Gate Ventures Research Institute: In-depth analysis of MEV, illuminating the dark forest (Part 1)

With the dramatic increase in on-chain activities and the evolution and enrichment of on-chain infrastructure, on-chain MEV has always been regarded as the most dangerous part of the Ethereum Dark Forest, which directly causes profit loss and degradation of user experience in users' on-chain financial activities. The goal of this article is to analyze the inherent centralization and trust issues brought about by this mechanism based on the technical evolution of Ethereum 2.0's block generation mechanism and proposer-builder separation (PBS), which is in stark contrast to the reality of Ethereum's values.

The intensification of on-chain MEV is indeed a double-edged sword, with positive and negative externalities. The positive ones include reducing DEX price differences and helping to clear transactions; the negative ones include damage to users' mezzanine transactions. Therefore, the solution of MEV is more about reducing negative externalities, but it cannot eradicate them. In the process of exploring mechanisms to reduce the negative externalities of MEV and solve the current problems based on third-party trust middleware Relayer, there are mainly three types of measures: improvements in the auction mechanism, improvements in the consensus layer, and improvements in the application layer. These three improvements will have different degrees of impact on the modern landscape of MEV, but some solutions cannot actually solve the problem of sandwich attacks encountered by users. User transactions are still in the public pool, so more privacy pool technologies need to be introduced to protect the optional privacy of user transactions. These MEV solutions are worth trying in combination.

In addition, as an inevitable byproduct of mechanism design, MEV will become even more complex in the future. We have also explored in this article more technical challenges and opportunities for MEV that may arise with the implementation of new transaction types such as Layer 2 architecture and EIP-4337 account abstraction.

Finally, we hope to use this article to explore potential solutions to mitigate the negative externalities of MEV and to have a comprehensive understanding of the pros and cons of the current MEV solution, not only to illuminate the dark forest for future users, but also to illuminate the dark forest for industry researchers to further study MEV.

Ethereum 2.0

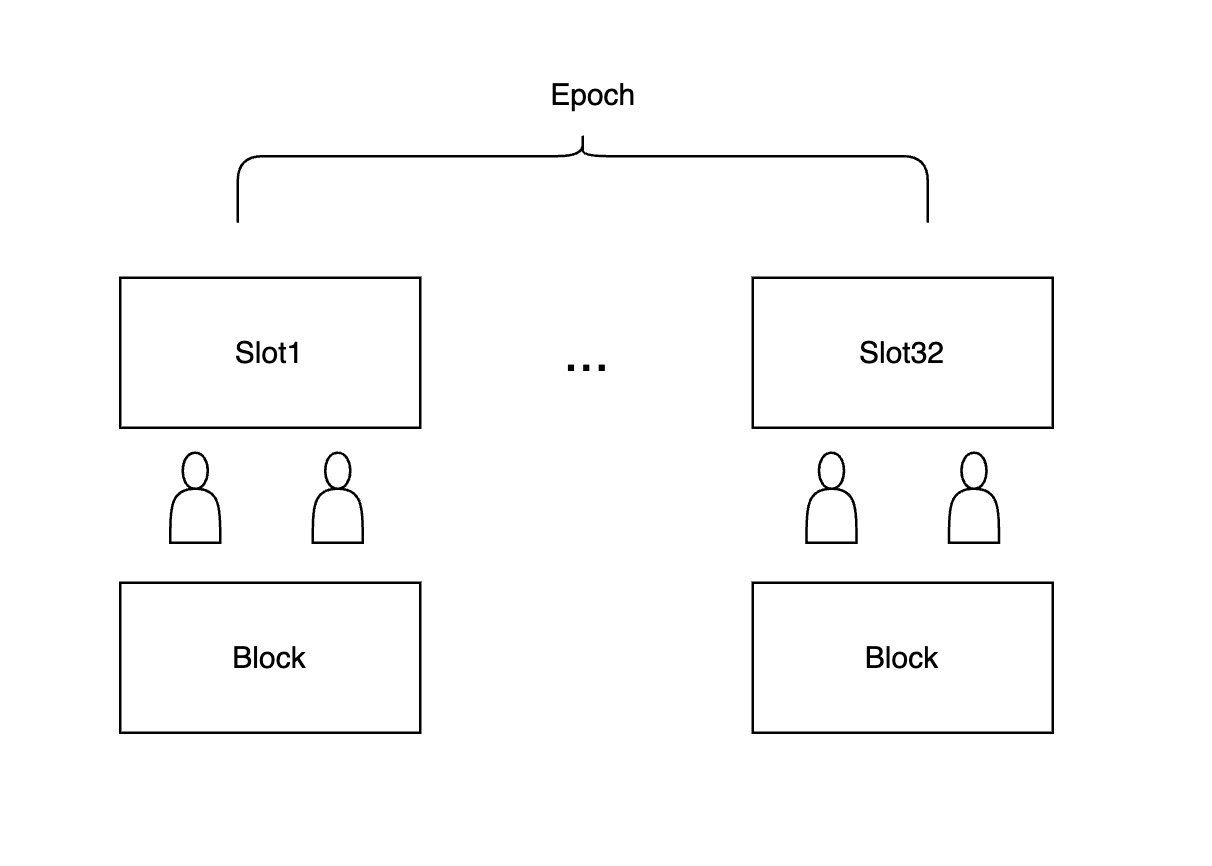

Since The Merge, Ethereum has adopted the POS mechanism to ensure the security of the network. At the same time, in terms of block production, it has abandoned computationally intensive competition and adopted proof of stake. After the merger, Ethereum is divided into an execution layer and a consensus layer. The output of the entire block has also changed. Each Epoch is a POS cycle, and each Epoch is divided into 32 Slots. Each Slot is equivalent to a block time unit, which is 12 seconds.

Validator proposed block diagram

The entire network will randomly select a committee from the validators in each Epoch. The person who proposes the block is randomly selected from the committee set. The block proposer needs to package and sequence the transactions to produce a block. Other committee validators will supervise this process and then vote for the block. And this committee will be re-elected after each Epoch. At the same time, certain operation time limits are imposed to ensure the efficiency of block generation and voting. Here, we standardize the terminology for readers. Payload is the execution payload, which means the state change of the transaction, which can be regarded as part of the execution block. The block proposer will implement the execution payload (that is, the state change of the transaction result) and the block proposal.

PBS Architecture

In fact, when a validator is selected as a block proposer, the proposer often has no motivation to execute the Payload, that is, to sort and execute transactions, because this requires a lot of computing power to execute state changes. The original thought was that if we use a decentralized committee election and include the execution load, then transaction sorting and so on become decentralized matters. However, the validator seems to naturally want to hand this part over to a third party to complete, while the Proposer focuses on proposing blocks. Therefore, the idea of PBS was derived, which is to separate block proposals and construction. The node proposer is only responsible for verifying blocks and does not participate in block construction. The separation between proposers and builders promotes an open market in which block proposers can obtain blocks from block builders. These builders compete with each other to construct blocks and offer the highest fees to the proposer, which we call a "block auction."

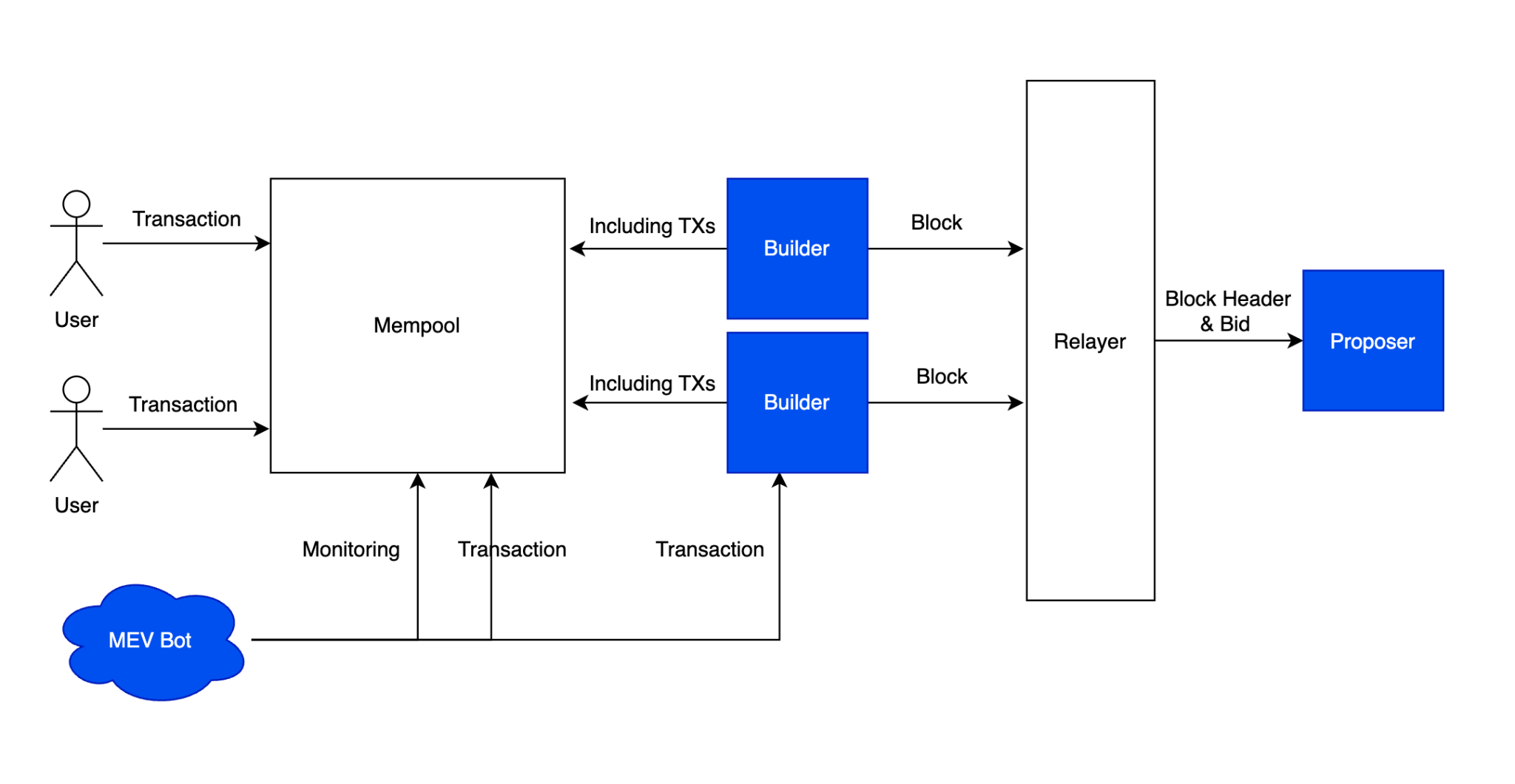

PBS process diagram

Let's briefly introduce the entire PBS (Proposer Builder Seperate) sealed first auction model. When a user submits a transaction through an RPC agent, RPC is equivalent to running a node and submitting the transaction to the public Mempool. Multiple builders find the most suitable transactions and sort them to generate a block with maximum profit (maximum profit refers to the transaction fee Base+Priority+MEV). Then multiple builders interact with the Proposer through the MEV-Boost Relayer. The Relayer is a bridge for multiple builders to interact with the Proposer. The Builder submits a bid to the Relayer, and the Relayer submits multiple block headers and corresponding bids to the Proposer. The Proposer generally adopts the block with the highest bid. Among them, the Relayer will implement the MEVBboost specification, which is a technical specification proposed by Flashbot on how to regulate the interactive bidding between builders and proposers. In this process, all information is closed, and the Relayer will only submit the block header to the Proposer, so the Proposer is censorship-resistant.

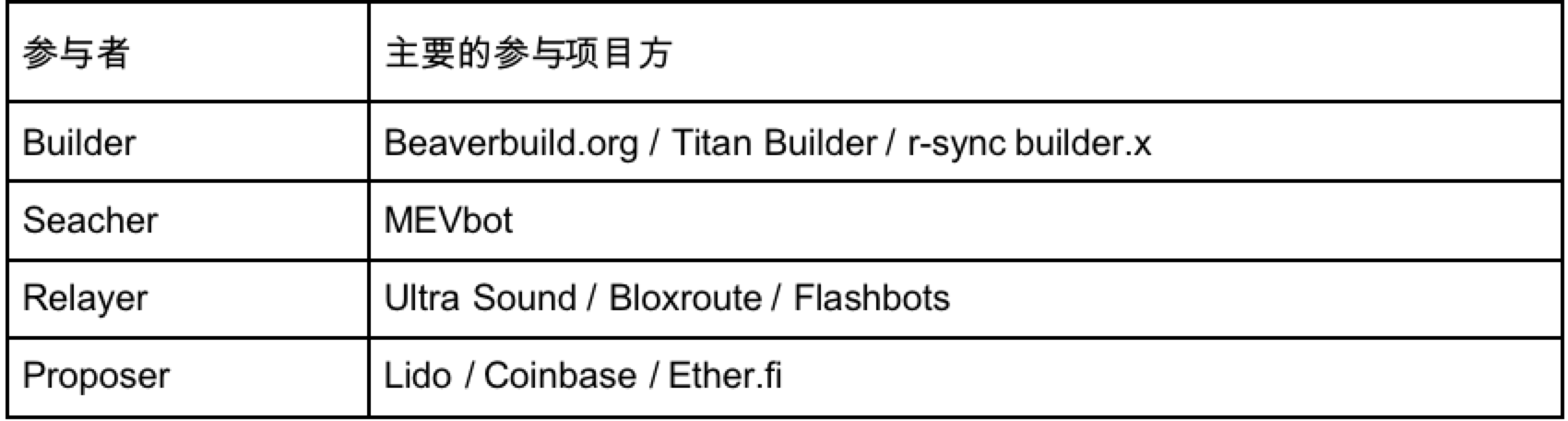

Various participants and games under PBS

Its main participants are Builder, Relayer, Proposer, and MEVbot (Searcher).

Builder

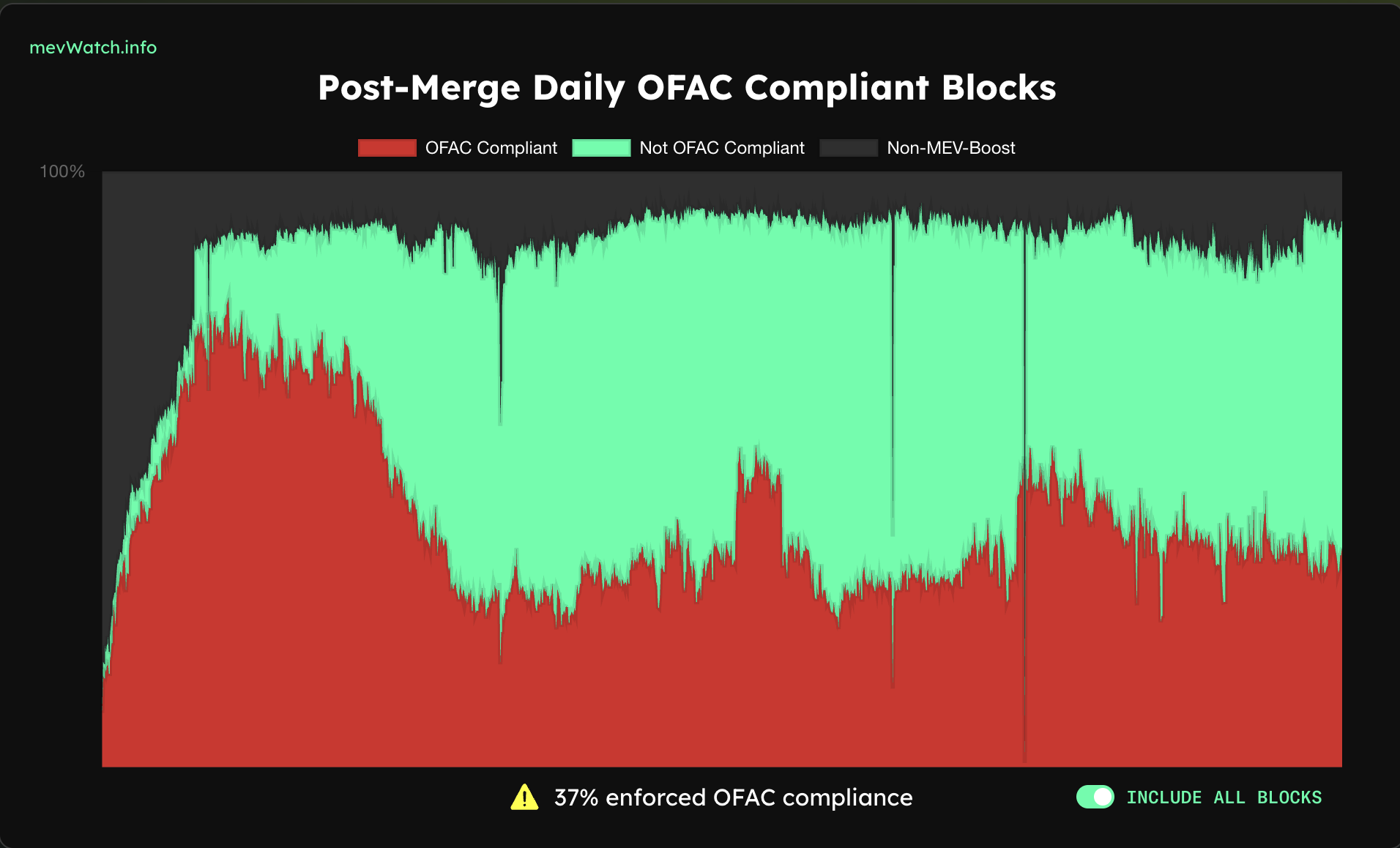

Among them, the Builder is mainly responsible for building the content of the block. After using the MEV-Boost technology, it is in a more advantageous position in the bidding because it not only supports Gas Fees, but also supports MEV income. The Builder can directly review the transactions between users and Searchers, which has always been criticized. Especially after the US government announced OFAC, a large number of Builders participated in OFAC Compliant. Compared with the beginning, although the proportion of reviewed blocks has decreased recently, we can see that in the process of block construction, the Builder has a direct role in the direct review of transactions.

OFAC compliance block ratio, source: MEV Watch

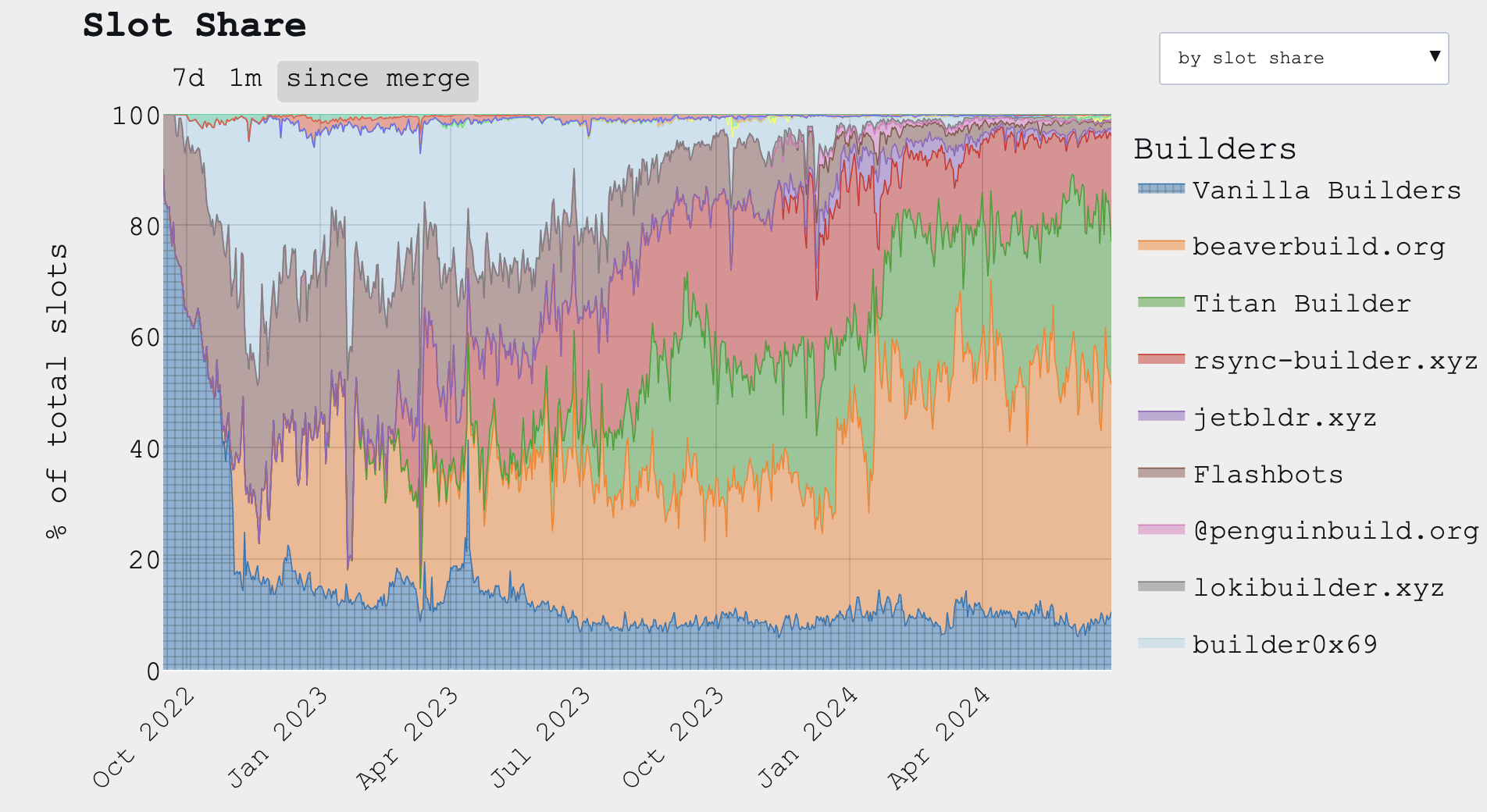

Builder market share, source: MEV Watch

Judging from the current market share of Builder, pure, uncensored Build such as beaverbuild.org is gradually expanding its market share, and everything is profit-oriented.

Searcher

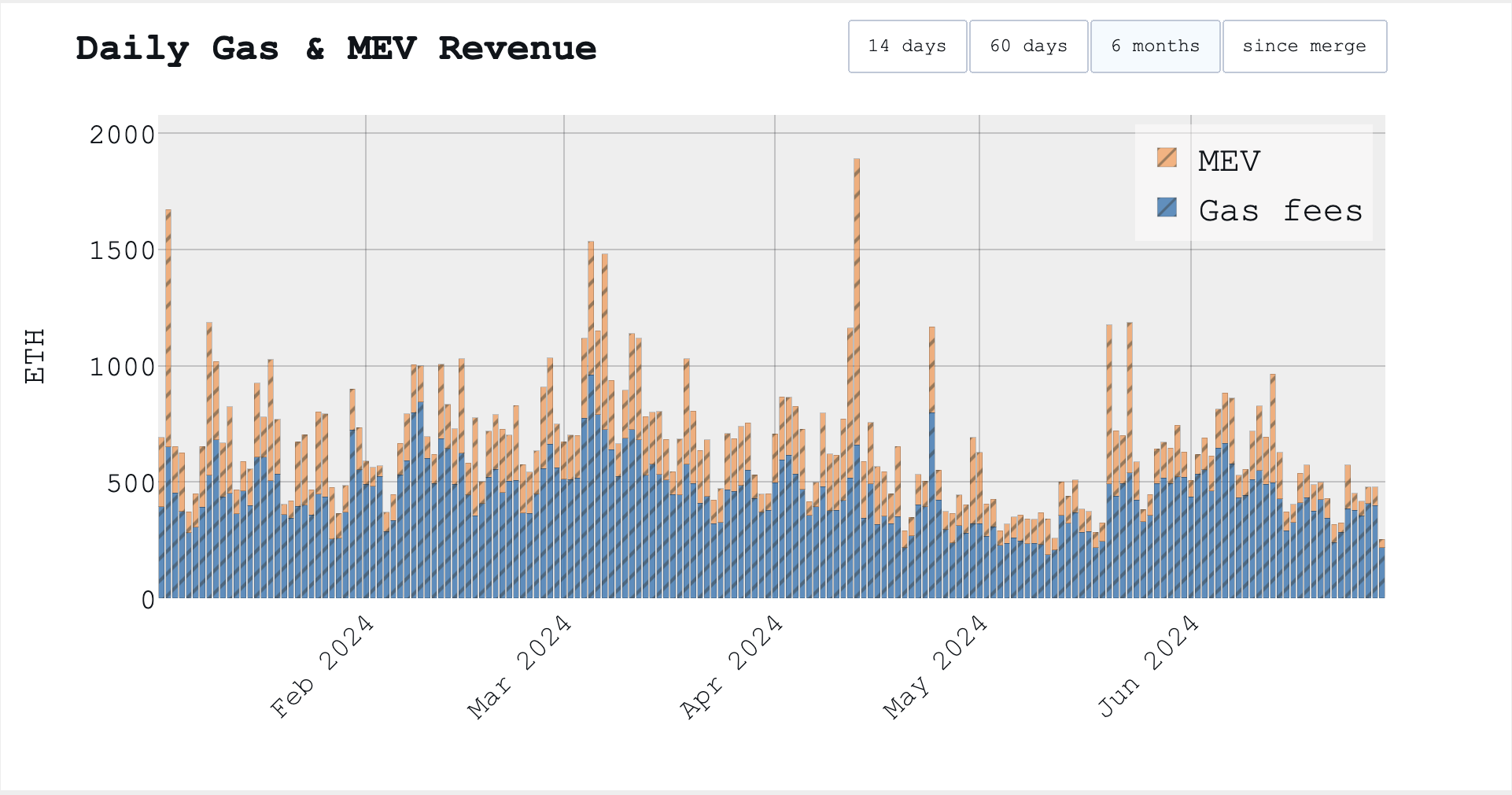

Ratio of MEV revenue to Gas Fees revenue, source: mevboost

In essence, the work of maximizing profits requires the joint efforts of Searcher and Builder. Searcher often cooperates with specific Builders, thus forming a Dark Pool or Private Pool, in which Searcher's transactions will only be displayed to specific Builders, and some Builders will obtain MEV transactions that maximize profits, and then bid for block space. In theory, if the Builder does evil or censors, then Searcher can choose other Builders, which will cause the Builder's market share to gradually decrease. Therefore, under the control of Searcher, Builder often considers the hidden costs of evil. The above picture shows the income of MEV and daily Gas. It can be seen that the MEV income contributed by Searcher can even be twice the daily Gas income when the market fluctuates significantly.

For Searcher, it is divided into CEX-DEX (off-chain) arbitrage and two categories: DEX, mezzanine, and liquidation (purely on-chain).

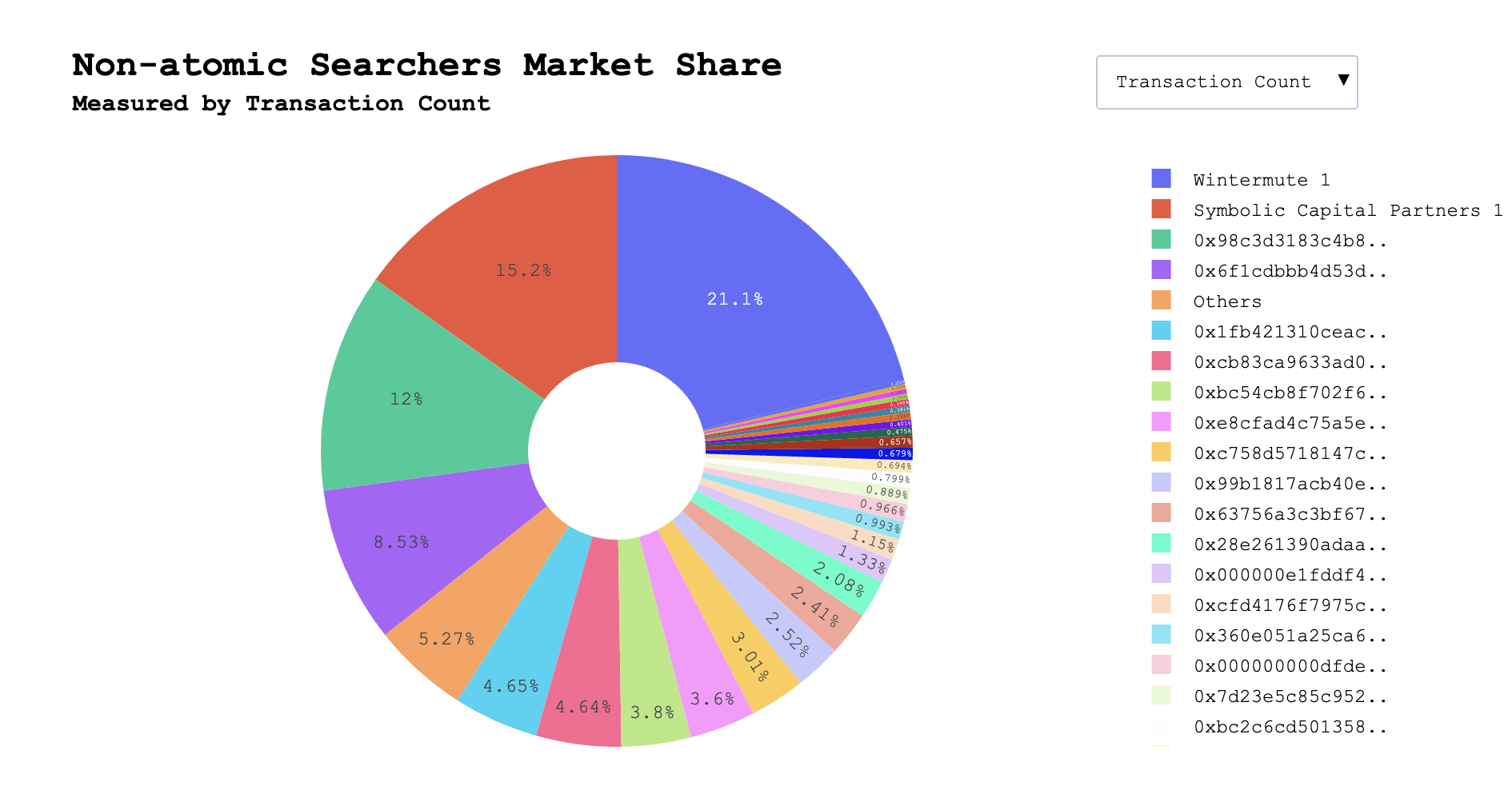

Searcher market share, source: Searcherbuilder

Currently, Wintermute occupies the largest market share in CEX-DEX arbitrage transactions.

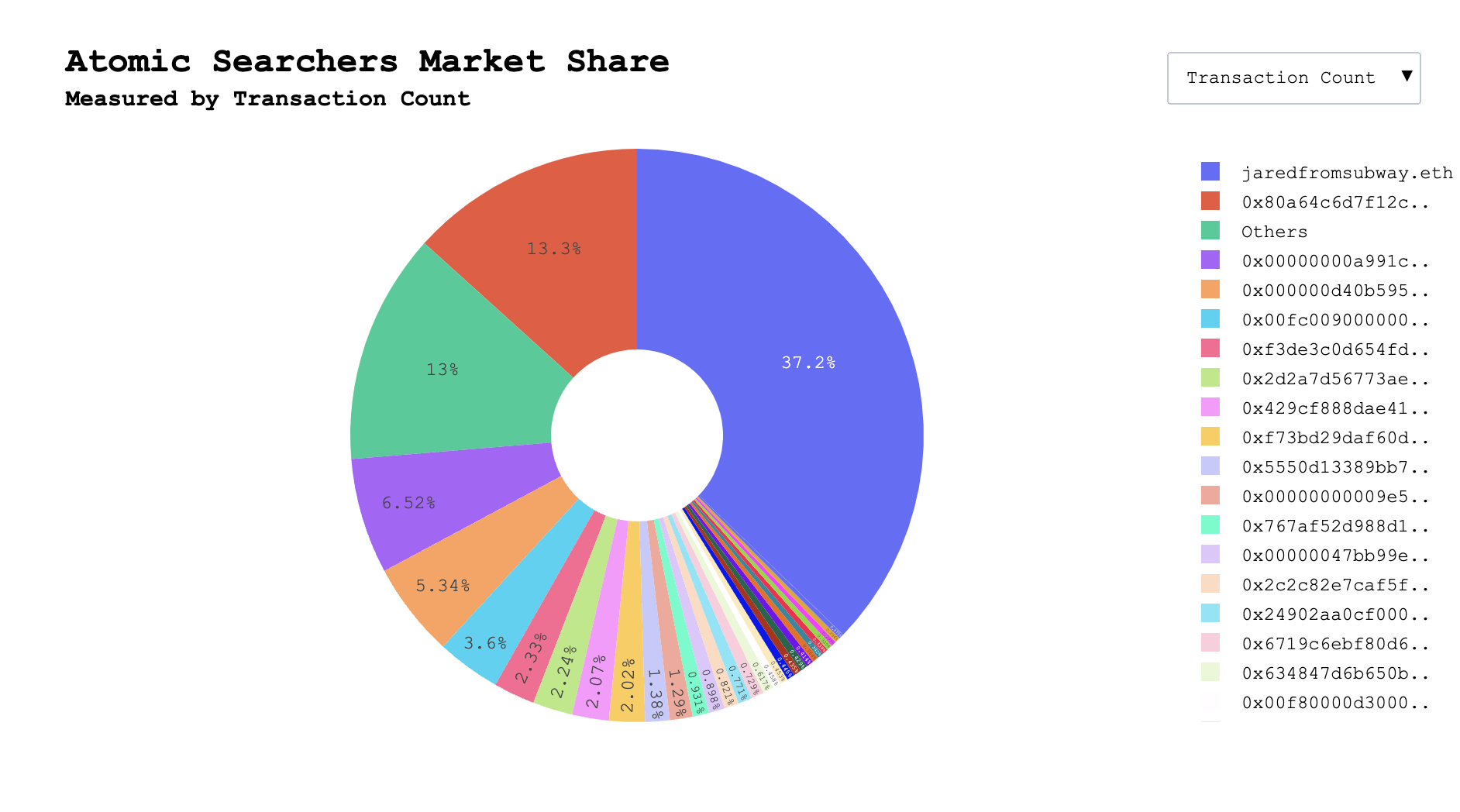

Searcher market share, source: Searcherbuilder

For pure on-chain MEV opportunities, there is a trend of gradually forming studios, among which jaredfromsubway.eth has a staggering 37.2% market share. It is good at sandwich attacks on Etheruem on-chain users and once became the user with the highest gas consumption on the chain, consuming about 1.5% of the gas for a whole day. From February 2023 to June 2024, the robot spent a total of 76,916 ETH, which is equivalent to about $175 million based on the value when these transactions were executed. Because Seacher is closely connected to Builder, in practice, many Searchers will send their order flows to the top three Builders. In fact, all Builders can be broadcast, but some small Builders may split the Searcher's order flow, causing the Searcher's MEV strategy to fail, resulting in the risk of loss. In addition, binding Builders can also maintain their influence in the ecosystem.

Relayer

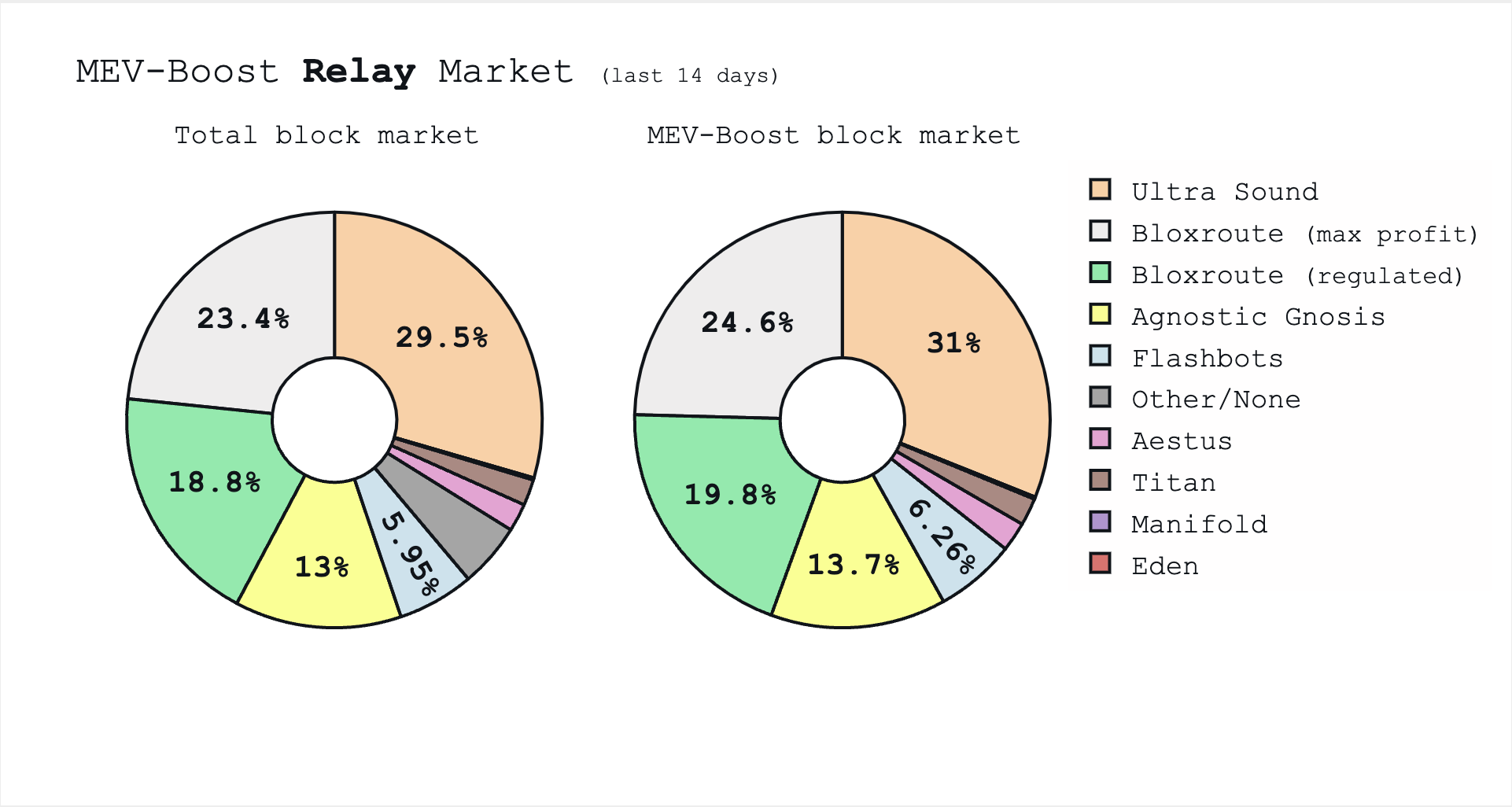

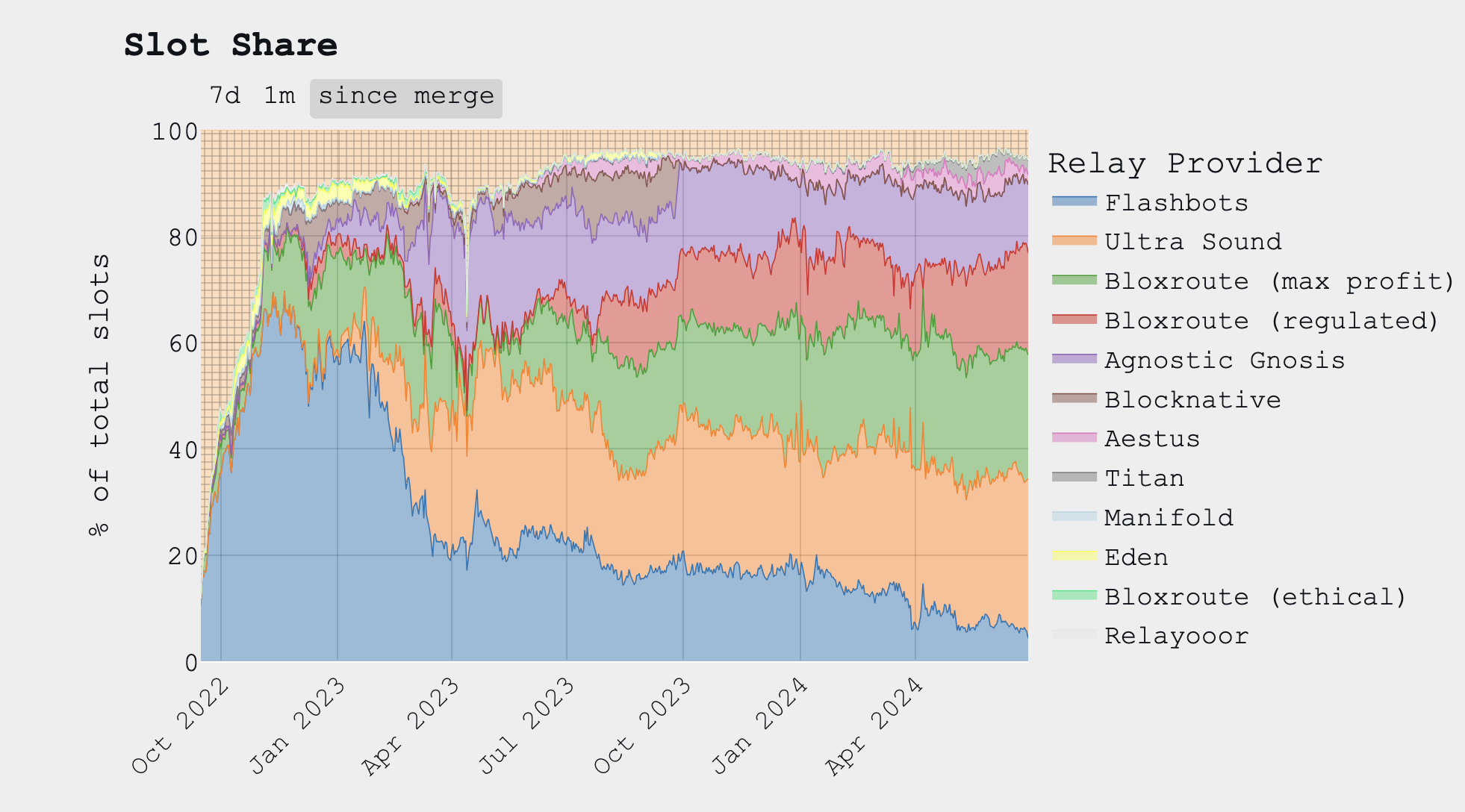

Relay market share, source: mevboost

The Relayer is responsible for the collective bidding, and then acts as a transit station to submit the block header and the price of the auction block to the Proposer. At this time, the Proposer does not know the transaction details in the block. Once the Proposer selects and signs the block header, the Relayer will release all the transaction content to the Proposer. We will find that the Relayer, as a third party without economic incentives, has gained great trust. The Builder relies on the Poposer for quotation, and the Proposer relies on the Relayer's quotation and block content. Similar problems have occurred in history. There is a potential vulnerability in the Ultrasound Relayer, which caused the Proposer to extract more than $20 million in MEV. Although these vulnerabilities can be patched, the Relayer itself can still choose to act maliciously and steal MEV.

Market share trend chart, source: mevboost

The above picture shows the market share of Relayer. We can find that the market share of Builders who run pure MAX Profit has gradually expanded since Merge. Therefore, in a free market, it is impossible to artificially control MEV through Builder.

At the same time, Relayer also faces a problem, that is, there is no economic incentive. Therefore, Blocknative also withdrew from the research and development of Relayer. Relayer currently relies on the MEVBoost specification proposed by Flashbots to build. Ethereum relies on a third party to provide PBS, which is not a long-term solution. Therefore, the Ethereum community is also exploring the inclusion of PBS at the protocol level.

Proposer

For the Proposer, a committee is randomly selected from all validators by an algorithm, and a block proposer is selected in each slot. The block proposer itself has the ability to execute the load, but because the proposer naturally wants to outsource this part, it is easy to cause vertical cooperation between the Builder and the Proposer. The Relayer of MEV-boost hopes to be the middle point of this method to reduce the vertical cooperation collusion caused by direct communication between the two. Since the mining pool is now used as the validator pool, this mining pool and the LSD validator pool have strong scale effects, especially the emergence of LSD, which releases the potential of the originally pledged tokens, enhances capital efficiency, and the influence of the DEFI building blocks behind it, the validator pool is also in a more centralized trend.

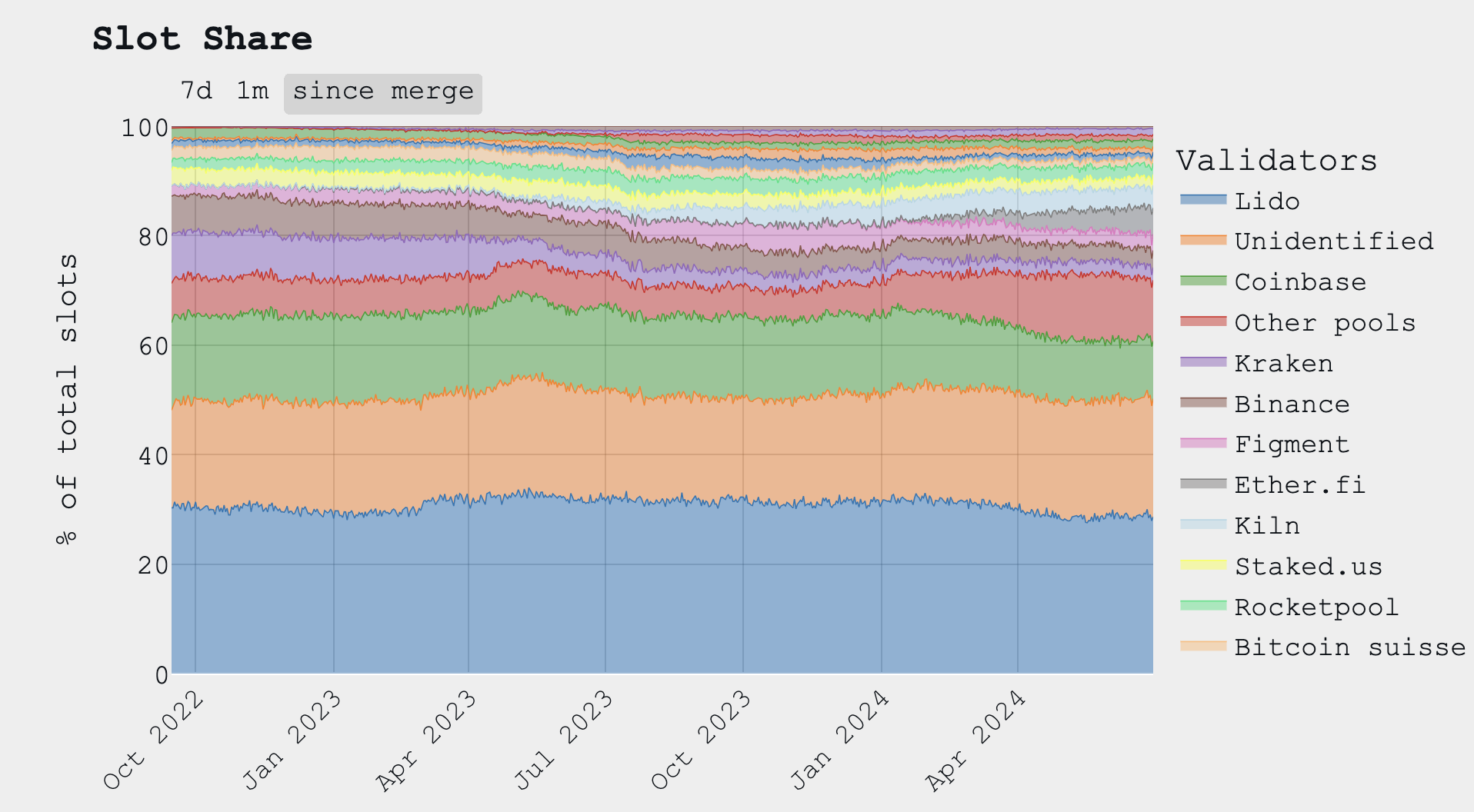

Validator market share, source: mevboost

Lido currently holds about 28.7% of the market share, with Coinbase and Ether.fi ranking second and third. In the past, when the MEV-BOOST PBS solution was not actively implemented, the Proposer was responsible for the Builder's task, that is, the execution load (Payload), but most Proposers gave up their ability to sort and execute transactions, because this would seriously degrade the verification performance under heavy computing work, so it is better to outsource the execution load and let a third party auction the blocks.

User

Finally, let's talk about the user. The user is often the weakest party in the entire architecture design, because the user's transactions are placed in the Mempool, and various MEVbots will earn MEV profits from them, but these profits will not flow to the users. However, this is not always a disadvantage. For example, in DEX, when the on-chain market fluctuates greatly or the user's transaction volume is greater than the liquidity of DEX, MEVbot will use arbitrage to reduce slippage and the price difference of each platform. Therefore, the existence of MEV has positive and negative externalities, which need to be discussed separately, and this is also its complexity.

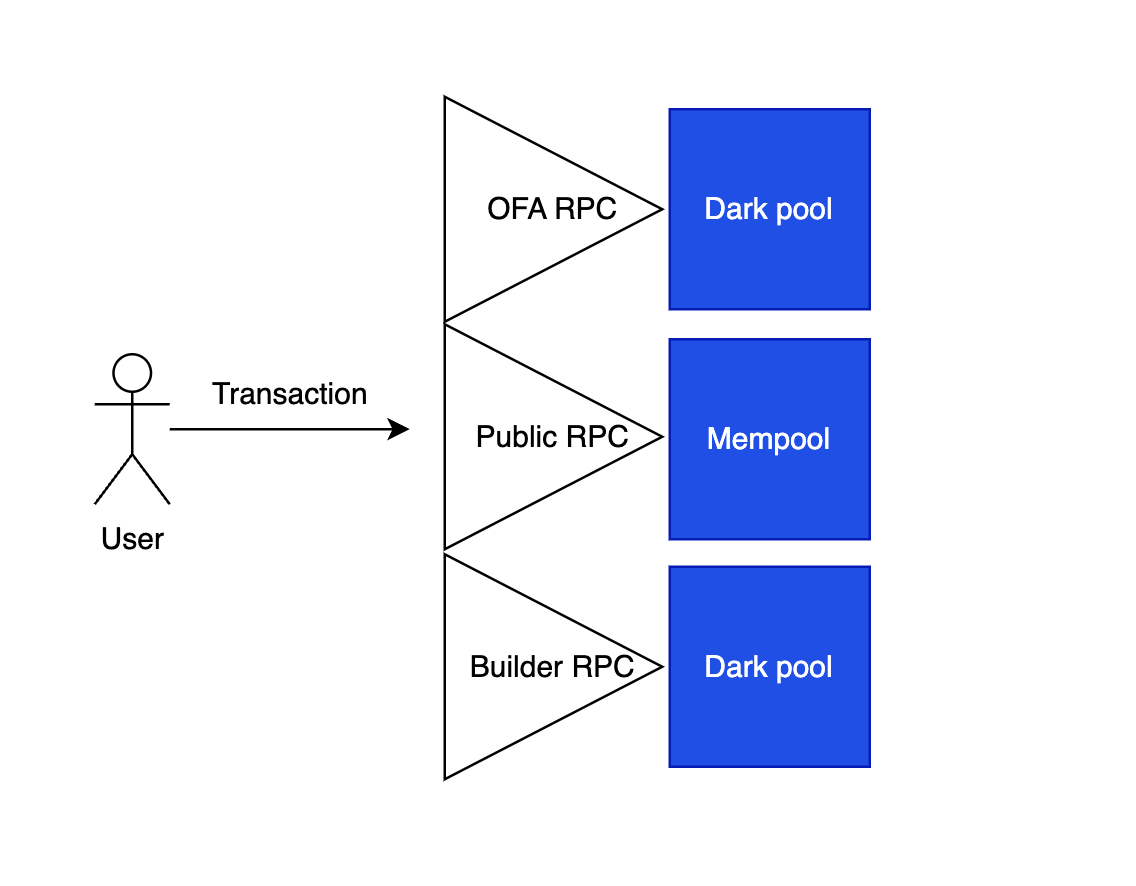

User transaction diagram

In order to prevent users from being monitored by MEVbot and causing damage to users, there are many RPC node providers that can help users place transactions in a private Mempool, such as interacting directly with the Builder through the Builder's RPC. A relatively novel way is to compensate users for MEV profits through the OFA (Order Flow Auction) order flow auction. The OFA RPC operator establishes a cooperative relationship with the Searcher. By auctioning the user's order to the Searcher, the Searcher can obtain the maximum MEV, thereby including the entire order flow in the block, and then the Searcher returns these profits to the user.

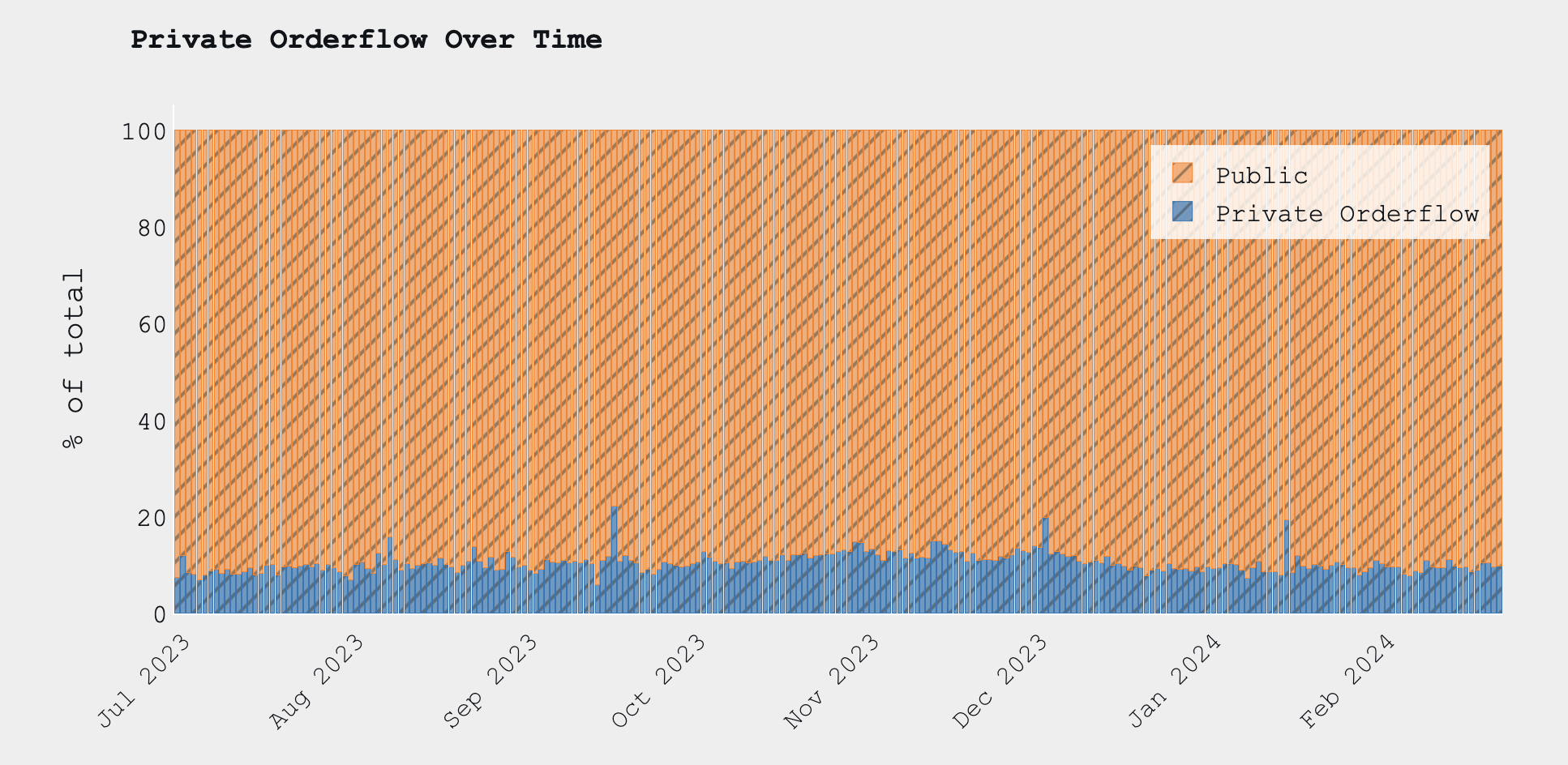

The percentage of users running private order flow transactions, source: Mempool

Currently, the proportion of users using private order flows is still low, at about 10%. The main reason is that the cost of educating users is high, and many users cannot be properly educated about MEV knowledge and countermeasures, and the operation is complicated. If you want to optimize the user experience, users are more likely to be passive rather than actively accepting.

Summarize

Under the current PBS architecture, we have seen that since the introduction of the MEV-BOOST specification, this profit-maximizing sealed-bid auction mechanism has led to the gradual guidance of Builders and Searchers in the direction of cooperation and trust. After the interests of both Searchers and Builders are tied together, this trend of centralization is also very obvious. Under POS, it will lead to the centralization of Validators. The entire MEV industry chain has become very centralized in all links, and it has also introduced the problem of multi-party trust. Searchers trust Builders, and Builders and Proposers trust Relayers. The development of MEV centralization and trust is in clear conflict with Ethereum's ultimate vision of decentralization and trustlessness. The Ethereum community is currently discussing three proposals to mitigate this centralization:

Regarding the centralization of Builder and Searcher bundling: The SUAVE technology proposed by Flashbot can make transactions more transparent and lower the trust threshold of Searchers in Builders, thereby encouraging Searchers to send order flows to all Builders.

Trusting the Relayer: Use Enshrined PBS to replace the current PBS solution and eliminate the reliance on the Relayer in the bidding process.

Regarding Validator centralization: Use decentralized AVS, such as SSV, etc. Lido has already cooperated with it.

Participant concentration trend

MEV Status

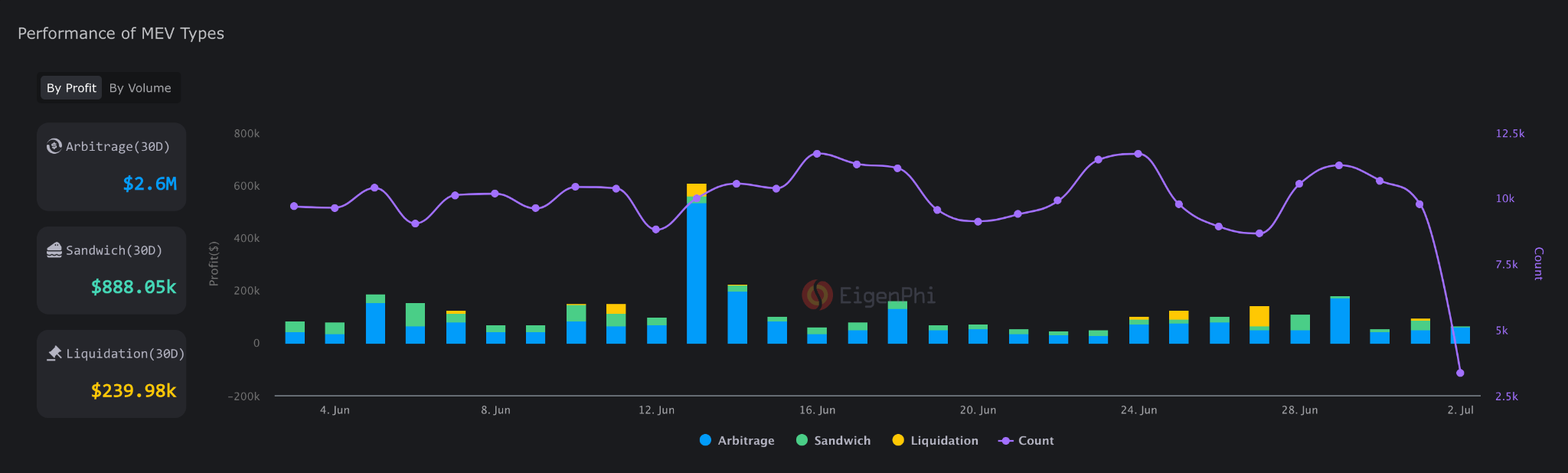

MEV types and profits from June 1 to July 1, 2024, source: eigenphi

Currently, the main MEV on the chain is arbitrage, sandwich attacks, liquidation, etc. Among them, arbitrage has the largest profit. In the past 30 days, MEV bots can be counted to have made a total profit of 2.6 million US dollars.

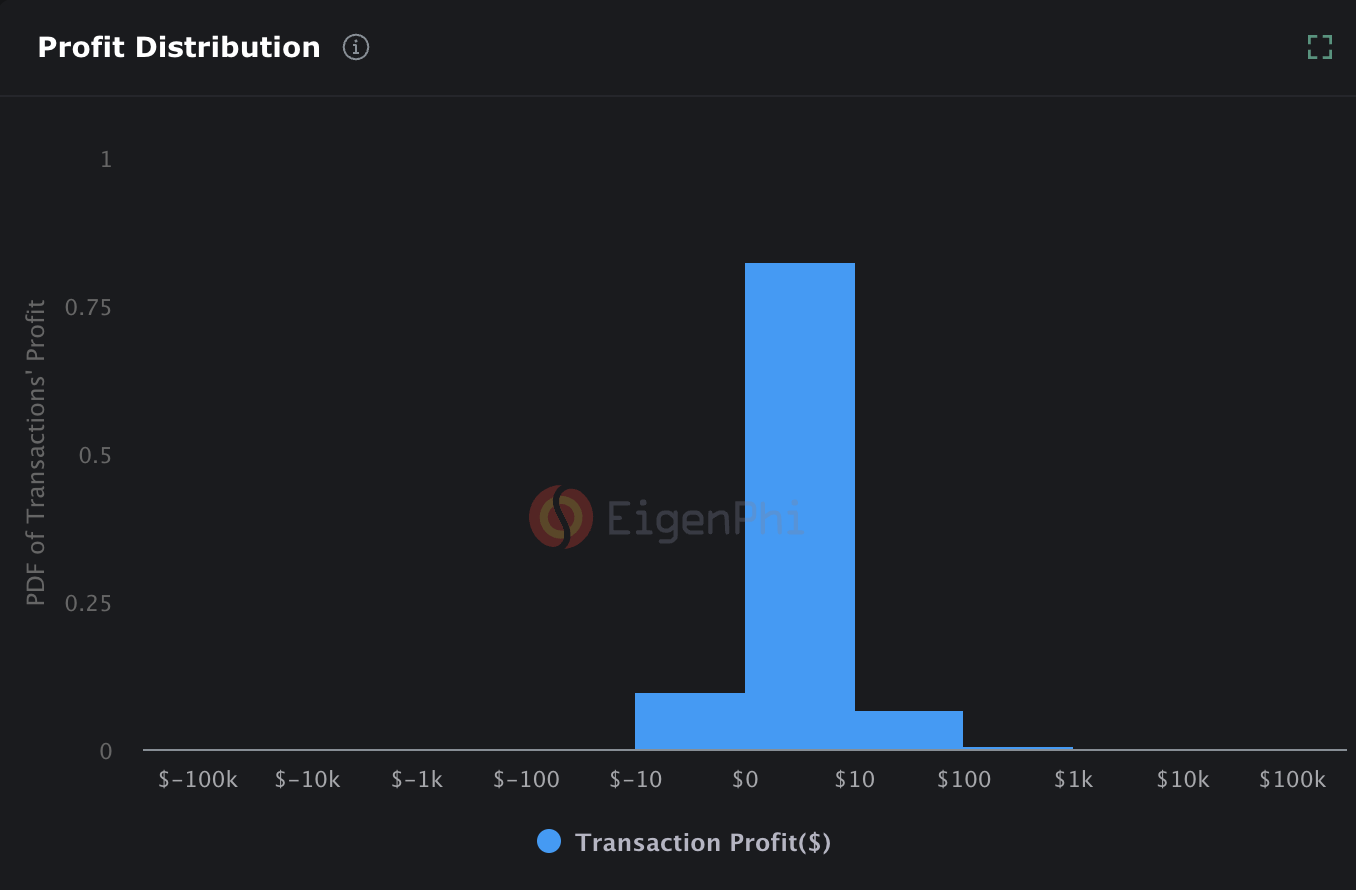

Profit distribution of sandwich attack transactions from June 1 to July 1, 2024. Source: eigenphi

In fact, the average profit of a transaction is $0.8. Relying on a large number of transactions, the profit of the sandwich attack on the Ethereum chain in the past 30 days is about $880,000.

MEV has positive and negative external effects. Positive external effects include reducing the price difference between DEXs due to arbitrage and helping DEFI protocols to clear collateral, which are all positive effects. The negative effects mainly come from mezzanine transactions for users, which will cause users to lose part of their profits. In the current on-chain fee mechanism, although Ethereum has implemented a smoothing mechanism for Gas Fees, when there are more arbitrage trading opportunities on the chain, MEV bots and users will trade on the chain together, resulting in a short-term surge in on-chain Gas Fees, which in turn causes economic and experience losses to users.

Not only because of the MEV and centralization problems brought about by PBS and POS architecture, but also in the process of Ethereum's migration to Layer 2 architecture, the problem of cross-chain MEV between Layer 2 has also arisen.

Potential MEV Complexity of Layer 2 Architecture Design

Currently, a large number of Ethereum transactions are placed on Layer 2, and Ethereum’s main goal is to focus on the world settlement layer. Therefore, in the future, large-scale on-chain arbitrage activities will shift to more complex and technically demanding multi-chain cross-chain MEV.

In cross-chain MEV, there is less concentrated research at present, but some countermeasures have been proposed for the potential of MEV. In Layer 2, the main improvement is to improve the sorter, because the sorter is responsible for sorting and running transactions. The cross-chain bridge is a necessary product for cross-chain between different Layer 2s. In fact, Searcher can help slow down the fragmented liquidity between Layer 2s, although it is still not significant at present. The main reason is that the experience and security of the cross-chain bridge still need to be improved, and the finality of different cross-chain bridges is different, which leads to the need to take this into account when customizing strategies, making cross-layer 2 cross-chain a higher threshold.

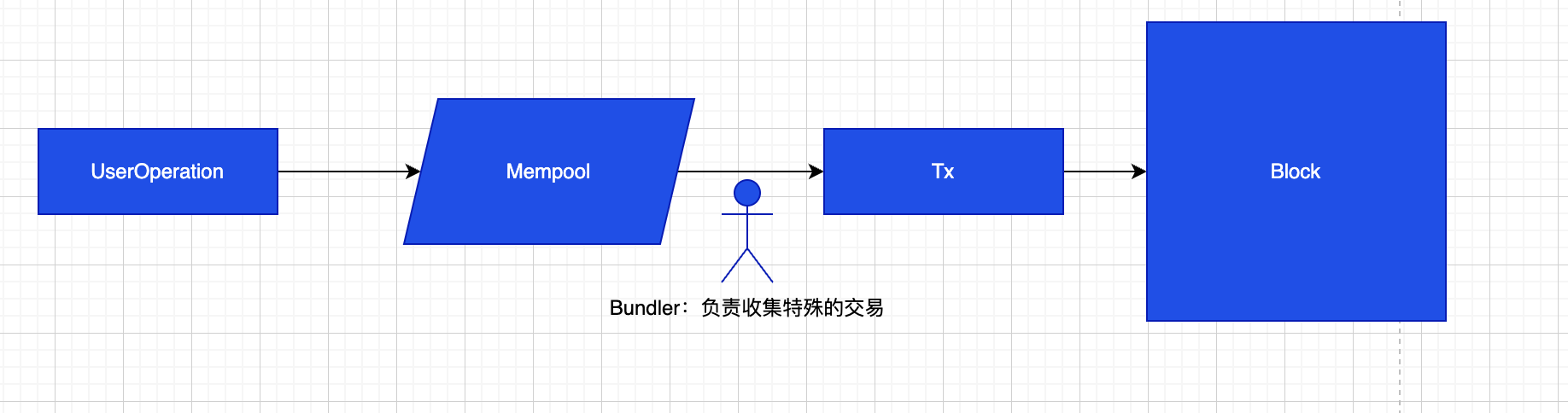

Potential MEV of EIP-4337

Not only will the new architecture increase the complexity of MEV, but EIP-4337’s introduction of account abstraction and new transaction types will also significantly change the MEV landscape.

ERC-4337 Workflow

In ERC-4337, a new transaction type User Operation will be introduced and enter the Mempool. The role of Bundler will look for this type of transaction in the Mempool and then package it into a normal transaction. Once the user's transaction enters the public pool, it will be monitored by the Searcher. Bundler is similar to Builder, which can work with Searcher to reorder User Operation to obtain MEV. At the same time, the specifications of User Operation on different chains may be different, which will further increase the technical threshold of cross-chain MEV.

To be continued.

References

"The MEVM, SUAVE Centauri, and Beyond": https://writings.flashbots.net/mevm-suave-centauri-and-beyond

"Blockchains, MEV and the knapsack problem: a primer": https://arxiv.org/html/2403.19077v1

《MEV ECOSYSTEM EVOLUTION FROM ETHEREUM 1.0》

"The Future of MEV" by Blockchain Capital

"FRP-18: Cryptographic Approaches to Complete Mempool Privacy" by Flashbots

《Execution Tickets》: https://ethresear.ch/t/execution-tickets/17944

"Payload-timeliness committee (PTC) – an ePBS design": https://ethresear.ch/t/payload-timeliness-committee-ptc-an-epbs-design/16054

Disclaimer:

The above content is for reference only and should not be regarded as any advice. Please always seek professional advice before making any investment.

About Gate Ventures

Gate Ventures is the venture capital arm of Gate.io, focusing on investments in decentralized infrastructure, ecosystems, and applications that will reshape the world in the Web 3.0 era. Gate Ventures works with global industry leaders to empower teams and startups with innovative thinking and capabilities to redefine social and financial interaction models.

Official website: https://ventures.gate.io/

Twitter: https://x.com/gate_ventures

Medium: https://medium.com/gate_ventures