Original article by Stacy Muur

Compiled by Odaily Planet Daily Golem ( @web3_golem )

First there is the web3 stage, and then the protagonist will be born.

When a protocol becomes popular, we can see people talking about it on social media, and all other projects either start to fawn on it or start to imitate it. You should know that feeling, you definitely feel it on Pump.fun, and if you are experienced, you can also find the same feeling on FriendTech, Farcaster, Bananagun, Unibot, etc. They all have their own cycles.

The cruel reality is that the web3 stage is always there, and the hype will always continue, but the protagonists always change frequently. Its not because the product failed, but because people found something more dazzling. In this field, people only stay fresh for a short time for new things, and the spotlight will never stay for too long .

This is not a eulogy. While not all once-hot protocols are dead, they all go through cycles of popularity and obscurity. This post is about the projects that once had a halo and what it looks like when they are no longer in the headlines.

Who is a faded star?

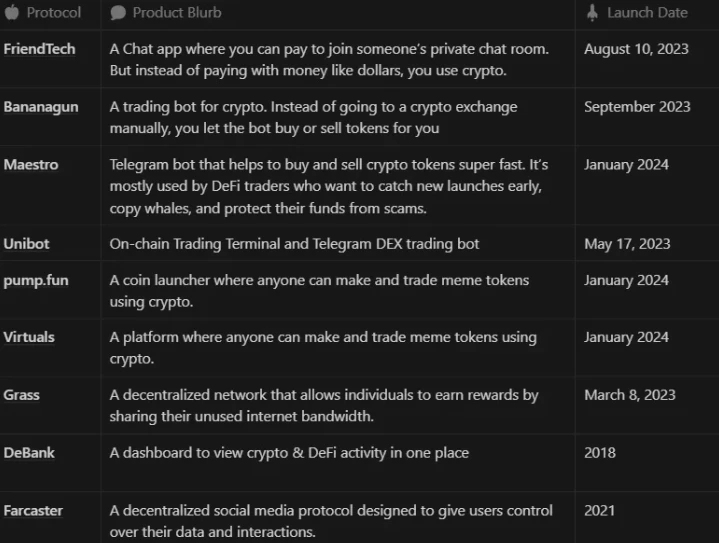

If you’ve been around web3 long enough, you’ve seen a cycle: a protocol becomes popular, takes over everyone’s timeline, and then disappears. The chart below is a snapshot. It doesn’t measure total locked value (TVL) or token price, it measures something more elusive: attention, memory, and emotional relevance. These projects are former stars, and some are still alive today.

web3 has-been stars

Take FriendTech , for example. Its rise was rapid and high-profile, but its fall was complete. There was no roadmap, no user stickiness, and no signs of recovery. After falling from the altar, people realized that it was just a facade.

Unibot is slightly better. It has experienced hacker attacks, copycat competition and market recession, but it is still recognized as having a better trading experience among similar products.

Virtuals is one of the few companies that not only survived, but also transformed. It started out as a prediction platform based on Base and now positions itself as the Wall Street of AI agents. This transformation is not easy in the crypto space, especially for a project born in a degen casino.

Pump.fun and Maestro are not dead, they are just diluted. They are still operational, still active, and seeing a surge in user activity, but no one is calling them revolutionary anymore. Meme coin machines and sniper bot networks were never built to last; they were built to make a splash. And they have done that, more than once.

There are also some slow-burning projects, such as Grass , DeBank , and Farcaster , which all have their own characteristics: speculative returns, DeFi social identity, and decentralized social networking. They are not flashy projects, nor have they died, they just developed quietly after the hype period.

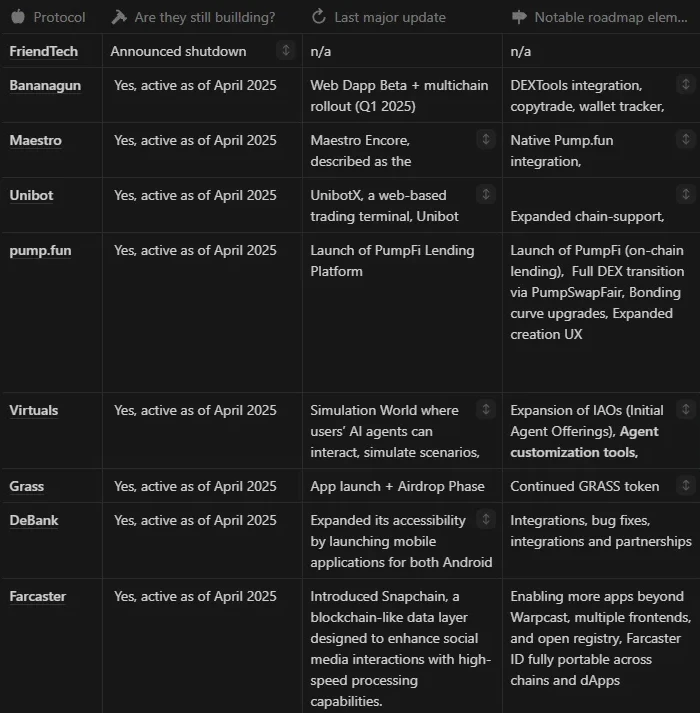

Still building, still iterating

If the first table measures attention, the next table focuses on something completely different: perseverance. The hype period of a project will be lively, but the construction process is quiet and difficult.

Some of the protocols above have not been hyped by the public, but they have not stopped developing. This table depicts the hidden reality of who is still pushing updates, expanding integrations, or strengthening infrastructure long after the spotlight has moved away.

Unfortunately, FriendTech was the first to give up, having officially shut down in September 2024. The remaining projects are still growing quietly, not in the Twitter timeline, but in the project update logs.

Peak activity ≠ project persistence

We can always feel a project peaking. Telegram is stuck and can’t be scrolled, the community is full of copycats and half-baked posts from new friends, and the protocol’s website is paralyzed under the weight of hype. But this state is fleeting, and here are some data comparisons of projects during their peak and after.

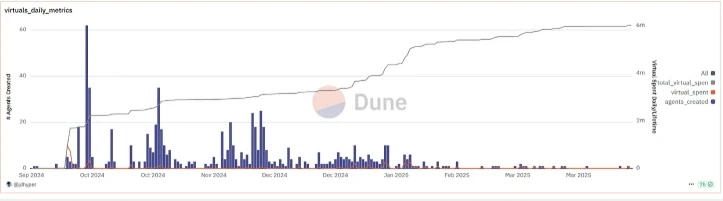

Virtuals

Virtuals saw a peak in agent creation in October 2024, with more than 60 new agents added per day, followed by a wave of experiments in November and December. But by early 2025, the number of daily agent creations had dropped to single digits.

Bananagun

In July 2024, Bananagun s user activity peaked at over 700 million. But nine months later, it was only 124.6 million, a drop of 82%.

Bananagun is still running and developing, but it is no longer the first choice for users. Telegram robots have flooded the market and sniping has become the norm. The market landscape is constantly changing. Bananagun has not died, but has gradually faded out of peoples sight.

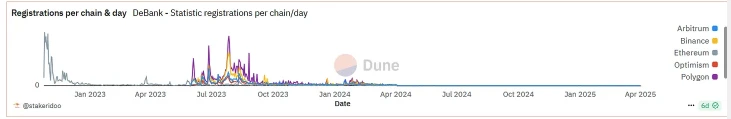

DeBank

DeBank experienced a surge in multi-chain registrations in mid-2023, and then entered a state of stagnation. By early 2024, new users had stopped pouring in. There was nothing wrong with the product itself, it was just that the market landscape had changed. DeFi social sounded good, but people didnt stay for it. Maybe they just tracked a few wallets with DeBank and then left.

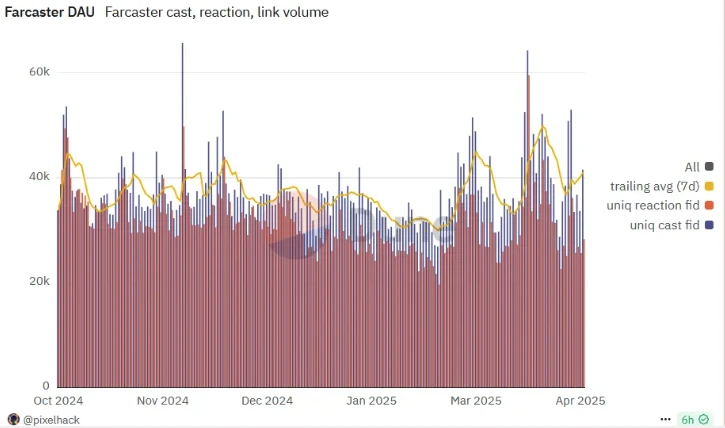

Farcaster

Farcaster is the epitome of quiet complication. Its daily active users (DAU) have remained stable between 20,000 and 50,000 since the end of 2024, and user engagement has remained consistent, with no major spikes or airdrop bait, just real usage. While most social protocols are chasing traffic, Farcaster is building habits, which may be the real advantage.

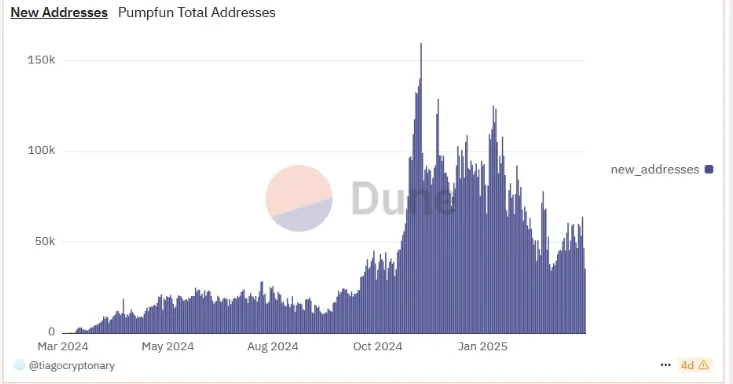

Pump.fun

Pump.fun is like a volcano. At the end of 2024, millions of Meme coins were created on its platform, with more than 150,000 new wallets at its peak. But since then, the trend has dropped sharply, but it has not died. Currently, there are 50,000 to 60,000 Memes created on the Pump.fun platform every day, but it is no longer in the spotlight.

What narratives have we bought into in the past?

You can track the usage of projects on a dashboard. But the narrative exists elsewhere. To understand this, we have to revisit the moment when they truly made a difference. FriendTech turned social influence into liquidity, Pump.fun changed the rules of token issuance, and Farcaster was more than just a social app, it was a web3 declaration of independence.

People dont just use these protocols, they align themselves with them. FriendTech makes us feel powerful, Pump.fun makes us feel smart, and Farcaster makes us feel like were on a purer platform than Twitter.

FriendTech

FriendTech’s narrative was compelling: tokenize your social graph, monetize influence. At its peak, it was more than just a SocialFi tool, it was a status-as-asset. But the narrative eventually collapsed under the weight. No roadmap, no engagement loop, no cultural legacy. This is a rare case where the use case, narrative, and product all disappeared simultaneously. It was both a clean rise and a clean fall.

Bananagun

Bananagun tells a narrative of fair play. Fast sniping, smart token economics, and a bot for everyday traders. It thrived on the Telegram bot wave, earning a reputation for being sharper and faster. It’s still running, still serving traders, but it’s become infrastructure, useful but no longer trending.

Unibot

Unibot focused on trading speed and precision. It positioned itself as a tool for the sharpest Telegram traders, not just a product but an identity. Despite competition and even hacks, Unibot’s image has remained strong. Its functionality has expanded, and its user base has endured. It didn’t rely on virality, but on reliability. This narrative still applies today.

Pump.fun

Pump.fun decentralized token creation and brought with it the get-rich-quick story. At its peak, it felt like a new token was created every 10 seconds, but the market quickly became saturated. Today, it’s still active, but the magic is gone. The “anyone can issue a token” narrative lost its luster in “PVP.”

Virtuals

Virtuals started out as a speculation hub on Base that understood attention but grew to dominate it. It pivoted to an AI agent platform, redefining itself as a narrative larger than a prediction market. Now, instead of chasing memes, it’s building infrastructure. “Wall Street for AI agents” is a bolder and more enduring narrative, and it’s one of the few protocols in this article that’s rewriting its own narrative.

DeBank

DeBank told the market that a user’s DeFi portfolio constituted their identity, and it made wallet tracking social. This narrative worked, but it has stagnated. The DeBank product is still fully functional and highly regarded among advanced users, but it never made the leap from a tool to a network. In a way, DeBank is a victim of its own user experience stability, it is too good to ignore, but not attractive enough to be actively promoted.

Farcaster

Farcaster’s original intention was to own your social network. It is not trying to copy Twitter, but to reimagine the mode of publishing, interacting and building on the chain. The current situation proves one thing: Farcaster has not declined. It has been slowly accumulating trust and attraction. As a long-tail narrative, it will be more resilient if it does not pursue virality.

Which once popular projects are about to die

In addition to the well-known examples mentioned above, there are other protocols that have gained significant attention for a short period of time, but then saw a significant decline in user activity, transaction volume, or related data. These projects are not fringe projects. At their peak, they also led the market narrative and attracted strong attention. This section focuses on some of these cases.

Blast

Blast peaked at 900,000 MAUs during the points-driven boom in July 2024. Currently at around 120,000 MAUs, the revenue narrative quickly died as user points fatigue set in.

Scroll

At the peak of the zkEVM hype, Scroll had 1.2 million monthly active users, but is currently around 111,000. Scroll is still up and running, but the novelty is wearing off as infrastructure shifts to a performance-first narrative.

Starknet

Starknet once had $1.6 billion in bridge deposits, but currently stands at around $390 million. Some developer loyalty remains, but mainstream adoption has been slowed by cost and tooling friction.

Renzo Protocol

Renzo’s monthly active users peaked at 155,000 and are currently slightly below 19,000. Although it still has influence in the liquidity re-staking track, its brilliance has been overshadowed by the more powerful EigenLayer ecosystem participants.

Sushiswap

Sushiswap peaked at $11.3 billion in trading volume. Current trading volume is around $200 million. This is a cautionary tale that shows that fragmentation, governance expansion, and competition from centralized exchanges (CEX) will all weaken the advantages of first movers.

Each of these protocols was once considered an industry leader. While some are still active, their data suggests a shift in how users interact with them today. Is this decline due to changing market conditions, evolving narratives, or simply stronger market forces? The lesson remains the same: early momentum does not correlate with long-term project survival.

in conclusion

In web3, most narratives don’t die, they just stop being talked about. The projects in this article were chosen not because they failed, but because they were relevant for a short period of time. While they did fail, it wasn’t because they lost funding or users, but because they lost narrative momentum — the hard-to-measure force that turns products into action.

The deeper pattern is in the emotional arc of belief. When this arc flattens, users leave, not because they are disappointed, but because there is no longer a reason to stay.

This is why long-lived projects in web3 are so rare. To last, a protocol needs to be not only usable, but narratively vibrant. It needs to provide more than just benefits or tools, but identity, possibilities, and a reason to “come back tomorrow.”

The next narrative breakthrough of web3 will not only come from solving certain problems, but also from some kind of meaning. And those projects worth paying attention to are also quietly building after the hype, waiting for their second moment.