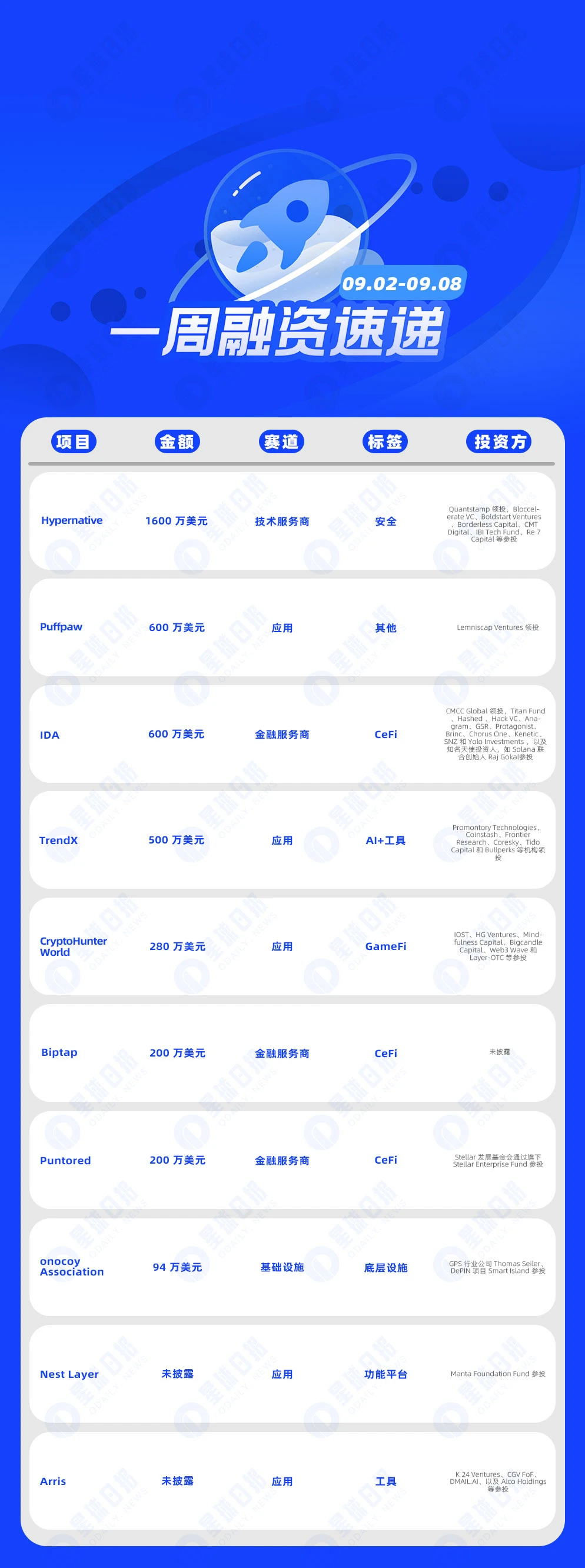

According to incomplete statistics from Odaily Planet Daily, there were 19 blockchain financing events at home and abroad announced from September 2 to September 8, a significant decrease from last weeks data (29 events). The total amount of financing disclosed was approximately US$40.74 million, a significant decrease from last weeks data (US$203 million).

Last week, the project that received the most investment was Web3 security company Hypernative ($16 million); Web3 e-cigarette Puffpaw followed closely behind ($6 million).

The following are specific financing events (Note: 1. Sort by the amount of money announced; 2. Excludes fund raising and MA events; 3. * indicates a traditional company whose business involves blockchain):

Web3 security company Hypernative completes $16 million Series A financing, led by Quantstamp

On September 3, Web3 security company Hypernative announced the completion of a $16 million Series A financing round, led by Quantstamp, with participation from Bloccelerate VC, Boldstart Ventures, Borderless Capital, CMT Digital, IBI Tech Fund, Re 7 Capital, etc. Hypernative co-founder and CEO Gal Sagie revealed that the company started its Series A financing earlier this year and completed the financing in mid-2024. As of now, Hypernatives total financing has reached $27 million.

Puffpaw Completes $6 Million Seed Round Led by Lemniscap Ventures

On September 5, Puffpaw announced the completion of a $6 million seed round of financing, led by Lemniscap Ventures.

The Puffpaw project plans to launch a blockchain-enabled e-cigarette that aims to help users reduce nicotine intake through token incentives. The project encourages users to quit smoking by recording their smoking habits and rewarding them with tokens. Puffpaws token economics aims to cover 30% of the users first month of using its products and provide social rewards. The project also considers possible system abuse, but is not clear about the problem that users may not report their smoking habits honestly.

Stablecoin issuer IDA completes $6 million seed round of financing, led by CMCC Global

On September 2, stablecoin issuer IDA has raised $6 million in a seed round led by CMCC Global, with participation from its Titan Fund and Hashed. The capital injection will enable IDA to advance the development and launch of its first fiat-referenced stablecoin, HKDA, which is designed to be regulated in Hong Kong. Other participants in this round of financing include Hack VC, Anagram, GSR, Protagonist, Brinc, Chorus One, Kenetic, SNZ and Yolo Investments, as well as well-known angel investors such as Solana co-founder Raj Gokal.

On September 2, according to official news, AI-driven Web3 tracking platform TrendX announced the completion of a $5 million Series A financing round, led by Promontory Technologies, Coinstash, Frontier Research, Coresky, Tido Capital and Bullperks. Together with the $1 million seed round earlier this year, TrendXs total financing has reached $6 million.

On September 3, the P2E gaming platform CryptoHunter World announced the completion of a $2.8 million private round of financing, with participation from IOST, HG Ventures, Mindfulness Capital, Bigcandle Capital, Web3 Wave and Layer-OTC. The new funds will support its construction of a blockchain RPG game. The project uses GPS technology to provide gaming experience and allow players to own game assets on the chain. It is reported that the project plans to release a closed beta test between September and October.

Privacy fintech company Biptap completes $2 million Pre-Seed round of financing

On September 3, Biptap, a privacy-focused fintech company, announced the completion of a $2 million Pre-Seed round of financing. The names of the investors have not been disclosed yet, but it is reported that they include several Web3 decentralized investment funds, a travel service provider with a network of 2.5 million hotels, a crypto technology company that once owned the MotoG racing team, and the former founder of a crypto investment fund. Its current business is mainly in the Web3 field, and the new funds will be used to expand its business to markets outside of Web3 to ensure that users can control their own financial transactions with privacy as the core.

On September 8, Puntored, a fintech company that enables cross-border transactions on the blockchain, announced that it had completed a $2 million financing round. The Stellar Development Foundation participated in the investment through its Stellar Enterprise Fund. Puntored will use this new capital to expand its technical capabilities and enable cross-border transactions in Latin America through the Stellar blockchain network. It will mainly explore digital wallets, enterprise embedded payment services, and small and medium-sized enterprise credit to provide financial transaction services to users in rural, metropolitan, and remote areas in Mexico, Colombia, and Puerto Rico.

On September 5, the community-based blockchain global GNSS network Onocoy Association announced the completion of a strategic round of financing of US$940,000. GPS industry company Thomas Seiler and DePIN project Smart Island participated in the investment. As of now, the companys total financing amount has reached US$4.2 million. The specific valuation information has not been disclosed. Onocoy uses shared infrastructure supported by blockchain technology to provide professional-grade GNSS data. The new funds will support its construction of a decentralized platform to expand into agriculture, construction, land management and autonomous systems.

On September 8, Web3 ecosystem service Nest Layer announced the completion of a new round of financing, with Manta Foundation Fund participating. The specific valuation and financing amount have not been disclosed yet. The new funds will be used to support the development of its product suite Dropnest. Nest Layer currently supports services including investment, node management, NFT, airdrop farming, staking, income generation and DePIN. Dropnest can simplify airdrop farming through a one-click interface.

On September 8, Arris, a comprehensive airdrop task platform, announced the completion of a new round of strategic financing, with participation from K 24 Ventures, CGV FoF, DMAIL.AI, and Alco Holdings. The specific financing amount and valuation information have not yet been disclosed. The new funds will be used to support its airdrop protocol optimization and simplified Web3 chain interaction. In addition, Arris is reported to expand its Arris AI and optimize airdrop interaction returns through the OiEarn model to provide points rewards to users who increase transaction volume.

On September 8, BlaBla, a decentralized SocialFi video platform based on the Morse ecosystem, announced the completion of its seed round of financing, with participation from Nebula lnvestment, the Blockchain Association of Europe (BCAEU), Hopechain, etc. The specific amount and valuation data have not been disclosed. BlaBla plans to use the new funds to build its decentralized model and transparent reward system. It is reported that its platform supports users to earn tokens by watching, interacting and sharing content, and creators benefit from rewards directly provided by users.

E-PAL Completes $30 Million in Funding and Launches Web3 Experience Infrastructure BALANCE

On September 3, Web3 gaming and social companion platform E-PAL announced the launch of the AI-driven blockchain experience platform Balance, which has successfully completed two rounds of financing led by Andreessen Horowitz (a16z) and Galaxy Interactive. The latest round of financing also received support from other investment institutions, including Animoca Brands, K 5, CLF Partners, MBK Capital, New Heights Fund, AMBER, MarbleX, Sky Mantra, Tuna, Aptos Labs, IOBC, Leland, Halcyon Capital, Uphonest, Taisu Ventures, Gate Labs, DWF Ventures, BING, WAGMI, YouTube co-founder Steve Chen, Riot Games CEO Marc Merrill and League of Legends Director Thomas Vu. As of now, E-PALs total financing amount has reached US$30 million.

Gate Ventures invests in Japanese Web3 gaming giant double jump.tokyo

On September 5, Gate Ventures officially announced that it has made a strategic investment in double jump.tokyo Inc., a top Japanese Web3 gaming company, as part of a $10 million financing round led by SBI Investment. This important investment demonstrates Gate Ventures’ firm commitment to promoting the development of blockchain technology and the Web3 gaming ecosystem globally.

The Series D round was led by SBI Investment and attracted participation from industry leaders such as Sony Group Corporation, Taisu Ventures, and Kitadenshi Inc.

On September 5, the DeFi ecosystem aggregation airdrop platform Arris announced the completion of a new round of financing. Institutions such as CGV FoF, K 24 Ventures, DMAIL.AI and Alco Holdings participated in the investment and will jointly support Arris in shaping the future of Web3.

On September 4, Gate Ventures announced that it had made a strategic investment in Space and Time (SxT) to participate in its Series A financing. The Series A financing was officially announced on Tuesday, August 27, 2024, and will advance SxTs mission in building and scaling AI-driven decentralized data infrastructure.

On September 3, blockchain gaming platform Yooldo announced the completion of a new round of financing. Consensys participated in the investment through its Linea Ecosystem Investment Alliance. The specific amount and valuation information have not been disclosed yet. The new funds will be used to promote its integration of Web3 games into the Linea ecosystem.

Layer 2 blockchain solution provider Kroma completes Series A financing

On September 3, Kroma, a Layer 2 blockchain solution provider, announced the completion of its Series A financing, with Asia Advisors Korea, Gate Ventures, ICC Venture, Planetarium, Presto, RFD Capital, Taisu Ventures, The Spartan Group, Waterdrip Capital and others participating. The specific financing and valuation information has not yet been disclosed. Kroma, built on OP Stack, has currently launched native account abstraction (AA) in the Superchain ecosystem to provide a seamless Web3 gaming experience.

Web3 infrastructure project Caduceus completes Series A strategic financing, led by SIG

On September 2, Web3 infrastructure project Caduceus announced the completion of its Series A strategic financing, with a total financing amount of tens of millions of dollars. This round of financing was led by Susquehanna International Group (SIG), a leading global venture capital and cryptocurrency liquidity provider founded by Jeff Yass, and co-led by BlockFills, with participation from well-known institutions such as DWF Labs and KuCoin Ventures. It is reported that other institutions participating in this round of financing include Bin Zayed Group, Qredo, TokenInsight, Nukkleus, Digital RFQ and Luna VC. This financing will be used to promote the further development and application of the Caduceus technology platform.

On September 2, the Scroll ecosystem project Pencils Protocol announced that it had completed a new round of financing with a valuation of US$80 million, with Taisu Ventures, DePIN X, Bing Ventures and Black GM Capital participating. Previously in May this year, Pencils Protocol completed a seed round of financing of US$2.1 million, with investors including OKX Ventures, Animoca Brands, Galxe, Gateio Labs, Aquarius, Presto and other well-known institutions and individual investors.