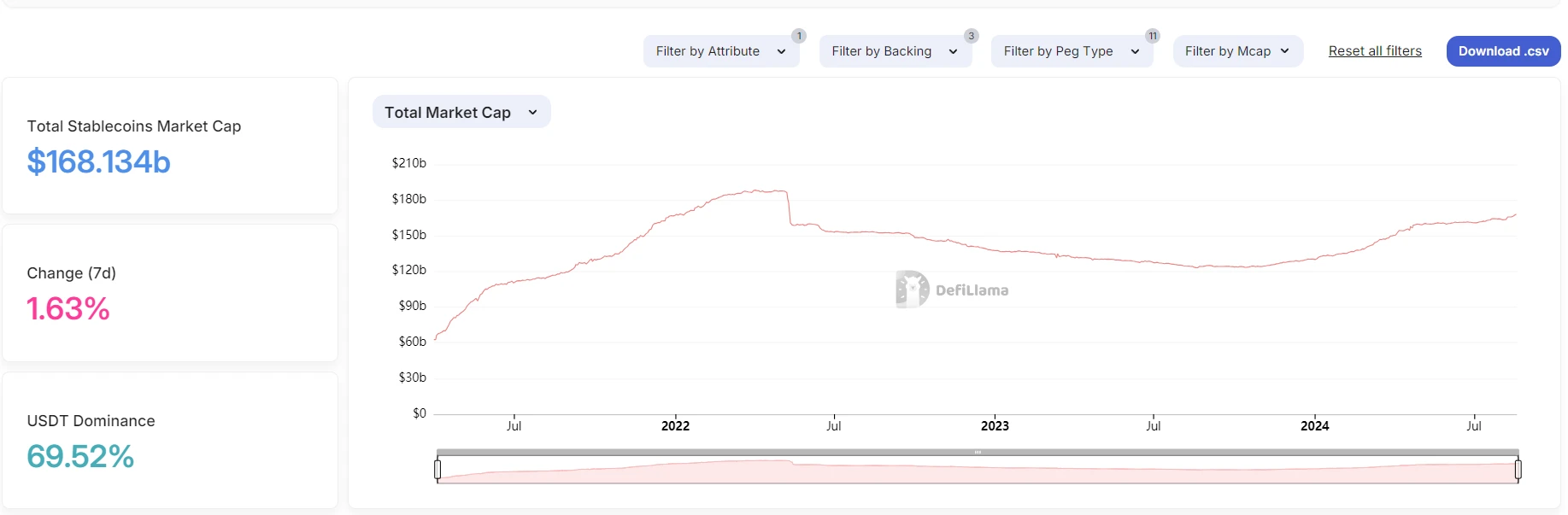

Total stablecoins

Despite the recent sluggish market trading and low sentiment, the total amount of stablecoins on the exchange is still slowly accumulating, and has now reached the highest level since this cycle, at approximately US$168 billion.

BTC.D hits new high, touching daily pressure level

BTC.D has reached a new high since this round of market, touching the daily pressure level, and may experience a daily level correction. If BTC can maintain a relatively mild shock, the altcoin has the opportunity to outperform BTC on a daily level.

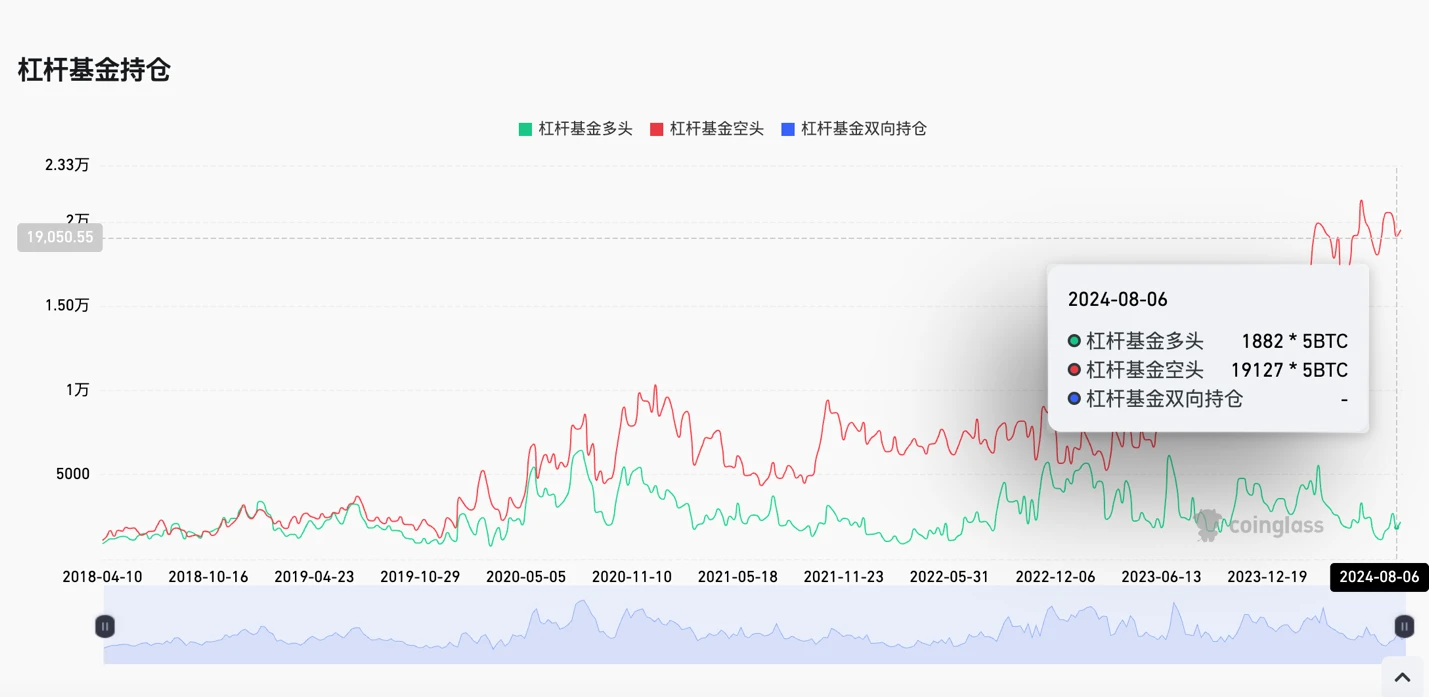

CME Open Positions

CME BTC short position liquidation has turned around. Overall, the liquidation is still lower than expected. Arbitrage funds will gradually withdraw after the interest rate cut.

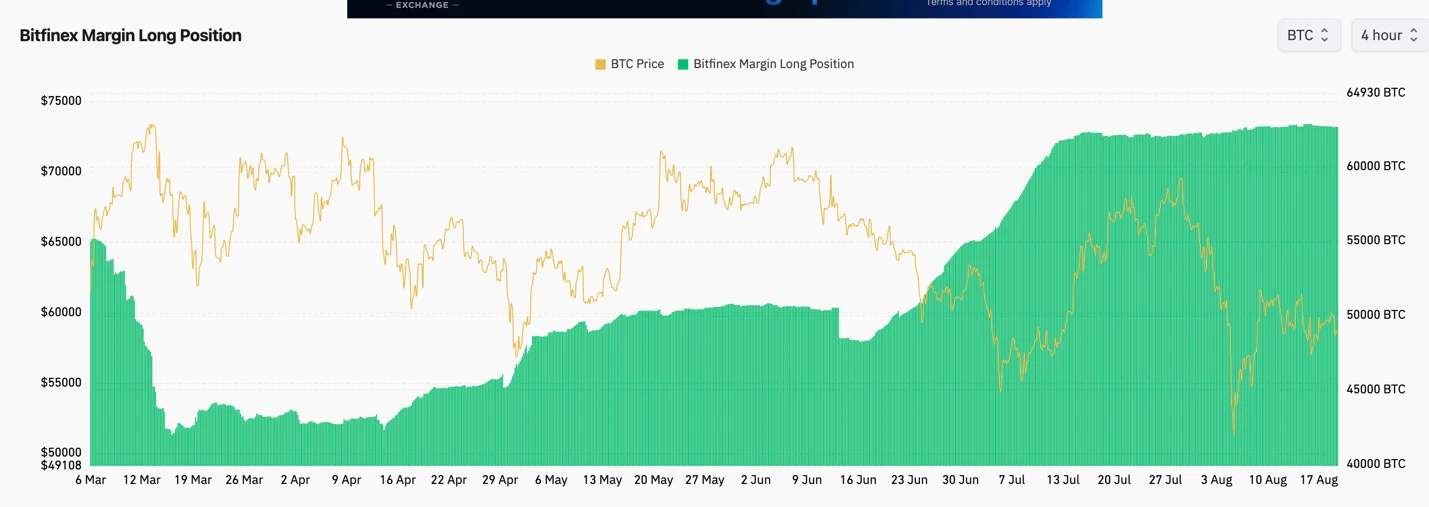

Bitfinex Holdings

There has been no movement in Bitfinexs long positions recently. There has been no obvious reduction in positions after the sharp drop on August 5, but there has been no increase in positions either. The overall situation is to control risks while holding positions for price increases.

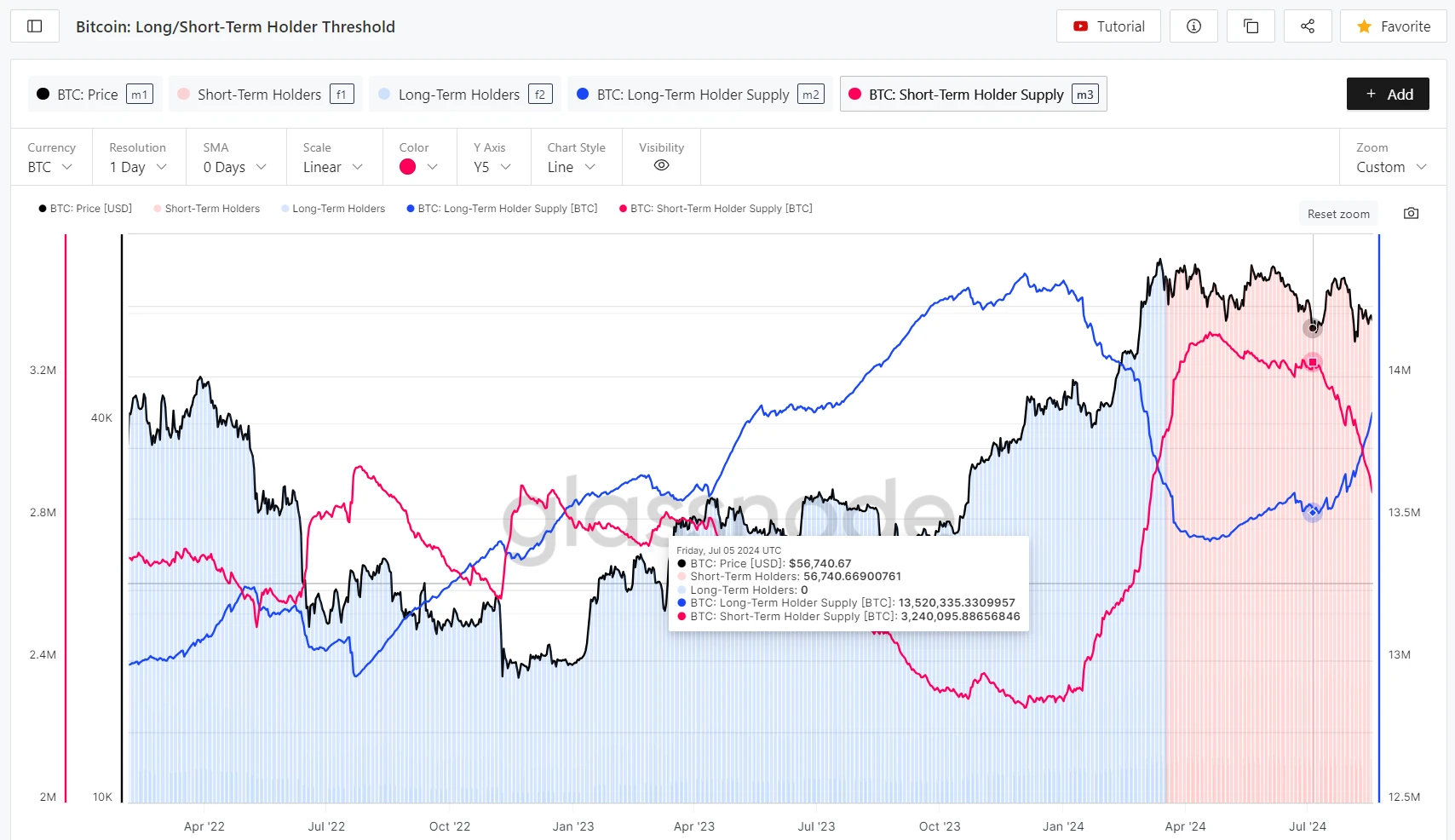

BTC long-term holders accumulate faster

BTC long-term holders stopped selling after the decline in April 2024, and accumulated slowly in May-June. After July, the accumulation speed accelerated. Long-term holders are still accumulating chips in this shock zone.

Short-term holder MVRV reaches lowest level since 2023

The MVRV for short-term holders reached 0.84 during the decline on August 5, which is the lowest level since the beginning of 2023. From a medium- to long-term perspective, this is a good position to buy low and build a position.

By referring to the MVRV of short-term holders, we can further calculate where the extreme retracement will be under the current circumstances. Since 2020, the lowest value of STH-MVRV is about 0.6, which has occurred twice, namely the global plunge caused by the COVID-19 pandemic on March 12, 2020, and the plunge caused by the bankruptcy of Three Arrows Capital in the context of the US interest rate hike in May-June 2022. In the bull market of 2021, the lowest value of STH-MVRV was about 0.67, which occurred after the release of the Chinese governments mining withdrawal policy on May 19.

According to the current price, if STH-MVRV= 0.6, the BTC price is about 38,000 US dollars, and if STH-MVRV= 0.67, the BTC price is about 43,000. The COVID-19 pandemic is a black swan that affects the survival of the world. It is believed that the probability of its occurrence in this round of market is extremely low, so the BTC price will not reach 38,000. If the US economy is in a serious recession, there may be a decline comparable to the intensity of 519.