Original author: Carl

According to market news, in October 2024, Binance, Bybit, Bitget and other leading trading platforms announced the launch of their own SOL liquidity staking tokens to enter the Solana re-staking track. And it seems that affected by the release of liquidity staking tokens such as BNSOL and BGSOL, SOL has risen from $135 in early October to more than $170 at present. This seems to be a signal of some kind, and it cant help but make people wonder: Why do these leading trading platforms choose to layout this track at the current stage, and what opportunities can the launched liquidity staking solutions bring to ordinary investors?

Solana re-staking track brings new opportunities

Liquidity re-staking is actually a narrative that has only begun to emerge in the crypto asset industry in the past two years. It allows users to use already pledged assets again for other blockchain networks or DApps. Liquidity re-staking assets can meet the actual needs of AVS (Active Verification Service) and expand the security of the original chain based on the PoS system to more ecological applications.

The platform or DApp that obtains the re-pledged assets will take out part of the income or airdrop rewards to give back to the participants of liquidity re-pledge. Liquidity re-pledge is actually conducive to improving the security and activity of the network and promoting the prosperity and development of the ecological economy. It can be seen that liquidity re-pledge is already a complete system with a clear supply and demand market. Participating in liquidity re-pledge not only contributes to the crypto ecosystem, but also increases the opportunity for participants to obtain more benefits.

In the past year, Solana has rapidly gathered a huge amount of technical resources and user base by virtue of its own technological advantages and the popularity of the Meme market, and has become one of the most outstanding public chain projects. Solanas ecological landscape is also rapidly improving, including wallets, DeFi infrastructure, NFTs, and various DApp applications.

According to SOLSCAN data, the SOL pledge market value has reached 65.7 billion US dollars in October 2024, accounting for 67% of the total market value of SOL. Faced with such a multi-billion dollar market, the liquidity re-staking sector naturally becomes the focus of Solanas ecological development at this stage.

Leading trading platform launches SOL liquidity staking solution

Liquidity pledge tokens such as BGSOL (Bitget), bbSOL (Bybit) and BNSOL (Binance) are essentially a liquidity pledge solution launched by exchanges in cooperation with decentralized re-pledge protocol service providers, and the underlying mechanisms are not very different. Since Bitget has just recently announced the launch of BGSOL, we will take BGSOL as an example to mainly introduce the underlying principles and participation methods of this type of liquidity pledge service.

BGSOL is a liquidity pledge token, and is also a more flexible liquidity pledge solution launched by Bitget and Solayer. Users can obtain BGSOL on the platform by staking SOL or directly purchasing trading pairs.

Participants should note that the exchange ratio of BGSOL and SOL is not 1:1. The reason is that the underlying value of BGSOL consists of two parts, one is SOL, and the other is the basic reward obtained by staking SOL on the chain (the current annualized rate of return is about 8%). For example: the user originally pledged 10 SOL and exchanged for 9.725 BGSOL. After 1 month, the user exchanged BGSOL for SOL again and is expected to get 10.06 SOL. The extra part is the accumulated on-chain reward.

As mentioned earlier, the biggest benefit of this type of liquidity staking token is that it can not only obtain basic on-chain income, but also re-stake to obtain superimposed rewards. Bitget launched BGSOL on October 22, 2024, and launched a one-month financial management activity in the platforms financial management section. The superimposed annualized rate of return can reach 30%.

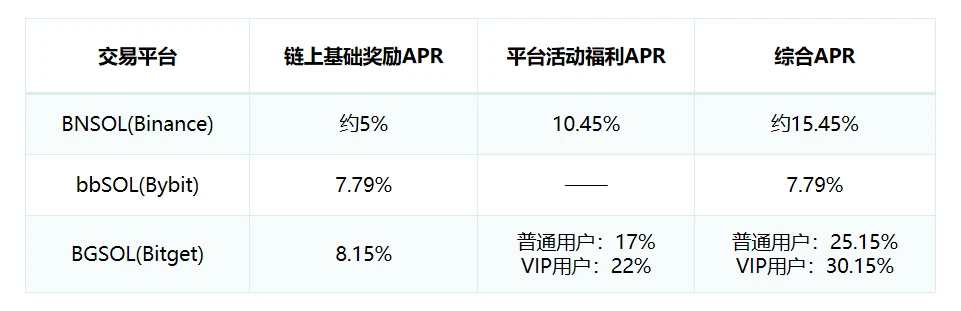

Interest rate statistics for each platform: October 24, 2024

Although the liquidity staking tokens of major platforms have good returns, Bitget is undoubtedly the investment category with the highest interest rate on the market.

Some users may also consider other factors, such as asset security or future application scenarios of liquidity staking tokens. In terms of security, Solayer has to be mentioned. Solayer is one of the leading projects in the Solana re-staking sector. It not only has rich development experience but also focuses on maximizing staking returns, including SOL native staking, MEV-boost and AVS returns, etc. Trading platforms such as Biget, Biance and Bybit have cooperated with Solayer to build the first security barrier for SOL re-staking.

Unlike Solana re-staking service providers such as Solayer, Jito, and Cambrian, the top exchanges also provide users with a second line of funding guarantee based on their emphasis on brand image. Just as Bitget paid full compensation to all affected users within 72 hours after the BGB price experienced abnormal fluctuations not long ago, giving users a full sense of security.

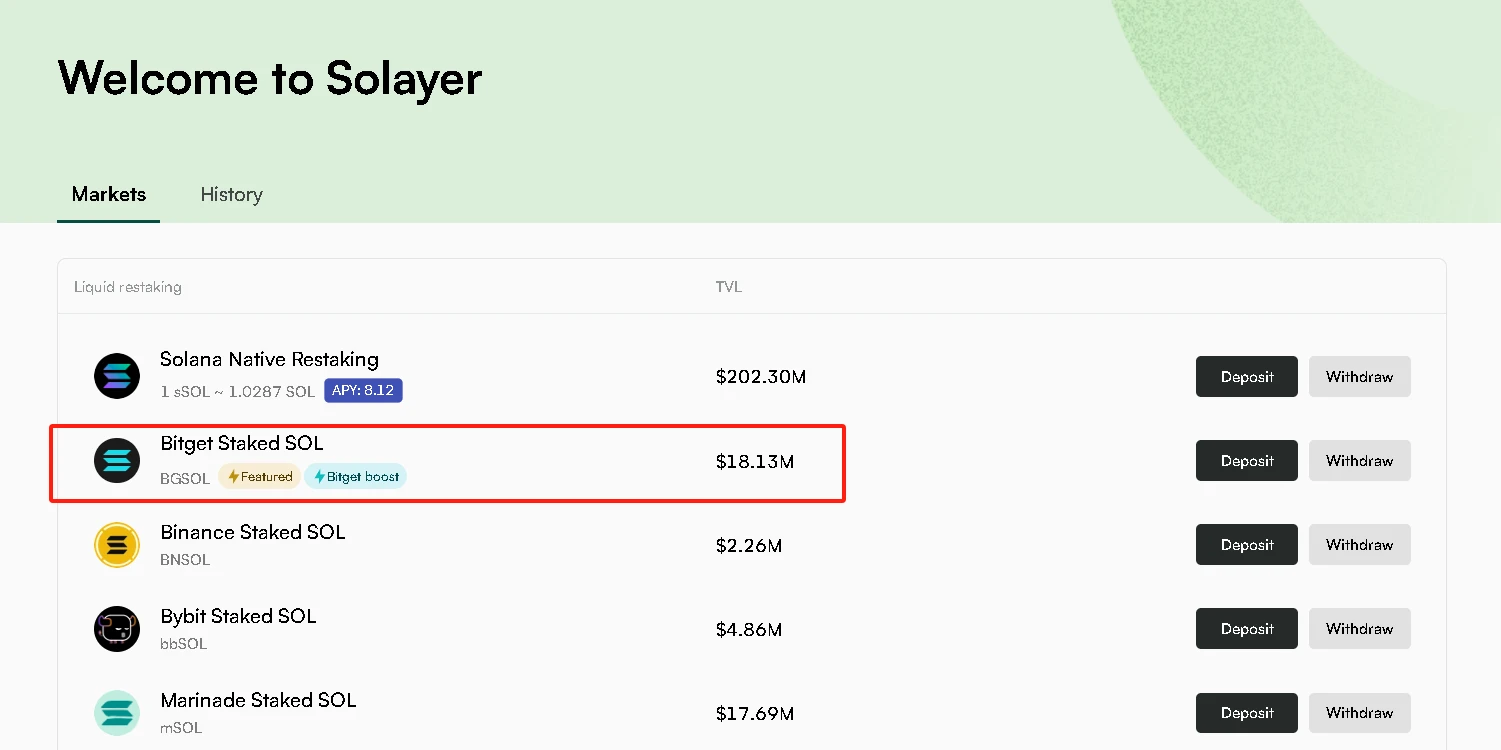

In terms of application scenarios, there is no big difference in the liquidity pledge tokens of major trading platforms. However, according to the on-chain data, on October 22, a whale address pledged 6653.9 SOL (worth about 1.1 million US dollars) to BGSOL . And the data on the Solayer page shows that the current pledged amount of BGSOL has exceeded 18 million US dollars, far exceeding BNSOL and bbSOL.

Data source: https://app.solayer.org/dashboard

Based on the comprehensive comparison, it seems that the smart money in the market has made its choice.

Solana’s expected return on re-staking may be much higher than this

The greatest charm of the crypto world lies in the unexpected encounter with wealth, just as the ETH ecosystem applications or protocols give various airdrop rewards to early participants. The Solana ecosystem is still far behind the huge ETH ecosystem, but at the current development speed of the Solana ecosystem, a large number of ecosystem projects will emerge in the near future, bringing more potential opportunities.

The deployment of Solana re-staking on the leading trading platforms will undoubtedly bring new vitality to the entire ecosystem, and will also bring more application scenarios for their respective SOL liquidity staking tokens based on their own resource advantages. At that time, investors can flexibly exchange BGSOL for other liquidity tokens according to their needs, and then invest in more attractive application scenarios.