From November to early December 2024, as the altcoin market strengthened, decentralized trading platforms ushered in a new round of development opportunities. Binance has launched a number of DEX native tokens, including COW, AERO and VELO, and the trading performance of these tokens is very impressive. Users are becoming more and more accustomed to trading on DEX platforms. Market hotspots are also rotating rapidly: as the popularity of Meme tokens in the Solana ecosystem cools down, trading activity has begun to shift to the Base chain and BSC chain. The up-and-coming Hyperliquid is sucking the on-chain funds on Solana. Its total locked value (TVL) has soared 14 times in just one week, exceeding US$2.8 billion, and has jumped to the eighth place among all Layer 1 public chains.

1. Hyperliquid Project Overview

Project Background:

Hyperliquid is an innovative Layer 1 blockchain that uses the HyperBFY consensus algorithm and is designed to achieve high throughput and low-cost transactions with a block latency of less than one second, born for DeFi applications. With its native token HYPE and a fully on-chain decentralized exchange, Hyperliquid provides a platform focused on order book perpetual futures, bringing significant profit opportunities. At the same time, Hyperliquid also provides an auction mechanism to give new tokens the opportunity to be listed.

Industry Background:

Although the project has not yet disclosed detailed team background and financing information, judging from its significant capital inflow scale and professional quantitative trading system, market rumors that the founding team has a quantitative trading background on Wall Street have a certain degree of credibility.

Competitors:

Hyperliquids core business focuses on order book perpetual futures trading. It competes with platforms such as Uniswap and Jupiter in the DEX track, and is also challenging traditional centralized exchanges such as Binance and Coinbase. This strategic positioning reflects the markets growing demand for transaction transparency and security. Although many projects have tried to establish decentralized trading platforms in the perpetual contract field in the past, CEX still dominates this market. Hyperliquid is gradually breaking this pattern through innovative trading mechanisms and optimized user experience, gaining a significant share in the perpetual contract market and challenging the dominance of CEX.

Ecological data:

The ecosystem TVL ranks 8th among all Layer 1 blockchains. The current total locked value (TVL) is 2.466 billion US dollars. Including some cross-chain protocols, the total TVL has exceeded 3 billion US dollars, but there is a lack of ecological projects.

Significant capital inflows have been pouring into Hyperliquid, with $1.87 billion inflows in the past seven days, ranking third in capital inflows, behind only Bitcoin and Ethereum. From the perspective of total DEX TVL, Uniswap still dominates with a market share of 23.95%, while Hyperliquid has surpassed Raydium with a share of 8.95%.

Dexes total TVL is: $ 27.6 Billion, including:

Uniswap: 6.61 B (23.95%)

Hyperliquid: 2.47 B (8.95%)

Raydium: 2.3 2B(8.41% )

Among all on-chain futures trading markets, Hyperliquid ranks first in trading volume, with a trading volume of US$5.95 billion in the last 24 hours and a total platform trading volume of US$532.88 billion.

2. Ecological Project

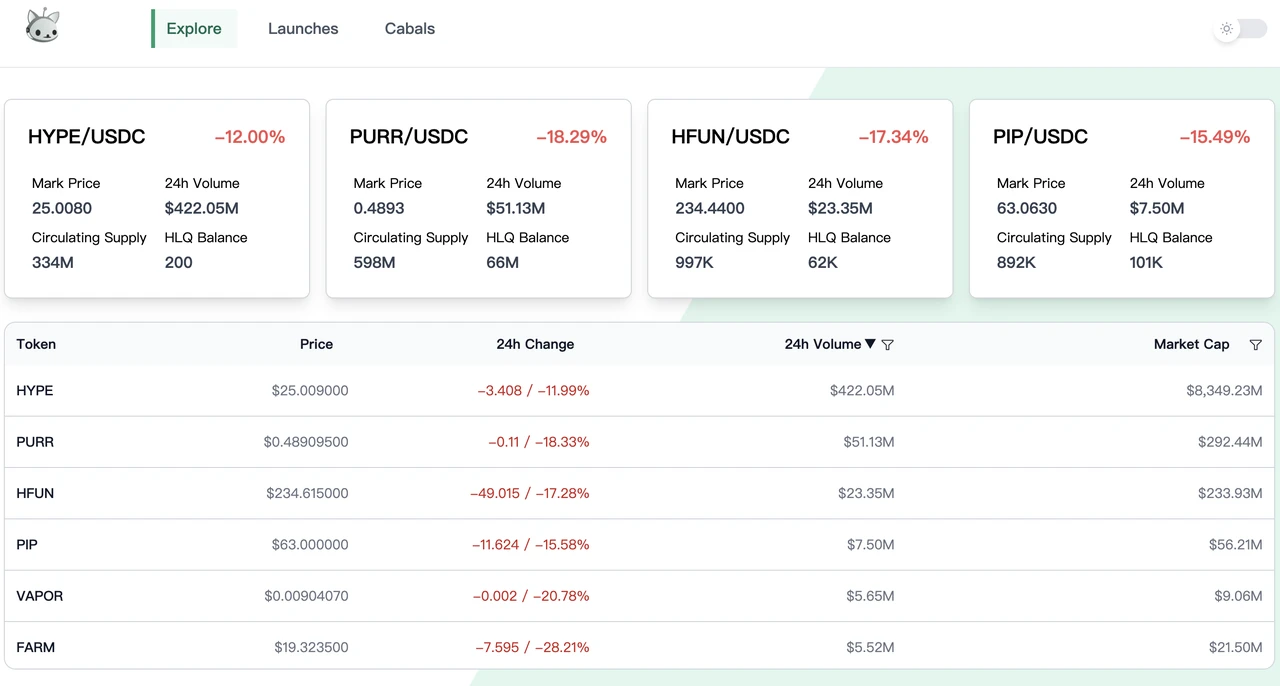

Hyperliquids ecological tokens have performed well recently, with the platform token HYPE exceeding $29 and setting new historical highs; currently, the market value of three tokens exceeds $100 million, namely HYPE, PURR and HFUN; and the market value of 17 tokens exceeds $10 million. With Hyperliquids open and transparent listing mechanism and the emergence of platforms like Pump, many targets have sprung up, and HYPEs daily trading volume market share has dropped from about 92% at the beginning to about 70%. Next, lets take a look at some tokens in the Hyperliquid ecosystem.

1) PURR

PURR is the first native token on Hyperliquid that implements the HIP-1 standard, a cat-shaped meme coin. The token did not have an initial sale, but 50% of the tokens were airdropped to users in proportion to their points held, and the remaining 50% were added to the PURR/USDC fund pool (40% of the tokens were subsequently destroyed at the suggestion of the community). As of December 18, PURRs market value was approximately US$296 million, making it the official meme token on Hyperliquid with a high degree of community consensus.

2) HFUN

This project can be seen as Pump.fun on Hyperliquid, with a Telegram trading robot designed specifically for it. As we all know, the success of Hyperliquid is inseparable from the open and transparent listing mechanism. First of all, if the project party wants to list spot products, it needs to apply for the deployment rights of the HIP-1 native token (HIP-1 is the token standard established by Hyperliquid), and then the Dutch auction mechanism will be used to decide who will get the final token ticker.

In response to Hyperliquids coin auction mechanism, Hypurr Fun came into being. Participating users invest funds and then compete for the spot coin quota on Hyperliquid. We can query the Hypurr token information and transaction status through the web version, including basic information such as project introduction, token price, market value, and transaction volume. Specific transactions are currently only supported through Telegram Bot.

Website: https://app.hypurr.fun/launches

Trading robot: https://t.me/HypurrFunBot

Currently, Hypurr Fun is still in its early stages and continues to grow. The tools are obviously very imperfect and there is still a lot of room for improvement. It is completely incomparable with other mature pump ecosystems. Because of this, there may be more Alpha opportunities.

3) FARMFARM is the first GenAI-related AI agent game built on Hyperliquid. Through the Genai model (Cryptokitties 2.0) + Stardew Valley (simulation game) + Pokemon GO (battle/e-sports), it supports users to perform biological synthesis on the chain through AI.

Official website: https://www.thefarm.fun/

The current product roadmap is designed in three phases, which will be launched successively in the future. The first phase is now online at 08:00 am EST on December 13, 2024. Its token economic model is 20% allocated to MMs super liquidity, and 80% is allocated to Hypurr Pump participants through fair launch. Its supply is fixed and FARM will not be issued. In addition, 50% of the fees collected in FARM will be automatically destroyed, and 50% of the profits will be used to repurchase the circulating supply and destroy it.

4) RAGERage Trade is a derivatives and yield aggregation platform in the DeFi field. It was launched on Arbitrum around 2022 and is known for its Delta Neutral GLP strategy. By integrating GLP (GMXs LP token) with corresponding hedging positions, it provides users with stable returns in volatile market conditions. Its core functions include: ETH perpetual contracts with 10x leverage, full-chain circulating liquidity, and 80-20 vaults that generate income. In August this year, RAGEs public offering was completed, raising $6 million in 15 minutes. According to previous news, Rage Trade released token economics, including: 35% token sales, 30% community finance, 15% team, 13.5% private buyers, and 6.5% airdrops. The current market value of RAGE is approximately US$22 million.

Summarize

At present, Hyperliquid has occupied the largest scale of the on-chain Perps market, with a daily trading volume of up to 6 billion US dollars, and the market size is still growing. The platform attracts users with zero gas fees and only 0.03% transaction fees. Its transaction execution speed is comparable to that of centralized exchanges, which greatly reduces the transaction costs of users. However, it seems that the volume and income of the platform are not transparent to the outside world. It cannot be queried on DefiLlama for the time being, and its data can only be obtained on the official website of Hype. According to public reports, the platform has more than 50,000 active users per month. Although Hyperliquid has performed well in terms of user activity and daily usage, its operating model is closer to centralized exchanges, and there is still room for improvement in terms of decentralized features. This CEX-like attribute has also triggered discussions in the community about its true degree of decentralization.