Original author: BitMEX

Welcome back to our weekly options strategy analysis. This week, we will explore a trading opportunity to take advantage of XRPUSD volatility which is currently reaching 150%. In the past two weeks, XRP price has more than doubled on a series of positive factors.

In this article, we will analyze why XRP implied volatility is so high and how you can profit from selling options. In the current market environment, this strategy may be particularly effective!

Let’s get started.

XRP’s surge

Two major events pushed XRP up more than 100% in just two weeks, creating a perfect storm: First, with Trump’s election victory, the resignation of SEC Chairman Gensler heralded a shift in the regulatory environment to be more favorable to cryptocurrencies. This could have a positive impact on Ripple’s legal case.

In addition, speculation is intensifying about two major potential developments: the launch of an XRP ETF and Ripple’s IPO plans. These developments would increase institutional investor participation and adoption of XRP (given the successful precedent of the Bitcoin ETF) while providing Ripple with more funding for expansion.

The market’s reaction to these developments has been remarkable. XRP’s trading volume on South Korea’s largest exchange Upbit briefly surpassed Bitcoin’s, while its open interest also hit an all-time high, indicating strong institutional participation.

However, it is worth noting that XRP has historically been a range-bound asset. Despite the current high market sentiment, we expect the enthusiasm to fade over the coming weeks, with volatility decreasing and entering a consolidation period. This pattern is consistent with XRPs historical trading behavior, making this high volatility environment particularly suitable for option strategies.

Consider selling an ATM option straddle

The current market may present a unique opportunity for option traders to sell an at-the-money option straddle:

Implied volatility above 150% is significantly higher than historical levels. Are options overvalued?

Market sentiment appears overheated, suggesting prices may stabilize or correct in the short term

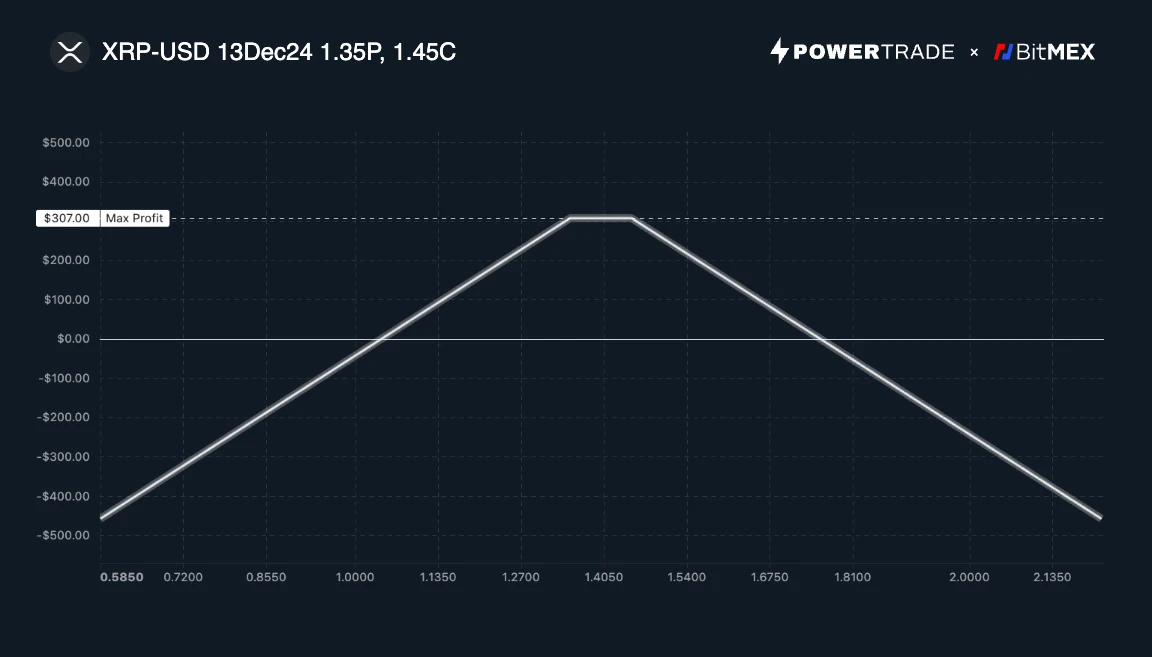

The option premium is high, providing an attractive risk-return ratio. As long as XRPUSD remains within the range of ± 35% ($1.03-$1.76) over the next 15 days, the trade will not lose money. The specific visualization is as follows:

Strategic advantages:

Take advantage of unusually high volatility levels by collecting option premiums

Especially suitable for markets expected to enter a consolidation period

However, we need to be aware of the following important risks:

Transaction Risk

The main risk is the potential for unlimited losses

Selling options requires a margin deposit

Large price movements in either direction can result in rapid losses

Stop loss orders must be set to manage risk

Entry timing and position management are critical to optimizing risk-return:

Entering the market when volatility peaks

Use moderate leverage and maintain sufficient margin to cope with market fluctuations

As long as risk management is done properly, this strategy could generate attractive returns in the current high volatility environment.

Specific operation plan

Trading strategy:

Sell XRP put option with strike price of $1.35 expiring on December 13

Sell XRP call option with strike price of $1.45 expiring on December 13

Potential profit: (taking 1000 contracts as an example)

Breakeven point: XRP price at expiration is $1.03 or $1.76

Max Profit: $307 if XRP stays in the $1.35 to $1.45 range

Maximum loss: Large price movements in either direction can result in unlimited losses

Scenario Analysis:

1. XRP price ranges: In this case, we will receive the full premium as the maximum profit. This is the best case scenario for the trade, and the profit will be gradually realized through time value decay as the expiration date approaches.

2. XRP price fluctuates significantly: one option position will generate a loss, while the other is close to zero value. In this case, traders should consider stopping losses in time to effectively control risk exposure.

Key risks:

1. Unlimited risk of loss: Violent price fluctuations may lead to huge losses. Stop loss orders must be set.

2. Liquidity risk: Compared with mainstream cryptocurrencies, the liquidity of the XRP options market may be lower, and slippage may occur when closing positions.

Summarize:

XRPs current high implied volatility provides an opportunity to sell a straddle. If you expect the price to enter a consolidation in the near term, you can consider this strategy. However, strict risk management and a proper stop-loss strategy are essential.