At the Jackson Hole Annual Meeting at 10 pm on August 23, Federal Reserve Chairman Powell sent a clear signal of interest rate cuts, suggesting that the Feds monetary policy may have completed its shift. This overall dovish attitude triggered a chain reaction in the market. Last night, the SP 500 rose 1.15% and the Nasdaq Composite rose 1.45%. At the same time, Bitcoin rose 6.06% and closed at $64,037.

1. Macro-financial analysis

1. September rate cut forecast

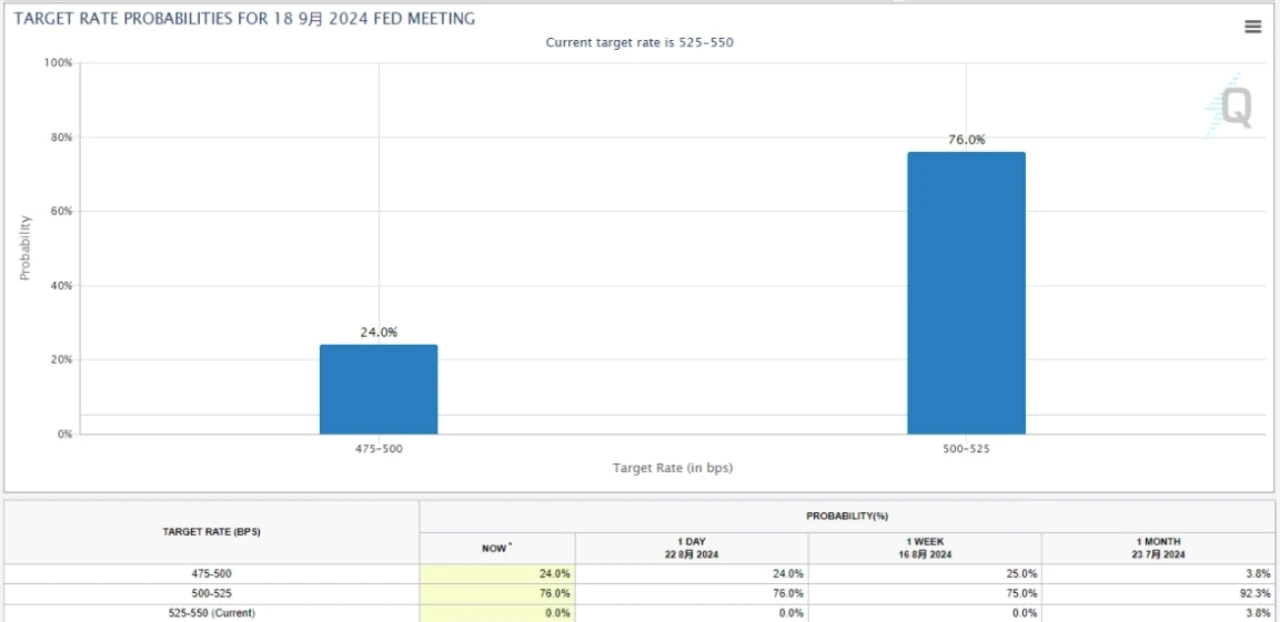

Powells dovish remarks have increased the markets expectations for a September rate cut to 100%, with a 25 basis point cut forecast at 76% and a 50 basis point cut at 24%. The significant increase in the number of forecast points for a rate cut shows the markets expectations for future loose monetary policy.

Figure 1: CME Fed September rate cut forecast percentage

2. The US dollar index fell to a one-year low

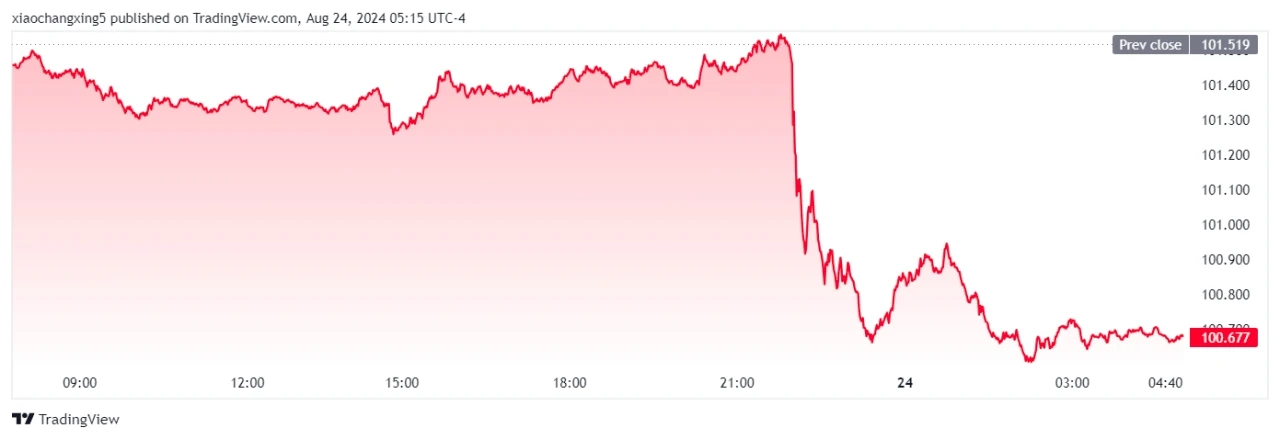

Affected by Powells speech, the US dollar index fell to 100.6, the lowest point in a year, and it is likely to fall further below 100. This weak dollar performance has brought direct benefits to the Bitcoin market. Investors began to look for other hedging assets, and Bitcoins status as digital gold was once again consolidated.

Figure 2: US dollar index fell to a one-year low

II. Market Fund Flow

1. BTC ETF has seen net inflows for seven consecutive days

From August 15 to August 23, Bitcoin ETFs had net inflows for seven consecutive days. It is particularly noteworthy that Grayscales GBTC selling pressure is close to exhaustion, while BlackRock and Fidelitys Bitcoin ETFs continue to buy, indicating their unwavering confidence in Bitcoin. The participation of institutional investors has injected new vitality into the Bitcoin market, and market sentiment has significantly improved.

Figure 3: BTC inflow and outflow of various ETFs

2. Fund Q2 financial report shows that institutions continue to increase their holdings of Bitcoin

The latest Q2 earnings report shows that 71 new funds reported holdings of spot Bitcoin ETFs, bringing the total number of holders to 195. 66% of ETF institutional investors chose to continue to hold or increase their holdings of BTC. Large investors, such as Goldman Sachs and Morgan Stanley, hold more than $400 million and $200 million in Bitcoin, respectively. This trend shows that long-term holders have been increasing their positions since late July, and the interest of large global institutions in Bitcoin is also increasing. For example, pension funds in South Korea and New Jersey further demonstrated their favor for Bitcoin by purchasing MicroStrategy shares and planning to purchase BTC spot ETFs. The Norwegian sovereign fund holds $100 million in BTC, once again proving the importance of Bitcoin as a long-term asset allocation.

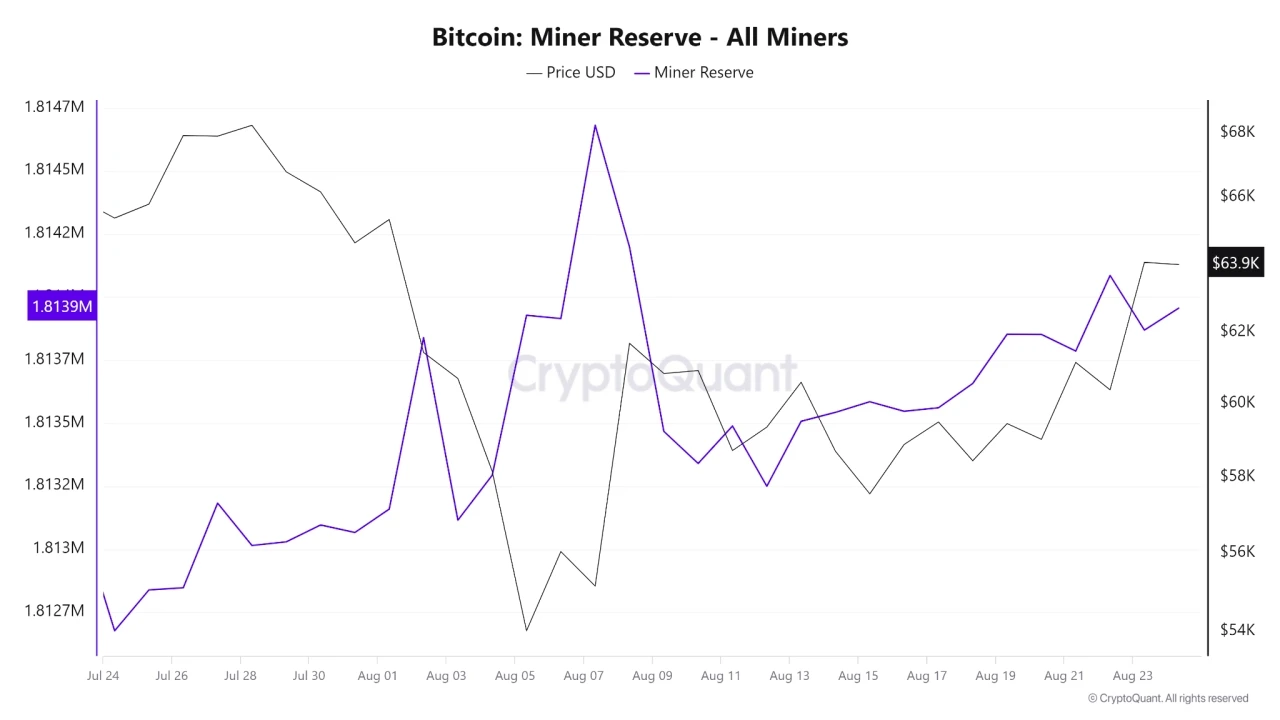

3. Miners reduce Bitcoin selling, and market selling pressure eases

The behavior of miners is also an important signal for the market this week. After the exit wave on August 5, miners began to return to the market, buying new mining machines and increasing their Bitcoin reserves. Marathons issuance of bonds to purchase BTC as a reserve strategy further proves its optimism about the long-term prospects of Bitcoin. Data shows that miners have stopped selling a large number of Bitcoins, and the number of Bitcoins flowing out has decreased significantly, and the market selling pressure has been reduced, providing support for the stability and rise of Bitcoin prices.

Figure 4: Miners Reduce Bitcoin Selling

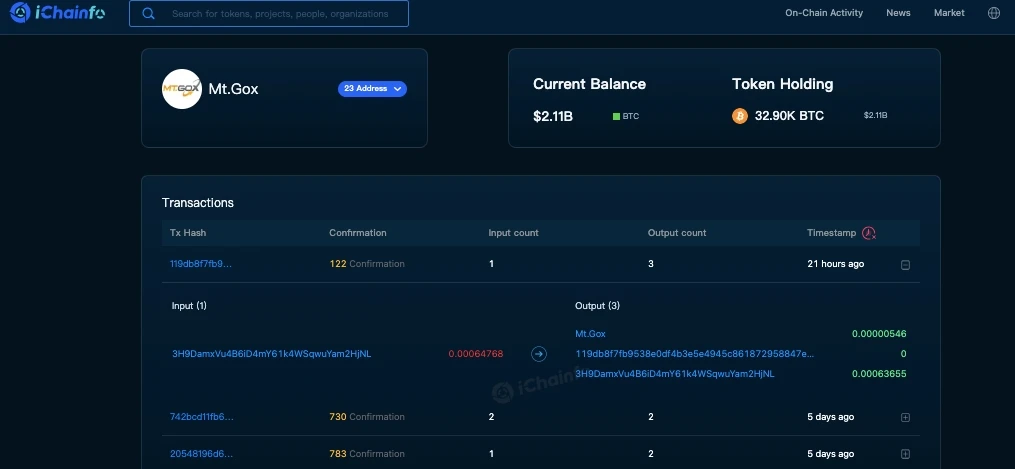

4. Mt. Gox compensation plan nears completion

On August 18, the on-chain data analysis platform ichainfo detected a small test transfer in the Mt. Gox wallet, and on August 21, 14.4k bitcoins were transferred out. So far, there are only 32.9k bitcoins left in the Mt. Gox wallet, a significant decrease from 142k bitcoins two months ago. Most customers compensation transfers have been completed, and the markets selling pressure on Mt. Gox has gradually been digested. The impact of this historical event is gradually fading from the markets view.

Figure 5: Mt. Gox compensation plan is nearing completion

3. Market Transaction Level Analysis

1. Technical indicators show a bullish arrangement, and the short-term trend is bullish

From the perspective of technical analysis, Bitcoin has shown bullish formations on the 1-hour, 4-hour, and 1-day trend lines. These technical signals indicate that the short-term trend of the market is bullish, providing important support for Bitcoin prices this week.

Figure 6: Technical indicators show a bullish arrangement

2. Net outflow of funds from exchanges, strong buying demand

The flow of funds in exchanges also showed positive signs. Data showed that the net outflow of bitcoins from exchanges in the past week exceeded 10,000, indicating that there was a large-scale buying demand in the market. These capital outflows directly reduced the bitcoin inventory of exchanges, setting a new record for the lowest inventory in the past month, providing further impetus for the price of bitcoin to rise.

Figure 7: Net outflow of funds from the exchange, new funds entering the market to buy

Summarize

On August 23, bulls launched a full-scale counterattack, using Powells dovish speech as a signal that the Fed would cut interest rates. The spot sellers on the exchange have almost dried up, and only the contract shorts are still stubbornly resisting in the market. It is expected that the shorts will build a new line of defense between $68,000 and $70,000. However, with the continuous entry of new institutional funds, the shorts line of defense will gradually collapse, and the pace of a full bull market is gradually approaching. As Mark Twain said, History does not repeat itself, but it rhymes. The outcome of this battle will determine the future direction of the Bitcoin market, and the course of history will eventually be unstoppable.

iChainfo Search: https://search.ichainfo.com/

Twitter: https://twitter.com/iChainfo

Discord: https://discord.gg/AaVKSHewKw

Telelgram: https://t.me/ichainfo_global

Medium: https://medium.com/@ichainfo

iChainfo: https://ichainfo.com/