Original article by Eli Nuss

Original translation: TechFlow

Who’s doing the best in crypto venture capital?

We used funding data from @tokenterminal and market data from @artemis__xyz to answer this question.

View our full analysis here .

Summarize

It’s important to note that we rely on the accuracy of this data. There are often undisclosed funding rounds or other announcements that lack key data. Even so, however, we can still gain some interesting insights from the available data.

First, let’s review the most successful crypto investments in history.

We rank each round by calculating the ratio of its fully diluted market capitalization (FDMC) at the end of the third quarter to the amount raised.

We then sorted by funding cycle to identify the best performing investments in each vintage.

Here are the top investment cases from 2015 to 2017:

Figure compilation: TechFlow

illustrate:

FDMC refers to fully diluted market capitalization.

FDMC/Funding Amount represents the ratio of market value to financing amount.

Here are the top investment cases from 2018 to 2021:

Figure compilation: TechFlow

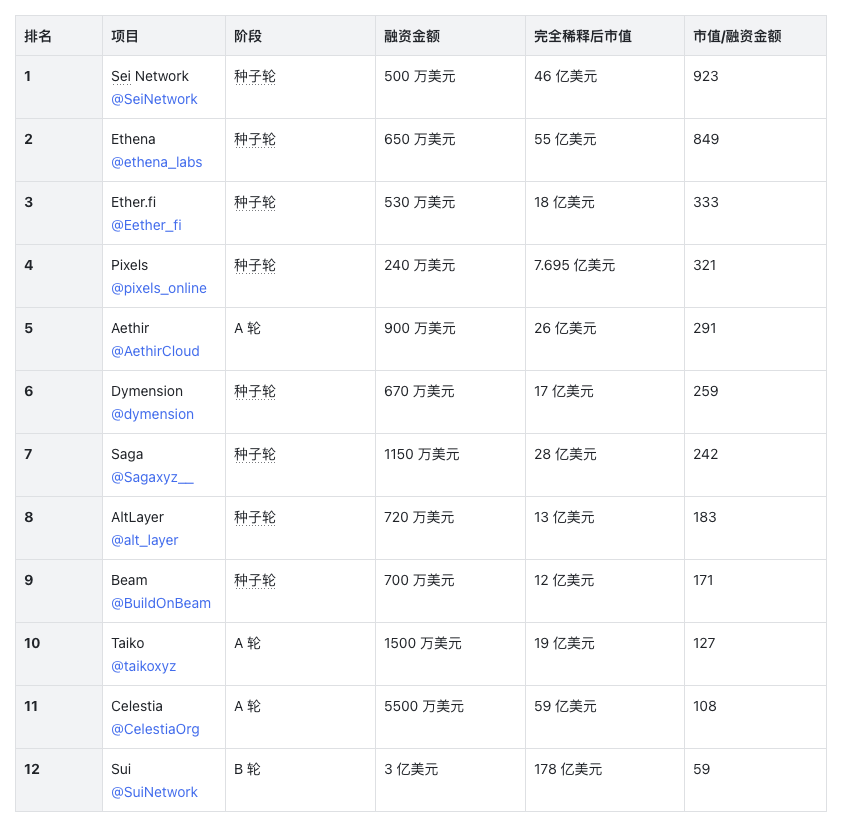

Here are the top investment cases for 2022-2024:

Figure compilation: TechFlow

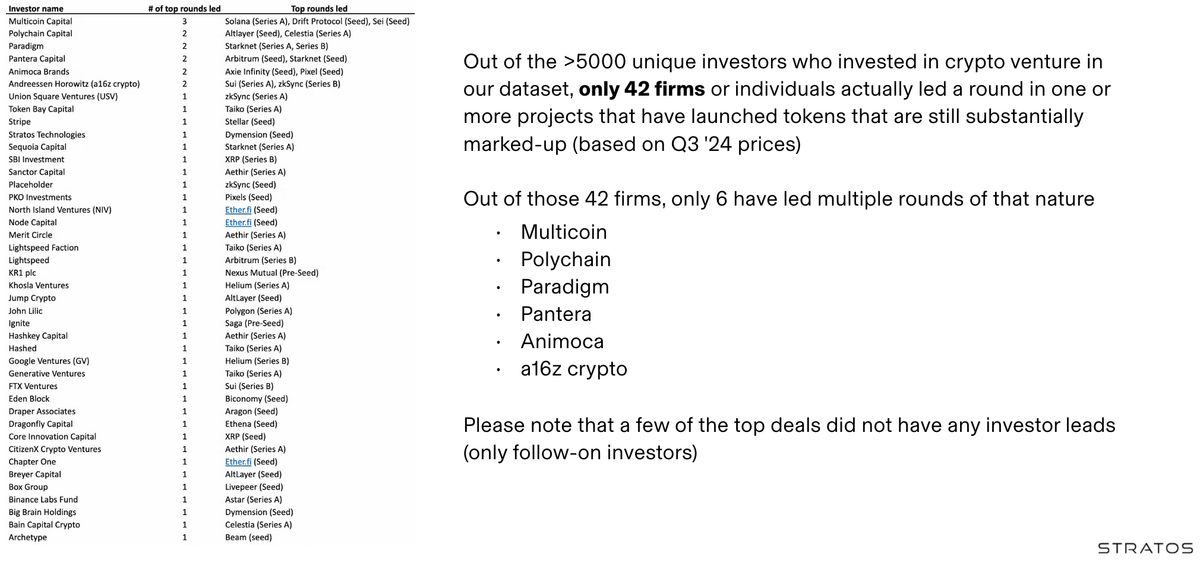

After identifying the investments with the highest returns, we next looked at which funds participated in these financing rounds.

We distinguish between lead investors and follow-on investors. Here is a list of those investors who led or co-led these high-return rounds:

Notably, @animocabrands and @a16z crypto stand out as the only firms to have repeatedly dominated these high-return trades.

Of the over 5,000 unique investors in our dataset, only 42 firms or individuals actually led one or more rounds for projects whose tokens still appreciated significantly above Q3 2024 prices.

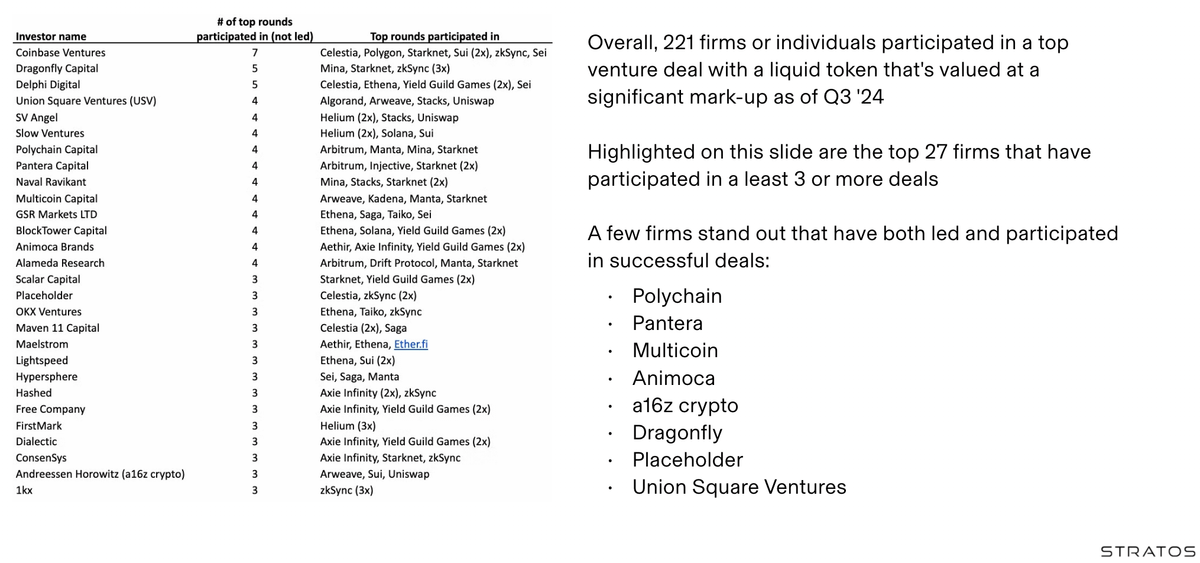

Here are the funds that most frequently participate in these rounds:

Overall, 221 companies or individuals participated in a top venture deal whose liquid tokens saw significant appreciation in valuation in Q3 2024.

This chart highlights the top 27 companies that were involved in at least 3 or more deals.

Considering that some investors are more active than others, it’s also important to look at the hit rate. We not only used the previous data, but also took into account the total number of transactions each investor participated in to find out the ones with the highest hit rate. It’s worth mentioning that @BlockTower performed particularly well in this regard!

Based on the above information, we have constructed a matrix that we hope will provide an overview of funds in this space.

The matrix is dynamic because sometimes a major success can move a fund into a new quadrant.

We look forward to the day when all funds can move into the upper right corner of the matrix.

Hopefully this analysis will be as interesting to you as it was to us.

We welcome any feedback or suggestions to help us improve our analysis in the future. We plan to update this data regularly, so we hope to be as accurate as possible.