Original article by: Tricia Lin Daniel Shapiro

Original translation: TechFlow

Key Takeaways

The survey shows that most respondents (69.2%) are currently staking Ethereum (ETH), of which 78.8% are investment companies or asset management companies. This shows that institutional participation in staking ETH has reached a certain scale, mainly driven by returns and network security contributions.

About 60.6% of respondents use third-party staking platforms, and they prefer large, integrated platforms that can solve the problems of low capital efficiency and technical complexity encountered when staking alone.

Liquid Staking Tokens (LSTs) are increasingly popular as they enable capital efficiency, keep staked ETH liquid, and can be used in decentralized finance (DeFi) strategies. 52.6% of respondents hold LSTs, and 75.7% are willing to stake ETH through decentralized protocols.

Distributed Validators (DVs) are becoming increasingly popular among institutional participants due to their enhanced security and fault tolerance. More than 61% of respondents expressed willingness to pay a premium for the security advantages provided by DVs.

introduction

As the cryptocurrency industry continues to develop, staking has become an important way for institutional investors to earn returns and enhance network security. However, institutional investors still face a complex environment when it comes to staking.

This research report provides a comprehensive analysis of the staking behavior of institutional token holders, with a particular focus on the Ethereum ecosystem. Our main research goal is to shed light on the current state of institutional staking and explore the motivations and challenges faced by market participants. By collecting survey data from multiple types of institutional stakers (such as exchanges, custodians, investment firms, asset managers, wallet providers, and banks), we hope to provide valuable insights into the market for distributed validators and multi-validator models, allowing both new entrants and established players to better understand the complexities of this rapidly evolving field.

The survey included 58 questions covering ETH staking, Liquid Staking Tokens (LSTs), and related topics. We used a variety of question formats, including multiple-choice questions, Likert scales, and open-ended questions, and allowed respondents to choose not to answer certain questions. The survey results showed:

The majority of respondents (69.2%) are currently staking ETH.

The majority of respondents were institutional players:

78.8% are investment companies or asset management companies

Of these institutions, approximately 75% focus on investing in crypto assets.

9.1% are custodians

9.1% are exchanges or wallet providers

12.1% are blockchain networks or protocols

4.2% are market makers or trading firms

0.8% belong to other categories

Respondents demonstrated extensive knowledge of staking economics and generally had a high level of self-awareness of staking concepts and associated risks.

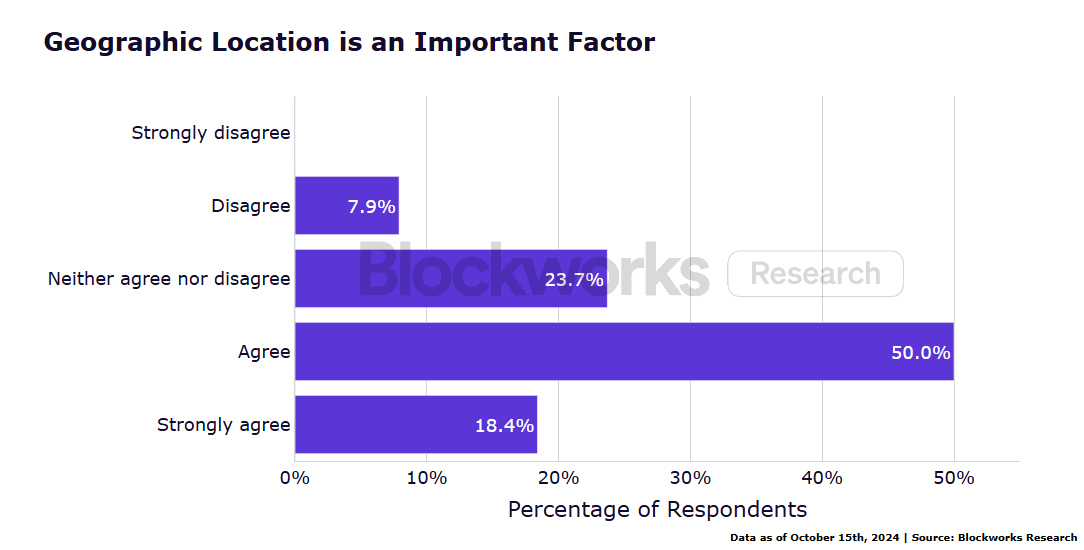

Geographic diversity of respondents and node operators: Although specific locations were not provided, many respondents emphasized the importance of geographic diversity of node operators.

Current ETH staking status

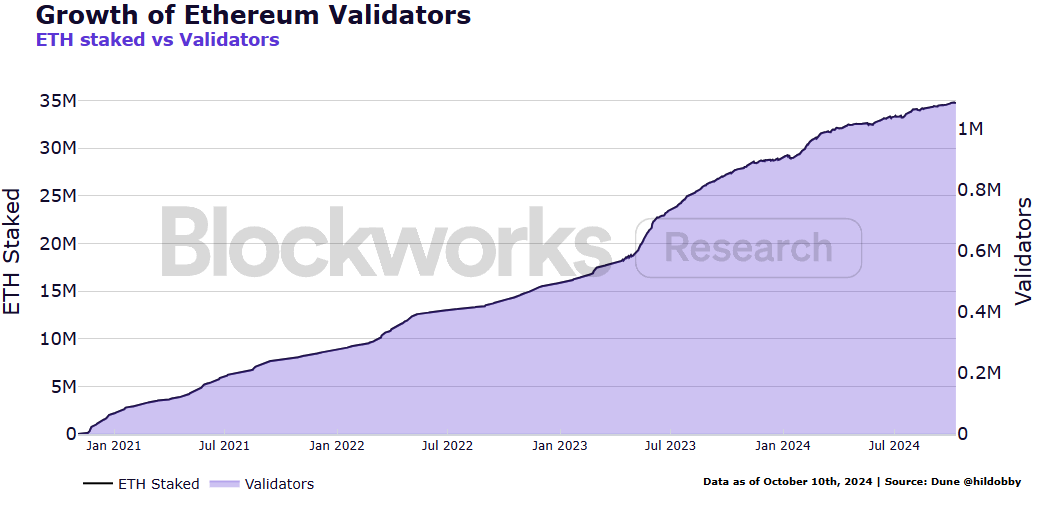

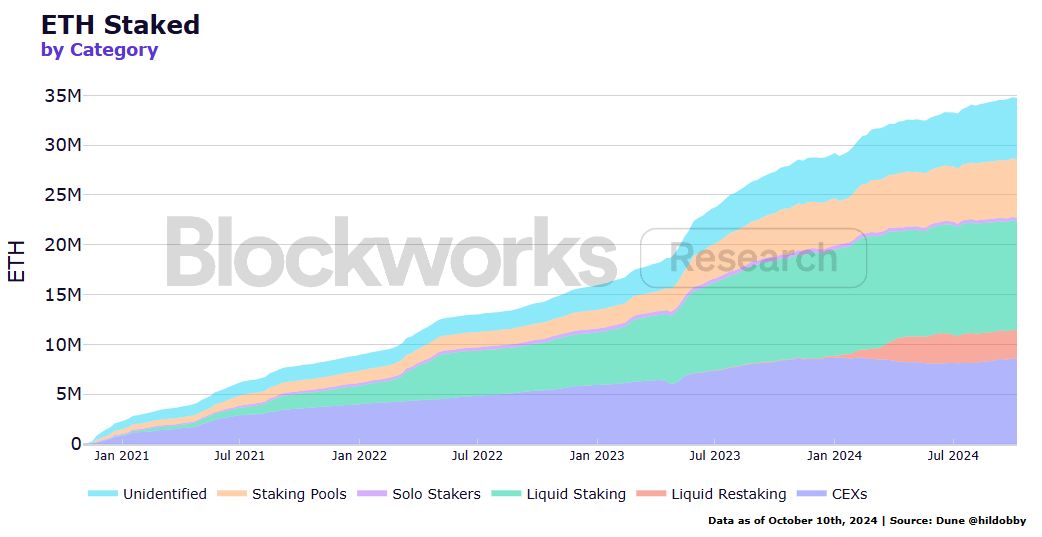

Since the Ethereum network upgraded to Proof of Stake (PoS), the environment for ETH staking has changed significantly, an event known as The Merge. It is worth noting that the number of validators and the total amount of ETH staked have been increasing. Currently, there are nearly 1.1 million validators on the network, with 34.8 million ETH staked.

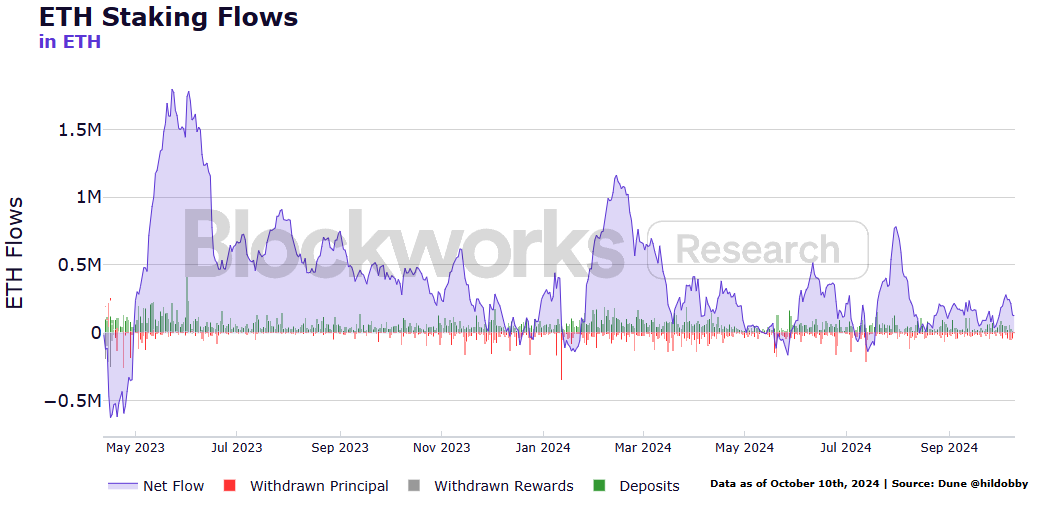

After The Merge, early ETH stakes were locked to ensure a smooth transition to PoS. Network participants could not withdraw their ETH until after the Shanghai and Capella upgrades (collectively known as Shapella) in April 2023. After a short initial withdrawal period, the network observed a sustained net inflow of ETH staked. This shows that demand for staked ETH remains strong.

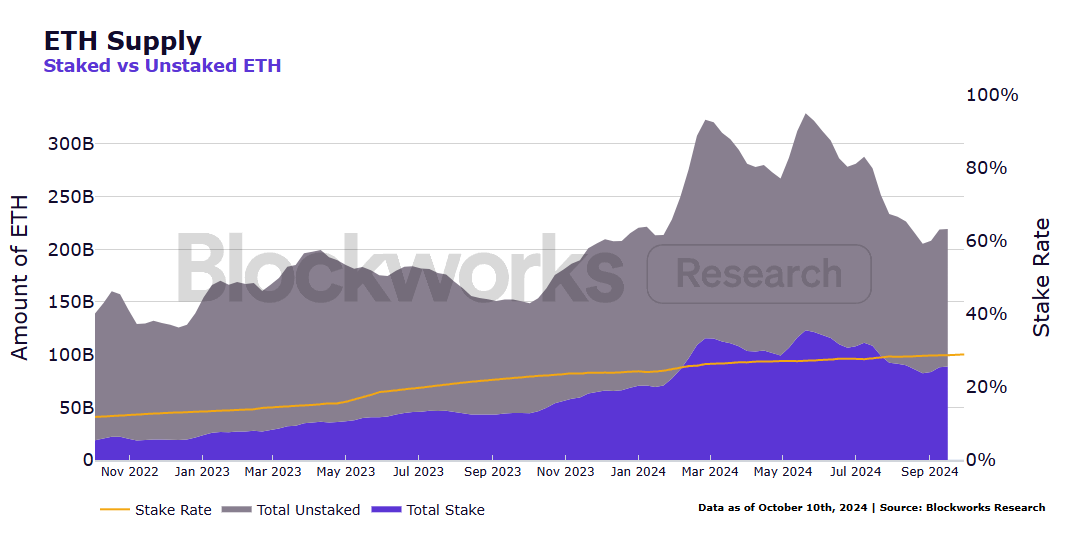

To date, 28.9% of the total supply has been staked, resulting in a robust staking ecosystem worth over $115 billion. This makes Ethereum the most staked network in terms of USD, with a lot of potential for growth.

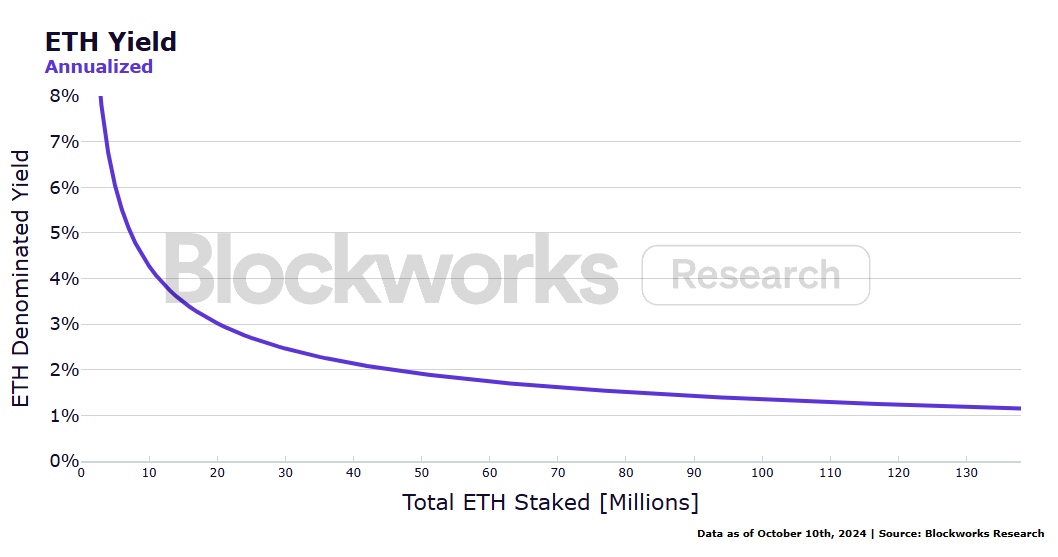

The staking ecosystem continues to expand as users pursue the rewards that come with participating in network validation. The annualized effective issuance yield is dynamic, decreasing as more ETH is staked, as illustrated in an earlier white paper, “Bonds for the Internet,” by Obol and Alluvial CEOs Collin Myers and Mara Schmiedt.

The staking reward rate is typically around 3%, but validators can also earn additional rewards through priority transaction fees, which increase during periods of heavy network activity.

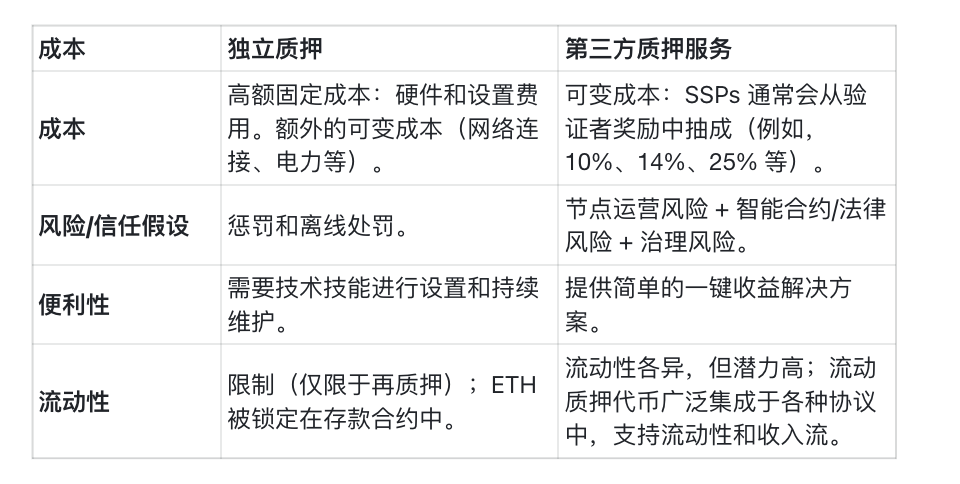

To obtain these rewards, you can choose to stake ETH as an independent validator or delegate ETH to a third-party staking service provider.

Independent stakers need to deposit at least 32 ETH to participate in network verification. This amount is to find a balance between security, decentralization, and network efficiency. Currently, about 18.7% of network participants are independent stakers. Unidentified stakers are generally considered independent stakers.

Over time, independent staking has become less attractive for several reasons. First, the number of people who can afford 32 ETH and have the technical ability to run an independent validator is small, which limits widespread independent participation.

Another important reason is the low capital efficiency of staked ETH. ETH locked in stake cannot be used for other financial activities in the DeFi ecosystem. This means that it is no longer possible to provide liquidity for various DeFi projects, nor can ETH be pledged for loans. This creates opportunity costs for independent stakers, who must also consider the dynamic reward rate for staked ETH to ensure that they get the best risk-adjusted returns.

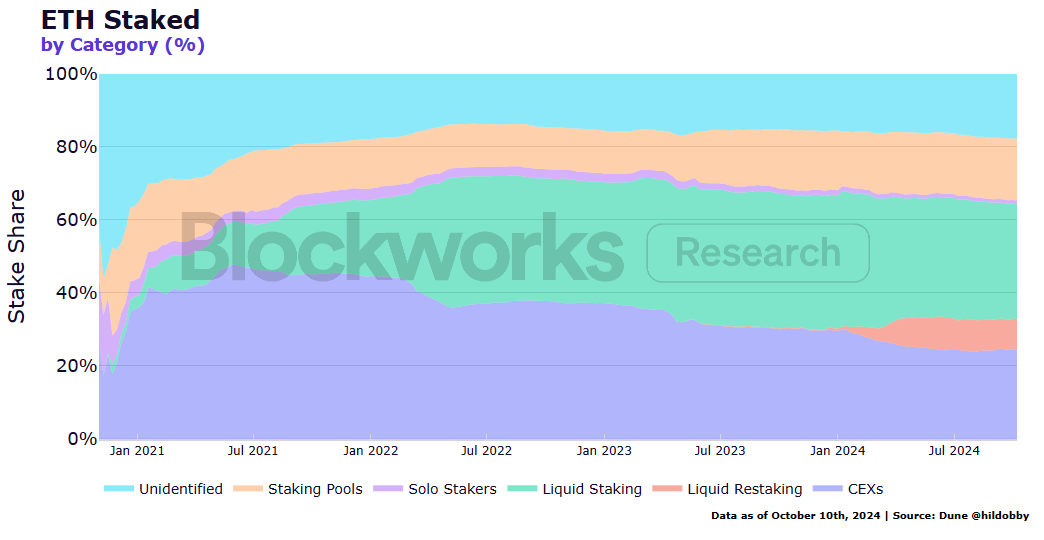

These two issues have led to the rise of third-party staking platforms, which are mainly dominated by centralized exchanges and liquid staking protocols.

Staking platforms offer ETH holders the opportunity to delegate their ETH to other validators for staking in exchange for a fee. Although there are some trade-offs, this approach has quickly become the preferred choice for most network participants.

Source: Endgame Staking Economics

The survey results confirmed the following:

69.2% of respondents said their company is currently staking ETH.

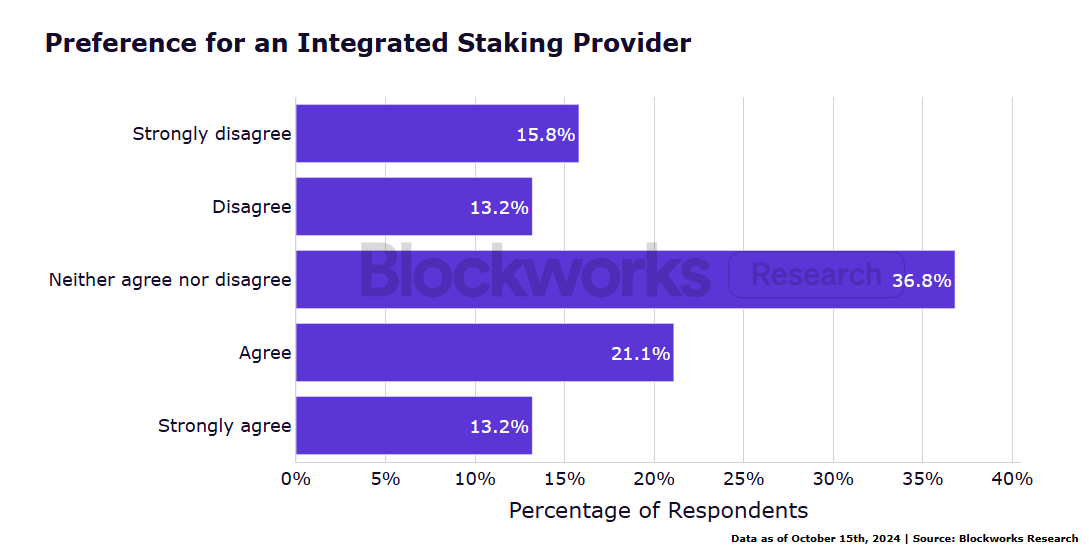

60.6% of respondents said they use a third-party staking platform.

48.6% of respondents prefer to stake ETH on comprehensive platforms (such as Coinbase, Binance, Kiln, etc.).

The main reasons respondents cited for choosing a staking provider included:

reputation

Supported network types

price

Easy onboarding process

Competitive fees

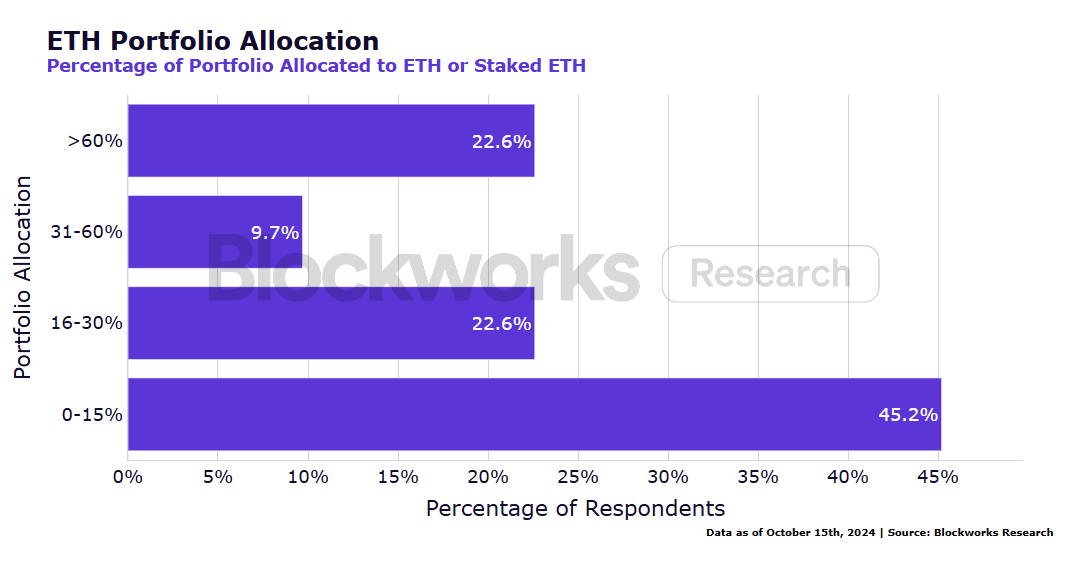

Expertise and Scalability Finally, respondents allocated the following percentage of their portfolio to ETH or staking ETH:

Liquid Staking Protocol

To address the challenges faced by independent staking, the third-party staking platform market has grown rapidly in the past few years. This growth is mainly due to breakthroughs in liquid staking technology.

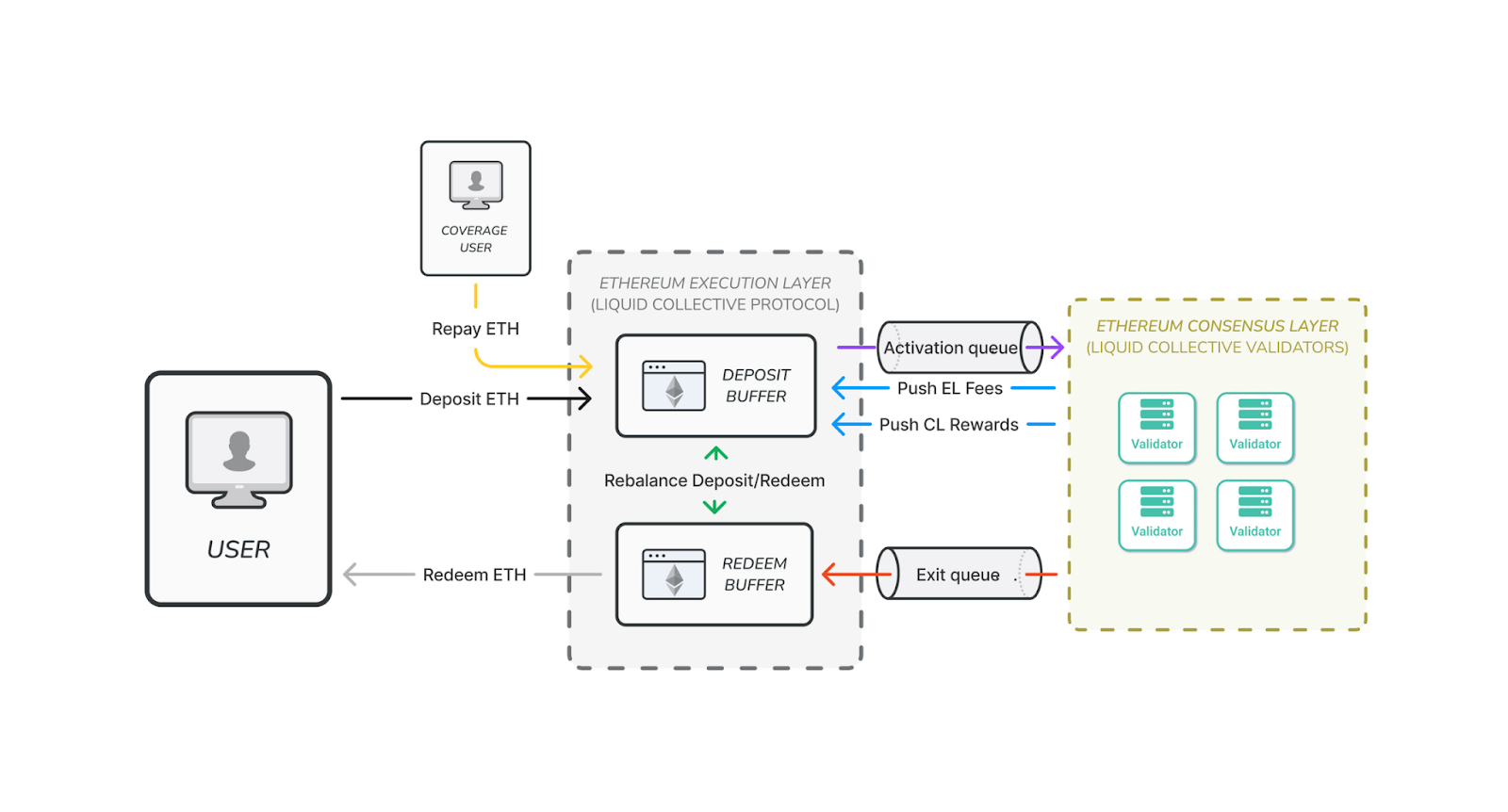

Liquid staking refers to receiving the users ETH through a smart contract protocol, staking it, and returning a liquid staking token (LST) to the user as a certificate for their staked ETH. LST represents the underlying asset (ETH), is fungible, and usually automatically generates staking rewards, providing users with an easy way to earn returns. Users can redeem their LST for native ETH at any time, although there may be delays due to the implementation ofEthereum PoS withdrawal restrictions in the Cancun/Deneb upgrade. Liquid Collective provides detailed documentation on deposit and redemption buffers to ensure a smooth user experience.

Deposit and redemption system architecture. Source: Liquid Collective

Liquid staking protocols typically consist of code deployed on-chain and a decentralized set of professional validators, which are usually selected through DAO governance. Validators may be selected based on a variety of factors such as technical ability, security practices, reputation, geographic diversity, or hardware diversity. Users ETH deposits are centrally managed and then distributed among the validator set to reduce slashing risk and the possibility of centralization.

Due to the popularity of liquid staking, many DeFi applications in the on-chain ecosystem have adopted liquid staking tokens, further enhancing their use value and liquidity. For example, many decentralized exchanges (DEXs) have adopted LSTs, allowing holders to immediately provide liquidity for their LSTs or redeem them for other tokens.

Since withdrawals may be delayed, decentralized exchange (DEX) integration is particularly important. While users can redeem their Liquid Staking Tokens (LST) for ETH at any time, the price of LST may deviate from the price of ETH during times of market tension or high liquidity demand. This is due to redemption queues. This price deviation is driven by users who want immediate liquidity and are willing to redeem ETH at a discount on the DEX. When the market is stable, redemption queues are usually smaller.

When LST has enough liquidity and its price is consistent with ETH, it can be adopted by DeFi money markets, further increasing its value. Leading DeFi money markets, such as Aave and Sky (formerly known as MakerDAO), have integrated LST, allowing users to borrow other assets without selling staked ETH. This approach can increase returns because users can earn additional income by using LST in DeFi strategies while receiving Ethereum PoS rewards.

Ultimately, LST increases accessibility to ETH staking, maximizes capital efficiency, and enables new yield-generating strategies.

The survey showed that respondents had a positive attitude towards LST.

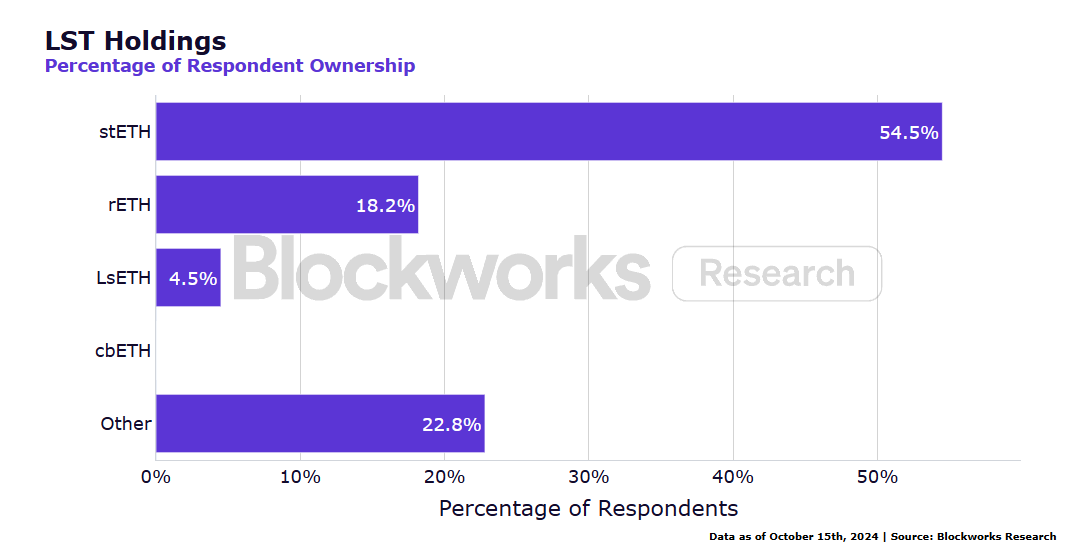

52.6% of the respondents hold LST.

75.7% are willing to stake ETH through decentralized protocols.

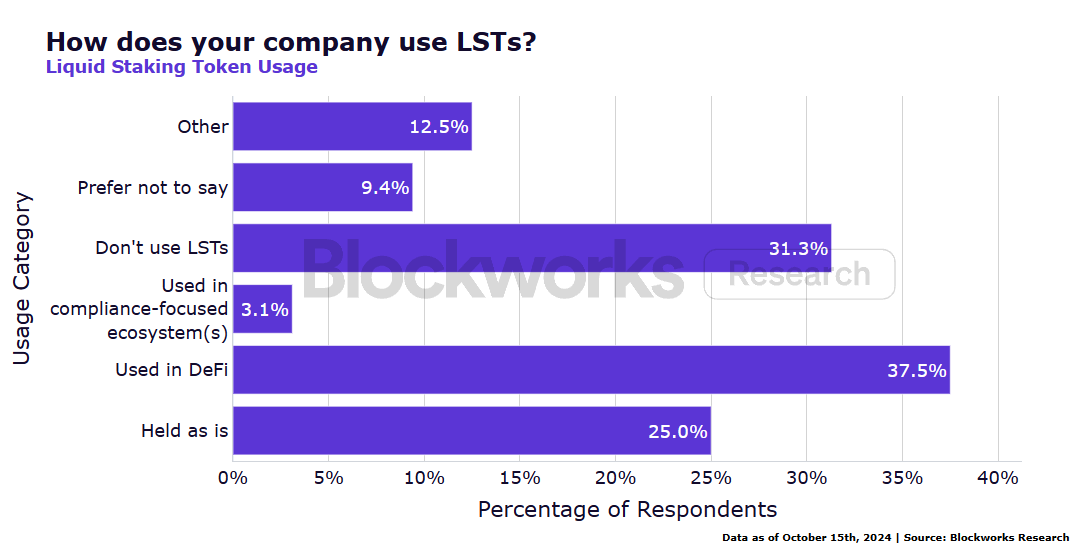

Finally, we asked respondents how their companies use LST.

Advanced staking technology

Distributed Validators (DVs)

Liquid staking protocols have found market fit in their existing form, attracting retail investors, DeFi users, and crypto funds. However, in order to attract significant institutional capital inflows, the implementation of distributed validators (DVs) may be required.

DVs, pioneered by Obol, enhance the security, fault tolerance, and decentralization of staking networks. The core problem Obol solves is the risk of centralized points of failure in traditional staking configurations. For example, if a validator node goes offline due to hardware failure or software bug, it is subject to an offline penalty. Additionally, validator keys may be copied and run simultaneously on two nodes, which creates a risk of double signing of transactions, triggering slashing penalties. This is a significant risk for institutional participants who require high security and the assurance of delegated ETH staking.

There are multiple problems and risks with single-node validators:

There is no protection against machine failure.

Active-passive redundancy is difficult to implement effectively. Misconfiguration, software glitches, or lack of monitoring can lead to duplicate validation of the same validator key, leading to slashing penalties.

Hot keys used by validators are vulnerable to attack.

The scale of the validator infrastructure may lead to client centralization, thereby increasing the correlation risk for end users.

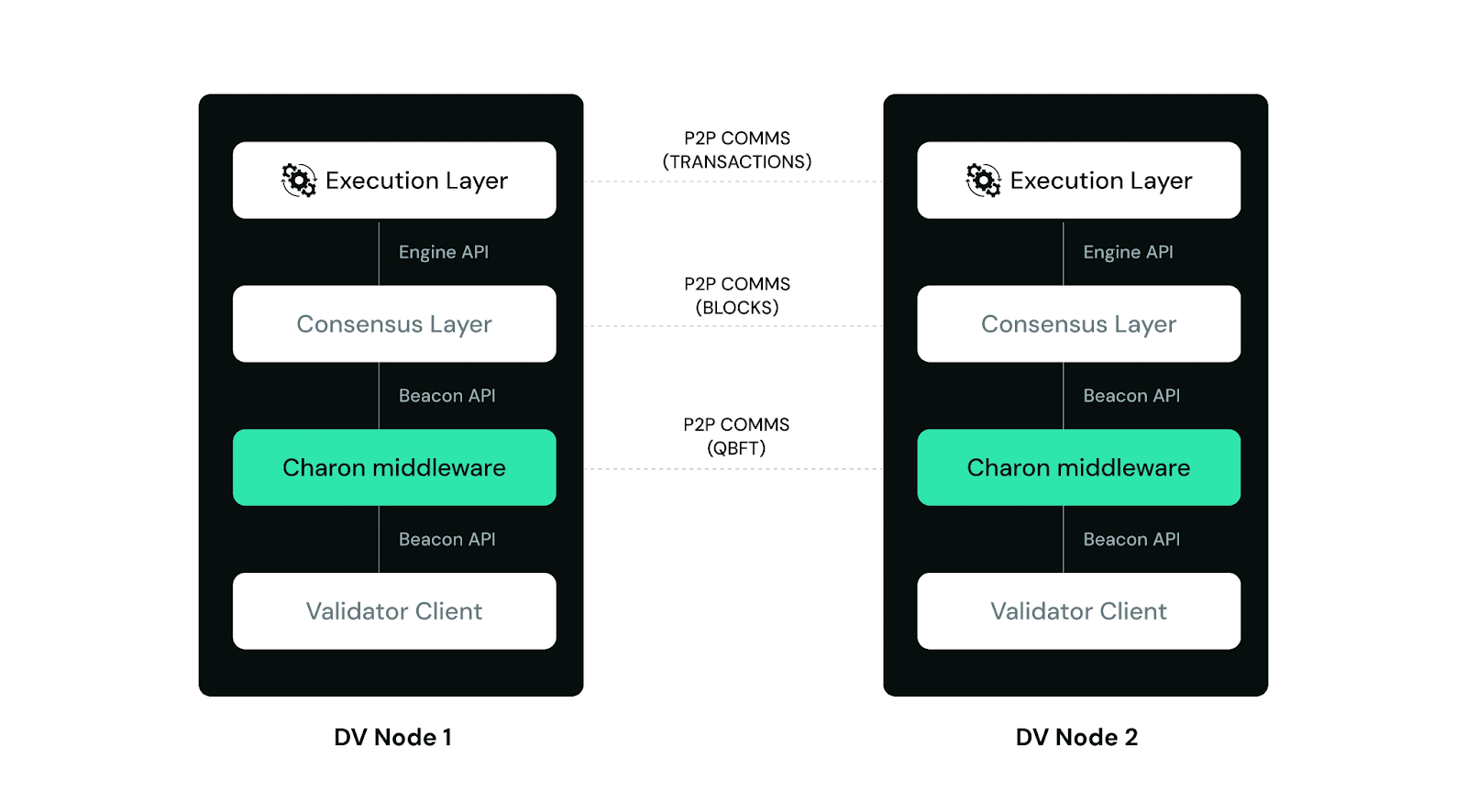

Obols distributed validators solve these problems through multi-node validation technology, enabling trust-minimized staking. By spreading the responsibilities of a validator across multiple nodes, this distributed validator setup can keep a single validator up and running even when a node in the cluster fails. Specifically, as long as two-thirds of the nodes in the cluster are functioning properly, the validator can remain operational. Distributed validators also allow for diversification of client software, hardware, and geographic locations within the same validator, as each node can run different hardware and software configurations. Individual validators, as well as the entire network, can be highly diversified in these aspects.

Obol DV architecture. Source: Obol (DV Labs) The survey shows that respondents have a very positive attitude towards distributed validators.

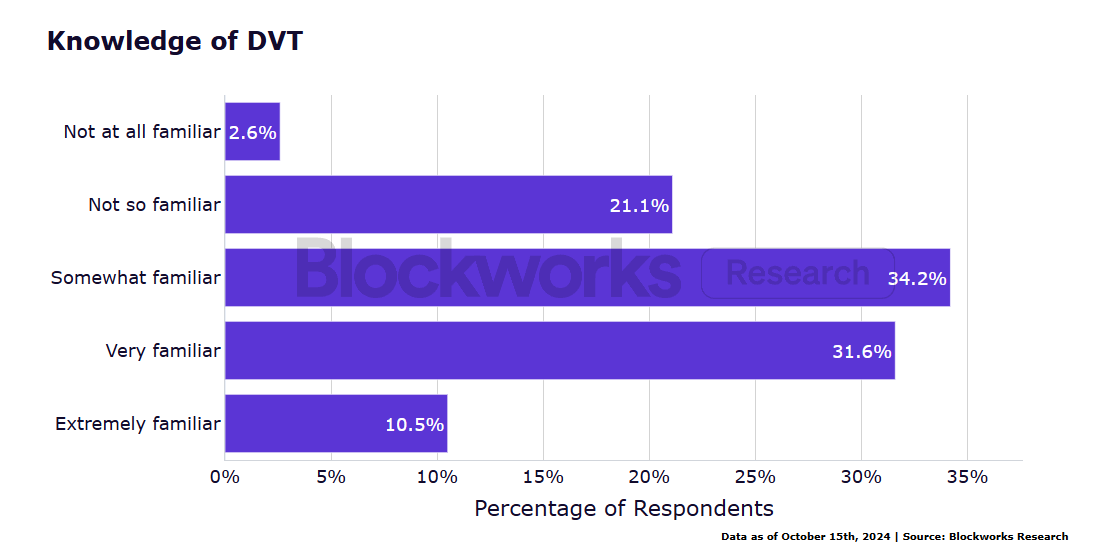

65.8% of respondents are familiar with distributed validators.

61.1% are willing to pay more for specialized features such as enhanced security, stability, decentralization, and fault tolerance.

Overall, awareness of distributed validators (DVs) is high, with only 2.6% saying they are completely unfamiliar with the technology.

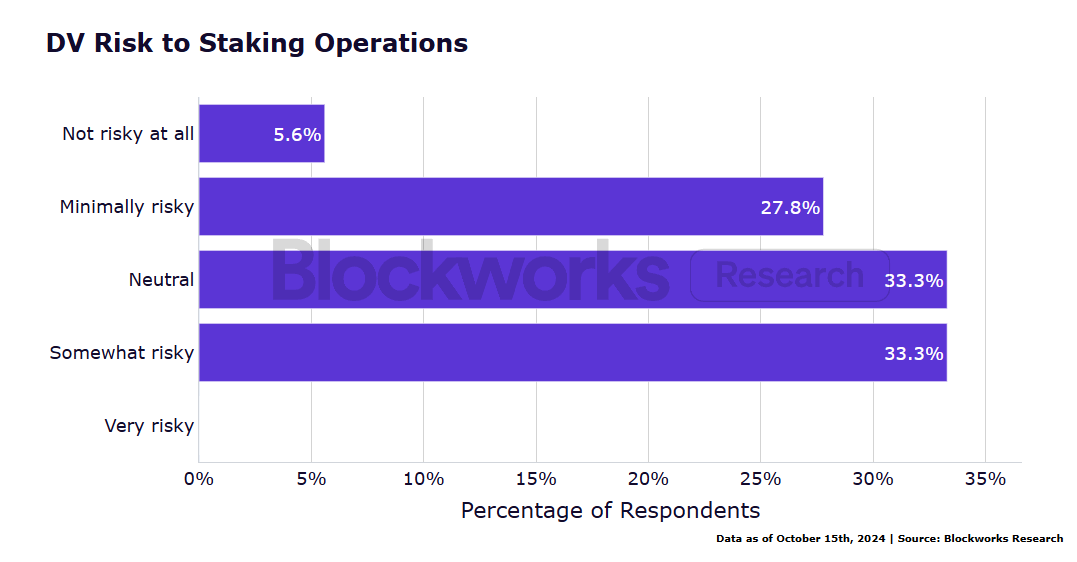

No respondents thought DVs posed a great risk to their staking operations, while 5.6% thought there was no risk at all.

This feedback supports the view that institutional capital allocators prefer DVs as the best option for staking.

The potential and risks of re-staking

In addition to DVs, re-staking is also an important technical innovation that brings new income opportunities to stakers. Re-staking allows validators to use their staked ETH or Liquid Staking Tokens (LST) to provide security support for multiple protocols at the same time, thereby potentially earning additional income.

However, this comes with additional risks. Re-staking assets is used to secure multiple protocols, where any single malicious action or operational error could result in slashing penalties and losses. Re-staking also introduces other risks , including centralization of stakes, protocol-level vulnerabilities, and network instability.

EigenLayer already supports Liquid Collectives LsETH. This will allow LsETH holders to earn protocol fees and rewards through the EigenLayer protocol and receive ETH network rewards while holding LsETH.

Symbiotic also provides support for LsETH holders, who can now receive additional protocol fees and rewards from the Symbiotic protocol by holding LsETH, while receiving ETH network rewards.

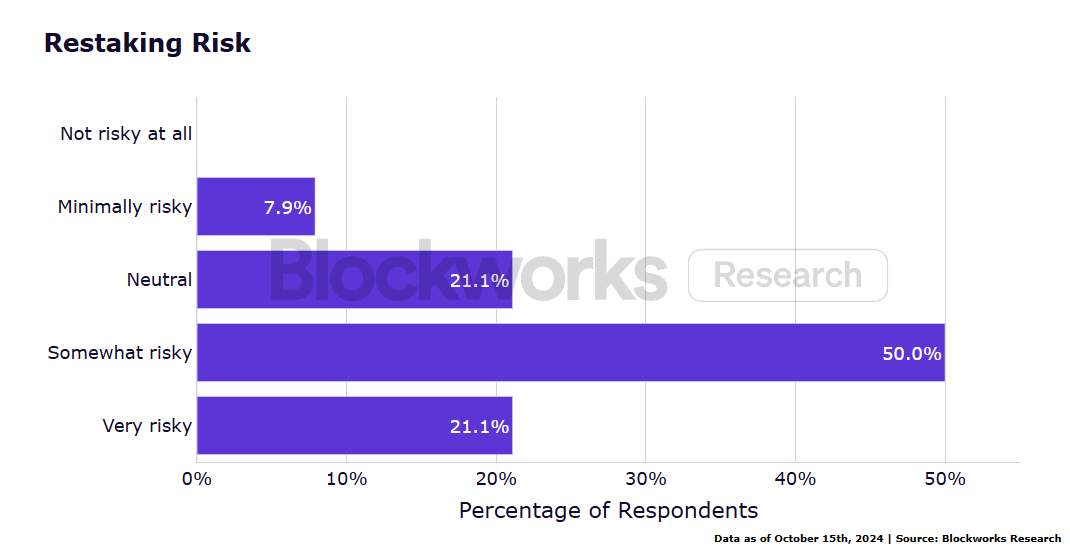

The survey results show that respondents generally have a positive attitude towards re-pledge and have a strong understanding of its risks.

55.3% of respondents expressed interest in re-staking ETH.

74.4% of respondents said they understood the risks of re-staking.

Despite this, respondents generally believe that re-pledging carries certain risks.

Our survey shows that 55.9% of respondents are interested in re-staking ETH, while 44.1% are not interested. Considering that 82.9% of respondents said they understand the risks of re-staking, this shows that people have a positive attitude towards re-staking. However, overall, people still believe that re-staking is inherently risky.

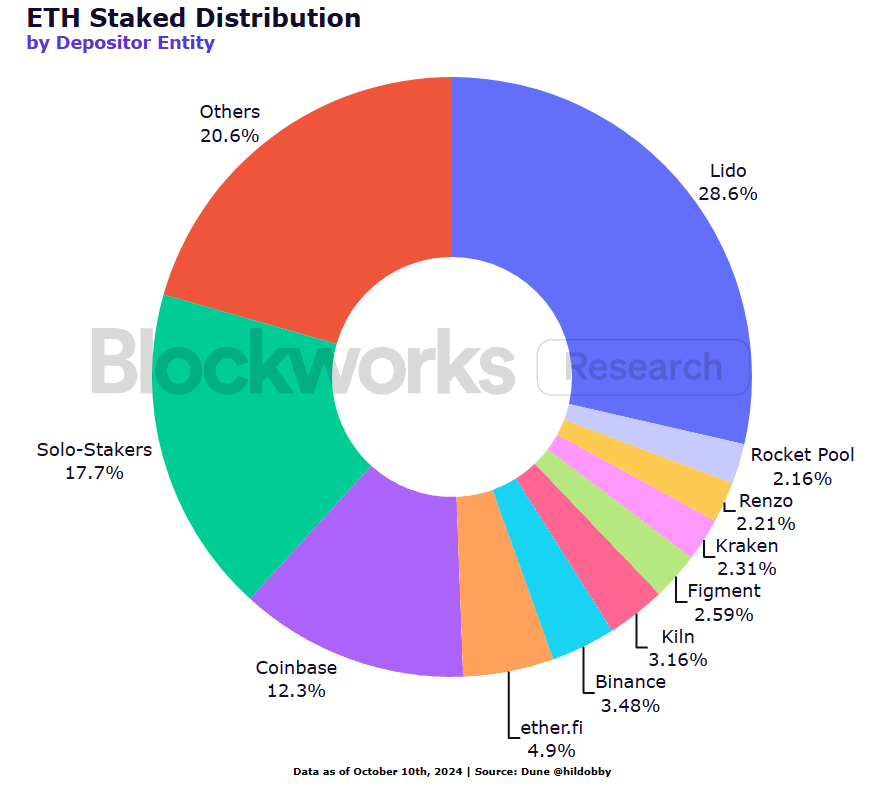

Decentralization and Network Health

Liquid Staking Tokens (LSTs) display characteristics of a “winner-takes-all” market due to strong network effects formed by multiple factors. As LSTs grow, they offer better liquidity, lower fees, and more integration with decentralized finance (DeFi) protocols. This widespread adoption results in deeper liquidity pools, making the token more attractive for use in trading and other DeFi applications. Large LSTs also benefit from economies of scale: they attract more operators because they generate more fees. This in turn enhances security because there are more operators to allocate staking. Currently, over 40% of all ETH is staked by Lido and Coinbase.

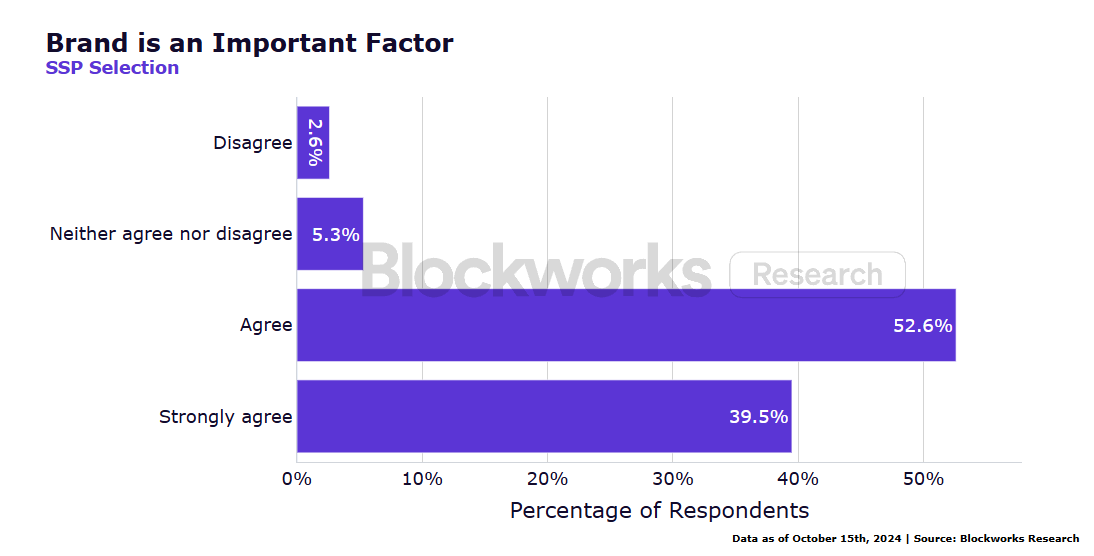

Large LSTs may also benefit from better branding, which was considered an important factor by respondents in the survey.

The survey further confirmed the concentration phenomenon of third-party staking platforms: more than half of the respondents held stETH.

This situation has led to the concentration of staking power in the hands of a few LST or centralized exchanges. In some cases, large staking pools often rely on a limited number of node operators. This concentration not only violates the core decentralization principle of Ethereum, but also may bring security risks and censorship attacks to the networks consensus mechanism.

The survey showed that respondents were very concerned about centralization, with 78.4% expressing concerns about the centralization of validators and generally believing that the geographic location of node operators is very important when choosing a third-party staking platform. The survey results suggest that the market may be seeking more decentralized alternatives than the current market leaders.

Custody and Operational Practices

Most respondents (60%) use a qualified custodial service to manage their ETH. Hardware wallets are also popular, with 50% of respondents choosing to use them. In contrast, centralized exchanges (23.33%) and software wallets (20%) are less commonly used for custody purposes.

Respondents generally expressed a high level of familiarity with node operations, with the majority (65.8%) agreeing or strongly agreeing that they were familiar with node operations, 13% being neutral, and 21% disagreeing or strongly disagreeing.

In terms of client diversity, which is the use of different software to run Ethereum validators to reduce single points of failure, maintain decentralization, and optimize network performance, respondents generally have a high level of awareness. 50% of respondents said they are familiar with the concept, and 31.6% strongly agree. Only 2.6% are unfamiliar with client diversity. Overall, 81.58% of respondents understand the concept of client diversity.

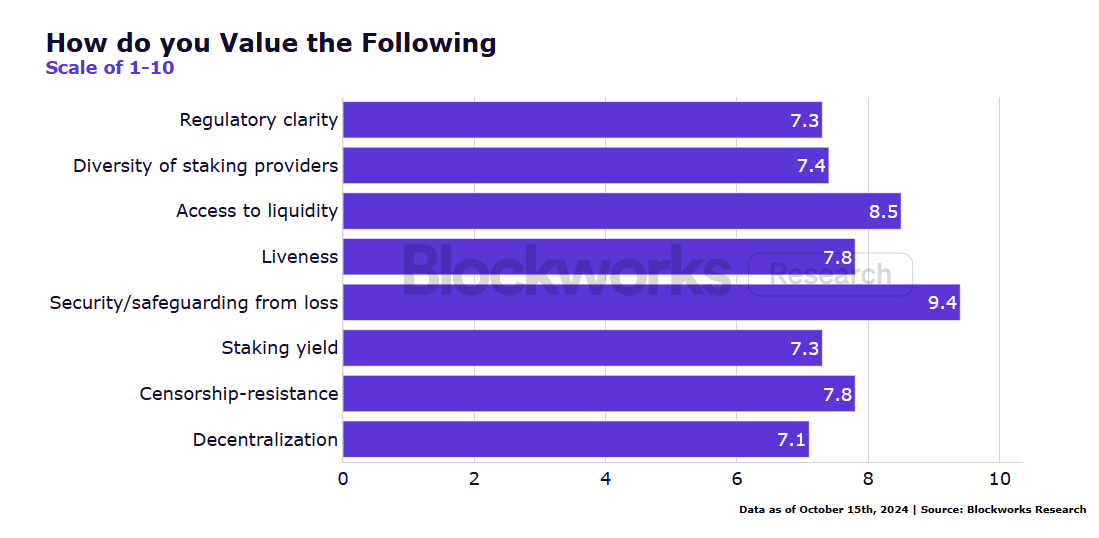

Liquidity is considered a very important factor by respondents. On a scale of 1 to 10 (10 being the most important), the average rating for liquidity importance was 8.5, second only to the importance of protecting assets from loss (9.4). Clearly, liquidity is a key consideration for many institutional participants in the ETH staking ecosystem. In addition, 67% of respondents said that the source of liquidity is very important when choosing a liquid staking token (LST), and they tend to choose decentralized exchanges such as Curve, Uniswap, Balancer, and PancakeSwap, as well as aggregators (such as Matcha) or on-chain exchange platforms (such as Curve, Uniswap, Cowswap).

Finally, respondents expressed moderate to high levels of confidence in their ability to withdraw staked ETH during periods of market volatility, with the majority (60.5%) confident in their ability to withdraw during periods of volatility, but 21.1% expressing some concerns. These confidence levels suggest that while most feel secure in their ability to withdraw funds, a significant portion still have concerns about the security of the withdrawal process during periods of market turmoil.

Risk Management and Safety

Institutions face multiple risks when staking Ethereum:

Slashing mechanism: When a validator makes an incorrect proof, proposes an incorrect block, or double-signs, a slashing event may be triggered. This means that the validator will lose part of the staked ETH due to violating the protocol rules, and the staking institution may also suffer significant financial losses. In addition, the downtime or inactivity of the validator will also be punished. Although slashing is an irreversible consequence of malicious behavior, the downtime penalty is usually small and recoverable.

Liquidity risk: If the staked ETH is locked or the Liquid Stake Token (LST) lacks sufficient liquidity, institutions may find it difficult to quickly exit large positions. In addition, fluctuations in the exchange rate between ETH and LST may also lead to losses. 71.9% of respondents expressed concerns about liquidity.

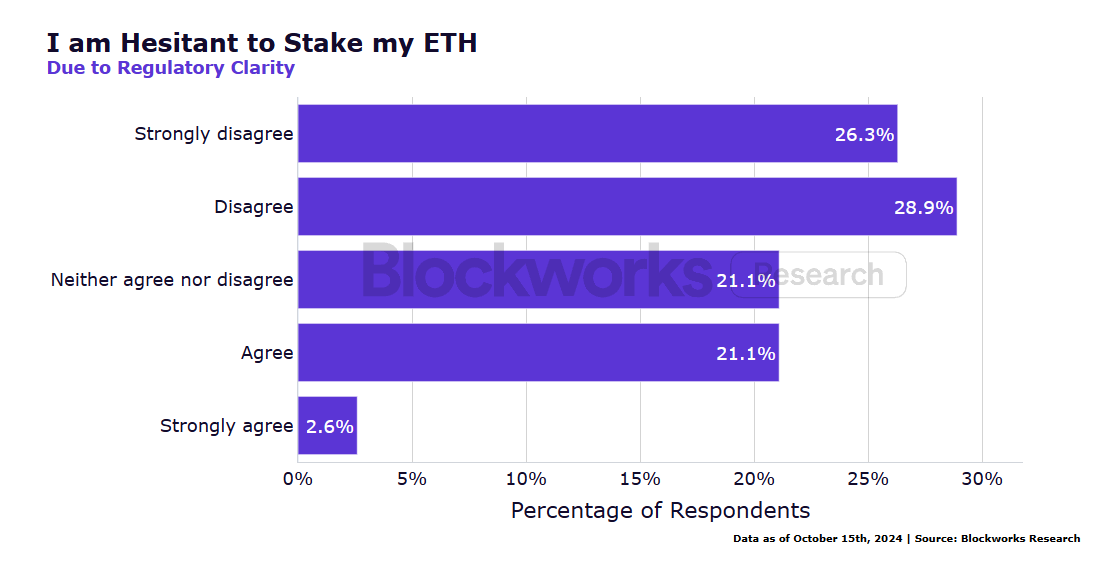

Regulatory uncertainty: As the global regulatory environment is still changing, institutions need to pay attention to the latest developments on regulators’ classification of staking rewards, compliance requirements for validator infrastructure, and the tax impact of staking income. Despite regulatory uncertainty, more than half (58.9%) of people are still willing to stake their ETH, but 17.7% choose to wait and see.

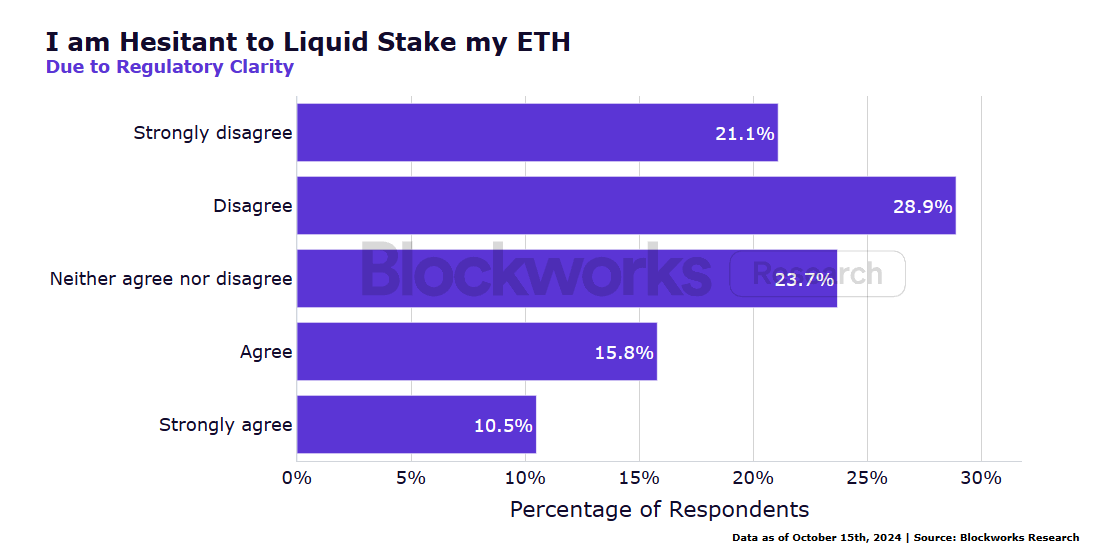

Similarly, 55.9% are not participating in liquid staking protocols due to a lack of regulatory clarity, while 20% are taking a wait-and-see approach.

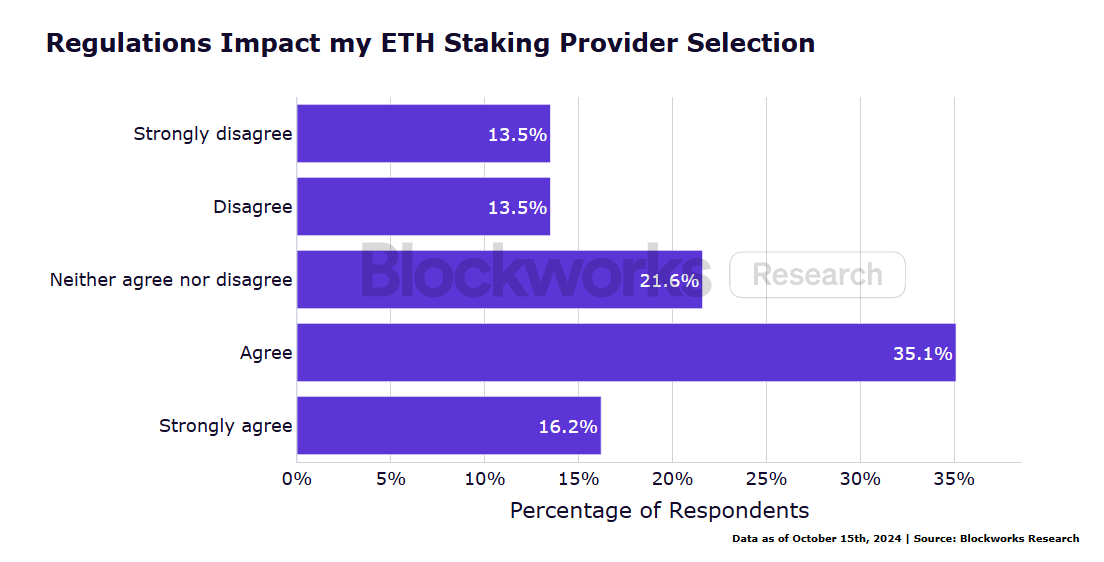

Overall, regulatory factors influenced the decision-making of 39.4% of respondents when choosing an ETH staking service provider, of which 24.3% said they did not consider regulatory factors when making their choice. This may be because the regulatory framework for staking is still developing, causing these institutions to focus more on other operational risks that they consider more important.

Operational risk: More than 90% of respondents expressed familiarity with the withdrawal process for ETH staking, indicating that institutions are aware that if the withdrawal process is delayed, it may lead to large deviations in the LST price. However, respondents were somewhat mixed in their confidence in their ability to withdraw staked ETH in volatile market conditions, with respondents being almost evenly divided between confident, neutral, and lack of confidence.

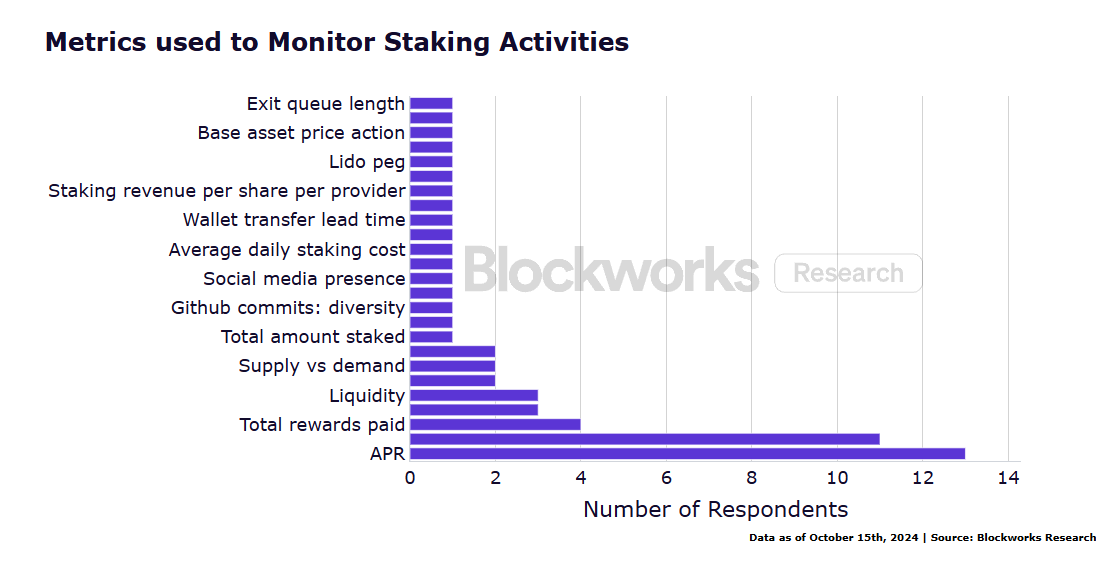

Our survey shows that running a validator infrastructure at scale requires ensuring high uptime and performance across multiple validators while protecting private keys and promptly patching software vulnerabilities. Operational challenges have been a focus for respondents. Among the various metrics used when monitoring staking activity, annualized rate of return (APR) and validator uptime are the most important, followed by total rewards paid, proof rate, and liquidity.

*Some survey respondents chose not to answer this question due to proprietary and regulatory concerns

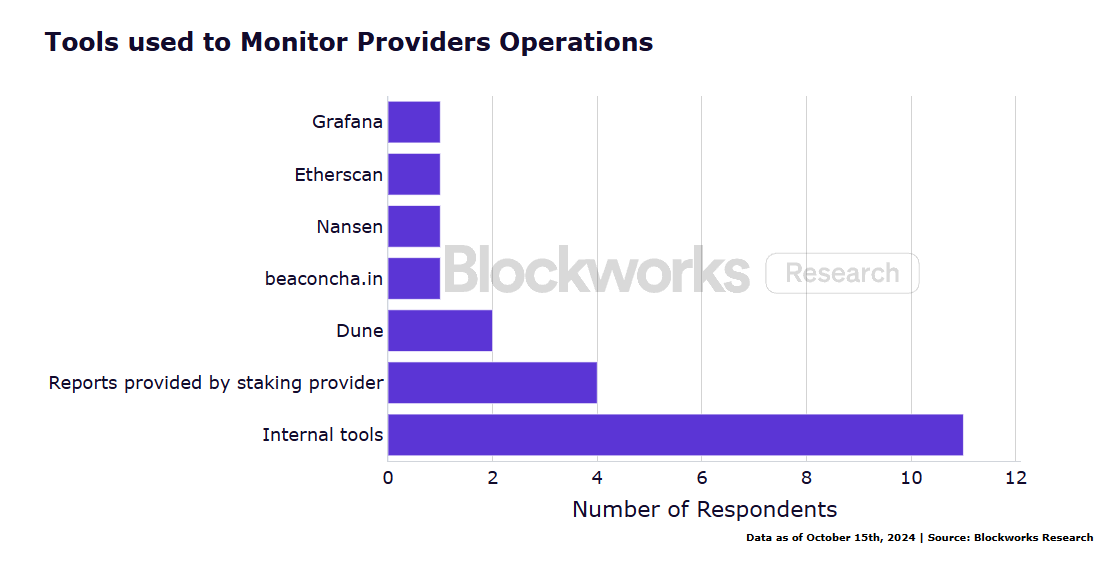

The tools most commonly used by surveyed institutions to monitor staking operations include internal monitoring tools generated by proprietary risk management systems, reports and dashboards provided by staking providers, and Dune.

*Some survey respondents chose not to answer this question due to proprietary and regulatory considerations.

Additionally, respondents were split on the importance of pursuing above-average staking returns versus targeting a benchmark.

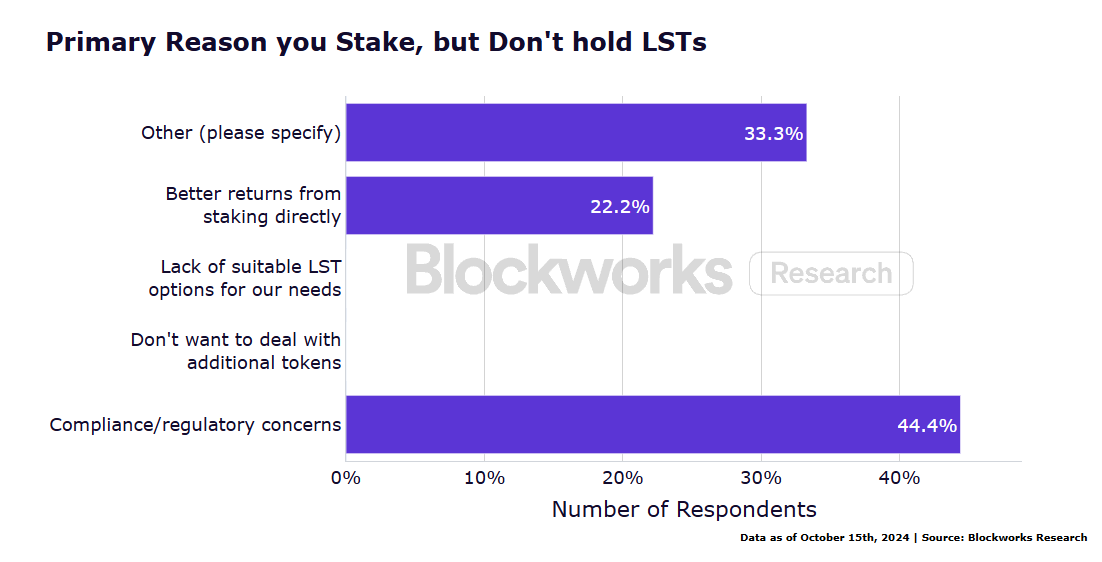

Respondents were also divided on whether to participate in Liquid Staking Tokens (LST), with 44.4% expressing concerns about regulation and compliance.

Some asset managers mentioned that holding custody of LST is a problem because of the imbalance between risk and perceived input and reward. One respondent said: We hold PoS tokens, but are not mature enough. We dont know where to start processing or thinking about staking, yield, etc. We have a small team. We want to do it in compliance with regulatory requirements and limit risks. Another respondent believes: LST is not staking. They are decentralized finance (DeFi) disguised as staking.

Notably, the banks in the survey mentioned that staking client-owned ETH and having it in their custody would affect disclosures to clients and regulators, and introduce new capital requirements and operational risks stemming from the liquidity, or lack thereof, of LST.

Key Trends and Insights

From the survey results, we summarize several key points. The data shows that liquidity and regulatory transparency are crucial in influencing institutional participation in ETH staking, and many institutions remain cautious. Overall, the report reveals a complex but promising institutional ETH staking development environment as companies explore changing market conditions:

Institutions actively participate in ETH staking, but the extent and methods of participation vary.

Despite the risks, interest in decentralized validation (DVs) and re-staking technologies is growing.

Decentralization remains an important consideration, influencing the choice of provider.

Liquidity is a key factor that institutional stakers focus on, influencing their choice of Liquid Staking Tokens (LSTs) and staking methods.

Due to regulatory uncertainty, institutions have adopted different strategies, with some choosing to proceed with caution and others not too worried.

Institutional participants are highly aware of the operations and risks of staking.

Despite the risks and challenges of Ethereum staking, Liquid Staking Tokens (LSTs), and re-staking, these technologies offer attractive opportunities for institutional investors because they can generate yield. In a market where returns from traditional fixed-income investments are low, Ethereum staking provides relatively stable and predictable returns. Currently, the annualized yield on ETH staking is approximately 3-4%, and participants may also receive additional rewards from priority fees. In addition, LSTs improve capital efficiency by allowing staked ETH to be used in decentralized finance (DeFi) applications, allowing institutions to earn additional returns on their assets while earning staking rewards.

Overall, the widespread use of LSTs in DeFi protocols has created new market opportunities. With 39.3% of respondents mentioning the use of LSTs in DeFi applications, this trend is likely to continue, increasing the liquidity and utility of these tokens. Although regulatory issues remain, adaptability to the regulatory environment related to staking seems to be increasing.

Participating in staking enables institutional investors to align with the long-term development of the Ethereum network, potentially bringing not only financial returns but also strategic advantages in the blockchain ecosystem. Although there are still challenges, for many institutions, the potential benefits of staking, liquid staking tokens (LSTs), and re-staking appear to outweigh the risks. As the ecosystem matures and the proportion of ETH staked increases significantly, these technologies may become an increasingly attractive part of institutional crypto strategies.