The bankrupt Bitcoin exchange Mt.Gox reported multiple unauthorized attempts to log into creditor accounts in the past 24 hours, causing creditors to worry about the safety of their remaining assets and possible selling pressure on the currency price. The market may be worried that the incident will have an adverse impact on the short-term currency price. Coupled with the sharp drop in ETF traffic in the past two days, the gradually spreading risk aversion has spawned a sell-off of assets, causing the BTC price to pull back below $64,000, testing the key support level again.

Source: TradingView; Farside Investors

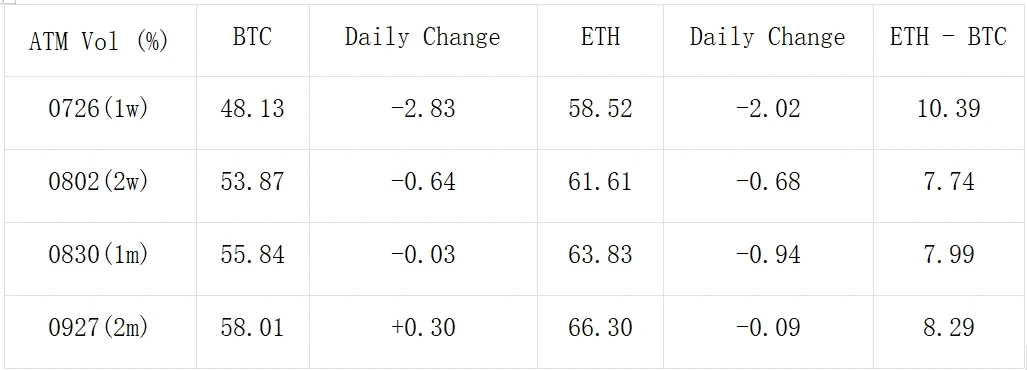

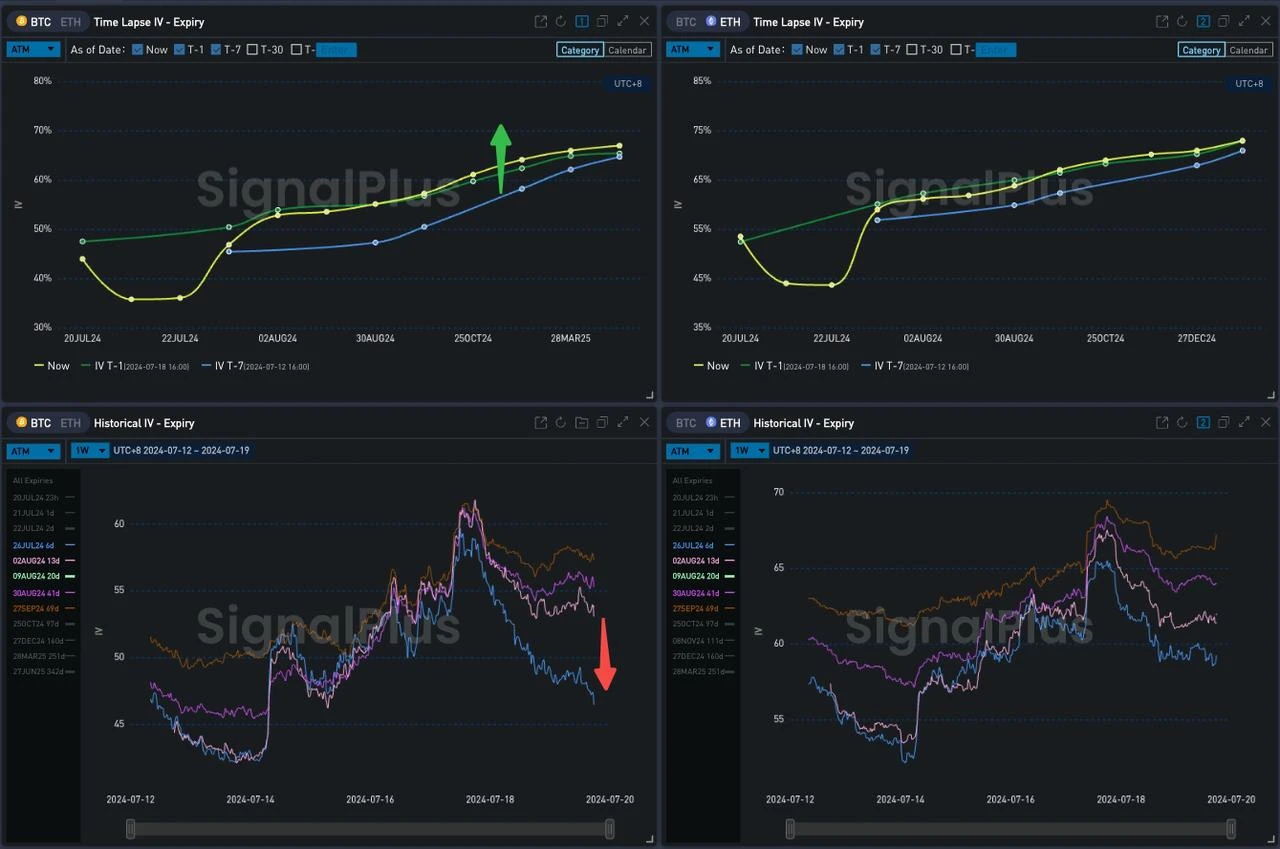

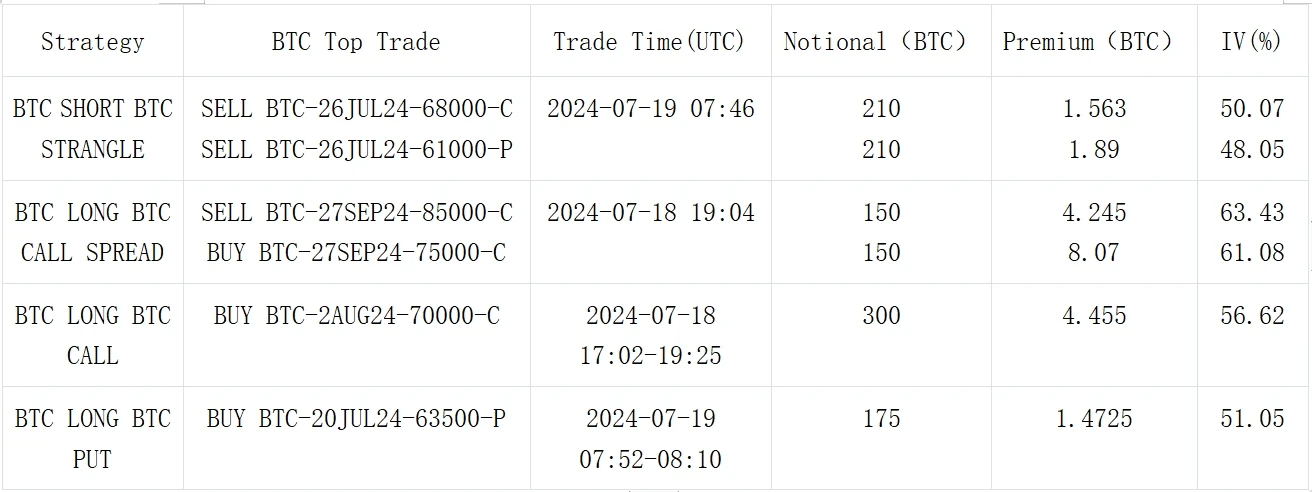

In terms of options, the overall implied volatility level has been relatively stable since yesterdays sharp decline, but it is still at a recent high. There are three changes worth noting. First, BTCs IV and RR at the end of December were significantly higher, which may be affected by the flow of buying a large number of 100,000-C on the Deribit market on that expiration date (see the figure below).

Data Source: Deribit, BTC transaction distribution

Secondly, the steepening of the BTC IV maturity curve is more obvious than that of ETH. Similarly, compared with the end of July and other more distant maturity dates, the gap between BTC maturity dates is more significant, providing a better tool for cross-period volatility hedging.

Source: Deribit (as of 19 JUL 16: 00 UTC+ 8)

Source: SignalPlus

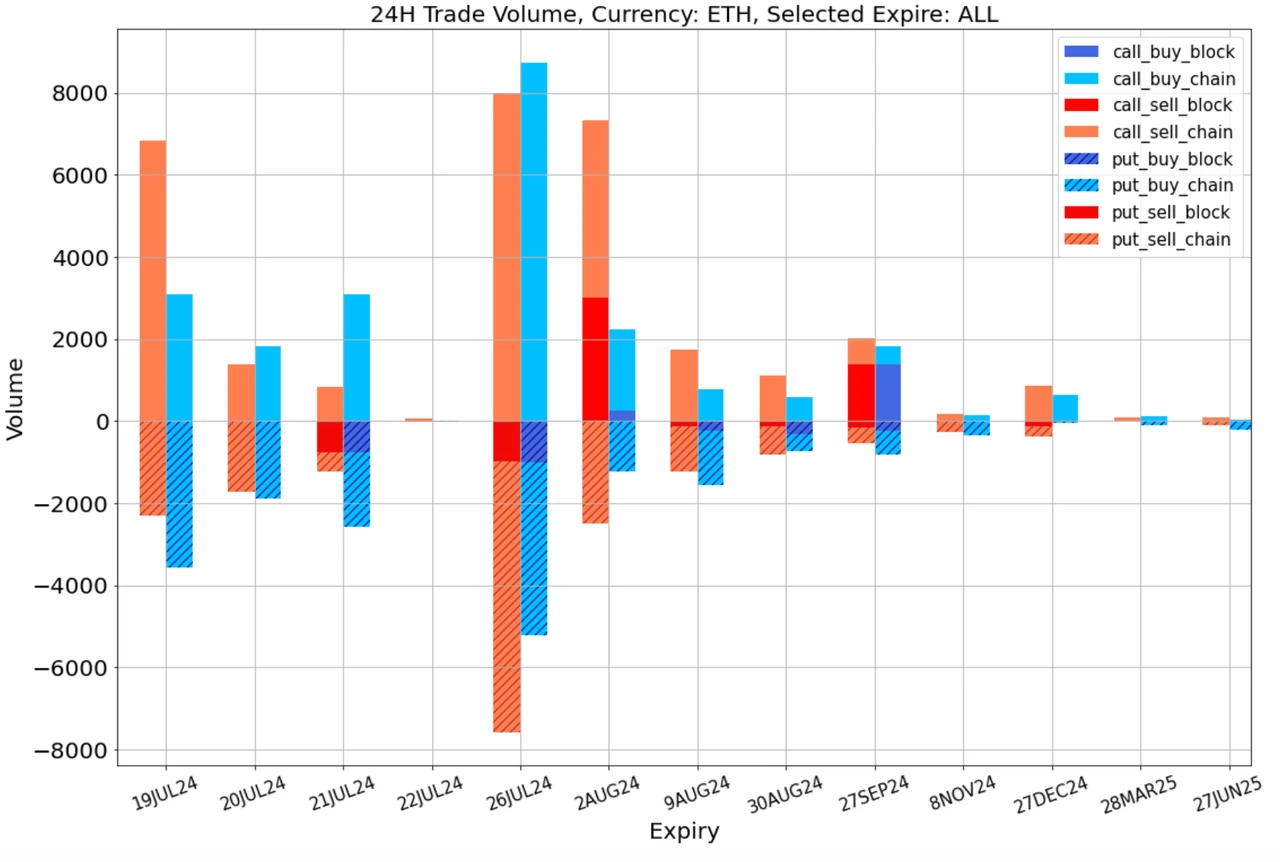

Finally, we also notice that the vol skew of 2 AUG 24 formed a local high compared to surrounding maturities, however BTC and ETH traded very differently on this expiration date, with BTC being heavily bought at 70000 C, while ETH was under strong selling pressure at 3400 C.

Source: SignalPlus

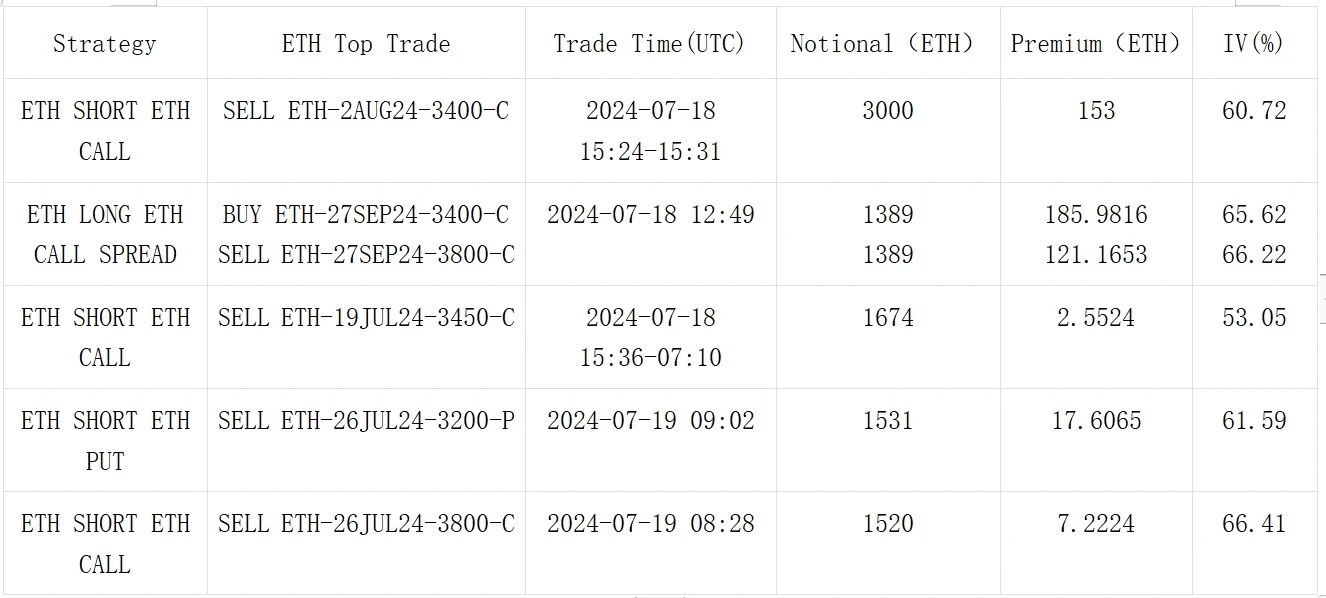

Data Source: Deribit, overall distribution of ETH transactions

Source: Deribit Block Trade

Source: Deribit Block Trade

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com