Original author: BitMEX

Back in last week’s article , we advised cautious optimism amidst the generally bullish sentiment in the market. In the following week, despite the generally bullish sentiment, the price of $BTC has steadily dropped from $64,500 to a low of $60,000. Currently, it is stabilizing around $62,000. We hope that you have made some nice gains, or at least avoided losses.

In today’s article, we will outline the latest macro tailwinds that support a positive long-term outlook for the cryptocurrency market. Despite the negative news, we will explore why current price levels may be a good opportunity to initiate a long position, while also considering short-term risks.

As always, we’ll share how to use cryptocurrency options to potentially capitalize on these market views, taking both upside and downside risk into account.

Let’s get started.

First of all... thats why we are cautious

Before we dive in, we want to highlight several factors that lead us to continue to maintain a cautious outlook.

China’s continued strong stock market rally is likely to continue to divert traders’ attention and funds away from cryptocurrencies, as evidenced by the discounted price of OTC USDT to RMB outbound channels, which has remained above 1.5% for two weeks.

Bitcoin ETFs have not maintained sustained strong inflows. From October 1 to 3, three consecutive days of outflows of up to -400 million USD indicated a lack of strong consensus among traditional investors.

Reasons to buy at current prices

Fed officials reach consensus on rate cut target; CPI data released on Thursday could lead to a bigger rate cut

The latest interviews with senior Fed officials this week showed that all agreed with the September 50 basis point rate cut decision, less concerns about inflation, and more attention to the importance of employment data. This shows that the Fed is more willing to accelerate the rate cut process to maintain the health of the US economy. Therefore, this outlook is positive for risky assets such as Bitcoin and US stocks because it means increased market liquidity.

To summarize:

Federal Reserve Vice Chairman Philip Jefferson said the risks to the central banks employment and inflation goals are now more balanced. ( Source )

Boston Federal Reserve Bank President Susan Collins said on Tuesday that the U.S. central bank is likely to implement more interest rate cuts as inflation trends weaken. ( Source

New York Federal Reserve Bank President John Williams said the central bank is well positioned to achieve a soft landing for the U.S. economy, signaling support for a more gradual pace of rate cuts after a sharp half-percentage point cut in September. ( Source )

If Thursdays CPI data comes in better than expected, it could significantly boost the Feds confidence in accelerating the process of rate cuts as they prioritize creating a monetary environment conducive to a soft landing.

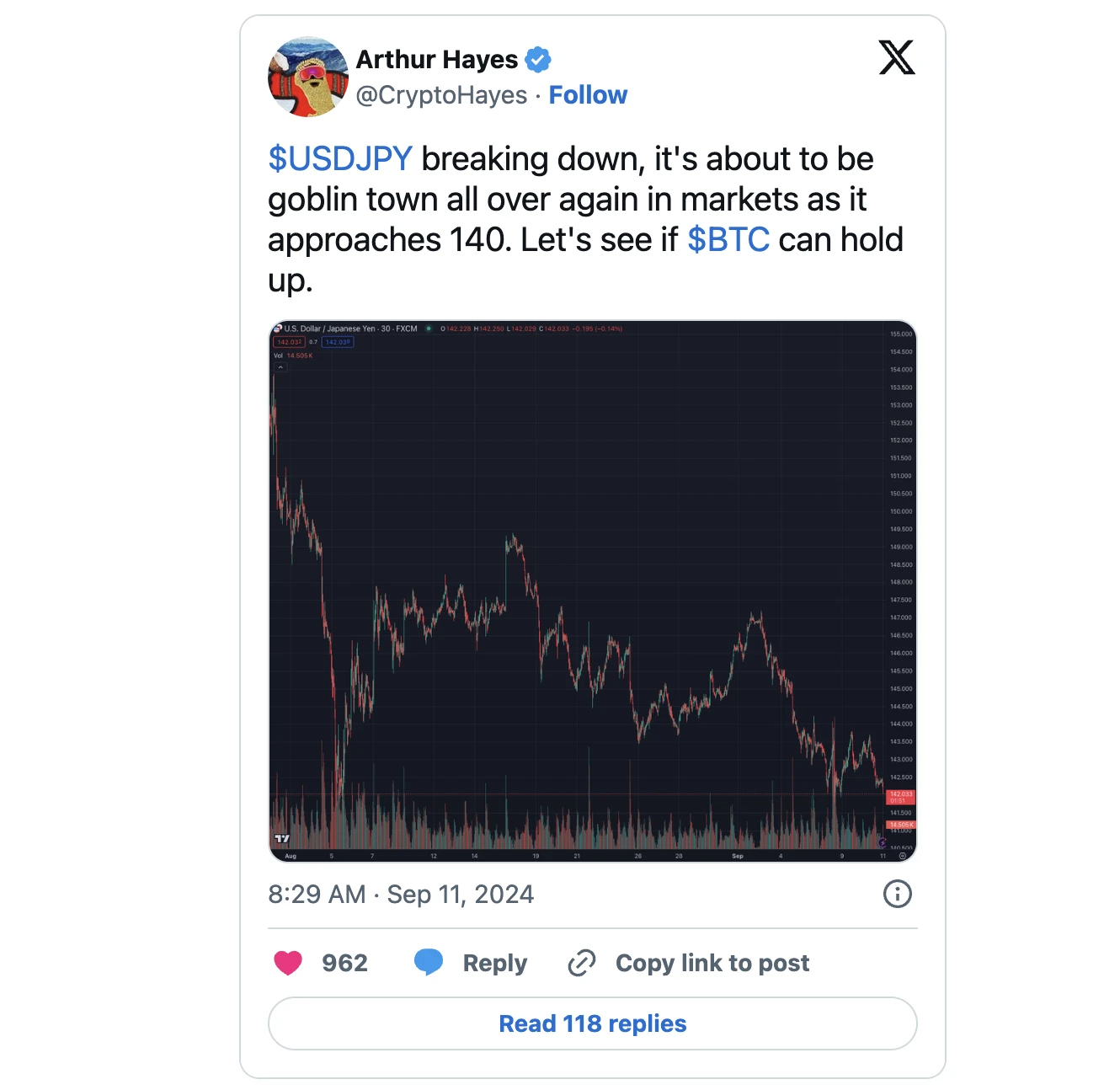

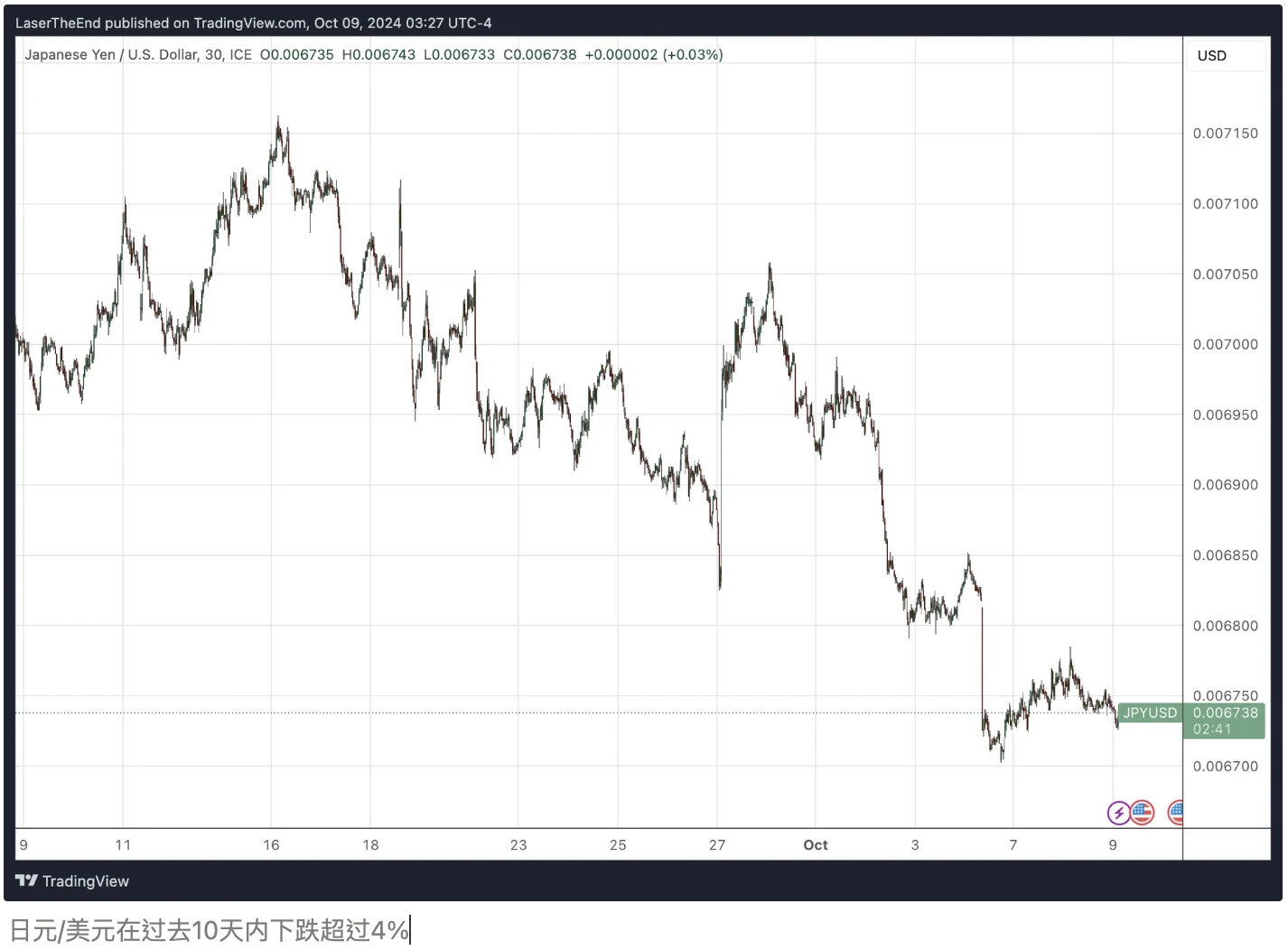

Weaker yen/dollar

The JPY/USD exchange rate chart is another important indicator for the global economic landscape and cryptocurrency traders. Our boss Arthur Hayes has been highlighting the potential damage that a strong yen could cause to current financial markets.

Fortunately, we can now take some temporary comfort as the Bank of Japan has reiterated its intention to hold off on another rate hike.

Although Japans inflation-adjusted wages and household spending fell in August, analysts believe that the underlying trend shows that wages and consumption are gradually recovering. This should support the central banks plans for future rate hikes. But on Tuesday, Japans new Economic Minister Ryosei Akazawa said the government is confident about the timing of the central banks future rate hikes, despite uncertainty about the new political leaderships stance on monetary policy. The Bank of Japan governor also said the bank has ample time to carefully examine market developments, even though real interest rates are still extremely negative.

Put your market views into practice: Trading options

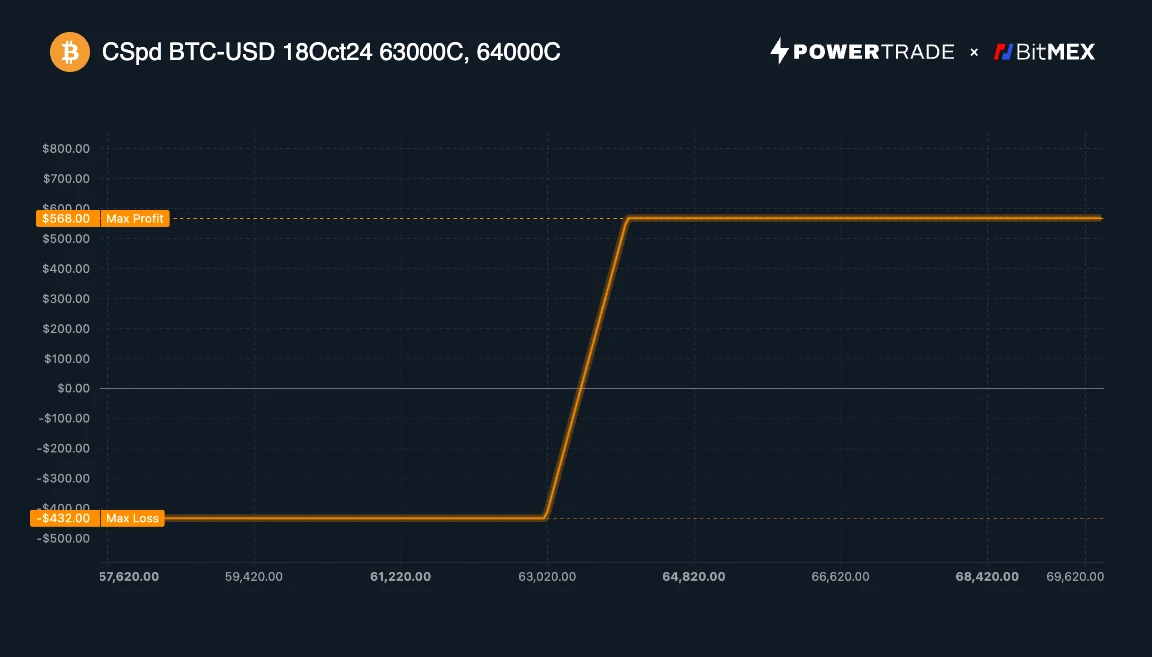

Taking the above into account, we continue to maintain the same view — 1) BTC will rise modestly, but 2) it is unlikely to break $68,000 or create new all-time highs in the next few weeks.

Consider a call spread strategy

The call spread strategy involves buying a lower strike price call option and simultaneously selling a higher strike price call option, both with the same expiration date. This strategy is ideal for traders who believe that the underlying asset (in this case, Bitcoin) will experience a modest upside but will not exceed a certain price point. It allows for potential profits with limited risk while also providing some downside protection.

Trading strategies

Buy 1 $BTC call option with a strike price of $63,000, expiring on October 18

Sell 1 $BTC call option with a strike price of $64,000, expiring on October 18

Potential Benefits

Breakeven Point: $63,432

Max loss: $433 if $BTC is below $63,000 on expiration date October 18

Max profit: $567 if $BTC is above $64,000 on expiration date Oct 18

Advantages

Limited Risk: Maximum loss is limited to the net option premium paid, providing better risk management.

Lower Cost: Selling a call option with a higher strike price reduces the overall cost of the strategy.

Clear profit potential: Maximum profit is realized when the asset price reaches or exceeds the higher strike price at expiration.

risk

Limited upside: Profits are capped and potential gains may be missed if the asset price significantly exceeds the higher strike price.

Option Time Value Decay: Time decay affects both options and can work against you if the asset price does not move as expected.

Breakeven point: This strategy requires that the asset price must exceed the breakeven point to make a profit.

This strategy is suitable for traders who have a mildly bullish view on the market, expecting asset prices to rise but not beyond a certain level. It offers a balance between risk management and profit potential, making it an attractive option for traders seeking a more conservative bullish position.