Original article from Delphi Digital

Compiled by Odaily Planet Daily Golem ( @web3_golem )

In the past few weeks, the most eye-catching Web3 game is undoubtedly the TON ecosystem. From NOT, which opened with a FDV of more than $1 billion without any VC support, to Hamster Kombat reaching 142 million registered users in 77 days, and then to the Telegram Meme airdrop DOGS that became popular overnight , the TON ecosystem seems to have new milestones every week.

In the past few weeks, the most eye-catching Web3 game is undoubtedly the TON ecosystem. From NOT, which opened with a FDV of more than $1 billion without any VC support, to Hamster Kombat reaching 142 million registered users in 77 days, and then to the Telegram Meme airdrop DOGS that became popular overnight , the TON ecosystem seems to have new milestones every week.

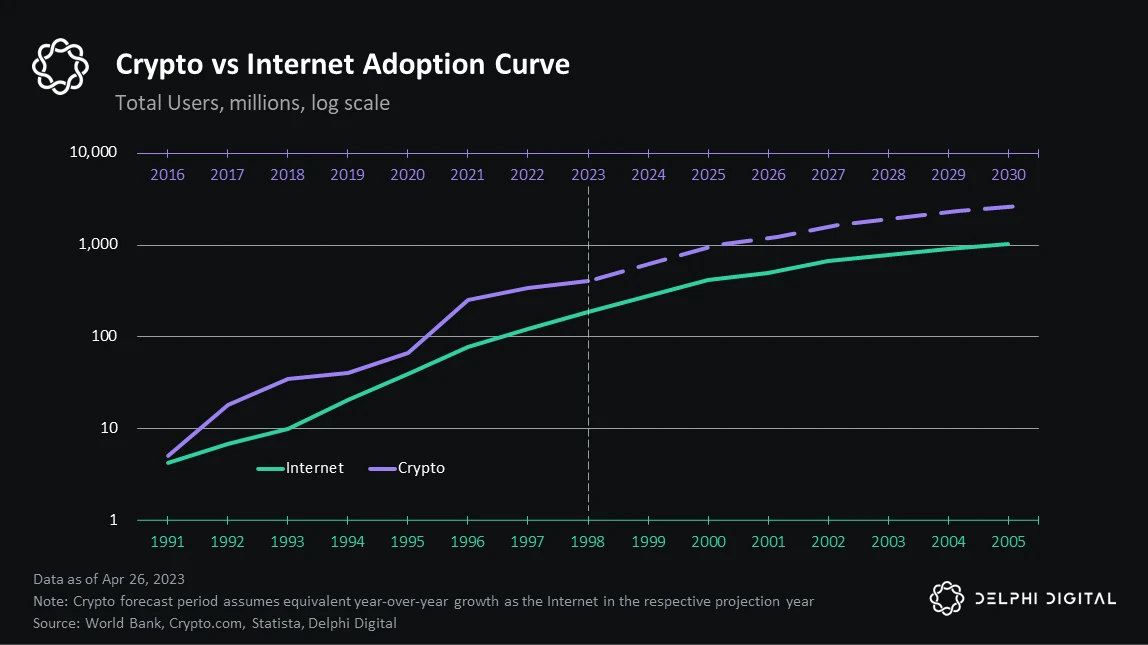

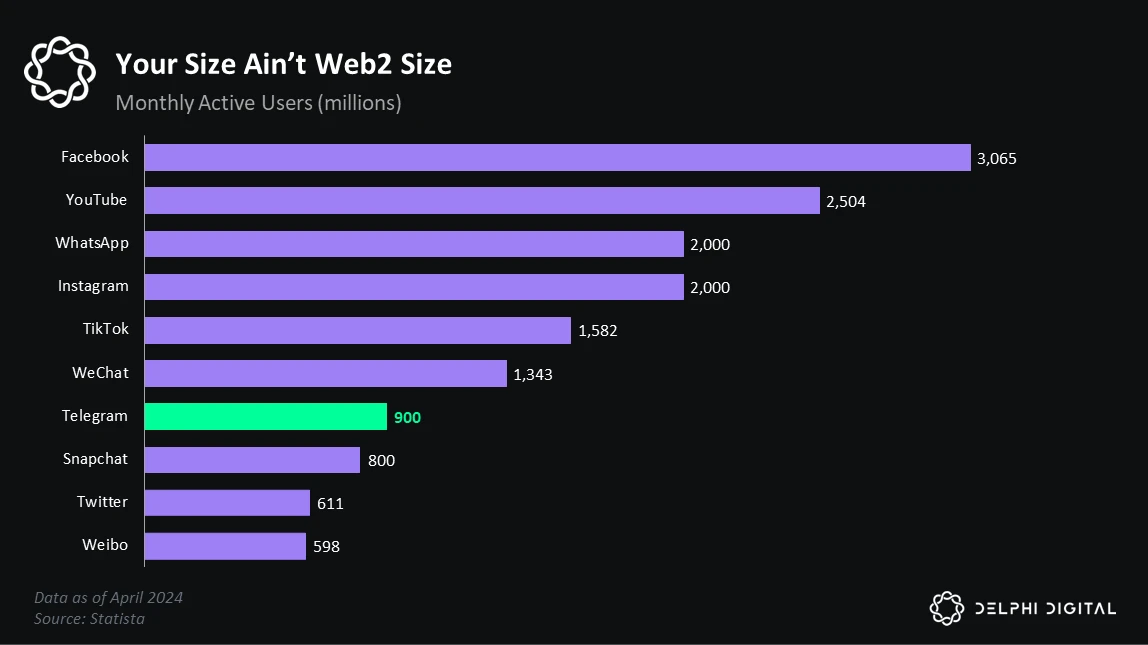

Telegram, with 900 million monthly active users, is one of the biggest channels for converting Web3 users. Due to its greater security and privacy, Telegram, the worlds fifth largest and second fastest growing communication tool, has become one of the main encrypted communication applications. Every non-US user will automatically generate an account abstraction crypto wallet when signing up for Telegram, which makes the TON ecosystem have great potential in promoting the mass adoption of Web3.

In this article, we will take a deep dive into social games on Facebook and WeChat, analyze the TON ecosystem, explore Telegram’s uniqueness in user acquisition, and finally answer a question: Can Telegram+TON replicate the success of WeChat mini-program games, or is it just a meme craze?

Social platforms and games

In 2010, the Internet became a public resource accessible to everyone, paving the way for the development of online social platforms. In order to retain users and make profits, these platforms began to expand their business scope to many fields such as games, daily services, e-commerce, etc.

Facebook — The Beginning of the Social Gaming Era

After the millennium , the user base of social platforms has grown exponentially. In order to retain as many users as possible, they began to look for ways to entertain users. Games are easy to spread, highly scalable, and can allow users to spend a lot of time on the platform while quickly monetizing, so they naturally become the best choice. Facebook, WeChat, and Telegram have all allocated dedicated resources to establish their own game departments. The benefits of large social platforms developing games are as follows:

Users can access richer content to augment their core experience on the platform;

Games also often have a social aspect, encouraging competition and socializing;

Most games are casual and free-to-play, with the characteristics of easy access and dissemination, low development costs and fast iteration speed;

Social platforms themselves have a huge user base, and their game distribution capabilities are far better than most game studios;

Games consume a large amount of users’ time while providing huge consumption potential, thus improving the overall user retention rate and lifetime value (LTV) of the platform.

The social gaming era began when Facebook began to expand the functionality of its platform, with simple games able to gain millions of daily active users (DAU) within weeks. These social gaming ecosystems grew quickly and in scale, with Farmville, a social farming game developed by Zynga on Facebook, having 10 million monthly active users (MAU) just two months after launch, and peaking at 80 million MAU in 2010. Even three years after its launch, the game still accounted for approximately 20% of all Zynga revenue.

But the social nature of these games tends to concentrate players on a few hits. Because players want to compete with friends and share their achievements, network effects ultimately steer players toward a handful of hits, like Candy Crush, Farmville, and Zynga Poker, making it difficult for other latecomers and lesser-known games to gain traction.

WeChat - More than just an instant messaging tool

While most messaging apps have added social features such as short videos and group chats over time, user engagement and monetization through alternative entertainment features such as games remain limited. While there is nothing directly preventing game developers from developing games on the platform, as with early TikTok games , the lack of proper infrastructure and payment channels makes it both challenging and risky. Margins in the gaming industry are slim, and most development teams are unwilling to risk unnecessary user friction by limiting users to in-app purchases (IAPs).

However, as Facebook games fade into obscurity, WeChat, China’s all-purpose platform , continues to prove that the intersection of social apps and games has huge growth potential. WeChat can be considered a super app, where users can chat, make calls, pay utility bills, order food, book international travel, and more. 80% of Chinese users use it monthly, and spend an average of about 80 minutes on WeChat every day.

In 2017, WeChat launched Mini Programs, which enabled small applications to run natively within the app. WeChat then launched the first batch of Mini Program games (developed by Tencent as the first party). Later in 2018, third-party developers were introduced, and by the end of the same year, the number of registered Mini Games on WeChat exceeded 7,000.

Over the next few years, WeChat rolled out several new supporting features and updates that ultimately made mini games better, more polished, and with more complex game mechanics. By 2021, despite the number of mini-program game developers well over 100,000, the number of MAUs had not grown significantly since the feature was introduced (MAUs in 2017 were around 20 million). New user acquisition was an obvious problem for these mini-program games, and to address this, Tencent allowed mini-program game developers to buy advertising traffic across the Tencent ecosystem.

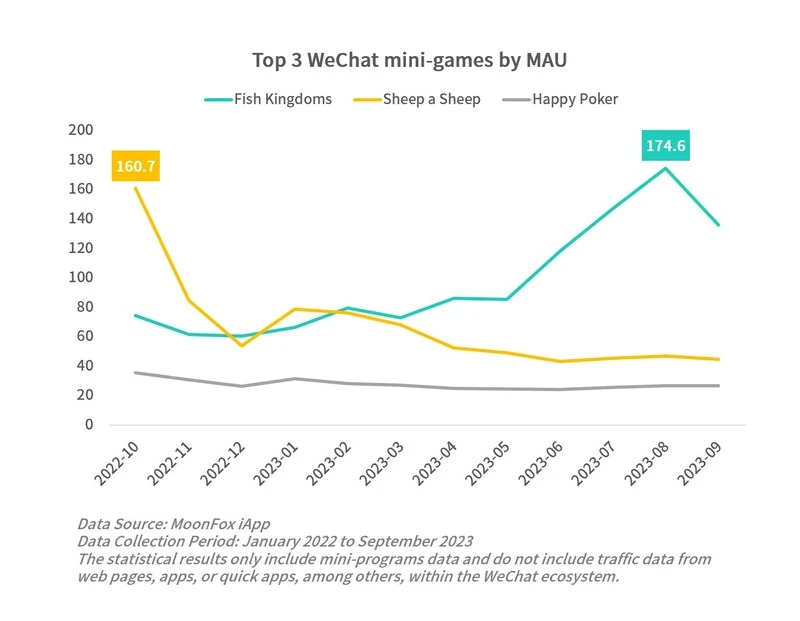

Source: Nasdaq | Top 3 WeChat Mini Games by Monthly Active Users

But the effect was modest until two other Chinese social platforms, Bilibili and TikTok, allowed ads to link users directly to WeChat mini-games. A string of hits followed, led by a match-3-style game called “Sheep 2,” which attracted 60 million daily active users in a month.

By June 2023, there will be more than 300,000 WeChat Mini Program game developers and more than 400 million monthly active game players, accounting for about 31% of WeChats 1.3 billion total users. In addition, the industry estimates that the WeChat Mini Program game market size will be US$6 billion in 2023, and the annual growth rate is expected to be between 25% and 30% in the next five years.

Source: Chinamarketingcorp

By the second quarter of 2023, more than 100 mini-program games had quarterly revenues of RMB 10 million (USD 1.38 million), with several games generating monthly revenues of more than USD 15 million. The main reason is that WeChat mini-games have much higher profit margins (>30%) compared to traditional mobile games.

But stepping back, games only account for 10% of the top 500 WeChat mini programs by monthly active users, and WeChat is still primarily a social application, followed by life service applications, and finally games, etc. However, it is currently the most successful case of using games to increase user engagement and add new monetization avenues on a highly integrated and almost frictionless platform.

With this background, we will now discuss Telegram, the TON Foundation, and the sudden explosion of Telegram mini-app games.

Telegram——Web3 social games center

Telegram was the first pure chat app to really enter the gaming space. In 2016, Telegram bots integrated HTML 5, and in 2017 the development of the TON blockchain further reduced friction between users and game developers. Through TON, developers can access payment channels, decentralized storage for storing game assets, or smart contracts for secure and automated game mechanics, while being able to efficiently distribute their games to a platform with 900 million monthly active users.

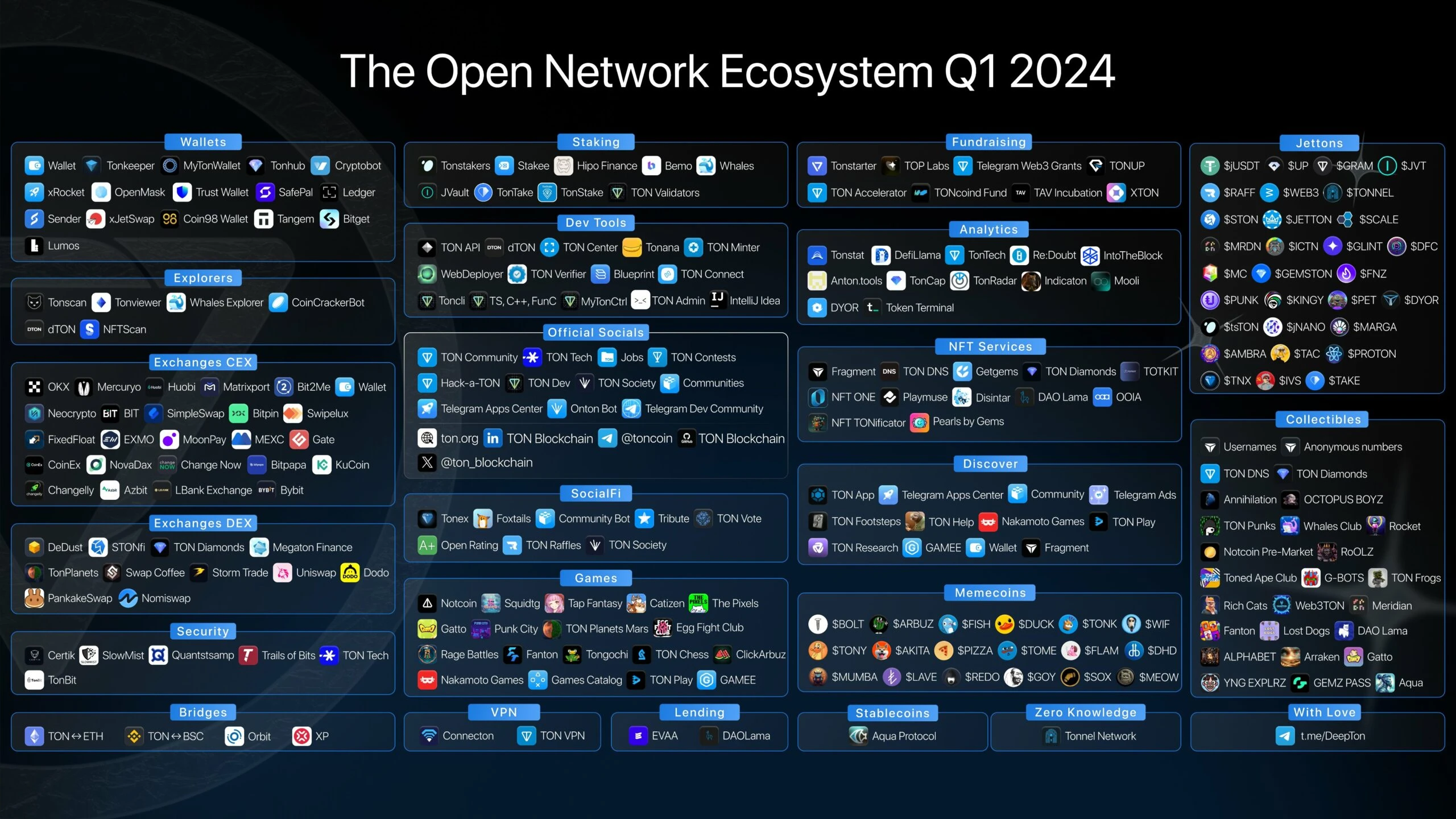

TON Ecosystem

TONs technology stack provides developers with tools to develop various dApps on Telegram. Hundreds of teams are serving the needs of wallets, exchanges, cross-chain, games and more in the ecosystem.

Source: X.com @dacrimeator

TON tokens are the core of the TON ecosystem. First, it is the network gas consumption, and validators need to stake TON to participate in the POS verification process, similar to the ETH or SOL network. In addition, developers need to pay TON to deploy and run smart contracts on the TON network. The total fee includes basic fees, storage fees, and execution fees to ensure the scalability of tokens and validator income.

At the same time, users and developers can use TON to exchange value within the ecosystem with minimal wear and tear. While the TON token supply grows at a fixed 0.6% per year, 50% will be burned as network fees, incentivizing people to hold the token as an asset whose value will expand with TON network activity. If we use the destruction rate in June 2024 as a benchmark, approximately 2.89 million TONs are burned each year, accounting for about 10% of the 30.65 million new TONs that will enter the ecosystem through inflation over the next year.

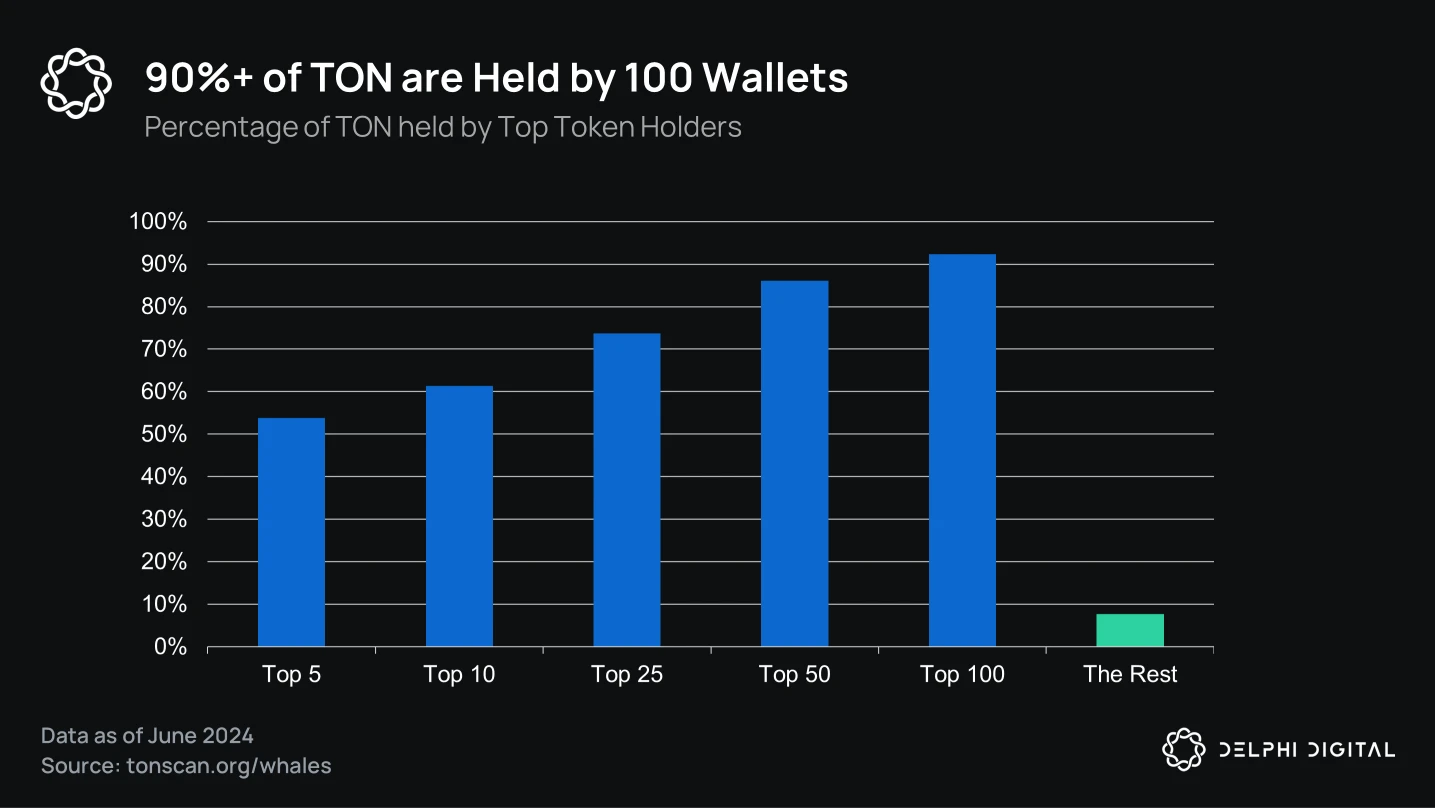

In order to achieve decentralized decision-making, governance rights are distributed to TON holders in proportion to the TON they hold. While governance is not the primary function of the token, it is a supplementary function that theoretically plays an important role in shaping the future of the protocol. However, the high degree of centralization - the top 100 holders hold 92% of the supply - greatly limits the role of decentralized decision-making through governance rights.

The Ton Believers Fund is TONs steadfast core community. Over the past five years, more than 1.3 billion TON has been locked in the fund, accounting for about 25% of the total supply. In 2023, the fund stopped accepting deposits and began a two-year hard lock-up period, after which the locked tokens and rewards will begin a three-year linear unlocking period. While locking a large amount of supply for five years reflects the long-term belief of the TON community, it also further centralizes governance. In addition, the incentive plan is unclear, as stakers rewards come from donations and a proposal passed with a 99.4% approval rate, which approved the distribution of 1 million TON (<0.1% of staked tokens) to stakers.

TON is gaining a lot of attention

TON has suddenly achieved explosive growth, and ecosystem dApps have been breaking records. Notcoin has reached 40 million users in six months, and Hamster Kombat has more than 200 million registered users and more than 30 million DAU. This is similar to the rapid growth of early social games mentioned above, such as Farmville and Sheep, but this time it highlights the powerful power of cryptocurrency in growth incentives.

Source: Tokenterminal

Telegram’s announcement in late February that its ads would share 50% of revenue with channel owners through TON is a big reason why TON has gained attention. Implementing a convenient payment channel opens up a huge potential market for advertisers who can now access Telegram’s massive user base. TON tokens rose 40% on the day of the announcement.

The developer community of the TON ecosystem has grown steadily between Q1 2022 and Q4 2023. In Q1 2022, TONs Telegram developer community had about 2,200 users, and by Q4 2023, that number had risen to 13,500. As of June 2024, the number of users has grown by nearly 100% to 36,500.

The number of Chinese developers has increased significantly recently, from 2,300 to more than 7,300, an increase of more than 300%, but the Russian community has only grown by about 50%, which shows that the Chinese community interested in cryptocurrency is increasingly interested in TON.

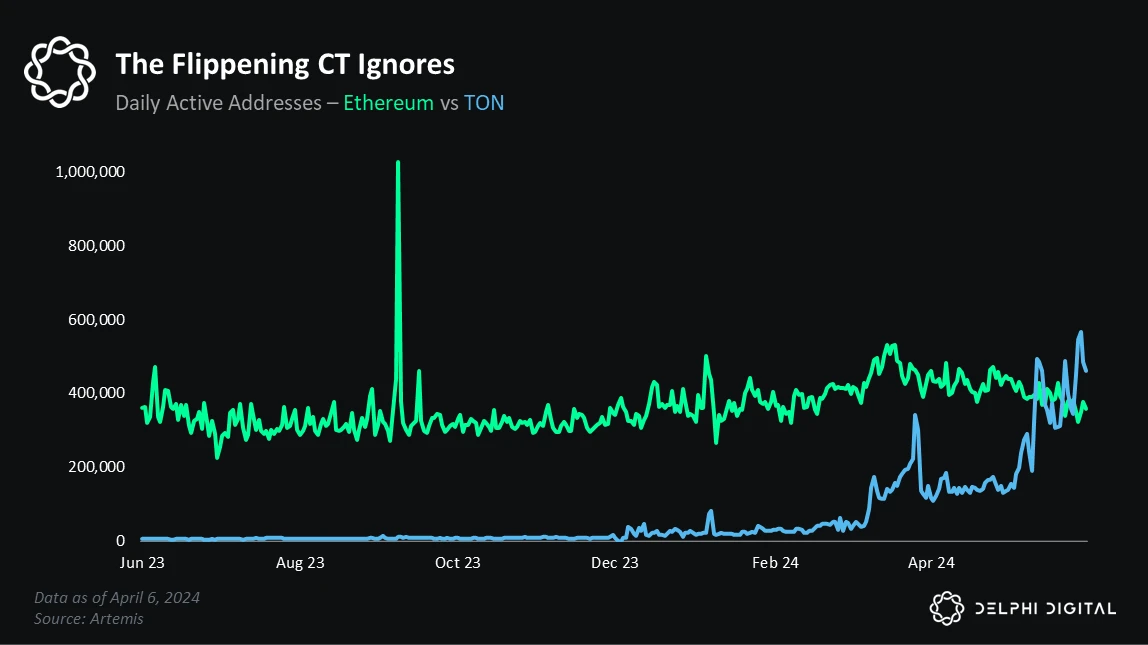

TON’s daily active wallets and transaction volume showed an upward trend in the second quarter, mainly due to the popularity of Notcoin and Hamster Kombat. This trend is also reflected in the number of wallets, wallets activated on the chain, minted NFTs, and overall DAU. TON’s various activity indicators have begun to show exponential growth.

TON Growth Plan

The TON Foundation plays a key role in overseeing and driving the development of the ecosystem. As a non-profit organization, its mission is to incentivize innovation to benefit the entire TON ecosystem. Supported by the $90 million Ecosystem Fund established in 2022 and the recently established $30 million TON Community Rewards Program, it makes various investments and grants to promote native dApps on TON.

Their accelerator program has gained a lot of attention since March. Of the 82 proposals approved on Questbook, 17 were games or gaming infrastructure, making GameFi one of the most represented industries. TON recently announced a new $5 million TONX accelerator program, which will help further drive TON’s growth.

Community incentives are an important part of TONs long-term growth strategy. Most programs last 2-4 weeks and are designed to be very easy to understand to attract as many participants as possible. To date, TON has distributed over $40 million, with many other programs ongoing or planned. Between airdrops, LP bonuses, and The Open League rewards, $22.4 million has been distributed, of which 17% ($3.9 million) has been allocated to games.

Source: ton.org

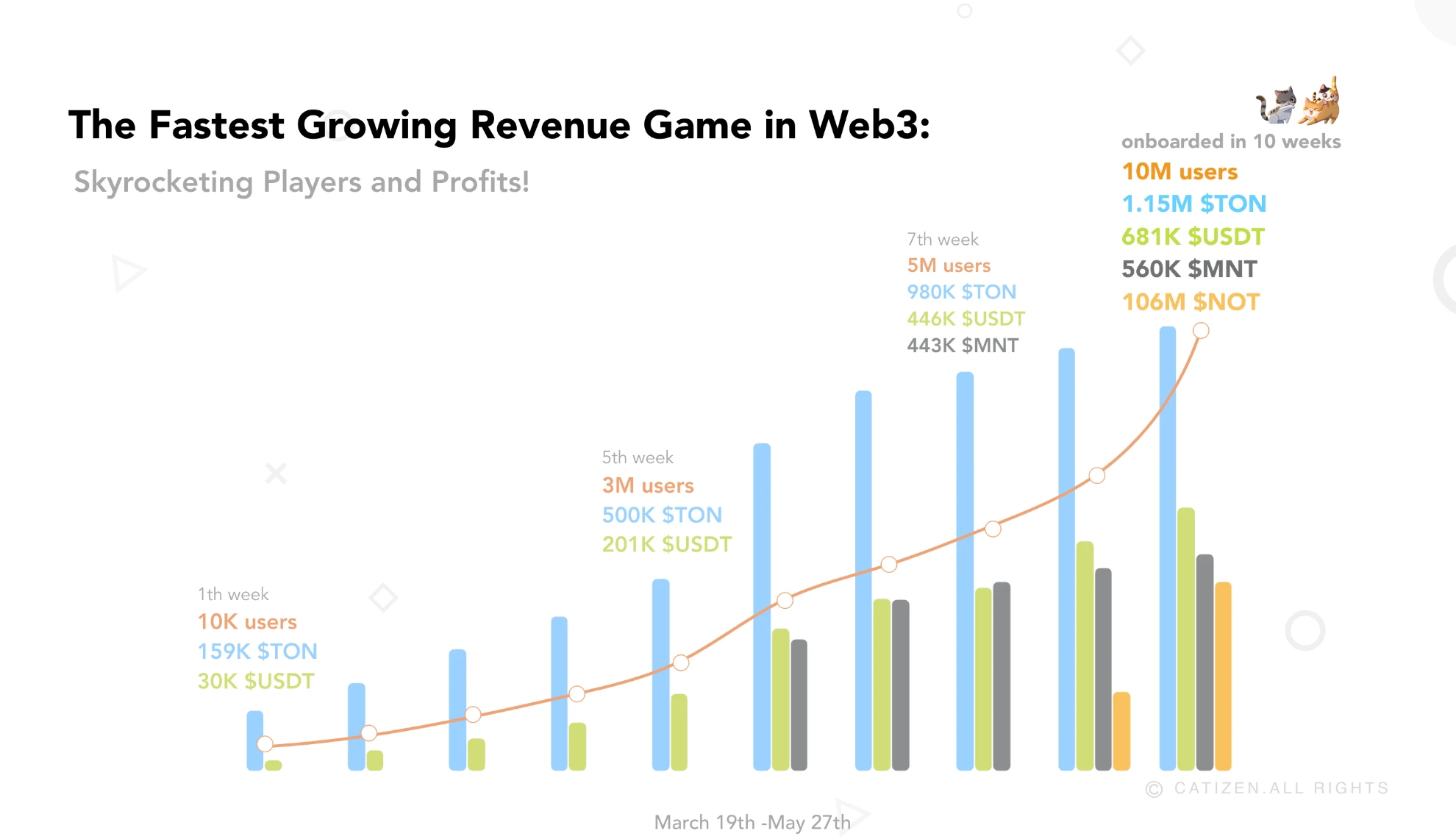

TON Games was very successful in these competitions and occupied several top rankings. TAP Fantasy took second place in the Beta season and then won the championship in the first season. The championship in Season 2 and Season 3 was won by Catizen, a game developed by a Chinese team with experience in WeChat mini-games.

Gaming is one of the main ways TON will generate meaningful and sustainable user traffic. Teams like Catizen have been able to generate over $10 million in revenue from in-game purchases in the last three months, proving that teams with commercialization experience can turn partially hype-driven user metrics into meaningful revenue streams.

Source: Catize

While the above numbers are impressive, teams building on TON need to prove their ability to sustain operations and convert free users into paying customers without an infinite inflationary token reward strategy. User acquisition is the first step, but retaining users requires continuous operation of updated content, especially in an attention economy like Web3.

In addition, robots are also a problem. If there are no effective countermeasures, token rewards will attract a large number of robots to dilute player rewards and increase selling pressure after airdrops.

Game User Acquisition

User acquisition (UA) has become a key metric for any mobile gaming studio. In an industry that is extremely competitive and profit-thin, expanding the user base is crucial to sustainable success. According to CNBC calculations, the gaming industry has an operating profit margin of less than 6%, forcing companies to cut costs on all fronts.

Source: 42 matters

There are more than 300,000 game apps in the Google Play Store and more than 225,000 game apps in the AppStore. With so many games competing for the approximately 2.2 billion mobile gamers worldwide, UA costs have increased dramatically. In 2018, the cost per install (CPI) was approximately $1.24 on iOS and $0.53 on Android. Just six years later, it has risen to $2-5 on iOS and $1.5-4 on Android.

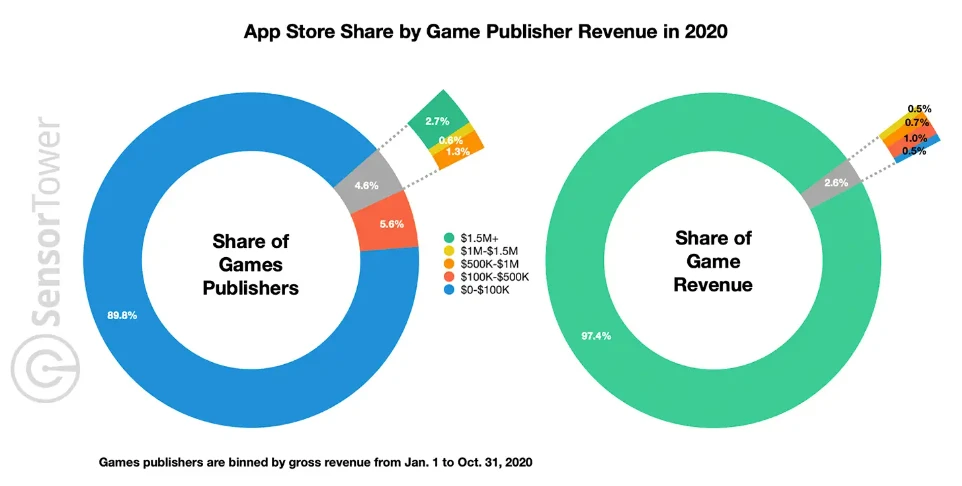

Source: SensorTower

According to a report by Sensor Tower, in 2020, 28,000 mobile publishers had revenues below $1 million, accounting for a total of approximately $834 million (2%) of AppStore game revenues, compared to a cumulative revenue of $34 billion (98%) for 940 studios with revenues exceeding $1 million, indicating that small studios that cannot afford large UA expenditures are at a great disadvantage. If you consider that approximately 60% of gaming time is spent on games that are more than six years old, it is not surprising that 83% of mobile games fail within three years of launch. For new mobile studios that want to be sustainable, efficient UA has become the basis of survival.

To help developers in an increasingly competitive mobile market while further improving the Web2→Web3 pipeline, Telegram recently launched stars, a native in-app purchase (IAP) currency that can be easily integrated into bots and mini-games. Users can now seamlessly purchase in-game items with this AppStore-compliant currency, unlocking deeper player spending and a more stable revenue stream for developers, who will receive a 70% share of IAP.

By subsidizing ads purchased with stars, Telegram enables the team to significantly reduce customer acquisition costs, making Telegram and its Web3-friendly user base an attractive platform for Web3 marketing. In addition, stars can be converted into TON tokens, effectively connecting them to a more liquid market. As long as TON tokens remain stable, developers will have a stable and efficient income.

Considering the rising cost of user acquisition for mobile games and Telegrams large crypto-friendly user base, TON has the potential to become a valuable channel for Web3 game traffic. Although the technology stack limits the scope of games that developers can build on Telegram, the large user base, low platform development costs, and low-friction environment make it a strong competitive platform in the Web3 gaming ecosystem.

Telegram’s unique positioning makes it an ideal platform for mobile gaming user acquisition, and perhaps mature gaming projects will take advantage of this channel in the future. By building a free gaming experience on TON that can be logged in with minimal friction, teams can acquire users widely and use in-game rewards as an effective bait to introduce new potential players into their ecosystem.

Can Telegram replicate the success of WeChat Mini Programs?

While some readers may naturally compare today’s Telegram Mini Program gaming ecosystem to the early WeChat Mini Programs and get excited about the exponential growth that can be foreseen in the future, it is still necessary to point out some obvious gaps between the two before expounding on the positive point.

Telegram can’t replicate WeChat’s success

While not impossible, it is unlikely that Telegram will become a universal app on the same scale as WeChat in the next five to ten years. User behavior on the two platforms is completely different, and for WeChat, the number of competitors competing for user attention and consumption in China (the worlds second largest economy) is far smaller than Telegrams global audience and market.

Furthermore, WeChat directly benefits from its highly centralized structure. Tencent is a global tech giant with direct ties to the Chinese government, and as such, WeChat not only benefits from Tencent’s vast ecosystem of products and services, but also from a highly favorable regulatory environment that has accelerated the app’s growth in domestic market share.

WeChat Pay is an example of a highly centralized platform whose success is difficult to replicate. Due to its absolute dominance in the domestic market, WeChat has direct integrations with almost all Chinese banks. Therefore, in many cases, users have fewer steps from playing a game to purchasing it than downloading an app from an app store. In contrast, TON users must first purchase a certain number of Stars or deposit cryptocurrency directly before they can make in-game purchases, so player conversion rates are relatively low and may persist.

Another key point is user acquisition. While Telegram allows you to reduce ad spend by using Stars, this does not change the fact that ad services on the platform are limited. The best that Telegram mini-game developers can hope for is to identify users who have opened certain mini-programs. WeChat has rich data, including financial, credit, and social scores of all users.

Furthermore, while ad services may improve over time and more third-party integrations (such as its WeChat and TikTok partnerships) are introduced, Telegram’s privacy-centric value proposition means that highly detailed data (such as demographics and location) may remain unavailable.

Telegram is expected to become the next social gaming giant

Still, Telegram/TON has many unique features that distinguish it not only from WeChat, but from all other Western social apps. The creation of TON immediately positions Telegram as one of the largest on-ramps for Web2 users into Web3. This makes Telegrams ~900 million MAUs one of the largest pools of Web2.5 users and a distribution channel for nearly all major cryptocurrency markets.

In addition, unlike centralized exchanges such as Coinbase and Binance, Telegram is essentially a social application, which means that user behavior within the application is completely different. In other words, since users log in to Coinbase to trade cryptocurrencies (a highly isolated and serious behavior), when users see any leisure entertainment or social functions, there will undoubtedly be a higher tendency to resist or churn, while social-related applications (such as games) on Telegram are easier to integrate and have better product-market fit.

Based on the case studies presented above, the Telegram user base seems to be a perfect fit for an application that combines a social application with highly financialized incentives. Even assuming that 80%+ of these “users” are profit seekers with no stickiness, the metrics for these simple games still exceed many of the big budget games of this and last cycle.

Looking back at the WeChat Mini Program growth section mentioned above, the ecosystem will only truly grow when more cross-platform user acquisition channels are open and the cost per customer acquisition is reduced. Telegram should learn from this lesson and make third-party integration a priority, despite the risk of user cannibalization. Combined with a deeper understanding of native user behavior and genre-market fit, this will provide a rare growth opportunity for professional operation and commercialization of Telegram Mini Games.

Alternatively, many developers may continue to choose Telegram as the preferred UA channel. After all, even with a high ceiling, only about 30% of WeChat mini games do not have independent apps, and most other mini games operate with independent apps to enjoy the benefits of cross-platform UA, cross-platform games (players using multiple platforms usually spend more), and a larger potential market.

in conclusion

TON has received a lot of attention in recent months, with the mini-program game ecosystem led by Catizen, Notcoin, and Hamster Kombat leading to a sharp increase in on-chain activity. This year, hundreds of millions of anonymous users are playing TON games and have invested tens of millions of dollars in the ecosystem.

In the short term, many teams may take advantage of TON’s current attention and try to divert users from the platform to their games or protocols. However, if we assume that the tools to support developers will gradually become more complete, then learning from platforms such as WeChat and applying it to native games on Telegram will become a direction worth paying attention to in the medium and long term.

The second half of 2024 is critical for TON Games. After the initial explosive growth of users laid a solid foundation for the ecosystem, the focus of the ecosystem has now shifted to retention and user lifetime value (LTV). Compared with UA, these two key sustainability indicators rely more on content than virality, which will force the team to execute meaningful operations to achieve sustainable development.