Original author: Chase

Original translation: Blkok unicorn

One of the biggest opportunities in Web3

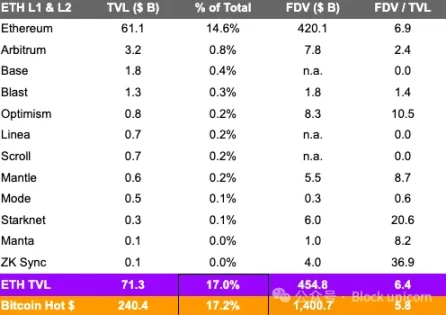

Bitcoin was created in 2008 as a digital currency, initially used for payment purposes, and over time it evolved into a store of value. With the rise of retail-focused Layer-1 and Ethereum Layer-2, Bitcoins utility is ripe for disruption. There is currently $240 billion in Bitcoin hot money (3.4 times the total locked-in amount of the entire Ethereum ecosystem) to capture and build on.

Bitcoin = Individual Investors

It is often believed that Bitcoin has more institutional adoption than Ethereum. However, data shows that this is not the case, and Bitcoin is primarily driven by individual investors, with 57% of the supply held by individuals and only 9.7% held by institutions (including miners). I define individual investors as non-professional investors and individuals who are more likely to be converted to Bitcoin applications due to the speculative nature of the new market.

There is currently $240 billion of hot money in centralized exchanges (CEX) and ETFs, which represents a huge opportunity to capture value by building a programmable layer on Bitcoin. In comparison, the total amount of Ethereum hot money on CEX is $76 billion. CEX capital is a good indicator of hot money because cold money is usually stored in cold wallets as long-term capital. ETFs can also be considered hot money, as both BlackRock and VanEck have stated that more than 80% of ETF inflows come from non-professional investors using online brokerage accounts. In the hypothetical downside scenario, even if it is reduced by 50%, there is still $120 billion of Bitcoin hot money that can be deployed. Therefore, a large amount of individual investors capital can be deployed into Bitcoin native Dapps.

Bitcoin volume on CEX and ETFs

Bitcoin is the most widely distributed digital asset in the world, with over 460 million unique wallets. Since the advent of Ordinals and inscriptions, the demand for Bitcoin has increased significantly. On December 19, 2022, Bitcoins Dick Butt (pictured above) became the first inscription to be engraved on Bitcoin. Since then, Bitcoins mempool utilization has averaged over 50% (pictured below), much higher than before, even reaching twice the 2021 bull cycle. This shows that the demand for Bitcoin block space is very strong, but it has also caused transaction fees to rise to the point where it is difficult for ordinary users to use the chain.

Bitcoin memory pool usage

Hot money in Bitcoin increased by 23% between January and July 2024, during which time the supply of Bitcoin on CEXs decreased from 2.9 million to 2.7 million, while the supply of Bitcoin in ETFs grew to 890,000, resulting in a net increase of 680,000 Bitcoins. According to statistics on ETF holders and CEX hot money flows, this was mainly driven by individual investor capital.

Bitcoin on Centralized Exchanges

Embracing speculation by individual investors

Bitcoin may be at the beginning of a speculative cycle, which was first triggered by Ordinals and reached a cumulative trading volume of $117 billion. Combined with Bitcoin-native Dapps and $240 billion in hot money, Bitcoins speculative cycle will inevitably be longer and larger than the cycle experienced by Ethereum LRTs and Solana DeFi in early 2024. In addition, Bitcoins individual investor adoption in terms of utility has just begun. According to research, 57% of Bitcoin is held by individuals, and only 3.4% is held by miners who usually sell mined Bitcoin for profit.

Bitcoin Distribution

Current Scaling Solutions

Most current scaling solutions cannot effectively serve Bitcoins large base of individual investors because they are either slow and costly or focused on institutions. For example, @Stacks, one of the earliest Bitcoin sidechains, still takes 30 minutes to complete transactions after the Nakamoto upgrade. @Lightspark is building a business-to-consumer payment solution based on the Lightning Network, focusing more on merchant and institutional adoption rather than existing individual investor needs, and these solutions are still in the early stages of Bitcoins adoption cycle. In the future, we may even see high-fidelity DeFi, such as Bitcoin open order book exchanges, perpetual protocols, and prediction markets.

A successful example of a Bitcoin hot money application is @Bounce_bit, a protocol focused on CEX hot money returns, which has reached $1 billion in Bitcoin TVL within six months of its launch. This shows that CEX users have a strong demand for utilizing Bitcoin.

Network Effects: Rollups and Sidechains

Bitcoin is the largest and most widely distributed digital asset, and therefore has the strongest network effect in Web3. Bitcoins hot money is 3.4 times the TVL of the Ethereum ecosystem. We may be witnessing the birth of a new global Internet computer.

Since 2019, Ethereum sidechains such as Wanchain, Neo, and Ziliqa have been created as alternative solutions. At their peak, there were more than 700 PoS and EVM sidechains. However, due to technical and economic limitations, these sidechains failed to effectively leverage Ethereum’s network effects and were unable to successfully attract and retain developers.

In contrast, @Optimism and @Arbitrum focus on Ethereum’s network effects and work closely with Ethereum to scale its base layer. As a result, they have been more successful than EVM sidechains and have become the leading scaling solutions. A similar trend is also emerging in the Bitcoin ecosystem, where multiple sidechains are being created. If history is any guide, the real winners in the Bitcoin ecosystem may be those scaling solutions that align economics, security, and incentives with Bitcoin. This means Bitcoin native gas (Bitcoin can be used as a fee payment), any Bitcoin full node verification state, and unilateral asset exits to the Bitcoin base layer.

Compared to Ethereum

Bitcoins hot money as a percentage of total value is similar to Ethereums total TVL, and this value can be unlocked by implementing programmability on Bitcoin. Ethereum L1 and L2 have a combined TVL of $71 billion, or 17% of Ethereums total value. Unlike Ethereum, Bitcoins hot money is largely underutilized, primarily stored in CEXs and ETFs. There is reason to believe that financial instruments native to Bitcoin could significantly increase its utilization.

Hot wallet comparison between Bitcoin and Ethereum

challenge

1. Bitcoin’s positioning as digital gold is difficult to change, resulting in low adoption of scaling solutions.

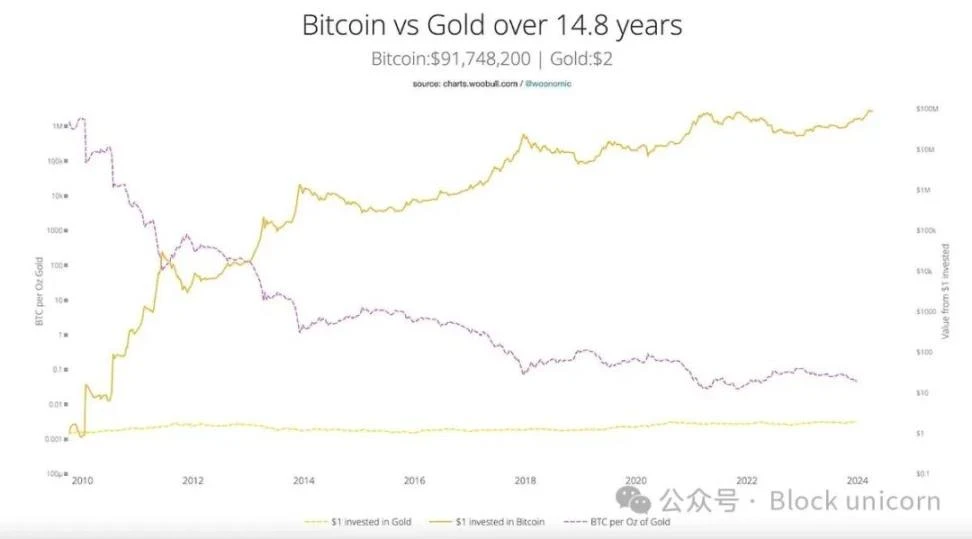

Mitigation: The narrative is driven by demand, and available data suggests that there is excess demand from individual investors for Bitcoin. Bitcoin’s positioning as digital gold may be misleading. Historically, Bitcoin’s price volatility has not been correlated with gold prices (see chart below), but has instead been highly correlated with technology stocks. This suggests that the market is more inclined to view Bitcoin as a technological innovation rather than a store of value. Bitcoin’s roots also foreshadow future programmability, as it was originally created as a utility token for payments.

Bitcoin and gold price comparison

2. Bitcoin will mainly target institutions and serve as a decentralized payment settlement layer. It will be difficult for Bitcoin native applications such as DeFi to emerge.

Mitigation measures: There is $240 billion of hot money in Bitcoin on CEX and ETF. Referring to the Ethereum ecosystem, the historical utilization of ETH increases with the increase in the number of applications.

3. Retail users are reluctant to spend Bitcoin.

Mitigation: Smart contracts through scaling solutions can unlock Bitcoin and make it a global digital currency, not just a digital asset. Before the DeFi summer of 2020, Ethereum had low utility and TVL was less than $1 billion. But with the rise of DeFi, TVL grew to $100 billion in November 2021.

Future trends

Over the next 6-12 months, the following catalysts could allow us to replicate Ethereum’s “DeFi Summer” phenomenon on Bitcoin:

1. OP_CAT (Technical): New opcodes in the Bitcoin programming language enable verification of zero-knowledge proofs and trustless bridging, the missing components for creating a native Bitcoin scaling solution. In addition, covenants and vaults will also improve Bitcoins utility. This upgrade only requires a soft fork, as the opcodes already exist in Bitcoins codebase.

2. BitVM (Technical): As an alternative to OP_CAT, BitVM can perform arbitrary computations off-chain and enable the creation of trustless bridges.

3. US Monetary Policy (Monetary): Due to the US election and the policy shifts of Trump and JD Vance, it is expected that interest rates may fall by up to 50 basis points in the next 6 months, which will drive capital inflows into Bitcoin, one of the most trusted cryptocurrencies.

4. Liquidity staking on Bitcoin: Liquidity staking driven by @babylonlabs_io can bring a new wave of liquidity to Bitcoin native applications. For reference, @Lombard_Finance was launched in September and attracted more than $260 million in Bitcoin TVL in less than a week.