On August 5, 2024, the total trading volume of six Hong Kong digital asset spot ETFs under China Asset Management, Harvest Global and other issuers exceeded HK$240 million, setting a new single-day trading volume record since their listing on April 30.

In the context of the July U.S. non-farm data falling far short of expectations and the unexpected surge in unemployment, the risk of geopolitical war in the Middle East has also risen sharply. This series of factors has led to a Black Monday in the global financial market, with Japanese and Korean stock markets triggering circuit breakers one after another, and the digital asset market also experiencing a flash crash. At the same time, the trading volume of Hong Kongs digital asset ETFs has increased dramatically, with the daily trading volume of Bitcoin and Ethereum ETFs both surging several times compared to the past, setting a record high.

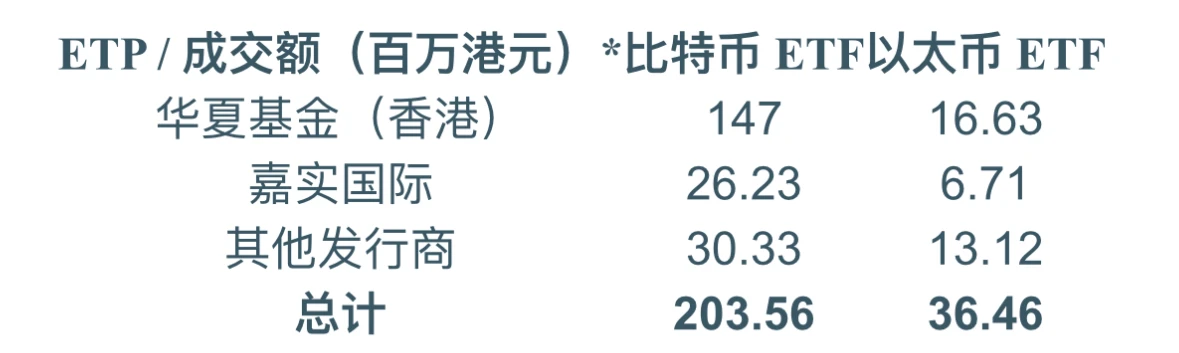

*Data as of August 5, 2024, Hong Kong time (Source: Hong Kong Exchanges and Clearing Limited)

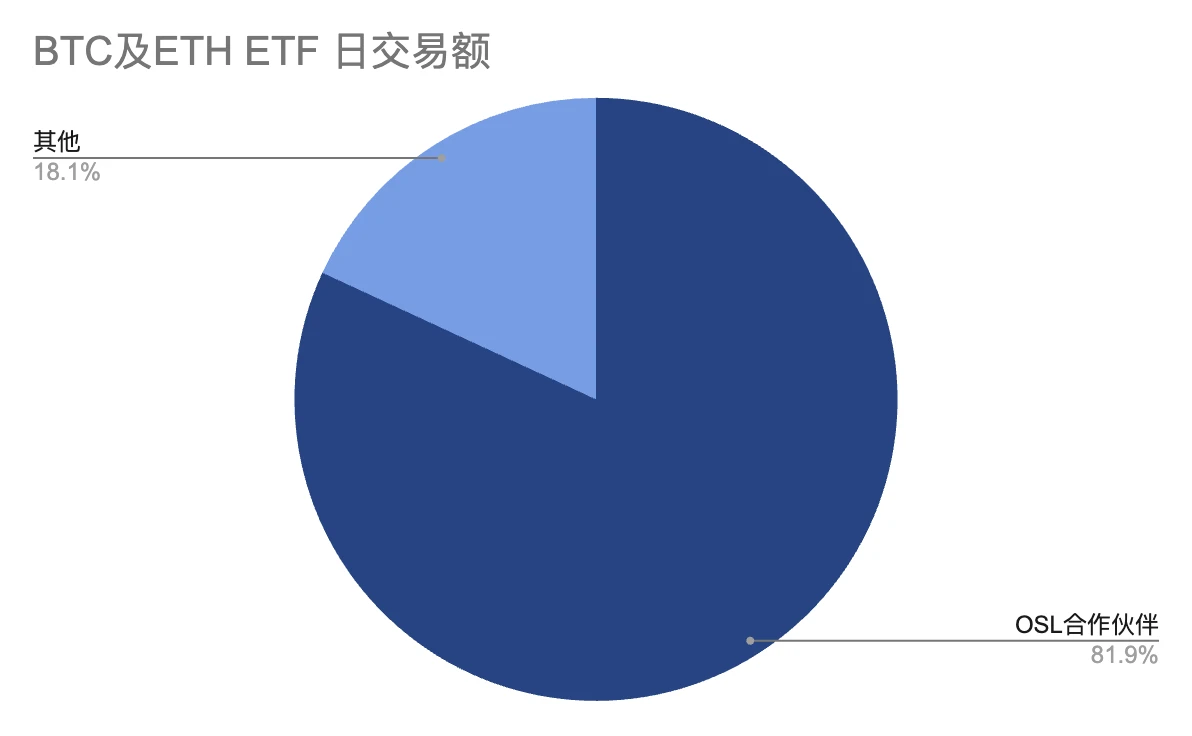

Among them, China Asset Management, for which OSL Digital Securities Co., Ltd. serves as the virtual asset custodian and trading partner, and four spot Bitcoin and Ethereum ETFs under Harvest Global ETFs have a total daily trading volume of approximately HK$196.5 million, accounting for a total of nearly 82% , ranking in an absolute leading position; the other two spot Bitcoin and Ethereum ETFs have a total daily trading volume of approximately HK$43.45 million, accounting for approximately 18%.

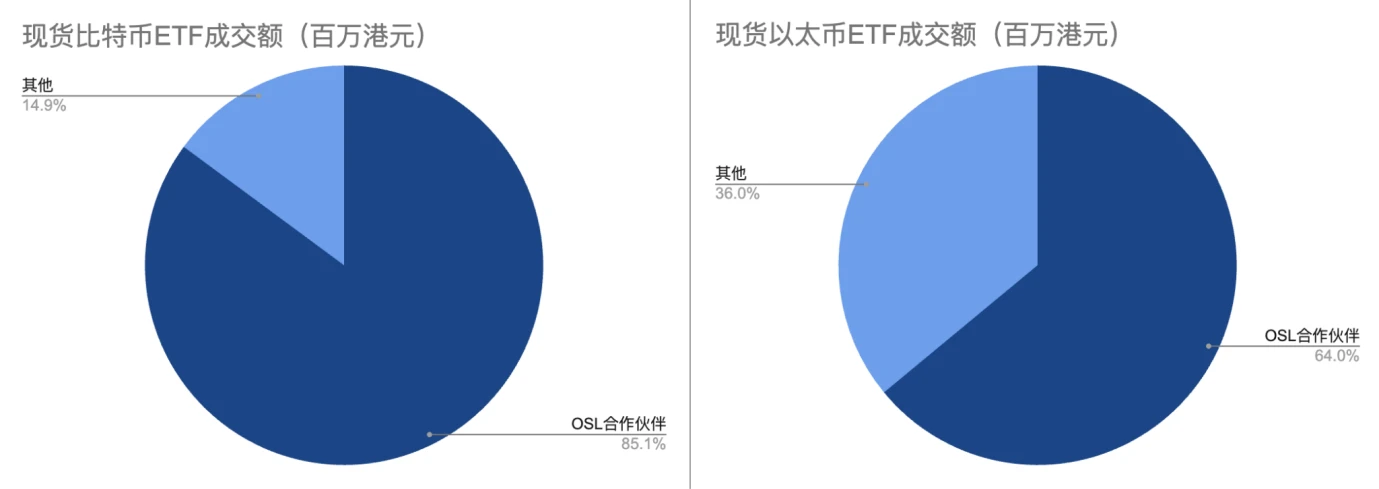

From the perspective of the Bitcoin and Ethereum ETF segments, OSL is also in a clear leading position in the trading volume of the relevant ETFs as a custody partner:

● The total trading volume of these three Hong Kong Bitcoin ETFs exceeded HK$203 million, of which the OSL-custodial ETFs - China Asset Management Bitcoin ETF (3042.HK) and Harvest Bitcoin Spot ETF (3439.HK) had a trading volume of over HK$173 million, accounting for more than 85%;

● The total trading volume of these three Hong Kong Ethereum ETFs exceeded HK$36.46 million, of which the OSL-custodial ETFs - China Asset Management Ethereum ETF (3046.HK) and Harvest Ethereum Spot ETF (3179.HK) had a trading volume of over HK$23.34 million, accounting for more than 64%;

In addition, from the perspective of asset management scale, the total asset management scale of the six Hong Kong digital asset spot ETFs has exceeded HK$2.157 billion, of which OSL has custody of HK$1.313 billion, accounting for more than 60%.