Original translation: Nancy, PANews

Recently, the Ethereum L2 Movement based on the Move language has set off an airdrop craze. While achieving the Grand Slam of exchange listings, it has also entered the FDV 10 billion club. In this context, the investment institution Primitive Ventures published an article to share its investment story in Movement. The founding partner of the institution, Dovey Wan, is one of the investors in Movements Series A financing.

Looking back to 2023, the Primitive Ventures team initially decided to abandon its investment in Movement, but this decision was eventually rejected by Dovey Wan, prompting the team to re-examine the project. Today, $MOVE is officially launched - this is undoubtedly an epic story about how a non-consensus and contrarian investment decision eventually became the protagonist of the industry. Whats even more surprising is that all of this was created by two college dropouts. This article will share in depth the struggles and reflections of Primitive Ventures in investment decisions, as well as the growth and transformation of Movement in the past 20 months.

veto

Initially, Movement was just a decentralized application (dApp) based on Aptos, but after the Aptos ecosystem encountered liquidity difficulties last year, the team decided to move to other platforms. Movement’s vision was to overcome the limitations of the Move ecosystem and build a bridge between Move and EVM, but at the time, this market was too niche and challenging, especially considering the limited resources of the team and the fact that the members were two college dropouts.

While Primitive Ventures has been supporting alternative virtual machine (VM) narratives and young entrepreneurs, it was hard to imagine how Movement could compete with Sui and Aptos, which have strong resource backing. These two projects are well-funded, well-connected, and hailed as the aristocrats of the Move ecosystem. In comparison, Movement seemed to have little prospects, so Primitive Ventures initially passed on the investment.

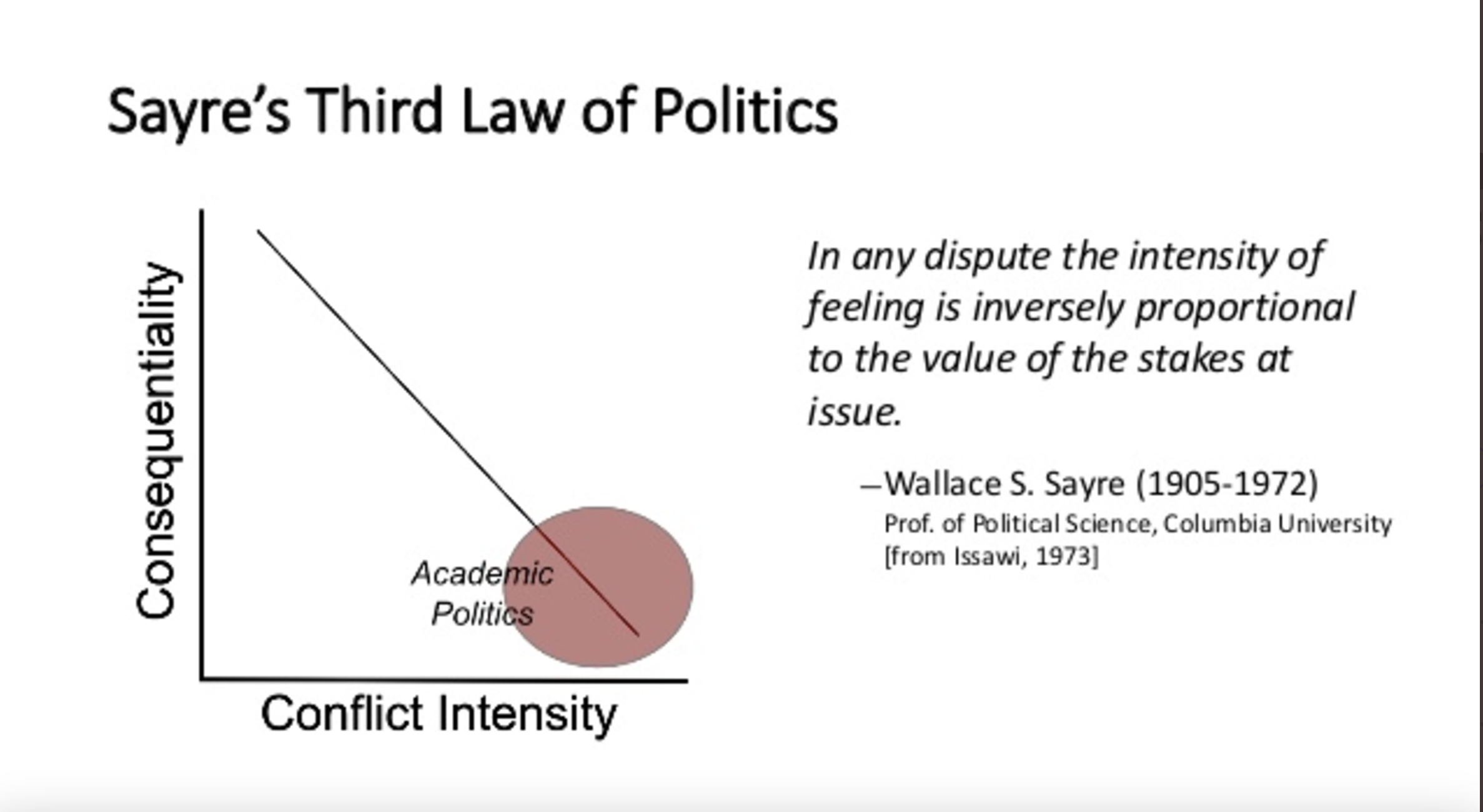

The crypto industry’s approach to infrastructure investment has long favored the principle of “super brains” supremacy, focusing too much on minor technological advances while ignoring the critical human factors that ultimately drive success. This pattern is not new—Sayre’s Third Law of Politics once stated: “Academic politics is so vicious because the stakes are so small.” This law perfectly explains the endless debates between “super brain researchers” and the intense but often counterproductive dynamics in intellectual-led projects.

However, after several in-depth exchanges with Rushi, Dovey proposed a completely new perspective: a people-oriented investment philosophy. The success of a project depends not only on a group of super brains, but on those who can transcend the technical echo chamber, unite the community, motivate developers, and build a sustainable ecosystem. As the industry matures, real entrepreneurs will be increasingly rewarded, rather than those who are pure idealists and crypto geeks, which has been seen in the resurgence of Hyperliquid, Ethena, and Solana in this cycle.

In addition to demonstrating its technical advantages, adopting a new programming language is more about building a sense of identity among developers. This is not just a technical breakthrough, but also requires a clear distribution strategy and identity fit with developers. More importantly, there must be a charismatic leader who can inspire the next generation of developers, especially those beyond the traditional crypto-native group, to embrace this language and its ecosystem.

This is what makes Movement and Rushi unique. As an independent third party, Movement has the potential to fill this gap. Rushis story as a founder shows tenacity, ambition, independence from established paths, and unremitting struggle, which give him unique founder characteristics and make him a dark horse worth betting on. From this perspective, Dovey reversed the initial decision, the team decided to firmly support Rushi, and what happened next, as they say, has become crypto industry history.

Why Move?

Infrastructure fatigue does exist, but it is important to distinguish between what works to advance the industry and what works to be a minor optimization. The industry often gets caught up in pseudo-intellectual micro-optimization debates, but the real power of blockchain lies in ongoing experiments in human coordination and capital formation.

Currently, the security of smart contracts is one of the main obstacles hindering such experimentation. Billions of dollars are lost each year due to exploits, making the cost of maintaining on-chain security far greater than the benefits, thus hindering true mainstream adoption.

This is where the Move programming language comes in. Pioneered by the crypto team at Meta (formerly Facebook), the Move language fundamentally rethinks how to write secure, modular, and verifiable smart contracts. In short, the Move programming language aims to provide developers and application builders with an overall better programming language. As detailed in the Movement Labs documentation, Move aims to provide developers with a safer and more predictable development environment, greatly reducing the risk of catastrophic vulnerabilities.

Essentially, Move prioritizes correctness and safety in its programming language design. The result of this design is an optimized development environment that protects developers and users while helping to drive experimentation without exposing the community to constant risk.

Thanks to the early work of the Aptos and Sui teams — projects started by the same engineers and architects who originally developed Move at Meta — Move now has a real track record. Aptos and Sui have proven that blockchain platforms based on Move can deliver strong performance and the security they promise.

Why $MOVE?

Despite some progress in development on Move, there are still gaps. As projects with aristocratic pedigree, Sui and Aptos have abundant resources to support them, but they have not been able to fully realize their potential in developer adoption (at least when the team invested in Movement). These two protocols have received a lot of funding since 2023, but have failed to break through the market cycle and gain real market traction. Whether due to misaligned priorities or inefficiencies caused by inertia, their efforts have failed to make substantial breakthroughs in building grassroots communities and developer ecosystems.

As mentioned earlier, the adoption of a new programming language depends not only on its technical merits, but also on building a sense of identity among developers. With the resilience and execution shown by the founding team, Movement Labs is the ideal team to promote the Move language. In just 18 months, the Movement Labs team has made remarkable progress:

· $45 million in private equity funding

60 applications running on the testnet

More than 2,000 hackathon participants

$150 million TVL commitment

1 million active addresses

52 active Movement communities in various regions

Movement Labs vision is to create a more secure and scalable future for the crypto world, extending the benefits of the Move programming language to the broader crypto ecosystem.

Ethereum L2 based on Move language: This solution combines the security and efficiency of Move language with the world’s largest smart contract ecosystem (Ethereum), allowing developers to enjoy the advantages of both development environments at the same time.

· Fractal: Ethereum Virtual Machine (EVM) interpreter. To address developer experience and cross-chain integration, the Movement Labs team launched Fractal, which allows developers to convert Solidity code bases to a Move-based environment.

Community-driven participation: Recognizing that technology adoption relies on social norms, the Movement Labs team invests a lot of resources in developer education, community engagement, hackathons and other grassroots activities. Instead of imposing a top-down vision, they invite the community to participate and create an environment conducive to development.

Why Rushi?

The crypto market has gradually deviated from its original cyberpunk spirit and has become more and more like a game dominated by the privileged and elite. In the core values of the Primitive Ventures team, we always adhere to the concept of substance over identity - giving priority to meaningful growth potential rather than superficial pedigree or background investment.

Over the years, Primitive Ventures has consistently supported anonymous founders and entrepreneurs in adversity, and exposed the hypocrisy of self-proclaimed elites. This belief has given us a deep empathy for founders who lack resources but go further through resilience and perseverance.

In the spirit of the Roman Empire, the Movement Labs team seeks to build an ecosystem from scratch - an inclusive, resilient and meritocratic ecosystem. Just as ancient Rome was a city built by people from all walks of life - welcoming not only the elites but also outsiders, exiles, refugees and people from lower social classes. Movement Labs is creating a place for these homeless developers. Their strategy is to provide a supportive environment for talented developers who lack high-end resources or connections, ensuring that innovation is driven by ability, not privilege.

In this market cycle, we have seen a decisive shift in the founder group: those who deeply understand global communities and culture are becoming the dominant force - this is also an important reason why we invested in Movement and Berachain, and even Solanas revival is due to the cooperation between the East and the West. As second-generation Indian founders, Rushi and Smokey bring a fresh perspective, combining Eastern philosophy with Western expertise in technology and capital markets.

Their true qualities stand out: humility, openness, rapid iteration, and no interest in politics or ranking games. For example, Rushi still lives in a small rented house and promises to do his laundry only after the chaos of the Movement TGE (token generation event) wartime is over (as shown below). This unadorned resilience embodies the spirit of the new generation of builders.

When the Movement testnet launched, it sparked widespread criticism for its task design, with many users complaining on Twitter about the heavy task burden. The team’s response was a model of transparency. Within 10 minutes of receiving feedback, Rushi launched a livestream to directly address community concerns. He issued a detailed written clarification within an hour, ensuring community members felt their voices were heard and valued.

Rarely have we come across a team that is so responsive to criticism and always grounded. Rushi’s leadership is marked by honesty and directness, qualities that come from his background. He is very willing to engage with the community in real time, attending over 50 different sessions during the conference to understand grassroots sentiments and developer struggles, and inspiring many of his peers.

You know, building an ecosystem requires a lot of coordination and trust, and Rushi, as a first-time startup founder, is particularly good at building meaningful relationships. In early 2023, when GMX core contributor Coinflip introduced Movement to Primitive Ventures, the team was moved by Rushis unwavering support. Despite the age difference of more than 20 years between the two, Coinflips pride in Rushis growth is obvious, which also proves that Rushi can build deep trust across generations.

Some people might think that being “community-driven” and raising millions of dollars in private rounds are mutually exclusive. But is that really the case? The ultimate goal of private investors and the community is the same: the success of the project and the positive impact it brings.

The essence of venture capital is to support bold contrarian investments: supporting ideas and founders when no one else dares to take risks. This is the true spirit of venture capital.

We share this view, even though Primitive Ventures doesn’t follow the typical VC playbook and doesn’t rely on outside capital like most VCs do. Since Primitive Ventures is 100% self-funded, every investment is a true venture investment. This shared commitment connects us closely with early community members who also believe in the potential of the project.

What people really dislike is not venture capital investment itself, but circle culture, sense of privilege, family background games, hypocrisy and politics. When projects put financing milestones above actual results and real community participation, and even openly devalue others as electronic beggars, this behavior that deviates from the original cypherpunk spirit and financial populism will eventually lead to failure.

Under the leadership of Rushi and Coop, Movement Labs has demonstrated that these forces can be aligned. By prioritizing transparency, humility, and execution, they have shown how to build a project that is enduring and true to the values of the community.

South Korean Markets and Financial Populism

Tokens are a financialized belief system where market dynamics, human nature, and social psychology are key drivers of growth and adoption. The interplay of these elements creates a unique interaction between financial incentives and community engagement, shaping how products resonate with their target audiences. For crypto founders, entrepreneurship is a multi-dimensional challenge that requires mastering capital markets, cultural development, and technological adaptation.

The Korean market is a classic example of financial populism in action. In our in-depth analysis of the Korean market, we explored the country’s huge wealth gap, coupled with strong social and peer pressure, which has not only given rise to the world’s lowest birth rate, but also fostered a loyal fan culture - willing to YOLO (You Only Live Once) to invest in projects that resonate with them, both spiritually and financially. If founders can invest time in building local connections, cultivating local heroes and maintaining a continuous presence, they can cultivate a strong fan base.

The Movement Labs team deeply understands these unique market characteristics and has adapted their strategy accordingly. They have demonstrated a deep commitment to the Korean market by organizing local developer workshops, setting up local community centers and hotlines, and becoming a major sponsor of Korea Blockchain Week. This hands-on approach has earned them a reputation as being highly in tune with the region’s cultural and economic nuances.

The last international project to penetrate the Korean market and conduct grassroots outreach before its official launch was Cosmos, but after the Terra crash, the market left a gap for a new generation of crypto leaders to emerge. Movement Labs is ready to fill that gap.

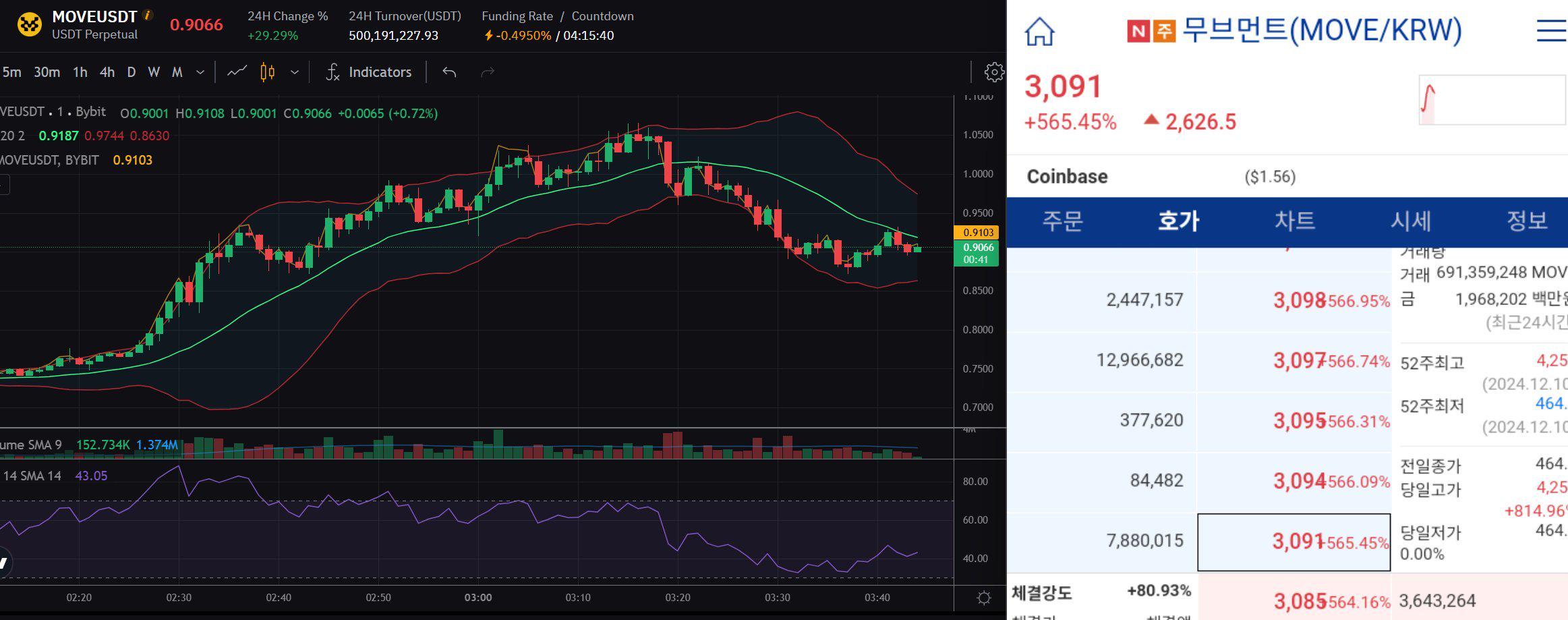

The results speak for themselves: $MOVE TGE was the hottest event in the Korean crypto market this year. On the first day of TGE, $MOVE’s premium on the local CEX in Korea soared to 100%, Upbit’s price trend significantly outperformed Binance, and $MOVE’s trading volume became the highest trading pair of the year. TGE and price trend are the most powerful marketing strategies for any project, and $MOVE successfully conquered the Korean market with strong momentum.

MOVE premium on South Korea CEX (Source: @kysmeplzz)

If Move represents the next evolutionary leap for smart contracts, then Movement Labs is undoubtedly the driving force behind ensuring that potential is realized - a potential that is not limited by geography or demographics, but seamlessly integrated into the global crypto ecosystem. In the spirit of the Roman Empire, Movement Labs is building a digital global city that welcomes everyone: developers, users, and communities from all corners of the global crypto space. This city thrives on cohesion, transcending age, race, language, nationality, and creed to unite people in pursuit of a common vision of innovation and inclusion.

As Rushi said at TGE night: “The work has just begun.” Welcome to the Movement.