Original author: SecondLane

Original translation: TechFlow

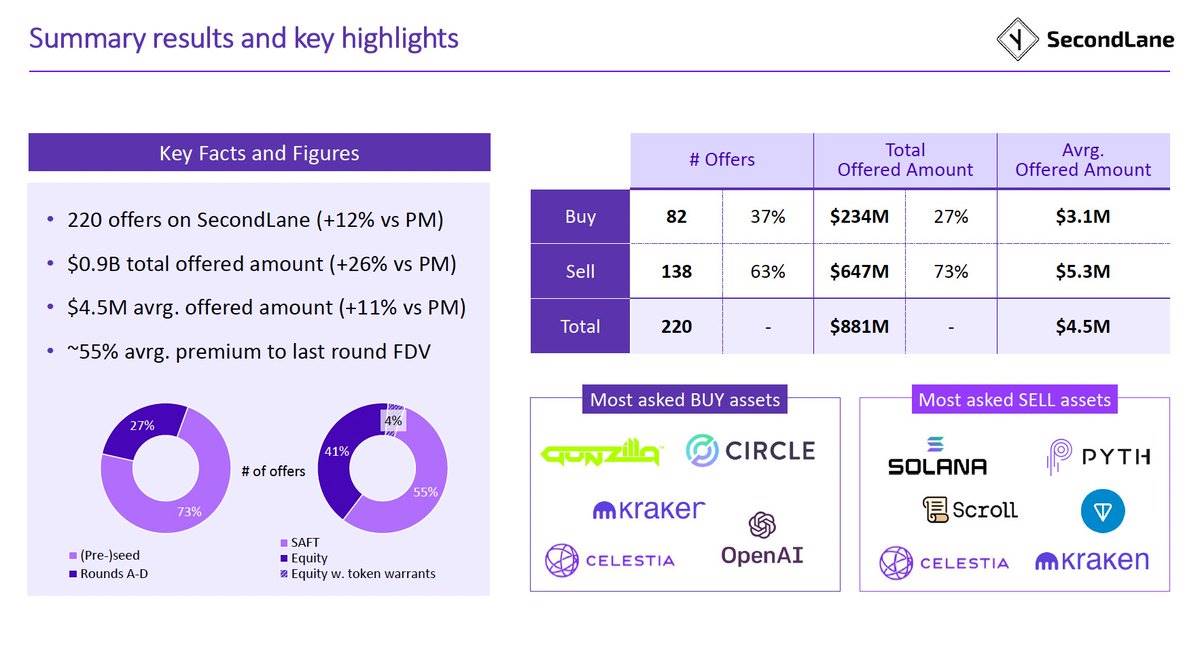

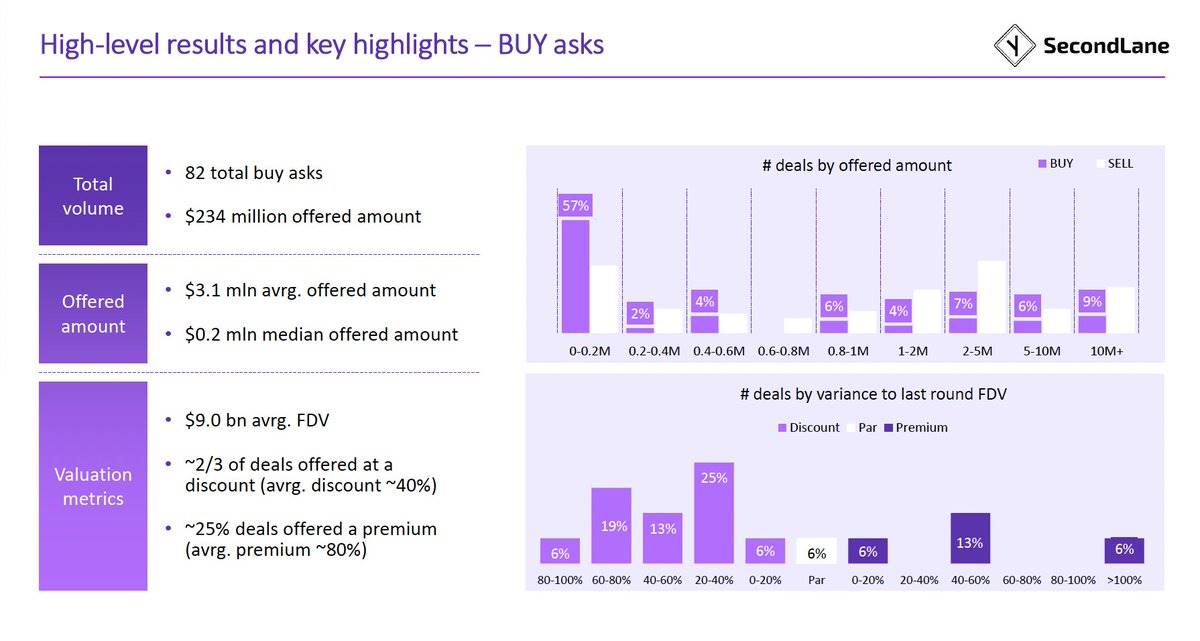

June was the first month this year that clearly showed a buyer’s market, with buy requests outnumbering sell offers by 75%!

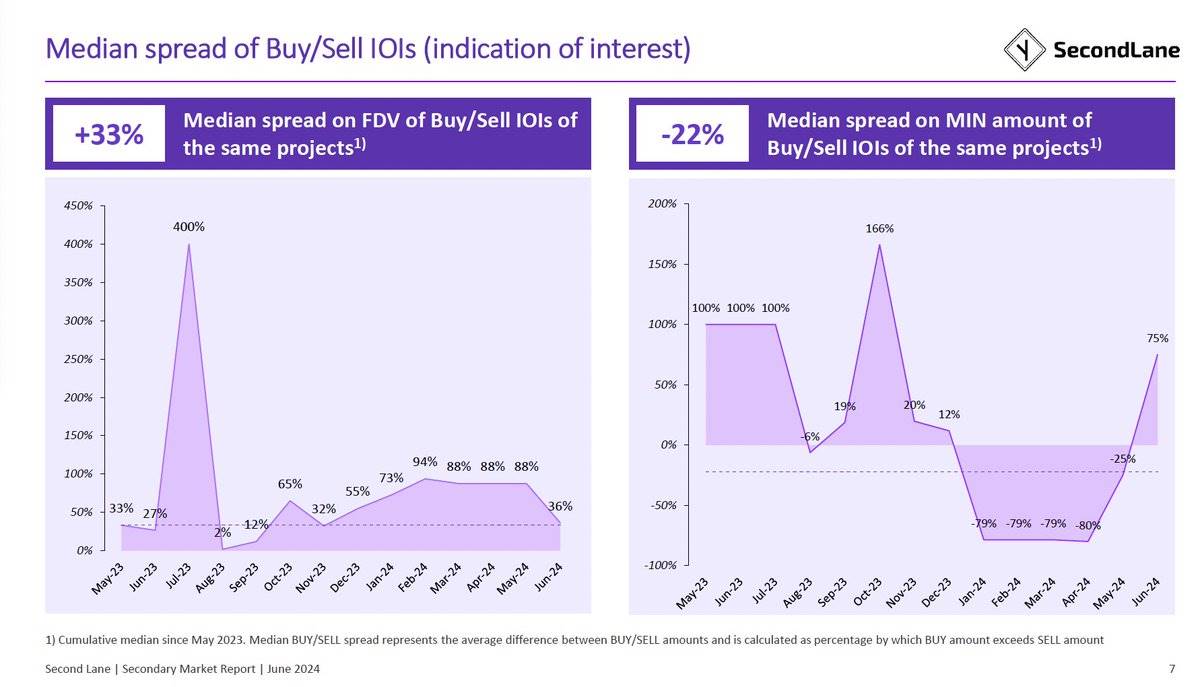

The valuation gap between bid and ask prices for the same asset fell to 36% from 88% last month

The total order book value for June 2024 is $883 million

The average asking price was $4.5 million, up sharply from $3.9 million last month.

The average premium was 55% of the last fully diluted valuation

Major projects: Circle, Solana, Scroll, Kraken, Celestia, TON, Pyth, Gunzilla, OpenAI

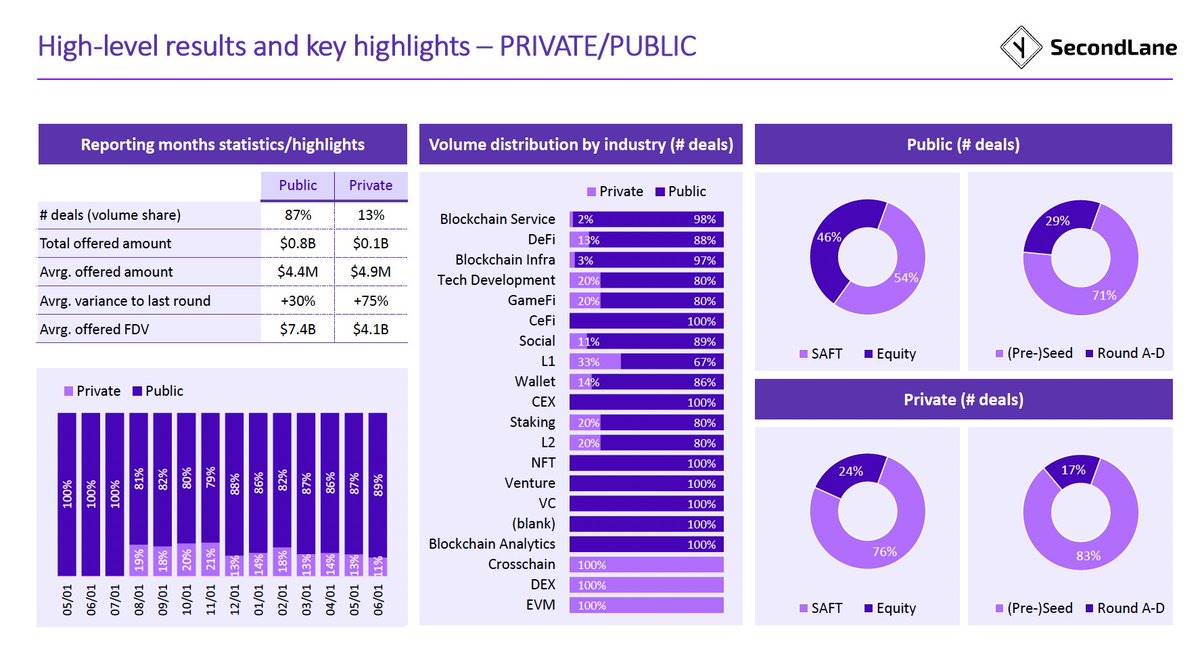

57% of transactions were SAFTs and 44% were equity transactions

73% of deals were (early) seed rounds, and 27% were Series A to D rounds

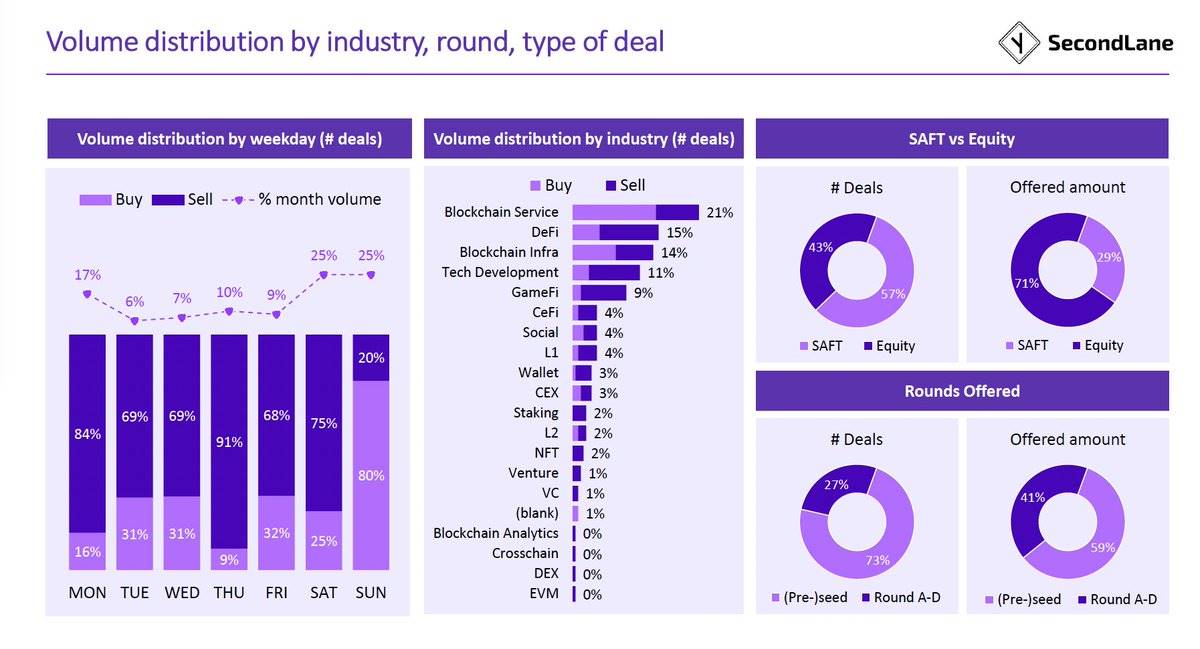

70% of transactions are concentrated in five areas: blockchain services, DeFi, infrastructure, technology development, and GameFi

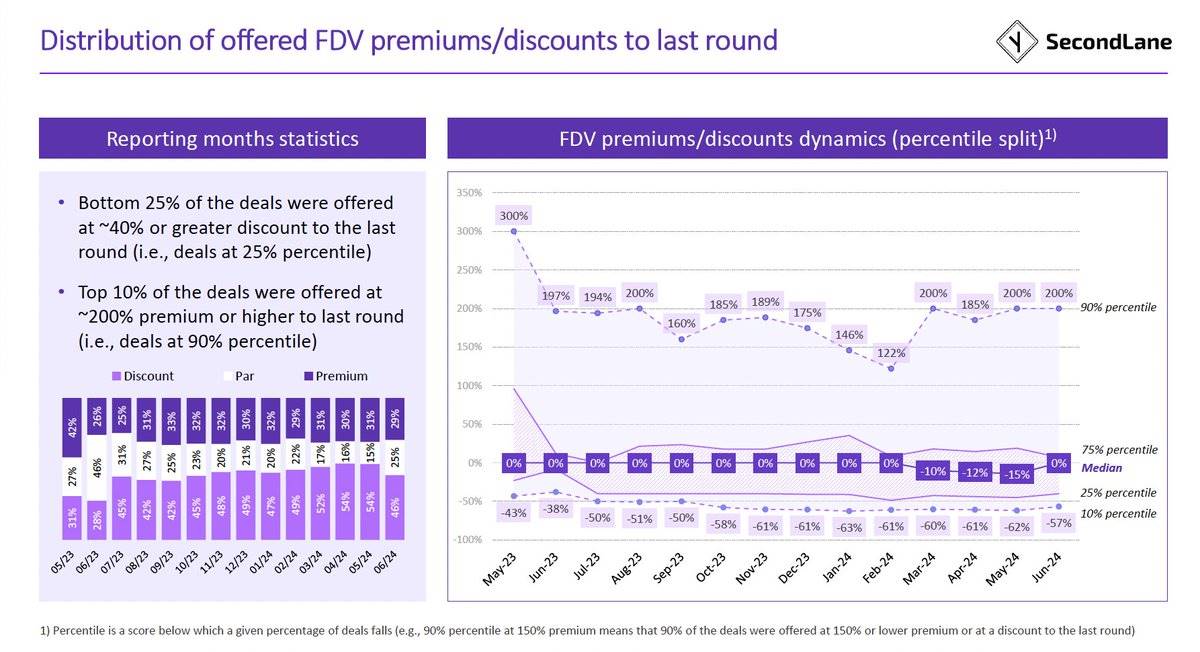

Deals with a previous round premium decreased by 2%

The number of transactions was the same as the previous round, an increase of 10%

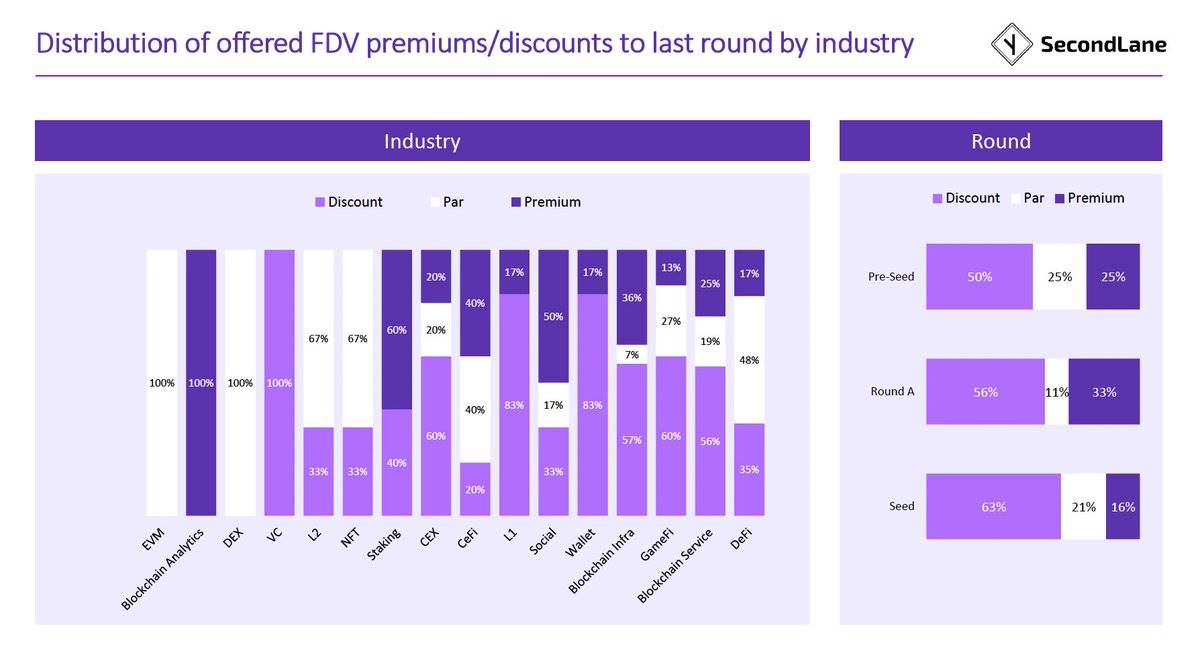

46% of deals in June were at a discount, 25% were flat, and 29% were at a premium to the previous round

The median discount across all deals in June was 15% of the previous round

The top 10% of deals offer a 200% or higher premium over the previous round

The bottom 25% of deals offer discounts of 40% or more from the previous round

Enjoy the biggest discounts on LP positions in VC funds, CEXs, L1s, wallets, GameFi, blockchain infrastructure and services

(Note from Shenchao: The term “discount” in this article refers to a discount in a transaction, which means that the transaction price of some assets is lower than its previous round of financing or market price. For example, some transactions are conducted at a price lower than the previous round of financing, which is called a “discount”)

Blockchain analysis and staking projects enjoy the highest premium

Series A projects enjoy the highest premium, and seed round projects enjoy the biggest discount

13% of deals floated without public exposure and at lower valuations ($4.1 billion fully diluted valuation for private offers vs. $7.4 billion for public offers)

Most private placements were SAFTs (76%), at (early) seed stage (83%), targeting DEXes, EVM, and cross-chain solutions

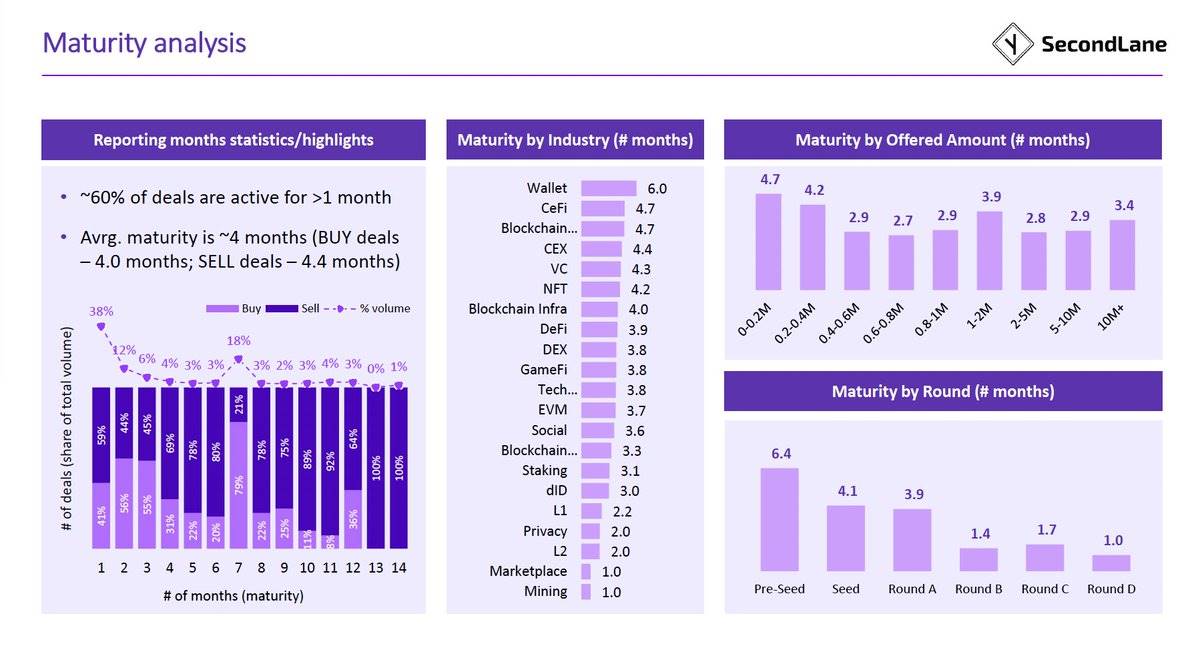

The average time to expiration of trades increased to 4 months for buy requests and 4.4 months for sell offers until expiration or trade completion.

60% of transactions are active for more than 1 month

The maximum expiration time is:

Early vs. late rounds: 6.4 months for early seed rounds; about 4 months for seed and A rounds, and more than 1 month for B, C, and D rounds

CeFi, wallets, CEX projects, VC, NFT, blockchain infrastructure

The median buy request was $200,000 and the average valuation was $9 billion

2/3 of buy requests were made at a discount (average discount was 40% of the previous round or spot price); 6% were flat; 25% required an average premium of more than 80%

The median asking price was $2 million, with an average valuation of $6.5 billion

40% of deals were done at a discount (average discount was 45%); 32% were flat; 29% required a premium (average was over 270%)