It has been three months since the Bitcoin halving. How long will it take for the bull market to come?

On July 19, 2024, Richard Teng, CEO of Binance Exchange, tweeted about the cyclical nature of the cryptocurrency market. He said that a longer-term view is needed, as it has only been three months since Bitcoin’s last block reward halving.

For comparison, he also listed the 6-month and 12-month increases after the past few Bitcoin block reward halvings, intending to show that it seems a bit too early to start worrying about when the bull market will begin.

Figure 1: Richard Teng’s tweet, source: twitter

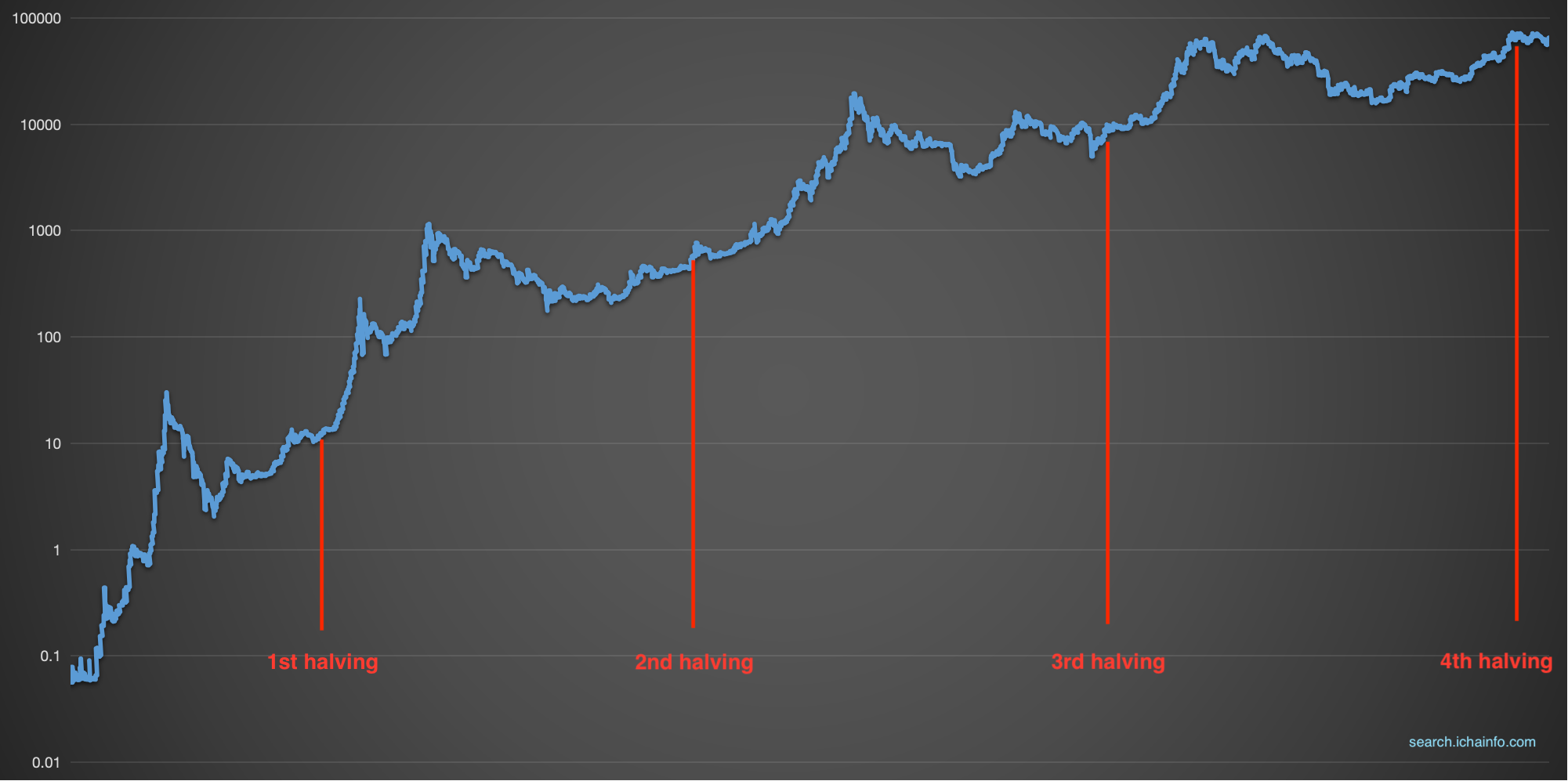

Richard Teng's tweet makes sense. Looking at the past few halvings of Bitcoin's block rewards, the price of Bitcoin tends not to start rising at or immediately after the halving, but to start climbing six months later and reach the peak of the bull market about a year later.

Figure 2: Bitcoin price logarithmic chart, source: search.ichainfo.com

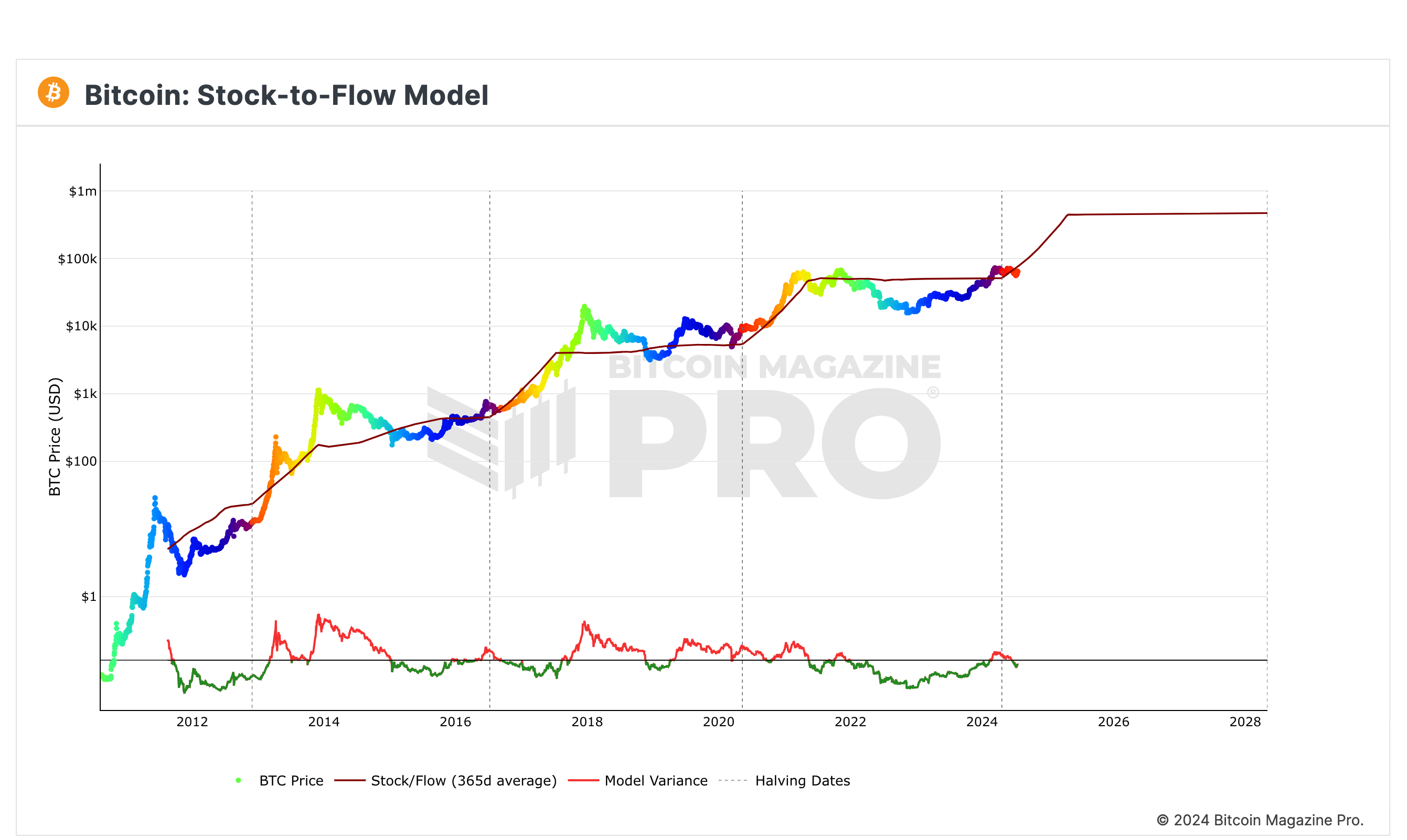

According to the classic Stock-to-Flow model, we can see that after each Bitcoin block reward halving, the market will go through a short period of sideways consolidation to accumulate energy for the next stage of transition. According to this model, Bitcoin will have a breakthrough in 2025, and the price is expected to exceed $100,000.

Figure 3: Bitcoin Stock-to-Flow Model, source: Bitcoin Magazine

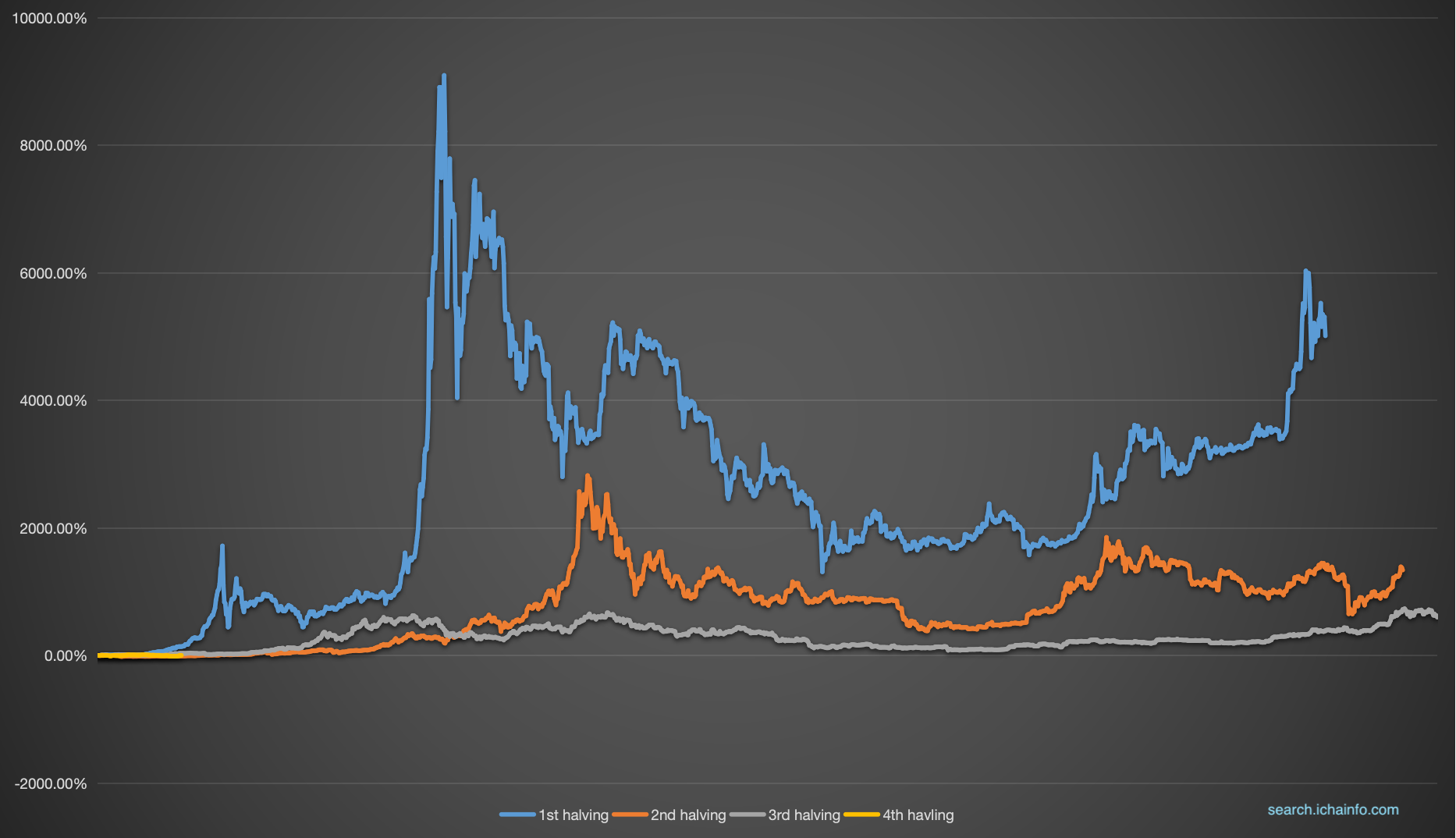

However, it should be noted that although the virtual currency market has its own bull and bear cycles, history is not a simple repetition. Although the overall market trends after each halving cycle show certain similarities, there are also differences.

The most noteworthy point is that the price increase of Bitcoin in each market cycle will be lower than the previous one, which also means that although the bull market may arrive as expected in half a year, the increase may be difficult to reach the level of previous times.

Figure 4: Bitcoin price increase after halving, source: search.ichainfo.com

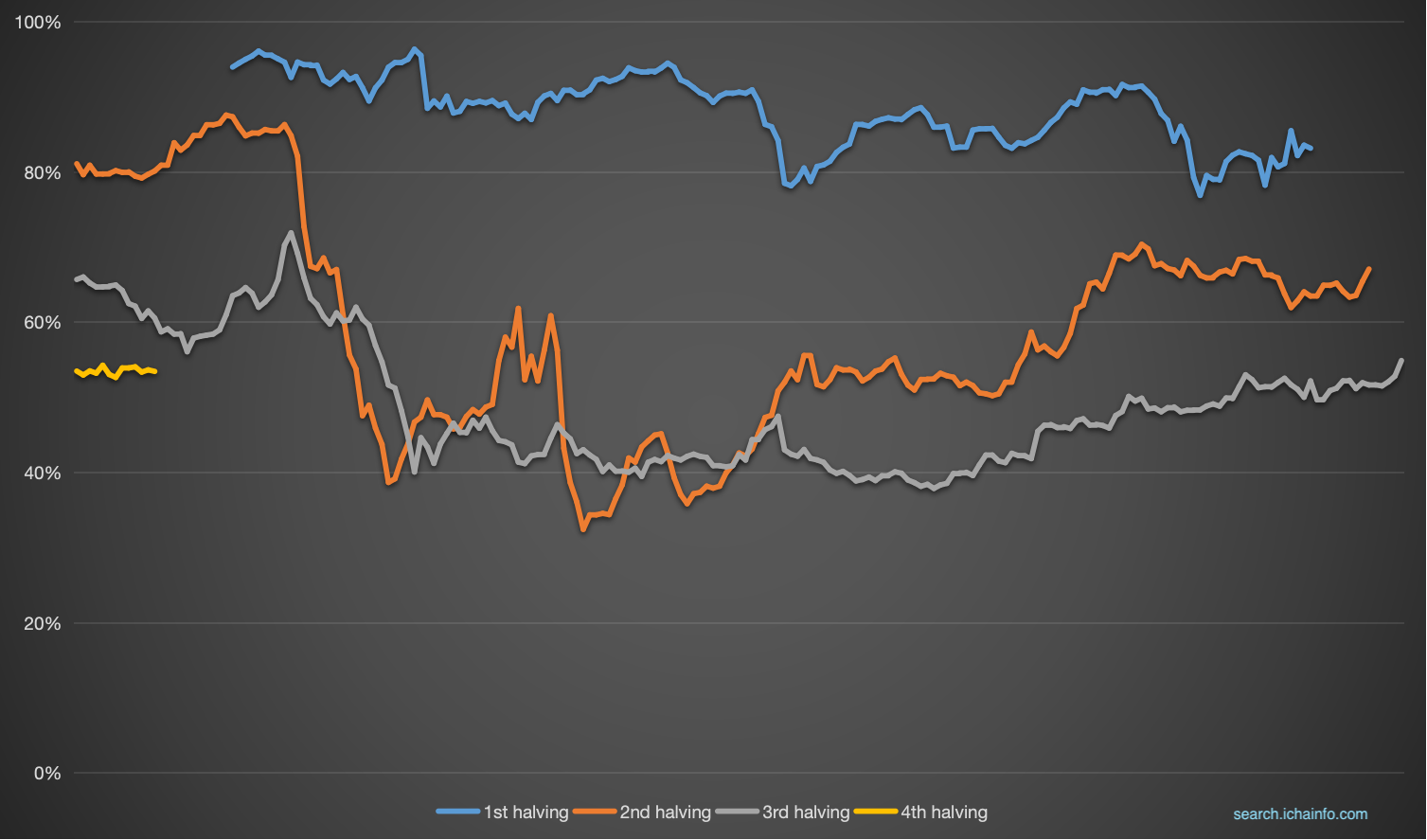

In addition, for the entire virtual currency market, although Bitcoin occupies a dominant position, the bull market is driven by the entire virtual currency ecosystem. Under this general background, Bitcoin's market dominance tends to decline, such as the prosperity of DeFi in the last bull market, and the prosperity of smart contracts and ICOs in the previous bull market.

Therefore, in the new round of bull market, the industry needs new driving forces to push the virtual currency market to new heights together with Bitcoin.

Figure 5: Changes in market dominance after Bitcoin halving, source: search.ichainfo.com

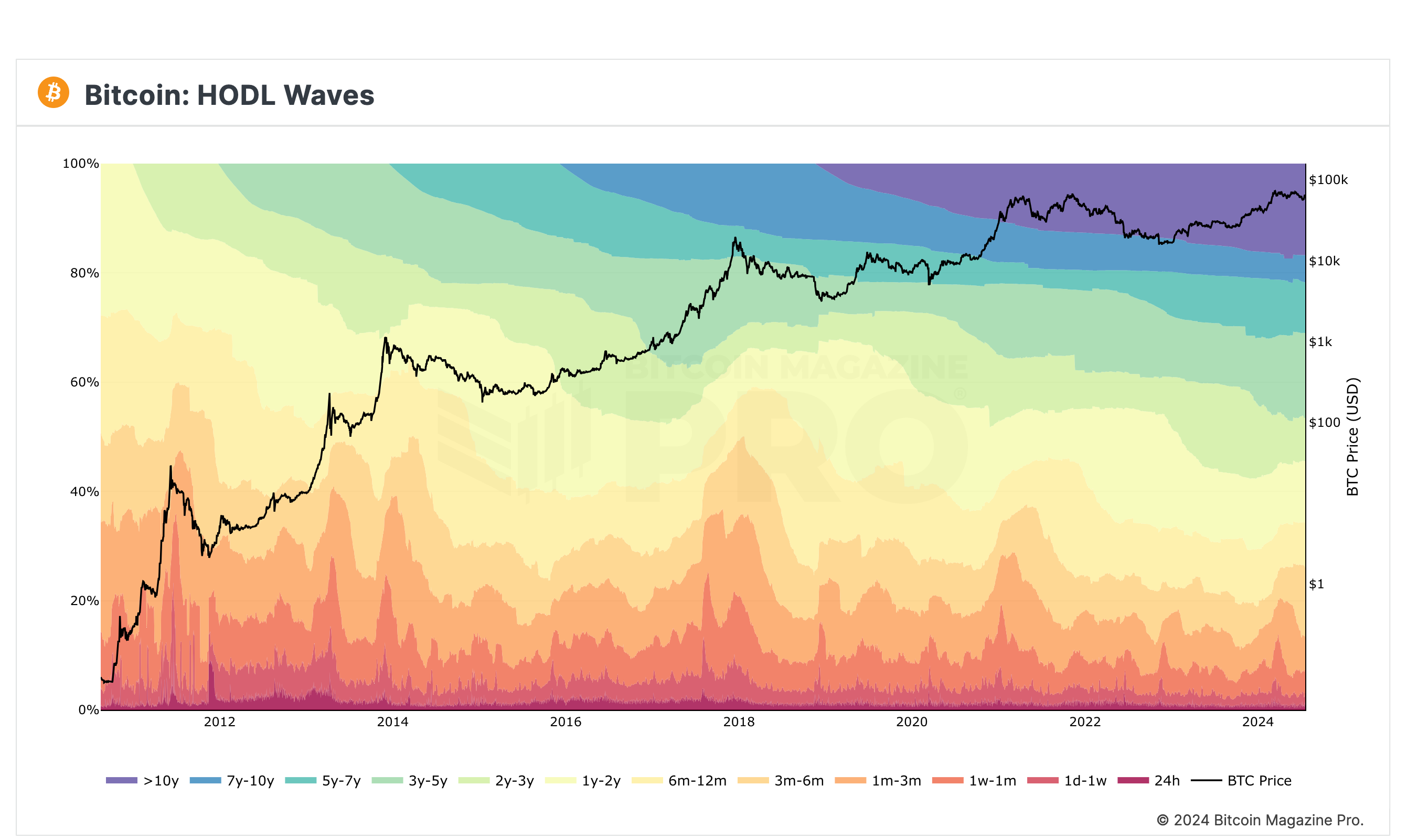

Judging from the on-chain data, every bull market in history has been accompanied by the flow of Bitcoin from long-term holders to short-term holders, and this sign is now quite obvious.

Figure 6: Bitcoin HODL Waves Chart, Source: Bitcoin Magazine

All signs indicate that the virtual currency market will usher in huge development opportunities in the second half of 2024 and into 2025. As Richard Teng said, we need to look further ahead and look at the market performance from the perspective of the market cycle.

By Auguste

Source: When Will the Bull Arrive After Bitcoin's Halving Three Months Ago?