC TVL, enabling traders to obtain fixed income from their principal (such as spot alternatives), hedge against interest rate fluctuations, and obtain income liquidity, long/short income positions.

Altcoin yields: Yields may be volatile. YT holders receive base yields in LST, exchange fees, fixed yields, and PENDLE tokens.

Risks: A drop in the PENDLE token price would significantly impact participation. Pendle relies on sustainable yield volatility — tricky when a large portion of its assets rely on multiple layers of altcoin incentives (including Pendle itself).

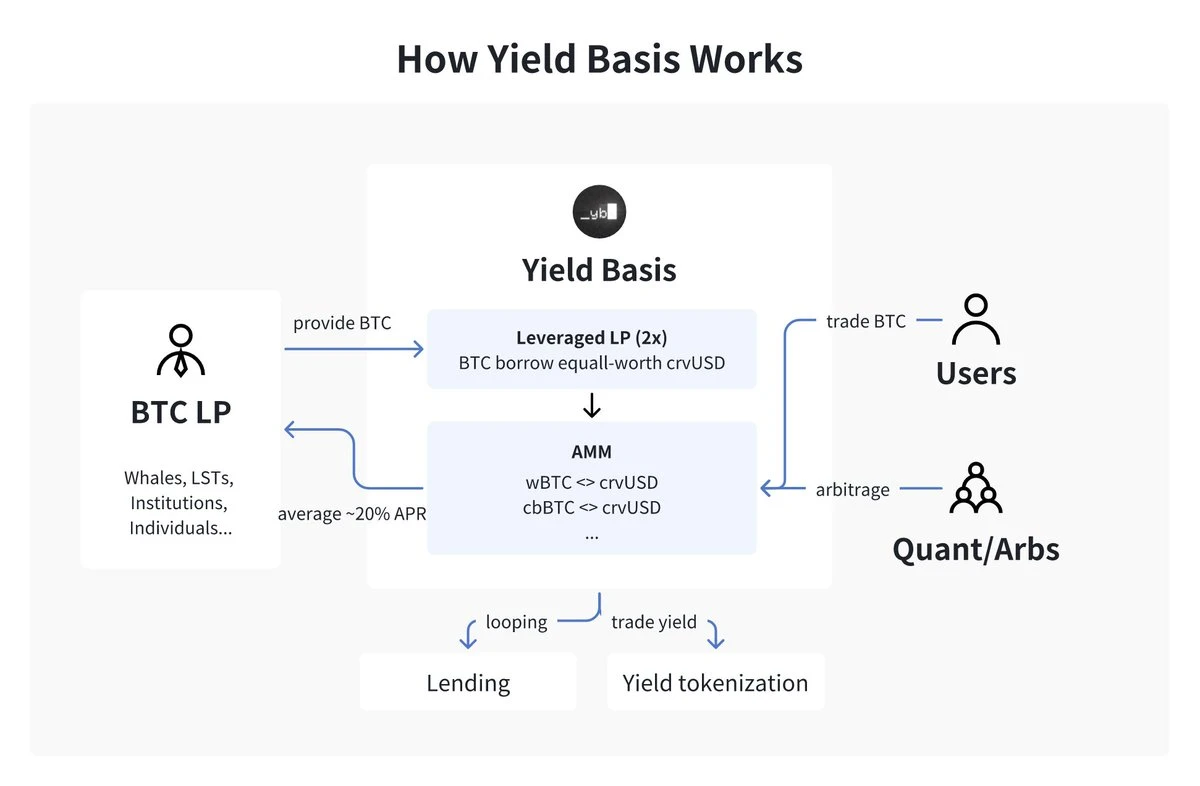

A New Place for BTC Returns: Yield Basis

(The above picture shows the Yield Basis operation process)

As mentioned above, while altcoin-denominated yields are unsustainable, true BTC-based yields are scarce and risky. Quant teams need sufficient liquidity, but DEX does not have enough.

What is Yield Basis: YB is an automated market maker (AMM) that minimizes impermanent loss and facilitates BTC LP, cross-market arbitrage, and real trading.

BTC income base layer: Based on the data simulation of the past 6 years, YB can provide an average APR (net profit) of 20%, even higher in a bull market. In addition, it can be combined with any LST that wants to gain exposure to real income based on BTC, and Pendle can cooperate with the income generated by YB.

A place for complex trading strategies : gradually build a place with sufficient liquidity to conduct meaningful quantitative trading. It also provides a profitable compounding opportunity to increase the BTC lending rate in the lending protocol. Currently, there are $3.286 billion of WBTC on Aave, with a lending rate of about 0.02%.

BTC trading venue for retail investors: YB’s long-term goal is to create the deepest on-chain liquidity for wrapped BTC and compete with CeFi transactions.

Mechanism: Solving Impermanent Loss

Mechanism: One AMM embedded in another AMM

When BTC LP deposits to YB, it creates LP by borrowing half of the LP value and constantly re-leveraging. This will create a stablecoin to BTC pool with a rebalancing model, and the borrowing rate and 50% of the pool production fee will be used to subsidize the rebalancing of the pool.

The APR is 2x the pool yield (borrow rate + re-leverage loss) , and the fixed cost is the borrow interest on crvUSD, which is controllable because the system will use it to earn more. Higher volatility will increase re-leverage losses, but will also increase pool income, so the strategy will still work unless volatility exceeds the selected maximum liquidity concentration. Parameter selection is critical: more aggressive parameters can increase yields, but at the expense of greater risk of re-leverage losses, and vice versa.

YBs way to increase APR

LPs can choose to earn pool fees or stake to earn YB tokens, and when YB tokens are attractive, more LPs choose to exit the pool, resulting in a higher APR.

Looking ahead

BTC yield generation will become increasingly sophisticated, with a focus on risk management, BTC-denominated, and institutionalized products. The winners will be those who can provide deep liquidity and fair returns without excessive risk exposure, and innovate within the regulatory framework.

Small mistakes can lead to catastrophic losses

“Nothing is unbreakable — it just hasn’t been attacked yet.” BTC faces increasingly sophisticated attacks from multiple risk levels: CEX trust delegation, self-custody phishing, smart contract vulnerabilities (permissions, logic, algorithms), and mechanism risks (liquidation, principal loss). Social engineering poses a serious threat by exploiting relationships and interfaces, and major BTC LPs even require chain pauses and bridge blocks. Although it sounds counterintuitive, public chains and highly liquid, permissionless protocols are not ideal for their security. Aquarius proposes a security framework that enables comprehensive testing, monitoring, and risk tracking.

Scarcity of elite quantitative teams

Obviously, real returns denominated in BTC are more attractive. While DEX LP is still in its infancy, quantitative trading still dominates. Some teams package their strategies into BTC products that generate returns and raise funds from external LPs. However, the ability to arbitrage at high frequencies may be limited, and top teams often keep these strategies in-house, reducing external capital - forming a kind of adverse selection. That being said, market neutral and other low-risk strategies make sense as productized BTC return products.

TradFi, CeFi and DeFi converge, with IPO opportunities

As BTC liquidity continues to deepen, we are witnessing the convergence of TradFi conservatism, CeFi accessibility, and DeFi innovation. In January 2025, Coinbase launched Morpho Labs, a loan backed by BTC. This is a signal: CeFi is implementing DeFi mechanisms for a wider audience. In the process, institutional-grade asset managers will have the opportunity to emerge and potentially go public. Companies that combine security-first infrastructure, transparent risk disclosure, and trusted governance will build strong brands, provide the recurring income that TradFi asset managers need, and serve everything from high-net-worth clients to pensions and endowments.