Original translation: Pzai, Foresight News

Crypto asset growth and usage trends

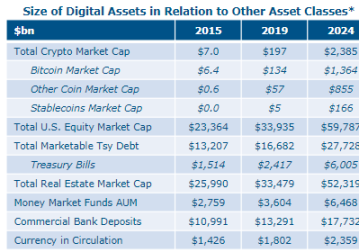

Crypto assets have experienced rapid growth, albeit from a small base. Growth has come both from native cryptocurrencies such as Bitcoin and Ethereum, and from stablecoins.

Cryptocurrency market capitalization chart

Cryptocurrency adoption by households and industries has so far been limited to holding crypto assets for investment purposes, crypto asset market capitalization remains low relative to other financial and physical assets, and growth to date does not appear to have cannibalized demand for Treasury securities. Crypto asset use cases are evolving, but interest is primarily along two tracks: Bitcoin’s primary use appears to be as a store of value in the DeFi world, aka “digital gold.” Speculative interest appears to have played a prominent role in crypto growth so far. Crypto asset markets are working to leverage blockchain and distributed ledger technology (DLT) to develop new applications and improve traditional financial market clearing and settlement infrastructure.

The size of crypto assets relative to other asset classes

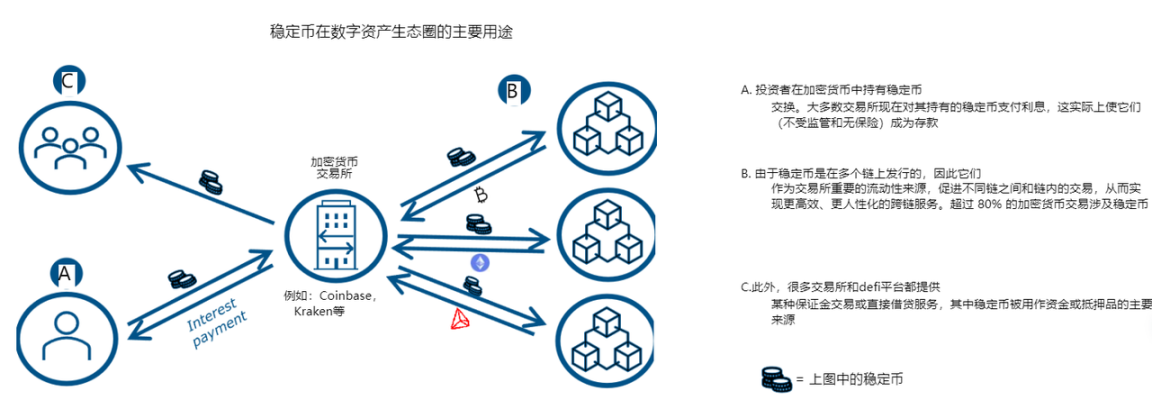

Stablecoins

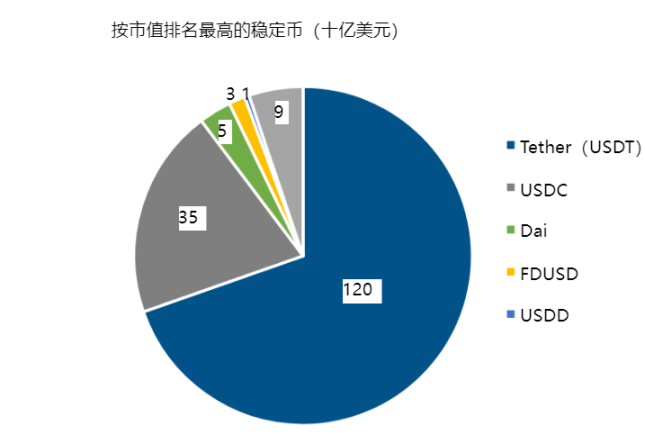

Stablecoins are cryptocurrencies designed to maintain a stable value, usually by tying the value of the currency to an underlying pool of collateral. In recent years, as the cryptoasset market has matured, its use has grown rapidly, including increased demand for cryptoassets with stable cash-like characteristics, and they have been attractive collateral for lending on DeFi networks. While there are different types of stablecoins, fiat-backed stablecoins have grown the most significantly. The cryptoasset market now has more than 80% of cryptocurrency transactions involving stablecoins.

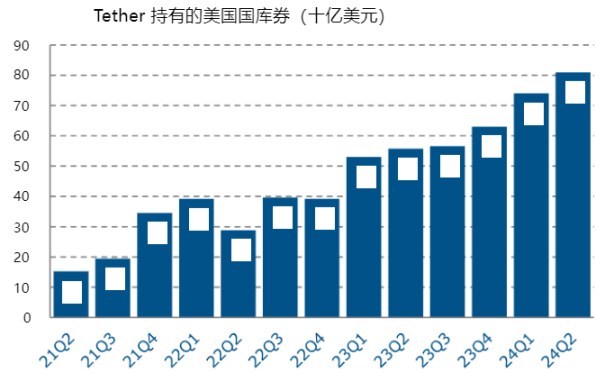

The most popular stablecoins in the market today are fiat-backed stablecoins, with a large portion of this collateral taking the form of Treasury bonds and Treasury-backed repo transactions. We estimate that a total of $120 billion of stablecoin collateral is invested directly in Treasury bonds. In the short term, we expect the size of the stablecoin market, as well as the overall size of the digital asset market, to continue to grow, and medium-term regulatory and policy choices will determine the fate of this private currency. History shows that private currencies that do not meet national quality assurance requirements can lead to financial instability and are therefore highly undesirable.

Demand Analysis

In recent years, the price of native crypto assets such as Bitcoin has risen significantly, but volatility remains high. Since 2017, Bitcoin has experienced four major price adjustments. To date, the digital asset market has limited access to traditional safe-haven or risk-hedging tools such as Treasury bonds. Institutional support for Bitcoin has grown in recent years (such as BlackRock ETF, MicroStrategy), and crypto assets have behaved like high volatility assets. As the market value of digital assets grows, the structural demand for Treasury bonds may increase and exist as both a hedging tool and an on-chain safe-haven asset.

Tokenization

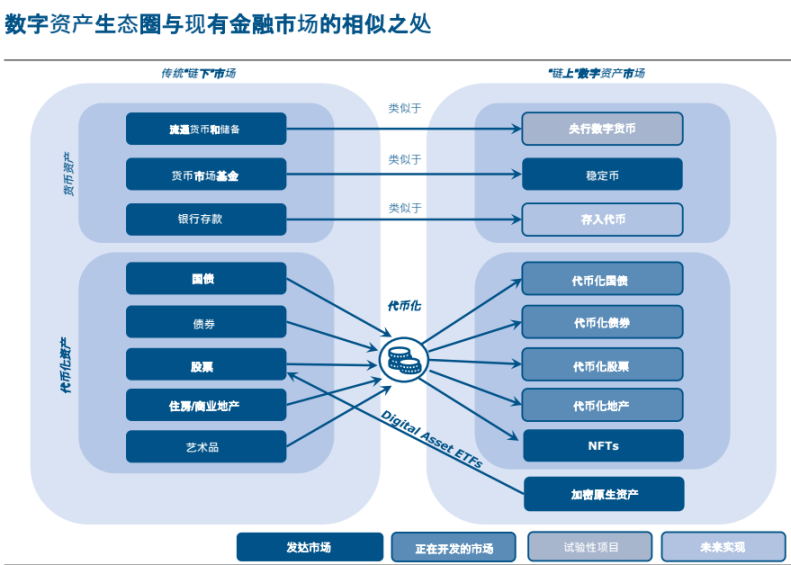

Similarities between the digital asset ecosystem and the traditional financial market

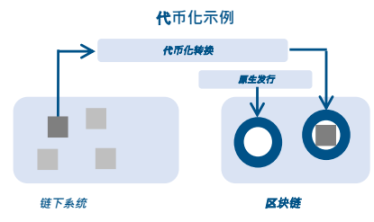

Tokenization is the process of digitally representing rights in the form of tokens on a programmable platform such as a distributed ledger/blockchain. Tokenization has the potential to unleash the benefits of programmable, interoperable ledgers to a wider range of traditional financial assets. The main features and advantages of tokenization are:

Core Service Layer: Tokenized assets integrate a “core layer” containing asset and ownership information with a “service layer” that manages transfer and settlement rules.

Smart Contracts: Tokenization makes automation possible, through smart contracts that automatically execute transactions and allow the transfer of assets and claims when predefined conditions are met.

Atomic Settlement: Tokenization simplifies settlement by ensuring that all parts of a transaction occur simultaneously between all parties involved, thereby simplifying settlement, reducing the risk of settlement failure, and improving the reliability of settlement.

Composability: Different tokenized assets can be bundled together to create more complex and innovative financial products, providing highly customizable solutions for asset management and transfer.

Fractional Ownership: Tokenized assets can be divided into smaller, more accessible parts.

The benefits of tokenization extend far beyond and are independent of native crypto assets like Bitcoin and the public, permissionless blockchain technology they popularized.

Some markets (such as international payments or repo) will see immediate and large potential benefits from tokenization, while other markets will see incremental gains. However, to realize this potential, a unified ledger is needed, or at least a set of highly interoperable, integrated ledgers that work together seamlessly. These ledgers will also need to be developed with the support of central banks and the trust they provide.

Tokenization of Treasury Bonds

Tokenization of U.S. Treasuries is a relatively new trend and most projects have yet to scale; some notable public and private initiatives underway are as follows:

Tokenized Treasury Fund: Allows investors to obtain Treasury bonds in a tokenized form on the blockchain. Its behavior is similar to a Treasury ETF or government MMF in many ways.

Tokenized Treasury Repo Project: Tokenized Treasury bonds allow for instant, 24/7 settlement and trading, potentially paving the way for more timely intraday repo transactions.

Pilots Underway by DTCC and Others: Several private and public market participants are conducting pilots to use tokenization to streamline payments and securities settlement.

The main potential advantages of treasury tokenization are:

Improvements in clearing and settlement: Tokenized Treasuries allow for more streamlined “atomic settlement,” where all parts of a transaction involving Treasuries are settled simultaneously between all parties, reducing the risk of settlement failures

Improved Collateral Management: Smart contracts programmed directly into the tokenized treasury enable more efficient collateral management, including pre-programmed collateral transfers when preset conditions are met.

Improved transparency and accountability: An immutable ledger can increase transparency into Treasury market operations, reduce opacity, and provide regulators, issuers, and investors with more real-time insight into trading activity

Composability and Innovation: The ability to bundle different tokenized assets could lead to the creation of new and highly customizable financial products and services based on U.S. Treasuries, such as derivatives and structured products.

Increased inclusion and demand: Tokenization can make Treasury bonds more accessible to a wider range of investors, including small retail investors and those in emerging markets.

Increased liquidity: Tokenization has the potential to create new investment and trading strategies through seamless integration and programmable logic, and tokenized treasuries can be traded 24/7 on blockchain networks.

While tokenization of U.S. Treasuries has potential benefits, design choices may present certain risks and challenges that require careful consideration.

Technical Risk: Tokenized infrastructure is difficult to develop in parallel in a cost-effective manner and is unlikely to be as efficient as traditional markets (“incumbent advantage”) until it reaches sufficient scale (“incumbent advantage”). It is unclear whether DLT platforms have convincing technical advantages over traditional systems, and given the smaller scale of traditional markets, transition costs may also be high.

Cybersecurity threats: Certain types of DLT solutions (public, permissionless blockchains) are vulnerable to hacking and other cybersecurity attacks, which could pose a risk to the security of tokenized treasuries

Operational risks:

Counterparty risk: Investors may be exposed to counterparty risk, which is the risk that the issuer or custodian of the tokenized security may default.

Custody Risks: Ensuring the safekeeping of tokenized Treasury bonds requires strong custody solutions, which may include challenges associated with digital asset custody.

Privacy concerns: Some participants will see the increased transparency of public blockchains as a disadvantage

Regulatory and legal uncertainty:

Evolving regulations: Legal requirements/compliance obligations regarding tokenized assets remain unclear

Jurisdictional challenges: Regulatory frameworks vary across jurisdictions, which can complicate cross-border transactions and raise complex legal issues.

If the tokenized market grows substantially, it will bring financial stability and market risks:

Spread risk

Complexity and interconnectedness

Banking/payment disintermediation

Basis Risk

24/7 trading: May make it more vulnerable to market manipulation and higher volatility

Financial stability risks from significant future expansion of the tokenized market

Contagion and linkage risks:

Tokenization provides a bridge. As the scale of tokenized assets grows, the volatility of “on-chain” assets may spread to the broader financial market.

In times of stress, a seamless ledger can become a negative factor as deleveraging and hot selling can spread quickly across all assets

Liquidity and maturity mismatch risk:

There may be liquidity and maturity mismatches between non-native tokens and underlying assets, which can trigger price volatility due to potential deleveraging; similar to ETFs, MMFs, and Treasury futures

Smart contract driven automatic margin liquidation may lead to liquidity pressure, while also needing to meet fast settlement targets

Increase leverage:

Tokenization can directly increase the leverage of the financial system. For example, the underlying assets of the tokens can be re-hypothecated, or the tokens themselves can be designed as derivatives.

Tokenization has the potential to create securities from illiquid or physical assets that can be used as collateral

Increased complexity and opacity:

Tokenization leads to more composability, and new non-traditional assets are added to the digital financial ecosystem, which may greatly increase the complexity and opacity of the financial system.

Poorly coded smart contracts can quickly trigger unnecessary financial transactions with unintended consequences

Disintermediation of the banking industry:

Tokenized Treasury bills could prove to be an attractive alternative to bank deposits and have the potential to disrupt the banking system, negatively impacting core operations.

Stablecoin operation risks:

Even with better collateralization, stablecoins are unlikely to meet the NQA principles needed to support tokenization

Stablecoin runs have been common in recent years, and the collapse of major stablecoins like Tether could lead to a sell-off in short-term Treasuries.

Designing DLT/Blockchain for Tokenized Treasury Bonds: Elements of a Framework

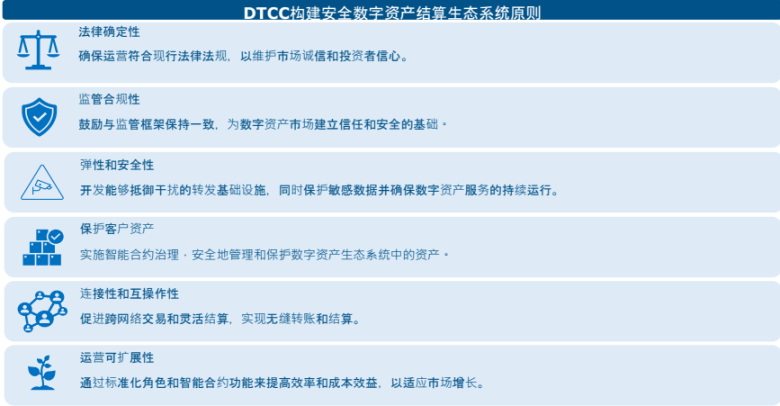

Establishing a framework that encourages trust and industry-wide acceptance is necessary for the expansion of digital assets and distributed ledger technology, as fraud, scams, and theft have grown in tandem with the growth of the digital asset market, eroding trust in the underlying technology.

To date, most major crypto projects have been developed on public and permissionless blockchains. This is considered one of the main attractions of blockchain.

We believe this architecture is not suitable for wider adoption of tokenized treasuries:

Technology Choice: Public, permissionless blockchains use complex consensus mechanisms (e.g., proof-of-work, proof-of-stake), making it difficult to process large volumes of transactions efficiently.

Operational fragility: These blockchains rely on decentralized nodes with no centralized authority, which leads to fragility

Governance vulnerabilities: Public blockchains lack a clear governance structure, which increases the risk of system failure or attackers exploiting vulnerabilities in the blockchain.

Security risks: The decentralized nature and lack of scrutiny of public blockchains increase the risk of vulnerability exploits and attacks, as evidenced by the historical cases of Bitcoin and Ethereum vulnerabilities being exploited.

Money Laundering and Compliance Issues: Public, permissionless blockchains allow for anonymity, which may facilitate illegal activities such as money laundering and sanctions evasion, and circumvent sanctions.

Tokenization of the treasury market will likely require the development of a blockchain managed by a single or multiple trusted private or public institutions.

Regulatory elements

In recent years, the global regulation of digital assets and cryptocurrencies has increased, but it remains highly fragmented and full of loopholes.

United States: Regulation in the United States remains fragmented, with regulatory authority spread across multiple agencies such as the SEC, CFTC, and FinCEN

Ensuring the Responsible Development of Digital Assets (2022): An executive order signed in 2022 outlines a government-wide strategy to address the opportunities and risks of digital assets. The order calls for the development of a regulatory framework for digital assets - the 21st Century Financial Innovation and Technology Act (FIT 21) passed by the House of Representatives in 2024, which would be the most significant and comprehensive effort to regulate digital assets, stablecoins, and cryptocurrencies.

EU: The Crypto-Asset Market Regulation Act (MiCA) will come into effect in 2024. MiCA is the EUs first comprehensive regulatory framework for cryptocurrencies and digital assets. It sets rules for issuing crypto assets, stablecoins and utility tokens, and regulates service providers such as exchanges and custodians. It focuses on consumer forecasting, stablecoin supervision, anti-money laundering measures and environmental impact transparency. Licensed entities under MiCA can operate a passport model across the EU, enabling them to provide services to all member states under a unified framework.

Impact on Treasury Market

Assuming current trends in stablecoin collateral selection continue (or are forced by regulators), the continued growth of stablecoins will create structural demand for short-term U.S. Treasuries, and while stablecoins currently represent a marginal part of the Treasury market, over time, the Treasury market may face greater risk of a sell-off due to runs in the stablecoin market. Different redemption and settlement characteristics may lead to liquidity and maturity mismatches between tokens and underlying assets, which in turn may exacerbate financial instability in the Treasury market.

Tokenized “derivative” Treasury products could create an underlying market between digital and local (like futures or total return trading) — which would both create additional demand and lead to increased volatility during deleveraging.

The growth and institutionalization of the cryptocurrency market (Bitcoin) could create additional hedging and quality demand for tokenized Treasuries during times of heightened downside volatility. Demand for quality can be difficult to predict. Hedging demand could be structural but depends on how well Treasuries continue to hedge against downside cryptocurrency volatility.

Tokenization could create greater access to Treasury securities for domestic and global savings pools (particularly households and small financial institutions), which could lead to increased demand for U.S. Treasuries.

Tokenization can improve liquidity in Treasury trading by reducing operational and settlement friction.

in conclusion

Although the overall market for digital assets is still small compared to traditional financial assets such as stocks or bonds, interest in digital assets has grown significantly over the past decade.

To date, the growth of digital assets has created negligible incremental demand for short-term Treasuries, primarily through the use and popularity of stablecoins.

Institutional adoption of “high-volatility” Bitcoin and cryptocurrencies could lead to increased hedging demand for short-term Treasuries in the future.

The development of DLT and blockchain brings hope for new financial market infrastructure, and the unified ledger will improve operational and economic efficiency

There are a number of ongoing projects and pilots in both the private and public sectors to leverage blockchain technology in traditional financial markets, notably by the DTCC and the Bank for International Settlements (BIS).

Central banks and tokenized dollars (CBDCs) may be required to play a key role in future tokenized payments and settlement infrastructure.

The legal and regulatory environment needs to evolve as tokenization of traditional assets advances. Operational, legal, and technical risks need to be carefully considered when making design choices around technology infrastructure and tokenization.

Research projects should include the design, nature and concerns of treasury tokenization, the introduction of sovereign CBDCs, and the technologies and technological risks.

Currently, financial stability risks remain low due to the relatively small size of the tokenized asset market; however, financial stability risks will increase due to the strong growth of the tokenized asset market.

The way forward should include a cautious approach led by a trusted central agency with broad support from private sector players.