Original author: BitMEX

Brief Overview

There are only T-3 days left until Trumps inauguration. The CPI data was in line with expectations and boosted the overall market sentiment, while Trumps inauguration day led to a rise in US-based crypto projects and Bitcoin.

This week continued to be dominated by US-backed cryptocurrencies and AI-related tokens, with XRP and FARTCOIN both hitting all-time highs.

In our Trading Alpha section, we will focus on $USUAL and explore whether it is worth considering trading $USUAL by analyzing the risks and potential of USD 0++.

Data Overview

Best Performer

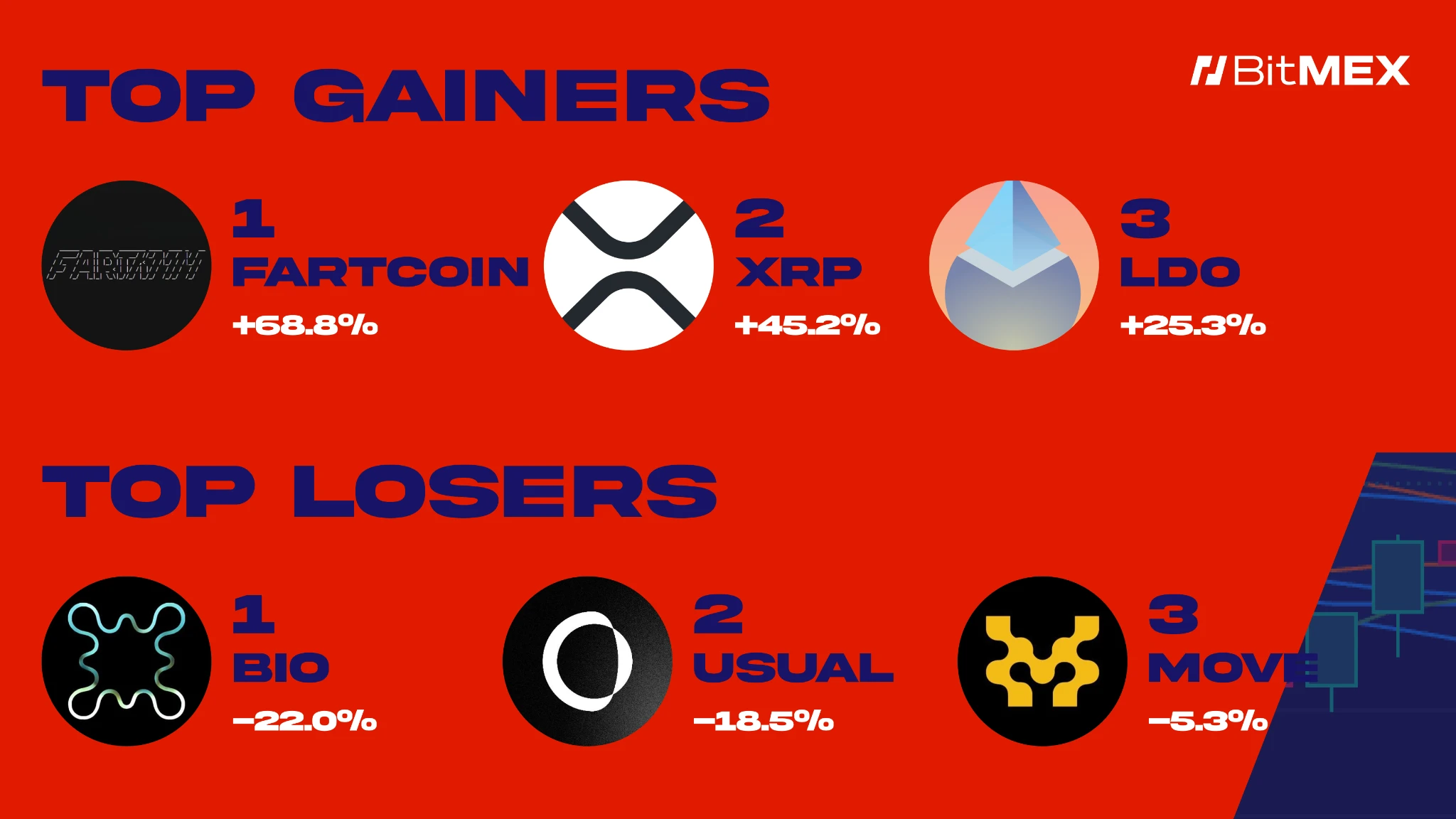

$FARTCOIN (+68.8%): FARTCOIN has shown strong resilience, with a market value approaching $1.5 billion even though no major spot exchanges (CEX) have launched it yet.

$XRP (+45.2%): As the largest US-backed cryptocurrency, XRP continues to rise against the trend, defying many doubts.

$LDO (+25.3%): LDO reached its highest level in the past 6 months and is approaching a potential breakout range.

Worst performance

$BIO (-22.0%): While traders are paying more attention to AI agents and US-based cryptocurrencies, the popularity of “decentralized science (DeSci)” has declined.

$USUAL (-18.5%): The Usual protocol faces uncertainty due to the depegging of its USD 0++ token (often misunderstood as a stablecoin), sparking community concerns.

$MOVE (-5.3%): MOVE is consolidating near key support levels.

News

Macro:

ETH ETF weekly outflows: $76.9 million ( source )

BTC ETF weekly inflows: +$359.4 million ( source )

Unexpected decline in core CPI drives Bitcoin price higher ( source )

Bitcoins Coinbase Premium Reaction Muted as Trump Allegedly Plans to Make Cryptocurrency a National Policy ( Source )

The last major SEC legal official leaves, leaving a clean slate for the Trump era ( Source )

Lummis, a crypto supporter in the U.S. Senate, urges federal agencies to take action on digital assets ( source )

If similar to the Bitcoin ETF is adopted, the Litecoin ETF may attract up to $580 million in inflows ( source )

Trump’s nominee for Treasury Secretary, Bessent, opposes the idea of launching a U.S. central bank digital currency (CBDC) ( Source )

Malaysia is considering introducing legislation related to cryptocurrency and blockchain ( source )

Project Trends

XRP’s bullish momentum is strongest since January 2018 ( Source )

Sonys blockchain launch sparks controversy ( source )

Indian telecom giant Jio has partnered with Polygon to bring Web3 services to more than 450 million users ( Source )

MoonPay acquires crypto payment processor Helio for $175 million ( Source )

Azuki announces launch of native ANIME token ( source )

Singapore blocks access to Polymarket, following similar measures taken by Taiwan and France ( Source )

The decoupling of the Usual protocol caused turmoil in the DeFi market ( source )

Trading Alpha

NOTE: The following does not constitute financial advice. This is a compilation of market news and we always encourage you to do your own research before executing any trades. The following is not meant to express any guaranteed returns and BitMEX cannot be held responsible if your trades do not perform as expected.

Panic about USD 0++: Analyzing the risks and potential of $USUAL

I. USD 0++——Another DeFi storm

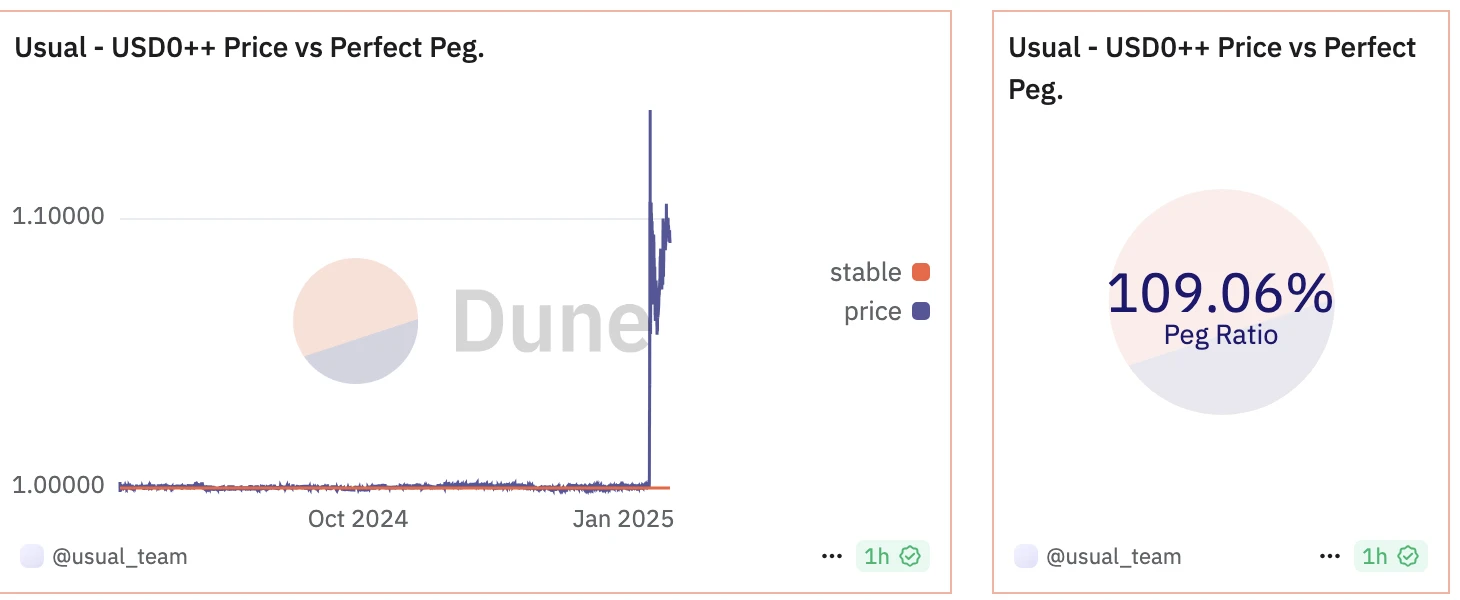

Usual, a DeFi project, has recently stirred up a lot of FUD (fear, uncertainty and doubt) for its USD 0 and USD 0++ products. On the surface, USD 0++ looks like an ordinary stablecoin; but if you look deeper, you will find that it is a token that borrows the concept of zero-coupon bonds, and this design has caused huge waves in the market.

The controversy is that Usual marketed USD 0++ as a stablecoin without clearly explaining its design principles. As a result, many retail investors mistook it for a common 1:1 anchored asset; until the project announced the real mechanism - the reserve redemption price was $0.87, USD 0++ quickly fell from $1 to the $0.90 to $0.95 range.

What’s worse is that the positions using high leverage in the DeFi lending protocol at the time were forcibly liquidated. Investors who bought after the listing of Binance at USD 0++ and originally expected high returns have now seen their returns cut in half. One can imagine how disappointed they are.

II. Why is USD 0++ locked for four years?

You may be curious: Why does it have to be locked for four years? Why not maintain a 1:1 peg like most stablecoins?

This is where it shines: USD 0++ is inspired by zero-coupon bonds, and aims to generate long-term, stable returns from real-world assets (RWA). The four-year lockup ensures a steady flow of funds into the protocol, providing a collateral and reward mechanism for $USUAL holders.

Without this lock-up design, Usual would not be able to provide value support for $USUAL from long-term returns. In short, USD 0++ holders are actually helping Usual to make profits through RWA in exchange for $USUAL tokens.

The project hopes that by locking up for four years, it will be able to incentivize stakers to hold long-term, keep pace with the growth of the protocol, and return real value to the Usual ecosystem. However, the markets focus is still more on short-term profits, which has led many to question whether Usual can truly achieve its grand goal.

III. RWA Revenue — Usual’s Value Prop

Lets turn our attention to the positive side: Usuals RWA strategy may provide real value to the project. Usual can earn about 4% per year through investment in real-world assets. This number does not sound particularly high, but considering that the Usual fund pool is about $1.5 billion, it is still considerable after scale. If 40% of the funds are staked, it can bring up to $60 million in revenue per year.

What is even more attractive is that the staking mechanism backed by RWA can also maintain a certain stability when the market is down, which is also the main difference between Usual and those DeFi protocols that rely heavily on token price fluctuations. In theory, as long as Usuals staking model can maintain operation, the project is likely to bring relatively stable returns to investors when the market falls.

IV. Beyond FUD — Is there a promising future for $USUAL?

Despite the current controversy, Usuals long-term prospects are still promising. Here are the main reasons:

1. RWA income support: Based on RWAs 4% annualized return, it may not seem high, but if the fund size reaches $1.5 billion, the annualized income can reach about $60 million, which becomes a solid foundation. If the projects token economic model (tokenomics) is well designed, as long as the staking mechanism remains stable, it is still possible to bring good returns.

2. DeFi demand: If the Usual ecosystem can continue to expand, especially in exchanges or other DeFi use cases, such as using USD 0 as collateral for futures or margin, demand may rise rapidly. This will provide strong support for the price of the token.

3. ve(3, 3) model: Usual may introduce the ve(3, 3) model to bring governance rights to token holders and incentivize long-term lock-up. This may attract stablecoin issuers and other DeFi projects to compete to buy $USUAL, thereby further increasing its value.

4. Expansion in the payment field: Usual plans to make USD 0 a payment tool and is even developing a dedicated payment chain to give it a “fuel” value similar to ETH or BNB, thus occupying a place in the payment field.

V. Core risks - be aware of

Before investing, the following key risks should not be ignored:

1. Market volatility risk: Although Usual has a certain degree of defense by adopting the RWA staking model, the project still needs to rely on the prices of underlying assets and tokens. Once the underlying assets depreciate significantly, its income will also decline simultaneously.

2. Regulatory pressure: As the regulatory environment for stablecoins and DeFi continues to change, Usual may also face compliance pressure, especially when its nature is regarded as a stablecoin, it may encounter relevant scrutiny. This is a major uncertainty for any DeFi project.

3. Team execution: The success of a project depends on whether the team can implement the roadmap. The negative sentiment and questions about transparency surrounding the project are real - if the subsequent performance is poor, the markets trust in it will drop rapidly.

VI. Conclusion — Should I Trade $USUAL?

Currently, Usual is at a critical moment. Its new attempt at stablecoins - combining RWA endorsement with a long-term lock-up mechanism - may indeed bring considerable potential, but the recent turmoil has also hit the confidence of many people.

Due to its high token inflation (large-scale issuance) and staking income, $USUAL may still be an interesting trading opportunity in the short term. If the team can manage the ecosystem and effectively resolve FUD, the project may still be able to achieve further expansion. However, given the current market environment and internal challenges, any mistakes may have a significant impact on its progress, so be cautious.