Original author: Alex Liu, Foresight News

In the early morning of December 20, the markets reaction to the Feds hawkish decision to delay rate cuts the day before expanded, and the crypto market continued to fall. Bitcoin fell to below 96,000 USDT, and Ethereum fell from a high of 3,900 USDT in the early morning of the 19th to 3,322 USDT. The violent fluctuations caused the 24-hour contract liquidation volume of the entire network to exceed US$1 billion, and the decline of altcoins was generally more tragic.

The party is over, and I have to pay the bill again? Should I sell at the top or buy at the bottom? Dont panic, see what top traders and investors have to say.

Chris Burniske, a well-known investor and partner at Placeholder

Stay firmly long - this is just a little fool punch and its still early for the end of this cycle.

If you are mad at yourself for not selling before the FOMC turned hawkish and caused a pullback, remember that you have little advantage in predicting the markets reaction and view it as an opportunity to take your time. Dont overtrade. In the long run, just be patient and youll be fine.

Solana Bottom-fishing VC, SOL Big Brain

Well-known trader DonAlt

Bitcoin’s chart is not bearish (yet), and even if another leg appears on the chart (typical for these types of moves), it will not be bearish.

I think if we go to $90,000, it will cause a lot of altcoins to explode, providing a very good buying opportunity.

But its not certain that will happen, and sentiment is already very bearish.

Still think the last leg of the bull market is missing, it hasnt gotten crazy enough yet, and it seems like the way the US government facilitated it kind of feels like a huge waste of a ready-made powder keg.

Personally, I wasnt panicked at all, but that may have been because I was complacent.

Well-known KOL KALEO

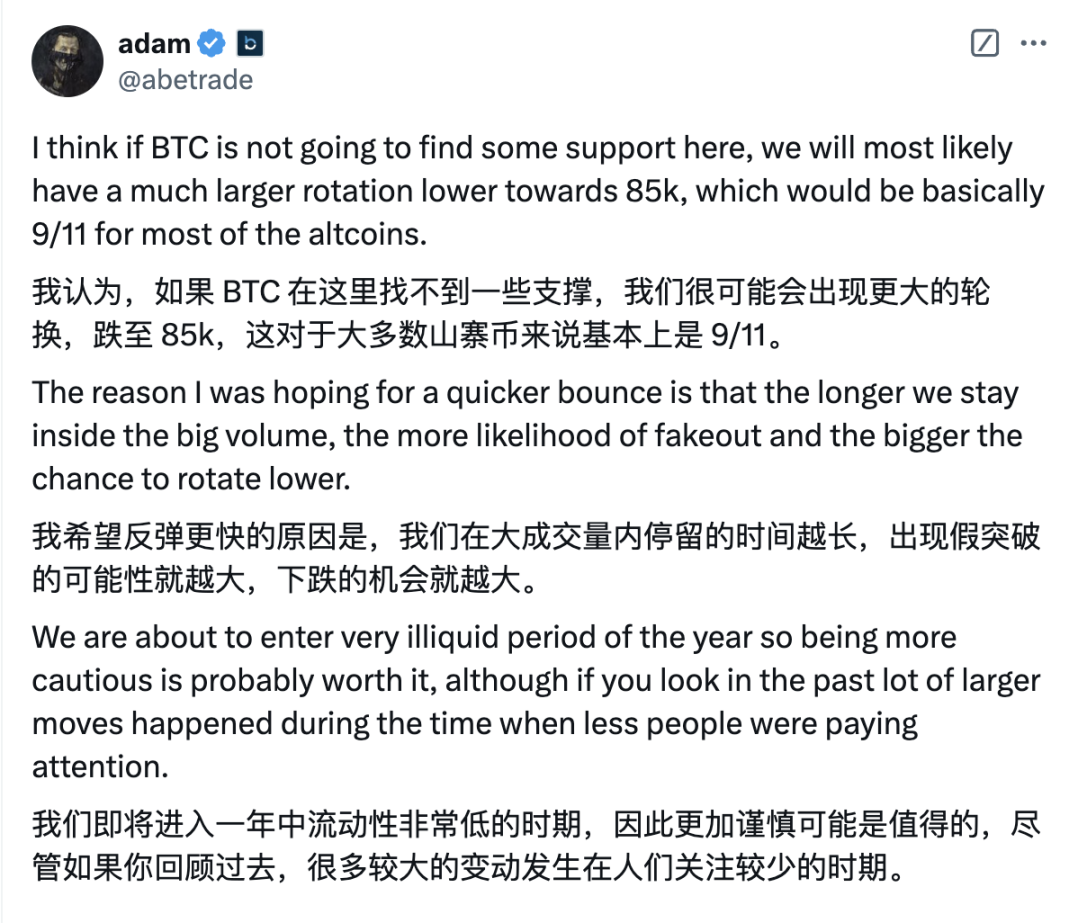

Trader Adam

Top Trader Saint Pump

If Bitcoin breaks down, I predict buying will start again at $90,000. In pure panic, it could go all the way down to $85,000. Altcoins will completely collapse.

Suitable prices to buy ETH would be 3000, 2900, and SOL’s is 160.

Well-known Solana Meme Ansem

Easter egg: Top trader Eugene Ng Ah Sio

A few hours ago, when the price of SOL was 208 USDT, Eugene Ng Ah Sio wrote a post explaining why he was optimistic about SOL at this price, and said that he had adjusted his Meme position to SOL (his single position usually ranged from several million to tens of millions of US dollars). In this wave of decline, SOL fell below 190 USDT.