introduction

South Koreas cryptocurrency market may be the most active and mature. Almost no one in South Korea is unaware of BTC, and people are more friendly to emerging projects. In particular, young people are much more enthusiastic about cryptocurrency than older people. At the same time, due to South Koreas market economic environment, young people have a stronger FOMO emotion.

1. Macroeconomic indicators and current situation

South Korea is a high-income developed country and the most industrialized member of the OECD. South Korean brands such as LG Electronics and Samsung are internationally renowned and have earned South Korea a reputation for high-quality electronics and other manufactured goods. South Korea became a member of the OECD in 1996.

Geographic location and population size

South Korea, also known as the Republic of Korea (ROK), is located in the southern part of the Korean Peninsula, extending approximately 1,100 km from the Asian mainland, bordering North Korea along the Korean Demilitarized Zone, with its western border formed by the Yellow Sea and its eastern border defined by the Sea of Japan. South Korea (including all its islands) is located between 33° and 39°N latitude and 124° and 130°E longitude, with a total area of 100,410 square kilometers (38,768.52 sq mi), and the country claims to be the sole legitimate government of the entire peninsula and adjacent islands.

It is estimated that South Koreas population will be about 51.7 million in 2022, but South Koreas birth rate became the lowest in the world in 2009, and it is the country with the largest decline in working-age population among OECD countries. It is expected that by 2025, the proportion of the population aged 65 and above will reach more than 20%, and by 2050 it will be close to 45%.

Additionally, South Korea is known for its population density, estimated at 514.6 people per square kilometer in 2022, more than 10 times the global average, making it the third most densely populated country in the world, excluding microstates and city-states. South Korea is also one of the most ethnically homogeneous societies in the world, with ethnic Koreans making up approximately 96% of the total population. Since many immigrants are ethnic Korean themselves, statistics do not record ethnicity, making it difficult to estimate an accurate number.

Economic structure and characteristics

South Korea is a mixed economy whose main industries include textiles, steel, auto manufacturing, shipbuilding and electronics. South Koreas rapid growth over the past few decades has been driven primarily by exports of electronics and telecommunications equipment, which have earned the country a reputation as a top global producer and innovation hub.

The country has a significant or even dominant presence in many major global industries, such as nuclear power, consumer electronics and biotechnology, and is committed to becoming a major player in several other areas, such as smart grid technology, the Internet of Things (IoT) and robotics.

South Koreas economy is heavily dependent on international trade, and in 2014, South Korea was the worlds fifth-largest exporter and seventh-largest importer. However, against the backdrop of a tightening interest rate environment and weakening external demand for South Korean exports, economic growth is expected to be modest but slowing in the near term. In particular, South Koreas main export product, semiconductors, fell 41% in April 2023, and the International Monetary Fund predicts real GDP growth of 1.5% in 2023.

As of 2023, there are 82 chaebols in South Korea. These conglomerates are usually run by a single family and have combined assets of more than 5 trillion won ($3.69 billion). Chaebols are large South Korean industrial conglomerates run and controlled by an individual or family. Samsung, with a market cap of more than $375 billion, is one of the most valuable chaebols, making it larger than the economy of Qatar. As of May 2023, the five largest conglomerates (also known as chaebols) Samsung, SK Group, Hyundai Motor Company, LG, and POSCO account for nearly 53% of the total revenue of South Koreas 82 major business groups, according to Statista.com.

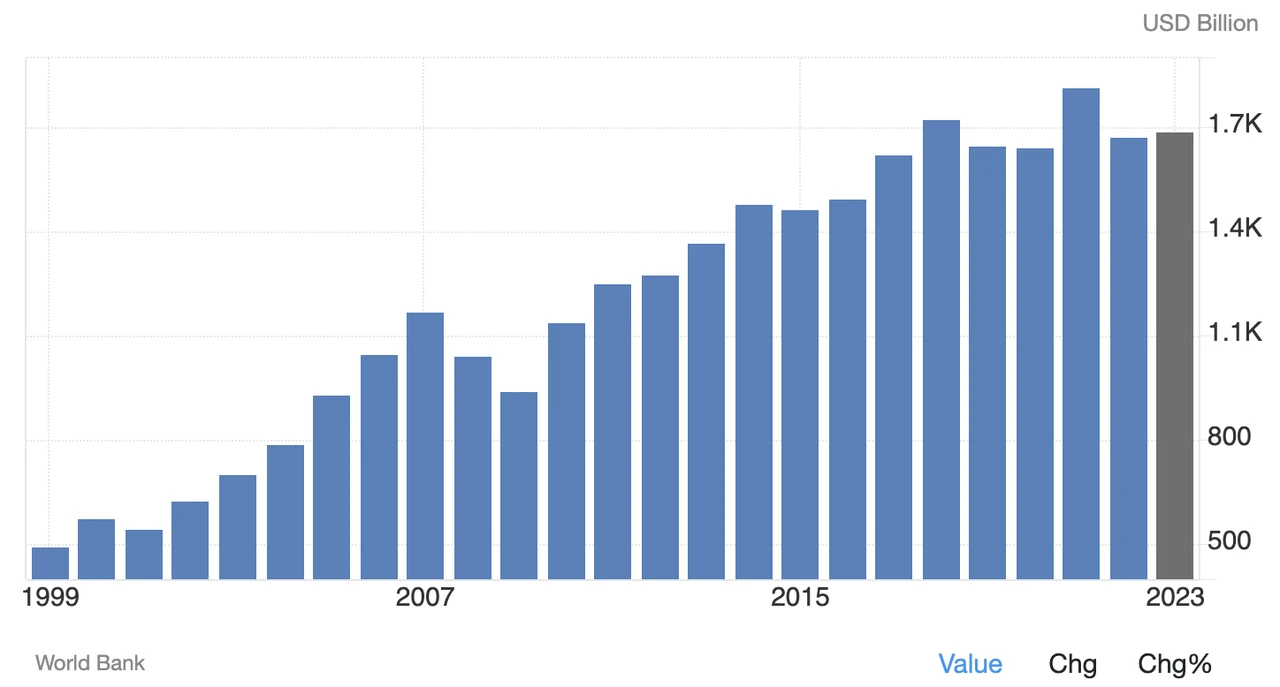

South Korea GDP ranking

The South Korean economy is one of the largest and most advanced economies in the world, with the 13th largest nominal GDP and 14th largest GDP by purchasing power parity. According to the World Bank, South Koreas gross domestic product (GDP) was $1.67392 trillion US dollars in 2022. South Koreas GDP accounts for 0.72% of the world economy.

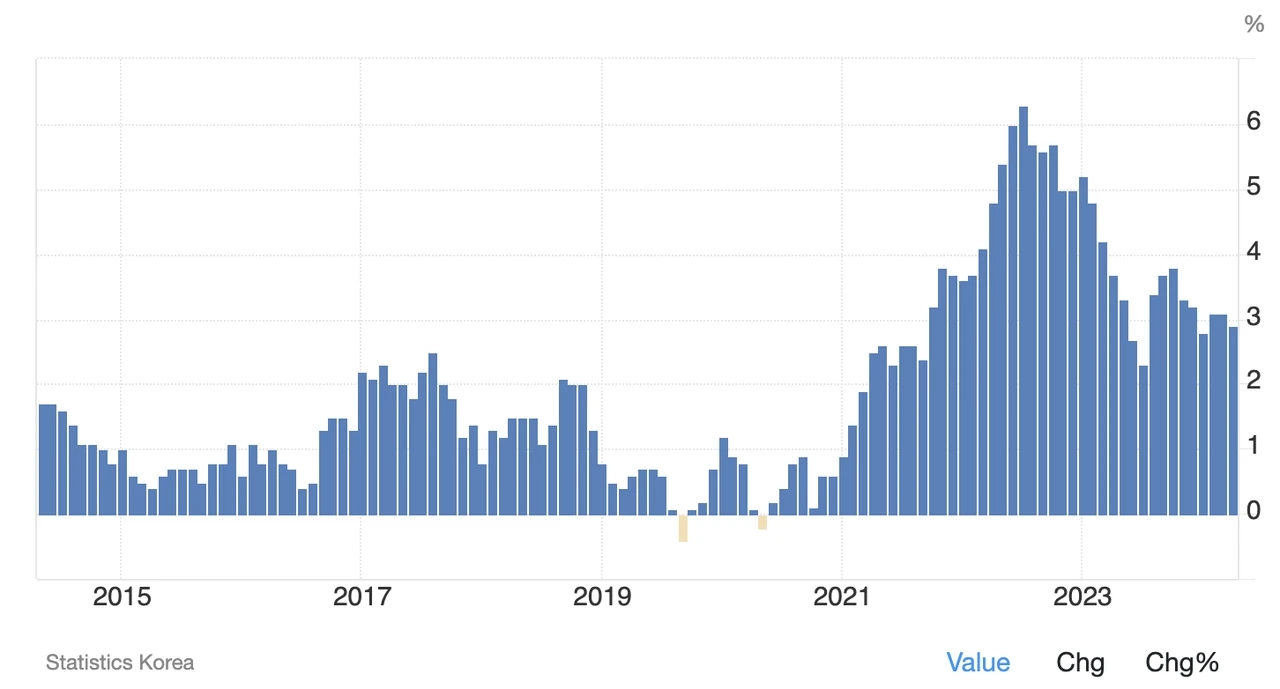

Inflation rate data

South Koreas annual inflation slowed to 2.9% in April 2024 from 3.1% the previous month, slightly below the market forecast of 3%. It was the lowest reading since January as the cost of food and non-alcoholic beverages (5.9% vs 6.7% in March) and restaurants and hotels (3% vs 3.4%) rose at a slower pace.

Meanwhile, the cost of housing, electricity, gas and water rose at the same rate (1.8%), while prices rose faster (2.9% vs 2.8%). On a monthly basis, inflation stagnated after edging up 0.1% last month, below market expectations for a 0.2% rise.

South Koreas legal tender

The Korean won is the official currency of South Korea. Its currency code is KRW and its symbol is won. The conversion factor of the Korean won is 6 significant digits. It is a legal tender. According to research firm Kaiko, in the first quarter of 2024, the Korean won became the leading currency for global cryptocurrency trading, with a cumulative trading volume of $456 billion, reflecting South Koreas growing speculative interest in high-risk crypto assets.

2. Current status and characteristics of the crypto market

High proportion of users

According to the semi-annual report on crypto asset business released by the Korea Financial Intelligence Agency (KOFIU), the number of active users of registered crypto asset exchanges in South Korea increased by 390,000 as of the second half of 2023, exceeding 6.4 million (11% of the population) in South Korea.

High adoption rate

Driven by a tech-savvy population and a strong interest in financial innovation, South Korea has seen significant and growing cryptocurrency ownership and adoption. Most of these investors primarily engage in investment activities centered around centralized exchanges, which makes centralized exchanges a significant influence in the Korean cryptocurrency market. At the same time, cryptocurrency ownership in South Korea has increased significantly, with significant adoption particularly among individuals in their 40s and 50s, as well as younger investors in their 20s and 30s.

Large transaction size

In addition, with the arrival of a new cycle and the rise in BTC prices, South Koreas cryptocurrency trading craze has risen again. In March 2024, the trading volume of domestic cryptocurrency exchanges in South Korea reached a record 11.8 trillion won (about 9 billion US dollars), exceeding the trading volume of the South Korean stock market at the time, 11.47 trillion won (about 8.7 billion US dollars).

3. Encrypt user features

According to recent data, cryptocurrency ownership in South Korea has increased significantly. This includes a diverse demographic range, with notable adoption among individuals in their 40s and 50s, as well as younger investors in their 20s and 30s. According to Forkast’s report, 31% of South Korean investors are in their 30s, 27% are in their 40s, and a quarter are in their 20s.

The proportion of female users exceeds that of other regional markets

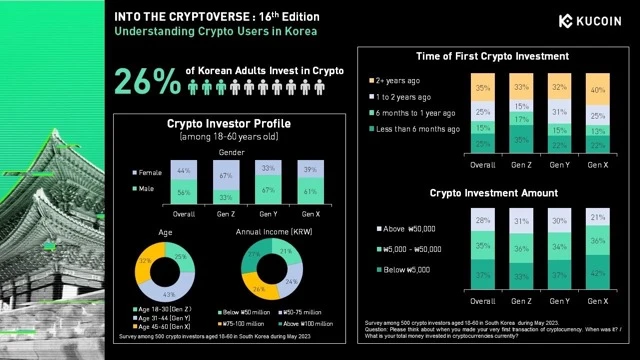

According to Kucoin’s 2023 survey:

26% of adult internet users aged 18 to 60 in South Korea have invested in cryptocurrencies in the past six months;

Among the entire crypto investor population, participation rates are higher among men (56%) than women (44%).

Young women aged 18-30 (Gen Z) have seen a significant increase in investment, accounting for 67% of female crypto investors;

This trend suggests that women, especially those from Generation Z, may play a more important role in cryptocurrency investing in the future.

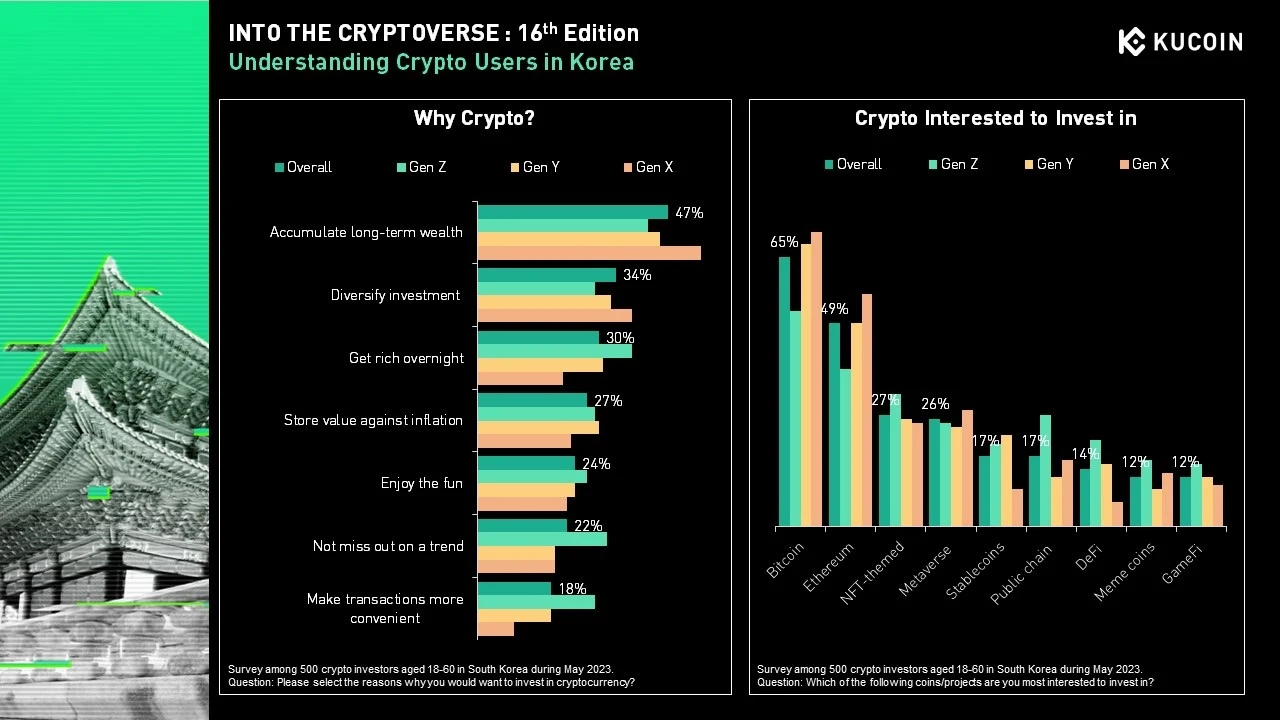

Generation Z prefers to get rich overnight

The survey also analyzed the different motivations people have for investing in cryptocurrencies:

The motivation for older people is long-term wealth accumulation (47%);

Gen Xers are more likely to invest for the long term (55%) and diversify their portfolios (38%).

The Z group favors quick gains, with 38% aiming to “get rich overnight,” compared to an overall average of 30%;

Younger investing is driven primarily by FOMO, a mindset reflected in their higher trading frequency, with 64% of Gen Z investors trading more than once a week, compared to 48% of Gen Y and 42% of Gen X.

Additionally, Gen Z expressed a higher interest in the entertainment value of crypto investing (27%), viewing it as a fun activity that offers more than just financial returns.

4. Current status of CEX in South Korea

South Korea is one of the world’s largest and most active cryptocurrency markets, with its five licensed exchanges Upbit, Bithumb, Coinone, Korbit, and Gopax processing more than $2 billion worth of crypto transactions as of May 14, 2024, according to CoinGecko.

Upbit

Upbit is the largest exchange in South Korea, dominating the market with over 80% of trading volume (1.5 billion USD as of May 17, 2024), making it one of the top five cryptocurrency exchanges in the world. It also operates in Singapore, Thailand, and Indonesia, and focuses on the Southeast Asian crypto market.

Bithumb

Founded in 2014, Bithumb has grown to become one of South Korea’s largest and most influential cryptocurrency exchanges headquartered in Seoul, South Korea. According to Coingecko, it ranks second with a daily trading volume of USD 411 million as of May 14, 2024.

Other CEXs

According to Coingecko: As of May 17, 2024, other CEXs have a small market share compared to Upbit and Bithumb as their daily trading volumes are 5 million USD (Korbit) and 2 million USD (Gopax) and 29 million (Coinone).

5. Web3 projects in South Korea

ZEAT

Zeat is a gaming social platform designed to connect players, facilitate finding gaming partners, chat with friends, and share content. It supports clans with features such as scrimmage, tournaments, and quests. ZEAT aims to integrate Web3 elements such as NFTs, SocialFi, and tokens to enhance the gaming experience. The platforms AI recommendation system helps players discover like-minded people and build communities.

CXT.Tax

CXT.Tax, also known as CryptoTax, is a platform designed to efficiently manage cryptocurrency assets and taxes. It provides features such as transaction data aggregation from various trading platforms, real-time monitoring of assets, and the latest news and disclosures. Users can preview and report taxes, estimate future tax liabilities, and receive notifications of important updates about their assets. CryptoTax aims to simplify digital asset management and tax compliance for investors.

DSRV

DSRV is a blockchain infrastructure company based in Seoul, South Korea. It provides a range of services including node operation, staking, and blockchain development tools. DSRV supports more than 40 major blockchain networks and operates more than 4,000 nodes. The company also offers products such as Welldone Studio, an integrated development tool for multi-chain environments, and All That Node, a comprehensive multi-chain development suite. DSRV aims to simplify blockchain access and promote sustainable growth within the industry.

Hyperithm

Hyperithm is a digital asset management company based in Tokyo and Seoul that specializes in quantitative trading and venture capital. They provide institutional-grade services in the digital asset space using advanced trading strategies and investment expertise.

KODA

Korea Digital Asset (KODA), South Koreas largest institutional crypto custody service funded by KB Kookmin Bank (South Koreas largest retail bank), Haechi Labs and 2020 Korean VC Fund Hash, announced on February 22, 2023 that the value of its managed crypto assets expanded by nearly 248% in the second half of 2023.

6. South Korean Crypto Venture Capital

Lecca Ventures

Lecca Ventures is a South Korea-based venture capital firm focused on the Web3 and cryptocurrency sectors. They focus on investing in community-driven startups, especially those led by visionary founders. Lecca Ventures takes a hands-on approach, not only providing capital but also actively participating in the development and expansion of its portfolio companies.

Their investment strategy emphasizes quality over quantity and aims to support startups that provide unique and innovative solutions in the Web3 space. Their portfolio includes companies such as Airstack, Alloyx, Nibiru, Shield, Anima, and Mission ate Cash, which are well-known for their contributions to the crypto industry.

Hashed

Hashed is a well-known blockchain investment firm and incubator headquartered in Seoul with offices in Silicon Valley. The company focuses on supporting and investing in innovative blockchain projects and Web3 startups. Founded by Simon Kim, Hashed is committed to building a decentralized future by backing visionary entrepreneurs and providing comprehensive support to its portfolio companies. Hashed plays an important role in the global blockchain ecosystem, hosting events such as Korea Blockchain Week to promote community and collaboration within the industry.

7. Crypto Market Regulation in South Korea

South Korea has established a comprehensive cryptocurrency regulatory framework designed to ensure investor protection and market integrity. Key components of the framework include:

Digital Asset Basic Act

The upcoming legislation aims to provide a structured approach to regulating virtual assets. It includes regulatory provisions for virtual asset service providers (VASPs), standards for issuing and listing cryptocurrencies, and information disclosure requirements to prevent unfair trade practices.

Anti-Money Laundering (AML) and Compliance

The Financial Intelligence Unit (FIU) is stepping up its scrutiny of cryptocurrency exchanges. The FIU’s strategy includes stringent inspections and enforcement of strict regulatory standards to curb illegal activities such as money laundering and embezzlement. Exchanges must obtain real-name verification services and separate user funds from company funds.

Investor Protection Measures

Following high-profile incidents such as the Terra-LUNA collapse, regulatory focus has shifted to strengthening investor protection. This includes tighter controls on token issuance and listings, as well as mandatory disclosures by senior public officials to prevent conflicts of interest.

Globally consistent standards

South Koreas regulatory efforts are aligned with global standards, such as those set by the Financial Action Task Force (FATF). This ensures that the countrys regulations are aligned with international best practices, enhancing the reliability and security of its digital asset markets. These measures are intended to create a safer and more transparent environment for cryptocurrency trading in South Korea, balancing the need for innovation with the need to protect investors and maintain market stability.

8. South Korea’s tax policy

South Korea’s tax policy on cryptocurrencies is evolving, reflecting the government’s efforts to balance regulation and market growth. Initially, South Korea planned to impose a 20% tax on cryptocurrency gains over 2.5 million won (about 2,300 USD) starting in 2022. However, this faced several delays due to industry opposition and legislative changes. As of now, the implementation of the tax, which applies to income from cryptocurrency transactions and will require investors to report their gains for tax purposes, has been postponed to January 2025. In addition, the ruling People’s Power Party has proposed to once again postpone the priority of establishing a comprehensive regulatory framework, potentially pushing the effective date back to 2027.

Tax regulations classify cryptocurrency gains as “miscellaneous income,” and any non-sale transfer of crypto assets, such as gifts or inheritances, is subject to statutory gift and inheritance tax rates of up to 50%. The South Korean government is also focused on increasing transparency and combating illegal activities in the crypto market, requiring exchanges to share transaction records and requiring senior public officials to disclose their cryptocurrency holdings starting in 2024.

In South Korea, capital gains tax rates vary depending on the type of asset and whether the seller is a resident or non-resident;

Non-residents are subject to capital gains tax on Korean-source income, and the rates and rules are generally similar to those for residents;

9. Summary

South Korea plays an important role in the global economic landscape as a member of the G20 and has a strong economy supported by companies such as Samsung and Hyundai. At the same time, South Korea is also a highly culturally homogenous market. It is difficult for teams to enter the Korean market without a truly Korean team operating within South Korea.

On the other hand, South Korea’s financial system has a very high level of trust, which also leads to Korean users’ low enthusiasm for decentralized self-custody and DeFi. However, due to the FOMO sentiment of investment, value preservation and getting rich quickly, South Korea’s crypto market still performs well and stands out in the global crypto market, especially the large-scale adoption of licensed cryptocurrency exchanges and users.

As of 2024, South Koreas cryptocurrency market is indeed marked by a rapidly evolving regulatory environment, increased government oversight, and significant market activity. Coupled with high levels of market participation and strict law enforcement measures, South Korea has become a key player in the global cryptocurrency sector. As the industry continues to develop, South Korea will likely play an even more important role in the global crypto market.

Note: All the above opinions are for reference only and are not investment advice. If you disagree, please contact us for correction.

Follow and join the MIIX Capital community to learn more cutting-edge information Website: https://www.miixcapital.com

Twitter CN: https://twitter.com/MIIXCapital_CN

Telegram CN: https://t.me/MIIXCapitalcn

Join MIIX Capital: hr@miixcapital.com

Recruiting positions: Investment Research Analyst/Operation Manager/Visual Designer