Original author: Kazmin

Recently, the Bitget Launchpad project Bitget Wallet (BWB) has launched a snapshot at 11:00 on June 1, 2024. This is another big move since the announcement of the ecological token BWB and the points airdrop plan in March. This time, BWB adopts an investment model, and you need to invest BGB or USDT in the position statistics stage to obtain a purchase share. I have focused on Bitget Wallet since the announcement of the BWB token in March. In order to facilitate interested players to deepen their understanding, this article will introduce the Bitget Wallet product, ecology and BWB token economics, and briefly talk about its market competitiveness and future development potential.

Track veteran defines modern standards for wallets

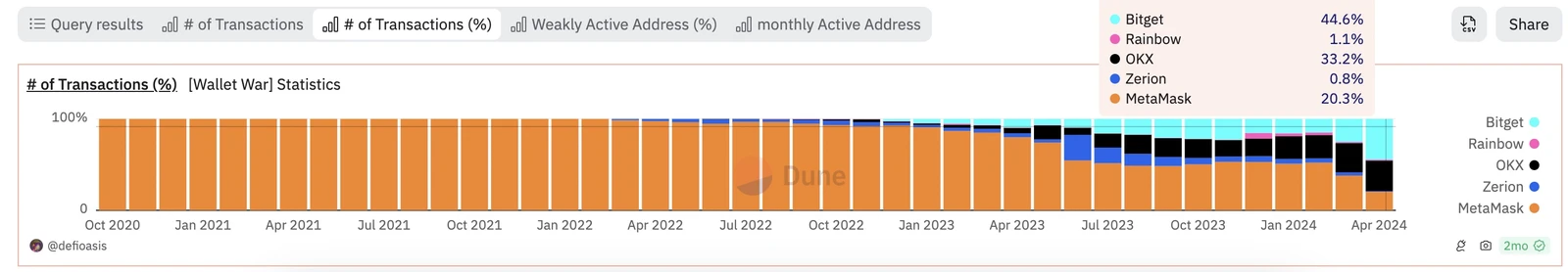

Bitget Wallet is a one-stop Web3 wallet. It is a long-standing veteran among the five major mainstream wallets (Metamask, OKX Web3, Bitget Wallet, Rainbow and Zerion). Public data shows that its global user base exceeds 20 million, and in April 2024, the number of Swap transaction orders and transaction amount exceeded MetaMask.

Bitget Wallet was formerly known as BitKeep, which was founded in 2018. It was unknown at first, but it became famous in the DeFi Summer in 2020 with its DEX currency market and other functions, occupying the top position in DeFi in the Chinese community. For a time, almost all Chinese DeFi participants were using BitKeep to query and trade tokens.

In 2022, Bitget Wallet completed a $15 million Series A financing led by Dragonfly Capital, with a valuation of $100 million. The following year, it received a $30 million investment from Bitget, one of the top ten centralized exchanges and top five derivatives exchanges in the world, and its valuation rose to $300 million. Subsequently, investments from well-known institutions such as Dragonfly Capital also provided support for the further development and growth of Bitget Wallet.

After that, Bitget Wallet continued to innovate, adding various practical Swap, cross-chain bridge, NFT, Dapp and other functions, gradually tending to the product structure we can see now. The current product structure of Bitget Wallet includes: multi-chain wallet + cross-chain transaction + AI market + NFT market + DApp + inscription platform + Launchpad + coin earning center. Such a product structure seems to be very common nowadays, and many popular wallets have similar product structures, but it was actually first defined by Bitget Wallet.

Horizontal comparison between mainstream wallets

Let’s compare Bitget Wallet with two equally mainstream wallets: MetaMask and OKX Web3.

First of all, MetaMask. I believe everyone is aware of MetaMasks status in the arena. The first wallet I used was MetaMask. However, MetaMasks limitations are obvious, such as the lack of support for multiple chains, the lack of DeFi tools, and even the inability to aggregate and display the value of all chain tokens in the same wallet, which makes MetaMasks experience in participating in various DeFi and airdrop projects difficult to describe. Of course, it is unfair to criticize MetaMask for this. MetaMask may be implementing the small and beautiful product design concept of personal private key wallet (just as Bitcoins simple design and lack of scalability complement each other), but the change in user choices may also point to the more popular design direction of wallets today.

By comparing with traditional wallets such as MetaMask, we can easily find the amazing pioneering nature of Bitget Wallet, and we cant help but admire the teams agility in capturing user needs:

- The first wallet that takes the whole chain as its perspective. While most wallets only rely on and support a certain public chain, Bitget Wallet has been breaking down the barriers between chains, allowing users to manage multi-chain assets with one wallet.

- The first wallet to launch DEX market information, starting from the on-chain market information on Ethereum and gradually expanding to multiple chains, providing real-time intelligent asset market information and popular lists;

- The first wallet to realize and promote seamless cross-chain transactions, allowing users to freely transfer assets between any public chains without having to understand concepts such as gas fees and cross-chain bridges;

- The first wallet to launch Launchpad, allowing users to participate in new listings within the wallet and capture more new money-making opportunities.

OKX Wallet is backed by OKX. Although it has an independent web plug-in version, both the web and mobile versions are designed as OKX built-in wallets, which is very different from Bitget Wallet, which is also backed by an exchange. There is not much to add about OKX. It has the same excellent interactive design and rich and thoughtful product functions as Bitget Wallet, and provided me with an excellent user experience when I was doing airdrop interactions and DeFi projects.

Since the bull market this year, there are many wallet projects that are active in the public eye, such as Backpack, Venom, Uniswap, and the newly started Binance Web3, etc. However, looking at the entire wallet track, the former king MetaMask seems to be exhausted, and Bitget Wallet and OKX Web3 are moving forward in parallel, leaving other competitors far behind. Considering the requirements of wallet products for technical accumulation, it is really hard to imagine which other players can intervene in the competition between these two new kings, but at the same time, we are also looking forward to who will lead the next development direction of wallets in the future.

From wallet to ecological platform, a six-year ambitious plan?

With so many functions integrated into one product, it is clear that Bitget Wallet intends to redefine wallet products from personal private key wallet to Web3 ecological platform. This is probably based on the rich experience of Chinese people in expanding excellent products into ecosystems. We have seen the same development path in many Chinese Web2 products, such as WeChat, Alipay and Douyin.

In fact, Bitget has indeed demonstrated the on-chain extension and decentralized future of the entire ecosystem around Bitget Wallet, and built the Bitget Onchain Layer, ultimately forming a complete Bitget Ecosystem. The official website has made a detailed outlook on the overall development path, and I will make some quotations and summaries here.

Currently, Bitget Ecosystem is first promoting the redefinition of Web3 wallets and the construction of Bitget Onchain Layer.

The redefinition of Web3 wallets refers to the transformation of wallets from entry points to platforms. The core needs of Web3 users are mainly divided into four categories: asset management, asset discovery, asset trading, and airdrop earning. The product functions mentioned above are all designed to serve these needs and are very effective.

The construction of Bitget Onchain Layer is divided into three parts:

- Aggregate trading service: Bitget Wallet aggregates hundreds of DEXs from nearly 50 public chains through its native Bitget Swap, providing users with the best trading path and launching gas-free trading and ultra-fast trading modes. This aggregation not only simplifies the users operating process, but also greatly reduces transaction costs and risks, providing great convenience for users.

- Security and liquidity: In terms of security, Bitget Onchain Layer provides users with effective protection measures to isolate malicious DApp attacks and ensure the security of user assets. In terms of liquidity, Bitget Swap not only aggregates on-chain spot liquidity, but also involves OTC, on-chain derivatives and Pre-Market and other fields, greatly enhancing the flexibility and convenience of user transactions.

- Improved user experience: Bitget Wallet has always adhered to the Mobile First concept, and through standardized development SDK and UI KIT, it promotes DApp to be more mobile-friendly and native. This mobile-focused strategy will further promote the large-scale adoption of Crypto and enhance the users operating experience on mobile devices.

The next step is to open up and build an ecosystem. Bitget Wallet has set up a $10 million BWB Ecological Fund to donate and invest in high-quality products and assets, especially products related to on-chain transactions. This not only shows its deep involvement and support for the development of the industry, but also provides developers with rich resources and platforms to promote the prosperity and development of the ecosystem.

By joining forces with industry developers, Bitget Wallet will create MFD (Modular Functional DApp). MFD can be used as an independent DApp or integrated into the native functions of Bitget Wallet as a functional component. This flexible architecture not only meets the diverse needs of users, but also helps developers and DApp project parties increase their income.

Introduction and analysis of BWB token economics

The official also introduced the BWB token economics in detail. BWB will serve as the official ecological token of Bitget Wallet and the system token of Bitget Onchain Layer. It will play multiple roles in the ecosystem, including community governance, staking, Bitget Wallet Launchpad and various airdrop activities, as well as the qualification to participate in Bitget platform activities. It also has the qualification to airdrop in Bitget Onchain Layer ecological projects, and the payment of multi-chain gas fees after the launch of AA wallet.

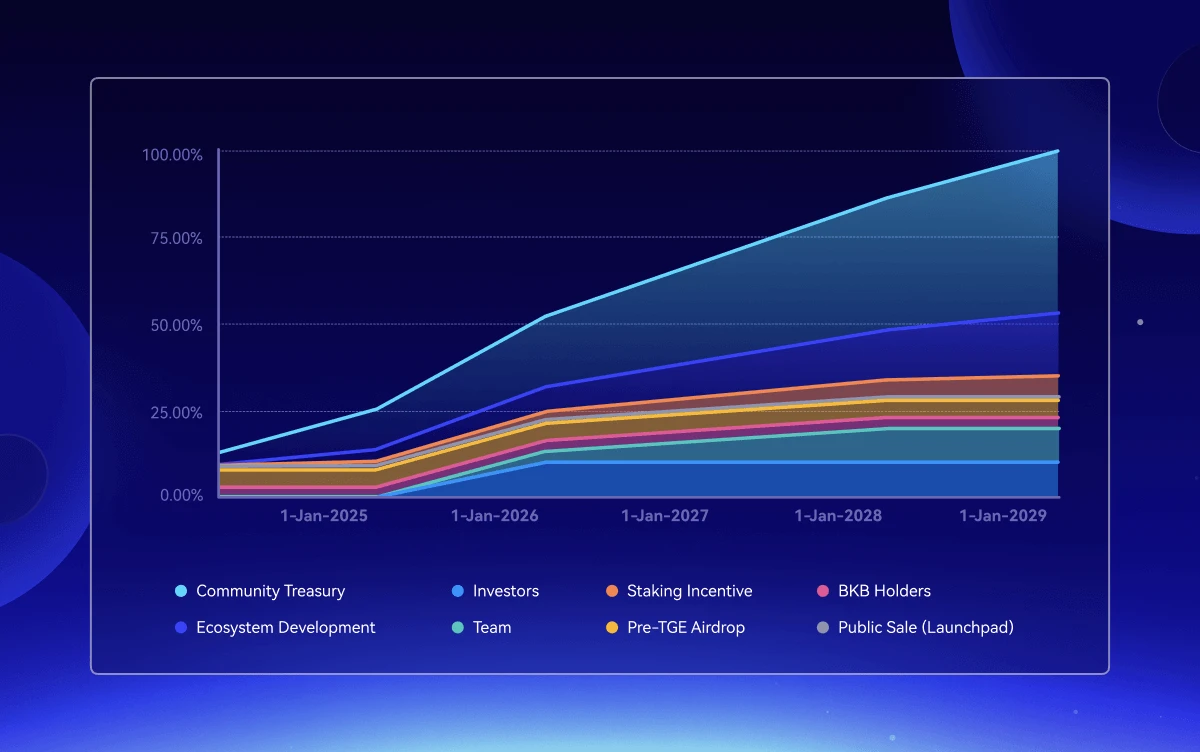

The total amount of BWB is 1 billion, and the specific distribution is as follows:

- Private placement investors: 10%, locked for 12 months and then released linearly for 12 months.

- Public offering: 1.1%, of which 0.1% will be allocated through Bitget Wallets Launchpad platform.

- Pre-TGE airdrop: 5%, for users who participate in the airdrop event.

- BKB holders: 3%, exchanged proportionally to holders of BitKeep platform points BKB.

- Team: 10%, locked for 12 months and then released linearly for 36 months.

- Ecosystem construction: 18%, used for ecosystem development, unlocked linearly after TGE.

- Staking incentives: 6%, used to encourage users to stake BWB.

- Community Treasury: 46.9%, used for user growth and community incentives, of which 6.9% will be issued at TGE and the rest will be released linearly.

The tokens will be distributed and released within five years according to the rules. The specific release time can be seen in the figure below.

I evaluate the entire BWB token economics from the following perspectives:

1. Reasonableness of the allocation plan

The distribution plan of BWB tokens demonstrates Bitget Wallets comprehensive consideration and long-term planning for the development of the ecosystem. Specifically:

- Private investors and public offerings: Private investors and public offerings account for 11.1% in total. The lock-up period and linear release period of private offerings ensure the stability of the market and avoid the risk of large-scale sell-offs. The public offering is relatively small, but the allocation through the Launchpad platform increases the participation opportunities for ordinary users.

- Team and ecosystem construction: The team accounts for 10%. The lock-up period and linear release period help motivate the long-term investment and development of team members and attract outstanding talents. Ecological construction accounts for 18%, which is a relatively high proportion, showing Bitget Wallets emphasis on ecosystem expansion and innovation, laying a financial foundation for future development.

- Community incentives and staking incentives: The community treasury accounts for 46.9%, of which 6.9% is issued during TGE. This part of the tokens is used for user growth and community incentives, ensuring the activity and loyalty of the community. Staking incentives account for 6%, encouraging users to stake BWB, which helps stabilize token prices and increase user participation.

2. Diversity of Token Uses

The various use cases of BWB tokens in the Bitget Wallet ecosystem have increased the utility and demand for tokens, including community governance, staking, multi-chain gas fee payments, participation in platform activities and airdrops, etc. These use cases not only enrich the user experience, but also improve the liquidity and value of tokens.

3. Feasibility of release schedule

The release schedule of BWB is set to be gradually distributed and released within five years. This long-term distribution mechanism helps control the market supply. Although it is too conservative for the money-grabbing party, it can avoid excessive inflation of tokens and face huge selling pressure. This shows Bitget Wallets long-term development plan and its attention to market stability, as well as its confidence in ecological participants.

4. Potential impact on the market

The design and distribution of BWB tokens reflects Bitget Wallet’s deep understanding of market demand and industry dynamics:

- Liquidity and Security: Through multi-chain deployment and strict lock-up period, the liquidity and market security of BWB tokens are guaranteed.

User participation and community building: Through a variety of incentive mechanisms, BWB promotes the active participation of users and the healthy development of the community.

- Innovation and Expansion: A high proportion of ecological construction funds provides solid support for future innovation and expansion, demonstrating Bitget Wallets determination to implement long-term strategic planning.

5. Potential Benefits

Compared with other wallets, BWB is in an undervalued state:

- BWB Total Supply: 1,000,000,000 BWB

- BWB distribution supply chain: 123,361,000 BWB (circulation rate accounts for about 15%)

- Points redemption ratio: 4.1 BWB points = 1 BWB

The current over-the-counter BWB points price is 0.15 USD, which is equivalent to the over-the-counter price of BWB of 0.615 USD. It can be calculated that the MC circulation market value of BWB is about 76 million, the market value of FDV Global is 615 million, and the project valuation is 300 million, which is only twice as much. In addition, the project has a large scale, and the benefits of participating in the project are worth looking forward to.

Only long-termism can lead Web3 into the future

We can see that Bitget Wallet and the Bitget Onchain Layer built by it are not just a tool or platform, but a complete ecosystem that will provide users with a full range of services from asset management, trading to value-added. Now, it seems that Bitget Wallet has been an important part of a long-term strategy since a long time ago, and it has been implemented and promoted with a consistent innovative concept, which is a rare long-termism in todays restless Web3 world.

I have deep respect for all the teams and projects that hold long-term principles in the Web3 world. In my opinion, in addition to providing excellent product experience, Bitget Wallet also demonstrates the teams advantages of deep insight into users, keen capture of needs, and rapid iteration and innovation. I believe this will be a strong cornerstone in the execution of any strategy.

Finally, I hope that BWB can play more roles in the ecosystem, provide more extensive empowerment and applications, and further build a successful Bitget Onchain Layer and Bitget Ecosystem. Just like defining the product structure of a wallet, we can define the evolution path of a successful ecological platform.