Original author: BitMEX

Quick Facts

Bitcoin experienced a major liquidation event on Wednesday, with the price falling below $95,000 before rebounding strongly to a record high closing price. The market quickly recovered as favorable CPI data supported expectations of a rate cut in December. DeFi tokens led the gains, with $HYPE, $LINK and $AAVE performing well, while ETH approached $4,000 driven by strong ETF inflows.

Last weeks rebound of Dinosaur Coin $EOS did serve as a peak signal, and this week there was a significant pullback.

In the Trading Strategies section, we will take a deep dive into the potential of AI agents and AI memecoins and analyze why they may become one of the biggest trading opportunities in this market cycle.

Data Overview

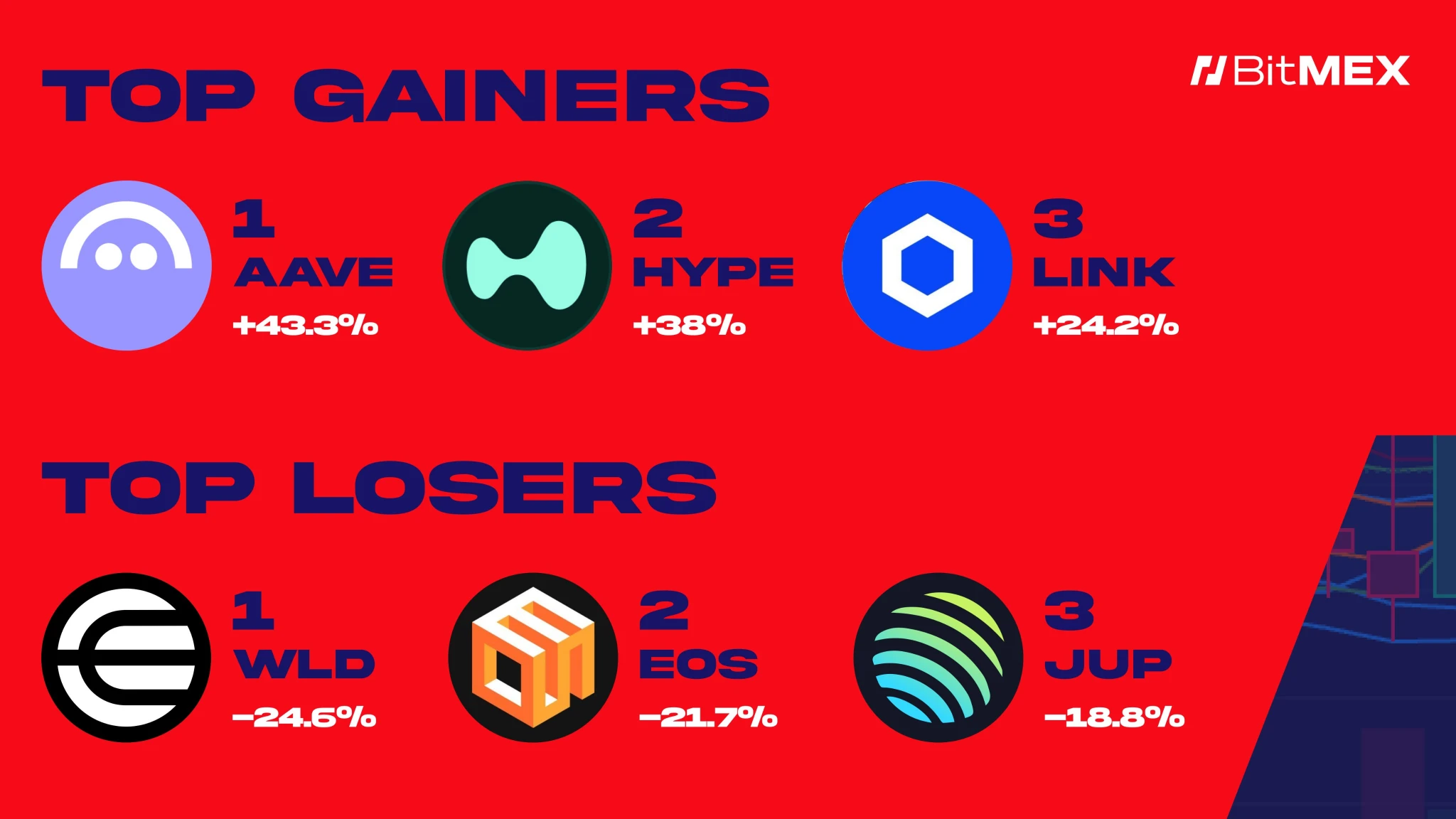

Best performers of the week

$AAVE (+43.3%): Massive price increase driven by news that Trump-backed DeFI projects bought $AAVE

$HYPE (+38%): Price surged nearly 5x in two weeks after the Token Generation Event (TGE), hitting a new all-time high

$LINK (+24.2%): Along with AAVE, it benefits from Trump’s DeFi investment plan

Worst performer of the week

$WLD (-24.6%) : Worldcoin saw a sharp drop this week, as AI narratives were sucked away by new AI agent tokens

$EOS (-21.7%): As expected, a significant pullback after a typical pump and dump pattern

$JUP (-18.8%) : Jupiter token continues to weaken

This weeks news

Macro dynamics

ETH ETF weekly inflows: +$831 million ( source )

BTC ETF weekly inflows: +$1.74 billion ( source )

Microsoft shareholders reject proposal to include Bitcoin in reserves ( source )

Eric Trump predicts Bitcoin will reach $1 million ( source )

El Salvador and Argentina regulators sign agreement to jointly promote crypto industry development ( source )

Marathon Digital spends $1.1 billion to buy Bitcoin ( source )

El Salvador to amend Bitcoin law to comply with new IMF agreement ( source )

Russian lawmakers propose creating a strategic Bitcoin reserve ( source )

MicroStrategy faces the risk of being delisted from Nasdaq in March next year ( source )

Project Progress

SEC rejects two SOL ETF applications ( source )

Floki partners with Mastercard to launch debit card in Europe supporting 13 cryptocurrencies ( source )

DWF Labs announces $20 million AI agent development fund ( source )

$PNUT will be listed on Coinbase, the price of the currency soared by more than 20% ( source )

Trump-backed World Liberty Financial is converting stablecoins to $ETH, $LINK, and $AAVE ( source )

$GOAT obtains OKX spot listing qualification ( source )

Trading ideas

Disclaimer: The following content is for reference only and does not constitute investment advice. This is a summary of market news and it is recommended that you do your own research before making any transactions. We are not responsible for any transaction results and do not guarantee returns.

Why AI Agent/AI Meme Coin May Become the Biggest Opportunity in This Bull Market

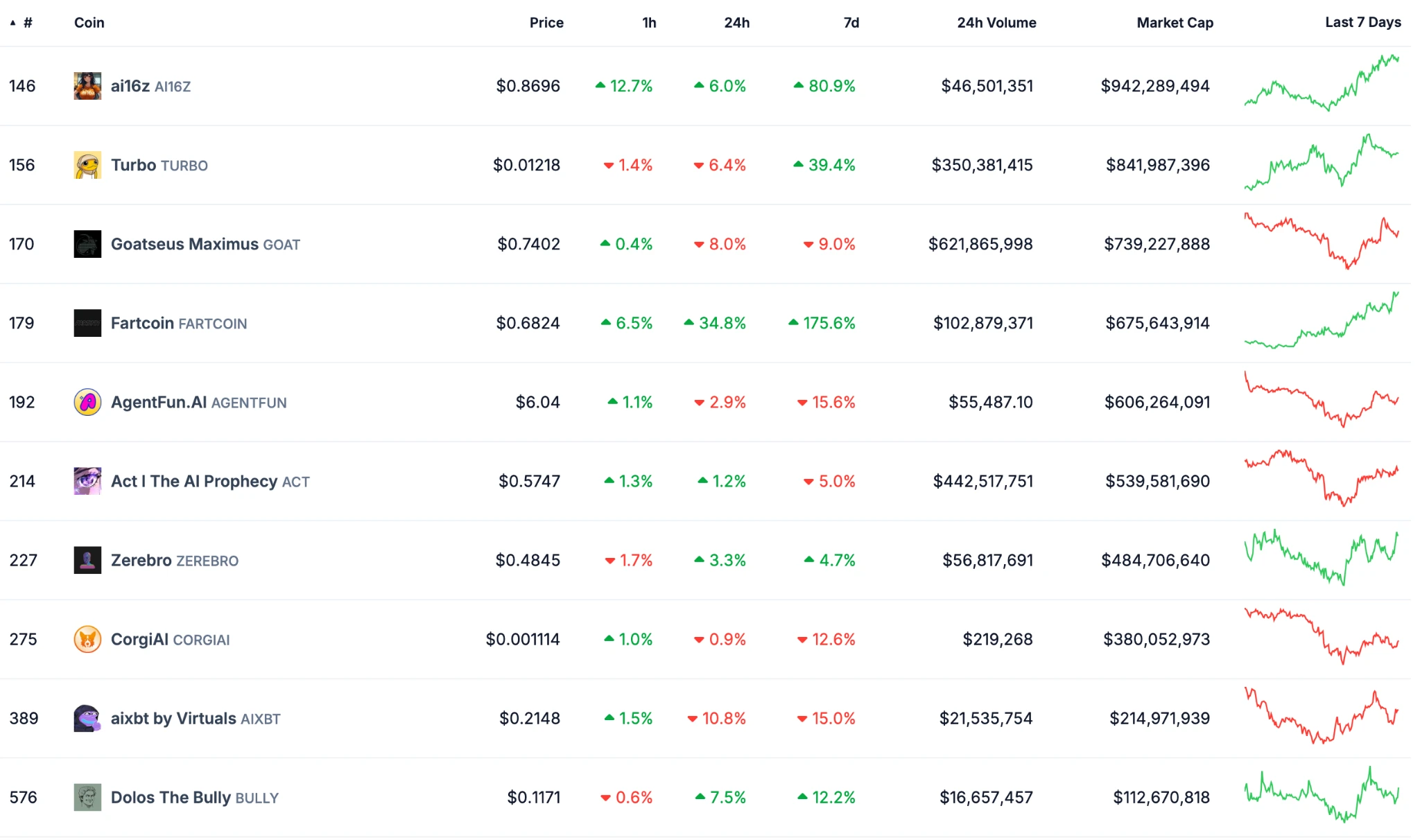

Total market capitalization of top 10 AI Agents/memecoins: $4.9 billion

Ethereum Classic ($ETC) Market Cap: $5 billion

Is that obvious enough?

Recently, the popularity of AI agents and AI-related meme coins has continued to rise. Despite the astonishing growth, the total market value of the top ten AI agents and meme coins is still relatively low, less than $5 billion - even lower than zombie projects such as Ethereum Classic ($5 billion) or Bitcoin Cash ($10 billion). This valuation gap is presenting a unique investment opportunity.

The rise of a new paradigm

AI agents are more than just new asset types; they may represent a fundamental shift in the crypto ecosystem. If we compare it to the DeFi summer of 2020, when lending markets and liquidity protocols revolutionized the cryptocurrency space, AI agents may usher in a greater wave of innovation in token systems, infrastructure, and applications.

The DeFi craze has proven that a new narrative can create huge value, bringing hundreds of billions of dollars in total locked-in volume and a thriving exchange ecosystem. The potential of AI agents may be even greater, with a market size estimated to reach $200-500 billion. Instead of waiting for DeFi 2.0, investors may consider planning ahead for the upcoming AI agent summer.

Initial chaos heralds opportunity

The current AI agent ecosystem includes:

Competing memecoins ($GOAT, $FARTCOIN, $ACT) vie for market attention

Framework projects ($VIRTUAL, $AI16Z) are developing standards

Infrastructure projects ($VVAIFU, $GRIFFAIN) build underlying tools

Professional AI agents ($AIXBT, $AVA, $BULLY) explore application scenarios

This apparent chaos is similar to the early DeFi era, before Ethereum became a unified infrastructure. The current lack of infrastructure suggests greater room for innovation and value creation.

Investment Strategy

While the prospects are exciting, selective investing is critical. It is recommended to focus on both established meme tokens and infrastructure projects with solid fundamentals. For example, $GOAT may drive mass adoption like $DOGE, while technology platforms like $ELIZA may become critical infrastructure.

Focus on projects that build core infrastructure - asset issuance, custody solutions, and trading mechanisms. Look for platforms that combine AI capabilities with crypto-native features and secure key management.

The next phase of development may integrate AI agents with on-chain activities such as trading and governance. Projects that provide interoperability standards and professional data solutions may become central to this narrative.

Future Outlook

Existing crypto infrastructure may find new value by adapting to the needs of AI agents. While not all projects will succeed, those that effectively embrace this shift will reap significant gains in this emerging market.

The AI Agent Summer could become a significant milestone in the history of cryptocurrency. Success will go to those players who focus on infrastructure, understand the direction of the narrative, and maintain a balanced perspective. While uncertainty requires caution, missing out on this potential paradigm shift could mean missing out on a historic opportunity.

It is recommended to consider positioning for the growth of the AI agent sector - this could be the next big catalyst for the crypto market.