Original article: Presto Research

Compiled by: Yuliya, PANews

The cryptocurrency market showed obvious differentiation in 2024. Data showed that Meme coins led the rise, VC-backed tokens were generally under pressure, and RWA tokenization became a new focus of the market, with a significant increase in transaction volume. The market structure continued to evolve, high FDV and low circulation tokens performed weakly, and institutional demand for Bitcoin allocation increased. These trends deserve continued attention in the new market cycle.

Looking ahead to 2025, with the improvement of infrastructure and clearer supervision, the crypto asset market will enter a new stage. Bitcoins value storage function, competition in the public chain ecosystem, and innovative applications such as DEX and NFT may become new growth drivers for the market.

Against this backdrop, Presto Research has released its first annual report, providing a comprehensive review of key market trends and forward-looking forecasts to 2025.

Key predictions for 2025 include:

Bitcoin price reaches $210,000

Total cryptocurrency market cap expands to $7.5 trillion

ETH/BTC Ratio Rebounds to 0.05 as Ethereum Addresses UX Issues

Solana breaks $1,000

Stablecoin market cap reaches $300 billion

DEX trading volume exceeds 20% of CEX trading volume

The new EVM Layer 1 public chain has a market value of $20 billion and a total locked value (TVL) of $10 billion

A sovereign nation or SP 500 company adds Bitcoin to its treasury reserves

Crypto Hedge Funds Outperform Crypto VCs

….

2024 Review

Best and Worst Performing Tokens Analysis

In a well-functioning market, asset prices reflect the wisdom of the crowd, forming dynamic signals that reflect market narratives, themes, and trends. Therefore, reviewing the best and worst performers in a thriving market is an effective way to reflect on the past. The following is a detailed analysis of this aspect.

Regarding the research methods, the following points need to be explained:

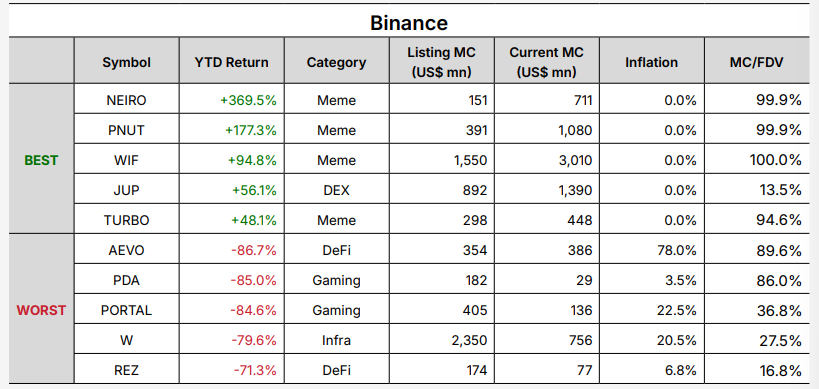

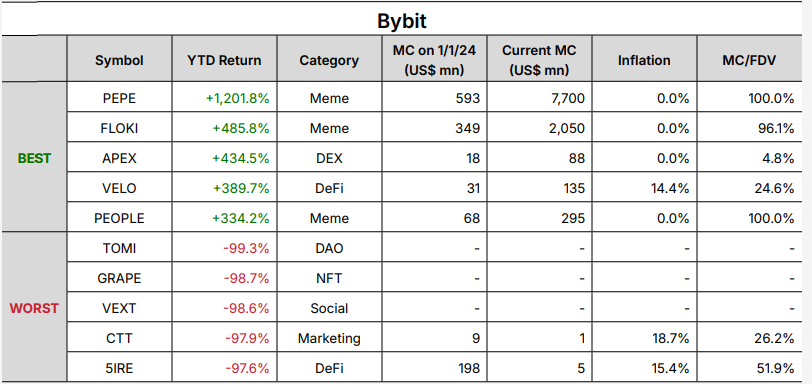

First, the analysis is limited to the three major centralized exchanges: Binance, Bybit, and OKX.

Secondly, the analysis objects are further subdivided into two categories: newly listed projects (listed in 2024) and existing projects (listed in 2023 or earlier).

Third, from each of the six subcategories, the five best and worst performing projects were selected.

It is worth noting that this analysis method may not fully reflect the trends of mainstream assets such as Bitcoin or Ethereum, as small-cap assets tend to show more extreme fluctuations. Instead, this analysis aims to uncover industry themes or individual projects that may have been overlooked.

Based on the above description, the research findings point to three key trends:

VC-backed tokens underperform

Meme coin craze continues

Real World Asset (RWA) Tokenization Has Gained Attention

The rise of decentralized exchanges (DEX)

Top 5 New Listings in 2024 (as of November 29)

Top 5 existing projects in 2024 (as of November 29)

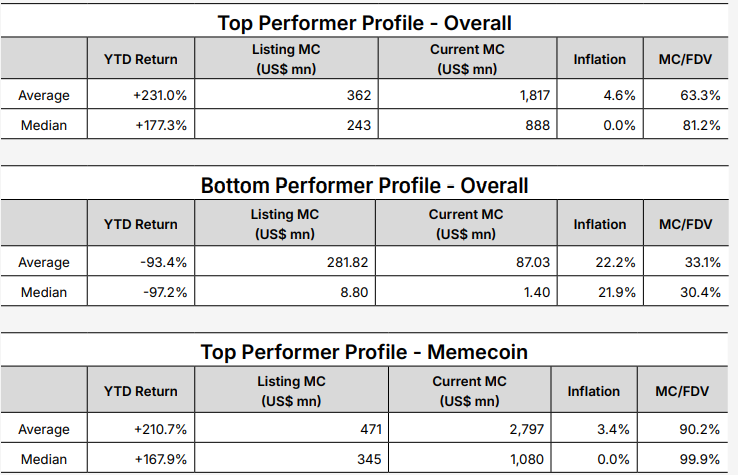

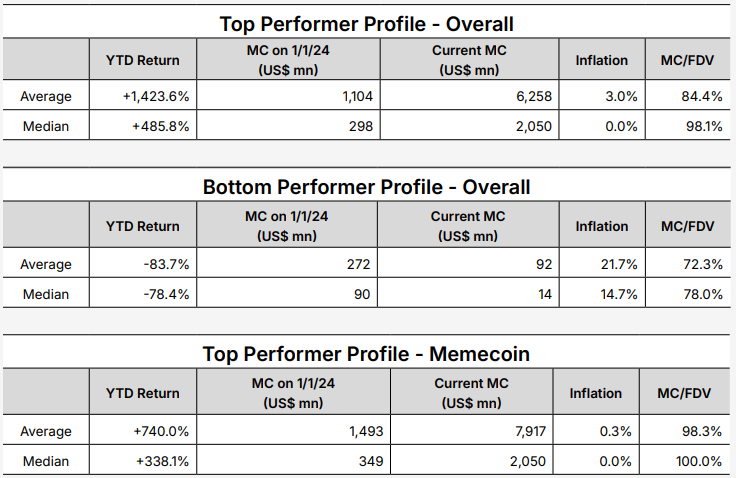

“VC coins” (low circulation/high FDV) underperform

Market data shows that poorly performing projects generally have two characteristics:

1. High inflation rate

New projects: median 22%

Existing projects: median 15%

2. Low circulation rate

New projects: median only 30%

Existing projects: median 78%

This trend has become a unique phenomenon in the cryptocurrency market in 2024. Although the negative impact of large-scale token unlocking has always been seen as a risk factor, this year it has become the dominant narrative, and exchanges, project owners, and investors are highly vigilant about it.

From the perspective of market development, this change reflects that the crypto market is gradually maturing:

New tokens are no longer popular among retail investors just by flashy packaging or endorsement from well-known VCs

The effectiveness of the strategy of using information asymmetry to use retail investors as a CEX exit channel is gradually declining

The short-term arbitrage model used by some VCs is difficult to sustain

Meme coin craze

Retail investors generally believe that VC coins are unfair, so a large amount of funds began to turn to the Meme coin market. This trend directly promoted the significant growth of the Meme coin sector, and the prominent position of Meme coins can be seen from the six best performance lists.

Meme coins and VC coins show a clear contrast:

Inflation is generally low

The overall circulation rate is high

Meme Coin’s “Fairness” Narrative Has a Significant Impact on Crypto Markets in 2024:

Successfully attracted a large number of retail investors to participate

Driving a shift in market sentiment

Becoming one of the most significant features of the crypto market in the year

RWA Project Surpasses Meme Coin

The most eye-catching project in 2024 is Mantra (OM), which has increased far more than other projects:

OM: Up 6,118%

PEPE (Best Meme Coin): Up 1,231%

Mantra positions itself as a purpose-built RWA public chain that can meet real-world regulatory requirements by supporting compliant on- and off-chain protocols for fiat currencies, stocks, and tokenized RWAs. OM, as the governance token of MANTRA DAO, provides users with a reward program related to key initiatives and ecosystem development.

OM’s outperformance reflects two key trends:

RWA track is gaining market favor

The appeal of the RWA concept may go beyond meme narratives

Early gains shift to DEX

Data shows that the yield of existing tokens is higher than that of newly listed projects, which is in contrast to traditional cognition. This phenomenon reflects the important changes in the crypto market in 2024: DEX has become the main place for early price discovery of tokens.

Thanks to the improvement of DEX functionality and user experience, many projects choose to list on DEX first. Therefore, the steepest rises often occur on DEXs, and centralized exchanges can only capture the later stages of the rise. In the early days of the crypto market, centralized exchanges were the undisputed liquidity providers. However, with the rise of DEXs such as Hyperliquid and Raydium, and the emergence of applications such as Moonshot and Pump.fun, the market landscape has changed.

Predictions for 2025

The institutionalization process is moving forward at full speed

The mainstreaming of cryptocurrencies is ongoing and is expected to reach new heights by 2025, with full participation from top institutions further accelerating the trend. Here are four key developments predicted.

Bitcoin price to reach $210,000 by 2025

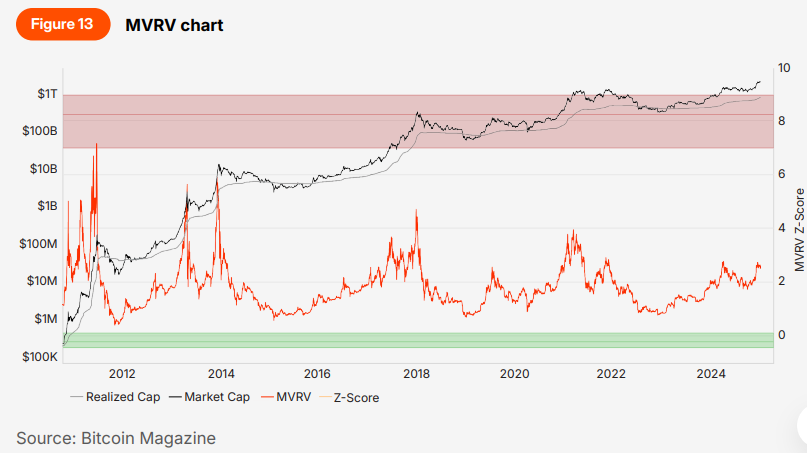

The MVRV ratio (market value/realized value) has become one of the most recognized reliable Bitcoin valuation tools in the digital asset industry. Market value (MV) calculates the total value of all circulating Bitcoins at the current market price, while realized value (RV) calculates the value of each Bitcoin at the most recent transaction price based on on-chain transaction records, representing the average acquisition cost of all circulating Bitcoins.

Historically, Bitcoins MVRV ratio has fluctuated between 0.4x and 7.7x. If only data since 2017 is considered (excluding early periods of extreme volatility), the range is narrower, between 0.5x and 4.7x. In the past two bull markets (2017 and 2021), Bitcoins MVRV peaked at 4.7x and 4x, respectively.

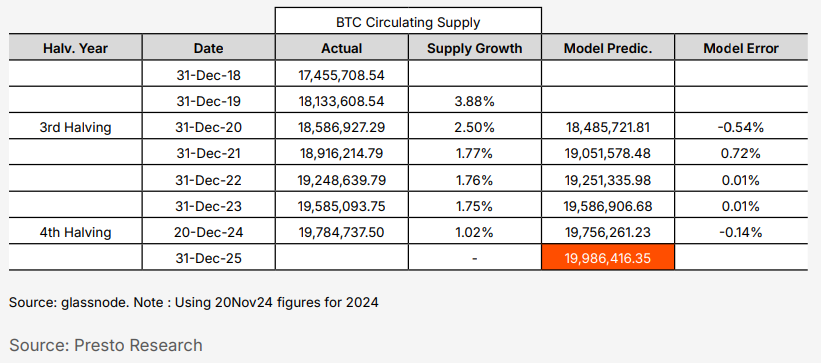

Using a more conservative 3.5x multiplier and assuming that the realized value grows at a compound monthly growth rate of 5.3% from the current $722 billion to $1.2 trillion in the third quarter of 2025 (this growth rate reflects the impact of institutional access facilitation brought by spot ETFs), the target value of the Bitcoin network in 2025 is $4.2 trillion (currently $1.9 trillion), or $210,000 per Bitcoin.

Bitcoin land grabbing movement: new sovereign states or SP 500 companies will adopt Bitcoin as reserves

It is expected that a sovereign or SP 500 company will announce the inclusion of Bitcoin in its reserve strategy. For sovereigns, adoption means that the government department proposes to include Bitcoin in the treasury reserves. At least one country has taken similar actions in each of the past three years. Trumps campaign promise on Bitcoin reserves after his election as president may prompt other countries to study similar strategies for game theory considerations.

MicroStrategys parabolic stock price rise this year has attracted unprecedented attention from the corporate community in terms of enterprise adoption. With the FASBs announcement earlier this year to switch from the original lower of cost and market to fair value accounting, this accounting treatment barrier will be alleviated. MicroStrategy plans to implement this change by the first quarter of 2025, providing other companies with clearer guidance and stronger motivation to adopt.

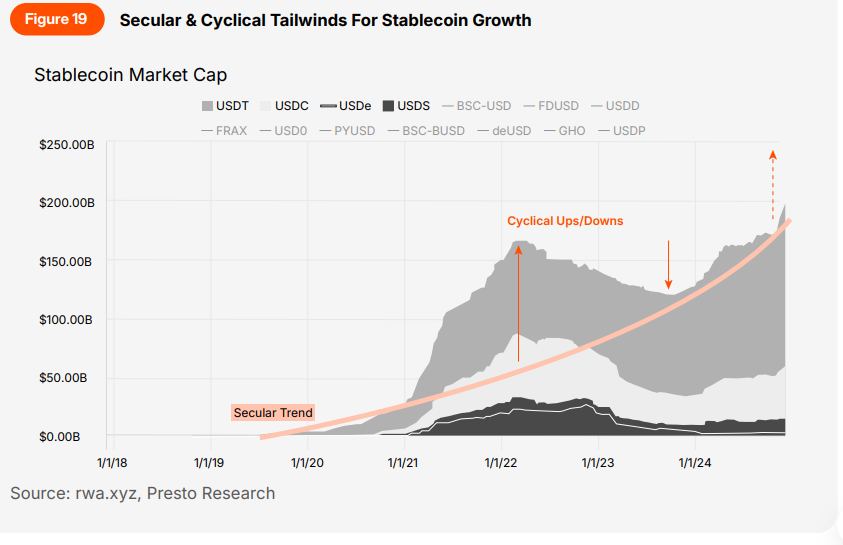

Stablecoin market cap to reach $300 billion

While stablecoins may not be the most popular topic among cryptocurrency speculators seeking high returns, they are undoubtedly the most successful application of blockchain. After rebounding from the local lows in November 2022, the total market value of stablecoins has now reached $200 billion, making it the largest cryptocurrency application category.

It’s no accident that 99% of stablecoins are pegged to the US dollar. Tokenizing an asset doesn’t create demand out of thin air; the asset being tokenized already has global demand. Few currencies other than the US dollar enjoy such universal demand, as evidenced by its dominance as a settlement currency. This is why blockchain and US dollar stablecoins offer the best product-market fit.

The stablecoin market cap is expected to reach $300 billion by 2025, with growth driven by both secular and cyclical factors. Secular drivers include recognition of the superior functionality of tokenized dollars and progress in stablecoin legislation in the U.S. Congress. Cyclical drivers include the broader cryptocurrency bull cycle. Even at $300 billion, this would only represent 1.4% of the U.S. dollar M2 supply, leaving a lot of room for growth.

More corporate action: Circle/Ripple/Kraken IPOs

In the crypto-friendly environment of the Trump administration, opportunities that were previously shelved due to political risks may be released. Traditional companies will see crypto startups as attractive assets to enter the crypto field, driving more MA activities and higher valuations. There are already signs of this trend, even the struggling Bakkt has found an acquirer, Trump Media.

Companies in the late growth stage will not miss this opportunity to go public. Well-known crypto companies such as Circle, Ripple, and Kraken have long been seen as potential IPO candidates. For reference, Coinbase went public at the peak of the last bull market (April 2021).

Cryptocurrency Stock Market Trend

The United States: The New Crypto Capital

Trumps Make America Great Again (MAGA) and America First policy philosophy is likely to extend to the cryptocurrency sector. To ensure that the United States stays ahead of competitors such as China in the global cryptocurrency landscape, the government may adopt a series of supportive policies. There have been rumors of plans to eliminate capital gains taxes on cryptocurrencies issued by U.S.-registered companies, indicating the governments intention to attract crypto innovation. This may be just the beginning of a series of policies.

This shift will fundamentally change the crypto industry. Currently, cryptocurrencies are viewed as global assets, and the location of the project or founder is not important. But as the United States differentiates through preferential policies, this perception will change. Just as the nationality of a company is important in traditional stock markets, so too will the cryptocurrency sector.

American cryptocurrencies will command a significant premium, attracting top talent and projects.

The United States will replicate its successful model in its stock market, where US listed companies enjoy a valuation premium due to the countrys legal and economic stability.

The knock-on effects of U.S. dominance will extend to trading dynamics.

The US trading session is likely to see a significant increase in volume and volatility as both macro and project-level news events will be concentrated during the US session.

Additionally, U.S. exchanges (particularly Coinbase) are expected to grow significantly, and listings on their platforms would serve as a signal of global legitimacy, similar to a major IPO on Nasdaq.

At the project level, Coinbase’s Base ecosystem will be one of the biggest beneficiaries of U.S. dominance.

Cryptocurrency turns to fundamentals: Liquid hedge funds will outperform

The crypto industry is moving away from speculative hype and toward fundamentals-driven investing, thanks to the rise of standardized valuation frameworks. These frameworks are reshaping the way projects are evaluated, financed, and traded, making crypto investing more regulated and closer to traditional financial principles.

As projects generate revenue through staking rewards, token buybacks, and transaction fees, they become systematically assessable. Investors can now calculate the actual return to token holders and assess project sustainability. Metrics such as TVL/Market Cap Ratio and Protocol Revenue Multiple are gaining acceptance.

Liquidity hedge funds are expected to outperform venture capital funds in 2025, using their valuation-based strategies to profit in both bull and bear markets. At least five major macro or equity long-short hedge funds are likely to enter the space, while major investment banks are expected to formally cover digital assets.

The rise of crypto indices: Index trading volume to rank among the top five

As cryptocurrencies become a mainstream asset class, ordinary investors begin to realize the importance of including them in their portfolios, and the market is increasingly in need of a simplified and diversified investment approach. This shift is similar to the development trajectory of the traditional stock market. Just as investors have shifted from selecting individual stocks to buying the SP 500 index, the crypto market is also undergoing a similar evolution.

In traditional finance, ETFs currently account for 13% of total U.S. equity assets. Cryptocurrency is expected to follow a similar trajectory, with index products offering a mix of assets across industries or themes.

Currently, projects are developing unique use cases and behavior patterns, and the performance of different industries is driven by unique fundamentals, no longer just following the price trend of Bitcoin. It is expected that the index will become the main product of major exchanges, and cryptocurrency equivalents similar to $SPDR products (such as the Coinbase 50 Index) may appear and continue to rank in the top five in trading volume rankings.

The second phase of the bull market

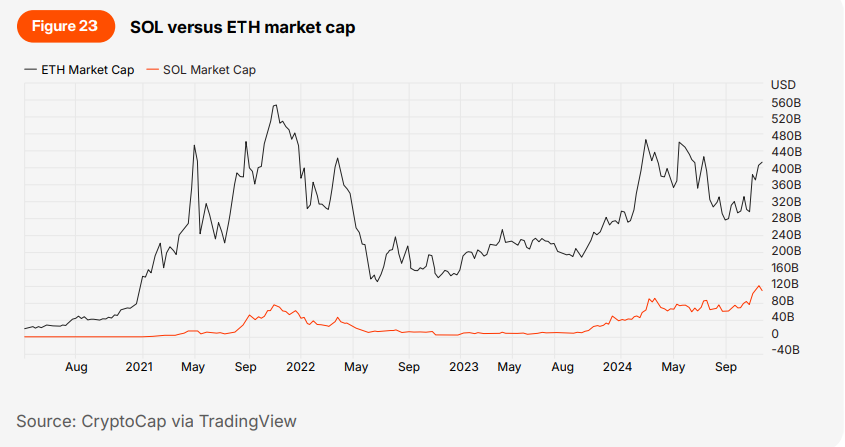

Solana will hit $1,000

Solana’s path to $1,000 is built on its transformation from a high-performance blockchain to a deeply institutionalized ecosystem. The surge in institutional adoption, coupled with $173 million in funding raised by projects in Q3 2024, reflects that the platform has achieved the critical intersection of technological excellence and institutional embedding.

Network activity is growing at an unprecedented pace, with Solana accounting for over 50% of all on-chain daily transaction volume and activity up 1,900% year-over-year. This explosive growth reflects a deeper truth about network success — as Placeholder’s Mario Laul explores, network success is not just about technology, but also about the degree of institutionalization achieved through professional infrastructure and developer network effects. Solana’s differentiation stems from its unique cultural philosophy: prioritizing rapid innovation over theoretical perfection, in stark contrast to Ethereum’s research-first approach.

From the technical roadmap, Anatoly promotes the vision of a global state machine with a block time of 120 milliseconds, and the network architecture is naturally suitable for rollup-based expansion, which lays the foundation for unprecedented scalability. The upcoming Firedancer client aims to achieve 1 million transactions per second, further reflecting this pragmatic progress.

1.93% of tokens will enter the market in the next year, with a projected market cap of $485.93 billion at $1,000 — well within Ethereum’s historical precedent. This combination of cultural differentiation, institutional adoption, technological evolution, and favorable token economics creates a compelling case for SOL to rise.

The total cryptocurrency market cap will reach $7.5 trillion

The crypto market continued to be dominated by Bitcoin in 2024. Institutional funds continued to flow in through ETFs, the institutionalization process of Bitcoin continued to deepen, and coupled with the benefits brought by Trumps victory, this cryptocurrency veteran continued to outperform most altcoins.

If Bitcoin reaches $150,000 and maintains a 60% market capitalization, the overall crypto market size will reach $7.49 trillion, more than 2.5 times the previous high (November 2021, $2.9 trillion).

Trumps presidency will be a key factor in how long this bull market lasts. There are two possible paths for the market to develop:

Under the optimistic path, Trump will implement policies that promote economic growth, relax regulations, maintain low tariffs and open immigration policies. This situation may lead to higher real interest rates, a stronger dollar, and rising stock markets, but gold prices will be under pressure.

Under the pessimistic path, a trade war may break out, with a 60% tariff on China and a 10-20% tariff imposed globally, while immigration policies will be tightened. This will lead to the Federal Reserve easing its policies and lowering interest rates, the dollar strengthening first and then weakening, the stock market adjusting, and gold strengthening.

In either case, there are positive factors for cryptocurrencies:

In an optimistic environment, Bitcoin could rise in tandem with risk assets;

In a pessimistic environment, Bitcoin may be positively correlated with gold and negatively correlated with the US dollar.

Considering Trumps cabinet members and overall policy orientation, the market environment is more likely to be optimistic, which will provide favorable support for risk-seeking crypto assets.

NFT rebound in 2025: monthly trading volume will reach $2 billion

Bitcoin is currently at an all-time high, but market sentiment seems different than before. The magic moment in the bull market cycle when a rising tide lifts all boats has not yet arrived, which is why we are optimistic about NFTs in 2025. The current market is entering a mature stage, and historical experience shows that this is often the most culturally innovative stage.

Current data supports the potential for this cultural renaissance, with NFT sales reaching $562 million in November 2024, up 57.8% month-over-month. The continued growth of the NFT subculture and its influence on the broader crypto culture, as well as the emergence of unique art movements from grunge art to generative art, reflect an increasingly mature ecosystem. The adoption of NFTs by mainstream brands like Nike and Sony is not only about corporate adoption, but also about legitimizing these digital sub-cultures. NFT monthly trading volume is expected to exceed $2 billion sometime in 2025 (up from an average of $2.056 billion per month in 2021).

Focus on fundamentals

Ethereum rebounds: ETH/BTC ratio will recover to 0.05

In the second half of 2024, Ethereum became one of the most controversial topics in the crypto industry. While single chains such as Solana have achieved significant development with convenience and speed, Ethereum still faces many challenges:

L2 networks lack a complete proof system

User experience issues caused by asset fragmentation

Lack of narrative cohesion

These factors have caused the ETH/BTC ratio to hit a new low since 2021.

Despite the challenges, Ethereum is worth keeping an eye on in 2025 and beyond. It is expected that the ETH/BTC ratio could return to 0.05 when Bitcoin reaches $120,000 and Ethereum climbs to $6,000. Two important upgrades are worth watching:

1. L2 network defragmentation (ERC-7683 and EIP-7702)

In the past few years, although Ethereums L2 solution has solved the expansion problem, it has also led to ecological fragmentation. Each L2 network has formed an independent ecosystem, and cross-chain operations have become complicated. The new upgrade will be achieved through:

ERC-7683 Standardized Intents: Allow users to declare desired operations without worrying about specific L2 network details

EIP-7702 Account Abstraction: Allowing External Accounts (EOAs) to be used temporarily as smart contract wallets

Realize seamless cross-chain operations: Users can complete cross-chain token swaps, asset transfers, and governance voting in one go

2. Beam Chain roadmap optimization

The Beam Chain roadmap announced by Justin Drake of the Ethereum Foundation at Devcon 7 proposes a long-term plan until 2029, involving 9 major upgrades in three categories: block production, staking, and cryptography:

Reduced finality time from 15 minutes to 36 seconds (3-slot finality)

Reduced block time from 12 seconds to 4 seconds

Reduce the minimum staking requirement from 32 ETH to 1 ETH

According to currently available information, L2 defragmentation related updates are expected to be launched in early 2025, while the Beam Chain roadmap has not yet determined a specific timeline. In particular, the core proposals of the Beam Chain roadmap involve ideas that fundamentally change the key mechanisms of the Ethereum consensus layer, and these updates may take more than 1-2 years to complete.

Focus on DAG-based blockchains (SUI, APTOS, HBAR, FTM)

Traditional blockchain is like a one-way street, where all transactions need to queue up and pass through in turn. However, DAG (directed acyclic graph) technology is like a complex road network that allows multiple lanes to pass at the same time. This design has made a qualitative leap in transaction processing efficiency and can be regarded as an important evolution of blockchain technology.

Although the early DAG project IOTA pioneered the introduction of this technology into the crypto world, it has many inherent limitations, just like the first generation of iPhone. When the network transaction volume is insufficient, the performance will decline, and a centralized coordinator is required to stand guard. These problems ultimately limit its development.

The emergence of Sui has injected new vitality into DAG technology. It does not completely abandon the advantages of traditional blockchain, but cleverly integrates DAG into the consensus mechanism. Through the innovative Mysticeti consensus protocol, validators can freely process blocks in parallel, which not only ensures decentralization and security, but also greatly improves network performance. This is like Teslas perfect combination of electric motors and traditional automobile craftsmanship.

Suis technological innovation quickly gained market recognition. Since September 2024, Suis coin price has soared by more than 300%, and it currently ranks third among non-EVM public chains with a TVL of $1.6 billion. Even after experiencing a large-scale unlocking at the end of 2024, Sui still showed strong resilience. Looking ahead to 2025, as the unlocking pressure is significantly reduced, Suis development prospects are brighter.

Not only Sui, but the entire DAG track is booming. Aptos, which also uses DAG technology, has jumped to the fourth place in TVL among non-EVM public chains, with a locked-in volume of $1.13 billion. DAG projects such as IOTA, HBAR, and FTM have also achieved at least 100% growth since September 2024.

As the technology continues to mature, DAG projects are proving themselves to be the most suitable public chain solutions for large-scale applications. It is expected that by 2025, the total TVL of major DAG projects is expected to grow from the current $3.1 billion to $5-6 billion, equivalent to more than half of Solanas current TVL.

The Golden Age of Chain

The gold rush of DEX: the ratio of spot DEX to CEX trading volume will exceed 20%, and the ratio of perpetual contract DEX to CEX will exceed 10%

Although CEXs such as Binance and Coinbase are still the main trading platforms for most investors, the trading volume ratio of DEX to CEX has gradually increased as the bull market progresses. This trend is expected to accelerate next year, with the spot trading volume ratio likely to exceed 20% and the perpetual contract trading volume ratio likely to exceed 10%.

Three factors are driving this shift:

First, under the new Trump administration, a more DeFi-friendly regulatory environment will expand the DeFi scene, encourage exploration with less scrutiny and token value accumulation. This will increase the demand for DeFi tokens and create a virtuous cycle for the entire on-chain ecosystem.

Secondly, the user experience has improved significantly at multiple levels, including wallets, trading terminals, and trading bots. After the FTX collapse, traders became more sensitive to counterparty risk, and on-chain activities became more popular. Phantom has been ranked among the top applications many times this year, indicating that on-chain user experience and popularity have reached unprecedented levels.

Third, the listing of highly valued tokens on CEX will drive more investors to turn to the chain. As the scale of the crypto industry reaches trillions of dollars, it is becoming more and more common for new tokens to be issued with valuations of hundreds of millions or billions of dollars. Investors are increasingly aware that the era of holding tokens on CEX to obtain excess returns is over, and the most profitable opportunities are on the chain.

Although there are still certain barriers to on-chain operations and self-custody, the bull market FOMO sentiment will surely drive more users to embrace the on-chain economy. This wave of gold rush will not only bring about an increase in the number of users, but will also promote the entire blockchain industry to move towards an open, trustless economic system.

Digital Gold Is Better Than Gold: Bitcoin Ecosystem Value Will Exceed 1% of BTC Network

After multiple cycles, Bitcoin is increasingly accepted by the public as digital gold and a means of storing value. Since 2023, numerous protocols have emerged to unlock the full potential of Bitcoin as digital gold. Native Bitcoin protocols such as Ordinals and Runes make Bitcoin the base layer of native DeFi by minting tokens and NFTs directly on its blockchain. In addition, various L2 solutions and re-staking protocols have begun to use Bitcoin to generate returns.

Since the launch of the Ordinals protocol in 2023, the transaction fees of the Bitcoin network have climbed to the high level of previous bull markets. However, on the eve of the upcoming new bull market, transaction fees have returned to normal, indicating that the on-chain demand for Bitcoin has not yet been fully released. According to market laws, if the bull market comes as expected in 2025, Bitcoins on-chain usage and transaction fees are likely to hit record highs.

Although most Bitcoin holders value stability, the market demand for Bitcoin to generate income always exists. Current data can illustrate this:

Bitcoin ranks sixth in total locked value (TVL) among all public chains, with approximately $3.8 billion in Bitcoin used for revenue generation

Combined with the total market value of Ordinals and Runes, the market size of the entire Bitcoin chain ecosystem has reached $7 billion

Considering Bitcoin’s status as a $2 trillion asset, 1% of its supply would represent over $20 billion invested in the ecosystem.

EVM Era Returns: New Alternative EVM L1 Will Reach $20 Billion+ Market Cap and $10 Billion+ TVL

In 2024, on-chain growth is primarily concentrated in the non-EVM ecosystem, particularly Solana and Sui:

Solana’s on-chain transaction volume exceeds that of Ethereum and all its L2 networks combined

Sui’s momentum outpaces most Ethereum L2 solutions

The EVM ecosystem, excluding the Ethereum mainnet, has seen a significant decline in market share in terms of TVL (total value locked)

This trend is expected to reverse by 2025:

New alternative EVM L1 public chain is expected to reach a market value of $20 billion

TVL is expected to reach $10 billion

This goal has been achieved by Avalanche in 2021

Despite the significant growth of networks like Solana and Sui, the EVM ecosystem still has unparalleled depth. It has the largest user and developer base, unrivaled liquidity, and a TVL of $165 billion, four times that of the rest of the ecosystem combined. This massive liquidity, primarily in ETH, has been on the sidelines during the Solana meme coin craze in 2024. However, the growth in interest in EVM-based protocols like Hyperliquid, Ethena, and Virtuals shows that latent demand exists.

This prediction is not bearish on Solana or Sui, but bullish on the development prospects of the EVM network. The EVM network has the following advantages:

Technical advantages

More convenient cross-chain bridging

Easier DApp deployment

Better wallet compatibility

User Base

Solana (and specifically the Phantom wallet) has a strong track record of attracting new users

Jupiter has more than 500,000 active traders per day

Even if only 10% of users switch to on-chain DeFi, it will significantly improve the vitality and liquidity of the ecosystem

Growth is expected to be concentrated in EVM-compatible L1 networks rather than L2 networks:

Challenges faced by L2 networks: Most L2 networks have difficulty gaining effective traction, and user adoption rates are lower than expected

Advantages of L1 network: attracting users and liquidity through the wealth effect of native tokens, as proven by the successful cases of BSC, Avalanche, Fantom, etc. in 2021

Potential alternative EVM L1s in this cycle include: Hyperliquid, Monad, and Berachain.

Conclusion

The crypto world is as complex as the vast starry sky. Even the most comprehensive research report can hardly fully describe this booming new continent. This study focuses on the track with the most practical application potential, trying to reveal how crypto technology can break through the shackles of speculative bubbles and truly serve the real world.

However, innovation in the crypto space never stops. Experimental fields such as blockchain games (GameFi), decentralized physical infrastructure networks (DePIN), and decentralized social networking (DeSoc) are not yet mature, but they contain infinite possibilities for breakthrough innovation. These emerging tracks may not have found a clear path to mainstream adoption, but their revolutionary potential cannot be ignored.

Looking ahead to 2025, the crypto industry will continue to evolve in a clearer regulatory environment. New ideas will continue to emerge and new trends will continue to evolve. In this noisy market, it is critical to maintain a humble and open mind, while also staying agile and focused. Only by tracing through the fog and finding the truth can we seize the opportunity in this digital revolution.