Author: @charlotte_zqh

This research report is supported by international Crypto media and first-tier investor @RomeoKuok

Pendle is undoubtedly one of the most outstanding targets in this round. From $0.7 in August 2023 to $7.5 in April 2024, it has risen strongly in half a year, with an increase of more than 10 times, becoming one of the best performing altcoins. At the same time, Pendles TVL has been rising all the way, with the highest point exceeding $6.6 billion. However, starting in April, Eigenlayers official announcement of airdrops ignited the first negative sentiment towards Pendle. By mid-May, PENDLE quickly fell to $3.8, a drop of more than 50% in less than a month. Although it rebounded afterwards, with the cooling of the re-staking track and even the spread of market pessimism about the entire Ethereum ecosystem, Pendle fell into a slump. On August 5, the price of PENDLE once reached $2. This article will provide a systematic mechanism analysis of Pendle, analyzing how Pendle quickly grasps market demand and completes the direct transmission of fundamentals to coin prices, and how it is negatively affected by the cooling of the Ethereum ecosystem and continues to fall.

1 Pendle 101: How to separate principal from earnings

1.1 Separation of interest-earning assets

Pendle is a decentralized financial protocol that allows users to tokenize and sell future earnings. In terms of specific business processes, the protocol will first package interest-bearing tokens into SY tokens (Standardized Yield Tokens), which are tokens under the ERC-5115 standard and can encapsulate most interest-bearing assets; then, SY tokens are divided into two parts, namely PT (Principal Token) and YT (Yield Token), representing the principal and yield of interest-bearing assets respectively.

Among them, PT is similar to a zero-coupon bond, allowing users to purchase it at a certain discount and redeem it at the par value on the maturity date. Its income is implicit in the difference between the purchase price and the redemption price. Therefore, if you hold PT until the maturity date, the user will get a fixed income. For example, if you buy PT-cDAI at a price of $0.9, you will get 1 DAI at maturity, with a yield of (1-0.9)/0.9 = 11.1%. The act of buying PT is a short yield behavior, that is, it is believed that the future yield of the asset will decline, which is lower than the current yield of buying PT. At the same time, the yield is fixed and suitable for users with low risk preferences. However, this behavior is different from real short selling, and it is more of a hedging behavior.

YT holders can obtain all the income of the interest-bearing asset during the holding period, corresponding to the income rights of the principal. If the income is settled in real time, then the holder of YT can receive the settled income at any time. If the income is settled after maturity, the user can only receive the income with YT after maturity. After the income corresponding to YT is received, the YT asset will become invalid. The act of buying YT is a long yield act, that is, it is believed that the future yield of the interest-bearing asset will rise, and the total income obtained will be higher than the current purchase price of YT. YT provides users with an income leverage. They can directly purchase the income rights without purchasing the complete interest-bearing asset, but if the yield drops sharply, the YT asset faces the problem of loss. Therefore, compared with PT assets, YT is a high-risk, high-yield asset.

Pendle provides tools for long and short yields. Users choose corresponding investment strategies based on their predictions and judgments of yields. Therefore, yield is an important indicator for participating in the protocol. Pendle also provides a variety of APYs to reflect the current market situation:

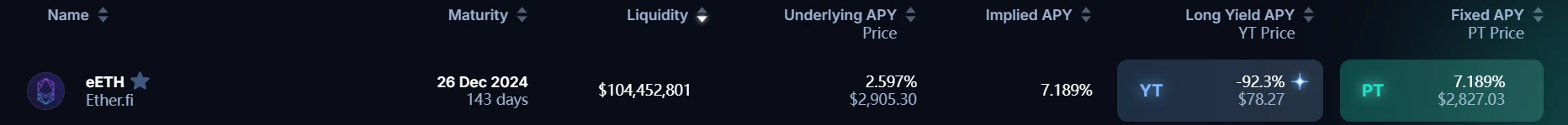

Underlying APY: It is the actual yield of the asset, taking the 7-day moving average yield to help users estimate the future yield trend of the asset.

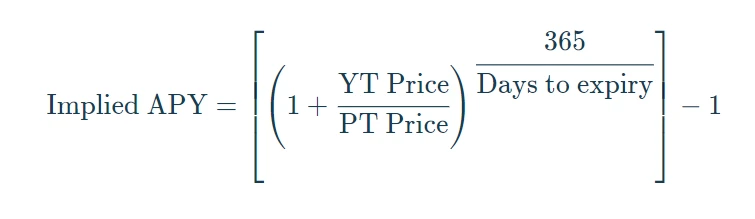

Implied APY: It is the market consensus on the future APY of the asset, which is reflected in the prices of YT and PT assets. The calculation formula is:

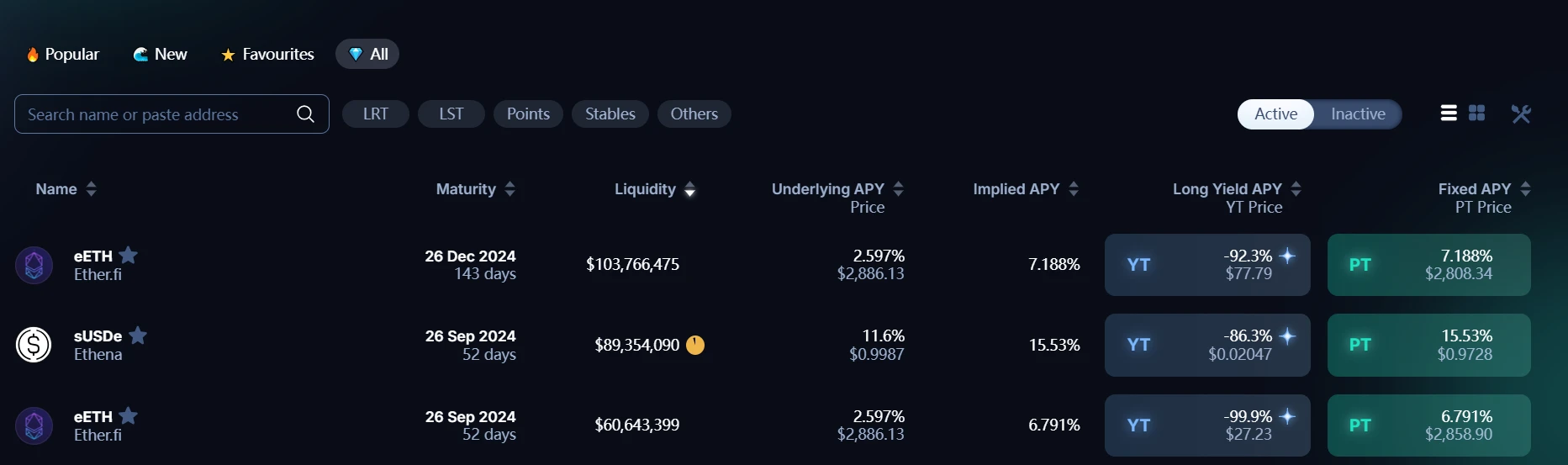

Fixed APY: Specifically for PT assets, the fixed rate of return that can be obtained by holding PT, this value is equal to the Implied APY value

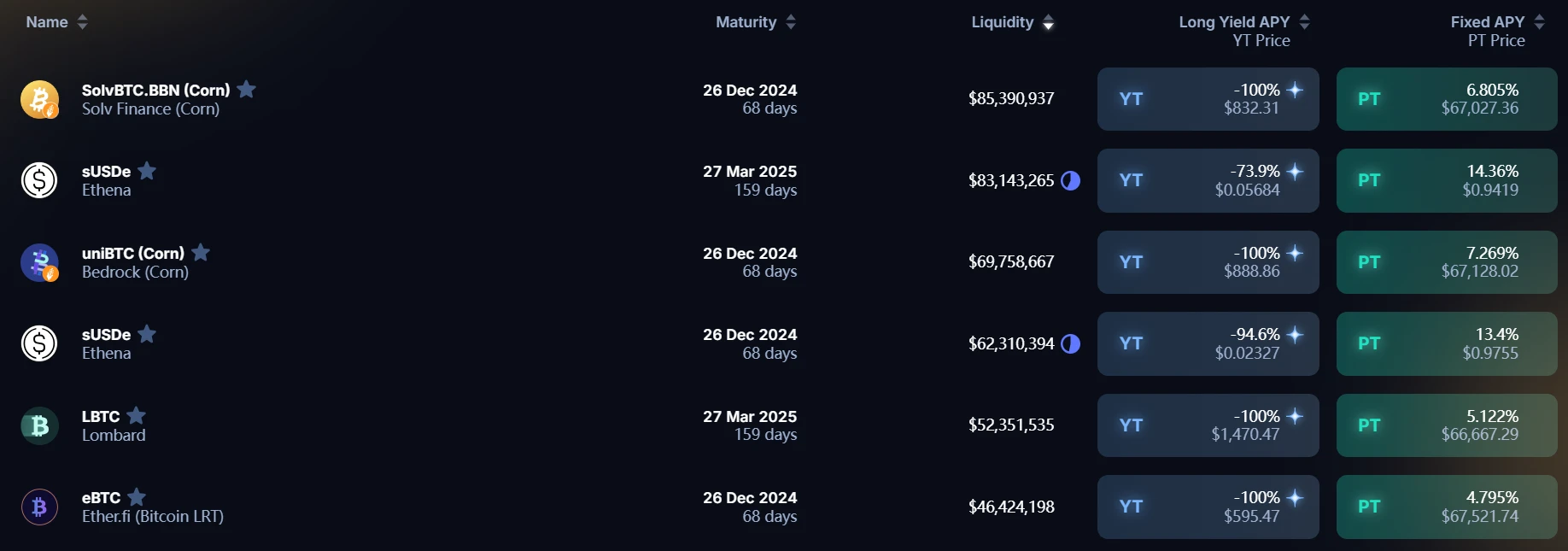

Long Yield APY: Specifically for YT assets, the annual yield of purchasing YT at the current price, but this yield is constantly changing because the yield of the interest-bearing asset itself is changing (this value may be negative, that is, the current YT price is too high, resulting in exceeding the future income of the project). It is worth noting that the potential income of many YT assets of Pendle is currently airdrops and points, and the value cannot be estimated, so the Long Yield APY of many YT assets is -100%.

These four yields will be given simultaneously in the Pendle Market interface. When Underlying APY>Implied APY, it means that the return on holding the asset will be greater than the return on holding PT. At this time, you can adopt a long yield strategy, that is, buy YT and sell PT. When Underlying APY<Implied APY, consider adopting the opposite strategy. However, it should be pointed out again that the measurement of these yields does not take into account future airdrop expectations, so the above strategy is only applicable to pure interest rate swap assets.

1.2 Pendle AMM: Realizing transactions of different types of assets

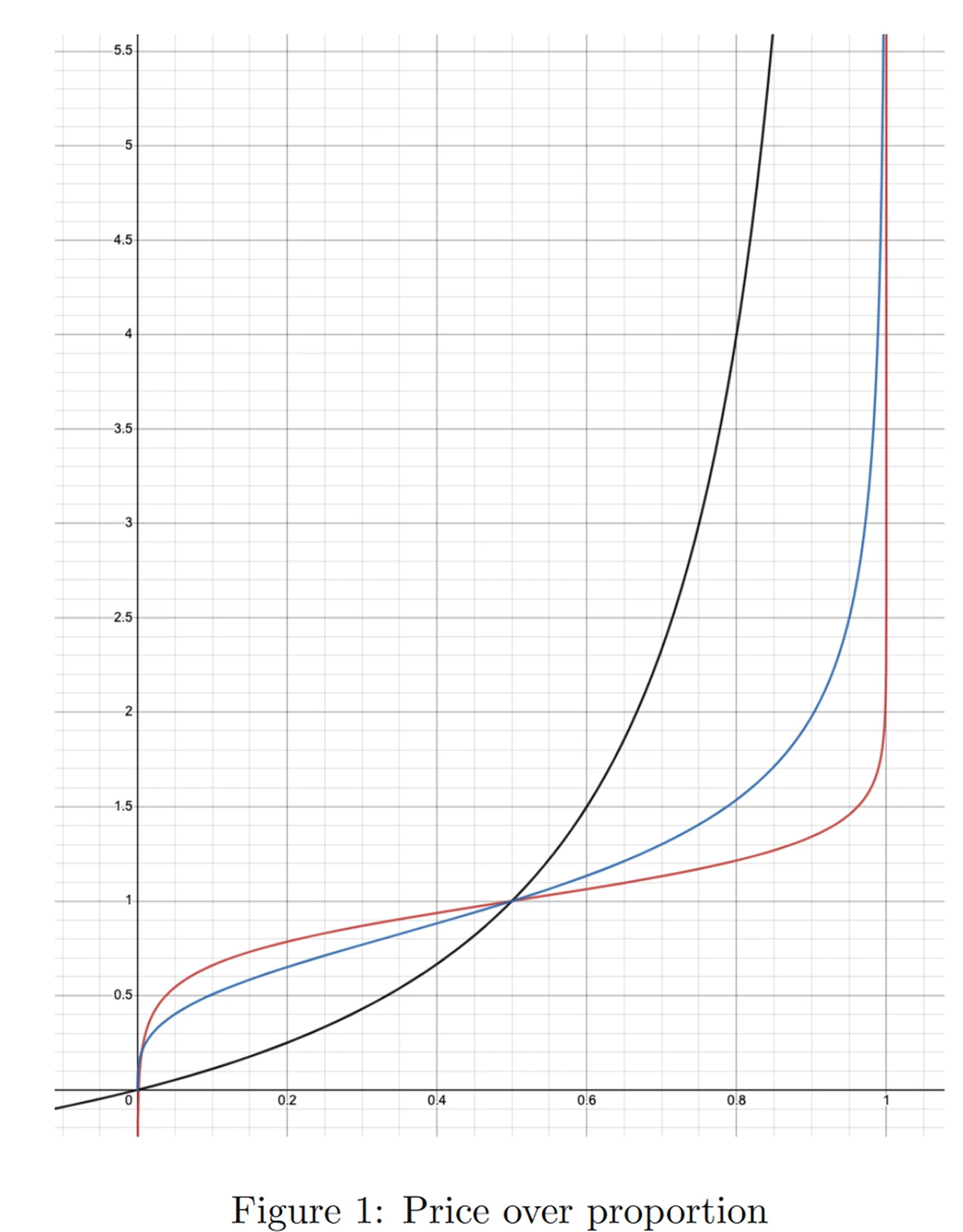

Pendle AMM is used to implement transactions between SY, PT and YT tokens. According to the Pendle white paper, in the V2 version, Pendle improved the AMM mechanism, borrowed the AMM model of Notonial Finance, improved capital efficiency and reduced slippage. The following is a diagram of the three AMM models of fixed-income protocols on the market, where the X-axis refers to the proportion of PT assets in the pool, and the vertical axis is the Implied Interest Rate. Currently, Pendle uses the AMM model corresponding to the red curve, the black curve is the V1 model, and the blue curve is the AMM model of other fixed-income protocols.

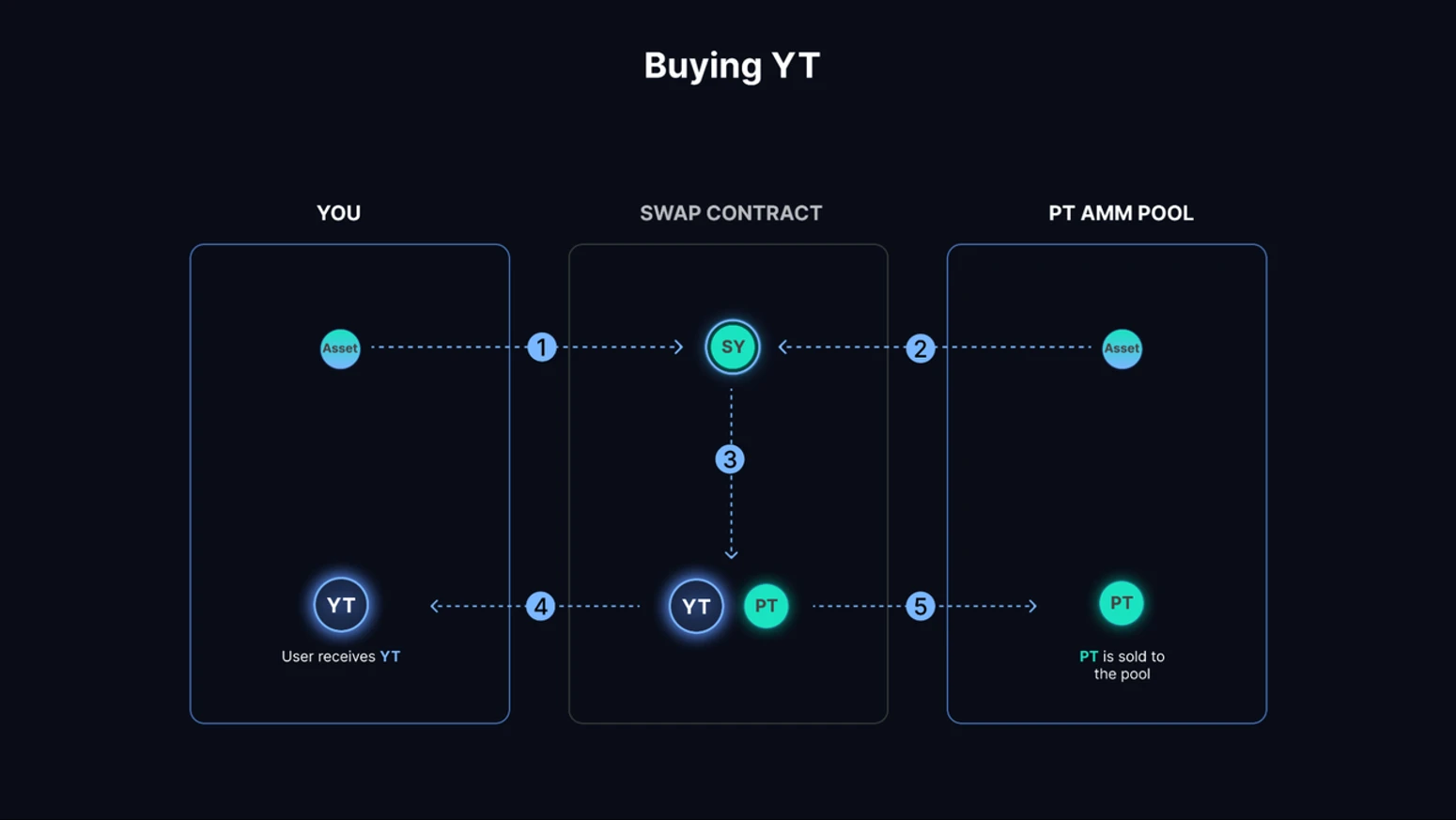

In the specific pool, Pendle V2 uses PT-SY trading pairs, such as PT-stETH and SY-stETH, which can greatly reduce the impermanent loss of LP (detailed analysis will be given later). Since SY=PT+YT, the exchange of YT can be realized through Flash Swap. The specific process is as follows. If a user needs to purchase YT-stETH worth 1 ETH, the exchange of ETH to YT-stETH needs to be realized. Assuming 1 ETH=N YT-stETH, the contract will borrow N-1 SY-stETH from the pool and convert the users ETH into SY-stETH (the specific process is to first convert ETH into stETH through Kyberswap, and then encapsulate it as SY-stETH within the protocol), and then split all SY-stETH (N) into PT and YT, give the appropriate number (N in this case) of YT to the user, and then return PT (N) to the pool. What is actually completed in the pool is the exchange of SY-PT (N-1 SY converted into N PT).

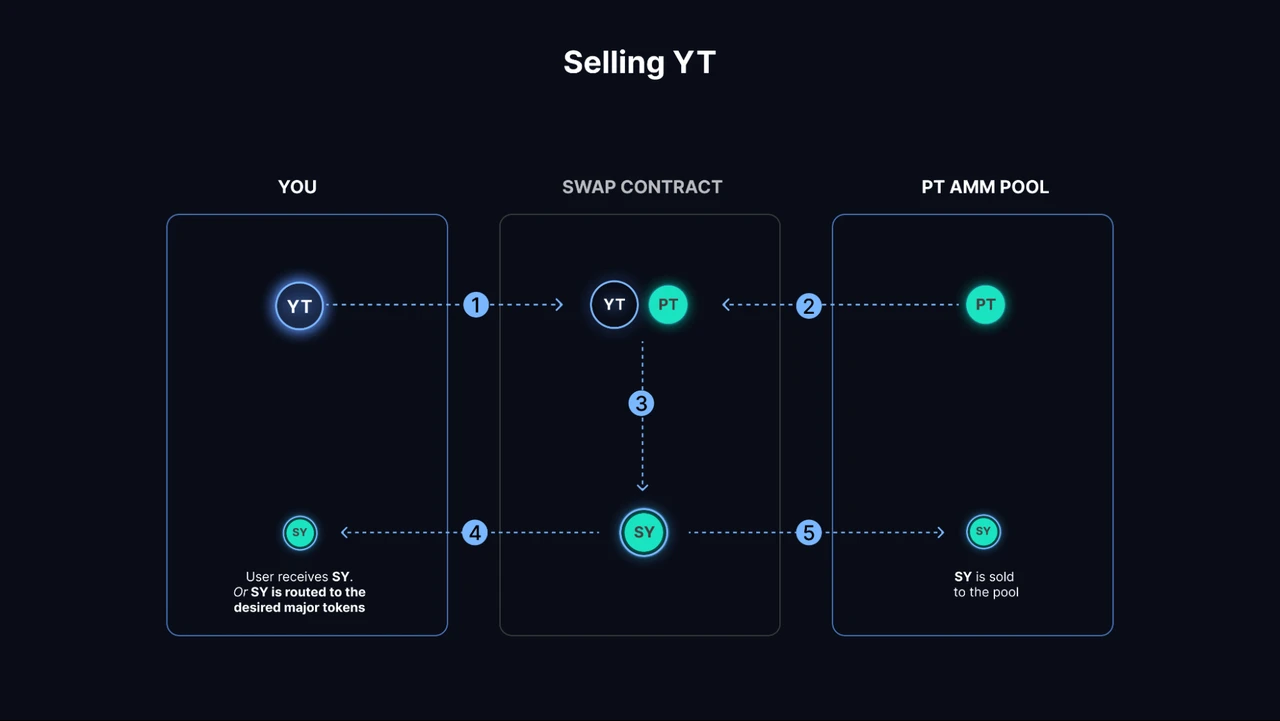

The process of selling YT is the opposite. If a user wants to sell N YT (assuming that N YT is worth 1 SY at this time), the contract will borrow N PT from the pool, merge them into N SY, give one SY to the user, and return N-1 SY to the pool. At this time, the actual exchange completed in the pool is PT-SY (N PT is exchanged for N-1 SY).

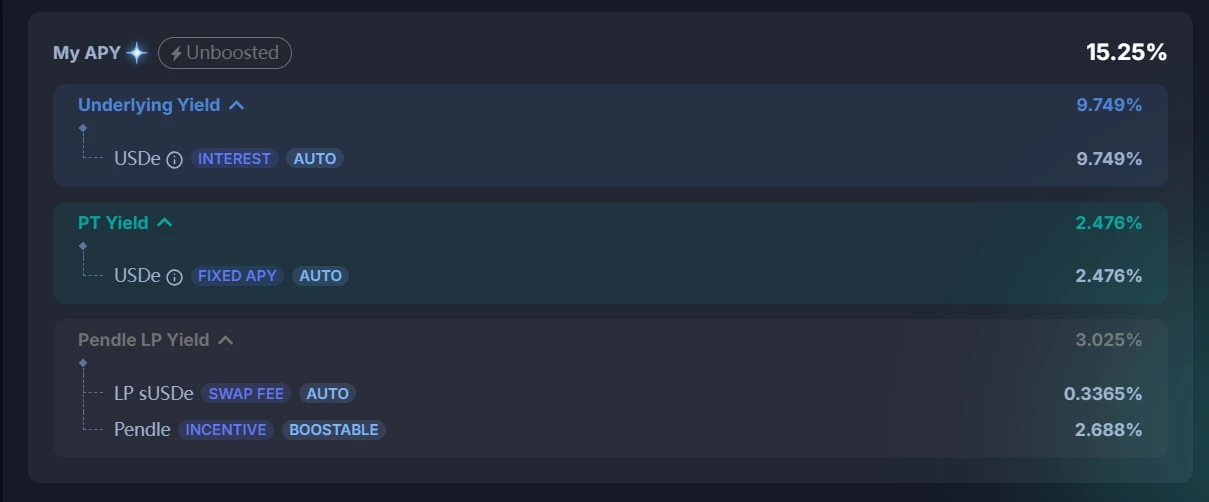

Like other AMMs, Pendle AMM also requires LP to provide liquidity for the pool, but since one PT must be equal to one SY on the expiration date, there is no impermanent loss for LP on the expiration date. When users provide liquidity, the assets they provide are SY and PT assets, so they will automatically capture the native income of these assets, in addition to transaction fees and PENDLEs liquidity mining rewards, which includes four sources of income:

PT fixed yield: the income from purchasing PT itself

Underlying yield: the income of SY assets

Swap fees: 20% of transaction fees

PENDLE Token Incentives

2 Token Economics: How does business revenue drive coin prices up?

2.1 Token Economic Mechanism: How to Realize the Economic Flywheel?

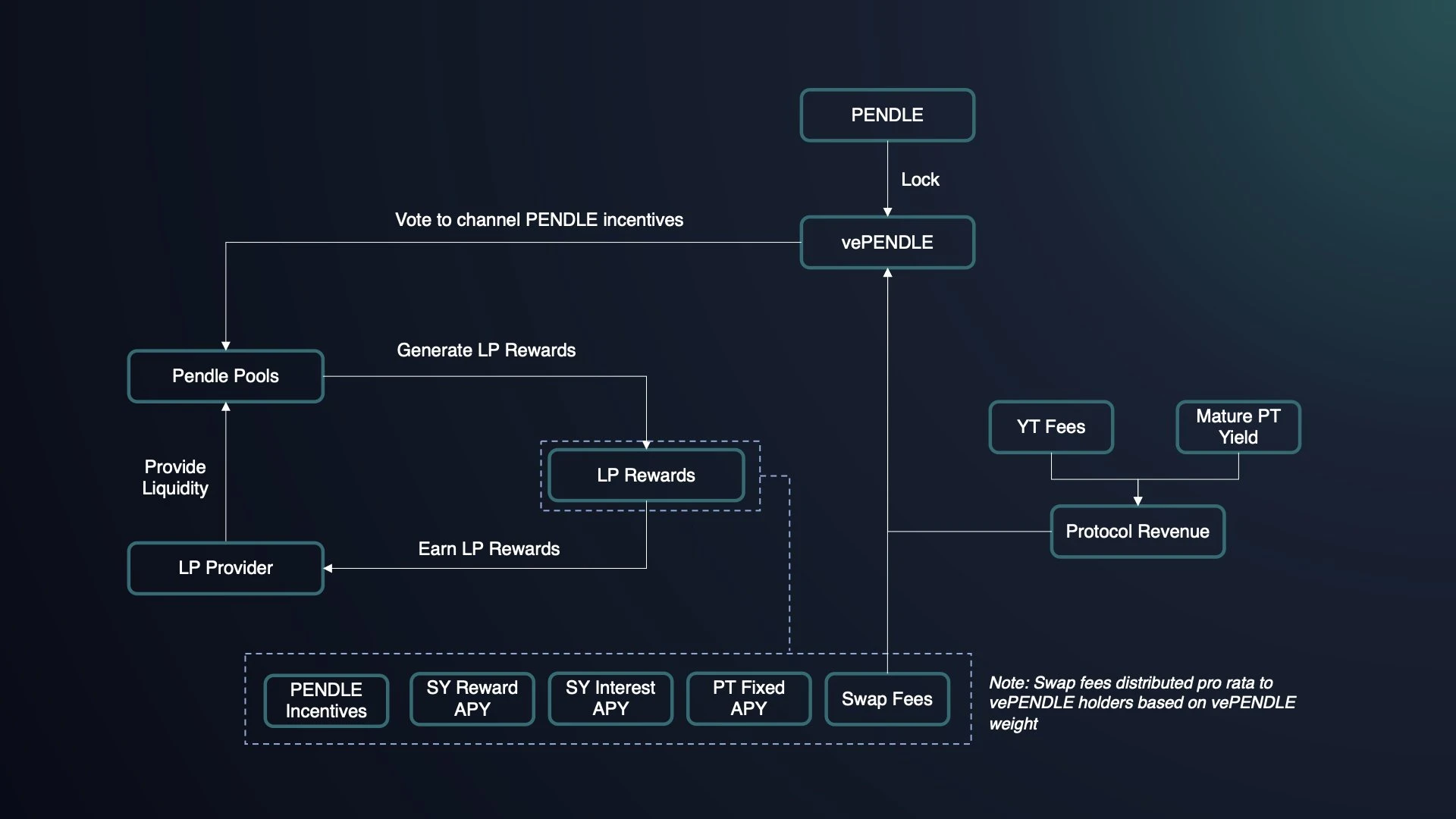

The token economic mechanism of PENDLE mainly lies in the protocol sharing and decision-making governance that can be participated in after locking up vePENDLE. Similar to Curves veCRV model, users can lock up PENDLE in exchange for vePENDLE. The longer the lock-up period, the more vePENDLE is obtained. The lock-up period ranges from 1 week to 2 years.

The benefits of holding vePENDLE include:

Boost income: You can boost your income as a LP, up to 2.5 times

Voting rights: vote on the allocation of PENDLE incentives in different pools

Revenue sharing: vePENDLE holders can obtain the following benefits:

80% of the transaction fees in the voting pool are divided into: vePENDLE holders vote on the direction of PENDLE incentives, and only after completing the vote can they receive rewards from the selected transaction pool

3% of all YT earnings

Part of PT income: This part comes from unredeemed PT. For example, a user purchased PT assets and did not redeem them when they expired. After a period of time, this part of the assets was acquired by the protocol.

In terms of yield calculation, the Total APY of holding vePENDLE = Base APY + Voters APY, where Base APY comes from the income of YT and PT, and Voters APY comes from the transaction fee sharing of the designated pool, which is also the main part of APY. Currently, Base APY is only about 2%, while Voters APY can be as high as 30% or more.

Pendles ve model also promotes the birth of vote-buying platforms. Penpie and Equilibria are both engaged in related businesses, similar to the business process between Convex and Curve. However, compared with Curve, the core project parties of the assets traded on Pendle do not have the need for vote-buying. As the main trading platform for stablecoins and other anchored assets, Curve ensures that the depth of the pool is of great significance to maintaining the anchoring of the currency price, which prompts the project parties to have a great demand to participate in vote-buying to guide liquidity. However, maintaining the trading depth of Pendle AMM does not seem to have much meaning for related project parties such as LSD and LRT. Therefore, the main motivation for participating in vote-buying will come from LPs on Pendle. The establishment of the vote-buying platform mainly optimizes two aspects of the problem: 1) Pendle LP can obtain higher returns without purchasing and locking PENDLE; 2) PENDLE holders can obtain liquid ePEDNLE/mPENDLE to obtain vePENDLE incentives. Since this article only analyzes Pendle, the vote-buying ecosystem will not be expanded here.

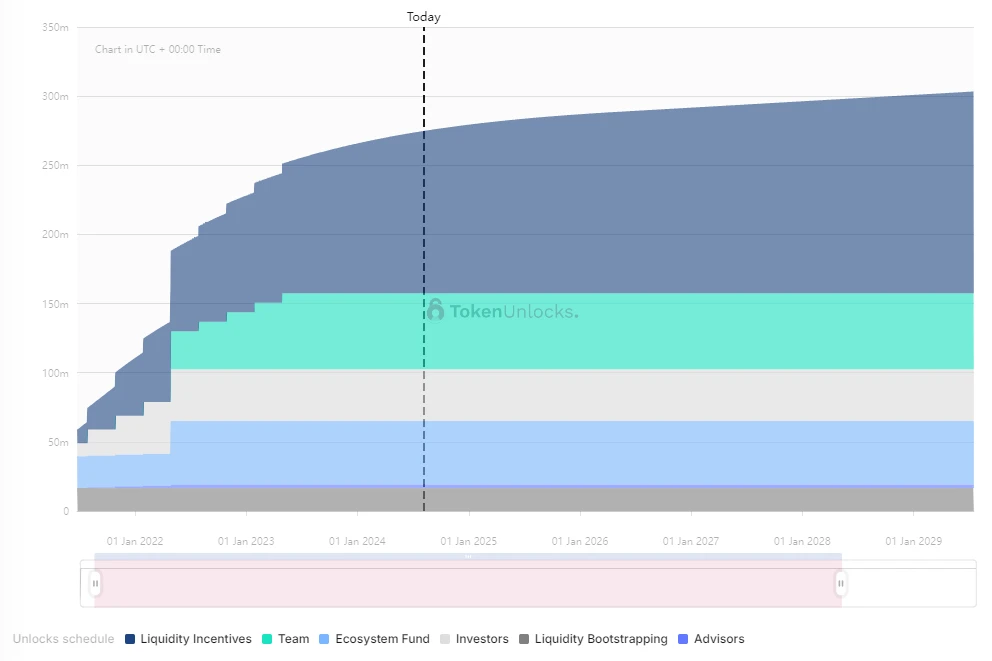

2.2 Token distribution and supply: No major subsequent unlocking events

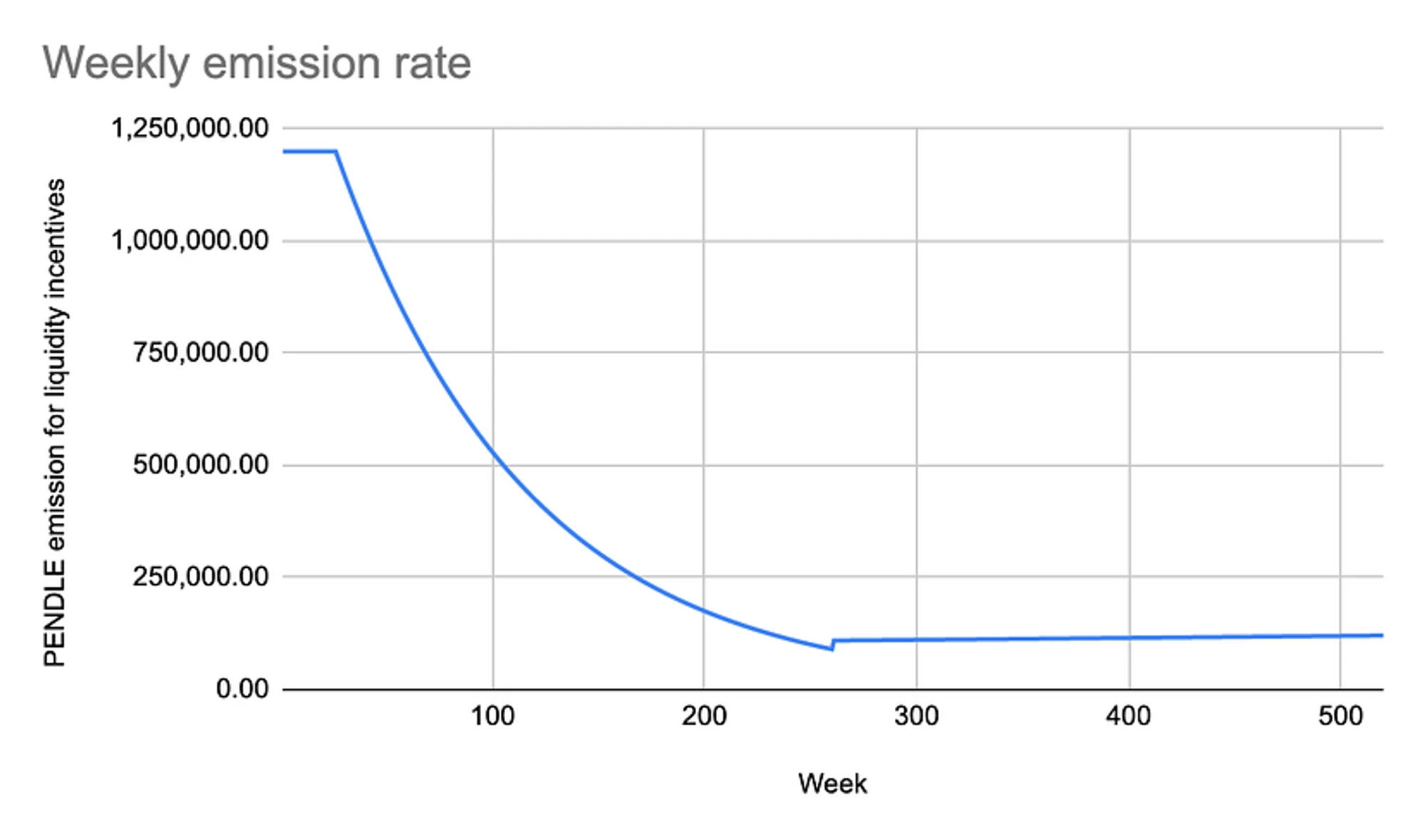

The PENDLE token was launched in April 2021 and adopts a hybrid inflation model with an uncapped token supply. It provides a stable incentive of 1.2 million PENDLE per week in the first 26 weeks. After that (weeks 27-260), the liquidity incentive will decay by 1% per week until the 260th week. Thereafter (after week 261), the inflation rate will be 2% per year for incentives.

According to Token Unlock data, the initial token distribution was given to the team, ecosystem, investors, consultants, etc. At present, all tokens have been unlocked. If OTC transactions are not considered and only the initial distribution is considered, PENDLE will not face large-scale centralized unlocking in the future. At present, daily inflation only comes from liquidity mining incentives. The daily emission amount of PEDNLE is about 34.1k. According to the coin price on August 5 ($2), the daily unlocking selling pressure is $68.2k, which is relatively small.

3 Application scenario development: stable financial management, interest rate trading and points leverage

The development of Pendle can be roughly divided into three stages:

Pendle was founded in 2021. Although it was the DeFi Summer at that time, DeFi was in the infrastructure stage, and the main projects revolved around DEX, stablecoins and lending. As an interest rate exchange product, it did not receive much attention.

Until the end of 2022, as Ethereum completed its transition to PoS, the Ethereum staking rate became the native interest rate in the cryptocurrency circle, and a number of LSD assets emerged rapidly, resulting in: (1) interest rates becoming one of the focuses of the cryptocurrency circle; (2) a large number of interest-bearing assets were born, and Pendle found its own PMF; (3) Pendle became a small-cap target for hype in the LSD track, and there were few competitors in the sub-track. The listing on Binance during this period further increased Pendles valuation ceiling.

From the end of 2023 to the beginning of 2024, Eigenlayer started the re-staking narrative of Ethereum, and a number of liquidity re-staking (LRT) projects were born. Both Eigenlayer and LRT projects announced points and airdrop plans, and the points war was about to break out. This led to: (1) the birth of more interest-bearing assets, effectively broadening Pendles path to increase TVL; (2) Most importantly, Pendle captured the intersection of principal and interest transactions and points leverage and found a new PMF. The following article will introduce more about how Pendle plays a role in the points war and how to empower PENDLE tokens.

To sum up, in addition to becoming an LP and a vePENDLE holder, the main usage scenarios of Pendle currently include three: stable financial management, interest rate trading and points leverage.

3.1 Prudent Financial Management

It is mainly a function corresponding to PT assets. By holding PT assets, a fixed amount of corresponding assets can be obtained at maturity. This fixed interest rate is determined on the date of purchase, and users do not have to pay attention to changes in APR. This function has a stable yield, and both risk and return are low. This function has increased the users yield after the point transaction is enabled: taking eETH as an example, users choose to give up the point income of holding eETH in exchange for a higher fixed yield. Therefore, the current yield of PT assets (7.189%) is much higher than (2.597%), which provides financial management tools for users who want to obtain higher Ethereum-based fixed income. Some users are not optimistic about the subsequent token performance of the LRT project. When the market FOMO pushes up the YT price, they can buy PT assets at a low price, which is actually a short transaction for LRT tokens.

3.2 Interest rate/yield forecast trading

Through swing trading of YT assets, long and short interest rates can be achieved. When it is believed that the future yield will increase significantly, YT assets are bought and sold when the YT asset price rises. This strategy is suitable for trading assets with high volatility in yields, such as sUSDe, which is a pledge certificate for the stablecoin issued by Ethena. The pledge income mainly comes from the funding rate of ETH. The higher the funding rate, the higher the pledge income. The funding rate depends on changes in market sentiment. Therefore, the pledge yield also has a certain volatility with the funding rate. By trading YT-sUSDe, you can quickly make a profit in swing trading. In addition, after the introduction of the right to point income, the transaction of YT assets also includes pricing changes for airdrop expectations. For example, before ENA is issued, by buying YT-USDe in the early stage and selling tokens after the market starts FOMO on the ENA airdrop, you can get higher returns. This type of swing trading faces high returns and risks. For example, the price of YT-sUSDE has been falling recently. On the one hand, as the holding period shortens, the points brought by holding YT assets are decreasing. On the other hand, it may be due to the continuous decline in ENA prices. The markets expectations for the value of airdrops are declining, and early buyers may face large losses.

3.3 Points leverage and transactions

The biggest impact on Pendle in this cycle comes from the points trading function, which provides users with high leverage of points and airdrops. This article will focus on this function and hope to answer the following questions:

(1) What projects are suitable for Pendles points trading?

Points have become the main form of airdrop distribution in this cycle. The forms of obtaining points include interaction, volume brushing and deposit, among which deposit has become the most important way. With the emergence of various LRT protocols, BTC second layer and pledge protocols, the TVL war has become a main theme this year. Among them, some protocols directly lock related assets, such as BTC second layer directly locks BTC and inscription assets, Blast directly deposits ETH, etc., and some protocols return the corresponding liquid assets as deposit certificates after deposit, and obtain points by holding. Pendles principal-income separation mechanism is more suitable for the second category, that is, an underlying asset is needed as a medium for point accumulation.

(2) In what aspects does Pendle’s point trading realize PMF?

Pendle has realized PMF in two main aspects: first, it has realized the leverage of points, and second, it has realized the early pricing and expected trading of airdrops. The TVL war is a game for whales. Ordinary retail investors cannot have enough ETH to deposit. Pendle supports the purchase of YT assets to obtain the right to earn points directly. You can get corresponding points without the principal. It has realized dozens of times of point leverage in projects such as LRT and Ethena. Secondly, Pendle essentially provides the earliest market pricing for points, and the transaction of YT assets is also a transaction of project airdrops and currency price expectations. It can be further divided into two situations: ① For tokens that have not yet had TGE, most of the airdrop rules are unclear, so they include both the markets expectations for the tokens that may be obtained and the early pricing of these tokens; ② For tokens that have already had TGE, the coin price already has a clear market pricing, and the unknown information may be how many tokens are airdropped for one point. If the airdrop rules are also relatively clear, and it is already known how many tokens the underlying asset can get when it expires, then this YT asset is equivalent to an option, and the current price includes the pricing expectations for the token price on the expiration date.

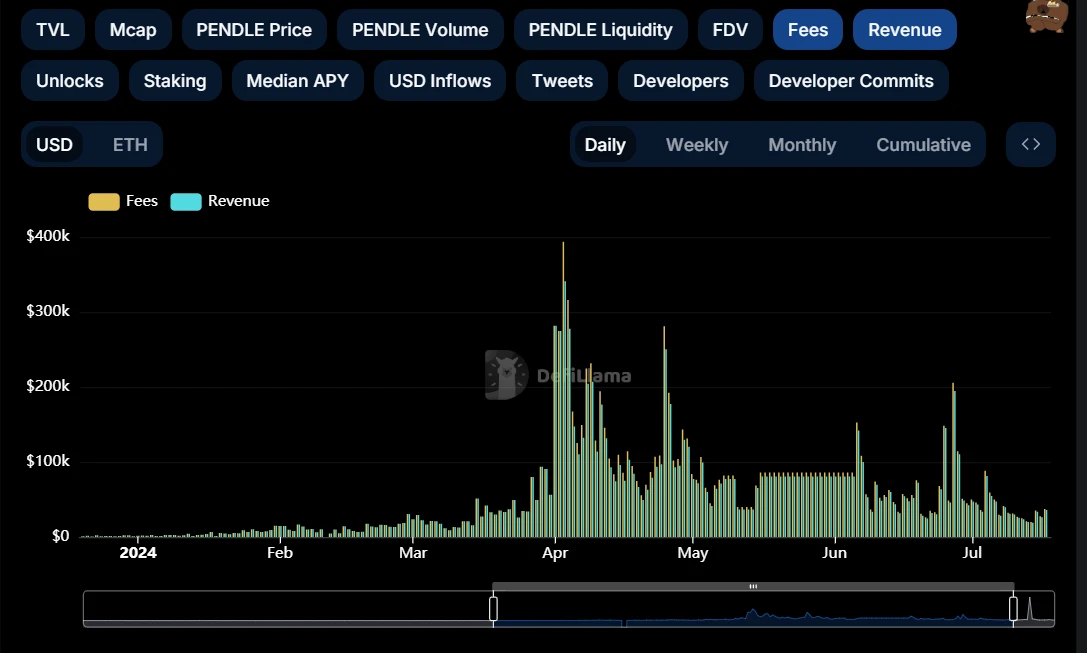

(3) How does point trading affect Pendle’s business revenue and coin price?

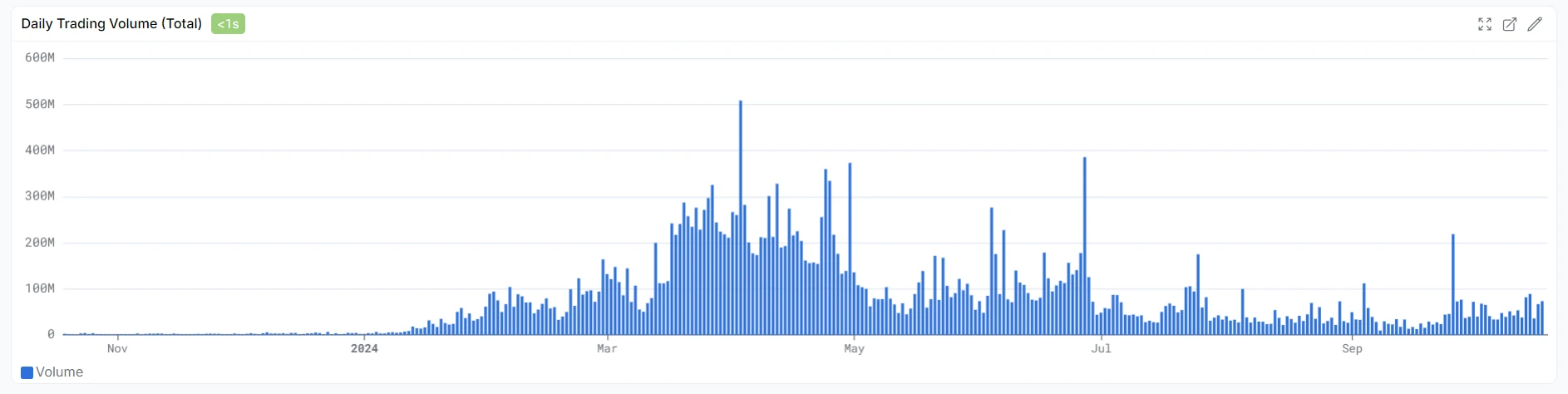

According to the analysis above, the introduction of point trading has brought about trading in anticipation of future airdrops. Compared to the rate of return, this expectation changes and fluctuates rapidly, which leads to higher speculation and trading demand. Most directly, this has rapidly expanded Pendles trading volume and transaction fee income. In addition, the enrichment of asset categories has also increased Pendles TVL.

The empowerment of PENDLE is more obvious. The income of vePENDLE holders mainly comes from the sharing of transaction fees. If there is not enough volatility and speculative demand, there will not be enough transactions. The yield of vePENDLE is extremely low. In July 2023, the total APY of vePENDLE is only about 2%. Therefore, although Pendle followed the hot speculation of the LSD track at that time, the currency price still could not benefit from the business. The introduction of point trading has changed this dilemma. At present, the APY of vePENDLE in multiple pools exceeds 15%, and the relevant asset pools of multiple LST assets are as high as more than 30%.

(4) How does the performance of related projects affect Pendle?

The two core negative impacts surrounding Pendle include: the airdrop of the main assets (LRT and Ethena); and the continued decline in the price of the main project coins. The airdrop has reduced speculative demand. Although the points plan will continue for many periods, coupled with the decline in the price of the coin, the markets confidence and expectations for the project have been greatly reduced. The number of users who continue to choose to deposit is decreasing, and the related transaction volume has also shrunk significantly. Currently, Pendles TVL and transaction volume have both fallen sharply, and the same dilemma is also reflected in the coin price.

4 Data Analysis: TVL and transaction volume are Pendle’s KPIs

This article believes that the business data around Pendle can be divided into two parts: stock and flow. Stock is mainly represented by TVL. In addition, it is necessary to pay close attention to indicators that affect the health and sustainability of TVL, such as the composition structure of TVL, the expiration time of the asset pool, and the extension ratio; flow is mainly represented by transaction volume, including transaction volume, transaction fees, transaction volume composition, etc. Changes in transaction volume will directly affect token empowerment.

4.1 TVL and related indicators

TVL denominated in ETH has grown rapidly since mid-January 2024, and has maintained a high correlation with the PENDLE price. The highest TVL exceeded 1.8M ETH. On June 28 and July 25, TVL experienced a rapid decline. The main reason was that a large number of asset pools expired, and there was insufficient demand for a new round of investment after expiration, resulting in a rapid loss of TVL. Currently, Pendles TVL is about 1M ETH, which is close to a 50% drop from the peak, and the downward trend has not been effectively alleviated.

Specifically, on June 27, 2024, multiple LRT asset pools including Ether.Fi s eETH, Renzos ezETH, Puffers pufETH, Kelps rsETH, and Swells rswETH expired, and users redeemed their principal investments. Although there are still asset pools with other expiration dates for related assets, the user rollover ratio is low, and TVL has not shown a trend of recovery so far. This also confirms the analysis in the previous article, that is, as the issuance and price performance of LRT projects decline, users demand for further participation in related asset management and investment has decreased. In this cycle, Ethereums ecological innovation is insufficient, and the market is not optimistic about the price of ETH. If the markets investment demand for ETH weakens, it will directly affect Pendles business income level. Therefore, Pendle and Ethereum are strongly bound.

In terms of Pendles TVL composition, the total TVL of Pendle is currently $2.43 B, of which there are 11 asset pools with TVL exceeding $10 M. The pool with the highest TVL is SolvBTC.BBN, accounting for about 3.51% of the total TVL. The TVL composition structure is relatively healthy, and there is no situation where a few asset pools occupy a large amount of TVL. Judging from the maturity of the asset pool, the next large maturity date will be December 26, 2024. Pendles TVL may show a relatively stable trend in the near future.

After the Ethereum re-staking wave ended, Pendle smoothly switched to stablecoin assets such as BTCfi and USDe/USD 0. Although the business data and market sentiment were not as good as in April, the TVL data was basically maintained without a sharp decline. However, with the issuance of coins by a number of Ethereum LRT protocols and the entry of EIGEN into transactions, the imagination of the re-staking track is decreasing, and the speculative enthusiasm for the BTC staking track has also been compressed to a certain extent, which is reflected in the decline of Pendles transaction volume data. The next event that may impact Pendle will be the issuance of coins by Babylon and the BTC staking track. After the end of BTC re-staking, can Pendle still find new application scenarios?

4.2 Trading volume and composition

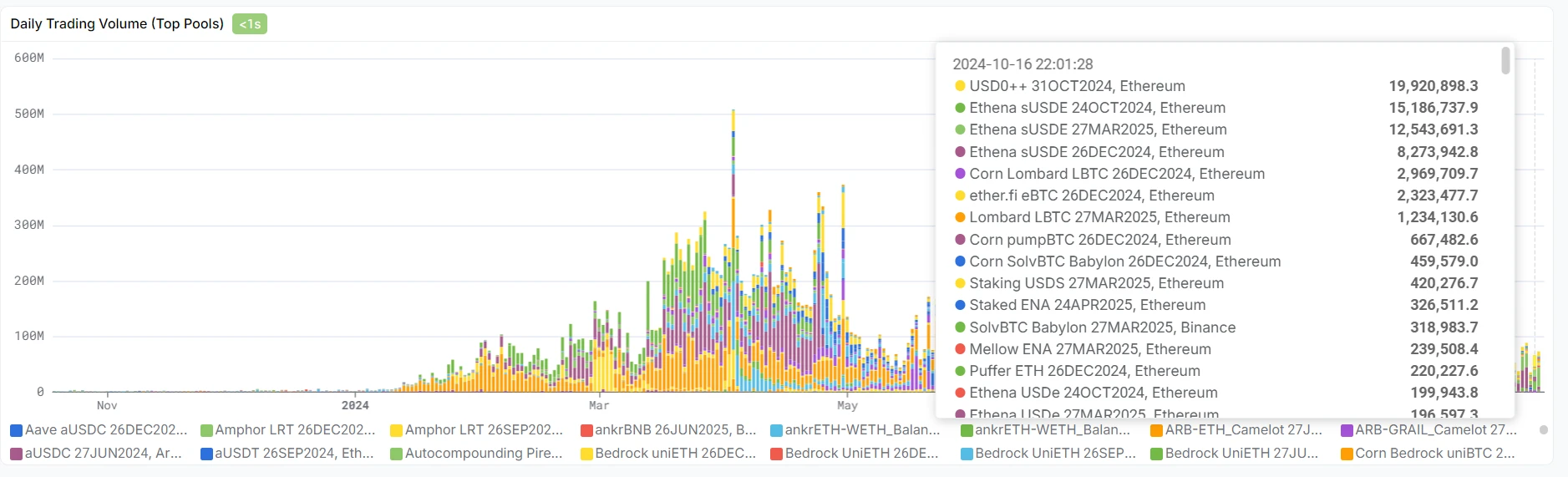

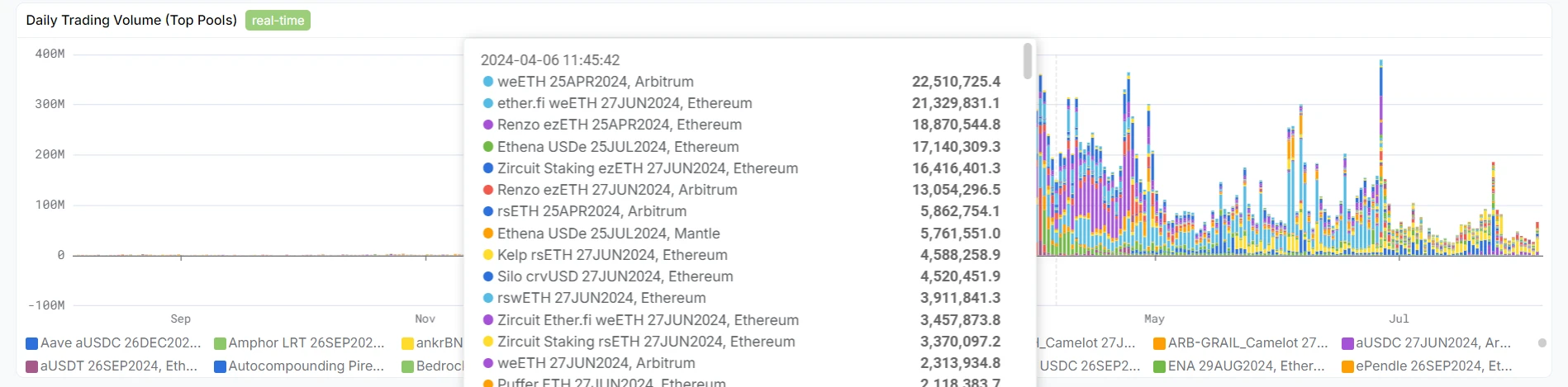

The transaction volume of Pendle AMM also rose rapidly after January 2024 and reached a peak around April. After Eigenlayer announced the issuance of tokens at the end of April, and with the expected airdrop of LRT projects such as Ether.fi, the transaction volume showed a significant decline. At present, the transaction volume has further declined and is at a low level since 2024.

From the composition of trading volume, in the first half of 2024, the trading volume is mainly composed of transactions of Renzo and Ether.fi related assets. At present, the trading volume of Pendle AMM mainly comes from the two protocols of Ethena and USD 0. The trading volume brought by BTCfi assets is relatively limited. The trading volume is directly related to the transaction fees and the annualized income of vePENDLE holders. Compared with TVL, it is a more direct transmission factor.

4.3 Token Locking Ratio

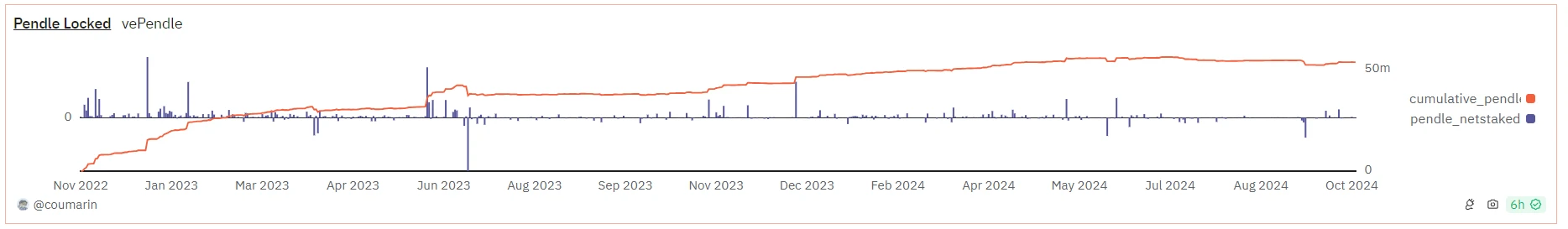

The token lock-up ratio directly affects the supply and demand of tokens. When the number of tokens released daily is relatively stable, the more PENDLE is locked as vePENDLE, the more positive the stimulus effect on the price of the token. The changes in the number of PENDLE lock-ups show similar trends to the changes in its business data and the price of the token. Since November 2023, the amount of PENDLE locked-up has begun to rise rapidly, from 38M to a peak of 55M. Since reaching 54M in April 2024, the growth rate of PENDLE lock-up has begun to slow down, and there has even been a net outflow of vePENDLE. This is consistent with the previous analysis of the business - as TVL and trading volume decrease, the yield of vePENDLE begins to decline, so the attractiveness of locking PENDLE begins to decline. At present, there has been no significant loss of vePENDLE. On the one hand, due to the restrictions of the lock-up period, this indicator is slower than TVL, transaction volume and coin price, and cannot change significantly in the short term. On the other hand, the top asset pool still has a good rate of return, which slows down the outflow of vePENDLE. However, it should be pointed out that both the business data and the growth data of vePENDLE reflect that Pendle is facing short-term business pains. Pendle has not yet found a new growth point after the cooling of Restaking and points to continue the previous legend.

5 Conclusion: Pendle urgently needs to find new scenarios after re-staking

To sum up the above analysis, Pendles success lies in the precise identification of PMF. What is even more rare is that the business income directly empowers the tokens and finds the direct factor for transmitting the currency price - packaging YT products into points trading targets, increasing the AMMs trading volume, and increasing vePENDLEs revenue.

After falling from $7.5, Pendle has not reversed its decline. It has to be denied that Pendle is a good DeFi product, which has both financial management and speculative attributes, meeting the needs of investors with different risk preferences. However, there is no sign of recovery after the decline of Ethereum-based TVL, and the poor performance of re-staking projects and Ethena has reduced the markets expectations for subsequent airdrops. The demand for Pendles use is declining, so the price of PENDLE is also looking for a new position. Pendle needs to find a new product packaging, or expand to new ecosystems such as Solana, increase its TVL and transaction volume, before it can find a new round of growth space.

Pendles other positioning is Ethereum Beta, but it is changing recently: in the era of Ethereum re-staking, Pendle is an important financial product for Ethereum and derivative assets. Even Ethena, although a stablecoin, but the USDe staking yield is directly related to the funding rate of ETH. If the market temporarily loses information about the Ethereum ecosystem and ETH is weak in rising, then Pendle will be powerless to turn the tide. It is also important to point out that Pendle is different from MEME-type Ethereum Beta such as PEPE. The price of ETH has a direct transmission effect on the price of PENDLE: ETH is weak in rising → the demand for ETH-based financial management decreases/the performance of the re-staking track cools down → the demand for Pendle usage decreases → Pendles business income decreases → the price of PENDLE decreases. However, Bitcoin staking assets have replaced Ethereum on Pendle, and this layer of transmission may be weakened.

Finally, this article gives the key points of attention in terms of fundamentals:

Pay attention to the progress of the points plan of the LRT project and stablecoin projects such as Ethena and USD 0. The end of the points season may reduce Pendles business revenue again.

Pay attention to the changes in Pendles TVL and trading volume. If multiple asset pools expire again, it may cause a sharp drop in TVL. At that time, you can sell part of the PENDLE position in advance to hedge.

Continue to pay attention to Pendles product progress, including but not limited to: the launch of Pendle V3; the launch of new asset pools and trading strategies; and the possibility of expanding into a new public chain ecosystem.