Original author: YBB Capital Researcher Ac-Core

TLDR

The two most mainstream design directions of GameFi are: 3A-level chain games with playability as the entry point and full-chain games (On Chain Game) with fairness and in line with the spirit of the Autonomous World as the entry point.

The current pain points of GameFis development are: 1. Lack of playability and full of speculation; 2. Lack of industry supervision, and cryptocurrency traders are the main speculative players; 3. On-chain operations are complex, with high barriers to entry, making it difficult to break the circle.

GameFi’s focus is on playability rather than speculation, not gambling with Earn.

The concepts of ServerFi mainly include: ServerFi — players are allowed to combine their in-game assets and ultimately gain sovereignty over future servers; Continuously reward high-retention players — provide targeted rewards for high-retention players to maintain token vitality and a healthy gaming ecosystem.

1. GameFi’s current situation and pain points

Image source: MPOST

During the last bull market in 2021-2022, since the rise of Axie Infinity, The Sandbox, and Stepn, the concepts of GameFi and P2E have quickly become popular, and similar breeding games (such as Farmers World) have also sprung up. However, due to its failed dual-token (governance token and output token) economic model + NFT (pets, farm tools, running shoes, and other props that can continuously produce tokens) design, the pure Ponzi model was exposed, and P2E also declined immediately. The output end of the entire game will far exceed the demand end and quickly fall into a death spiral.

After several years of development, GameFis two most mainstream design directions are: AAA blockchain games with playability as the entry point and on-chain games with fairness and in line with the spirit of the Autonomous World. If blockchain is used as the foundation of the world, the blockchain unambiguously saves the collection of all node entities in its state. In addition, they formally define the introduction rules in computer code. The world with the blockchain bottom layer allows its residents to participate in consensus. They run a computer network to reach a consensus every time a new entity is introduced.

— Analysis of the Core of Fully On-Chain Games: MUD Engine and World Engine

1.1 AAA blockchain games

Image source: abmedia - illuvium

Integration of traditional games and blockchain technology: Web2.5 games represent an innovative form between traditional games (Web2.0) and games that are completely based on blockchain (Web3.0). This type of game not only retains the core gameplay and user experience of traditional games, but also introduces certain elements of blockchain technology, such as the confirmation of digital asset ownership and decentralized transactions between players.

Partially decentralized features: Decentralized elements are usually concentrated on specific functions or modules. For example, virtual items, characters or currencies in the game may be managed and traded through blockchain, which can ensure the true ownership of digital assets by players. However, the main logic, operating environment and most of the content of the game are still maintained on the centralized server. This hybrid model can ensure the smooth operation of the game.

Higher performance and wide availability: Since Web2.5 games do not rely entirely on the underlying architecture of blockchain, they are generally superior to full-chain games in terms of performance and user availability. The support of traditional servers enables these games to host a large number of players online at the same time and provide richer and more complex game content without being limited by the throughput and response speed of current blockchain technology. This design enables Web2.5 games to take into account both high performance and the innovative features of blockchain technology.

Balancing traditional game experience with blockchain advantages: Web2.5 games attempt to find the best balance between the immersive user experience of traditional games and the new features brought by blockchain technology. By adding decentralized asset management, transparent transaction records, and cross-platform asset circulation to the game, Web2.5 games not only retain the in-depth gameplay and storytelling of traditional games, but also provide players with a new way to obtain value and a higher sense of participation.

Combination of AAA standards and blockchain games: Traditional AAA games are usually developed by large development teams, with high budgets, high-quality graphics, complex storylines, and deep player interaction. AAA blockchain games, on this basis, further combine the advantages of blockchain technology, allowing players to enjoy top-level gaming experience while truly owning and freely trading their virtual assets in the game, creating a more realistic gaming experience for players.

Wide support for game types: Since Web2.5 games adopt the asset chain model, in theory, almost all types of games can apply this model, from traditional adventure games to strategy games, shooting games, etc. At present, the most mainstream Web2.5 game type is massively multiplayer online role-playing games (MMORPG).

1.2 Full-chain game

Based on the views of 0x PARCs collection of crypto game papers Autonomous Worlds, full-chain games need to meet five key criteria:

1. Data comes entirely from blockchain:

Blockchain is not just a secondary storage or mirror of data, but the only source of all key data. This means that all meaningful data should be stored and accessed on the blockchain, not just limited to information such as asset ownership. In this way, games can take full advantage of the advantages of programmable blockchains, such as transparent data storage and permissionless interoperability.

2. Game logic and rules are implemented through smart contracts:

The core activities in the game, such as combat logic, are not limited to the transfer of ownership, but are completely executed on the chain through smart contracts. This ensures the transparency and credibility of the game logic.

3. Development principles of open ecology:

The games smart contracts and client code should be fully open source, allowing third-party developers to redeploy, customize, or even fork their own versions of the game through plug-ins, third-party clients, or interoperable smart contracts. This openness promotes creative output from the entire community and enhances the scalability and innovation of the game.

4. The game is permanently stored on the blockchain:

This standard requires that the game can continue to run without relying on the core developer or its client. If the game data is stored without permission, the logic is executed without permission, and the community can interact directly with the core smart contract, then the game can continue to exist even if the developer quits. This is a key standard for testing whether a game is truly crypto-native.

5. Interoperability between games and the real world:

Blockchain provides an interface for digital assets in games to interoperate with real-world values. Virtual assets in games can interact with other important assets, thereby enhancing the depth and meaning of the game and closely linking the virtual world with the real world.

Full-chain games built under these standards can be regarded as autonomous worlds based on blockchain as the underlying architecture.

1.3 Hitting the pain points of blockchain games

Image source: Discover magazine

GameFis innovation is the financialization of games, and the way to play financialization is Pay to Earn. Unfortunately, Pay to Earn is wearing a thick Ponzi coat. Looking back at the entire history of video games, it began to appear in the form of commercial entertainment media in the 1970s, and became the foundation of an important entertainment industry in Japan, the United States, and Europe in the late 1970s. In the two years after the Great Depression of the US game industry in 1983 and its subsequent rebirth, the video game industry has experienced more than two decades of growth and has become an industry with a market value of 10 billion US dollars. It competes with the television and film industry and has become the most profitable visual entertainment industry in the world. After decades of game development history, the game model has been constantly replaced and changed. Today, moving games to the chain still faces some significant pain points and challenges:

1. The users needs are not clear:

It is undeniable that at this stage, GameFi is far inferior to traditional games in terms of playability and gaming experience, although 3A-level blockchain games are constantly making up for it. For users, GameFis Pay to Earn model + lack of playability, when faced with the choice of having fun or making money, you always need to get the dopamine happiness of one side. If you dont have either, it will only accelerate your exit.

The current economic models of many GameFi projects are overly dependent on the price fluctuations of tokens, and are also subject to the influence of the cryptocurrency market. If the price of the currency plummets and the interests of players are damaged, it will greatly affect the player retention rate. Losing players will accelerate the end of the games life cycle.

2. Lack of supervision leads to loss of game traffic:

Behind the financialization of GameFi games is the immature global regulatory framework. This uncertainty causes players to face a certain degree of legal risk, and the push of traffic that breaks the circle will also be blocked everywhere. The remaining players are still speculative users at this stage.

3. The complexity threshold of on-chain operations is difficult to break through:

For non-cryptocurrency users, GameFi has a relatively high entry barrier. Players usually need to be familiar with blockchain operations such as crypto wallets and token transactions, which is not friendly to ordinary players. This technical threshold limits GameFis user expansion, especially its popularity among traditional game players.

2. What does the Yale University paper ServerFi concept say?

Image source: ServerFi: A New Symbiotic Relationship Between Games and Players

2.1 Concise summary

Note: This section does not verify the source of the paper or the authenticity of the author, but only refines and discusses the main points of the paper. For the original text, see the extended link (1)

GameFi reshapes economic production relations, combines games with finance, and realizes a new model of earning while playing through blockchain. This type of game creates crypto assets through NFTs and homogenous tokens, bringing decentralized ownership, transparency, and player economic incentives. However, market stability, player retention, and sustainability of token value are still facing challenges. Compared with traditional online games, blockchain games use their unique digital asset storage methods and gradually improved incentive models to build a new player-developer relationship and promote the transformation of the electronic society. However, in the context of the Web3 era, the traditional easy game experience has been placed in a secondary position.

Most games have a life cycle, and CryptoKitties is no exception. Its breeding mechanism increases the supply of cats, gradually reducing rarity and value. As more players participate, the market quickly becomes saturated, making it difficult for token prices to be maintained. Without enough active players, the imbalance between supply and demand will further exacerbate depreciation. Players who invest a lot of resources in breeding may find diminishing returns, with the initial scarcity replaced by excess supply, leading to a decline in player interest and engagement.

The original article discusses the development of blockchain games (the above content is condensed for the sake of simplicity). The core is to identify the main defects of the token economic model through the entropy theorem. Two new models are proposed: ServerFi and Continuously Rewarding Highly Retained Players.

The combination of entropy increase theory and token economics provides a profound perspective for understanding the flow and value fluctuation of tokens in blockchain projects. Entropy increase theory shows that the degree of disorder (entropy) in a closed system increases over time. This concept is manifested in token economics as the orderly distribution of tokens in the early stage, but as more tokens enter the market and transactions increase, the market disorder increases, leading to price fluctuations and inflation risks. If there is a lack of effective regulation mechanism, the system may enter a high entropy state, resulting in token depreciation and decreased player participation. Therefore, incentive mechanisms and regulatory measures are needed to slow down entropy increase and maintain market stability and player participation.

For example, Axie Infinitys token economy has several major flaws: 1. The token economy is highly dependent on the continuous generation of new tokens (such as SLP), resulting in oversupply and token depreciation; 2. Speculation during the TGE causes price fluctuations and affects market stability; in the long run, after the exit of early speculators, token prices may plummet, harming the interests of ordinary players; 3. The economic model lacks continuous incentives, and player enthusiasm is difficult to maintain; 4. The high initial investment cost also poses an obstacle to new players and limits the popularity of the game.

Based on the above discussion, the original article puts forward two suggestions to improve the GameFi token economic model:

ServerFi:

ServerFi is in line with the spirit of Web3, allowing players to synthesize in-game assets and gain sovereignty over game servers. This mechanism enables players to control servers by accumulating and merging digital assets such as NFTs, incentivizing deeper investment and enhancing participation and loyalty.Continue to reward high retention players:

Project teams can keep tokens alive and the game ecosystem healthy by monitoring player behavior and providing targeted rewards to high-retention players. This approach encourages continued participation and drives stability and growth in the token economy. For example, airdropping a portion of server revenue to top users creates a play and earn dynamic that incentivizes players to continue contributing.

Model Validation:

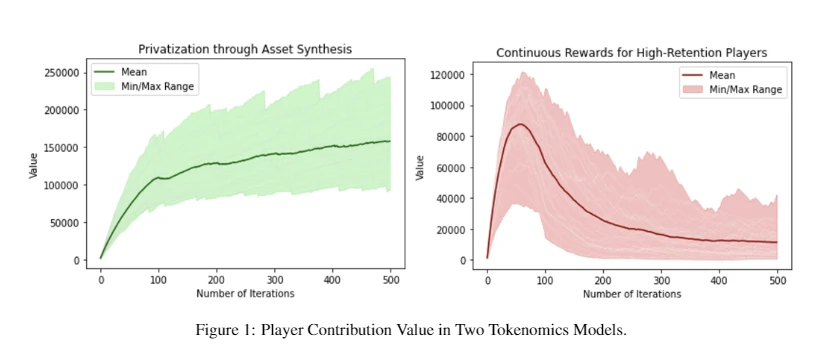

Yale University evaluated the effectiveness of these token economic models through group behavior simulation experiments, which took into account the randomness of the real world (introducing random noise from various angles, including individual behavior and population growth).

The experimental results show that in the asset synthesis privatization model (left), the player contribution value continues to increase with the number of iterations, indicating that the model can effectively maintain player participation and promote long-term value growth. In the continuous reward high retention player model (right), although the initial contribution value increased significantly, it then dropped rapidly, showing the challenge of maintaining player participation in the long term.

The original article believes that the strategy of continuously rewarding high-retention players can increase participation in the early stage, but in the long run it will aggravate player stratification, marginalize tail players and raise the entry threshold for new players, eventually leading to a vicious cycle. In contrast, the ServerFi mechanism introduces randomness through fragment synthesis and lottery, which enhances social mobility among players. Top players need to continue to contribute, and new players also have the opportunity to share rewards, thus maintaining the activity and sustainability of the system.

Image source: ServerFi: A New Symbiotic Relationship Between Games and Players

2.2 Putting aside the complex description of ServerFi, what does it essentially say?

If we separate the literal meaning of ServerFi from the original explanation, Server literally means server, and ServerFi is like a server network. In laymans terms, its main purpose is to delegate ownership of rights and interests, deepen the decentralized spirit of Web3, break up the server, and allow players to collect assets in the game to ultimately gain future server sovereignty.

But ServerFi alone is not enough, so a mechanism for continuously rewarding high-retention players is added. Simply put, the longer you play, the more server fragments you can collect. However, the original text does not explain in detail whether direct long-term consumption is required or the length of the game. If you still need to continuously purchase related tokens to continuously consume and earn the game, its essence is still Play to Earn, but this innovation is still to reduce or improve the pure Play to Earn Ponzi game to reduce speculative behavior.

To sum up in one sentence: ServerFi+s model of continuously rewarding high-retention players is essentially still the improvement and innovation of GameFis design parameters in the direction of financial attributes.

3. Final thoughts: Are GameFi and ServerFi essentially the wrong direction?

Image source: Photo Network

3.1 Is the playability of the game more important or is the gambling of Earn more important?

There is no doubt that the playability of the game is important. The essence of the game is to give players an addictive experience. Earn is just the icing on the cake. Earn without playability is not a game, but an electronic gambling slot machine. Maintaining a fun game experience is the key to attracting and retaining players, rather than relying on Ponzis short-term burst traffic. If there is only Earn without playability, then GameFi can only be a false proposition.

Economic incentives can only serve as an additional value to retain players, promote player participation, and attract more people to the game. Earns game drives the core of the in-game economy and token flow, empowering players with the economy instead of binding them. The two complement each other in GameFi. Playability provides long-term appeal and a continuous player base, while Earns game attracts initial users and drives the economic cycle. Therefore, the only purpose for the long-term development of the game is only one: fun.

3.2 What narratives do GameFi and ServerFi tell?

GameFi tells the story of the Pay to Earn model of game chain-linking. The outbreak was concentrated during the bull market of 2021-2022. The Ponzi craze brought about the rise of Axie Infinity, The Sandbox, and Stepn. After the tide receded, only the devastation was left, leaving behind the memories of explosive traffic and awakening the innovation and attempts of game chain-linking.

ServerFi talks about the improvement of the Pay to Earn model to reduce or improve the pure Play to Earn Ponzi scheme and further decentralize the economy and system. Compared with the way of obtaining ownership by completing the game of Ready Player One, ServerFi is a way for long-term loyal players to obtain ownership with strong financial attributes.

At this stage, most innovations on the blockchain are essentially the decentralized evolution of finance on the chain (or are still essentially derivatives of DeFi), and GameFi is no exception. It may not be wrong for blockchain games to give games strong financial attributes. The difficulty lies in how to make good use of the double-edged sword of blockchain with strong financial attributes. However, the narratives of GameFi and ServerFi are still innovations at the economic model design level. If they only use the slogan of making money by playing games, facing the inevitable plunge in the price of coins in the future, players can only lose money while playing games, which will eventually accelerate the irreversible death cycle of the game. Let GameFi return to the game, let the game return to fun. We need to design fun content instead of design economic values. This may be the way out for GameFi.

Extended Links

(1) ServerFi: A New Symbiotic Relationship Between Games and Players: https://osf.io/5dq4 k