Original | Odaily Planet Daily ( @OdailyChina )

Author: Wenser ( @wenser 2010 )

The latest data shows that the market value of XRP once exceeded US$136.2 billion, surpassing USDT and returning to the third largest cryptocurrency by market value, returning to the level before the SEC/Ripple lawsuit in 2020 .

Previously, Odaily Planet Daily had made a detailed analysis of the US court ruling that Ripple did not violate federal securities laws in August, see the article XRP once soared by more than 20%, another phased victory for Ripple in the SEC lawsuit . Nearly 4 months later, the price of XRP has exceeded 2.3 US dollars, an increase of nearly 4 times, and the market is optimistic about the future performance of XRP.

Odaily Planet Daily will summarize the latest developments and related information of Ripple and XRP in this article for readers reference.

The double superposition of macro and micro factors has led to a surge in XRPs market value

According to Infinite Market Cap data, XRPs market value briefly surpassed China Life Insurance, ranking 139th in global assets, based on a market value of $136.2 billion. Currently, its market value has fallen back to around $132.8 billion. Overall, XRPs market value surge is mainly due to a number of positive factors at the macro and micro levels:

Macro level: Trumps coming to power is expected to help settle the XRP vs SEC dispute

With Trumps successful election as the new US president, the six-year dispute between Ripple and the SEC over whether XRP is a security may see a final ruling. After all, as a crypto-friendly president, Trump will play a positive role in the subsequent development of the crypto industry.

At the same time, as an active participant in the US presidential campaign, Ripple previously donated $45 million to PAC before the 2024 election, making it one of the largest donors to Fairshake along with cryptocurrency exchange Coinbase, Jump Crypto and Andreessen Horowitz. Recently, it donated another $25 million to Fairshake , once again demonstrating its strong ambition to influence crypto political tendencies.

On the other hand, in the cryptocurrency advisory committee that Trump is about to establish, a series of cryptocurrency companies including Circle, Ripple, Kraken, Coinbase, a16z, and Paradigm are vying for relevant positions, seeking to have a say in his planned US policy reforms, which also laid the groundwork for XRPs recent good market performance.

Ripple CEO Brad Garlinghouse has also spoken out frequently before, emphasizing the possible changes in cryptocurrency regulation under President-elect Trump, in which he mentioned: Ripple and XRP may be facing a turning point, as the new pro-cryptocurrency regulatory shift is expected to bring new hope and potentially resolve years of legal disputes.

He then pointed out: Its been 6 years since the SEC began intervening in the cryptocurrency market and picking winners and losers... and its been 4 years since the SEC sued Ripple... Now, as these external (and frankly unnatural and manipulative) market factors fade away, were finally seeing the light at the end of the tunnel. The tide is turning, headwinds are turning into tailwinds, and the opportunities are huge for those of us who believe in the future of XRP. Not only that, in a previous interview , FOX Business reporter Liz Claman also indirectly confirmed the news that he had met with Trump and exchanged views on cryptocurrency-related topics.

In November, the US SEC v. Ripple case progressed to the Second Circuit Court of Appeals issued an order requiring the SECs litigation brief to be submitted by January 15, 2025. Subsequently , Judge Phyllis Hamilton approved the final judgment on the settled Ripple class action lawsuit and ordered the suspension of the remaining unresolved lawsuits. This decision shortened the class action and paved the way for the trial to begin on January 21, 2025. In addition , the current US SEC Chairman Gary Gensler previously issued a statement that he might resign around the time Trump took office, which also contributed to the previous price increase of XRP.

Coincidentally, the day before January 21st was exactly the first day of Trumps inauguration. Therefore, it can be said that Trump will play the role of key man in this battle between crypto institutions and regulators.

Micro level: 1 billion XRP locked in escrow, stablecoin release imminent

From the perspective of the project’s own development, XRP may also be able to “bloom new flowers on an old tree.”

One of the important reasons that directly boosted the price of XRP may be the 1 billion XRP tokens escrow lock early this morning. According to Whale Alert monitoring , Ripple re-locked 1 billion XRP in the escrow wallet at 2:21 a.m. today, worth about $1.546 billion. Earlier news, Ripple said that it uses the escrow account system to provide transparency and certainty to the XRP market. The company locks most of its XRP holdings to ensure that it does not oversupply the market and manipulate prices. However, the company also uses XRP in the escrow account to invest in and support projects in the Ripple ecosystem. The release of 1 billion XRP tokens from the escrow account each month does not mean that all of them will enter the market. Ripple may choose to sell some of them to institutions or retail investors, use some for its own purposes, or return some to the new trust.

In addition, as a crypto payment company, Ripple plans to expand its territory into the field of stablecoins. In mid-November, according to official news , Ripple announced that it would soon launch the US dollar stablecoin Ripple USD (RLUSD). RLUSD is a stablecoin designed for enterprise use cases (such as payments). It focuses on stability, efficiency and transparency, and aims to enhance Ripples cross-border payment solutions and meet the growing demand for transactions denominated in US dollars. It is reported that the stablecoin may be launched on December 4.

Previously, Ripple has also made a lot of moves in promoting industry cooperation. In October, digital asset infrastructure provider Ripple designated Uphold, Bitstamp, Bitso, MoonPay, Independent Reserve, CoinMENA and Bullish as trading partners for the upcoming Ripple USD (RLUSD) stablecoin, and its liquidity is supported by the market B2C 2 and Keyrock. According to official news , crypto payment infrastructure company MoonPay has also previously announced a partnership with Ripple to support users to use MoonPay accounts to purchase, store and manage XRP. In late November, Ripple also announced a partnership with Archax and British asset management company ABRDN PLC. The two parties plan to launch the first tokenized money market fund on XRP Ledger.

Stimulated by a series of positive news, Ripple and XRP ushered in the second spring of cryptocurrencies.

Not only that, XRP ETF will also continue to attract market attention as the next highlight of the crypto market.

Industry insiders have expressed positive opinions. Will XRP ETF be the first to go online?

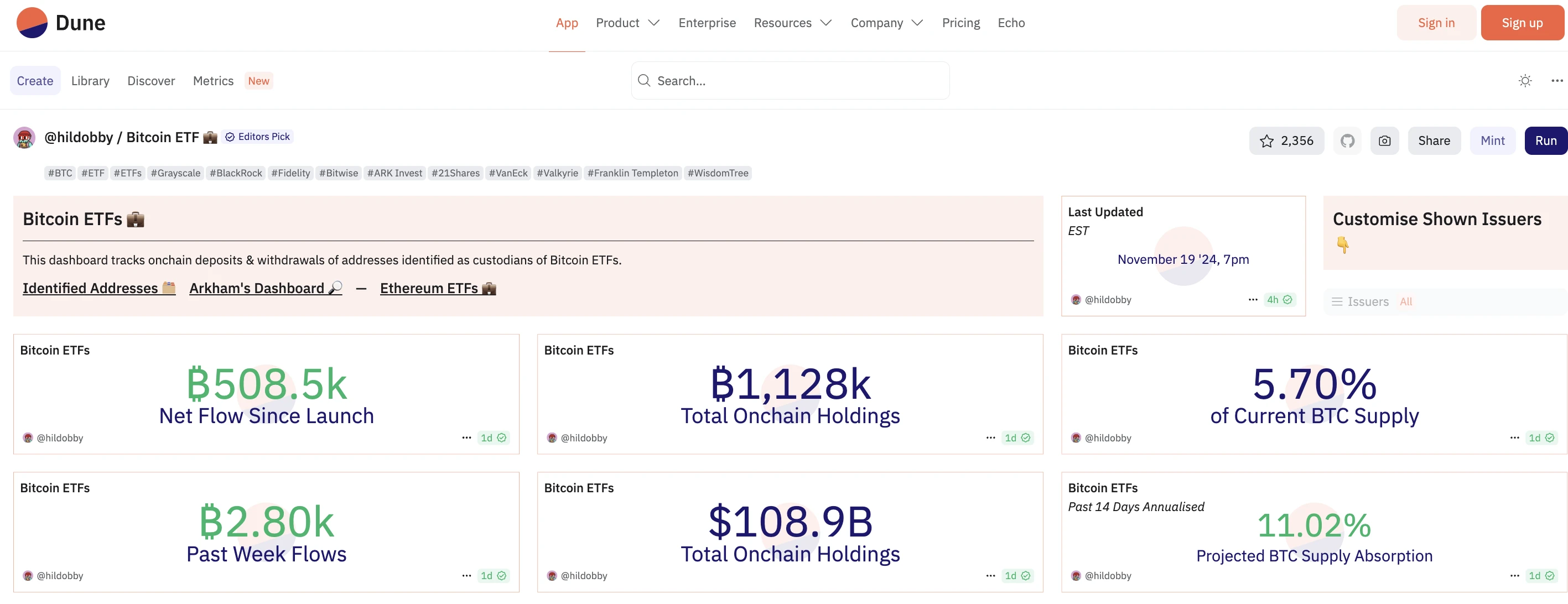

As early as late October, Ripple CEO Brad Garlinghouse wrote that the XRP ETF is inevitable. The main basis for this is the growing share of Bitcoin spot ETFs. According to the latest data , the total holdings of US Bitcoin spot ETFs on the chain have exceeded 1.12 million BTC (about 1.128 million BTC), accounting for 5.7% of the current BTC supply; the value of on-chain holdings has reached 108.9 billion US dollars.

At the same time, XRP has also received strong support from people in the crypto industry from different fields, mainly reflected in the following aspects:

XRP ETF registration has started: WisdomTree fired the first shot, followed by Bitwise, Canary, and 21 Shares

At the end of November, Fox Business reporter Eleanor Terrett wrote that global ETF provider WisdomTree has registered the XRP ETF in Delaware, USA. The company has now confirmed that it is a legal filing. It is reported that WisdomTree manages assets of more than US$100 billion.

At the same time, according to a post by Nate Geraci, president of The ETF Store: “There are currently three ETF applications to hold XRP, the third largest cryptocurrency by market value.

Bitwise, Canary, and 21 Shares have all filed for spot XRP ETFs. Speculation is that other issuers will follow.”

Grayscale Select: XRP now included in crypto portfolio

In early November, Grayscale officially announced that its XRP Trust Fund is now open to qualified accredited investors, providing investment opportunities in XRP. XRP is the core token of XRP Ledger, a distributed network that supports cross-border payments. Subsequently, at the end of November, Grayscale issued another statement saying that it is now open to qualified investors for private subscription of 17 token trust funds, including XRP.

As it turns out, Grayscale’s choice was very wise: According to statistics , the value of Grayscale’s cryptocurrency holdings increased significantly in November. According to Cryptorank data, the market value of its cryptocurrency holdings has increased by more than 85% in the past month, mainly due to tokens including XRP (which increased by more than 262% during the same period).

Asset management giant Bitwise has become a Ripple partner

In November, Ripple said it would invest in Bitwise Physical XRP ETP, but the specific investment amount was not disclosed. It is understood that Bitwise Physical XRP ETP was previously known as European XRP ETP and is part of Bitwises crypto asset fund suite.

Ripple CEO Brad Garlinghouse said that the decision to invest in the Bitwise Fund is in line with the surge in interest in exchange-traded products related to crypto assets. Subsequently, Bitwise officially announced that the asset management scale of Bitwise Physical XRP ETP (GXRP) exceeded US$80 million, and Ripple was one of the investors. The product was listed and traded on Deutsche Börse Xetra, and European investors could gain XRP exposure through GXRP.

Industry insiders all expressed their views: Solana, BNB, ADA and others all took sides

Just today, Solana co-founder Toly posted : We need a national XRP reserve. This remark is also seen as a response to Trumps previous emphasis on establishing a national strategic reserve of Bitcoin.

At the end of November, CZ retweeted a news report saying that because XRP is not a security but a commodity under the jurisdiction of the Commodity Futures Trading Commission, the SEC may abandon the Ripple case. The news came from an interview with former CFTC Chairman Chris Giancarlo .

Previously, Cardano (ADA) founder Charles Hoskinson had praised Ripple CEO Brad Garlinghouse in a post , calling him a “great CEO” and describing their interactions as “extremely collaborative.” This public exchange sparked speculation that Cardano and Ripple might explore a strategic partnership.

Data level: Market transactions are active, and many data hit record highs

From the perspective of market data, XRP is also one of the best.

In the Korean market , Upbits trading volume increased by more than 100% in seven days, with the biggest contributor being cryptocurrencies including XRP. In the fourth quarter, XRPs trading volume reached $38.6 billion, far higher than Bitcoins $30.1 billion.

In terms of price , XRP briefly broke through 2.29 USDT today, reaching a new high since January 2018.

In addition, in terms of contract data , according to Coinglass data, the open positions of XRP futures contracts across the network are 1.739 billion ETH, equivalent to US$4.051 billion, a record high, with a 24-hour increase of 20.34%. Among them, the open positions of Bybit XRP contracts are 548 million XRP (approximately US$1.277 billion), ranking first, with a 24-hour increase of 19.13%.

In terms of trading volume , as XRP broke through $2, its 24-hour trading volume also exceeded $25 billion, currently reaching $25,338,798,676. The trading volume to market value ratio reached 18.4%, indicating that trading activity is relatively high relative to its market value.

By the way, influenced by various positive news, the number of XRP-related posts on the X platform has reached 480,000, even far exceeding the DOGE-related content with a strong meme attribute.

One of the X platform content indicators

If everything goes well, XRP ETF may become the third cryptocurrency ETF in the US market after BTC ETF and ETH ETF.

Conclusion: Where is the future of Ripple and XRP heading?

As the market value of XRP has returned to the level before the SEC/Ripple lawsuit, this six-year-long first crypto regulatory case that originated in 2018 is about to come to an end. There are also different opinions in the market about the future of Ripple and XRP.

Previously, Yoshitaka Kitao, CEO of SBI Holdings, a large Japanese financial services institution, wrote that once the SEC issue is resolved, Ripple should start preparing for an IPO as soon as possible. (Odaily Planet Daily Note: It is understood that SBI Holdings has been working with Ripple since 2017 to promote cross-border payment innovation. Kitao is a core figure in the Ripple-SBI cooperation and joined the Ripple board of directors in April 2019. His long-term support for Ripple and XRP can be traced back to 2017, when he predicted XRP as the global standard for digital currency, emphasizing its efficiency, low transaction costs and scalability.) Although similar proposals have been shelved by Ripple CEO Brad Garlinghouse before, it can also be seen as one of the possible future directions of Ripple.

After all, as the regulatory environment for cryptocurrencies improves further, more cryptocurrency concept stocks may be listed on the U.S. stock market. By then, Ripple and XRP may usher in another wave of development peaks.