Original author: Alfred

1. Fundamental Development

Since we refocused on Livepeer in 2023, it has gradually moved from a decentralized video streaming network to a leader in the decentralized AI video track. The price of its token LPT has risen from around US$7 when the research report was released to more than US$21. For previous reports, please refer to LD Capital: [*Premium] Livepeer (LPT) market starts again, can it break through the previous high?: https://ld-capital.medium.com/ld-capital-premium-livepeer-lpt-%E8%A1%8C%E6%83%85%E5%86%8D%E6%AC%A1%E5%90%AF%E5%8A%A8-%E8%83%BD%E5%90%A6%E7%AA%81%E7%A0%B4%E5%89%8D%E9%AB%98-6d968158bd2a.

After OpenAI released Sora on February 16, 2024, Livepeer announced that the community will work to bring these features to the Livepeer network in the coming months as part of the AI video initiative, officially starting the new narrative of AI video.

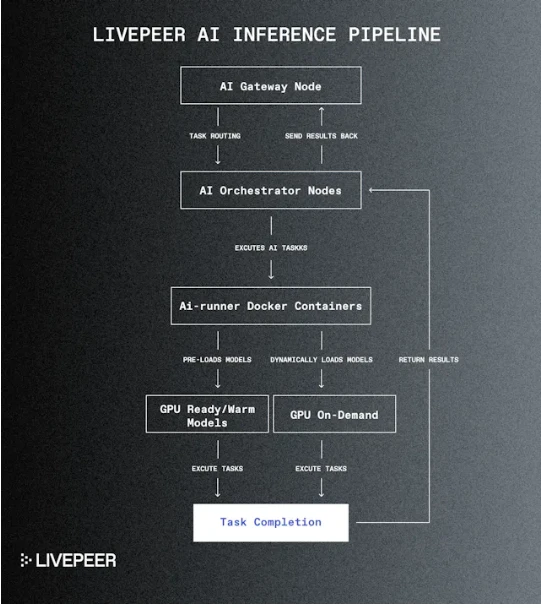

On May 21, Livepeer released an announcement about the launch of the AI subnet, marking the gradual implementation of its decentralized AI video plan. The AI subnet is a forked branch of the Livepeer video infrastructure network, providing a sandbox for the secure development and testing of new decentralized AI media processing markets and tools. The architecture of the AI subnet is designed to organize different AI reasoning tasks into discrete job types, and send, receive, and return job requests for different types of tasks through specific pipelines. The subnet also allows Livepeer Orchestrator node operators to earn ETH and LPT income by deploying GPU resources for AI processing tasks. The launch of the AI subnet is expected to make Livepeer the worlds first decentralized video processing network with AI computing capabilities. Livepeers open network of thousands of GPUs will be used to provide low-cost, high-performance processing to solve the structural problems of centralized AI computing.

The Livepeer AI roadmap is divided into three development phases:

Phase 1: AI Subnet Design and Stabilization (Completed)

The first phase of the subnet proof-of-concept design and initial onboarding of existing Livepeer Orchestrator node operators concluded on May 1, with over 20 high-performance AI Orchestrator nodes already active.

Phase 2: AI Subnet Optimization (in progress)

This phase focuses on improving the quality of service provided to AI Orchestrator and AI Gateway node operators. The goal is to enhance network provisioning by expanding the range of compatible GPUs (low VRAM GPUs and server GPUs), reducing container loading time, and handling edge cases. Work in this phase also includes working with select design partners through the new AI Video Startup Program to improve the onboarding experience for application developers.

Phase 3: Livepeer Mainnet and AI Network Expansion (Q3 2024)

The mainnet is expected to be launched in the third quarter of 2024, providing a high-quality experience for AI developers, equipped with tools and software development kits. Network expansion will allow efficient execution of custom models and workflows, secure running of custom container code, flexible reasoning requests to reduce developer costs, and establish a method to verify the authenticity of the coordinator and ensure the source of content.

In addition, Livepeer has introduced a staking feature and will launch a staking and related data dashboard in June to further promote the staking adoption of LPT.

2. Token Status Update

The current LPT market value is 720 million, the token is fully circulated, the main trading venue is Binance, and the trading volume/mc in the past two weeks is between 10%-20%

After falling from the March high, a new support was formed. The first concentrated trading area is at 14.5, followed by 17-19; the technical pattern conforms to the key points of Fibonacci, and currently stands above 21 (0.618)

In terms of the 4-hour volume-price relationship, the rise is accompanied by a large green column volume, while the red column volume is large and the decline is small, and the buyers power is relatively strong.

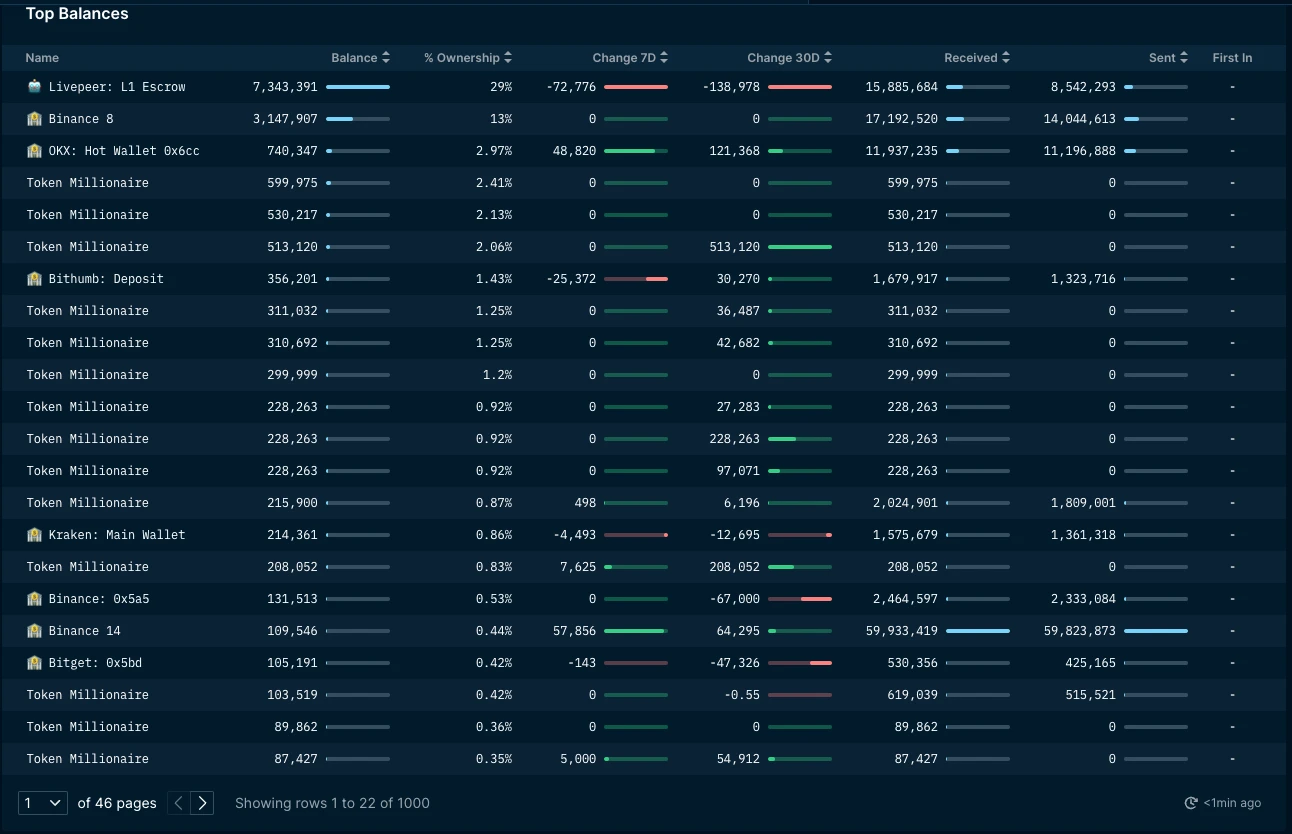

The on-chain data shows that there has been a large amount of withdrawals in the past 30 days. According to Scopescan data, 1.08 million coins were withdrawn on May 14, and the net outflow of CEX was about 500,000 coins. Referring to Nansen data, the top 20 positions have added three large addresses in the past 30 days, totaling about 950,000 coins. Except for the third-party custodian address, the outflow of other non-exchange on-chain addresses is relatively small.

Source: Scopescan

Source: Nansen

Conclusion

1. On a monthly basis, LPT has been accumulating funds at the bottom for more than a year. The current autonomous rise has lasted for 3 months, and the price has increased by 3-4 times. Long-term chips need to be continuously distributed.

2. In the recent daily level, there are obvious on-chain addresses for building positions in chips, and the price pattern conforms to the key positions of Fibonacci. In terms of the relationship between volume and price, buyers are stronger than sellers.

3. The project opens up a new narrative for AI, the tokens are fully circulated and fully traded, the market value is moderate compared to other AI targets, and there are foreseeable positive fundamentals waiting to be released.