Weekly Editors Picks is a functional column of Odaily Planet Daily. In addition to covering a large amount of real-time information every week, Planet Daily also publishes a lot of high-quality in-depth analysis content, but they may be hidden in the information flow and hot news, and pass you by.

Therefore, every Saturday, our editorial department will select some high-quality articles that are worth spending time reading and collecting from the content published in the past 7 days, and bring new inspiration to you in the crypto world from the perspectives of data analysis, industry judgment, and opinion output.

Now, come and read with us:

Investment and Entrepreneurship

Deep dive into the MSTR model: The biggest variable in this bull market?

First, you need to understand the basics of Convertible bonds (CB): Convertible bonds are debts that can be converted into shares after certain agreed conditions are met. They are essentially corporate bonds + call options on company stocks. But please note that if a company goes bankrupt, the order of repayment is ordinary bonds > convertible bonds > shareholders, so the repayment order of CBs should be later.

The major traditional investment banks (such as Barclays) helped MSTR issue CBs. The buyers of CBs were hedge funds that used volatility strategies and long-only bond and insurance funds that were optimistic about BTC but could not buy the coin directly (among them, the largest insurance company in Germany, Aliianz, with a scale of 2 trillion euros in insurance funds, began to participate in BTC, and most likely had a net long position in BTC).

Therefore, the core of the MSTR game is to allow funds that are optimistic about BTC but cannot participate to enter the market through channels such as CB. CB essentially speeds up the level of funds participating in BTC.

According to the latest regulatory filings: 8.2 billion of the 21 billion ATM stock quota has been used, and 3 billion of the 21 billion CB quota has been used. There are six phases of CB in the market, and investors in the first five phases have made a lot of money as the price of the currency and the MSTR stock price rose.

If you think that BTC will accelerate its rise in the next period of time, then buy MSTR directly; conversely, if you think that the price of BTC will remain flat in the next period of time, then sell MSTR.

From the perspective of historical process, the transfer of BTC ownership: hacker IT man → high net worth individual → technology company → fund institution → small country → large country. MSTR has introduced funds that may not be able to participate in BTC for many years in the future through various financial instruments, which is, to some extent, an overdraft of BTC price. If MSTR fails to issue bonds and other products in the future, and has greatly overdrawn the future price increase, but at the same time there is no larger fund to take over to buy BTC, BTC may usher in a terrifying spiral decline like LUNA.

The dusk of the MSTR model and the top of BTC Observation dimensions: the popularity of primary market subscriptions for CB and other subsequent products, the premium and financing costs of CB issuance, and the entry progress of larger funds.

The date to watch in the near future is December 23, the opening day of the U.S. stock market - MSTR will be officially included in the index and start trading.

The author suggests: protect the BTC in your hands and welcome the bigger main uptrend in 2025. Don’t hand over your precious chips easily until the game is about to end.

New capital is flowing in, rather than rotating; retail investors are returning, but with different focuses; familiarity and trust are the determining factors; Generation Z investors have less available funds, which has not significantly increased the inflow into the Meme market; the circulation supply of older currencies accounts for a higher proportion, so new capital will not be diluted by the continued issuance of tokens.

Wall Street institutions are eyeing the altcoin market

Although the current craze for copycat ETFs is still difficult to achieve under the current regulatory background, from a long-term perspective, with the relaxation of regulations and increased investor interest, in-depth research by institutions into crypto assets will become an objective reality for the sake of traffic acquisition and market competition.

The prices of ENA and HYPE continue to soar. What is the logic behind the pull-up?

HyperLiquid focuses on decentralized derivatives, while Ethena has quickly grown into a leading stablecoin protocol. Both have made decisions that are in line with product development by understanding user needs and dynamically adjusting strategies. The key to success is to guide decisions based on a clear vision and belief, rather than a one size fits all approach.

People believe in HyperLiquid’s vision and believe they will make money. This holy symbiosis between vision and execution and fundamentals may be unique to HyperLiquid, but it can also be seen to some extent in some of the other most profitable and widely watched DeFi projects this year, such as ethena labs.

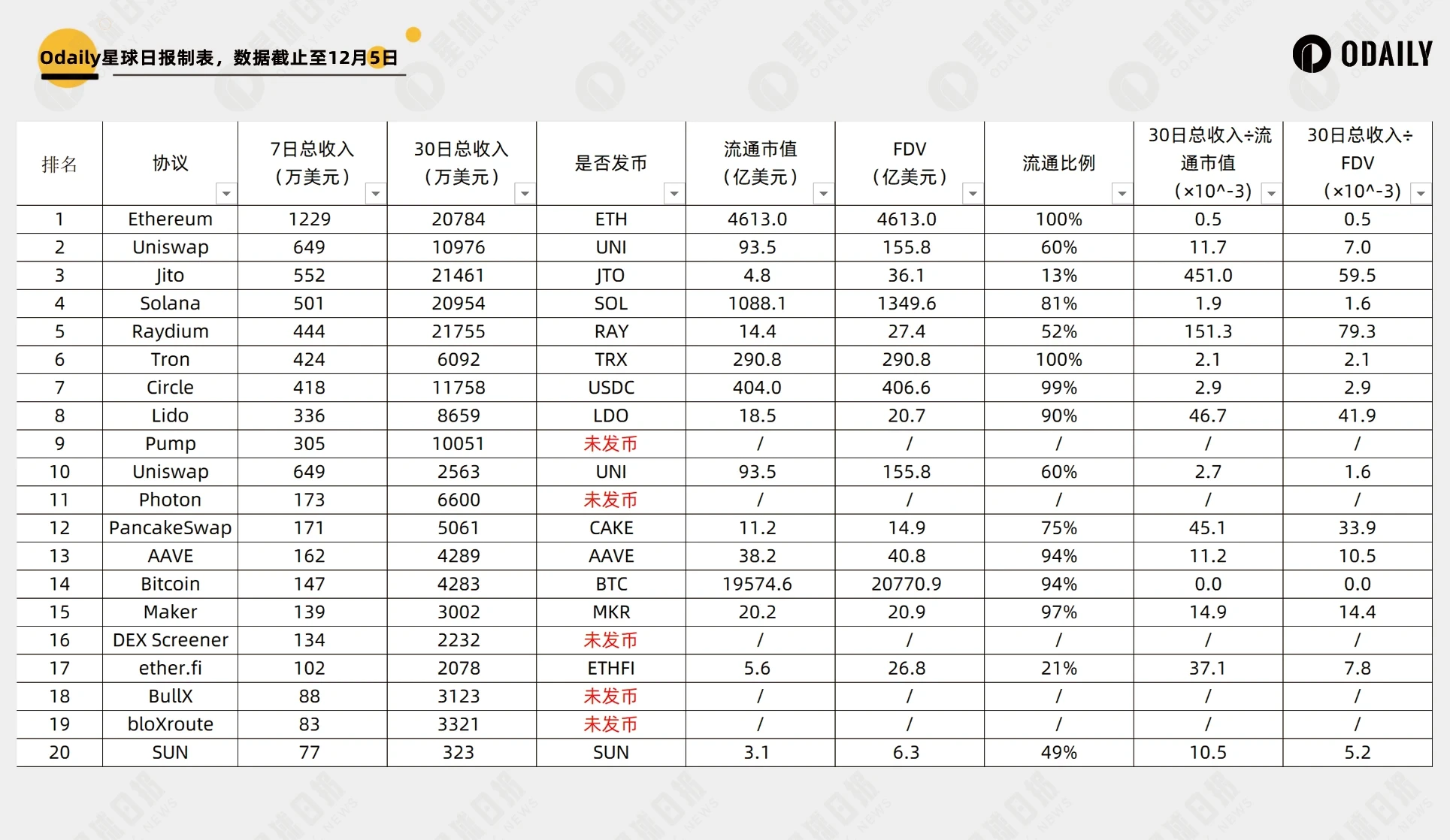

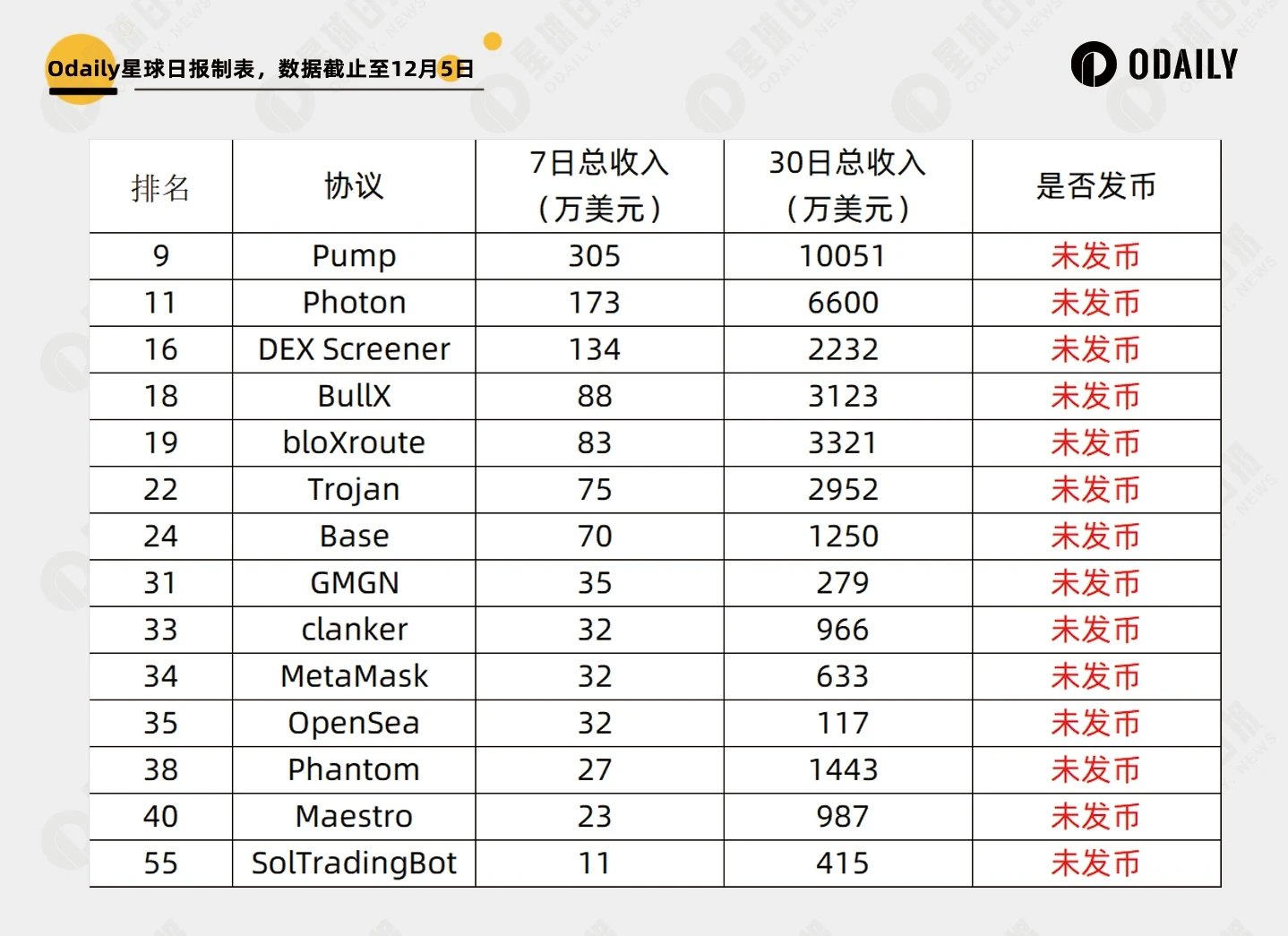

Meme tools performed well but the probability of issuing coins was low; Solana protocol had the strongest revenue; a dark horse emerged in an unpopular chain.

Also recommended: Tiger Research: US$33.3 billion sell-off and relocation of local projects amid South Koreas political turmoil .

Meme

After the Internet user base reached the threshold of quantitative change, the speed of innovation began to accelerate, and killer applications appeared more and more frequently.

With Tik Toks development path as a guide for the meme industry, the meme industry will most likely have the following trends in the future: the division of labor in the industrial chain will become more and more detailed and professional, and the strong in each division of labor will always be strong; UGC to PGC; KOL specialization; and top content owners will gather more and more traffic.

Todays meme market is far from being mass penetrated.

Clanker Technical Analysis: How do you use AI to send your Clanker MEME?

Clanker is an autonomous agent based on the Base blockchain. Its core function is to help users deploy ERC-20 standard tokens. Users only need to tag @clanker on the social platform Farcaster and provide relevant token information (such as name, code, and image), and Clanker will complete the creation of tokens, liquidity pool settings, and liquidity locks. The entire process does not require users to have complex technical knowledge.

The technical implementation involves two parts. Anthropic (AI side) responds to your creation needs until the Clanker backend can obtain enough executable parameter settings. Then you only need to automatically call the smart contract to create tokens for you, as well as subsequent on-chain operations. For Clanker, the main function of its conversational AI is to act as a customer service staff, and talk to you through Cast to guide you to provide all the necessary information, such as token name, symbol and logo, etc. Each user is allowed to create at most once a day.

DeFi mining, on-chain transfers, what new gameplay will Solana Meme have in the second half?

In the second half of the meme track, in addition to PVP on Sol and internal disk on Base Virtual, meme gameplay has also been updated and more and more varied. Repump began to recycle junk memecoins, and Farmer meme attracted users to build pools through high APR. The funds in the meme track gradually overflowed into the services and narratives around the main line of meme.

Want to explore the Virtuals ecosystem? I’ll contribute some ideas

The article first introduces Virtuals and the detailed steps of participation, and introduces that unlike pump.fun, the AI agent tokens with large market value that have emerged from the Virtuals ecosystem basically have practical functions, so buyers need to find those AI agents that truly have unique value and invest in them. Because the PVP level is relatively low, the initial market value of token issuance is relatively low, so there is enough time for players to invest and get on board. As a coin issuance platform, users can only be retained by differentiated products and the uniqueness of the ecosystem.

The speed of K-line tools GMGN and Photon is similar to that of abot, and Ray address monitoring is the fastest.

This weeks Meme focuses on BAN and MAX, with 4 tips from experts

Currently, there are three sectors in Meme that deserve special attention and positions, namely AI, animals, and science. No contracts are opened. Players who are not suitable for PVP should carefully study the second opportunity to get on board. Carefully investigate promising projects and increase positions in batches and work hard.

Meme Wave is not just about PVP, “mining” is also a good option

The article introduces two Meme LP platforms - Raydium and Meme Farmer.

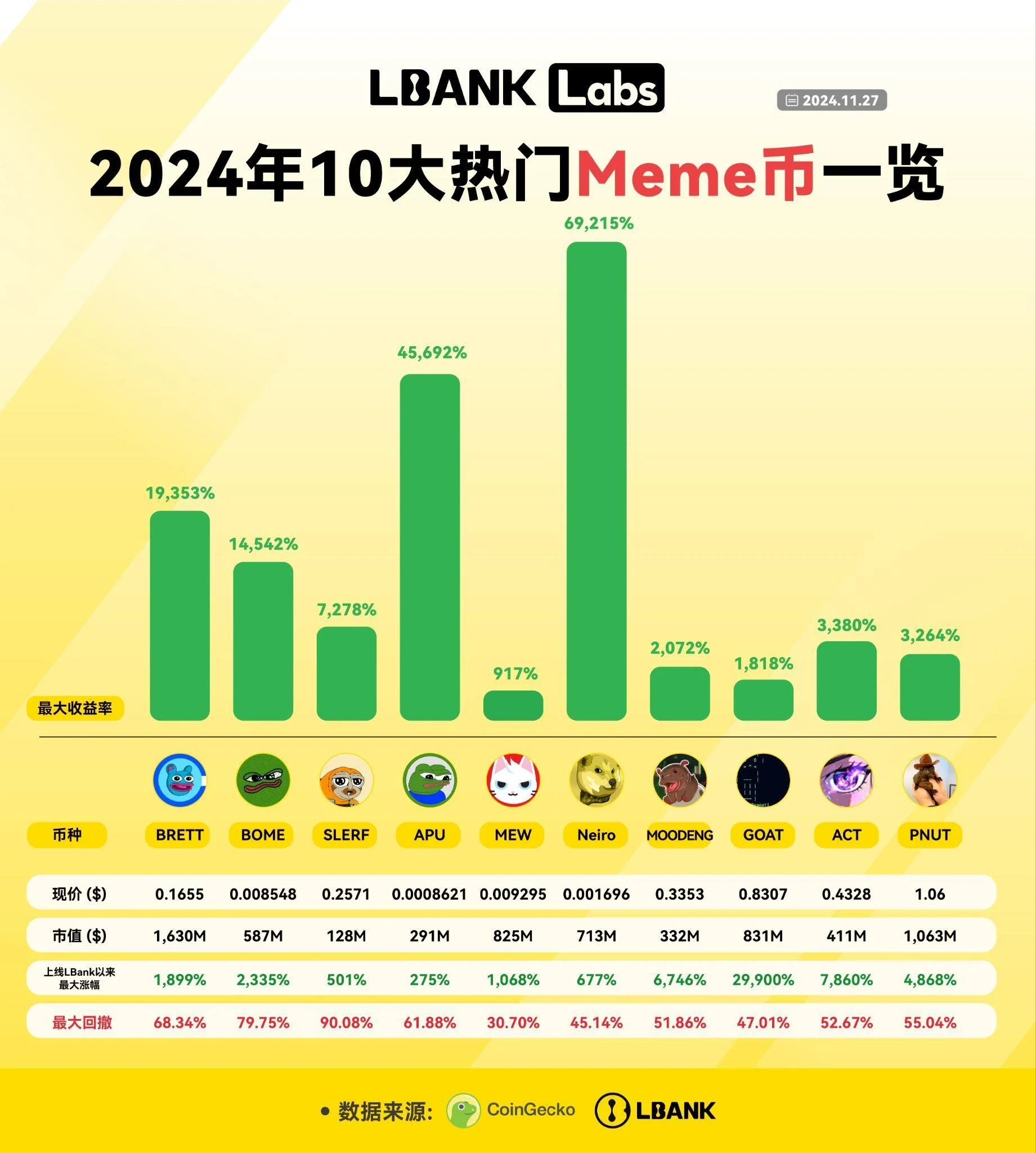

LBank Labs Report: Summary of the Top Ten Popular Meme Coins in 2024

I also recommend Base has obvious benefit effects, and teaches you step by step how to play the Golden Shovel Clanker .

Bitcoin Ecosystem

Bitcoins $2 trillion conspiracy: Expanding the boundaries of time and space

As BTCFi develops, Bitcoin will change from a passive asset to an active asset, from a non-interest-bearing asset to an interest-bearing asset, and generate institutional-level opportunities.

Multi-ecology

As the popularity rises, what potential projects does BNB Chain have that have not yet issued coins?

SERAPH: In the Darkness, DIN, Particle Network, GombleGames, REVOX.ai, MyShell, SideKick, CodexField, Elfin Metaverse, MEET 48, 4 EVERLAND, Redbrick.

The article introduces ANON, AIXBT, LUNA, LUM and the zoo-themed memes that were once popular (BRETT, MOG, TOSHI, ANDY, NORMIE, OKAYEG, ROOST, PEEZY).

XRP continues to soar, and this article lists 9 related ecosystem-related coin projects

XRP Ledger (XRPL) ecological projects: customized L2 Evernode (EVR), tokenized ecosystem Sologenic (SOLO), programmable smart blockchain Xahau Network (XAH);

XRP Ledger (XRPL) technical partners: Coreum (COREUM) that launched the XRPL cross-chain bridge, Evmos/Tharsis Labs (EVMOS), the XRPL sidechain technology provider, Axelar (AXL), the exclusive cross-chain protocol for the XRPL sidechain, and Band Protocol (BAND), the main provider of XRPL oracles;

Stellar (XLM), another payment network co-founded by Ripple, and the metaverse network The Root Network (ROOT)/Futureverse associated with XRPL.

$Army (players holding XRP call themselves an army), $589 (calling for XRP to rise to 589), $SCRAP (the pet dog of XRP developers, the first Meme in an important wallet app), $RIPPLE (same name as Ripple, another 589 narrative), $DROP (Ripple water drop meme).

The main participating tool is First Ledger.

DeFi

How to obtain stable high returns through DeFi in the bull market?

The article introduces the strategy of recycling sUSDe in different lending markets, how to use calculators to estimate actual returns, and how the JLP token works.

NFT, GameFi, SocialFi

Ethereum liquidity overflows, and trapped NFTs are saved

The recent data of Ethereum NFT sector is positive. Ethereum is recovering and liquidity is gradually overflowing. Users who still hold NFTs for a long time may choose to sell less in the early stage of launch. From the perspective of circulation and supply, the NFT market may have certain potential. However, whether the NFT market can rise again cannot be sustained by short-term liquidity overflow alone. Further innovation is needed to match demand and implement real application scenarios to be effective.

Web3 AI

Virtuals growth, views on the AI Agent track, differences with Pump.fun, and views on the Base ecosystem, etc.

The truth about AI agents: Why is the GOAT, valued at $1 billion, still a mechanical text generator?

The main limitations facing current AI development include: inability to access private data, inability to access data behind paywalls, and inability to access data on closed platforms.

The copycat season is coming, and these AI Agent projects are ready to go

The article first recommended three tools - Solana blockchain browser, GMGN and DEX Screener; and further introduced Goatseus Maximus (GOAT), Act I The AI Prophecy (ACT), ai16z (AI16Z), zerebro (ZEREBRO) aixbt (AIXBT), Fartcoin (FARTCOIN), and Dolos The Bully (BULLY).

Hot Topics of the Week

In the past week, Bitcoin broke through the $100,000 mark for the first time , and altcoins rose in turn; Trump confirmed that Paul Atkins was nominated as SEC Chairman ; South Korea suddenly imposed martial law , and Upbit had a large negative premium and temporarily suspended trading;

In addition, in terms of policy and macro market, Grayscale and other four asset management companies have applied to US regulators for a risk-averse Bitcoin ETF ; FOX reporter: SEC has notified some SOL spot ETF applicants that their ETF applications will be rejected ; Head of BlackRock Investment Institute: Global bonds will be more popular than US Treasuries; Elon Musk applied for an injunction to prevent OpenAI from transforming into a for-profit company ; OpenAI responded to being sued by Musk: The application was repeated and still unfounded ;

In terms of opinions and voices, Arthur Hayes: South Korea postpones taxation of virtual assets for two years, and the bull market can continue ; Arthur Hayes: Make ICO great again ; Rich Dad Poor Dad author: Bitcoin is about to break through $100,000, and low-income groups and the middle class should buy it in time ; Tim Draper predicts that Bitcoin will reach $250,000 in 2025 and will rise 30 times in the future ; Michael Saylor said that he could convince Buffett to buy Bitcoin through Berkshire Hathaway; Michael Saylor suggested to Microsoft: Bitcoin is the best asset your company can have ; Bitwise CEO: Bearish ETH will not last long, and the L1 category will grow significantly ; Analysis: BTC market share is about to break through the multi-year support level, which may indicate the arrival of the altcoin season ; CryptoQuant CEO: Altcoin trading volume is driven by stablecoins and fiat currency trading pairs, reflecting actual market growth ; The ETF Store President: More issuers are expected to submit spot XRP ETF applications; Dragonfly Partner: Bases community-driven model is very successful, and some DeSci The project is pretending to be scientific research; Virtuals Protocol co-founder: I don’t want to be Pump.fun , but I want to make my competitors despair; The former head of Meta’s stablecoin project Diem said that the project was forced to terminate due to political pressure ;

In terms of institutions, large companies and top projects, MagicEden opened an airdrop query page; Sothebys vice president issued Meme coin VOID again; RTFKT announced the cessation of operations ; Pudgy Penguins will launch PENGU tokens in 24 years;

According to data, MicroStrategy has sold over $6 billion in convertible notes to buy Bitcoin this year, and hedge funds have bought it for arbitrage bets; in 2024, institutional funds have purchased about 3% of the total supply of Bitcoin ; on December 2, XRPs market value surpassed USDT to rank among the top three; CFTCs fines and relief amounts for fiscal year 2024 hit a record high, mainly from crypto companies such as FTX;

In terms of security, DeBox: The loss of assets was caused by the leakage of the personal EOA wallet private key of the DeBox Social operating account; on December 6, the DEXX hacker address began to move abnormally, and the funds were gradually centralized... Well, it was another week of witnessing history.

Attached is a portal to the “Weekly Editor’s Picks” series.

See you next time~