In the past 24 hours, many new popular currencies and topics have appeared in the market, which may be the next opportunity to make money, including:

The sectors with relatively strong wealth-creating effects are: Curve-related tokens (CRV, CVX), Meme sector (NEIRO);

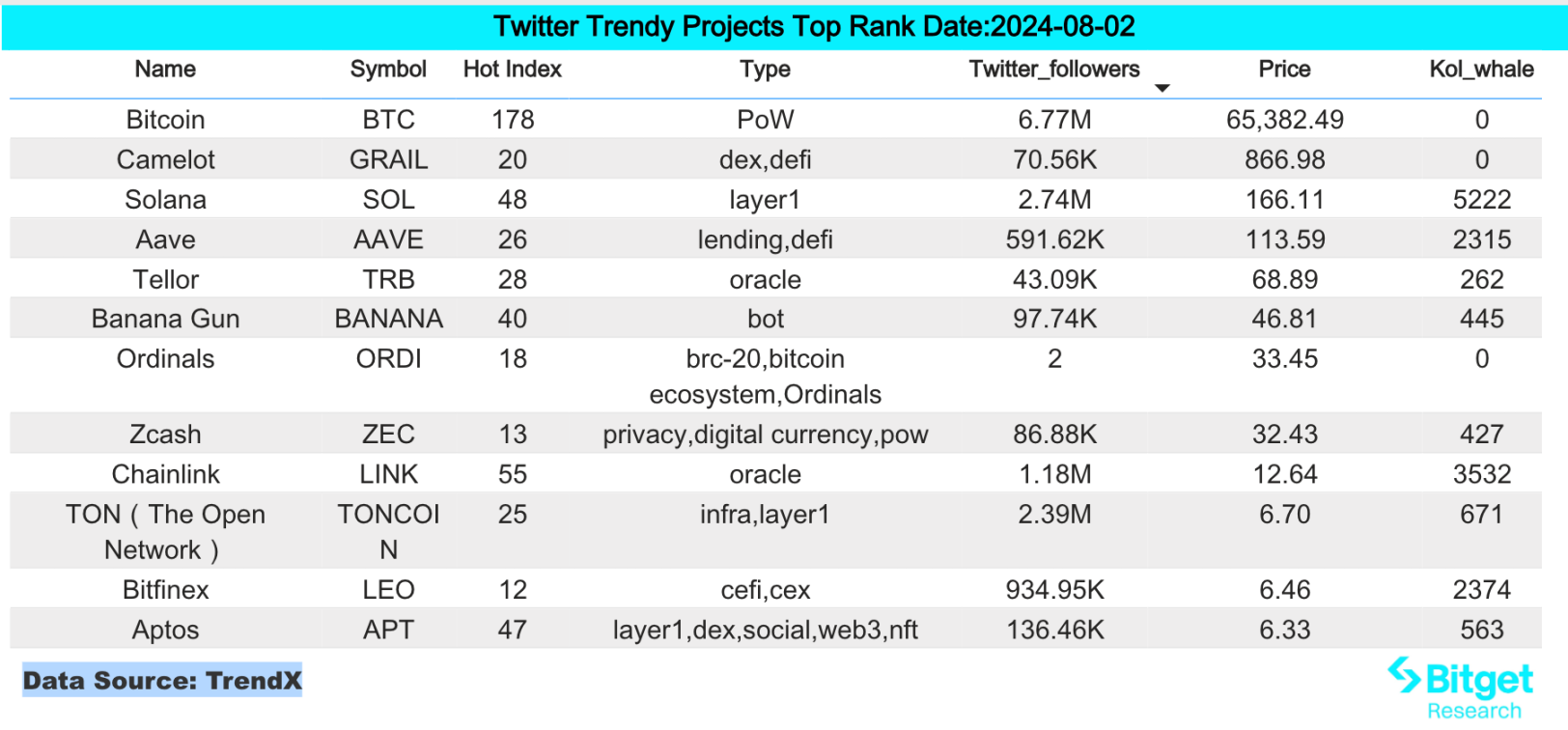

Hot search tokens and topics by users are: Morpho, Aptos;

Potential airdrop opportunities include: Symbiotic, Mezo;

Data statistics time: August 2, 2024 4: 00 (UTC + 0)

1. Market environment

The US ISM manufacturing PMI fell far more than economists expected in July, causing interest rates to fall to multi-month lows across the board. In addition, the number of first-time unemployment claims in the United States jumped to the highest level in about a year. Taken together, these data further confirm that the United States is on the verge of a monetary easing cycle by the Federal Reserve, which is a positive for risk markets in a sense.

Although the U.S. spot Ethereum ETF had a net inflow of $26.2 million and the spot Bitcoin ETF had a net inflow of $50.4 million yesterday, Bitcoin still maintained its downward trend and continued to fall sharply after reaching $70,000 this week. The price fell to a two-week low of $62,700 last night, and the short-term market conditions are poor.

2. Wealth-creating sector

1) Sector changes: Curve-related tokens (CRV, CVX)

main reason:

The whale has withdrawn a total of 18 million CRV (US$4.68 million) from Binance and OKX in the past 30 hours, with an average price of US$0.26. At the same time, the whale who withdrew CRV from CEX yesterday withdrew another 5.5 million CRV (approximately US$1.51 million) from Binance.

Rising situation: CRV and CVX rose by 7.46% and 5.38% respectively in the past 24 hours;

Factors affecting the market outlook:

Curve is still one of the best places for stablecoin bulk transactions, and it still maintains a good real profit. Its biggest problem is that its narrative is too old, and there are no new products or operations that excite the market. At the same time, the previous accidents and this liquidation decline inevitably make the market full of concerns. However, the price of CRV bought by many whales in OTC before was higher than 0.3 US dollars, so the current price of CRV is still attractive.

2) Changes in the sector: Meme sector (NEIRO)

main reason:

NEIRO has received a lot of support from KOLs, especially those in Japanese. With the help of KOLs with tens to hundreds of thousands of fans, such as @apipiro 22, @mikky_ 8080, @yukimaru_potty, @BrotherMKT, @KookCapitalLLC, and @OfficialTravlad, the price of NEIRO has also risen.

Rising situation: NEIRO rose 15% + against the trend on the day;

Factors affecting the market outlook:

On-chain activity: The valuation of DeFi infrastructure depends on whether the chain can have a stable market share, that is, the number of active on-chain users and DEX trading volume, which has a huge impact on DEX, PERP, language machine, and liquidity staking projects of different public chains. Investors should pay close attention to this type of data so that they can judge the markets upward and downward revisions to their valuations;

Impact on funding: After the launch of the Ethereum ETF, market funds began to gradually increase the liquidity of ETH. Affected by the increase in liquidity, related meme tokens may rise further in the future due to capital transmission.

3. User Hot Searches

1) Popular Dapps

Morpho

DeFi lending protocol Morpho has completed a $50 million financing round led by Ribbit Capital, with participation from a16z crypto, Coinbase Ventures, Variant, Pantera, Brevan Howard, BlockTower and Kraken Ventures. The specific valuation information has not been disclosed. Morpho is a lending protocol that combines the current liquidity pool model used in Compound or AAVE with the capital efficiency of the P2P matching engine used in the order book. Morpho-Compound improves on Compound by providing the same user experience, the same liquidity, and the same liquidation parameters, but with an increased APY due to peer-to-peer matching.

2) Twitter

Aptos

Yesterday, OKX Ventures and Aptos Foundation, a global blockchain leader, announced that they will jointly launch a new $10 million fund to support the growth of the Aptos ecosystem and the widespread adoption of Web3. The fund will be used to develop an accelerator program in partnership with Ankaa to drive the growth of high-quality projects and applications based on Aptos. Aptos is a scalable Layer 1 PoS blockchain that uses the Move programming language to make on-chain transactions more reliable, easy to use, and secure. The accelerator will provide selected Aptos ecosystem projects with risk support, focused guidance, marketing exposure, and a joint network of experts from OKX, Ankaa, and the Aptos Foundation.

3) Google Search Region

From a global perspective:

Why is down today fear and greed index:

Yesterday, the US July ISM Manufacturing PMI fell far more than economists expected, causing interest rates to fall to multi-month lows. The VXX index rose by 13.55%, the markets risk aversion heated up, and crypto assets followed suit.

From the hot searches in each region:

(1) Hot topics in the CIS region include Tapswap. TapSwap is a Tap2Earn Mini App that was once liked by Telegram founder Pavel Durov. It was launched at the end of 2023 and was initially released on the Solana network. It was later transferred to the TON ecosystem. The overall popularity of the project is extremely high.

(2) There are also no obvious hot spots in Asia, but the Philippines has shown interest in US stocks such as Tesla and Nvidia.

(3) Latin America showed a higher interest in SOL and ETH, and AI project tracks appeared on the hot searches in Colombia and Argentina.

Potential Airdrop Opportunities

Symbiotic

Symbiotic is a general purpose restaking project that enables decentralized networks to bootstrap powerful, fully sovereign ecosystems. It provides a method for decentralized applications, called Active Validation Services or AVS, to collectively ensure the security of each other.

Symbiotic recently completed its seed round of financing, with Paradigm and Cyber Fund participating in the investment, with a financing amount of US$5.8 million.

How to participate: Go to the project’s official website, link your wallet, and deposit ETH and ETH LSD assets.

Mezo

Mezo is a BTC Layer 2 project that focuses on the BTC ecosystem, helping BTC holders to transfer and manage money on the chain, and driving the development of the BTC DeFi system. Mezo recently announced the completion of a $21 million financing round, with participating institutions including Pantera Capital, Hack VC, Multicoin Capital and other leading institutions in the industry.

The official has already disclosed its BTC asset pledge plan and introduced a referral mechanism. There are strong expectations for the projects airdrops and it is currently in the initial stages of early operations.

Specific participation methods: 1) Visit the project official website and find the invite code in Discord; 2) Enter the invite code and link the unisat wallet; 3) Deposit BTC.

More information about Bitget Research Institute: https://www.bitget.fit/zh-CN/research

Bitget Research Institute focuses on focusing on on-chain data and mining valuable assets. It mines cutting-edge value investments through real-time monitoring of on-chain data and regional hot searches, and provides institutional-level insights for crypto enthusiasts. So far, it has provided Bitgets global users with early-stage valuable assets in multiple popular sectors such as [Arbitrum Ecosystem], [AI Ecosystem], and [SHIB Ecosystem]. Through in-depth data-driven research, it creates a better wealth effect for Bitgets global users.

【Disclaimer】The market is risky, so be cautious when investing. This article does not constitute investment advice, and users should consider whether any opinions, views or conclusions in this article are suitable for their specific circumstances. Investing based on this information is at your own risk.