For BTC, positive news from the traditional market has continued to emerge in the past 24 hours. For example, Trump chose JD Vance, a senator who supports cryptocurrency, as his presidential running mate; BlackRock CEO Larry Fink also acknowledged the financial value of Bitcoin in an interview, changing his previous skeptical attitude; ETF Flow is also continuing, with about $300M of funds flowing into the digital currency market during the day. But just as the price of the currency challenged the high ground of $65,000 amid the cheers of the community, according to Arkham data, the MtGox wallet address transferred 0.021 bitcoins to a newly created address, which may be a transfer test. The market sentiment suddenly turned, causing the price of the currency to fall below $62,500 in the short term, but after calming down, it rebounded back to the middle line of the Bollinger Bands, about 63,500.

Source: TradingView

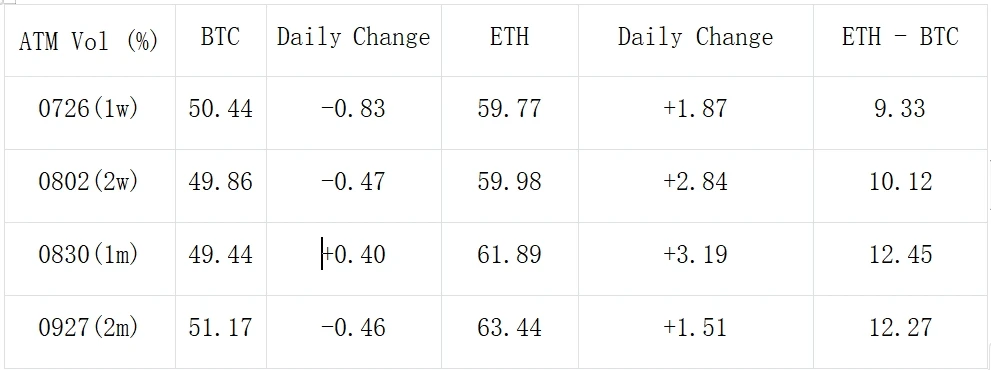

Although Mentougou only conducted a small test, traders in the options market always took the lead in showing a confrontational attitude, pricing in the potential uncertainty of future sell-offs in advance, causing BTCs medium- and long-term IV to rise rapidly by 4% Vol, narrowing the gap with ETH.

Source: SignalPlus

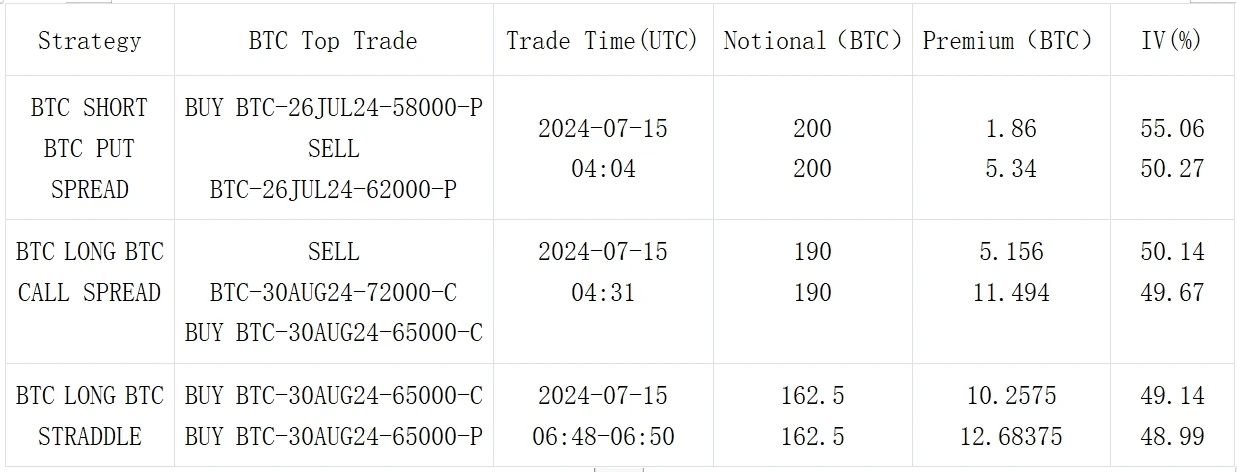

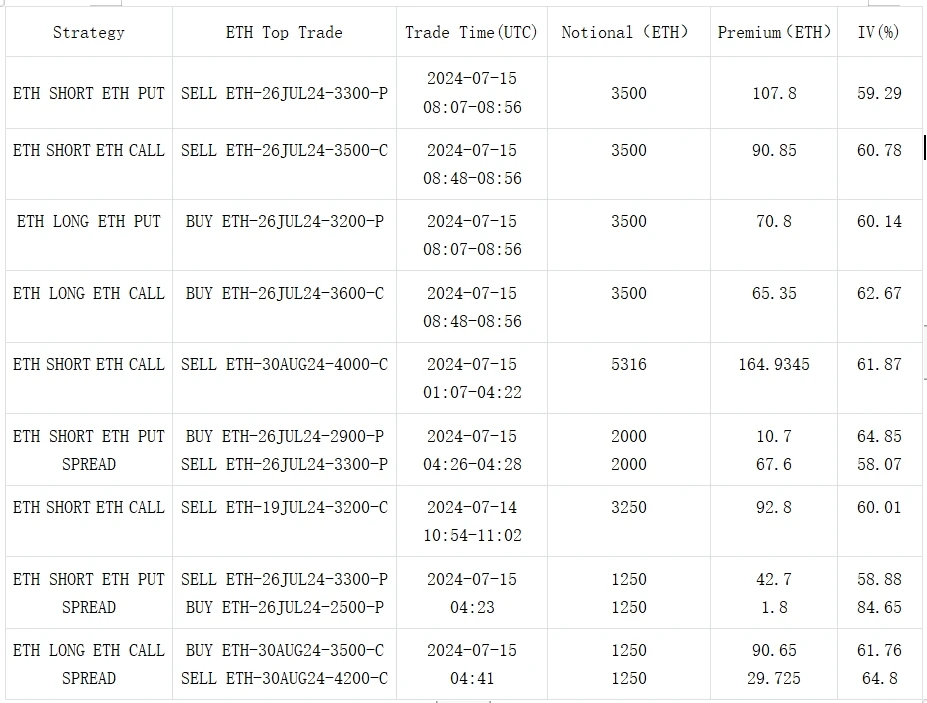

From the perspective of ETH, the U.S. Securities and Exchange Commission (SEC) postponed the approval date of multiple spot Ethereum from July 18 to July 23, continuing the previous trend of postponing the date. Despite this, the community remains optimistic about this, believing that regulatory acceptance of crypto products has increased and expecting a large amount of funds to flow into the digital currency market. As a result, ETHs IV for late July and early August expiration dates rose by about 2+%, and option strategies represented by 26 JU L2 4 3600/3800 Long Call Spread (3100 ETH per leg) and Buy 2 Aug 3700-C vs Sell 30 Aug 24 4000-C (7375 ETH per leg) appeared in the block market, expressing a positive attitude towards short-term price upside.

Source: Twitter

Source: Deribit (as of 16 JUL 16: 00 UTC+ 8)

Data Source: Deribit, overall distribution of ETH transactions

Data Source: Deribit, BTC transaction overall distribution

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com