1. Outlook

1. Macro-level summary and future forecasts

Last week, two Fed officials said the central bank has a major mission to complete the battle to stabilize prices after the pandemic caused a surge in prices and reach its 2% inflation target. Although this task is still in the works, their remarks also implied that while they are working hard to complete this task, they are reluctant to rashly impact the hard-won job market, because the stability of the job market is also related to the overall health and stability of the economy. Any careless decision-making may trigger a chain reaction and undermine the good situation in this key area of the current economic recovery.

In the subsequent policy formulation and implementation process, the Federal Reserve will inevitably have to carefully balance the inflation target and job market stability and find the most appropriate balance to ensure that the economy can continue to develop in a sustained and stable manner.

2. Cryptocurrency market changes and warnings

Last week, the price of Bitcoin achieved a significant increase of about 6% and has now successfully broken through the $99,000 mark. The altcoin market also rebounded across the board. This positive price change demonstrates the markets optimism and positive expectations for the future development trend of cryptocurrencies.

As European and American countries officially end the Christmas and New Year holidays, market liquidity has gradually recovered, which has brought positive signals to the cryptocurrency market, indicating that the field may usher in stronger growth momentum and rising prices.

3. Industry and track hot spots

The FLock.io project is committed to decentralized AI model training. Through community management and pragmatism principles, it promotes the consistency of AI goals with social ethics and creates a community-driven AI model ecosystem. ChainOpera AI has received US$17 million in financing to build an AI operating system, optimize AI reasoning efficiency, innovate token economics, and attract AI model developers to participate.

As a new Layer-1 platform, Trrue promotes compliant asset tokenization, focuses on ESG indicators, serves enterprises and individual users, and realizes the issuance and management of financial products; BVNK has obtained investment from Coinbase, providing stablecoin payment infrastructure, simplifying enterprise access to blockchain payments, and linking traditional banks with blockchain.

2. Market hot spots and potential projects of the week

1. Performance of hot tracks

1.1. What are the features of Flock, an infra project that is about to be launched and positioned to provide basic resources for AI Agent model training?

FLock.io aims to decentralize training and value alignment and ensure that AI goals are aligned with the publics ethical and social goals, that decision-making power belongs to the community, and that practicality is the top priority. FLock breaks down barriers to participation in the ecosystem, allowing developers to provide models, data, or computing resources in a modular way. The result: a large number of models with suitable uses created by the community, for the community, and managed by the community.

Flock democratizes the training, fine-tuning, and reasoning of AI agents. It stops user data collection and enables fair distribution of rewards and broad governance. Through the combination of blockchain technology and AI, Flock provides a powerful environment for processing large data sets.

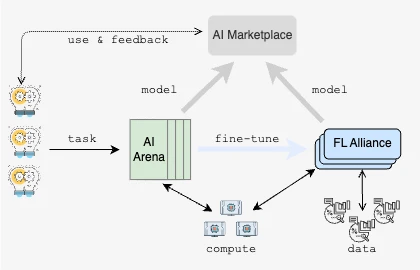

The system logic of FLock consists of three main components, namely AI Arena, FL Alliance and AI Marketplace.

As shown in Figure 1, after the task is created, the model is first trained and verified in AI Arena, a decentralized training platform based on blockchain, and then can be further fine-tuned in FL Alliance using the local data of participants. Finally, the model is deployed to AI Marketplace by the application, and the feedback from the application will be used to further improve the model.

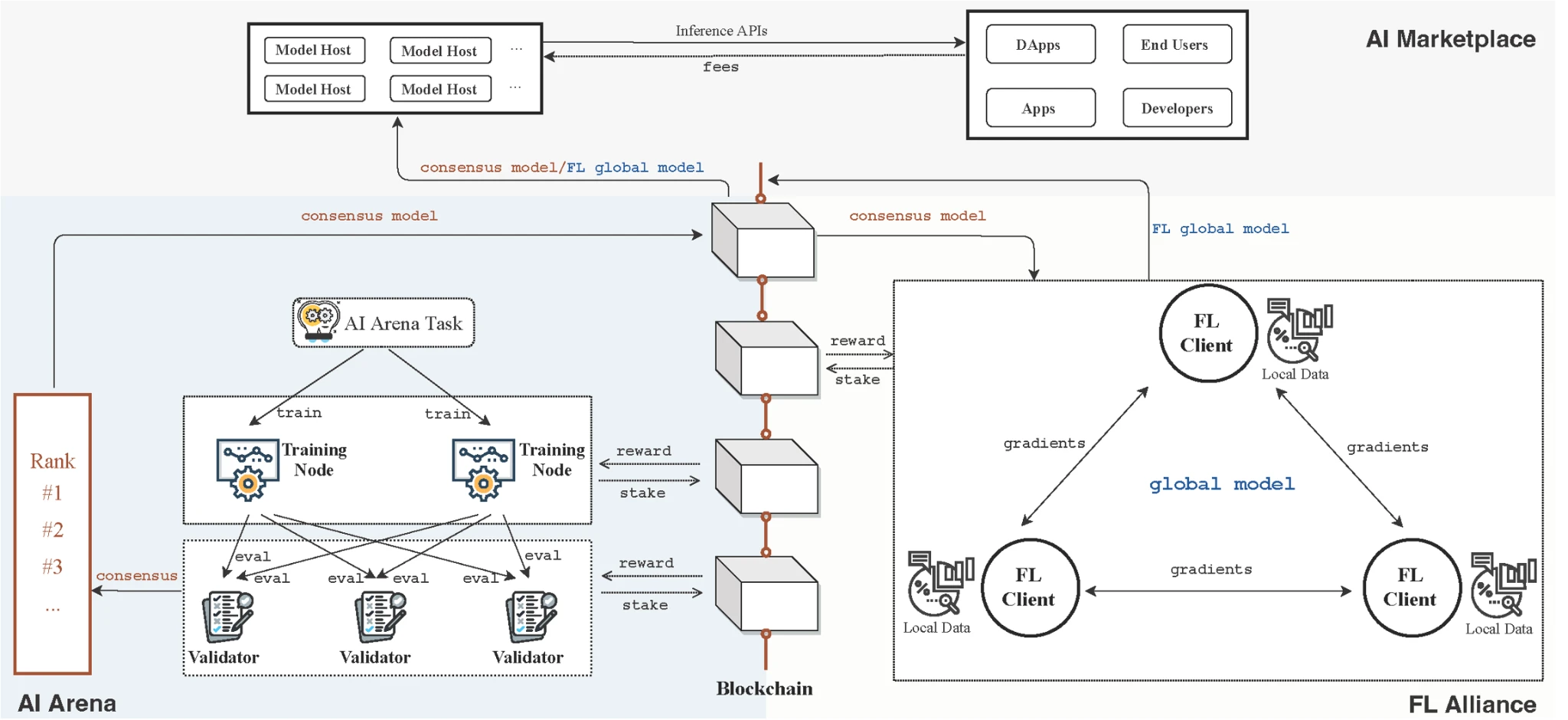

Specifically, as shown in Figure 2, when a task is first created in AI Arena, it is first trained by the training nodes. These nodes then submit their models to the validators, who evaluate and propose scores for each submitted model. The validators reach a consensus on these scores to determine the ranking of the submitted models. The consensus model can then be distributed to FL clients, which fine-tune and improve it using local data to form the FL global model. The AI Arena consensus model or the FL global model can be deployed and hosted in the AI Marketplace, providing an interface for various applications. AI Arenas training nodes, validators, and FL clients need to stake to participate in the system and will be rewarded based on their performance.

Reviews

The problem of centralization poses a heavy barrier to AI innovation. In its current state, the world’s largest companies dictate the trajectory of AI development based on their own goals, which are not necessarily aligned with the public interest. The danger of AI being controlled by centralized companies is that their biases and values are amplified globally. They decide who has access to the models, and their value alignment often degrades the performance of the models.

As a result, we see low public participation, less access to computing power, amplified data bias and inaccuracy due to poor quality and small amount of training data, and AI failing to fully realize its maximum potential as a benefit to society. Flock, a project that combines AI models with blockchain technology, which represents fairness and justice, is at least in the right direction and has potential. Of course, as for the investment value of its token, we still have to wait until its economic model is officially launched. If it is still the traditional financing logic of the current crypto market, it may lack appeal to investors in the secondary market, especially in the early stage of institutional shipments, but after this stage, the subsequent price potential will depend on the progress of the project.

1.2. A brief analysis of the potential of ChainOpera AI, the AI operating system L1, which has raised $17 million

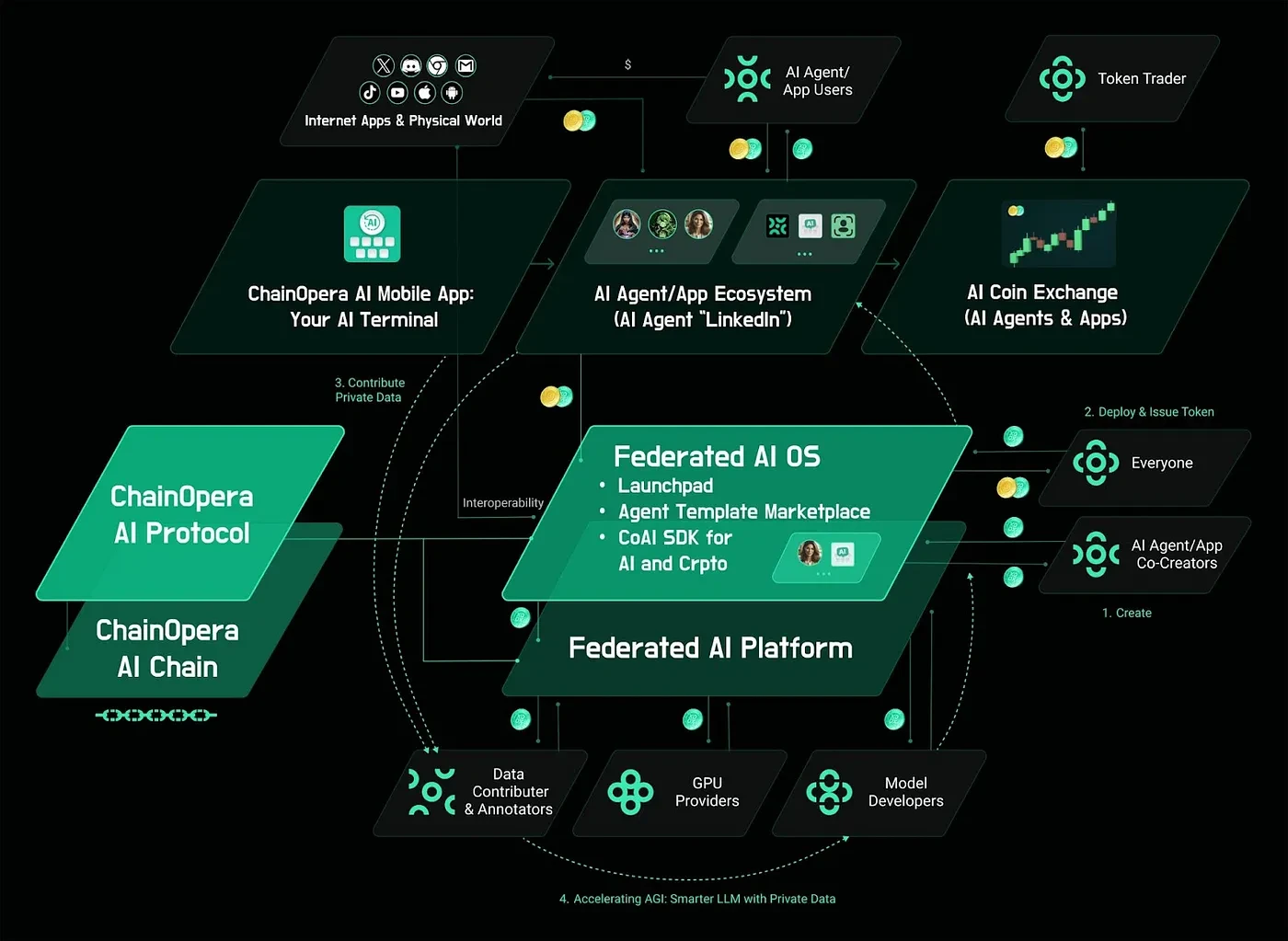

The narrative of ChainOpera AI and the platform it is building can be summarized as shown above.

Blockchain L1 and AI protocols enable co-ownership and co-creation of decentralized AI agents and applications. The L1 layer will be optimized for AI reasoning efficiency, scalability, and security, and will integrate an AI operating system (AI OS).

The Federated AI Operating System™ is an innovative platform for creating, deploying and managing AI agents, while providing everyone with the issuance of AI coins. It seamlessly integrates Launchpad, ChainOpera AI (CoAI) SDK, AI Agent Framework and AI Agent Template Marketplace, simplifying the creation process of AI coins.

FedML.ai, the worlds first decentralized machine learning platform, enables all AI resource contributors - including data, model, and GPU providers - to participate in providing services to AI agents and applications and receive rewards. The platform is built on the years of experience of TensoOpera.ai and FedML.ai.

Flagship AI agents and applications, especially AI terminal mobile applications, demonstrate how community-driven AI resources can drive AI content innovation and promote private data sovereignty in the protocol. The community can jointly own and co-create diverse autonomous and social AI agents.

Innovative Token Economics for AI Agent Launchpad and Personal AI Operating System

ChainOpera has several unique innovations in its token economics and revenue model, particularly in its token protocol:

Enable multi-role token value flow, allowing value exchange between AI resource providers, agent builders, token issuers, and users (i.e., allowing computing power, data, and model providers to directly contribute to online AI agents, while other platforms rely on Web2 GPU cloud platforms, including AWS Bedrock, Google Vertex AI, and Microsoft Azure AI).

Providing flexibility to token issuers, allowing for the release of a variety of AI software and custom token economic models.

Reward users for contributing private mobile data for training specialized Web3 language models and generative AI.

Provides an inter-agent transaction protocol as a basis for building a society of AI agents.

Uniqueness in terms of revenue model and technological barriers

Healthy revenue model: The ChainOpera ecosystem maintains a healthy revenue model, generating substantial and sustainable revenue from enterprise AI services, and has attracted 7,000 AI model developers to settle in, with high daily model reasoning usage. In addition, in the Web3 field, the platform generates revenue through token issuance to support community maintenance, platform fees, AI model and proxy services, and the upcoming AI mobile phone sales.

Deep technical barriers: Core team members have received more than 30,000 academic citations and have published papers at top AI and blockchain conferences. Their latest research includes pioneering work in proof of contribution, zero-knowledge machine learning (ZKML), Fox small language model, ScaleLLM for scalable LLM services, TensorOpera Router for edge-cloud hybrid model services, and federated and distributed training using geographically distributed data. The ChainOpera platform is supported by years of hard work on these deep technologies.

Reviews

Judging from the milestones and future development plans on the projects official website, ChainOpera attempts to serve as an underlying chain in the field of AI. Its service objects are not just AI Agents, but also the entire AI model from the beginning of training to data provision and GPU computing power providers. All participants in the entire process of the entire AI Agent from birth to application can seamlessly access its underlying L1. But we all know that you cant chew too much. Such a narrative of Hongwei requires relatively high technical complexity and funding for the project. Therefore, whether it will fail in the womb or become a blockbuster will largely depend on its subsequent financing situation. The current amount of funds alone is obviously not enough.

1.3. Trrue, an L1 upstart that promotes RWA compliance, enters the market attention list, and its mechanism is briefly analyzed

Trrue is a layer-1 blockchain platform designed to facilitate the compliant tokenization of real-world and digital assets, emphasizing sustainability and transparency in environmental, social and governance (ESG) metrics.

Initially, the Layer-1 TRRUE Chain protocol will be complemented by a range of blockchain solutions designed to ensure ethical practices and regulatory compliance.

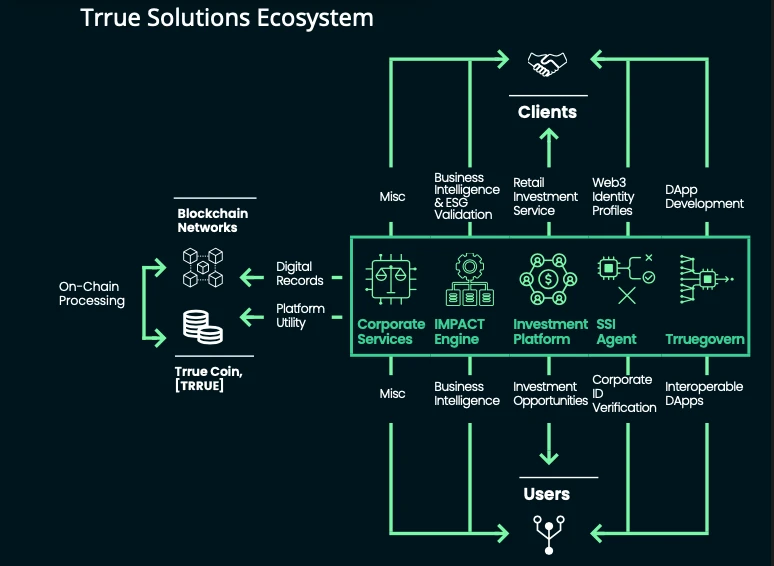

The resulting ecosystem will therefore serve both the companys corporate clients and international retail users. Corporate clients can use the TRRUE ecosystem for the issuance and management of regulated financial products, while users can invest in these products and benefit from the range of available solutions. The following figure shows the ecosystem flow chart of this economic system.

The initial ecosystem is expected to grow into a more complex international economy as customers launch their own solutions using the TRRUE infrastructure. Solutions can be fully decentralized decentralized applications (dApps), or hybrid applications based on the TRRUE Chain or other multiple integrated blockchain ledgers, as well as other available technologies.

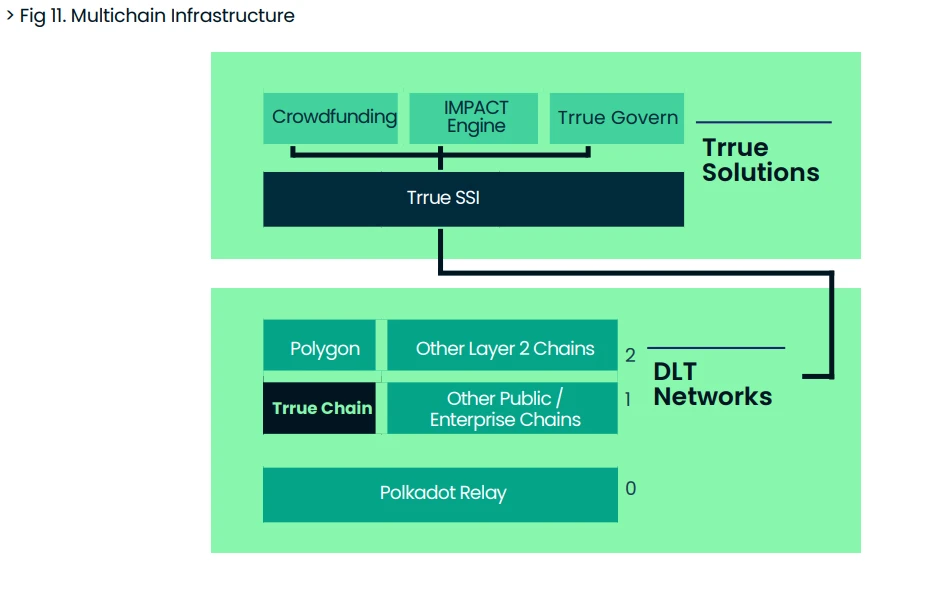

TRRUE Chain is being developed as a consortium blockchain so that all data on the chain is verified by a network of trusted and reputable businesses. This provides the benefits of distributed computing without sacrificing the scalability of the system and maintaining traditional legal relationships to ensure regulatory compliance. The ledger is also built on Polkadot Substrate, enabling interoperability between blockchains, so unlike other traditional asset (RWA) protocols, the TRRUE infrastructure can truly connect traditional financial markets with the entire Web3 ecosystem.

Multi-chain infrastructure

The main advantage of using Substrate to develop TRRUE Chain will be interoperability through Polkadots Layer 0 infrastructure. Since its launch in 2020, Polkadot has established itself as the leading Layer 0 protocol, using a central relay chain to integrate transaction data from a series of connected parachains, parathreads, and bridges to external networks. The result is a multi-chain environment suitable for TRRUEs blockchain-based solution, enabling cross-chain registration and calculation.

TRRUE Chain will be specifically tailored for the application scenarios of TRRUE SSI and its Aries standard, which serves as a comprehensive toolkit for decentralized identity (DID) solutions and trust in modern digital environments. By implementing Aries, TRRUE will enable users to issue, store and display verifiable credentials while ensuring maximum privacy protection.

Reviews

Overall, the characteristics and advantages of TRRUE are that the TRRUE investment platform provides an intuitive and secure environment for companies and entrepreneurs to raise funds for their ESG-focused projects, and innovative projects can access a diversified pool of socially responsible investors.

In full compliance with the EU Crowdfunding Service Providers (CSPs) Regulation, the TRRUE platform will enable users to easily transfer assets between EU member states. This regulatory compliance ensures transparency, trust and legality of all transactions, providing users with peace of mind.

Investors on the TRRUE platform can explore a variety of sustainable investment opportunities. From renewable energy projects to social impact projects, the platform carefully selects a range of projects that are consistent with ESG principles, allowing investors to support causes they believe in.

Leveraging blockchain technology, the TRRUE solution tokenizes equity and assets, increasing liquidity and accessibility. This innovative approach democratizes investing, allowing investors of all sizes to participate in high-impact projects that were previously limited to institutional funds.

The TRRUE ecosystem fosters a vibrant community where knowledge sharing and collaboration thrive. Entrepreneurs can pitch their ideas, get feedback, and connect with like-minded people, building a network of changemakers committed to sustainable development.

1.4. How does BVNK, a stablecoin payment infrastructure project invested by Coinbase, link traditional banks with blockchain?

BVNK provides businesses with a self-hosted, self-managed digital asset payment infrastructure. BVNK L1 is designed to eliminate the complexity of developing an in-house blockchain payment system by automating core functions such as wallet creation, reconciliation, asset management, and integration with third-party providers.

BVNKs mission is to accelerate the flow of funds around the world, using stablecoins as the core payment rail, making it easy for global businesses to access. Stablecoins are creating a new foundational layer for global payments that is faster, more transparent and more accessible.

Blockchain and digital assets are at the core of BVNKs business, and as the project grows, the technology must also be continuously upgraded. There is a lack of secure, self-managed digital asset solutions in the current market. Many customers need strong asset management solutions, but existing options fail to meet their needs. In addition, as BVNK expands globally, the industry needs an infrastructure that can be seamlessly deployed in different jurisdictions. Layer 1 was born to meet these needs.

Key features of BVNK’s Layer 1:

Vault: Store and manage your keys across your infrastructure using a modular, standardized key management system, ensuring you have complete control over your data.

Digital Asset Management: Access your assets easily and manage funds efficiently with seamless integration through a single API.

Trading Engine: Plug in your providers and execute multi-venue, multi-leg synthetic pairs trading strategies.

Transaction Screening: Automatically screen transactions by integrating compliant supplier credentials to ensure compliance while protecting data privacy.

White Label User Interface: A custom, easy-to-use portal that simplifies all campaign management and can be personalized to match your brand.

Seamless API Integration: Connect your key partners and exchanges, access currency rails with fully configurable parameters, and manage end-to-end digital asset trading within your infrastructure. For example, Layer 1 supports API integration with Talos, enabling enterprises to connect to different crypto exchanges and manage their digital asset trading from Layer 1.

Reviews

Deel uses BVNK to pay thousands of contractors around the world through the stablecoin USDC, achieving almost instant payments. Workers can quickly obtain US dollars in areas where local currencies fluctuate greatly, and no longer need to wait for days to get their wages or lose value due to unfavorable currency conversions. It has been proven that BVNKs path is currently feasible, but whether it can attract more large companies to join its system to provide stablecoin payment services is the biggest difficulty, because the competition in the stablecoin payment sector is still quite fierce. Traditional payment giants actually have more advantages after entering the decentralized payment field. Therefore, how native projects like BVNK can go their own way will depend on the convenience, security, privacy and low cost of payment services.

2. Inventory of potential projects of the week

2.1. A brief analysis of Sonic, the SVM chain that realizes the sovereign gaming economy on Solana

Introduction

Sonic is the first atomized SVM chain designed to enable sovereign gaming economies on Solana. Sonic enables sovereign gaming economies to be aggregated and settled on Solana.

Sonic is built on top of HyperGrid, the first concurrency scaling framework for Solana. Sonic is the first Grid instance orchestrated by this framework.

HyperGrid aims to introduce customization and extensibility while maintaining native composability with Solana.

Sonic Advantages

Lightning speed, low cost

Sonic provides the fastest on-chain gaming experience among all game L1s, relying on SVM technology.

Atomic interoperability

Executing transactions on Sonic does not require redeploying Solana programs and accounts, and directly benefits from Solanas base layer services and liquidity.

Write code for the EVM and execute it on the SVM

Seamlessly deploy dApps from the EVM chain to Solana through HyperGrid’s interpreter.

Composable game primitives and sandbox environment

Sonic provides on-chain native composable game primitives and extensible data types based on the ECS framework, and provides developers with game engine sandbox tools to build business logic on the chain.

Monetization Infrastructure

Sonic natively supports growth, traffic, payment and settlement infrastructure for games.

Technical Analysis

1. Rush ECS Framework

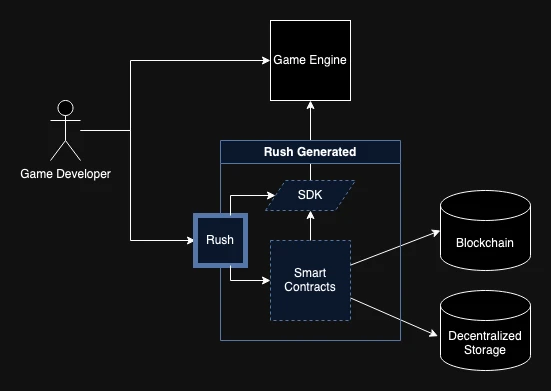

Rush is a declarative and fast Entity-Component-System (ECS) framework built entirely in Rust with a single goal: to reduce the complexity of integrating blockchain technology with known developer tools (such as game engine SDKs and APIs) using proven developer experience abstractions.

Rush envisions a future where any game that has been built or will be built can be easily transformed into a fully on-chain game or autonomous world by using Rush with the developer’s favorite game development stack.

How Rush works

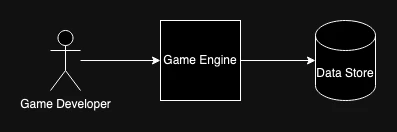

Typically, game developers use game engines to create games. Using a game engine, the complexity of the underlying logic can be greatly simplified. Game developers can focus on game design and game mechanics because the game engine is designed to take on these complexities.

On the other hand, fully on-chain games (FOCG) and autonomous worlds (AW) are only feasible when using decentralized data storage such as blockchain, because the decentralized nature of blockchain makes data persistence much more resilient than a single data repository.

However, this does not come without a price. Game developers now have to worry about the end-to-end implementation details of the blockchain technology stack.

This can be solved by having the game developer learn these techniques, or hiring experts who are already proficient in them, both of which require resources and are usually large obstacles that game developers must overcome before considering FOCG or AW. This is how Rush was born.

Rush aims to remove these complexities by using proven developer experience abstraction techniques. Declarative configuration, entity-component-system (ECS), and code generation are used as the main developer experience abstraction strategies. Game developers do not need to learn the end-to-end stack of blockchain technology. Game developers only need to use Rush.

The driving principles of Rush are as follows:

Declarative: Increase productivity without having to understand control flow and logic.

Fast: Iterate easily with lightweight tooling and loosely coupled integrations.

Entity-Component-System (ECS): Reduces the game to simple and easy-to-understand data units.

Simple: Developer experience is the top priority.

Product First: Value comes from product-community fit, not short-term FOMO driven by complexity and confusion.

Release fast and break things: The goal is to reduce assumptions and increase facts through rapid iteration, even if that means breaking things.

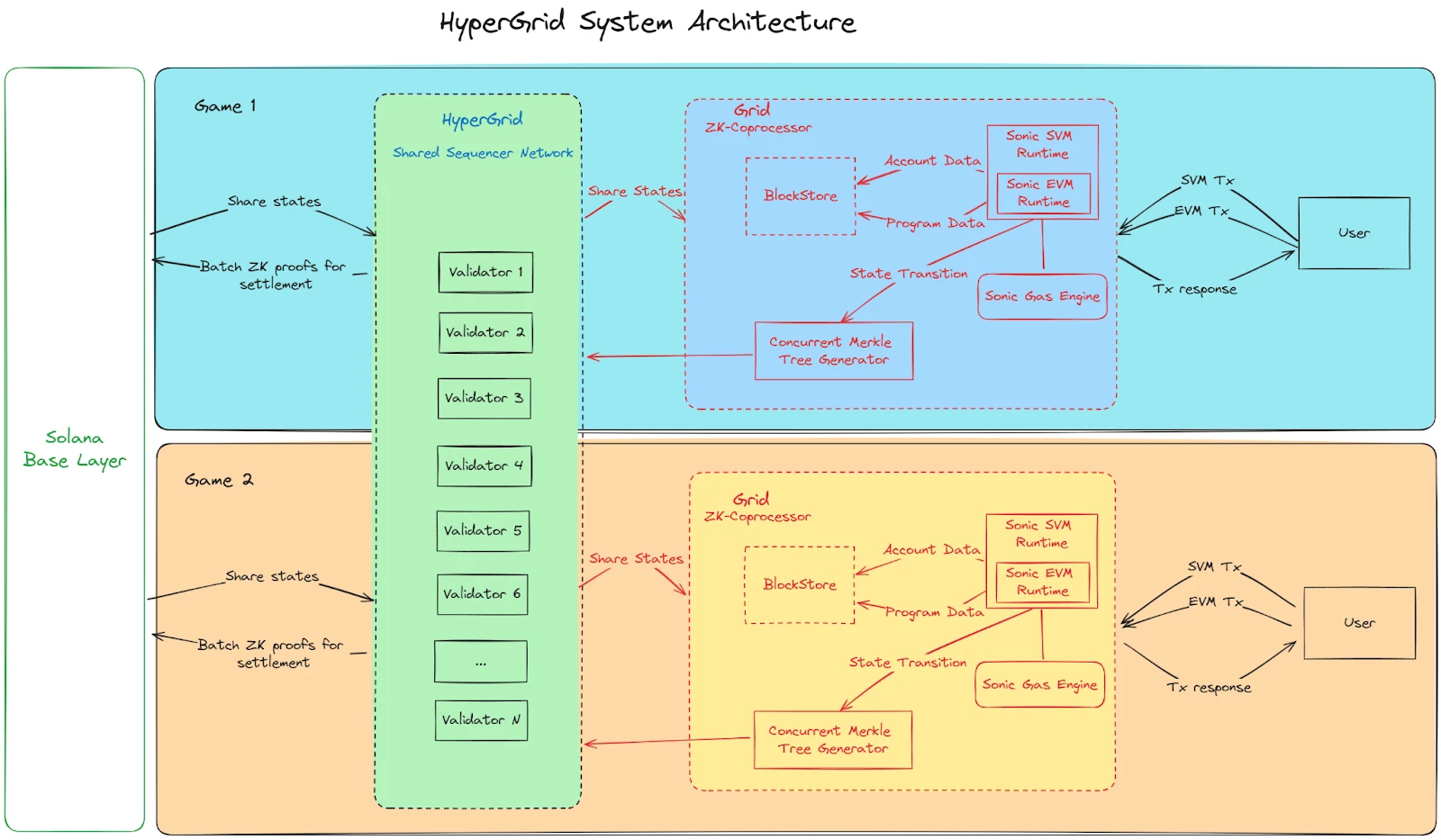

2. HyperGrid Framework

HyperGrid - A rollup scaling and orchestration framework for rollup operators for the dedicated Solana Virtual Machine (SVM) ecosystem.

The HyperGrid Protocol is a scaling and coordination framework designed for rollup operators of the dedicated Solana Virtual Machine (SVM) ecosystem. HyperGrid leverages state compression and Byzantine Fault Tolerance (BFT) techniques to achieve potentially unlimited transaction throughput by enabling horizontal scaling across multiple grids, including Sonic, a gaming-specific grid running on Solana.

One of the key features is atomic interoperability. Designed to be compatible with Solana, HyperGrid implements an interoperability interface that enables fully encapsulated programs on Solana to delegate execution to a grid coordinated by HyperGrid. This approach brings several benefits:

Create a single source of truth for everything running on Solana

Facilitates delegation of program computation to HyperGrid

Enable rollups to leverage base layer services and liquidity

Architecture Overview

Overview of HyperGrid’s multi-grid architecture: The semi-autonomous grid relies on Solana for consensus and final confirmation.

The architecture of HyperGrid is based on a multi-grid approach, where each grid is able to operate semi-autonomously while maintaining a connection to the Solana mainnet to ensure consensus and finality. This section will explain the various structural elements and their interrelationships in detail.

Key Components

Solana Base Layer: The foundation of the HyperGrid system, providing final consensus and confirmation.

HyperGrid Shared State Network (HSSN):

As the core of the architecture, spanning all grids

Contains multiple validation nodes (Validator 1 to Validator N)

Facilitates sharing of state between the grid and the Solana base layer

Batch ZK Proofs for Managed Settlement

Grid structure (taking Grid 1 and Grid 2 as examples):

Each grid represents a semi-autonomous ecosystem, perhaps specialized for a specific application (e.g., a different game)

Components inside each grid:

ZK coprocessor: manages grid-specific operations Merkle proof operations

SVM Runtime: Grid Execution Environment on Solana Virtual Machines

Sonic Gas Engine: Managing Computing Resources

Parallel Merkle Tree Generator: Efficiently Processing State Transitions

User Interaction:

Users can interact with each grid independently

Transactions (SVM Tx and EVM Tx) flow between users and the corresponding grid runtime

The transaction response will be returned to the user

Data Flow

Interoperability - State Sharing:

Two-way state sharing between Solana base layer and HSSN

HSSN shares state with each grid

State sharing can also occur between meshes, as described later.

ZK Proof:

Transactions are compressed and aggregated into a Merkle tree.

For each block, we will commit the corresponding root state hash.

The proof of validity of the block is computed on the grid.

ZK proofs from HSSN are published to the Solana base layer for settlement.

This architecture enables HyperGrid to achieve high scalability and flexibility while maintaining the strong connection with security and finality provided by the Solana blockchain.

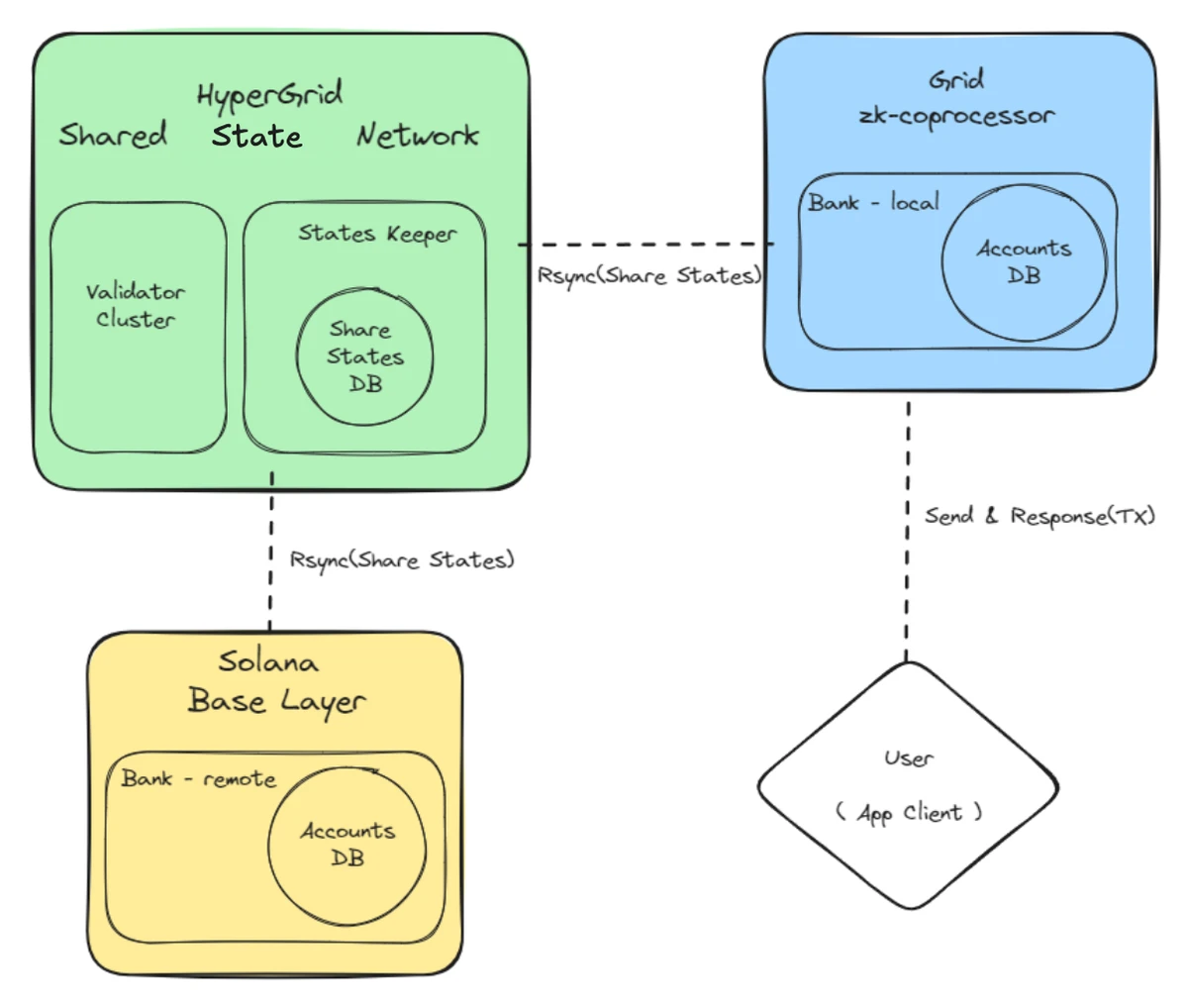

Grid and Network Relationship

HyperGrid’s network architecture: the relationship between the shared state network, grid instances, and the Solana base layer to enable scalable dApp deployments.

The HyperGrid framework is designed to support a wide range of application-specific networks or decentralized applications, especially for high-demand applications in its ecosystem, such as games, DeFi, AI agents, etc. The goals of the architecture are:

Reducing the pressure on Solana’s base layer performance

Minimize performance conflicts and block space competition between the base layer and various domain-specific dApps

Key Features

Flexibility for mesh network creators: Developers can choose to:

Using HyperGrid Public Network

Scale out to create dedicated networks tailored to specific needs

Performance and cost optimization: Developers decide whether to use a public or private network based on an evaluation of performance requirements and associated costs.

Network independence: Developers can deactivate their own network without affecting other networks in the ecosystem.

Operational Framework

Validation: Each network autonomously handles the validation of its transactions and state changes.

Logging: Each network independently maintains a log of transactions and state changes.

Data Retrieval: Each network performs the data retrieval process independently.

Integration with Solana

The link between HyperGrid and Solanas base layer ensures that, although operations in each grid instance are processed independently, they are ultimately anchored to Solana to ensure final consensus and security. This architecture provides a scalable and flexible environment for dApp deployment, enabling developers to leverage the security and stability of the Solana blockchain while optimizing application performance.

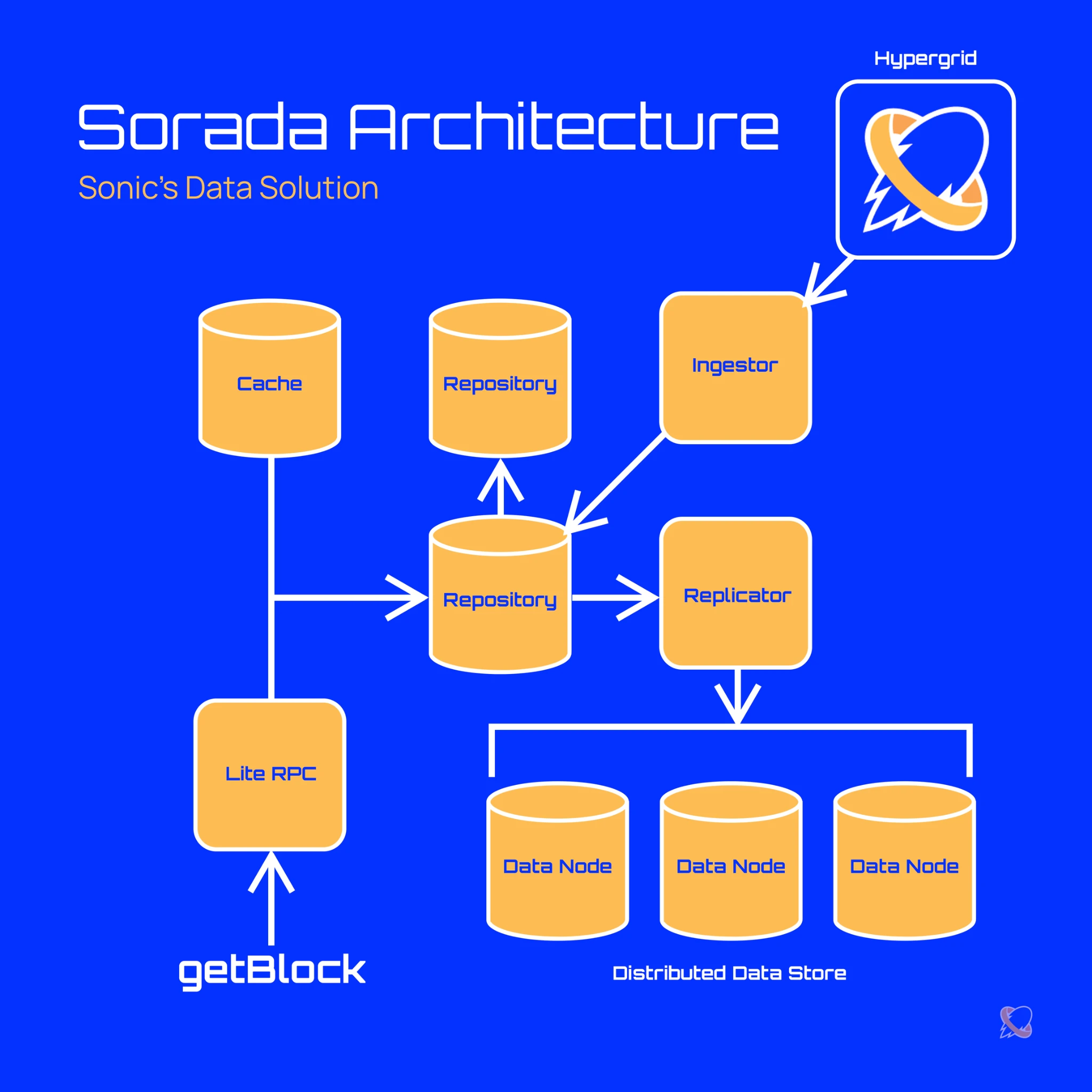

3. Sorada

Sorada – Sonics Archival Data Solution

Sorada is Sonics data solution, whose main goal is to decouple archive read requests from network write requests.

Bandwidth and storage bottlenecks are addressed by decoupling archive read requests from the primary Sonic validation node and migrating them to a separate, optimized data infrastructure.

Sorada enables SVM validator nodes to free up more computing resources for transaction processing, while optimizing the performance of archive read requests by 30 to 40 times.

Services provided by Sorada

Lite RPC

The Lite RPC service is an optimized Solana RPC service that removes the Solana full node part and only retains data retrieval endpoints such as getBlock and getTransaction.

Ingestor

The Ingestor service pulls data from Sonic Hypergrid in real time and persists the data to the big table storage.

Replicator

The Replicator service replicates index data in the big table storage to the distributed file system for stronger data protection.

Summarize

Sonic aims to unlock new experiences for builders and players. Relying on Solanas traffic and performance, Sonic focuses on a high-performance decentralized game incubation platform, creating a difference from the traditional game asset trading experience. At present, the direct competitor is Arbitrums Nova, and from the current stage of the crypto market cycle, blockchain games are still in a dilemma of technical bottlenecks and token economy being unsustainable. Whether the emergence of Sonic can solve these two major problems will determine its upper limit. With the advent of TGE, at least from the perspective of the primary markets attention to it, it must be worthy of the participation of the majority of users.

3. Industry data analysis

1. Overall market performance

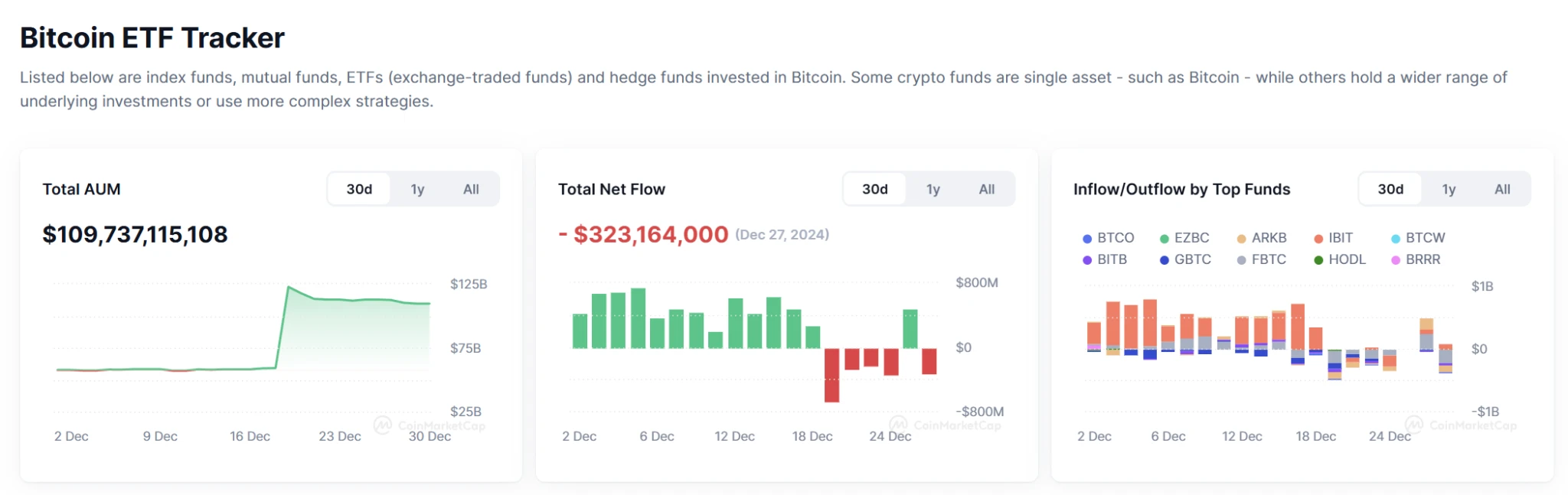

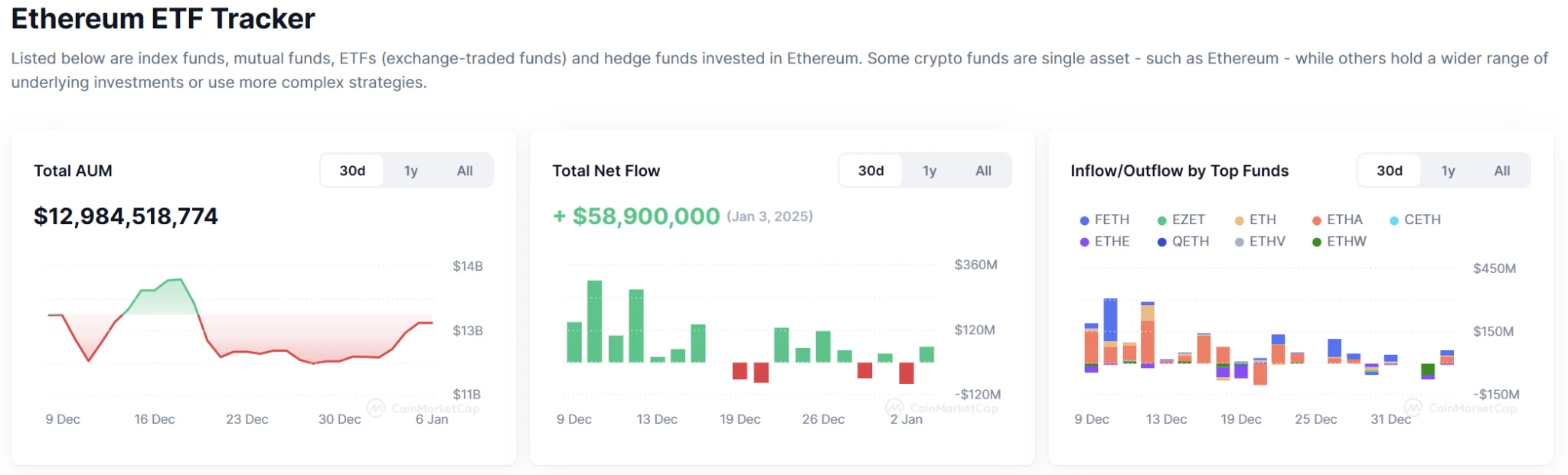

1.1 Spot BTCETH ETF

Analysis

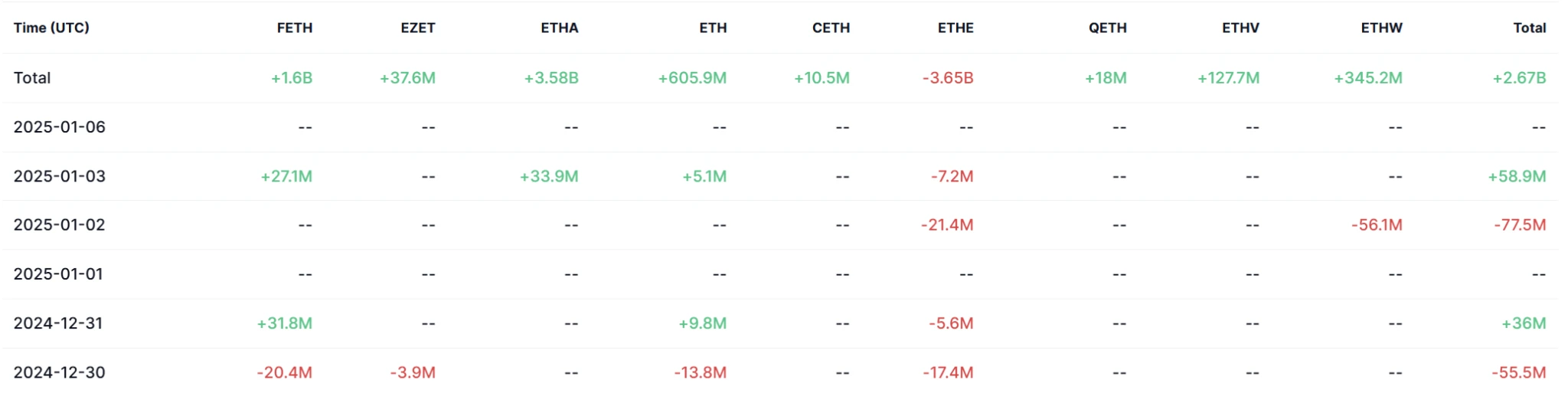

This week, the U.S. Bitcoin spot ETF received a total net inflow of US$1.871 billion.

Analysis

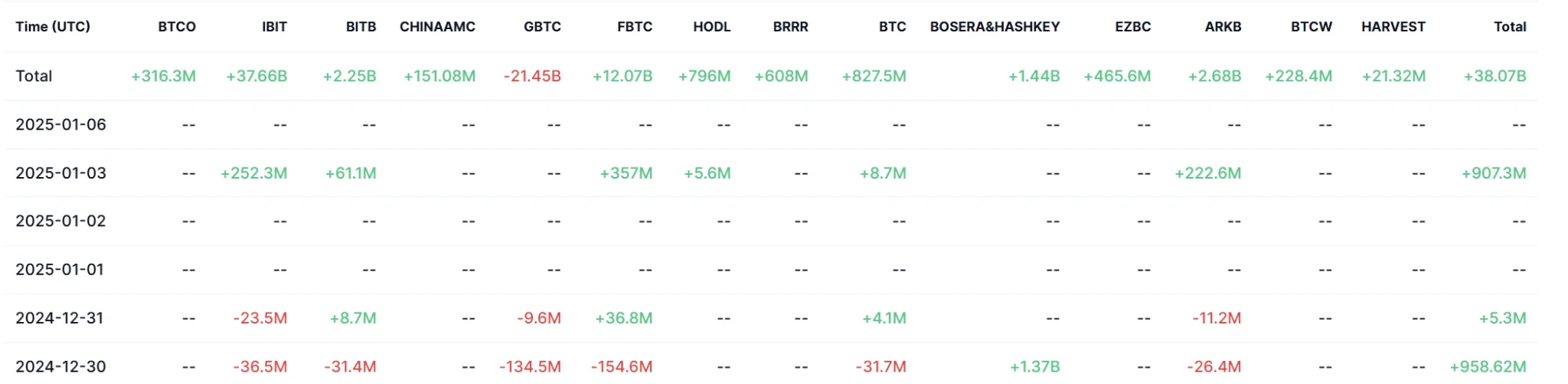

The U.S. Ethereum spot ETF saw a net outflow of $38.1 million this week.

1.2. Spot BTC vs ETH price trend

BTC

Analysis

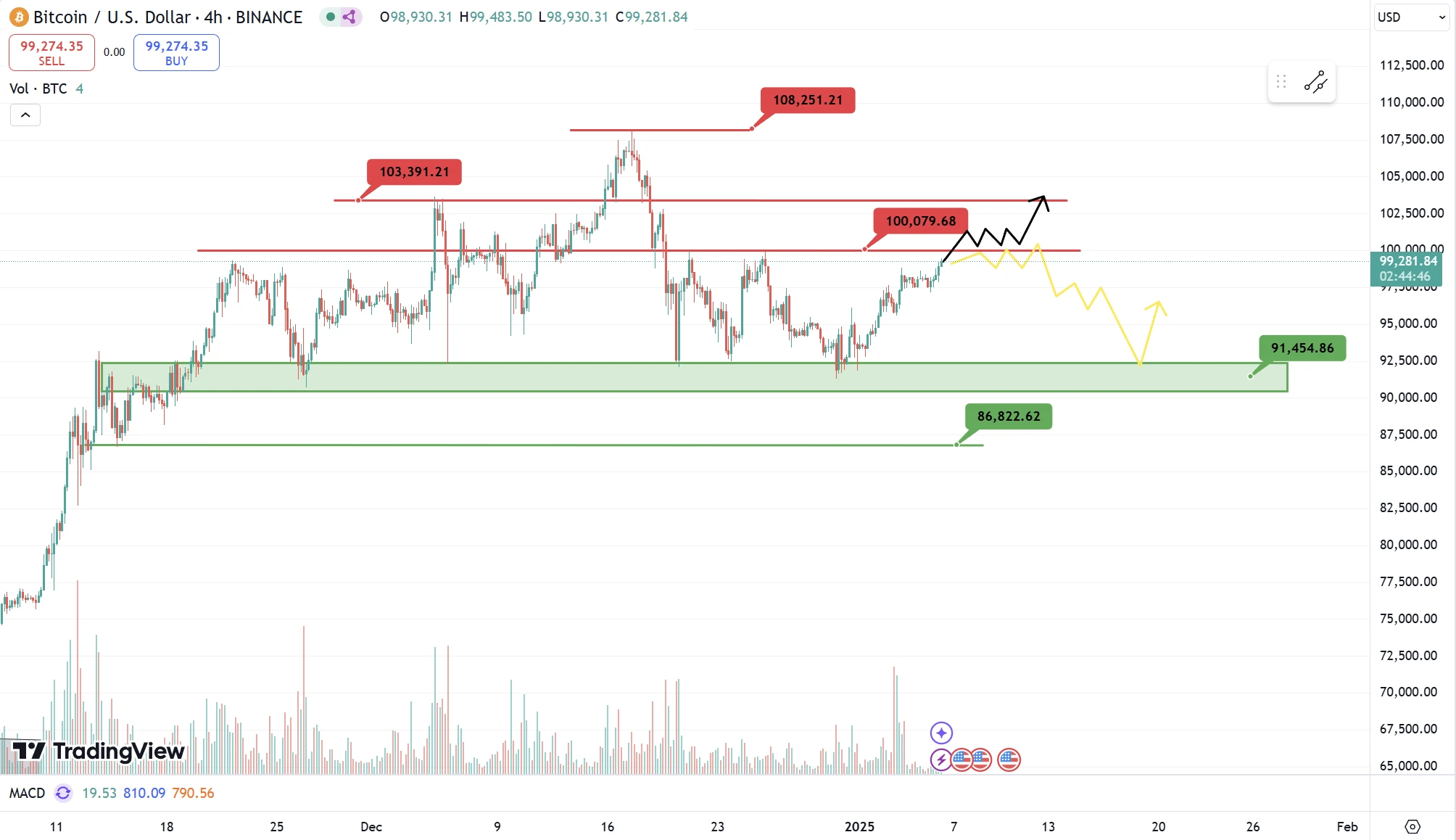

Last week, Bitcoin received support from the $90,000 to $92,500 range as expected, and started to rebound after clearing leverage in the short term. As of the time of writing, the price of the currency has hit the $100,000 resistance for the third time in a month. If there are signs of an increase in bullish trading volume when testing this resistance range, it is likely to successfully stabilize above $100,000. On the contrary, if the current trading volume continues to rebound slowly, it is likely to continue to test $100,000 this week and fail. If the second situation occurs, investors should consider the risk of selling caused by the collapse of bullish confidence due to the three failures to test the $100,000 resistance, but the principle remains that the long-term bullish view remains unchanged as long as the bottom support of $90,000 is not broken.

ETH

Analysis

Ethereum was generally strong last week. After successfully testing $3,300 several times, the price did not continue to build a second bottom near $3,100. This to a certain extent reflects the recovery of the bulls. As of now, the price of the currency has just rebounded and broken through the key position of $3,550. Compared with Bitcoin, Ethereum successfully tested the strong resistance for the third time. Then it will be a high probability event to continue to break through and test $3,830 after a short break. However, investors should be conservative about the price being able to break through quickly and even test the previous high of $4,000 this week or next week. After all, the current ETF buying sentiment for Ethereum has not yet reached the corresponding level of heat, but as long as the bottom of each wave of pullbacks continues to move up, the bullish trend will not change.

1.3. Fear Greed Index

Analysis

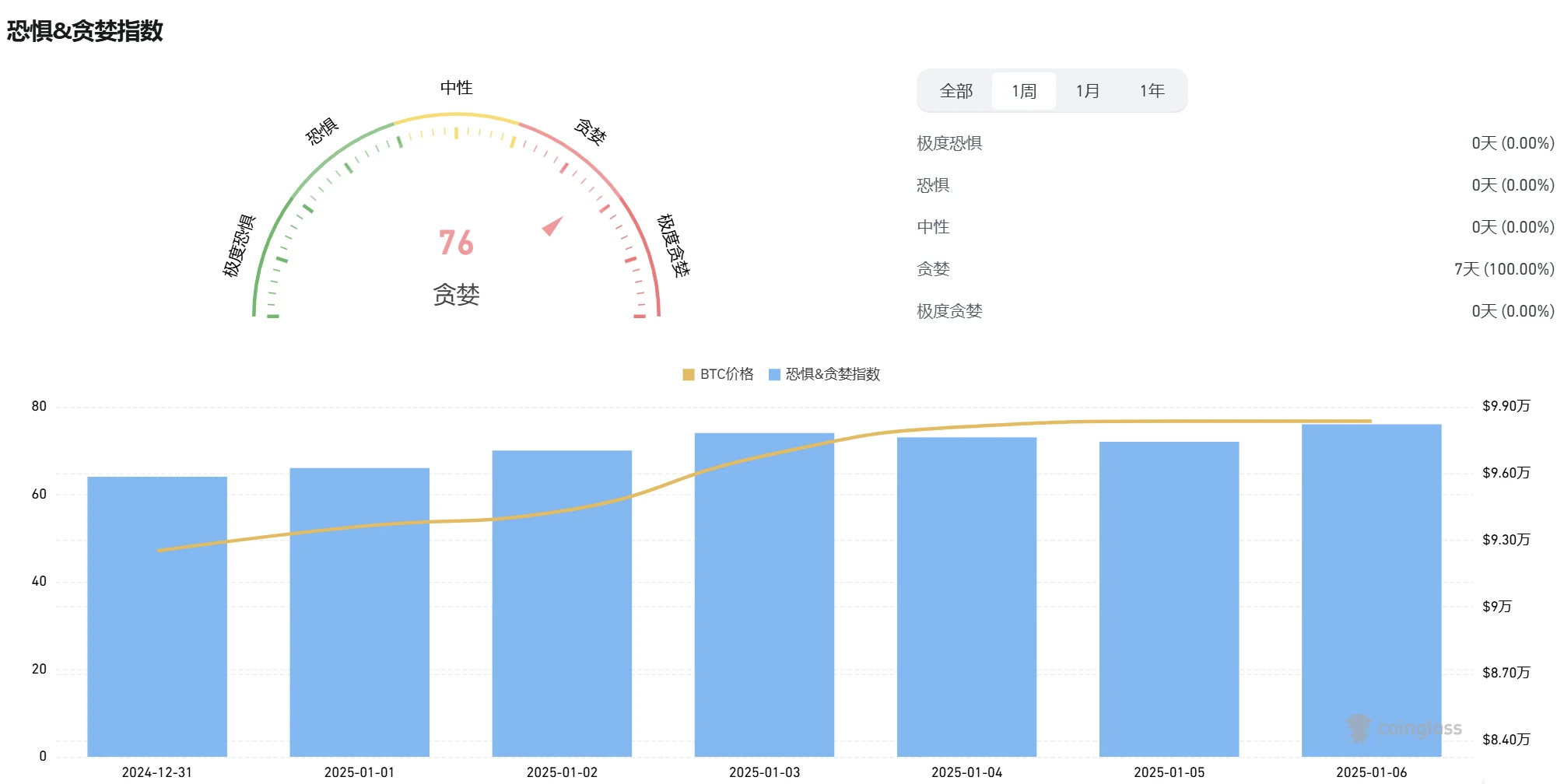

Thanks to the slow rebound of the market last week, the Fear and Greed Index once again stood above 70 and maintained greed sentiment for a week in a row, which means that bullish sentiment has shown signs of recovery after Bitcoin stopped falling. Therefore, whether the key resistance of $100,000 can be recovered this week will determine whether the subsequent greed sentiment can continue. If it fails to retreat to $90,000 again, the index will most likely tend to be neutral. Otherwise, if it succeeds, the sentiment will most likely continue to remain above 75.

2. Public chain data

2.1. BTC Layer 2 Summary

Analysis

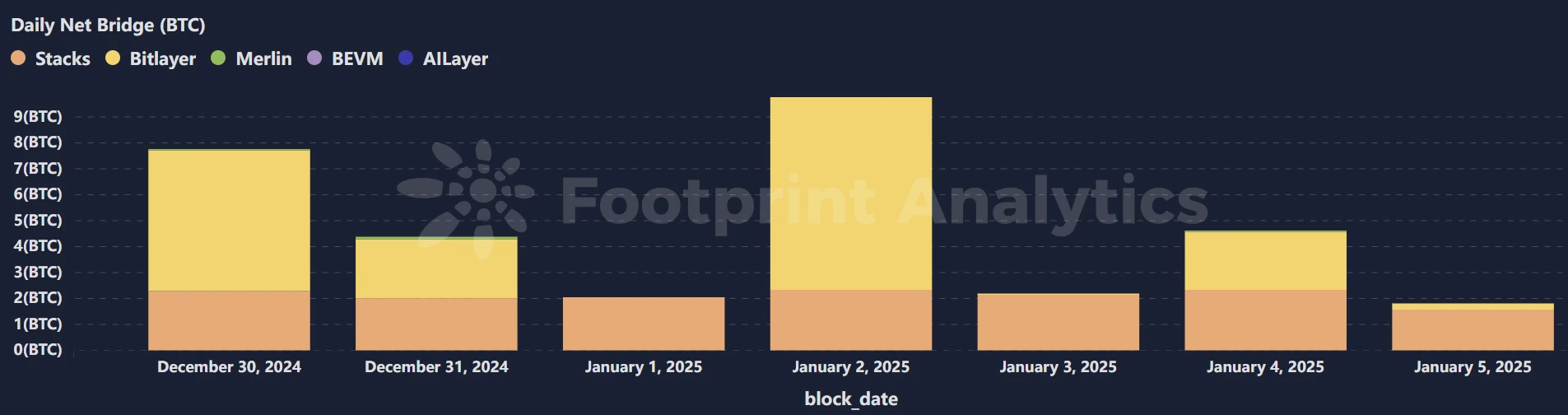

Although BTCs L2 was in an overall TVL outflow trend last week, the decline was not high, with an average drop of less than 5%. However, BitlayerTVL fell by more than 67%, which is an extremely terrible capital outflow trend.

Bitlayer TVL (Total Value Locked) plummeted by 67% possibly due to several reasons. Here are a few possible scenarios:

Market volatility or macroeconomic factors: The volatility of the crypto market may lead to a large outflow of funds, especially when market sentiment turns pessimistic. The sharp fluctuations in the prices of Bitcoin and other major cryptocurrencies may affect the flow of funds on DeFi platforms.

Technical problems or security vulnerabilities on the Bitlayer platform: If Bitlayer encounters technical problems or security vulnerabilities (such as smart contract vulnerabilities, hacker attacks, etc.), it may lead to a large amount of capital withdrawal, thus affecting TVL. For example, the platform may have suffered asset loss, theft, smart contract attacks, etc.

Platform governance or policy changes: If Bitlayer releases an unpopular governance proposal or update, it may cause users to lose confidence and lead to capital outflow. For example, the platform may adjust the yield rate, fee structure, or change the rules of use of the platform, resulting in user loss.

The rise of competing platforms: If new competing platforms emerge in the market that offer higher yields or stronger security, users may move funds from Bitlayer to these new platforms. Especially in the context of DeFi and liquidity mining, funds move very quickly.

Smart Contract Vulnerabilities or Attacks: Bitlayer’s smart contracts may expose vulnerabilities that allow attackers or malicious actors to manipulate the flow of funds, directly or indirectly leading to large-scale outflows of funds.

2.2. EVM non-EVM Layer 1 Summary

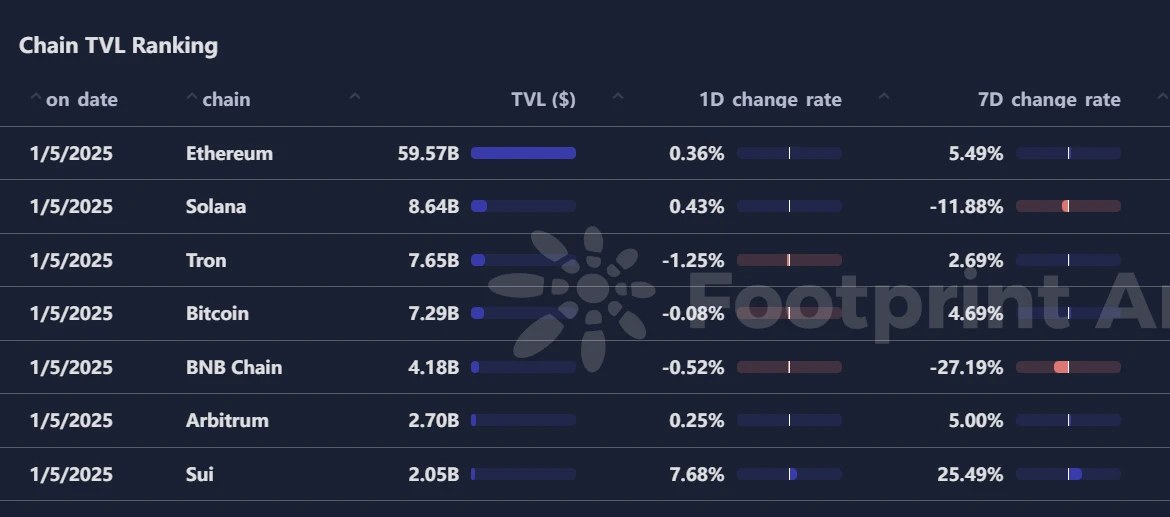

Analysis

Last week, the top public chains with the most obvious decline in TVL were still Solana and BNB Chain, and the capital fluctuations of these two chains have always been the largest among the top public chains, because the rise and fall of their TVL basically depends on the recent meme funds of the two sectors of AI and Desci. With the sharp correction of AI meme last week, funds have seriously outflowed. It is not surprising that the TVL of Solana and BNB Chain, the two largest meme hype chains, has declined, so it is judged to be a regular capital outflow.

Sui is the new generation public chain with the fastest TVL growth last week, thanks to the general rise in Sui ecological tokens, including: DEEP, CETUS, SEND and HIPPO, which have risen by 18% to 38%, triggering a positive flywheel effect. Judging from the current market situation, Sui has become another choice for hot sector projects to issue tokens, thanks to the advantages brought by its underlying MOVE language architecture. Sui tokens will also achieve a leading position in the next round of increases, so investors can continue to focus on Sui to explore entry opportunities.

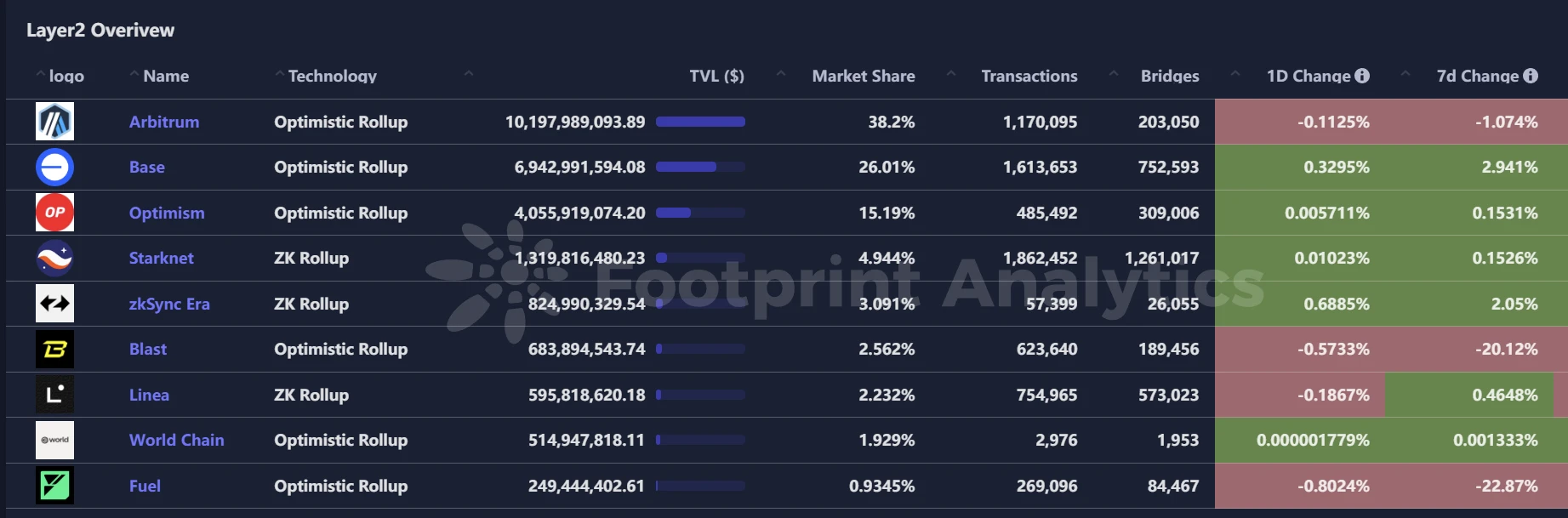

2.3. EVM Layer 2 Summary

Analysis

Last week, in the L2 sector, Fuel and Blast continued to be the top Rollup protocols with the most TVL outflow. Despite this, Fuel is positive, especially the announcement of the launch of the application-specific sorter FUEL ASS, which aims to provide users with a gas-free experience. Fuel released the SwayFarm game to support a gas-free demo through FUEL ASS. Fuels binding mechanism supports token holders to direct FUEL unlocks to specific applications to subsidize the fees of their users. Applications can use these unlocks to improve their application user experience through gas-free transactions, reduced application fees, and priority.

As for Blast, it is likely that it will be announced and launched this month due to the final adjustments to the mobile platform, token economics updates and other important announcements. Therefore, this is a capital fluctuation before the upgrade, and it has no impact on the essence of the project, so investors can rest assured.

4. Macroeconomic data review and key data release nodes next week

Investors will be watching the minutes of the Federal Reserves December meeting on Thursday to see how the central bank views its policy shift. Any information that hints at the timing or pace of rate cuts could cause market volatility.

Important macro data nodes this week (January 6-January 10) include:

January 8: US ADP employment figures for December;

January 9: U.S. initial jobless claims for the week ending January 4;

January 10: U.S. unemployment rate in December; U.S. non-farm payrolls in December, seasonally adjusted

V. Regulatory policies

During the week, with the EU Crypto-Asset Market Regulation Act officially taking effect, it means that the formal regulatory framework for the crypto industry has begun to be implemented worldwide. For the crypto industry, this is the beginning of global compliance. In the past year, countries and regions have tried regulatory methods to varying degrees. In 2025, it is expected that more complete regulatory policy systems will be introduced.

European Union

The EU MiCA regulatory framework will officially take effect on December 31, 2024. On June 9, 2023, the Markets in Crypto Assets regulation bill (MiCA) was published in the EU Official Gazette after nearly two and a half years of legislative review and officially became law. MiCA is the EUs first legislation on the regulatory framework for crypto asset markets. The implementation of MiCA will reshape the EUs cryptocurrency market through strict compliance standards and a ban on algorithmic stablecoins.

Switzerland

On December 31, the Swiss federal government officially began to review the referendum proposal entitled Building a Financially Strong, Sovereign, Independent and Responsible Switzerland (Bitcoin Initiative). The proposal has been published in the Federal Gazette and has entered the signature collection stage, aiming to incorporate Bitcoin into the Swiss national financial system through a constitutional amendment.

USA

On January 2, the U.S. Internal Revenue Service (IRS) postponed the implementation of crypto tax rules until the end of 2025. The rule stipulates that CEX will use the first-in, first-out (FIFO) accounting method by default when calculating capital gains. The first-in, first-out method generally assumes that the oldest assets are sold first, which often leads to higher taxable gains when the market rises. This postponement will increase the tax liability of crypto investors.

Japan

In the latest tax reform outline released by the Financial Services Agency of Japan, it is proposed to adjust the positioning of crypto assets from payment tools to financial assets. According to the outline, crypto asset transactions will receive the same tax incentives as financial products such as listed stocks, provided that appropriate investor protection mechanisms, explanation obligations and compliance requirements are established.

Hongkong

Hong Kong Financial Secretary Paul Chan attended the CCTV Financial Powerhouse - Hong Kong Financial Night and delivered a speech, saying that Hong Kong currently has more than 1,100 fintech companies, with an annual growth rate of about 15%. Hong Kong will continue to promote the development of central bank digital currency, mobile payment, digital banking, digital asset trading, etc., and strengthen cooperation with central banks around the world to promote blockchain-based cross-border trade digital currency settlement, so that financial innovation can better serve the real economy.