Global Economic Fluctuations and Crypto Market Turmoil: The Impact of Macroeconomics and the Yen Carry Trade

Hash( SHA1 ): a543a5b2582006c8b503b1182274b528c108388a

No.: Lianyuan Hotspot Insights Broadcast No.002

Trump comments on the sharp drop in US stocks: This is called the "Kamala Crash"

U.S. stocks fell sharply at the opening on Monday, and Republican presidential candidate Trump called this phenomenon the "Kamala Crash," pointing the finger at 2024 Democratic presidential nominee Kamala Harris. On the 10th floor of the White House, Trump wrote in capital letters: "TRUMP CASH VS KAMALA CRASH!" and insisted that he would not cause such an impact. He was in Atlanta, Georgia. At one rally, he claimed that if Harris was elected president, she would "destroy" the U.S. economy, pointing to the recent rise in unemployment to 4.3%.

The Fed's tightening policy and market reaction

Chicago Fed President Goolsbee said the Fed has been in a tightening mode and only needs to take such strict measures when there is a concern about overheating of the economy. The current data does not show signs of overheating in the economy, and the employment data is lower than expected, but There are no signs of a recession yet. Goolsbee stressed that the Fed needs to be forward-looking in making decisions.

Investment tycoon Warren Buffett has a record $277 billion in cash and has sold 50% of his Apple shares in preparation for a market crash that wiped out $1.4 billion in U.S. stock market value. Trillion dollars, while $1.2 billion in cryptocurrency leveraged positions were liquidated within 24 hours.

Global markets fell in sync

The rise in the US unemployment rate in July triggered concerns about a recession, leading to a sharp drop in global capital markets on Monday. Japan's Nikkei index fell 4,451 points, the largest drop in the Japanese stock market. South Korea's Kospi index and Kosdaq index fell more than 8%, The circuit breaker mechanism was triggered. The Nasdaq 100 index futures fell by more than 5%, and the Euro Stoxx 50 index fell by more than 3%.

The crypto market was not immune. Bitcoin did not find support after falling below $60,000 and fell all the way to below $50,000, hitting a low of $49,000, a daily drop of more than 15%. Ethereum fell more than 20% in 24 hours. , once fell below $2,200. According to CMC market data, the total market value of the entire network's encryption fell to as low as $1.76 trillion, a 24-hour drop of nearly 20%.

Historic market linkage

Zhu Haokang, head of digital asset management at China Asset Management (Hong Kong), analyzed that the plunge in Bitcoin prices often occurs almost simultaneously with the decline of the Nasdaq 100 Index, especially when the market faces widespread systemic risks, such as the COVID-19 pandemic in March 2020. The resulting market crash and market adjustment in 2022.

The chart data shows that there is a significant temporal relationship between Bitcoin price crashes and Nasdaq 100 declines over the past 16 years. For example, in March 2020, Bitcoin prices fell from about $10,000 to about $4,000, a drop of 1.3%. About 60%; during the same period, the Nasdaq 100 index fell about 30%.

Investor reactions and market expectations

Hayden Hughes, head of cryptocurrency investments at Evergreen Growth, noted that crypto assets have been a victim of the unwinding of yen carry trades. Crypto assets have been hit by a sharp rise in hedging costs caused by fluctuations in the dollar-yen exchange rate as investors adjust to higher interest rates in Japan. Influence.

Portfolio manager Daniel Tan expects it to be more reasonable for the Fed to cut rates twice by the end of 2024, one in September and one in November, for a total of 75 basis points, suggesting potential opportunities to add bonds in the coming months.

George Bourbouras, head of research at K2 Asset Management, believes that the market has clearly overreacted to the recent weak economic data. The recent economic momentum in the United States has slowed down, core inflation data has improved, and the market expects a 25 basis point interest rate cut in September.

Crypto market volatility

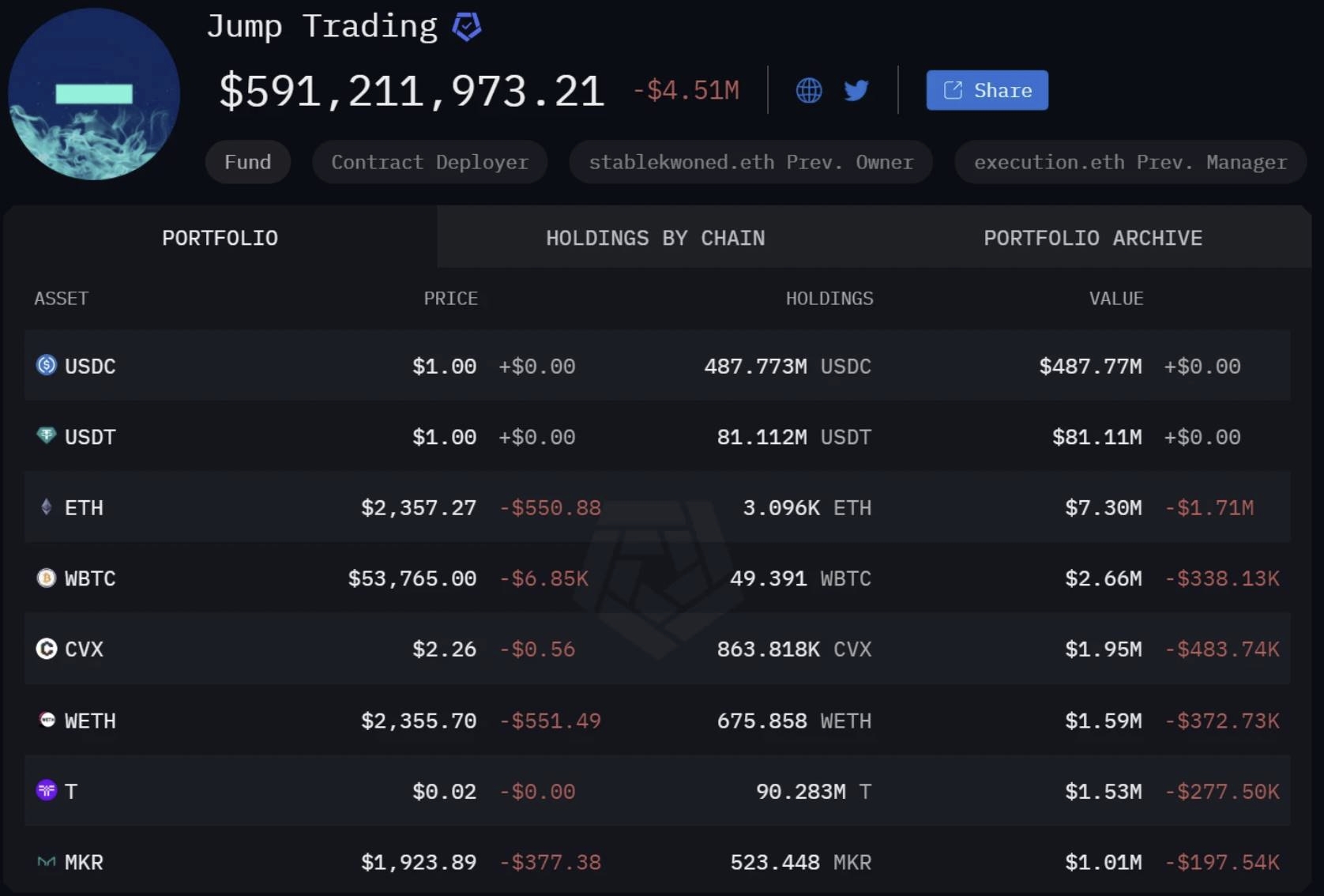

Min Jung, an analyst at Presto Research, pointed out that the employment data was lower than expected, economic recession concerns, and large transfers of Jump Crypto led to the decline in the crypto market. The decline of Bitcoin and Ethereum can be attributed to several factors, including the employment data being lower than expected. Expectations, Buffett selling Apple shares and Jump Trading transferring large amounts of crypto assets.

Crypto analyst Lark Davis said that despite the current market turmoil, there are still investment opportunities in the long run. Justin d'Anethan, head of business development for Asia Pacific at Keyrock, pointed out that the current market is not led by Bitcoin, but by market sentiment, especially Ethereum spot ETF trading and large investors unwinding their Grayscale ETH fund positions.

10x Research predicts that Bitcoin could drop to $42,000 and Ethereum could fall below $2,000. While this may seem extreme to some, market structure, on-chain data, and cycle analysis suggest further pressure ahead.

Binance CEO: The sharp drop in crypto assets seems to be mainly attributed to macroeconomic influences

The sharp drop in crypto and stock prices over the past few days can be attributed to the dual impact of macroeconomics and crypto-specific factors, and the former currently seems to be the more dominant reason. Binance CEO said that the impact of macroeconomics on the crypto asset market Especially significant.

From a macroeconomic perspective, this past week on Wall Street has been very volatile. Major indexes and stock market futures fell sharply over the weekend as fears of a recession grew. Those fears were exacerbated by Friday's U.S. jobs report, which sparked a Concerns about the extent of economic growth. In addition, ongoing geopolitical tensions have also increased market uncertainty and instability.

Specifically, with regard to crypto assets, the broad market sell-off sparked by recession fears has led to a reallocation of capital away from riskier assets, which crypto assets are still largely viewed as. This trend is further complicated by the dynamics of the coronavirus pandemic, which some market participants believe could be detrimental to crypto assets as an asset class. Finally, in crypto markets, summers have historically been duller than other months of the year, with lower returns. These seasonal factors may also be at play at this time.

Despite these challenges, we do not believe this indicates a long-term negative trend for the crypto asset market. The Federal Reserve is expected to cut interest rates in September, which should improve the outlook for the U.S. economy. In addition, with some time until the presidential election, market volatility As the election approaches, we may see markets impacted in both directions as candidates clarify their stance on crypto assets.

Impact of the Yen Carry Trade

Yen carry trade refers to a financial operation in which low-interest yen is borrowed to invest in high-interest or high-return assets. As interest rates in Japan are at extremely low levels all year round, market participants can borrow yen in Japan at a low interest rate. Borrowing money at low interest rates, then converting the funds into other currencies such as the US dollar to invest in assets in countries with high interest rates. In recent years, this carry trade has supported the bull market in global stock markets and enabled cheap monetary funds to be invested elsewhere.

However, the reversal of the yen carry trade often triggers turmoil in financial markets. The unwinding of the yen carry trade causes funds to withdraw from high-yield risky assets, which usually triggers a fall in asset prices. Financial institutions are Transactions require reducing leverage by selling assets and repaying debts, which leads to reduced liquidity in the credit market and further tightening of credit conditions. In addition, changes in market risk appetite have led to increased market volatility.

Conclusion

Despite the current challenges facing the market, the crypto asset market still has potential in the long run. The Federal Reserve is expected to cut interest rates in September, which will improve the outlook for the U.S. economy and could have a positive impact on the crypto market. As the election approaches, market volatility will continue to exist, and the candidates' stance on crypto assets will become the focus of market attention.

The blockchain market is highly volatile, and the ChainSource security team advises investors to be cautious in dealing with this high-risk environment. At the same time, technical security is the key to protecting blockchain systems and transactions. Effective security measures can not only prevent hackers, It can also enhance user trust and promote the widespread application of blockchain technology. A stable market and a solid technical foundation jointly promote the healthy development of the blockchain ecosystem.

Lianyuan Technology is a company focusing on blockchain security. Our core work includes blockchain security research, on-chain data analysis, and asset and contract vulnerability rescue. We have successfully recovered many stolen digital assets for individuals and institutions. At the same time, we are committed to providing industry organizations with project security analysis reports, on-chain traceability and technical consulting/support services.

Thank you for your reading. We will continue to focus on and share blockchain security content.