Original | Odaily Planet Daily ( @OdailyChina )

Author | Asher ( @Asher_0210 )

CoinGecko market data shows that earlier today, XRPs price suddenly began to rise rapidly around $0.5, breaking through $0.62 at one point, with a short-term increase of more than 20%. It is currently reported at $0.607, with a market value of $ 33,894,393,759 , ranking 7th among cryptocurrencies. And it is obvious that despite the sharp correction in the price of Bitcoin in the past few days, even falling below $49,000 at one point, XRP has performed more resiliently than other cryptocurrencies, and its price has also rebounded well as Bitcoin rebounded. So, what exactly caused the price of XRP to rise so rapidly today?

Image source: coingecko

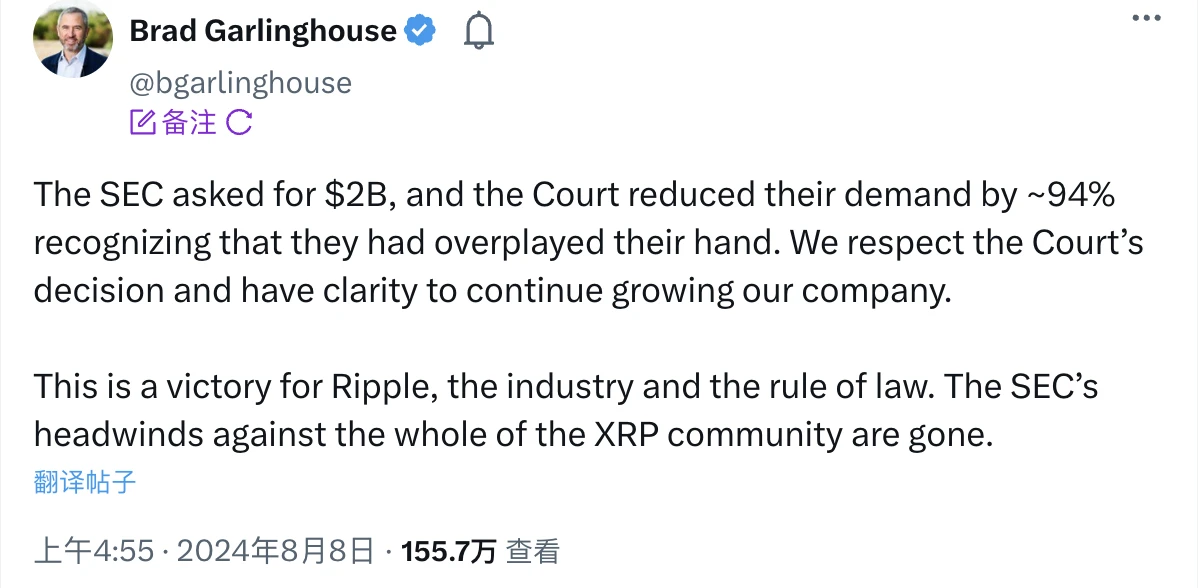

It turns out that this surge in XRP prices is another victory for Ripple in the SEC lawsuit after a US judge ruled that Ripples sale of XRP to retail investors did not violate federal securities laws. In the early hours of this morning, Ripple CEO Brad Garlinghouse posted on X: The SEC asked us to pay $2 billion, and the court recognized that they were asking too much and reduced their request by about 94%. We respect the courts ruling and are clearly continuing to develop our company. This is a victory for Ripple, the industry, and the rule of law. The SECs resistance to the entire XRP community has disappeared.

Ripple CEO: Judge reduces SEC fine by about 94%

The judges ruling that the SECs fine for XRP was reduced by about 94% has greatly reduced the resistance of the SEC in the XRP community. It is a great relief for both Ripple itself and the entire crypto industry. The judges ruling also temporarily put an end to the long lawsuit against Ripple by the SEC. Next, Odaily Planet Daily will review how Ripple won step by step in the SECs lawsuit against Ripple.

Lengthy lawsuit: SEC claims Ripple violated regulations by issuing unregistered securities

As early as December 21, 2020, the US SEC began a lawsuit against Ripple Labs, claiming that Ripple violated regulations by issuing unregistered securities . After the news was released, the price of XRP was halved, falling from $0.58 to $0.21. To make matters worse, the crypto exchange Coinbase removed XRP from its listing, possibly due to the news of the SEC lawsuit. The lawsuit between the SEC and Ripple has officially begun.

At the same time, Ripple CEO Brad Garlinghouse denied the SECs allegations and said the company would take legal action. Later, Brad Garlinghouse questioned the SECs approach, arguing that the agency did not give them fair notice of classifying XRP as a security. In a letter to the court, they stated that the SEC failed to provide clear guidance to crypto companies.

The legal fight has achieved some results. At a hearing requested by the SEC by Judge Sarah Netburn, Judge Netburn ruled that XRP has value and utility, which distinguishes it from cryptocurrencies such as Bitcoin. The ruling is significant because it highlights the legal differences between cryptocurrencies and paves the way for future asset classification and enforcement actions.

Achieving a phased success: XRP itself is not a security

Fast forward to 2023, and Ripple has been fighting the lawsuit since the SEC filed it. In the second half of 2023, Brad Garlinghouse said that the company had paid more than $200 million in legal fees, and if the SECs lawsuit was eventually appealed to the Supreme Court, Ripple would fight the SEC to the end.

Hard work pays off. On October 20 of the same year, Ripple announced that the US SEC had dropped all charges against its CEO Brad Garlinghouse and Executive Chairman Chris Larsen. Ripple had previously had two successes, including a court ruling in July 2023 declaring that XRP itself is not a security and a federal judges decision in October to dismiss the SECs appeal. After the news was released, XRP rose 7% in 24 hours.

But perhaps it is not the time to really celebrate yet. Crypto analyst Phyrex wrote on the X platform: First of all, it should be made clear that this dismissal was applied for by the SEC with the consent of both parties, which means that the SEC rejected its own application... It is not right to think that this is a comprehensive victory for Ripple. This is just that the SEC gave up the prosecution of the two executives, and the fine should still be imposed.

Another successful phase: Judge rules that SECs fine for XRP is reduced by about 94%

Although the SECs lawsuit against Ripple won on the grounds that XRP itself is not a security, the huge fine lawsuit is still ongoing. In March 2024, the US SEC plans to ask the judge to impose a $2 billion fine on Ripple Labs. Ripples Chief Legal Officer Stuart Alderoty said that Ripples response will be submitted next month, but as we have seen before, the statement issued by the SEC is false, mischaracterized and intended to mislead. The SEC did not faithfully enforce the law, but was bent on punishing and intimidating Ripple and the entire industry.

In May of the same year, according to foreign media reports, the US SEC described Ripples proposed stablecoin as an unregistered crypto asset in its revised relief measures response brief on May 7, and further proved that without a permanent ban on the company, it would continue to engage in unregulated activities. At the same time, the SEC also insisted on seeking a heavy fine of nearly $2 billion against Ripple to prevent the company and other imitators.

But then, Ripple said in a “supplemental authority notice” that the financial penalty proposed by the regulator was unreasonable. The company compared the SEC’s proposed $2 billion fine for its sale of XRP to institutional investors with the fine imposed on Terraform Labs, arguing that its fine should be closer to $10 million .

But the SEC has refuted Ripple Labs recent claim to reduce the fine, saying it is not comparable to the Terraform case . In a letter to Judge Torres, the SEC argued that its $4.5 billion settlement with Terraform and its co-founder Do Kwon, including a $420 million civil penalty, was reached when the company went bankrupt, agreed to return funds to investors and fired executives responsible for violations at the time. The SEC said Ripple believes that Terraforms $420 million civil penalty is about 1.27% of its $33 billion in total sales, but the two are not comparable, adding that it measures Terraforms fine based on gross profits from violations, estimating that the fine is more than $3.5 billion, a ratio of nearly 12%. It also believes that if Ripple asks for the same ratio to apply, its civil penalty would be $102.6 million, and such a low fine does not meet the purpose of the civil penalty statute.

Until today, the judge ruled that the SECs fine request for XRP was reduced by about 94%, which greatly reduced the resistance of the SEC in the XRP community. It can be said that Ripple has won another victory in the long lawsuit with the SEC. Perhaps, the SEC will file a lawsuit again to oppose the substantial reduction of the fine, but it has to be admitted that Ripple has made a huge contribution in fighting the US SEC.