Key indicator: (21 Oct 4 pm Hong Kong time -> 28 Oct 4 pm Hong Kong time)

BTC/USD price is stable ($ 68,500->$ 68,500), ETH/USD price drops -7.5% ($ 2,725->$ 2,520)

BTC/USD ATM vol at the end of the year decreased by -1.6 points (55.9->54.3), and 25-day skewness at the end of the year decreased by -0.6 points (4.3->3.7)

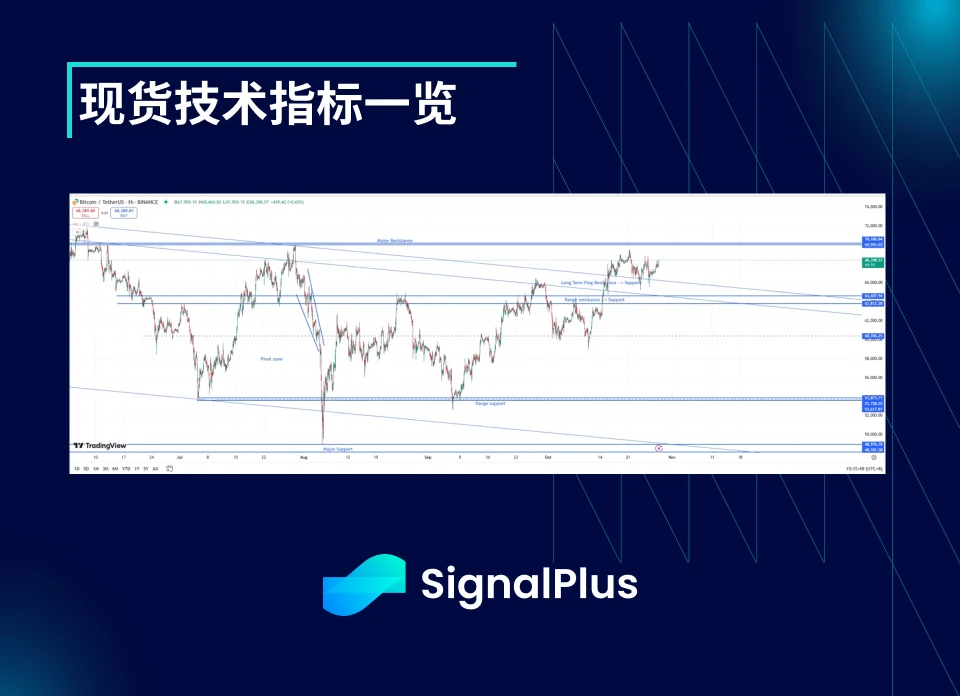

Spot technical indicators at a glance

The BTC spot market has been very restrained over the last week, staying between 69.5k and 65k. We continue to observe that the market is trapped between the support of the long-term flag pattern and the resistance above it at $70.25k. Therefore, we expect the market to continue to remain in this range for the next few days.

Considering the current state of the market and Trumps rising chances of winning the election, we believe that the market will try to break out of this range in the coming week and until the election.

Market Theme

Global markets remained calm all week as everyone was eagerly waiting to see the outcome of the US election. Generally speaking, no news is good news. Risk assets continued to rise slightly as US data remained relatively stable.

Although Israel fired rockets at Iranian military bases over the weekend, the market generally viewed this as a de-escalation move, as the strike was very targeted and Iran denied being affected. This incident shows that the United States has the upper hand over Israel and eliminates the tail risk brought by this geopolitical situation.

The Wall Street Journal reported on Friday evening that the U.S. government was investigating Tether, causing USDT to briefly fall below its peg and putting pressure on the entire cryptocurrency market. However, Tethers CEO denied the speculative report, and no further confirmation news emerged over the weekend. The cryptocurrency market subsequently recovered and the price of USDT returned to a level slightly below the peg.

Trumps odds of winning the election continue to climb (65-66% approval rating), while the odds of a Republican victory have also increased from 42% to 48%. Other markets have clearly begun to prepare for a Trump victory, but the crypto community is waiting for further confirmation before attempting to break through BTCs all-time high.

BTC Implied Volatility

It was another week of low realized volatility. Bitcoin prices were stable between $65k and $70k before the election. Bitcoin found good support in the $65k to $66k range, and after several failed attempts to break through $69k, the price of Bitcoin could not show any upward momentum.

Implied volatility levels have generally trended lower this week (except for November expiring contracts) amid a quiet spot market and more selling pressure from year-end vs. March next year. Although the absolute level of implied volatility looks lower, it still represents a fairly high premium compared to actual volatility.

Implied volatility for November expiry is bucking the trend and rising from last weeks lows. As the US election approaches, demand for options has started to increase. Interest ranges from pure buying straddles/wide straddles, buying call spreads to buying put protection. As the breakeven point for the day is still hovering around 6%, we expect demand for options for the November expiry to continue to increase in the coming week.

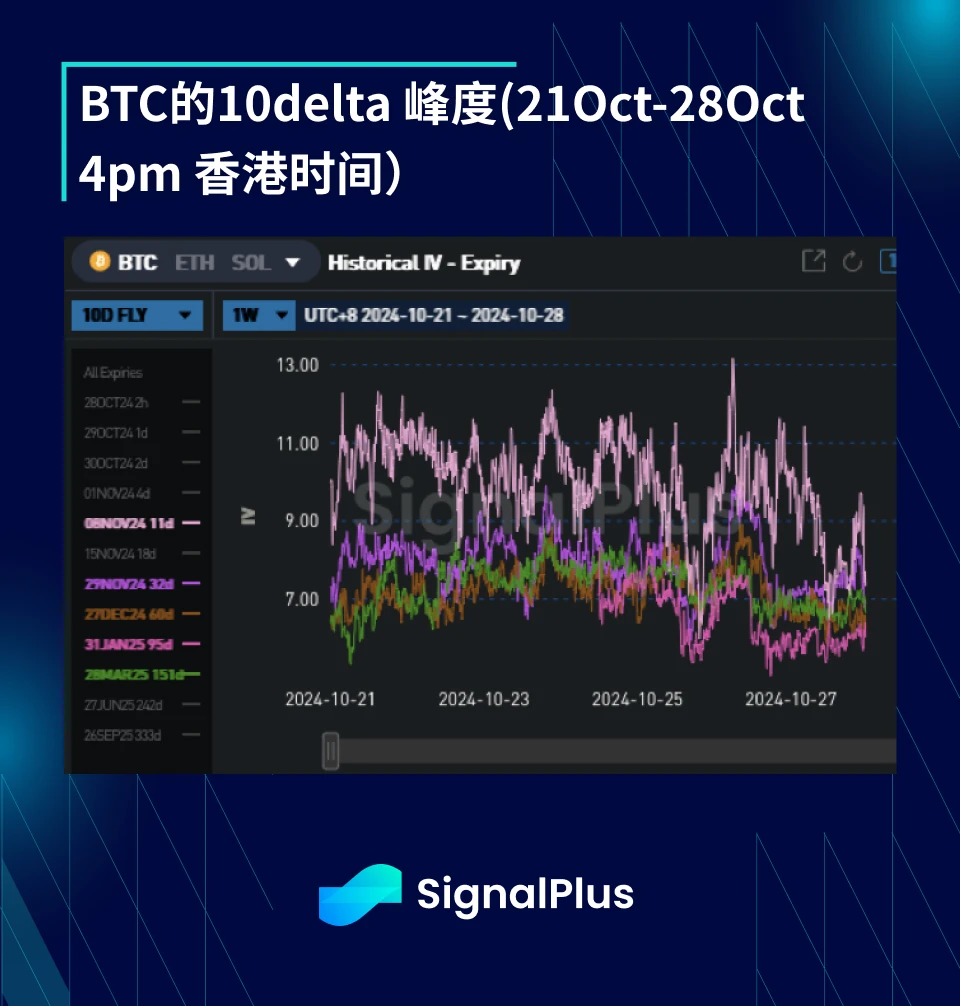

Skewness/Kurtosis

Overall, prices for skewness are generally back to highs from early last week, with Tether falling slightly on the news, but ending the week only slightly lower than it started. The general lack of interest in holding options in the 50k-60k strike range (except perhaps for short-term tail hedging for the election) offset the poor performance of spot actual volatility at price highs. More specifically, the market is more interested in the upside risk of a new all-time high in the case of a Trump election/Republican victory, which supports volatility skewness.

The level of kurtosis has not changed much, and the market has little interest in trading on the wings in a falling volatility environment. However, if the coin price moves sharply, changes in volatility and changes in skewness will be reflected on both wings, which provides support for the kurtosis to remain at the current level.

I wish you all a smooth trading week ahead!

You can use the SignalPlus trading vane function at t.signalplus.com to get more real-time crypto information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com