Original|Odaily Planet Daily

Author: jk

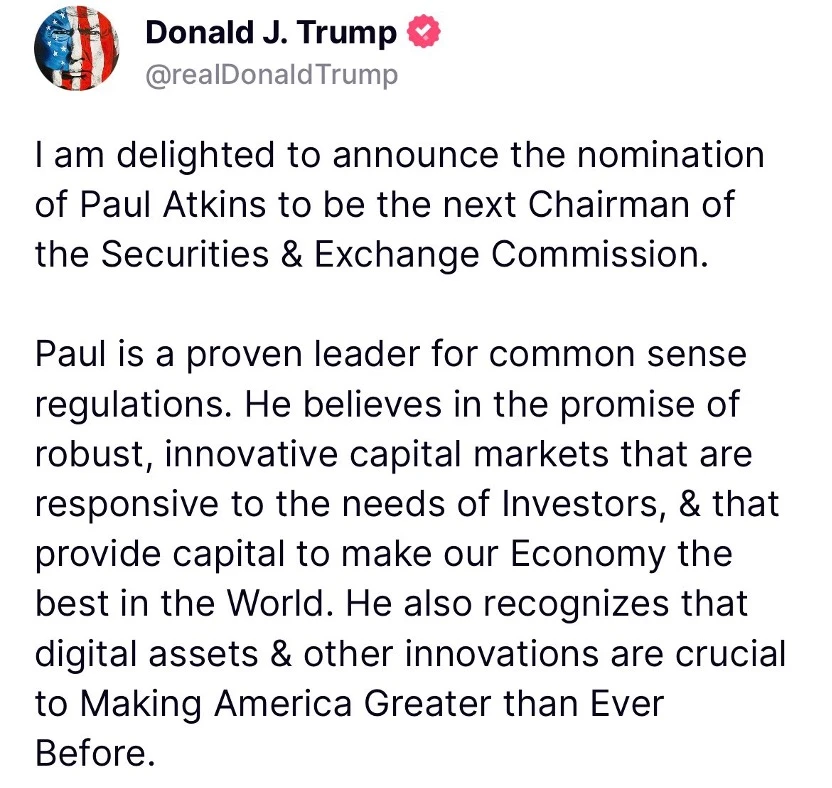

On Wednesday, December 4, local time in the United States, President-elect Trump announced that he had formally nominated cryptocurrency advocate and Patomak Partner CEO Paul Atkins as chairman of the Securities and Exchange Commission (SEC).

“Paul is a strong leader for common-sense regulation,” Trump posted on Truth Social. “He believes in strong, innovative capital markets that are responsive to investor needs and provide the capital that makes our economy the best in the world. He also recognizes that digital assets and other innovations are critical to making America greater than ever.”

Source: NBC Associated Press

Atkins served on a panel of economic advisers during Trumps first term that also included CEOs such as JPMorgan Chases Jamie Dimon, General Motors Mary Barra and Blackrocks Larry Fink.

After the news was released, Bitcoin surged. According to OKX, Bitcoin rose from around $95,000 to over $98,000, with the highest point approaching $98,950. Some data sites (such as Coingecko) showed that Bitcoin had risen above $99,000, aiming for a mid-term target of $100,000.

Why is this? It is because Paul Atkins is much more friendly to the crypto industry than the current chairman Gary Gensler. CNN directly declared, There is a lot to celebrate for the crypto industry. Lets start with his career resume.

Paul Atkins. Source: CNN

Career History

According to the official website of the SEC and Patomak Global Partners, Atkins resume is a typical example of someone leaving a US official agency and working as a senior executive in a corporate organization.

Atkins began his legal career at Davis Polk Wardwell in New York City, focusing on a variety of corporate transactions for U.S. and foreign clients, including public and private securities offerings and mergers and acquisitions. He spent two and a half years in the firms Paris office and was admitted to French law in 1988.

From 1990 to 1994, Atkins worked in the offices of two former SEC chairmen, Richard C. Breeden and Arthur Levitt. Under Breeden, he helped improve corporate governance regulations, enhance shareholder communications, strengthen management accountability through proxy reform, and reduce barriers to access to the capital markets for small and middle-market companies. Under Levitt, he was responsible for organizing the SECs individual investor programs, including the first investor town hall meeting and the SECs Consumer Affairs Advisory Committee.

According to his SEC profile, his most prominent case was Bennett Funding Group, Inc., a $1 billion rental company that ran the largest Ponzi scheme in U.S. history, causing more than 20,000 investors to lose most of their investments. Atkins assisted the company’s court-appointed bankruptcy trustee, serving as crisis president of Bennett’s only surviving subsidiary. By stabilizing its finances and operations, and rebuilding and expanding its business, he increased the stock price for remaining investors by nearly 2,000%. In a way, this is a president role similar to the one that turned the tide after the FTX bankruptcy.

Atkins was subsequently appointed by President Bush to serve as an SEC Commissioner from 2002 to 2008. From 2009 to 2010, he was appointed to the Congressional Oversight Panel for the Troubled Asset Relief Program.

From 2012 to 2015, he served as an independent director and non-executive chairman of the board of directors of BATS Global Markets, Inc., a leading operator of U.S. and European securities markets for listed cash equities and equity options (now acquired by CBOE).

Atkins has been involved in the digital currency space since 2017: he serves as co-chair of the Token Alliance, leading industry efforts to develop best practices for digital asset issuance and trading platforms.

Encryption policy and friendliness

Following the previous part, he has served as co-chairman of Token Alliance since 2017. From the official website, we can see that Token Alliance is an industry initiative led by the Association for Digital Commerce, which aims to become a key resource for tokenized networks and applications. The alliance is composed of more than 400 industry thought leaders, technical experts and innovators. Token Alliance has developed a series of tools and resources for industry and policymakers to make informed decisions when participating in the token economy.

He has spoken less directly about the crypto industry. However, according to the Associated Press, during his time at the Token Alliance, Atkins helped develop a set of practical plans for crypto regulation. If confirmed as SEC chairman, he is widely seen as taking a more relaxed regulatory approach, especially compared to Gary Genslers previous approach.

Meanwhile, his current company, Patomak, serves as a financial advisory firm that actually serves crypto-related clients, including exchanges and companies looking to integrate digital currencies into their businesses.

Patrick McHenry, a Republican congressman from North Carolina, said Atkins has the experience to “restore trust in the SEC.” On X, he wrote: “I am confident his leadership will bring clarity to the digital asset ecosystem and ensure that the U.S. capital markets remain a focal point for the world.”

Hester Pierce, a crypto mom who is extremely friendly to the crypto industry and is also a SEC commissioner, tweeted on the X platform: “We have a lot of work to do at the Securities and Exchange Commission (SEC) to promote free markets, capital formation, investor choice, and innovation. I am very pleased that Paul Atkins will return to lead this work. I worked for him during his last tenure at the agency, and I can’t imagine a better choice than him.”