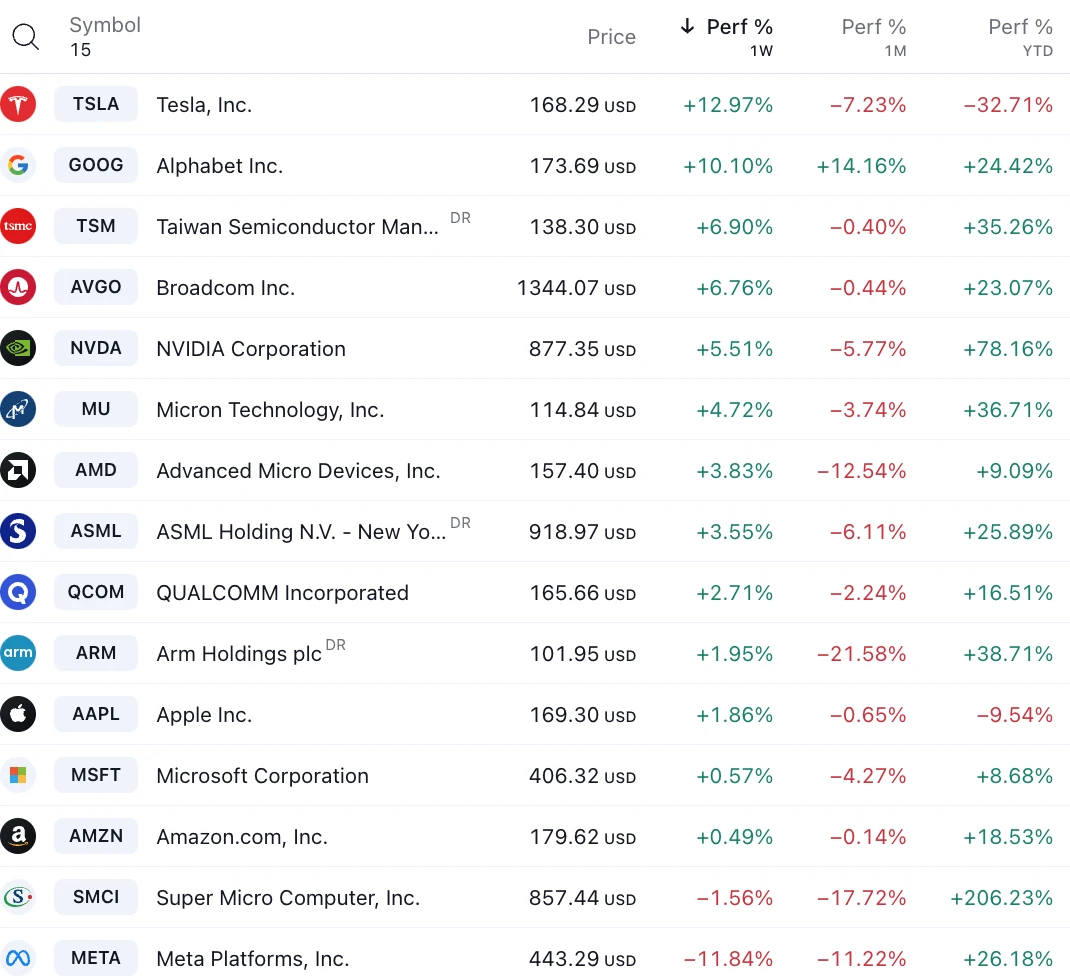

Last week, there were many economic information such as the earnings reports of large companies, GDP data and inflation indicators that the Federal Reserve pays attention to. Investors are faced with a massive influx of information and need to constantly reprice their assets. The market also showed large fluctuations, and the overall N-shaped trend ended up higher. Especially driven by technology stocks (Microsoft and Googles good earnings reports), the stock market has recovered half of the losses in April. After falling 5.4% last week, the Nasdaq 100 index rebounded 4% this week, the SP small-cap Russell 2000 rose more than 2%, and only the Dow Jones Industrial Average rose less than 1%.

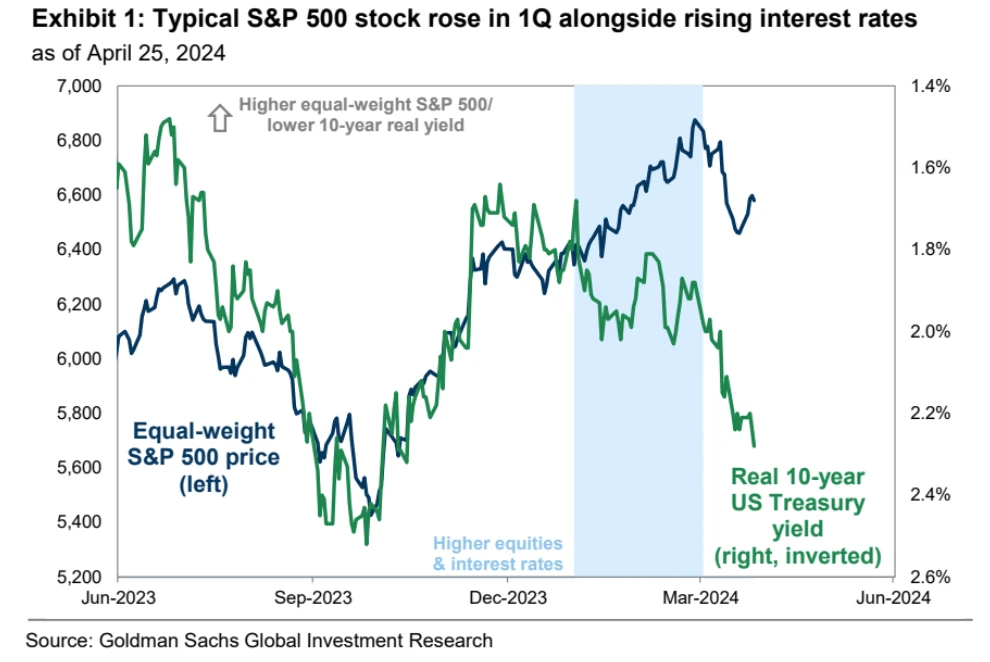

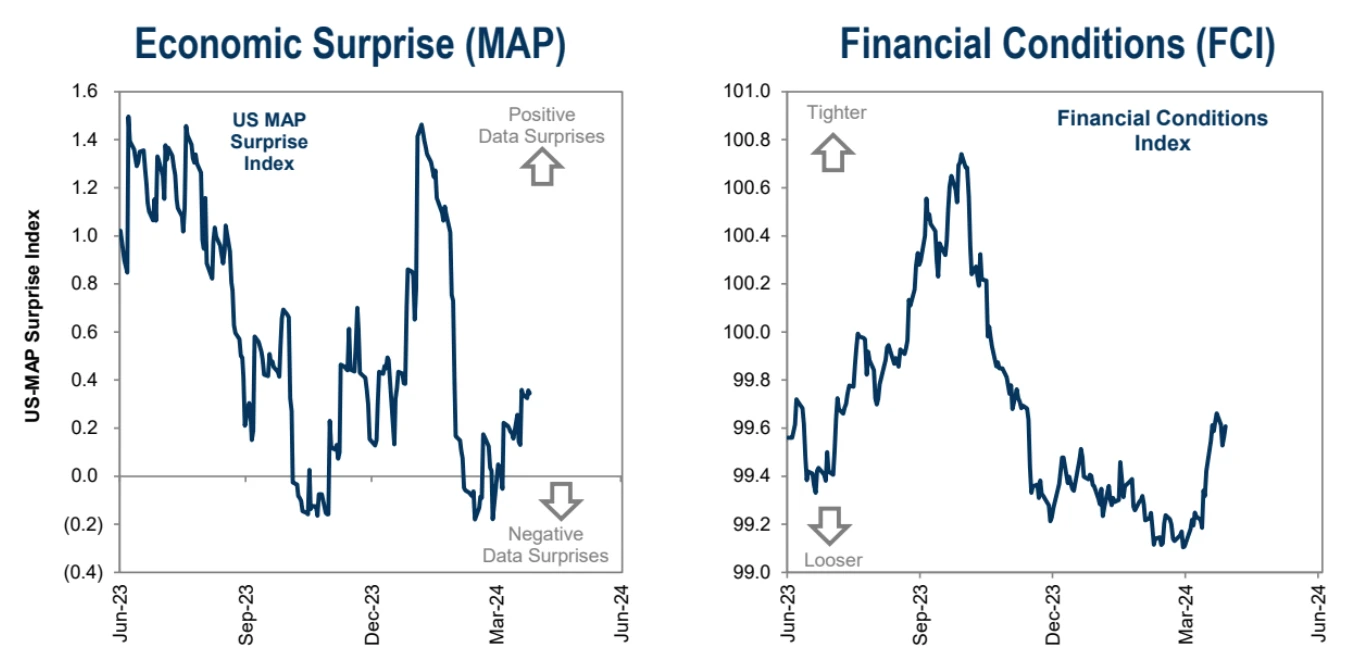

We find that the main narrative in the market has not fundamentally changed - the pace of economic growth has slowed slightly, inflationary pressures are higher, geopolitical tensions continue, and interest rates have risen slightly.

Job market data continues to be strong

The current market environment is in the process of reflation rather than recession

There is still a certain foundation for the recovery of the global manufacturing industry

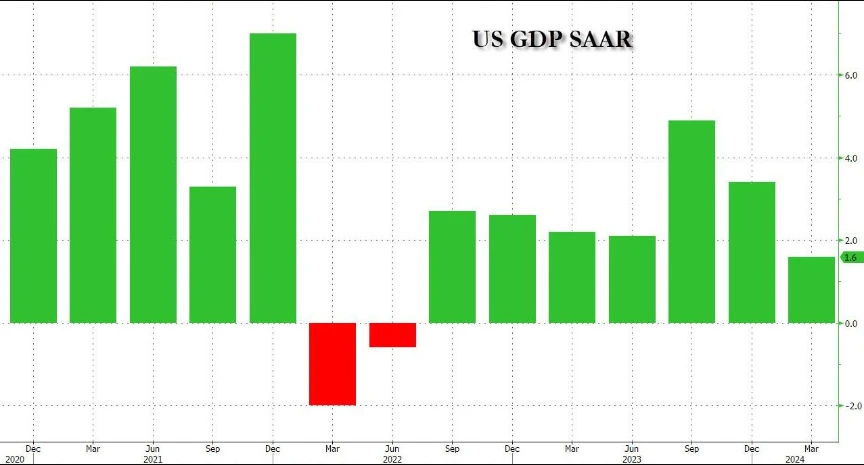

The just released GDP data showed that personal consumption expenditures were still growing at a relatively healthy rate of 2.5%.

Business spending on equipment increased for the first time in nearly a year, and residential investment grew at the fastest pace in more than three years.

Therefore, the overall environment is still favorable for risky asset investment in the medium term.

Figure: All SP sectors closed higher last week

Profits for the Big Seven are expected to grow 47% year-over-year in the first quarter, easily beating the 2% expected earnings growth for the SP 500. Three of the four companies that reported results last week saw gains (Tesla, Alphabet, Microsoft), with Alphabet standing out as it announced a dividend for the first time. But Meta, which had been a strong performer, fell as the company reported lower-than-expected revenue forecasts while targeting higher capital spending to support artificial intelligence.

Metas performance shows that investors are more concerned about the future investment and spending plans of big tech companies rather than just their current profitability. Meta announced that it would increase its AI infrastructure investment by up to $10 billion this year. Such a large expenditure scared investors and caused its stock price to plunge 15%.

Meta, Microsoft, Tesla and Google had a combined cash balance of $275 billion at the end of the first quarter. Investors would be happy if companies used their huge cash to make strategic acquisitions and get immediate returns. They dont want to see companies spending a lot of money on projects that dont know when they will be profitable. It feels like investors now have limited patience for high-valuation technology stocks and they expect quick returns.

An episode is that ByteDance insiders said that if it loses the case, the company is more inclined to shut down the entire software in the United States. On the one hand, TikTok is still losing money for ByteDance, and its revenue accounts for a small proportion, so the closure will not have much impact on the companys performance. On the other hand, the underlying algorithm in the APP is ByteDances trade secret and cannot be sold. If TikTok is eventually shut down, the biggest beneficiary will definitely be Meta, but such news did not prevent Meta from plummeting after the market, but if it happens, we are likely to see Meta jump up.

Chinese stock market becomes a hot commodity

Recently, overseas investment banks such as Morgan Stanley, UBS and Goldman Sachs have upgraded their ratings of Chinas stock market. Policymakers have hinted that the PBoC may gradually increase its active trading in the secondary market for bonds, which may have enhanced market liquidity and boosted investor sentiment.

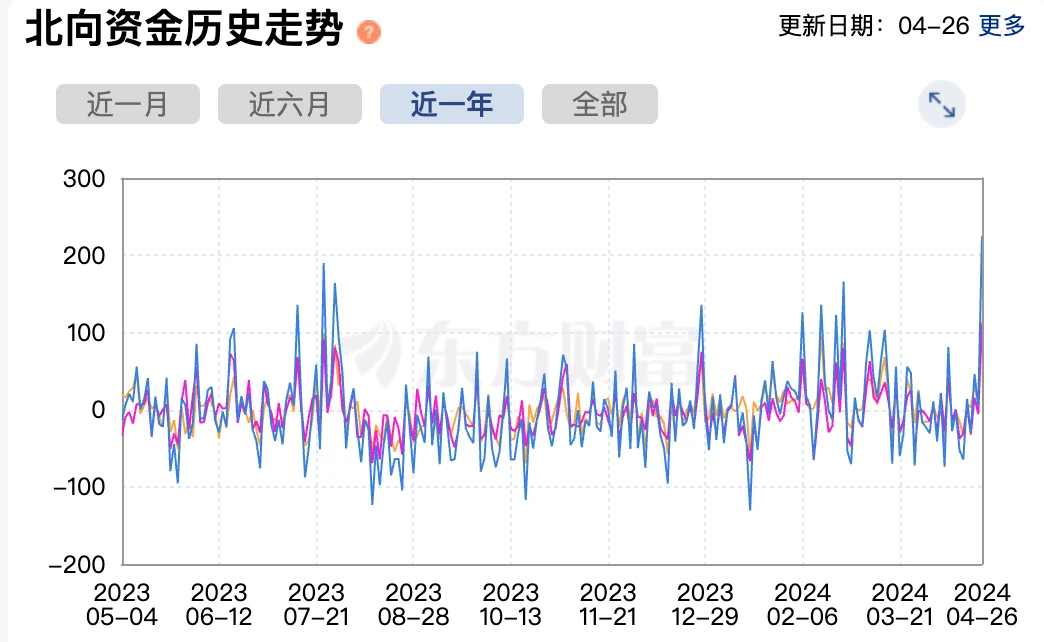

Last week, net northbound capital inflows hit a record high, with the CSI 300 index rising 1.2%, the MXCN (MSCI China Concept Stock Index) and the Hang Seng Index rising 8.0% and 8.8% respectively, the best weekly returns since December 2022, led by the technology sector (+13.4%). Analysts believe that the current low valuation of the A-share market is gradually becoming attractive. With the continued implementation of domestic economic growth policies, the numerator-side profit level and the denominator-side liquidity factors that affect the pricing of the A-share market are expected to be marginally improved, and the momentum of net foreign capital inflows may further increase.

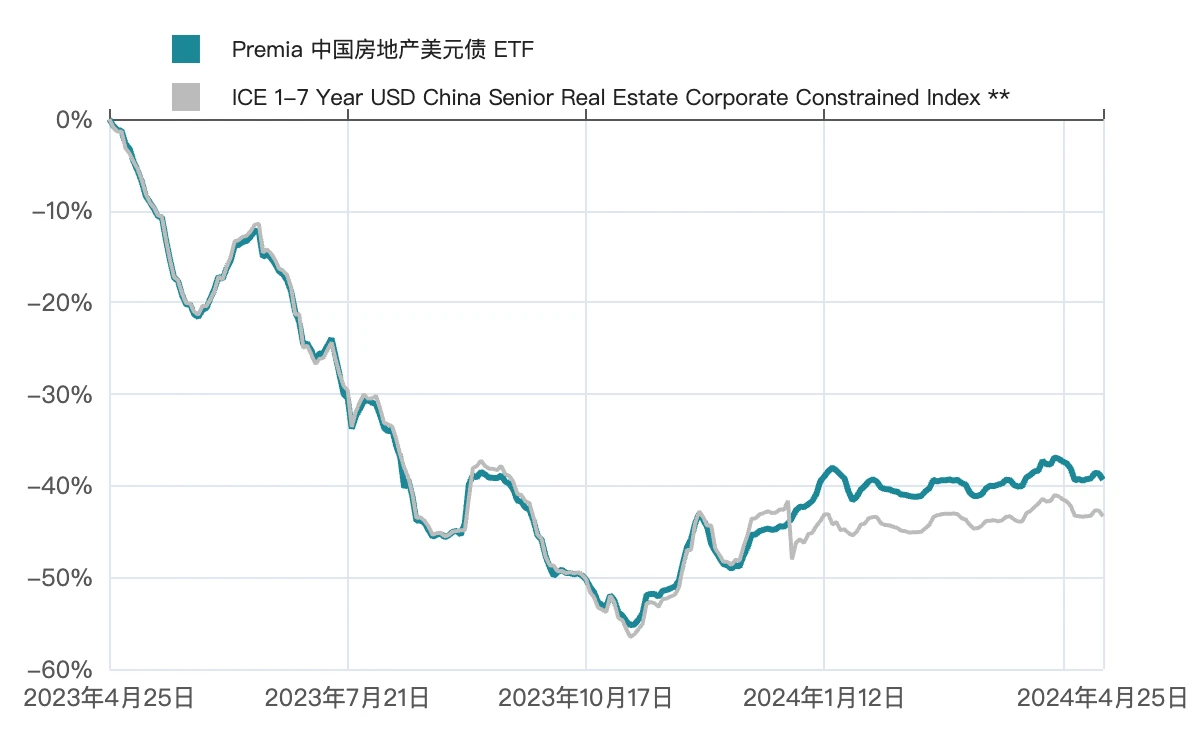

Another positive sign is the real estate market, such as the hot sales of luxury homes in Shanghai, which has driven up the new home price index. The Shenzhen property market has also shown signs of recovery, with a significant increase in the number of second-hand home transactions. John Lam, an analyst who was the first to give a sell rating to China Evergrande in early 2021, said that after the adjustment, Chinas real estate industry is preparing to recover slowly, and it is expected that Chinas real estate industry sales and prices will not rise this year, but the decline will ease. He believes that domestic residential sales by area may fall by 7% this year, lower than the record 27% drop in 2022. The start rate of new homes may fall by 7%, narrowing from the 39% drop in 2022. Once housing prices stabilize, pent-up demand will return, as the falling cycle of real estate prices in the past three years has caused people to postpone purchases.

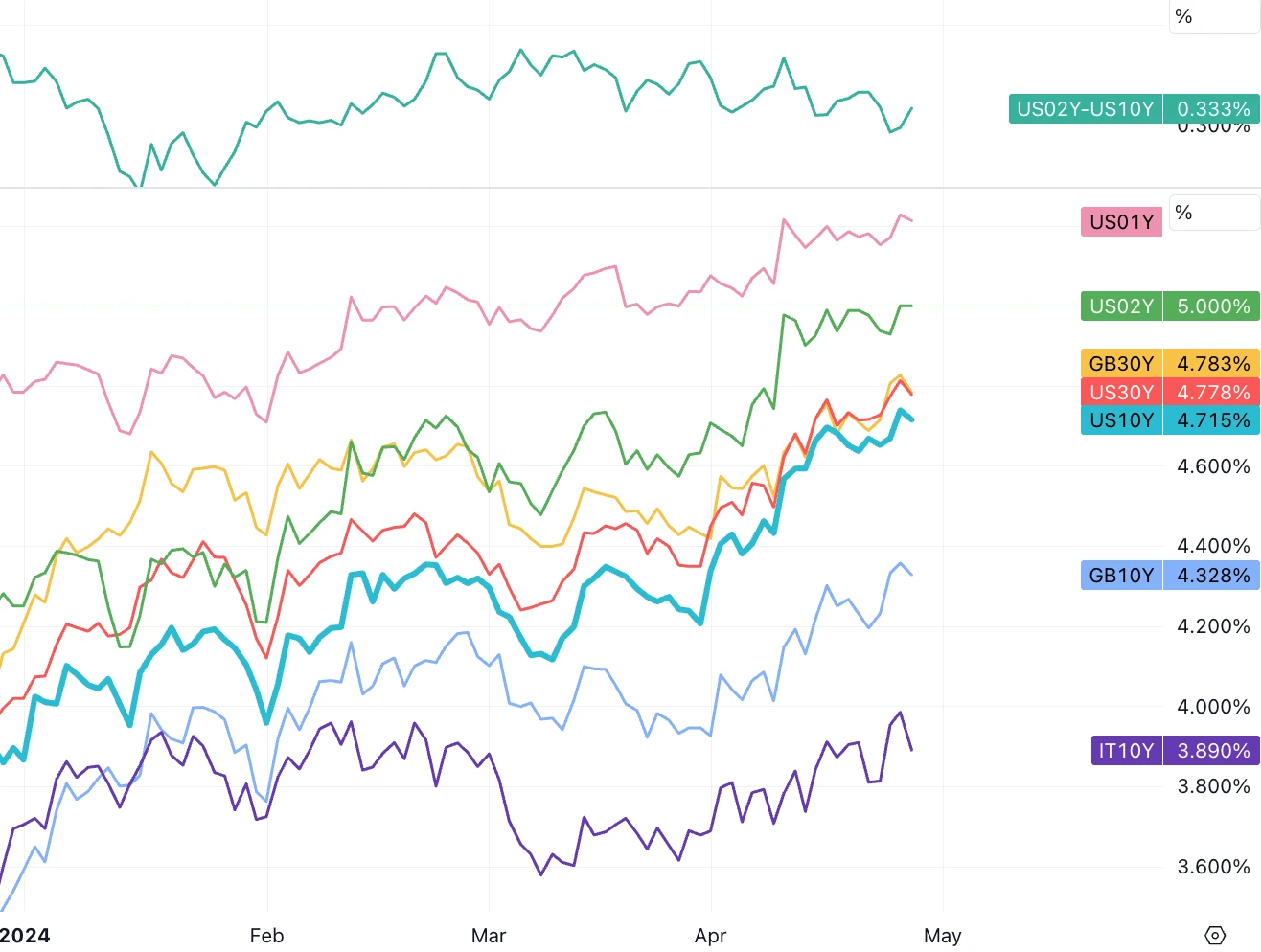

In terms of interest rates, the 10-year Treasury bond rate closed at 4.66% last week, gradually approaching 5%, and the 2-year Treasury bond rate closed at 5%. This week, the market absorbed a total of $183 billion in new Treasury bonds. The demand for 2-year Treasury bonds was strong, and the 5-year and 7-year Treasury bonds were not bad either.

High interest rates are usually not conducive to strong stock markets:

Oil rebounded last week, up 1.92%. WTI crude closed at $83.64, and the dollar was basically flat, with DXY closing at 106.09. Gold fell 2% to $2,337 as concerns about escalating conflict in the Middle East receded. The industrial metals index fell slightly by 1.2%.

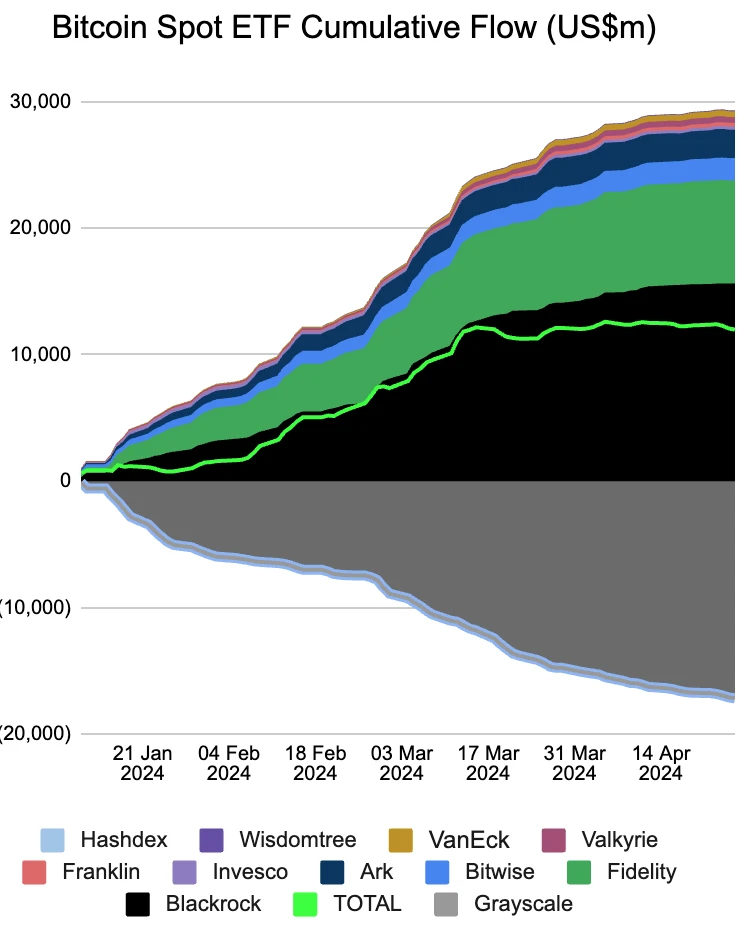

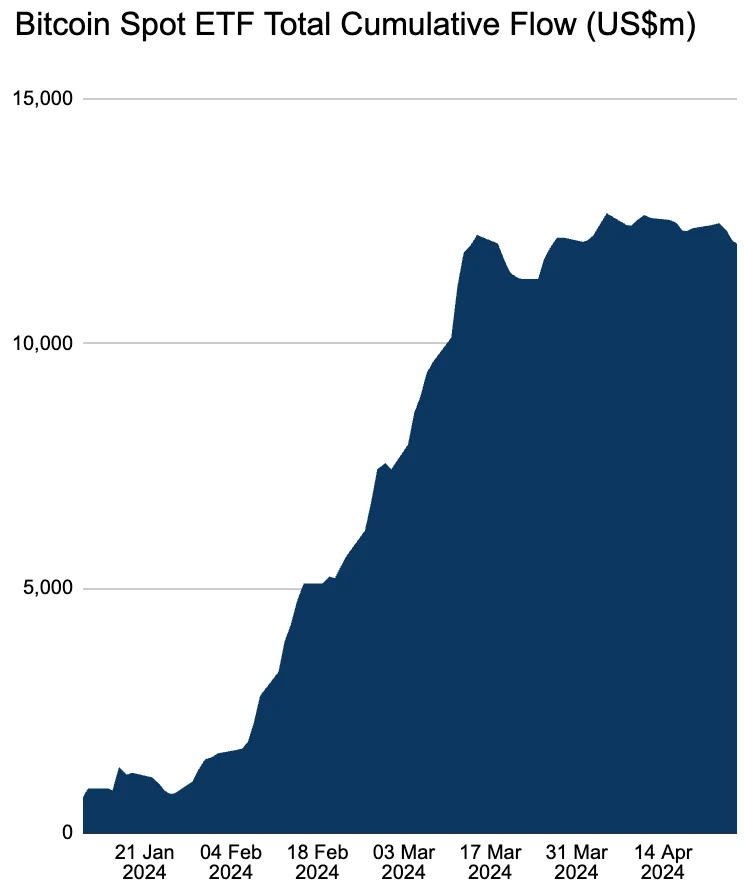

Cryptocurrency lacks new catalysts

Due to the lack of new catalysts, the favorable macro market sentiment rebound failed to drive cryptocurrencies. BTC spot ETF experienced net outflows for the third consecutive week (-328 million), and IBIT had zero inflows for three consecutive trading days, the first time since its launch.

After the conflict between Iran and Israel improved and Bitcoin was successfully halved, the crypto market rebounded, and BTC once rose to more than $67,000. With the first ETH spot ETF in Hong Kong about to be listed on Tuesday, ETH rose by 7% over the weekend. In addition, Ethereum development company Consensys filed a lawsuit against the SEC on the grounds of regulatory overreach in order to counter the Wells notice received on April 10 (indicating that the SEC is working to file a case). Since it is not uncommon for crypto companies to sue regulators and win, this also hedges the regulatory pressure for Ethereum.

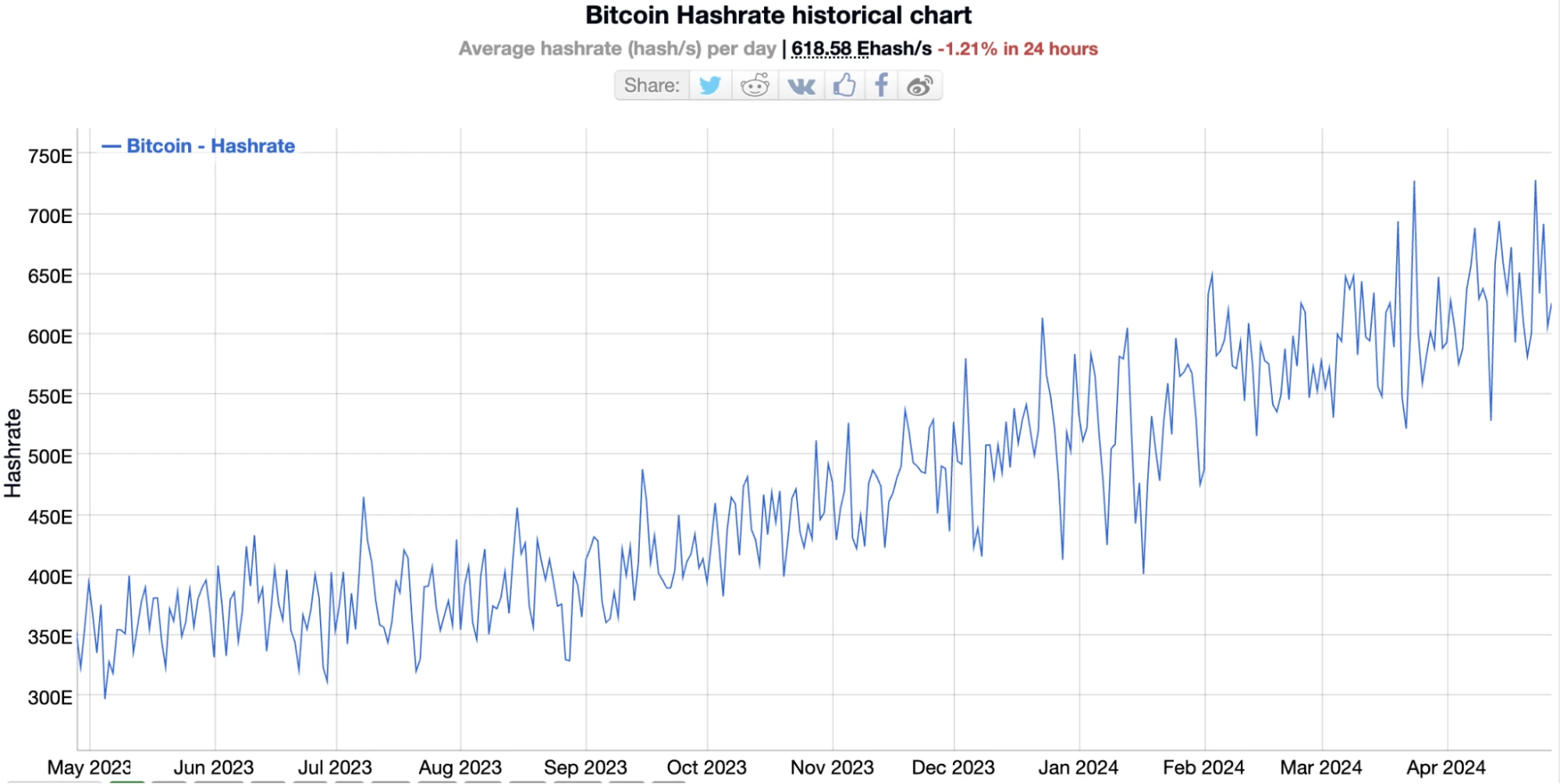

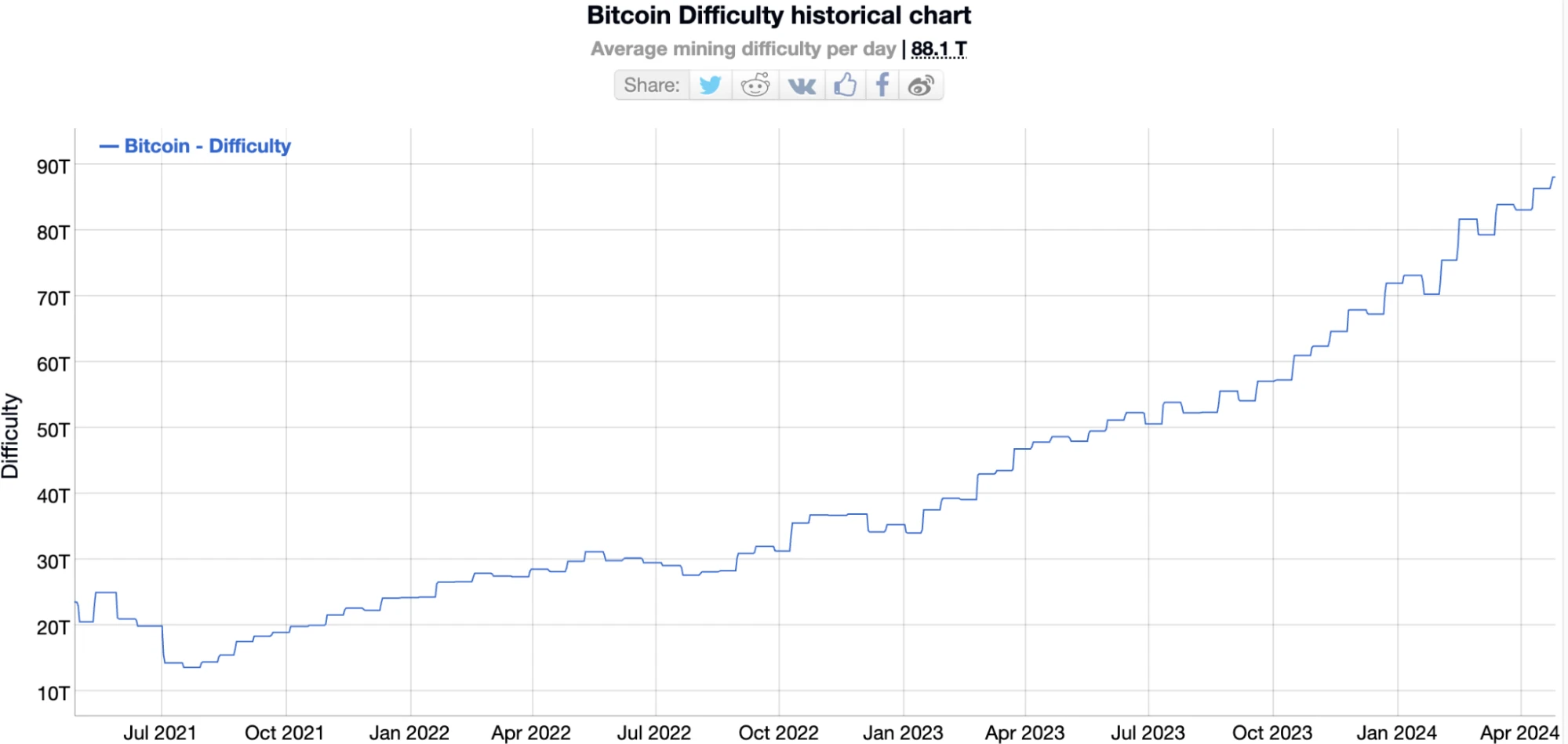

After the version reduction, the BTC network computing power remained high and did not drop significantly. Instead, the mining difficulty increased:

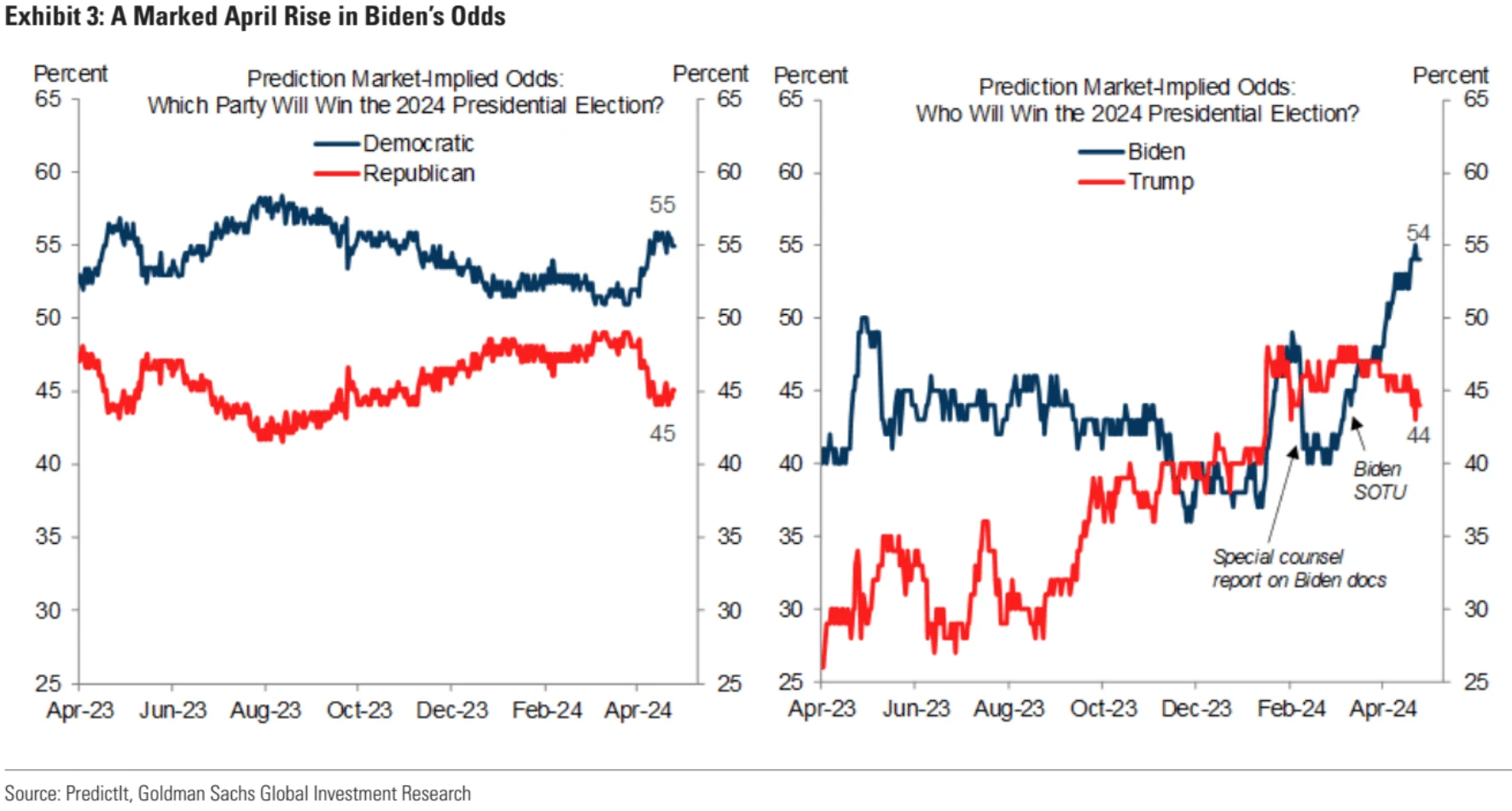

Trump is more closely tied to loose monetary policy

Politically, the Wall Street Journal published a blockbuster article about the Trump teams conspiracy to manipulate the Federal Reserve after taking office. Their proposed plan includes negotiating interest rate policy with the president and having the Treasury Department review the Federal Reserves regulatory measures. Trump hopes that the Federal Reserve Chairman can communicate with him and promote monetary policy that is in line with his wishes. Despite concerns, there are obstacles to Trumps influence on the Federal Reserve in practice, such as the lack of vacancies in the FOMC and the markets confidence in the independence of the Federal Reserve. These discussions and plans are only worth further consideration after Trump is re-elected, but they can strengthen the markets confidence that Trumps increased probability of winning = looser monetary policy and higher long-term inflation.

Signs of stagflation

The US real GDP grew 1.6% quarter-on-quarter on an annualized basis in the first quarter, far below the market expectation of 2.5% and a sharp slowdown from the 3.4% in the fourth quarter of last year. However, the GDP weighted price index in the first quarter was 3.1%, higher than the expected 3.0% and almost twice the 1.6% in the fourth quarter.

The annualized quarter-on-quarter growth of personal consumption expenditures (PCE) was 2.5%, a significant slowdown from the previous value of 3.3%, and also lower than the expected 3%; the core PCE price index excluding food and energy increased by 3.7% quarter-on-quarter, exceeding the expected 3.4%, almost twice the previous value of 2%, and the first quarterly growth in a year. It shows that core inflation is still stubborn.

Signs of stagflation were at the heart of Thursdays market plunge.

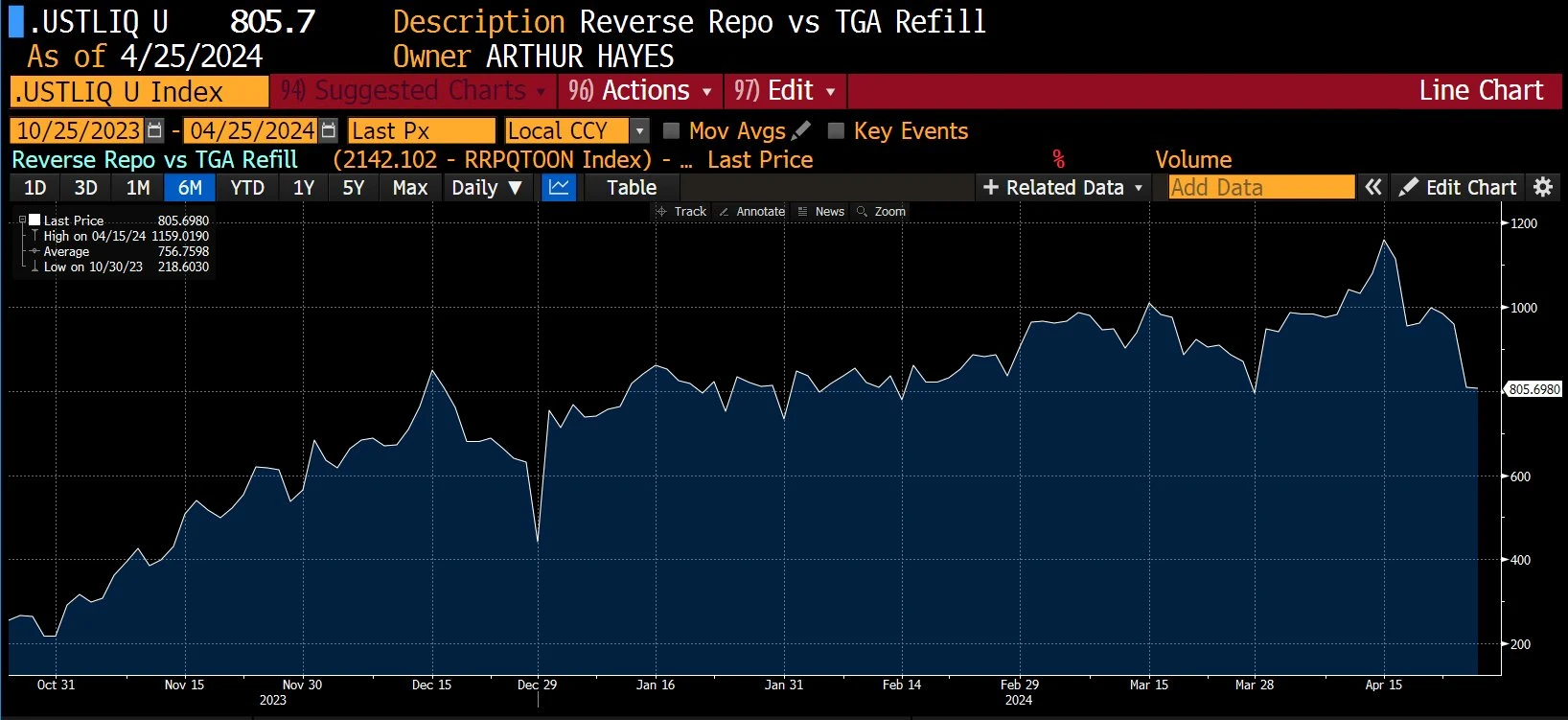

Modest debt issuance may bring optimism

The current cash level of the U.S. Treasury is far higher than the upper limit of previous forecasts. As of yesterday, the Treasury had about $955 billion in cash in its general account, $205 billion more than expected. The cash level of the Treasury increased significantly mainly due to the unexpected high income from capital gains tax on April 15.

In the context of having enough food in hand, the Ministry of Finance has no urgent need to issue short-term bills, causing the RRP balance to drop to near 0. In other words, the systemic liquidity in the United States will not drop to a level that causes market panic in the short term.

The Treasury Department has been increasing its pace of debt issuance over the past year, but that momentum now appears to be on hold. The federal budget deficit is narrower in fiscal 2024 than in fiscal 2023, largely due to strong revenue growth and roughly flat spending.

Therefore, lower debt issuance expectations will be a general positive for risky assets in the market.

With less than seven months until the 2024 U.S. presidential election, U.S. fiscal policy could change significantly. Sooner or later, the Treasury may need to increase the size of its auctions again to meet future deficit needs, and markets may need to adjust.

Small bank that is easy to confuse

After the market closed on Friday, the media reported that Republic First Bank was taken over by the FDIC. However, a closer look at the FDIC data shows that Republic First had about $6 billion in assets and $4 billion in deposits in January. This bank is very small, and it is not comparable to the $200 billion in assets of Silicon Valley Bank, $110 billion in Signature Bank, and $230 billion in First Republic Bank (similar in name) that went bankrupt last year. In addition, it was delisted by the exchange last year. Therefore, it did not cause the market to explode digital currencies like last year.

Cash flow

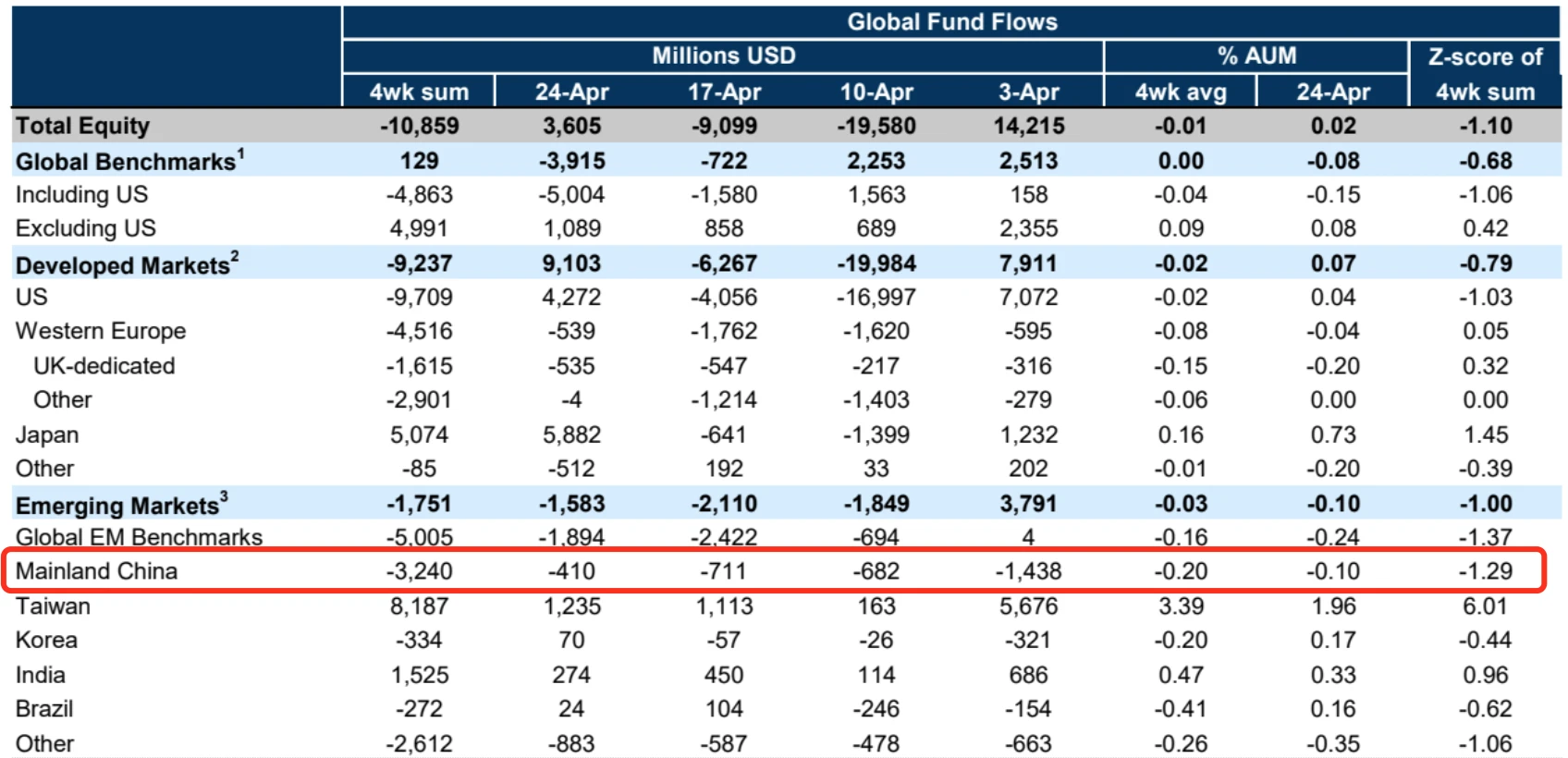

EPFR-based China-focused funds have seen outflows for seven consecutive weeks, in contrast to the record inflows of northbound funds.

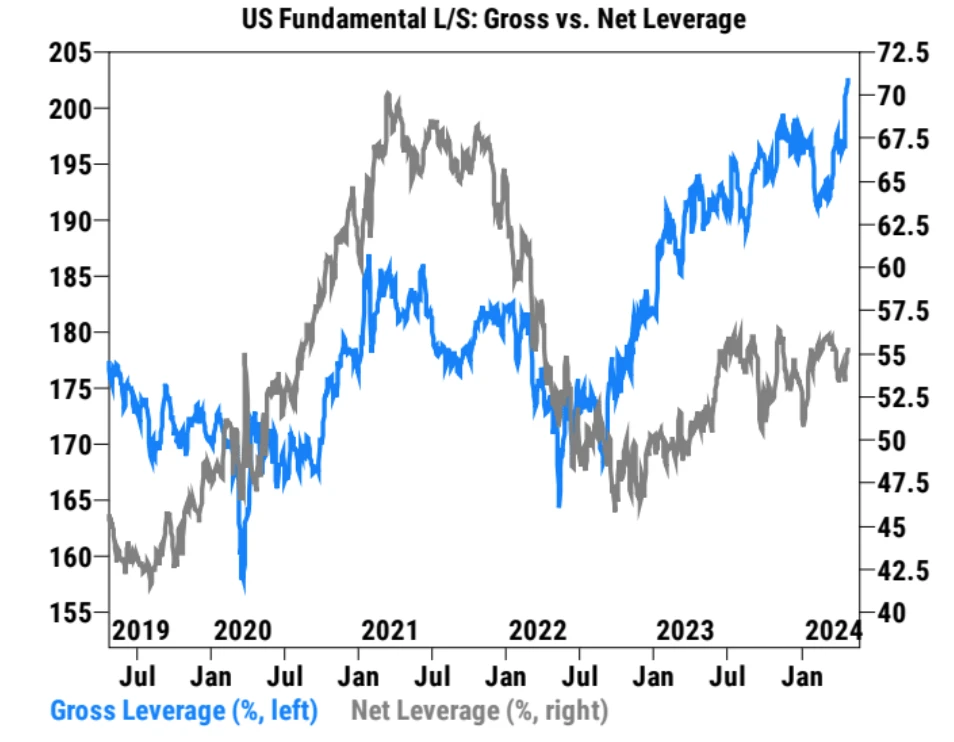

The net exposure of Goldman Sachs fundamental long-short strategy fund rose to 55%, at the 97th percentile in the past year, and the total leverage ratio hit a five-year high.

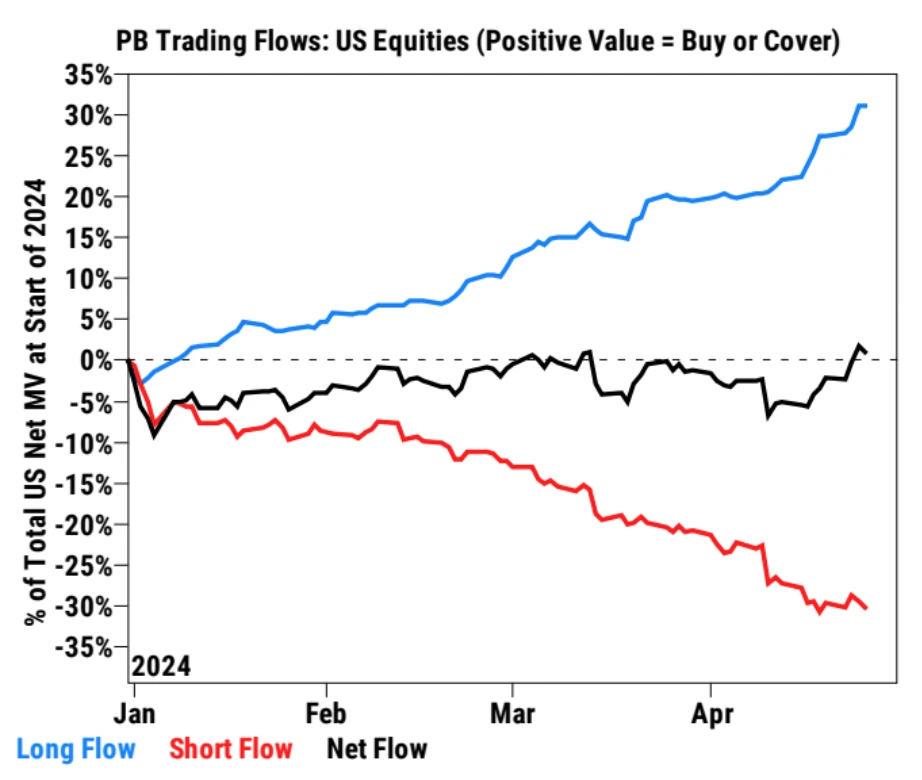

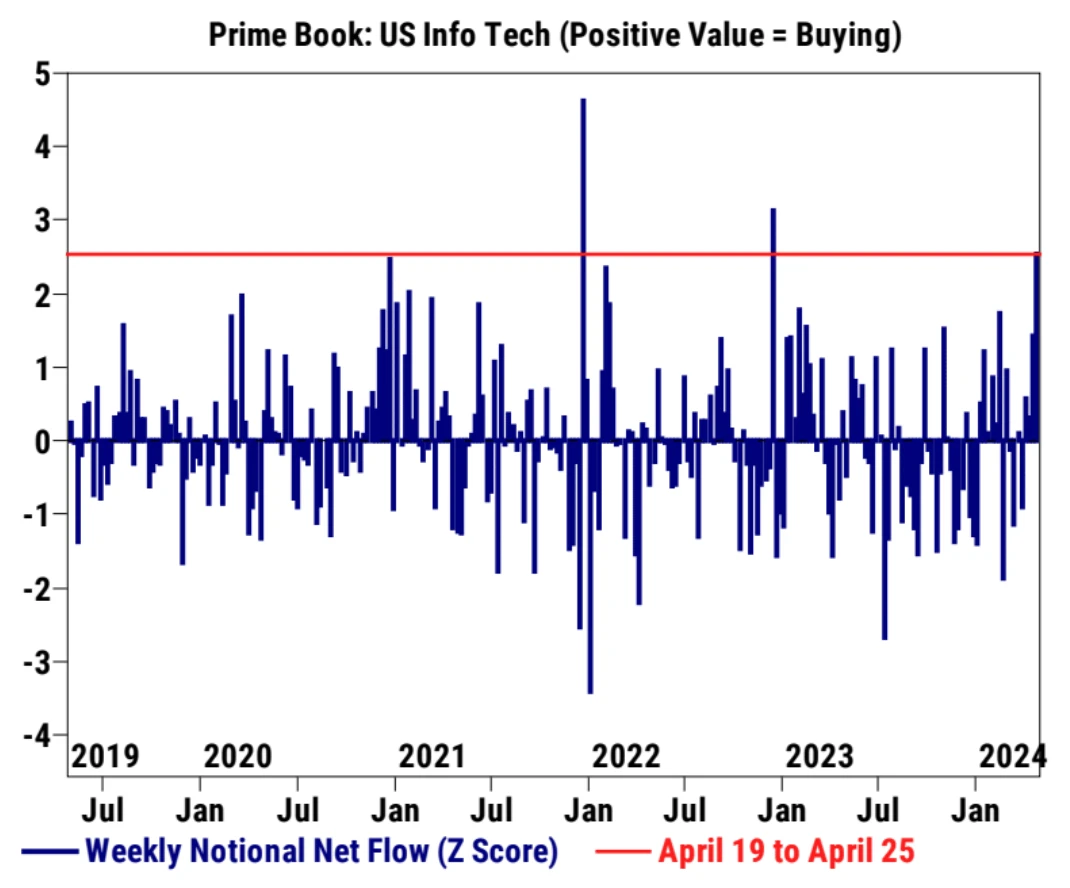

Hedge funds bought U.S. stocks for the second week in a row, the fastest in five months, driven by long buying and short covering (ratio 7 to 1). They were mainly concentrated in the information technology and health care sectors, while consumer goods, energy, etc. were sold.

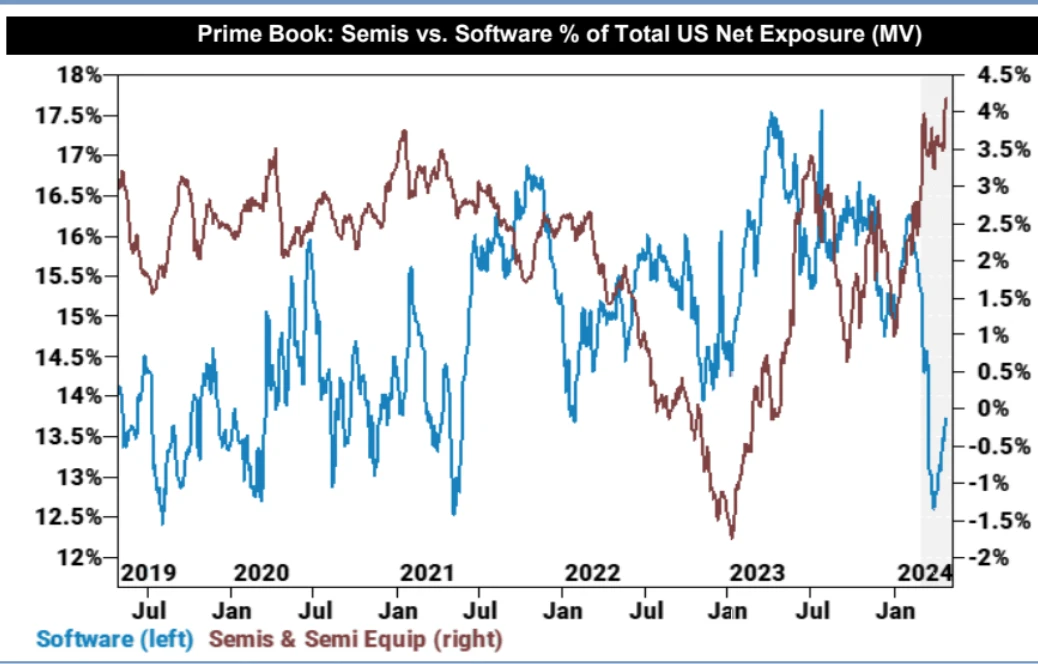

Fund allocation to semiconductor stocks reached a five-year high.

Goldman Sachs strategists believe that rising inflation and policy risks may put pressure on the stock market in the short term. After the interest rate market adjustment is over and inflation data improves, it may be a good time to increase stock longs. High-quality and non-US stocks may perform better. (As risks in the US stock market accumulate, some funds begin to allocate high-quality stocks with lower valuations and more stable performance, as well as non-US markets with improved fundamentals, to balance portfolio risks. These markets may be in or enter an easing cycle earlier than the United States.)

Institutional Views

JPMorgan Chase: TSMCs technological breakthrough is the key engine of the AI era

JPMorgan Chase rated TSMC as overweight with a target price of NT$900. The report emphasized TSMCs leading position in technological innovation and advanced packaging, as well as its key role in the AI era. Through a series of technological breakthroughs, including the launch of the newly announced A16 process node, the debut of advanced packaging technology SoW, and further innovation in silicon photonics technology. TSMC is expected to continue to maintain its leading position in the semiconductor industry in the coming years.

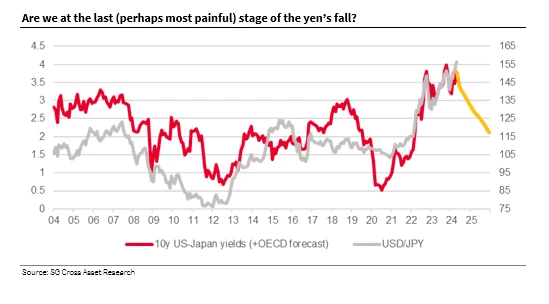

Societe Generale: The yen may see a final, sharp decline before it hits bottom

Kit Juckes, FX Strategist at Societe Generale: The decline in the yen has become disorderly, which suggests that there may be one last sharp decline before the bottom is found. Currently, US yields are rising, while Japanese yields are still supported by very low short-term interest rates. These low short-term interest rates provide positive returns for short yen trades, keeping the leverage trading community optimistic in the past few months. However, the yield gap between USD/JPY will narrow significantly in the next few quarters. If the purchasing power parity of USD/JPY is now in the mid-90s, the fair value is still about 110 even after adjusting for US exceptionalism and Japanization.

Supplement: Most institutions believe that the central bank will release hawkish signals by adjusting bond purchases to support the yen. As a result, the Bank of Japans decision last week only said that it would maintain the scale in March, and did not say anything about reducing bond purchases. The BOJ seems to have given up on the exchange rate. Such a dovish move will cause the yen to fall further, and in fact it has directly fallen below the 158 mark.

This week’s focus

In the coming days, investors will turn their attention to the results of other members of the Mag 7. Amazon is scheduled to report earnings next Tuesday, Apple will report on Thursday, and Nvidia will report on May 22.

The U.S. Treasury will announce its Treasury issuance plan for the next quarter on Monday and Wednesday. After increasing the scale of financing for three consecutive quarters, the market is closely watching this quarters financing, repurchase plan, and Treasury Secretary Yellens further explanation of the long-term financing strategy.

However, a series of interesting data may suggest that the U.S. Treasury may unexpectedly lower its financing expectations - which would lead to a squeeze on bond market shorts.

In addition, attention will also be paid to the Fed’s policy decision on Wednesday and Chairman Powell’s press conference to assess the possibility of a rate cut in the short term. The market expects that the FOMC’s post-meeting statement will not change much and there will be no new dot plot release.

Chairman Powell is not expected to change the current monetary policy stance in the near term. He is likely to reiterate recent comments that recent data has not strengthened his confidence that inflation will fall back. Considering that the latest Fed Funds futures implied rate shows only 1.3 rate cuts/34 bps expected for the whole year, which is very extreme, if Powell does not give a significantly more hawkish speech, there is more room for yields to fall than to rise.

In addition, it is necessary to pay attention to whether the Federal Reserve will issue a statement on slowing down the balance sheet reduction to warm up the taper QT, while preparing for a possible sudden tightening of money market liquidity and slowing down the recent rapid upward rate of US Treasury bond yields. If clear measures can be introduced, the market is likely to rise sharply.