Weekly Editors Picks is a functional column of Odaily Planet Daily. In addition to covering a large amount of real-time information every week, Planet Daily also publishes a lot of high-quality in-depth analysis content, but they may be hidden in the information flow and hot news, and pass you by.

Therefore, every Saturday, our editorial department will select some high-quality articles that are worth spending time reading and collecting from the content published in the past 7 days, and bring new inspiration to you in the crypto world from the perspectives of data analysis, industry judgment, and opinion output.

Now, come and read with us:

Investment and Entrepreneurship

After three months of decline, on-chain data shows that a bullish rebound is imminent?

The overall liquidity is tightening and the market activity is declining. The supply of Ethereum exchanges has dropped to the lowest level in nearly 10 years. In the short term, the market sentiment is pessimistic. The lack of capital inflow and the unwinding of arbitrage transactions will continue to exert downward pressure on prices; while the stability of long-term holders and the re-accumulation of some whales may provide necessary support for the market in the future.

Is the four-year cryptocurrency cycle dead?

With the launch of cryptocurrency ETFs and inflation of altcoins in the past two years, the four-year cycle price impact law has become invalid.

The only reliable currencies today are Bitcoin and gold, and the former has clear advantages.

Michael J. Saylors strategic bet: Bitcoins premium issuance and capital manipulation

MicroStrategy essentially turns the stock market into a Bitcoin ATM through capital structure design - raising funds to increase Bitcoin holdings by issuing new shares/convertible bonds, and then using Bitcoin holdings to feed back stock price valuations, forming a capital closed loop that is deeply tied to crypto assets. With this high-premium financing mechanism unique to U.S. stocks, MicroStrategy not only dominates the Bitcoin concept stocks, but also uses equity issuance and currency price manipulation to develop a set of alchemy certified by the U.S. stock market.

While the volatility of Bitcoin prices may indeed cause some short-term pressure on MicroStrategy, given the maturity of their debt and market trends, they are not currently at risk of being liquidated or forced to sell Bitcoin. Instead, they may take advantage of the current market environment to continue to increase their Bitcoin holdings and further consolidate their position in the cryptocurrency space.

2024 Korean Cryptocurrency Individual Investor Trend Report

After the cryptocurrency market heated up in 2024, new investors entering the Korean cryptocurrency market accounted for about 33%. Among them, investors who invested for less than half a year were mainly affected by the news of Trumps election, while investors who invested for half a year to a year were mainly attracted by the approval of the Bitcoin spot ETF.

Although Korean investors are not familiar with decentralized exchanges, the investment ratio of Meme coins has exceeded half. This is largely due to the active listing of Meme coins by centralized exchanges. As of February 2025, Bithumb has listed 16 Meme coins, including DOGE, TRUMP, PENGU, etc., which is more active than Upbits 6.

About 75% of crypto asset investors in South Korea are optimistic about the price of Bitcoin in 2025, and generally expect it to exceed 150 million won (about 102,000 US dollars).

Exclusive interview with Binance founder Zhao Changpeng: Four months that changed my life

The UAEs compliant environment provides Binance with a key fulcrum for its global development.

Binance cannot become a place where big players reap profits. It is not recommended that the exchange act as a screener. We are optimistic that decentralized exchanges (DEX) will become the mainstream in the future.

It is recommended that the project party disclose the lock-up mechanism and use third-party smart contracts to enhance transparency. The industry needs to break through financial speculation and explore practical applications such as government identity authentication and DeSci.

Ethereum’s current bottleneck is insufficient innovation at the application layer, not a technical issue.

In terms of investment, we will focus on three major areas: Web3 infrastructure, AI, and DeSci (decentralized science).

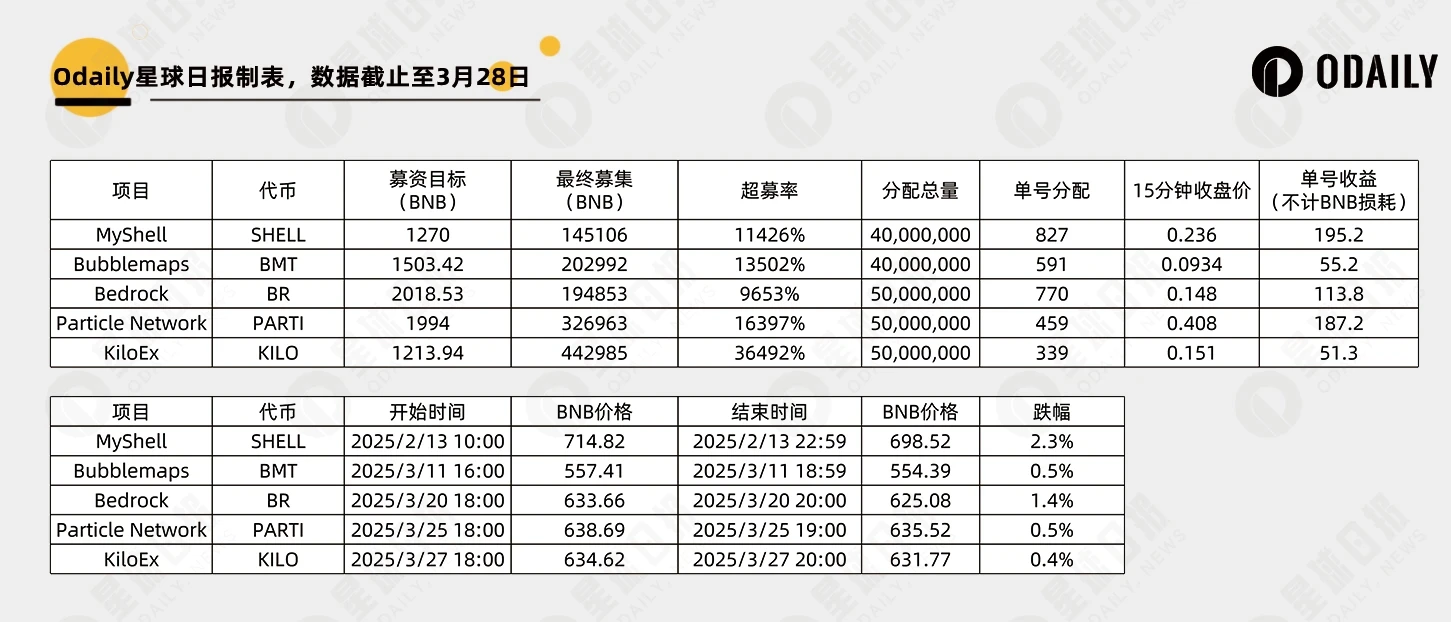

Binance has launched five exclusive TGEs through Pancake, which are characterized by short duration and high single-account yield. The single-account yields for each period are as follows:

From the beginning to the end of the IDO, the strategy of shorting BNB had a certain and clear profit margin.

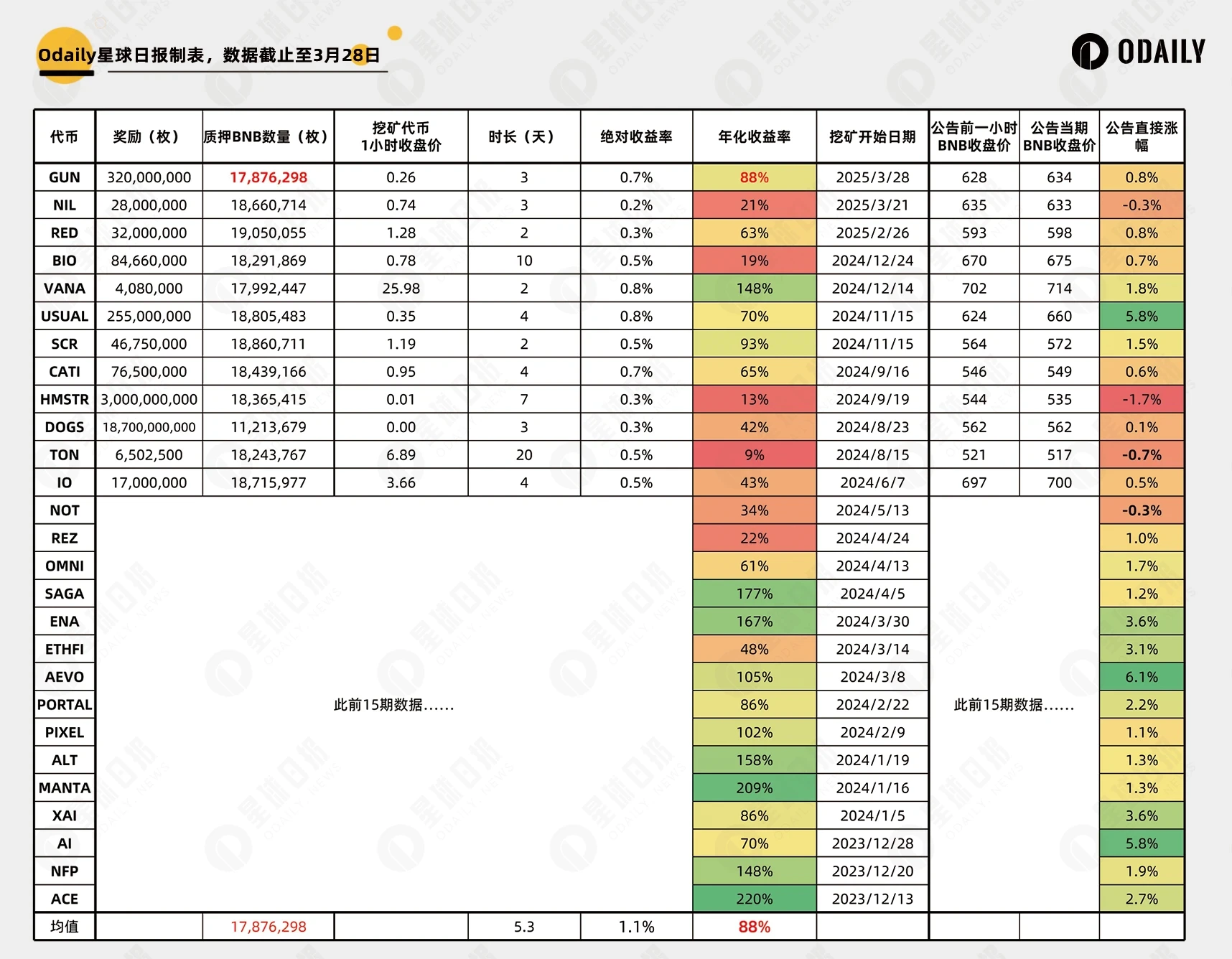

The data of Launchpool for the past 27 periods are as follows:  According to conservative estimates, the reasonable price of GUN is 0.13 USDT.

According to conservative estimates, the reasonable price of GUN is 0.13 USDT.

Airdrop Opportunities and Interaction Guide

The article introduces CAP (cUSD), Resolv (USR), Noble (USDN), and Level (lvlUSD).

Also recommended are MegaETH Interaction Guide: Is it worth it? How to participate? , This weeks featured interactive projects: Monad address collection, Voltix mining, Fluent NFT , and Airdrop Weekly Report | MoveDrop will be launched in April; Eclipse is suspected to have registered an airdrop subdomain (3.17-3.23) .

Bitcoin Ecosystem

The battle for wallets has long gone beyond the competition for market share, and is now a game about rule-making. In this game of technology, capital, and regulation, whoever can find a balance between security, compliance, and user experience will be able to control the future direction of BTC.

Multi-ecology and cross-chain

Detailed explanation of Berachain PoL mechanism: a more radical bribery model than Curve

Berachains PoL mechanism is designed to solve the incentive mismatch problem in PoS blockchains. In traditional PoS mechanisms, users need to lock assets to receive staking rewards, which leads to a distortion of the incentive mechanism - because DeFi projects built on these blockchains also require assets and liquidity, resulting in a situation where assets are directly competing with the PoS mechanism. By restructuring the incentive mechanism, PoL successfully shifted the incentive focus from asset locking to DeFi activities, while improving the security and decentralization of the network.

A fatal risk is that if the intrinsic value of BERA exceeds the income of BGT, BGT holders may line up to redeem and sell BERA. The landing of this risk depends on a game dynamic, where BGT holders need to judge whether the profit of holding BGT in exchange for income is higher than the profit of directly redeeming and selling BERA. This depends on how prosperous the Bera DeFi ecosystem can develop - the more competitive the incentive market, the higher the income of BGT delegators.

Also recommended: BNB Chain: Community Revolution and Web3 Blueprint under the Meme Wave .

DeFi

Web3 AI

Dragonfly partner Haseeb: I am confident in the future integration of encryption and AI

The impact of future AI agents on encryption includes: software engineering agents may become the murderers who destroy encryption software engineers; AI-driven wallets will completely change the encryption experience.

Currently, AI agents are facing suspension, and sovereign agents are facing big problems, unable to distinguish between people and AI in scams.

But in the future, the fusion of AI and encryption will accelerate.

With the support of crypto capital, what is the real moat of AI?

With the development of DeFi, Darwinian AI, and decentralized infrastructure, AI will not only be an assistant, but a direct participant in the on-chain economy, enabling asset holding, trading, and value creation.

Crypto AI combines programmable currency and intelligent entities to build a decentralized economic system, accelerate the arrival of the autonomous intelligent economy, and break through the limitations of Web2 AI.

Hot Topics of the Week

In the past week, in terms of policy and macro market, Ripple has agreed to give up the cross appeal against the SEC , and the SEC will retain a $50 million fine out of the $125 million; the US SEC Cryptocurrency Working Group will hold four new roundtable meetings in the next three months to discuss regulatory issues; SEC Chairman-elect Paul Atkins disclosed his assets : his net worth exceeded $327 million, and he was questioned before the hearing; the IMF included digital assets such as Bitcoin in the global economic reporting framework for the first time; Sam Altman: ChatGPTs picture function is more popular than expected , and the launch of the free version will be delayed; Ghibli style swept the crypto circle; insiders: Manus wants to seek tens of millions of dollars in financing in Silicon Valley with a valuation of $500 million;

In terms of opinions and opinions, Matrixport Investment Research: Rising global liquidity may no longer drive BTC prices up ; Trader Eugene: The bottom of strong altcoins may have appeared, but the current stage is not the time to enter the market; Canary CEO refuted the launch of altcoin ETFs as disguised advertising: early bets can gain first-mover advantage , and some applications are expected to be approved next year; Nick Tomaino: Ethereum has become the RWA-dominated ecosystem ; CZ: On-chain transactions are not as good as CEX , and futures clearing prices should retain privacy; CZ added a ReachMe chat application link to the X account profile ( introduction ); Trump posted on social media: I love $TRUMP ; CZ: The official stablecoin USD 1 launched by WLFI cannot be traded yet, beware of fake tokens with the same name;

In terms of institutions, large companies and top projects, STRF, a preferred stock, is listed on Nasdaq; Gamestop has established a strategic reserve of BTC and stated that it has not set an upper limit on its Bitcoin holdings and may sell its Bitcoin in the future ; Binance notified employees of insider trading using their old positions for profit , and the person involved has been suspended and will face legal prosecution; Binance voted to list 4 tokens including MUBARAK; Binance Wallet launched KiloEx exclusive TGE ; OKX Wallet independent App has been listed on Google Store; WLFI plans to launch USD 1 stablecoin for institutional users ( USD 1 current information introduction); Polymarket launched SOL deposit function; Dogecoin Foundation launched $1 billion DOGE reserve ; In order to make up for a loss of more than $200 million, Hyperliquids unplugging the network forced settlement has attracted criticism from many parties; Movement Co-founder responded to the recent airdrop controversy and stated that MoveDrop is coming soon ; Movement Labs has spent $5.44 million to repurchase 10 million MOVE tokens ; Lens Chain is about to be launched; Kelp DAO opens KERNEL Season 1 airdrop query , and TGE is expected in early April; Taproot Wizards starts Dutch auction, with a starting price of 0.4 2B TC; AC: The new algorithmic stablecoin can achieve an APR of over 200% when the TVL is about 10 million US dollars ( interpretation );

In terms of statistics, polls show that 57% of Argentines have lost trust in President Milley ;

In terms of security, Polymarket suffered an oracle manipulation attack , and large investors used their voting rights to confuse right and wrong; SlowMist Cosine: The theft of DEXX was confirmed to be an external attack , not theft by the insiders, and the compensation work is worthy of recognition... Well, its another week of ups and downs.

Attached is a portal to the “Weekly Editor’s Picks” series.

See you next time~