Ethereum is one of the worlds largest and preferred public blockchain networks by developers. In the future, as Ethereum 2.0 and Layer 2 solutions advance, it will continue to lead and shape the development trend of future blockchain technology. Justin Drake is an important member of the Ethereum Foundation (hereinafter referred to as EF) and has played a vital role in promoting the development and implementation of Ethereum 2.0. He has not only promoted the advancement of Ethereum technology, but also brought important innovations and inspirations to the entire blockchain field.

This is the 1st issue of the Developer Stories column, which will help you better understand the world of Ethereum from the perspectives of Justin Drake and Owen, the head of OKX Web3 products. This issue covers Ethereum 2.0s technical improvements, consensus mechanisms, scalability, security, DeFi, user experience, ecosystem, environmental impact, and future development and strategy, aiming to gain an in-depth understanding of the insights and plans of Ethereum core developers.

Ethereum and L2 changes after Cancun upgrade

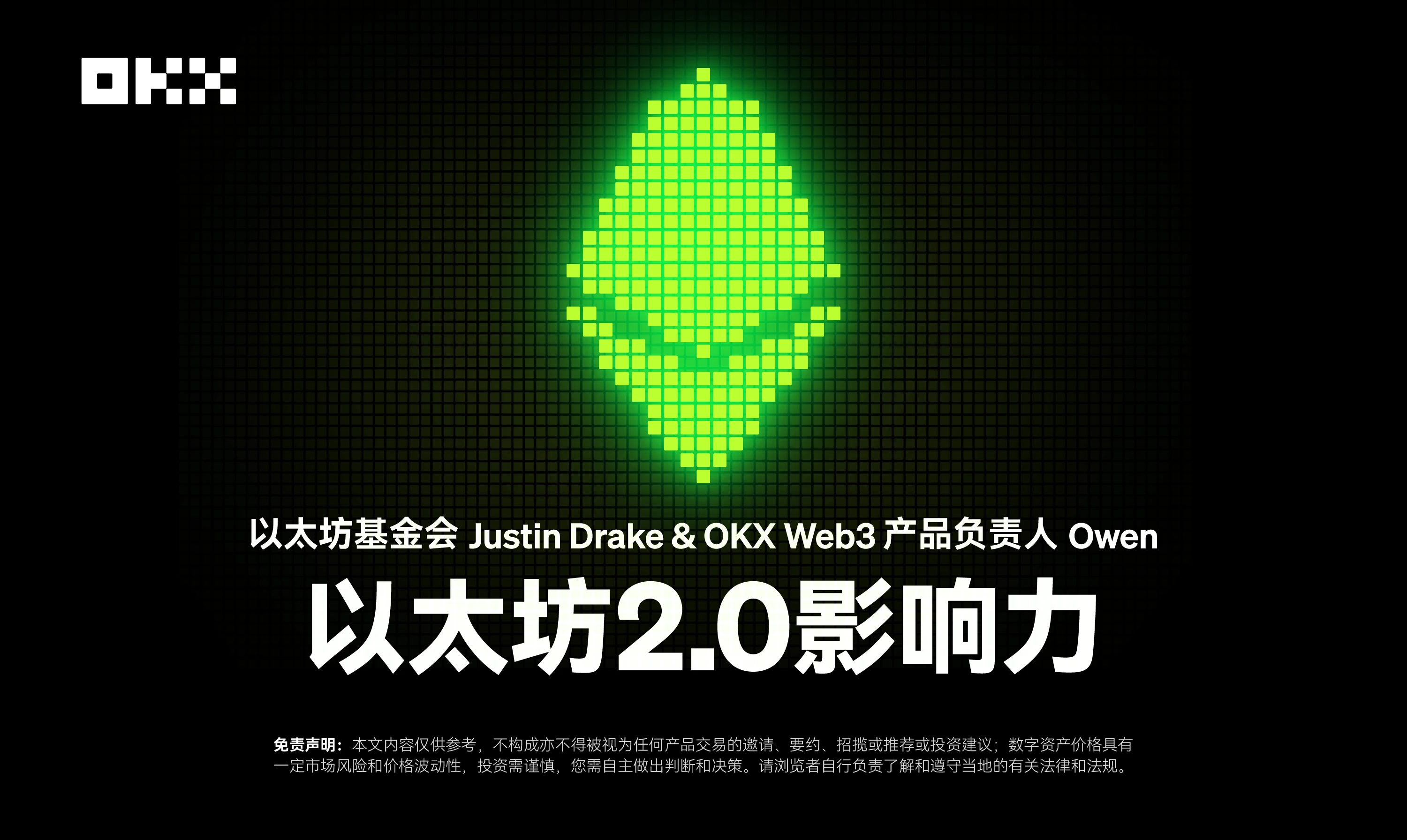

Justin Drake: After the Cancun upgrade, Ethereum throughput increased and the GAS fee of the L2 network was greatly reduced. From the data, after the Cancun upgrade, the attractiveness of Ethereum and L2 to developers and project parties has indeed increased significantly.

The L2 beat chart shows this nicely: transactions continue to grow over time.

Image 1: Source L2 beat

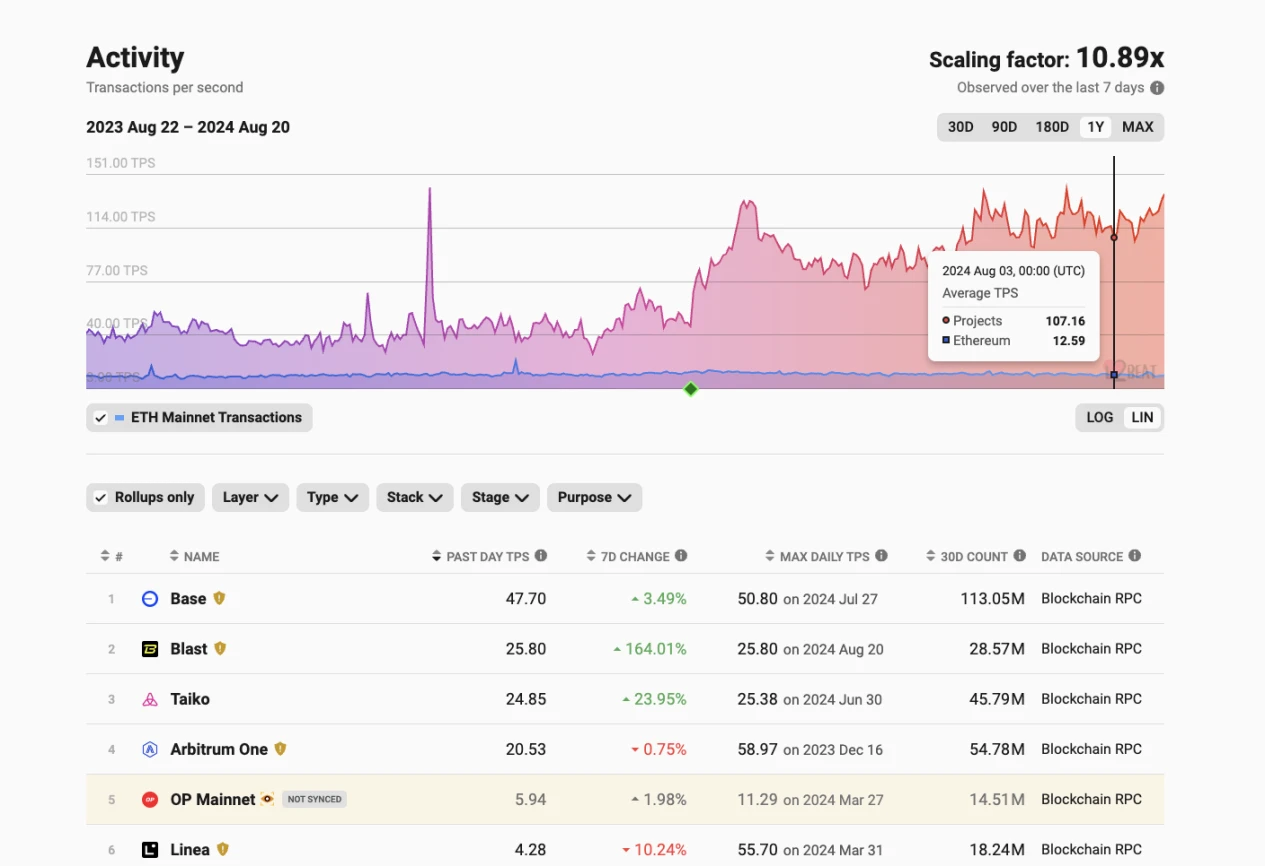

Additionally, Dune’s “Average Blobs per Block” chart shows that Blob usage has grown from ~1 Blob/block in March to ~2.3 Blobs/block today. A large part of this steady growth is coming from Ethereum’s bootstrapping of various L2s. In a few weeks, we should see Blob demand reach the 3 Blobs/block target and Blob fees reach market fair levels.

Image 2: Source: Dune

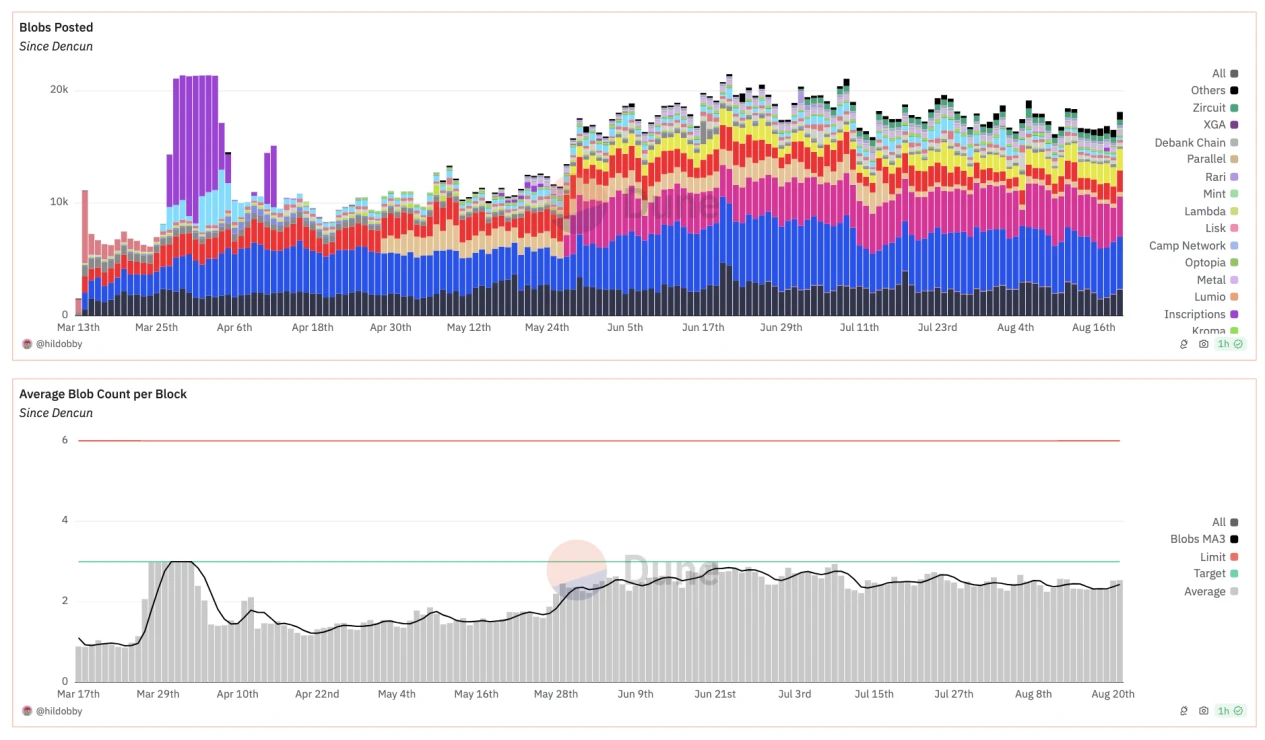

That is, the reduction of Gas stimulates user demand. From an economic point of view, when the supply curve moves from S 1 to S 2, the price equilibrium decreases from P 1 to P 2, and induces the demand to increase from Q1 to Q2.

Image 3: From the Internet

Owen, head of OKX Web3 product: So far, although the overall transaction volume of Ethereum and L2 has not shown a very rapid growth trend, assets are shifting to L2, and the total locked value (TVL) of L2 continues to rise. And the activity of L2 has surged. Take Base as an example. After the upgrade, Bases daily average active users (DAUs) increased by 560% compared with before the upgrade, and the daily average transaction volume (DTXs) increased by 540% compared with before the upgrade. The daily average transaction volume (DTXs) of Optimism and Arbitrum also increased by 70% and 200% respectively. From the perspective of transaction volume and daily activity, the upgrade has indeed attracted some traders, especially small traders.

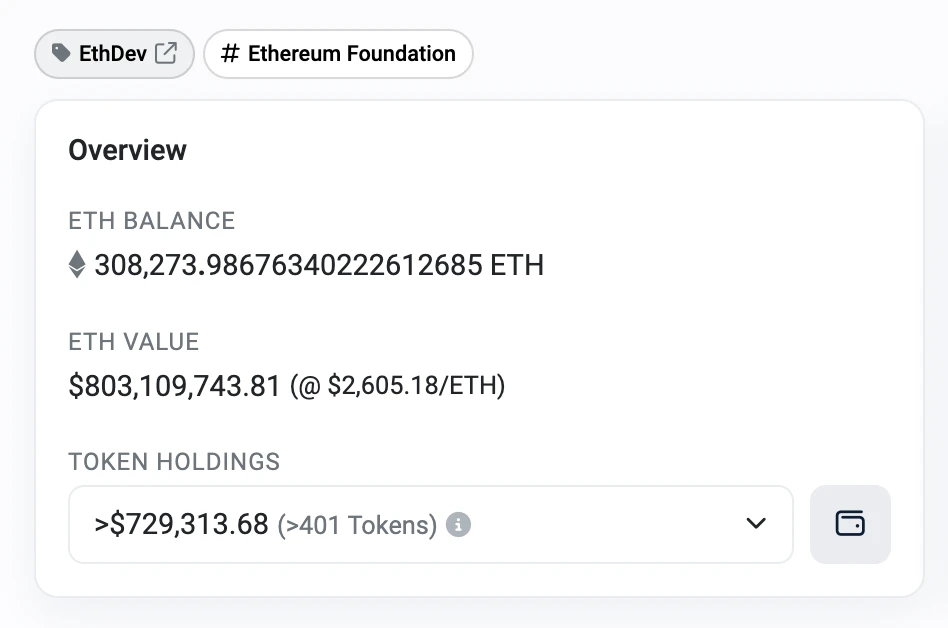

The Foundations reduction of ETH holdings is a good thing and will promote decentralization in the long run

Justin Drake: EF is often seen as a hands-off approach to promoting ecosystem development, and this style has faced some controversy. I think it’s a good thing that EF’s role in the entire ecosystem is decreasing.

Today, EFs responsibilities are primarily limited to:

1) Devcon or Devconnect is held every year. They are now just one of many conferences, and there are many peripheral activities that are more important than the main venue.

2) An execution client: Geth is one of the 5 execution clients, but EF does not maintain any consensus client.

3) Grants: Providing tens of millions of dollars in unconditional grants to the wider community each year has led to a reduction in EFs ETH financial reserves. In the long run, it is a good thing for the Ethereum Foundation to hold less ETH. EF currently controls 0.23% of the ETH supply, and it is healthy to keep this number close to 0% in the next few decades because it promotes the decentralization of the Ethereum ecosystem.

Image 4: Source Etherscan

4) Telephone coordination: Many conference calls are hosted by EF members, such as All Core Devs (ACD) hosted by Tim Beiko, All Devs Consensus (ACDC) hosted by Alex Stokes, RollCall hosted by Ansgar Dietrichs and Carl Beekhuizen, Sequencing and pre-conference hosted by me, MEV-boost conference call hosted by Alex Stokes,

You can click to see more: https://www.youtube.com/@EthereumProtocol/videos

5) Research: This may be one of the areas that will still be centralized, but it is possible that parts of the EF research team will become independent.

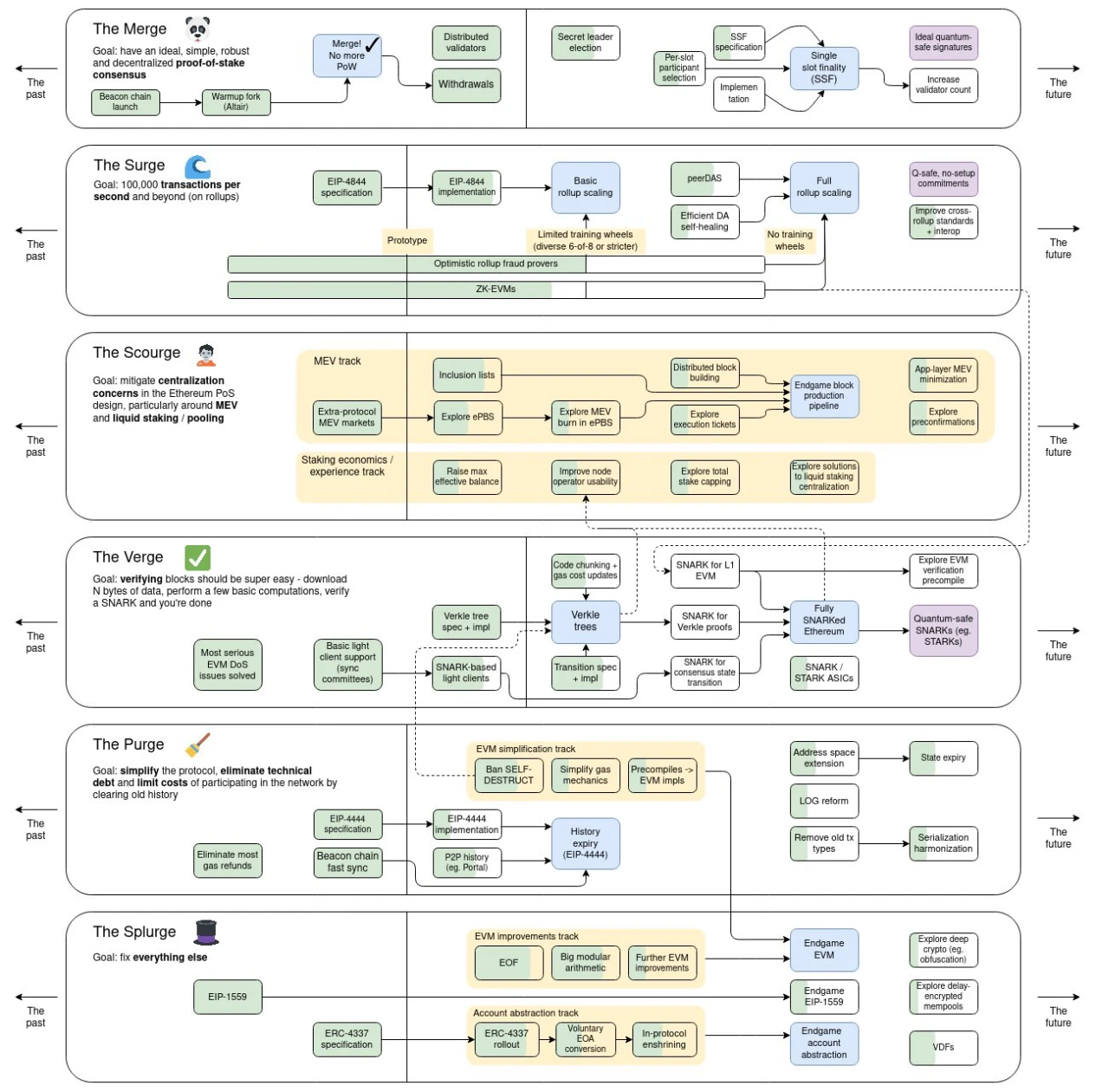

6) Roadmap Development: Vitalik updated the roadmap diagram, and then dozens of tasks were developed in parallel by different teams.

Image 5: Source: Vitalik’s tweet

Owen, head of OKX Web3 product: EF should play more of an advisory role. The ecosystem has gained enough attention to continue to develop without relying on key figures. This means that discussions can be carried out in an open and fair environment, making Ethereum a project that everyone recognizes, rather than being influenced by one party. This is also in line with the spirit of blockchain, that is, community-driven governance and transparency.

Ethereum DeFi Future Large-Scale Application Scenarios

Justin Drake: Currently, the Ethereum community has a very pure technical atmosphere and has been working on overcoming various technical difficulties, but technology ultimately needs to serve user needs and application scenarios.

First, I think the existing DeFi will grow 10 times in the next five years:

1) Stablecoins: We hope to see $1 trillion in stablecoins, a considerable portion of which will be decentralized stablecoins

2) DEX: The volume ratio of DEX to CEX is increasing, and I expect this trend to continue.

3) Lending market: Projects like AAVE and Compound should grow by about 10x

4) Prediction Markets: Projects like Polymarket should grow by about 10x

5) Derivatives: Liquid perpetual contracts, options, futures, etc., all of which will be available on Ethereum

Second, in addition to DeFi, I hope to see decentralized front ends using ENS and IPFS become more popular.

Owen, head of OKX Web3 product: From the data, the total locked value (TVL) of decentralized exchanges (DEX) is still the largest on Ethereum, but this data has dropped a lot compared to two years ago. We believe that the biggest obstacle to DeFi on Ethereum is the high transaction fees. The same transaction can be executed on Ethereum, compared to hundreds on L2, so the markets trading behavior will always move towards high efficiency.

The current technological development of the Ethereum community actually takes actual needs into consideration. For example, the EIP 4337 Account Abstraction that everyone has been promoting recently is based on the fact that Web2 users have an entry barrier when using Web3, so they want to promote Account Abstraction to lower the threshold for users to enter Web3. This will be a cornerstone for all future applications.

In the foreseeable future, I believe everyone will be able to easily self-host their own Web3 virtual assets with a user experience close to Web2.

Ethereum 2.0 Global Adoption Developer and User Attraction

Owen, Head of OKX Web3 Products: Ethereum 2.0 has now been widely adopted globally and is very attractive to both the blockchain world and current financial institutions.

From the perspective of network size and staking, the total staking of Ethereum 2.0 has reached 100 billion US dollars, and more than 50,000 independent validator nodes worldwide have participated in the consensus mechanism of Ethereum 2.0. From the perspective of DeFi market development, TVL has also increased significantly after Ethereum 2.0, because the PoS mechanism enables more DeFi projects to operate at lower transaction fees, thereby attracting more users and funds. From the perspective of global enterprises and institutions, many large enterprises and financial institutions (such as Microsoft, JPMorgan Chase, and IBM) are actively adopting Ethereum 2.0 technology. These enterprises use Ethereum 2.0 for supply chain management, financial transactions and other applications.

For new users and developers, Ethereum 2.0 offers faster transaction speeds and lower fees, making the Ethereum network more attractive to ordinary users, while for developers, the improvements in Ethereum 2.0 make building and deploying decentralized applications (dApps) more efficient. The new consensus mechanism and sharding technology allow them to build more complex and innovative applications without worrying about excessive costs or performance bottlenecks.

All of this shows everyones strong confidence in Ethereum 2.0.

However, Ethereum 2.0 still faces many obstacles in attracting adoption from a larger number of new users and developers.

First of all, for ordinary users, the entry cost is relatively high. It is important whether the wallet, the web3 entrance, can achieve seamless access for ordinary users.

Secondly, the overall learning cost is relatively high. Ethereum 2.0 contains many new concepts, such as Proof of Stake (PoS), sharding technology, Rollups, etc. These technologies may have a high learning curve for new users and developers. Developers need to spend time and energy to understand and adapt to these new technologies. In addition, Ethereums infrastructure and tools are still maturing, which also requires time and energy to continue to learn and follow up.

In terms of the market and competition, the competition in the entire market is becoming increasingly fierce, new platforms and technologies are constantly emerging, and other blockchain platforms (Solana, etc.) are also actively developing and promoting their own technologies. They may provide different technical advantages or lower entry barriers to attract a large number of users and developers.

Finally, in terms of regulation and compliance, the regulatory policies for blockchain and cryptocurrency are still changing, and the policies of different countries and regions may affect the adoption of Ethereum 2.0.

Ethereum 2.0s biggest technological advancements and technological improvements to watch

Owen, Product Manager of OKX Web3: Staking and Restaking.

On Ethereum 2.0, after adopting the POS consensus, staking has saved Ethereum a lot of energy, and it also gives room for restaking. Providing security guarantees for other projects has become a major mission of Ethereum, and only the size of Ethereum can bear this responsibility.

In addition, Vitalik recently proposed EIP-7702 as a solution that allows user wallets to support smart contracts, making it more convenient for users to use their wallets, supporting more login methods, and providing many convenient functions that ordinary EOA wallets cannot do, such as social recovery and non-native token gas fee payment, making it possible for large-scale web2 users to enter web3 in the future.

The Impact of PoS on Ethereum Decentralization

Owen, Product Manager of OKX Web3: We answer this question from multiple angles, including the impact of PoS consensus on decentralization, whether the incentive and penalty mechanisms for validators to participate in Ethereum 2.0 are effective enough, and how to ensure fairness for small validators under the PoS mechanism.

First of all, the impact of PoS consensus on decentralization. This is a long-standing topic. In the long run, the change in the consensus mechanism of Ethereum 2.0 is beneficial to its development. Ethereums goal is to become a world computer, so all its improvements and upgrades must move towards this goal, making it a computing platform more suitable for running decentralized applications (dAPP). After Ethereum 2.0 switched from PoW to PoS, it helped to effectively balance the impossible triangle between decentralization, scalability and security.

In addition, when discussing decentralization, we need to combine it with the real world. PoW is a permissionless way of participation, which can theoretically achieve maximum decentralization. However, in reality, mining is a highly specialized job, which has spawned professional services such as mining pools, mining machine manufacturers, and mining farms. Before Ethereum switched to PoS, the top five mining pools controlled more than 75% of the total network computing power, and the largest single mining pool accounted for more than 33% of the total network computing power. Ethereum mining consumes electricity comparable to that of a small country, and for professional mining farms, electricity prices are one of the most sensitive cost factors, so mining farms are usually concentrated in areas with low energy prices. This geographical concentration makes the supply of computing power vulnerable to regional government intervention, which in turn threatens the security and stability of the encrypted network. We have seen similar situations in Chinas environmental protection mining ban in 2021, when the total Bitcoin network computing power plummeted by more than 50% in two months. In addition, professional mining relies on professional hardware. Before Ethereum switched to PoS, mining required the use of graphics cards, and there were very limited chip companies that could produce graphics cards in the world. If hardware suppliers intervene in mining activities, network security will also be threatened. For example, Nvidia once reduced the Ethereum mining efficiency of the RTX 3060 graphics card by half to force miners to find other alternatives. Therefore, I think it is unrealistic to discuss decentralization out of touch with the real world. Ethereums shift to PoS is a move in a better direction.

Secondly, we want to discuss whether the incentive and penalty mechanism for validators to participate in Ethereum 2.0 is effective enough. The upgrade of Ethereum 2.0 has been going on for more than two years. Judging from the current operation results, the incentive and penalty mechanism is effective. The much-discussed attack modes before the upgrade, such as short-range reorganization, bounce attack, balance attack, avalanche attack and denial of service attack, have been effectively resisted.

The last point is how to ensure fairness for small validators under the PoS mechanism. These issues have been incorporated into Ethereums medium-term roadmap. For example, by reducing hardware requirements: using Verkle trees plus EIP-4444, staking nodes can run with extremely low hard disk requirements. This allows staking nodes to synchronize almost instantly, greatly simplifying the setup process and switching from one implementation to another. These proposals also make Ethereum light clients more feasible by reducing the proof data bandwidth required for each state access. Or through economic means, such as allowing a larger validator set (lowering the minimum requirement for staking) while reducing the overhead of consensus nodes. Through these measures, verification becomes fairer while also making light clients more secure.

Ethereum L2s Development Status Rollups Technology Potential

Owen, Product Manager of OKX Web3: Regarding the current development status of Ethereum L2s, the Layer 2 track on Ethereum is too crowded, which goes against the original intention of establishing Layer 2 to expand Ethereum. The fragmentation of Layer 2 liquidity and the separation of UI caused by competition are becoming increasingly obvious. It is difficult for users to play the Layer 2 ecosystem through a single entrance. OKX Web3 wallet is studying corresponding solutions. From the perspective of product development, the head effect itself will cause liquidity and interaction to concentrate on the top few Layer 2s, and finally form a long tail situation, and even Layer 2s without user volume will be gradually eliminated. From the perspective of technical solutions, we see that chain abstraction technical solutions are emerging. Users can enter through a single entrance and use Layer 2 imperceptibly through inter-chain atomic exchange service providers.

Regarding the potential of Rollups technology in the Ethereum ecosystem, it can be viewed from two aspects. Rollup has two sides.

Advantages of Rollup: 1) Scalability: significantly improve transaction throughput and reduce gas. 2) Security: Using ETH as the DA layer, the security and decentralization characteristics of the Ethereum main chain are retained. 3) Ecosystem support and compatibility: Ethereums community and developer ecosystem provide extensive support for Rollups. 4) Flexibility and innovation potential: Rollups support complex smart contracts and decentralized applications. 5) Future scalability development direction: With the gradual implementation of Ethereum 2.0 and the introduction of sharding technology, Rollups is seen as an expansion solution that complements the Ethereum main chain. 6) After the cancun upgrade, it is cheaper to upload main chain data.

Disadvantages of Rollup: 1) Data availability issues: To ensure data availability, compressed data and state root are published on the Ethereum main chain, and all data must be accessible and verifiable. 2) Delay and exit time: It is usually necessary to wait for a challenge period when exiting the Rollup chain. 3) Compatibility issues: There are partial incompatibilities between different rollups networks, such as EVM OP_CODE. 4) Centralization risk: Fewer nodes, more centralized.

In general, Rollups mainly promote the development of Ethereum by improving scalability, reducing transaction costs, enhancing security, and supporting complex applications. Although it faces some disadvantages, it is still an important boost to the development of Ethereum.

From the perspective of OKX Web3 wallet, how do you view Ethereum 2.0 security, community governance, energy efficiency and privacy technology?

Owen, head of OKX Web3 product: First of all, the main challenges of Ethereum 2.0 in terms of security cannot be underestimated, mainly including:

First, the security of the Proof of Stake (PoS) mechanism: Although Pos->Pow is more energy-efficient, there is a risk of ETH whales doing evil.

Second, the degree of decentralization of validators: staking projects such as lido occupy too high a proportion of the staking network, greatly reducing the degree of decentralization.

Third, new attack risks brought by sharding: Ethereum 2.0 introduces sharding technology to improve the throughput of the network. Sharding divides the network into multiple shard chains, each of which processes a part of the transaction, greatly improving performance, but also increasing the complexity of the chain and bringing new risks.

Fourth, economic incentives and attack costs: In the PoS mechanism, validators have economic incentives to maintain the security of the network. However, if the potential benefits of an attack are higher than the risks and costs, it may attract malicious actors to attack.

Fifth, contract code: such as EVM upgrades leading to incompatibility with old solidity features, etc.

Secondly, the future of community governance of Ethereum 2.0 is full of potential. As the network moves towards greater decentralization and scalability, governance will become more decentralized. From proof of work (PoW) to proof of stake (PoS), the influence of stakers increases. For example, in the first upgrade after Ethereum transitioned to proof of stake, the priority of ETH withdrawals was mainly affected by the interests of Ethereum stakers.

As the Ethereum ecosystem matures, the governance process will become more structured and formalized, and social governance will continue to play an important role in the development of the network. In addition, as Layer 2 solutions become more popular, governance will also need to address the interaction between Ethereum 2.0 and these scaling solutions.

Ethereum 2.0’s community governance will be more decentralized in the future, but it will require careful design and continuous innovation to maintain the decentralization of the network and the community’s voice in governance decisions.

Then, is there more room for improvement in energy efficiency of Ethereum 2.0? We have observed that Ethereum has reduced electricity consumption by more than 99% after switching to PoS, but storage overhead can still be optimized, such as transitioning Ethereum state management from Merkle Patricia Tree (MPT) to Verkle Tree (VKT).

Finally, the development of Ethereum privacy technology. We believe that the future of Ethereum privacy technology will focus on improving transaction privacy, protecting user data, and finding a balance between decentralization and regulatory compliance. The main development direction includes the wider adoption of zero-knowledge proof technology. Most importantly, with the advancement of quantum computing technology, research on quantum computing attacks will promote the development of quantum-resistant cryptographic technology to ensure the privacy and security of Ethereum in the long run. The Ethereum community has begun to study and discuss how to prevent quantum computing attacks.

The challenges facing Ethereum in the next 10 years will Ethereum exist in the next 30 years

Owen, head of OKX Web3 product: If we classify Ethereum and its corresponding EVM L2 (Ethereum Extension Layer 2) as Ethereum, the main challenge in the next 10 years will be to reduce the friction between L1 and L2, thereby improving the user experience of cross-chain interactions and reducing liquidity fragmentation. The ecosystems of L1 and L2 should be as seamless as a single chain, which is a challenge that teams like Polygons AggLayer are working hard to solve.

Ethereum should still be relevant in the next 30 years as it has established itself as one of the most decentralized and long-lived networks.

About the Developer Stories column

Web3 developers have made important contributions to the development of the crypto industry. Their innovative spirit and technical capabilities have injected lasting vitality and momentum into the development of the entire industry, not only improving the technology itself, but also providing support for future application scenarios and business models. However, although they are active, they are rarely paid attention to. The Developer Story column launched by OKX Web3 and ChainCatcher aims to understand the development context, technical insights, latest developments, market changes, hot comments, etc. of different public chains from the perspective of developers through dialogues with core developers of different public chain ecosystems and the OKX Web3 technical team, enhance the voice of Web3 developers, approach these most active and interesting people, and provide them with the greatest support.

Disclaimer

This article is for reference only. This article only represents the authors views and does not represent the position of OKX. This article is not intended to provide (i) investment advice or investment recommendations; (ii) an offer or solicitation to buy, sell or hold digital assets; (iii) financial, accounting, legal or tax advice. We do not guarantee the accuracy, completeness or usefulness of such information. Holding digital assets (including stablecoins and NFTs) involves high risks and may fluctuate significantly. You should carefully consider whether trading or holding digital assets is suitable for you based on your financial situation. Please consult your legal/tax/investment professionals for your specific situation. Please be responsible for understanding and complying with local applicable laws and regulations.