Original author: @Web3 Mario

Market sentiment has been relatively low recently. As the potential policy dividends are gradually realized and not as expected, and a series of celebrities such as Trump have harvested the liquidity of the Crypto speculation market, the two-year cryptocurrency speculation wave driven by the return of liquidity driven by macroeconomic factors seems to have come to an end. In response, more and more investors and believers have begun to think about the next value narrative of the Web3 industry, and the Web3 consumer application track has become the focus of many discussions. Only with more mass adoption of consumer-level applications can this ecosystem with over-constructed infrastructure bring real user adoption and sustainable business value. Therefore, during this period, the author has been thinking about the issue of Web3 consumer applications. I have some experience and hope to share it with you. In this article, I will review the current mainstream paradigms of Web3 consumer applications and explore their respective opportunities and challenges. In subsequent articles, I will continue to share some specific market opportunity insights and ideas, and welcome friends to communicate with me.

What is Web3 Consumer Application?

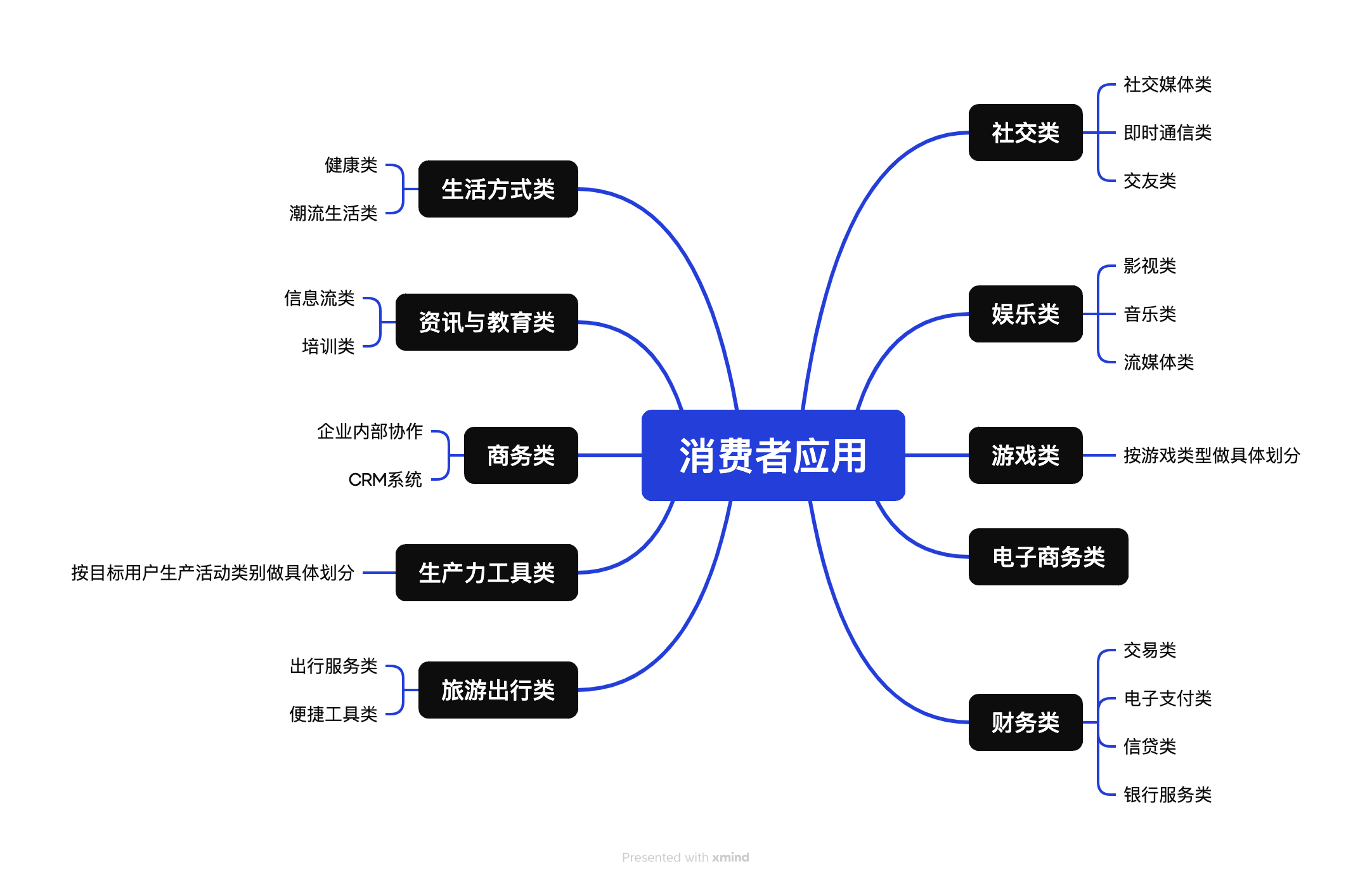

The so-called Consumer Application, or To C application in the Chinese context, means that your target users are most ordinary consumers, not enterprise users. Open your App Store, and all the applications in it belong to this category. Web3 Consumer Application refers to consumer-oriented software applications with Web3 features.

Generally speaking, according to the classification in most App Stores, we can roughly divide the entire Consumer Application track into the following 10 categories, and each category has different subdivisions. Of course, as the market matures, many new products will combine multiple features to a certain extent in order to find their own differentiated selling points, but we can still make a simple classification according to their core selling points.

What are the current Web3 Consumer Application paradigms and their respective opportunities and difficulties?

As of now, I think there are three common Web3 Consumer Application paradigms:

1. Utilize the technical features of Web3 infrastructure to optimize some problems existing in traditional Consumer Applications:

This is a common paradigm. We know that a lot of investment in the Web3 industry is centered around infrastructure construction, and application creators who adopt this paradigm hope to leverage the technical features of the Web3 infrastructure to enhance the competitive advantage of their products or provide new services. Generally, we can classify the benefits of these technological innovations into the following two categories:

Ultimate privacy protection and data sovereignty:

Opportunity point: Privacy track has always been the main theme of Web3 infrastructure innovation. From the initial asymmetric encryption algorithm identity confirmation system, it has gradually integrated many software and hardware technologies, such as ZK, FHE to TEE. A group of technical experts in Web3 seem to uphold the extreme theory of human nature, aiming to create a network environment that is completely independent of third-party trust and provide users with the ability to interact with information or value. The most direct benefit of this technical feature is that it brings data sovereignty to users. Personal privacy information can be directly hosted in local trusted software and hardware devices, avoiding the leakage of private information. There are many Web3 Consumer Applications optimized for this technical feature. Any project that claims to be decentralized XX belongs to this paradigm, such as decentralized social media platforms, decentralized AI large models, decentralized video websites, etc.

Difficulty: After years of market verification, it can be said that this core selling point has not been observed to have obvious advantages in market competition. There are two reasons. First, consumers emphasis on privacy is based on large-scale privacy leaks and infringements. However, in most cases, the formulation of more complete laws and regulations can effectively alleviate this problem. Therefore, if the protection of privacy is based on a more complex product experience or a more expensive use cost, its competitiveness will be obviously insufficient. Second, we know that the current business model of most consumer applications is based on the value of big data extraction, such as precision marketing. Over-emphasizing privacy protection will shake the mainstream business model, because user data will be scattered in a number of data islands, which makes it difficult to design a sustainable business model. If you can only rely on the so-called Tokenomics in the end, you have to introduce unnecessary speculative attributes to the product. On the one hand, this disperses the teams resources and energy to deal with the impact of this attribute on the product. On the other hand, it is not conducive to finding PMF, which will be analyzed in detail below.

Low-cost, global, 24/7 trusted execution environment:

Opportunity point: The emergence of many L1 and L2 provides application developers with a new, global, all-weather multi-party trusted program execution environment. Usually, traditional software service providers independently maintain their own programs, such as running them on their own server clusters or clouds. This naturally brings trust costs in businesses involving multi-party collaboration, especially when the strength or scale between the multiple parties is balanced, or when the data involved is particularly sensitive and critical. This trust cost is usually converted into huge development costs and user usage costs, such as cross-border payment scenarios. The execution environment brought by Web3 can effectively reduce the costs associated with running such services. Stablecoins are a good example of such applications.

Difficulty: From the perspective of reducing costs and increasing efficiency, this is indeed a competitive advantage, but it is difficult to explore application scenarios. As mentioned above, only when a service involves multiple parties collaborating, the relevant entities are independent, the scale is balanced, and the data involved is particularly sensitive, can the use of this execution environment bring benefits. This is a relatively demanding condition. At present, most of these application scenarios are concentrated in the field of financial services.

2. Design new marketing strategies, user loyalty programs or business models using crypto assets:

Similar to the first point, application developers who adopt this paradigm also hope to increase the competitive advantage of their products in a relatively mature and market-proven scenario by introducing Web3 attributes. However, these application developers are more interested in introducing crypto assets and taking advantage of the extremely high financial attributes of crypto assets to design better marketing strategies, user loyalty programs, and business models.

We know that any investment target has two kinds of value, commodity attributes and financial attributes. The former is related to the use value of the target in a certain actual scenario, such as the habitable attribute of real estate assets, while the latter is related to its transaction value in the financial market. In the field of crypto assets, this transaction value usually comes from speculative scenarios brought about by circulation and high volatility. Crypto assets are an asset class whose financial attributes are far higher than commodity attributes.

In the eyes of most such application developers, the introduction of encrypted assets usually brings three benefits:

Reduce customer acquisition costs through Token-based marketing activities such as Airdrop:

Opportunity: For most consumer applications, how to acquire customers at low cost in the early stages of a project is a key issue. Tokens, with their extremely high financial attributes and assets created out of thin air, can significantly reduce the risks of early projects. After all, compared to directly using real money to buy traffic and exposure, using tokens created at zero cost to capture users is indeed a more cost-effective option. From a certain perspective, such tokens are similar to advertising tokens. There are quite a few projects that adopt this paradigm, such as most TON ecological projects and mini-games.

Difficulty: This customer acquisition method faces two main problems. First, the conversion cost of seed users obtained by this method is extremely high. We know that most of the users attracted by this program are cryptocurrency speculators, so these users are not so concerned about the project itself, and are more likely to participate in the potential financial attributes of the reward. Moreover, there are currently a large number of professional airdrop hunters or hair-pulling studios, which makes it extremely difficult to convert them into real product users in the later stage. And it may cause the project to misjudge PMF, resulting in excessive investment in the wrong direction. Second, with the large-scale application of this model, the marginal benefits of using Airdrop to acquire customers are reduced, which means that if you want to establish sufficient attraction among the cryptocurrency speculator group, the cost will gradually increase.

X to Earn based user loyalty program:

Opportunities: Retention and activation is another issue that consumer applications are concerned about. How to ensure that users continue to use your product requires a lot of effort and cost. Similar to marketing, using the financial attributes of tokens to reduce the cost of retention and activation is also the choice of most such projects. A more representative model is X to Earn, which rewards key user behaviors based on tokens in advance and establishes a user loyalty program based on this.

Difficulty: Relying on the motivation of users to earn income to promote activity will shift users attention from the product function itself to the rate of return. Therefore, if the potential rate of return decreases, users attention will also be lost quickly, which is a great harm to consumer applications, especially some products that rely on a large amount of UGC. If the rate of return is based on the price of the token issued by itself, it will put pressure on the project party to manage the market value, especially in the bear market stage, and it will have to bear high maintenance costs.

Directly cash out using the financial attributes of Tokens:

Opportunity point: For traditional consumer applications, there are two most common business models. One is free use, which uses the platform traffic value after large-scale adoption to realize value. The other is paid use. If you want to use certain Pro services of the product, you need to pay a certain fee. However, the former has a longer cycle and the latter is more difficult. Therefore, Token has brought a new business model, which is to use the financial attributes of Token to realize value directly, that is, the project directly sells coins to cash out.

Difficulty: It can be clearly stated that this is an unsustainable business model. The reason is that after the project has passed the early high-growth stage, due to the lack of incremental capital inflows, this zero-sum game model will inevitably put the interests of the project party in opposition to the interests of users, accelerating user loss. If the project party does not actively cash out, due to the lack of strong cash flow revenue, the project party can only rely on financing to obtain funds to maintain the team or expand the business, which will fall into the dilemma of relying on the market environment.

3. Fully serve Web3 native users and solve the unique pain points of these users:

The last paradigm refers to consumer applications that fully serve Web3 native users. According to the direction of innovation, they can be roughly divided into two categories:

Construct a new narrative, design monetization around some untapped value elements of Web3 native users, and create a new asset class:

Opportunity point: By providing new speculative targets for Web3 native users (such as the SocialFi track), the benefit is that they have the pricing power over a certain asset at the initial stage of the project, thereby obtaining monopoly profits. This can only be achieved in traditional industries after fierce market competition and the construction of strong competitive barriers.

Difficulty: Frankly speaking, this paradigm is more dependent on team resources, that is, whether it can obtain the recognition and support of people or institutions with strong appeal or pricing power of crypto assets among Web3 native users. This brings two difficulties: First, with the development of the market, the pricing power of crypto assets is dynamically transferred among different groups, for example, from the initial Crypto OG, to crypto VC, then to CEX, then to crypto KOL, and finally to traditional politicians, entrepreneurs or celebrities. In this process, whether it is possible to identify trends and establish cooperation with upstarts at each transition of power has created great requirements for team resources and market sensitivity. Second, in order to establish a cooperative relationship with the pricer, it usually takes a huge cost and price, because in this market, you are not competing with other opponents for a larger market share in a certain application track, but competing with all other crypto asset creators for the preferences of the pricer, and this is a very competitive game.

By providing new tool products, we can serve the unmet needs of Web3 native users in the process of participating in the market. Or we can provide these users with better and more convenient products from the perspective of user experience:

Opportunity: I think this is the most promising paradigm in the future. With the gradual popularization of cryptocurrency, the overall base of this user group will gradually expand, which makes it possible to segment users. And because it focuses on the real needs of a certain user group, such products are often easier to achieve PMF, thereby establishing a more robust business model, such as some transaction-related data analysis platforms, Trading Bot, information platforms, etc.

Difficulty: Since it returns to real user needs, the product development path is more robust, but the construction cycle is longer than other paradigm projects. Moreover, since such projects are not narrative-driven but driven by specific needs, the product’s PMF is easier to verify. Large amounts of financing are usually not available in the early stages of the project. Therefore, it is very difficult to remain patient and stick to the original intention in the complex wealth myth brought about by “issuing coins” or high-valuation financing.

Of course, these three paradigms are not completely independent, and you can see their shadows in many projects at the same time. We just make this classification for the convenience of analysis. Therefore, for those who want to start a business in the Web3 Consumer Application track, it is of utmost importance to comprehensively evaluate their own advantages and demands and choose a paradigm that best suits them.