Original author: Circle

Original translation: Will Awang

We have seen enough cases and consensus in 2024 to establish the status of stablecoins as killer applications. Stripe even used real money to acquire the stablecoin service provider Bridge, setting a record for the highest acquisition transaction amount in the industry. With the release of clear regulatory signals from the current US government, 2025 will surely be a big year for the stablecoin market. Multiple stablecoin issuers, the issuance of various types of stablecoins, and the continuous enrichment of stablecoin application scenarios will emerge in an endless stream.

As the issuer of USDC compliant stablecoin, the financial technology company Circle is one of the most successful projects in the world today. As a Pre-IPO project, Circle follows the route of the traditional capital market. So how to give traditional finance a narrative and how to expand the application scenarios of traditional finance are what every stablecoin issuer and every project that claims to achieve Mass Adoption needs to learn and draw lessons from.

The first narrative: Financial upgrade of the Internet. Circle is building a value interconnected network based on stablecoins, providing network upgrades for global finance. Blockchain brings the speed and scale of the Internet to the transfer of value. Note that the story here is a continuation of Internet + rather than an expansion of blockchain +. After all, all application layers today are built on the Internet.

The second narrative: Upgrading the Internet through USDC. USDC digital dollars are tokenized versions of fiat currencies that are loaded onto the Internet, enabling individuals and businesses to transfer, consume, save, and store value with the same efficiency and scale as we transfer Internet data today.

Limited by financial infrastructure, the transmission of information and funds in todays world are separated. The blockchain-based Web3 value Internet directly embeds value into the architecture of the traditional Internet, allowing users to become owners of their data and other technical assets (including currency) and promote value exchange. In this Web3 value Internet, USDC is the US dollar on the Internet. USDC can use the innovative achievements of the blockchain network to make up for and strengthen the global banking and financial system.

The third narrative: using network effects to expand application scenarios. The U.S. dollar and the Internet itself have strong network effects. In the real world and on the Internet, the U.S. dollar is a currency with network effects. Blockchain technology gives USDC more powerful functions and new application potential than traditional U.S. dollars, while relying on traditional Internet networks for implementation. Circle is building an open technology platform based on USDC, based on the strength and widespread use of the U.S. dollar today, and making full use of the scale, speed and cost advantages of the Internet to achieve similar network effects and practicality for financial services.

The establishment of narrative and the expansion of rich application scenarios have contributed to the success of Circle USDC. Therefore, we compiled the 2025 State of the USDC Economy recently released by Circle for your reference.

The full text is 18,000 words. Enjoy as follows:

1. Executive Summary by Jeremy Allaire

The past year has marked significant progress for USDC in terms of economic growth and adoption maturity. Globally, this trend is gaining momentum as more and more individuals and businesses experience the power of digital dollars on blockchain networks. Developers continue to discover the ability to build application platforms using USDC and Circles technology, making global commerce and finance more efficient, fast, and inclusive.

Let’s look at the specific data of USDC in 2024:

USDC in circulation grew by more than 78% year-over-year in 2024, which is faster than any other large stablecoin. Meanwhile, monthly trading volume reached $1 trillion in November 2024 alone, and historical trading volume exceeded $18 trillion.

USDC user base is also strong and is becoming mainstream. Through expanded partnerships with leading digital asset exchanges, banks and wallets, USDC is now available to over 500 million end-user wallet products, supporting a range of use cases from digital capital market activities to USD value storage, as well as the growing wave of payment applications around the world.

USDC is a stablecoin based on the US dollar. In addition to the US dollars preeminent position in trade, payments, and global finance, there are three factors that are expected to accelerate the adoption and utility of USDC. This is like the way in the history of technology, dial-up Internet and immature browsers gradually evolved into broadband and mobile networks, and then search and e-commerce brought all the worlds knowledge and salable goods to the fingertips of billions of people.

Legal and regulatory clarity. Around the world, emerging stablecoin rules are developing robust compliance standards to protect consumers and pave the way for broader institutional integration, which is consistent with Circles approach to business. There are strong signs that the United States will soon follow suit and play an important role in harmonizing these rules globally. This trend towards regulatory clarity will give households, businesses, and financial institutions greater confidence in USDC.

Scalability of blockchain networks. At the same time, blockchain infrastructure is rapidly improving, becoming faster, more secure, and more flexible. Developers are simplifying the user experience and pushing complexity to the background so that the technology just works, and blockchains that have solved major scaling issues can now enable USDC payments around the world at a cost of just pennies.

Excellent user experience. The number of connections between USDC and traditional finance is surging. Circle’s expanding global banking network adds direct access to USDC to many financial centers around the world. Increasing the number of partnerships can unlock more traditional payment use cases, including global payroll payments, supplier payments, cross-border remittances, merchant payments, and more.

Based on all of the above factors, along with the open network and ultra-high throughput of the Internet of Value, the Circle stablecoin network can achieve near-instant global value distribution. Its like storing and moving videos as an example: In 2002, transferring video files was very troublesome. Twenty years later, people watch more than 1 billion hours of video every day.

The growth of the USDC economy reflects a larger trend toward financial openness, where technological advances and the proliferation of APIs are driving a future where instant, low-cost payments are the expectation. Recent research confirms this, with 65% of payments industry executives recognizing the need to expand instant payments infrastructure. However, traditional payments are lagging behind. USDC has the potential to help the rapidly evolving payments landscape reach its full potential, especially in emerging markets that are rapidly shifting from cash to non-cash payments.

Circle’s internet-scale, enterprise-grade, and regulatory compliance is more than a smart business strategy; it’s a necessity to become a platform for prosperity. More than a decade ago, Circle set out to build a company that would leverage the best features of blockchain—speed, low cost, inclusive reach, and programmability—to rebuild global value exchange from the ground up using internet infrastructure. As this report demonstrates, Circle is on a mission to increase global economic prosperity through frictionless value exchange.

Circle is more optimistic than ever about the future — not just for Circle, but for everyone in the entire USDC ecosystem. Jeremy Allaire, Circle Co-founder CEO

2. About Circle and USDC

2.1 Circle Stablecoin Network

Global interest in USDC is growing from the bottom up, as more businesses and individuals realize that stablecoins and blockchain networks can solve long-standing problems in global payments. These problems mainly stem from the old payment rails that todays business activities still rely on. SWIFT and ACH - just two of the many rails that make up todays fragmented global payments landscape - were established in 1977 and 1972 respectively. More recent developments, such as SEPA in the Eurozone and national instant payment systems in several major markets, still lack global interoperability and scale.

These shortcomings lead to high transaction costs, delays, and other barriers, while exacerbating financial inclusion issues for those who lack access to the global banking system. Collectively, these frictions impose a significant tax on global commerce. A new standard for global money movement that is easily connected, secure, and accessible to everyone is urgently needed to address these pain points and unlock tremendous opportunities. This vision is becoming a reality in the form of the Circle Stablecoin Network.

Circle works with leading global banks, payment service providers and other institutions to connect all participants in a comprehensive, Internet-based settlement system through a stablecoin network, with USDC, the worlds largest regulated stablecoin, at its core. USDC can use the innovations of blockchain networks to complement and strengthen the global banking and financial system. Since its launch in 2018, Circle has achieved more than $850 billion in two-way flows between fiat currencies and supported blockchains. This stablecoin network enables banks, payment providers, businesses and consumers to use USDC for real-time global settlements with extremely low transaction costs and global accessibility.

In the half century since the advent of SWIFT and ACH, global communications have undergone a radical transformation, enabling people to connect with each other instantly around the world. Billions of people can watch Hollywood movies on their handheld mobile phones while riding the subway, access all of human knowledge instantly and at almost no cost, and buy or sell almost any product from every corner of the world. Circle is building a stablecoin-based value interconnected network to provide a network upgrade for global finance. As this report explains, this transformation is underway, and Circle expects to make accelerated progress in 2025 and beyond.

2.2 USDC is both a currency and a platform

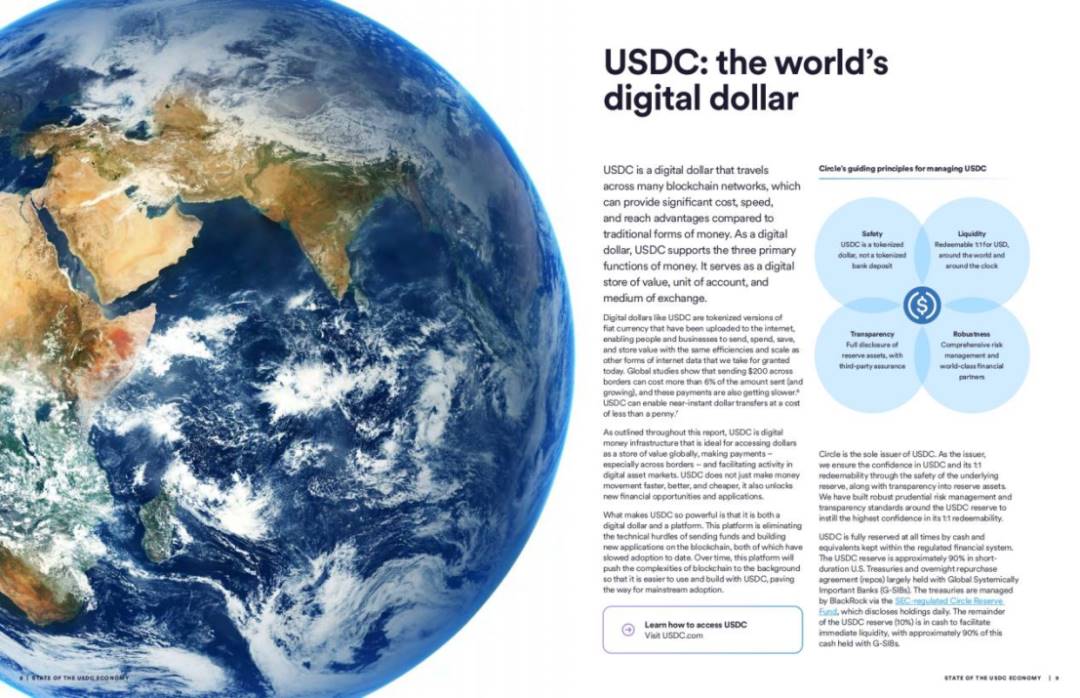

USDC is a digital dollar that can be transferred on multiple blockchain networks. Compared with traditional forms of money, it has significant advantages in cost, speed and coverage. USDC can embody the three basic functions of currency: it acts as a digital value storage tool (A Digital Store of Value), a unit of account (Unit of Account) and a medium of exchange (Medium of Exchange).

USDC digital dollars are tokenized versions of fiat currencies that are loaded onto the internet, enabling individuals and businesses to transfer, spend, save, and store value with the same efficiency and scale as we transfer internet data today. Global studies show that the cost of sending $200 across borders can be more than 6% of the amount sent (and growing), and the speed of these payments is also getting slower. USDC enables near-instant dollar transfers at a cost of less than a penny.

At the same time, USDC is an ideal digital currency infrastructure that can be used globally as a value storage tool, for payments (especially cross-border payments), and to promote activities in the digital asset market. USDC not only makes the flow of funds faster, better, and cheaper, but also unlocks new financial opportunities and applications.

As a bridge between traditional finance and blockchain, USDC needs to be tightly integrated with the banking system at all times. Circle works with leading banks, including several global systemically important banks (G-SIBs), to ensure that USDC can be exchanged for US dollars at a 1:1 ratio. These partner banks are strategically located around the world, making USDC cost-effective and accessible in markets with high demand.

This year, Circle began offering USDC in certain countries through national payment systems as well as local currencies. As Circle seeks more bank integrations, Circle expects this local availability to become more widespread. USDC is also accepted as a primary settlement currency by the world’s leading card schemes and payment networks, which supports its use as a medium of exchange.

What makes USDC so powerful is that it is both a digital dollar and a platform. This platform is removing technical barriers to moving money and building new applications on the blockchain, both of which have previously hindered the speed of adoption. Over time, this platform will push the complexity of the blockchain to the background, making it easier to use and build USDC, paving the way for mass adoption.

2.3 Circle’s compliance principles for managing USDC

Circles basic principles for managing USDC: 1) Security: USDC is a tokenized US dollar, not a tokenized bank deposit; 2) Transparency: reserve assets are fully disclosed and guaranteed by a third party; 3) Liquidity: convertible into US dollars at a 1:1 ratio around the clock worldwide; 4) Robustness: comprehensive risk management and world-class financial partners.

Circle is the sole issuer of USDC. As the issuer, Circle has established robust prudent risk management and transparency standards around USDC reserves to establish the highest confidence in its 1:1 redeemability. USDC is fully backed at all times by cash and equivalents held in the regulated financial system, with approximately 90% of the reserves in short-term U.S. Treasuries and overnight repurchase agreements (Repos). These Treasuries are managed by BlackRock through the Circle Reserve Fund, which is regulated by the U.S. Securities and Exchange Commission (SEC), and the fund discloses its holdings daily. The remainder of the USDC reserve (10%) is in cash to provide immediate liquidity, of which approximately 90% is also held in G-SIBs.

Circle also discloses reserve assets, minting and redemption information on a weekly basis on the transparency page of circle.com. Monthly, USDC and EURC reserve reports are published, and independent auditor Deloitte will comment on these reports. Circle is regulated in the United States and other global jurisdictions, including maintaining customer identification (KYC), anti-money laundering (AML), sanctions, privacy, regulatory reporting and other risk management programs, while conducting blockchain monitoring and screening to prevent child exploitation, sanctioned addresses, terrorist financing and other illegal activities.

USDC also enjoys this legal and regulatory clarity in Europe, where Circle has become the first major global stablecoin issuer to comply with MiCA rules - the EURC euro stablecoin, which is issued and reserved entirely by Circles regulated electronic money institutions in France, in line with the regulatory framework of the EU Crypto-Asset Market Regulation Act (MiCA). In early October 2024, EURC became the largest euro-backed stablecoin in total circulation and exceeded $1 billion in weekly transfers. EURC is available on multiple blockchains and has broad support from large digital asset service providers in the EU. The growth of non-USD stablecoins has brought new possibilities to blockchain-based finance, including foreign exchange (FX), local capital markets, and tokenization efforts, as well as regional cross-border and remittance payment channels.

3. Dollars on the Internet

Circles mission is to increase global economic prosperity through frictionless exchange of value. Circle firmly believes that the speed, cost, and accessibility advantages of blockchain-based commerce can materially benefit billions of people around the world.

USDC is already helping accelerate the evolution of traditional financial services in the developed world, but its most impactful impact may be its ability to help the 1.4 billion unbanked people. Many of these people live far from financial infrastructure such as mobile phones, the internet, and fintech (including physical banks). USDC is a way to put low-cost, transparent digital dollars directly into their hands.

3.1 The speed of value transfer on the Internet

All this is thanks to the inherent openness of USDC. USDC is built on an open blockchain network, allowing currency, payments, lending, and other programmable functions to be directly integrated into the architecture of the Internet. As of 2024, USDC natively supports 16 blockchains, including Ethereum, the worlds largest smart contract blockchain, and many third-generation blockchains designed from the foundation for near-instant, nearly free payment settlement.

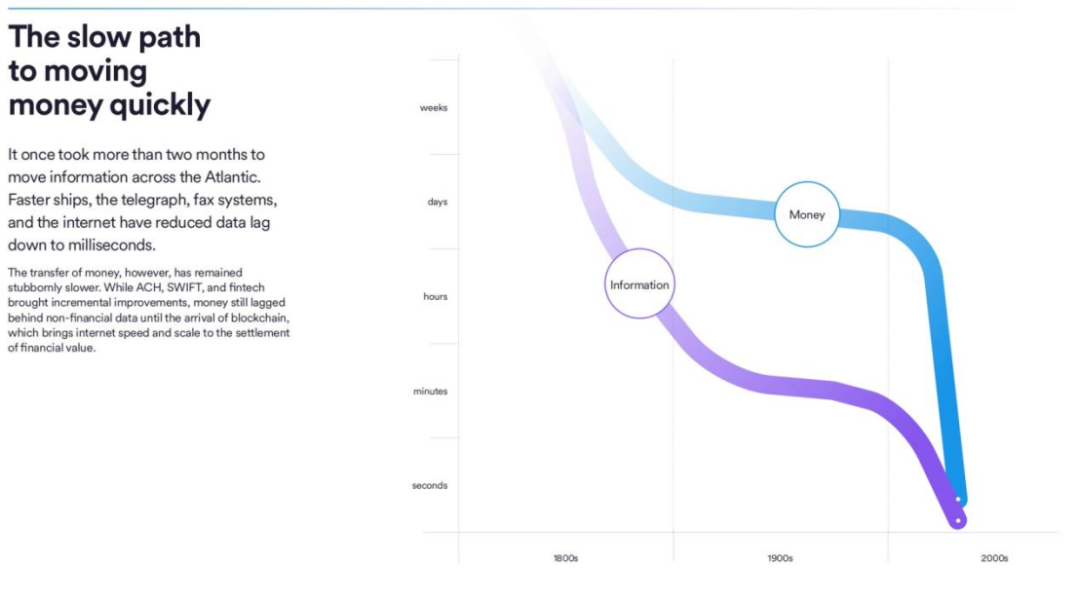

USDC will drive the next paradigm in money transfer. In the past, it took more than two months for information to cross the Atlantic Ocean. Faster ships, telegraphs, fax systems, and the Internet have reduced data latency to milliseconds. However, the transfer of funds has always been slow. Despite some improvements brought by ACH, SWIFT, and FinTech, before the emergence of blockchain, the transfer of funds still lagged behind non-financial data. Blockchain brings the speed and scale of the Internet to the transfer of value.

3.2 USDC user base gradually expands

Around the world, the number of people using USDC continues to climb steadily. Since the beginning of 2023, the number of wallets holding at least $10 in USDC has nearly doubled to 3.9 million addresses, with most of the growth occurring in 2024. This is part of a larger, longer-term shift in financial services that has been going on for at least two decades. The introduction of mobile devices and smartphones in the early to mid-2000s, along with regulations such as the EU Payment Services Directive (PSD), paved the way for technology companies to begin offering financial services.

In summary, financial digitization is driving major changes, digital wallets (including wallets linked to payment cards) are becoming a popular payment method, and commercial payments are also rapidly digitizing.

Over the past year, Circle has partnered with a number of businesses that can now distribute USDC directly to their millions of users. While these partnerships are in their early stages, Circle expects that with its large user base, these partnerships will help drive the next phase of USDC’s growth by expanding access to the dollar.

3.3 Global companies’ interest in Circle surges

From powerful financial institutions and enterprise technology companies to pioneering payment companies, the commercial interest in Circle has gradually deepened. Different businesses around the world are using the platform provided by Circle to better serve their customers, operate more efficiently, and create new connections. USDC is borderless, always online, and enables near-instant payments, powering the next wave of global commerce.

4. A new Internet financial system: the Internet of Value

The growth of USDC’s user base is happening in tandem with the rise of a new financial system for the Internet, creating new ways to exchange value and enhancing and expanding the activities of the traditional financial system. Over time, Circle expects that as more people, businesses, and institutions coalesce around the unparalleled utility provided by open Internet protocols, more traditional financial activities will migrate to this new Internet financial system - the Internet of Value. This trend extends from information to communications, and now to currency itself - stablecoins.

4.1 The development trajectory of the Internet

To understand this coming shift and the role Circle hopes to play, it’s helpful to look back at the trajectory of the early internet. The advent of the commercial internet in the 1990s and the advancement of “write” access in the early 2000s gave rise to new platform business models that empowered builders and directly connected users to each other. These platform businesses still dominate the internet today, spanning social media, ride-sharing, e-commerce, app marketplaces, and more. By accumulating significant network effects and global scale, they create utility that enables deep, ongoing engagement with a loyal base of users.

The rise of digital currencies like USDC stems from the collision of money with Moore’s Law and Metcalfe’s Law. In the real world and on the Internet, the US dollar is a currency with network effects. Circle is building a technology platform based on USDC, building on the strength and widespread use of the US dollar today, and taking advantage of the scale, speed and cost of the Internet to achieve similar network effects and practicality for financial services.

4.2 Value Layer of the Internet

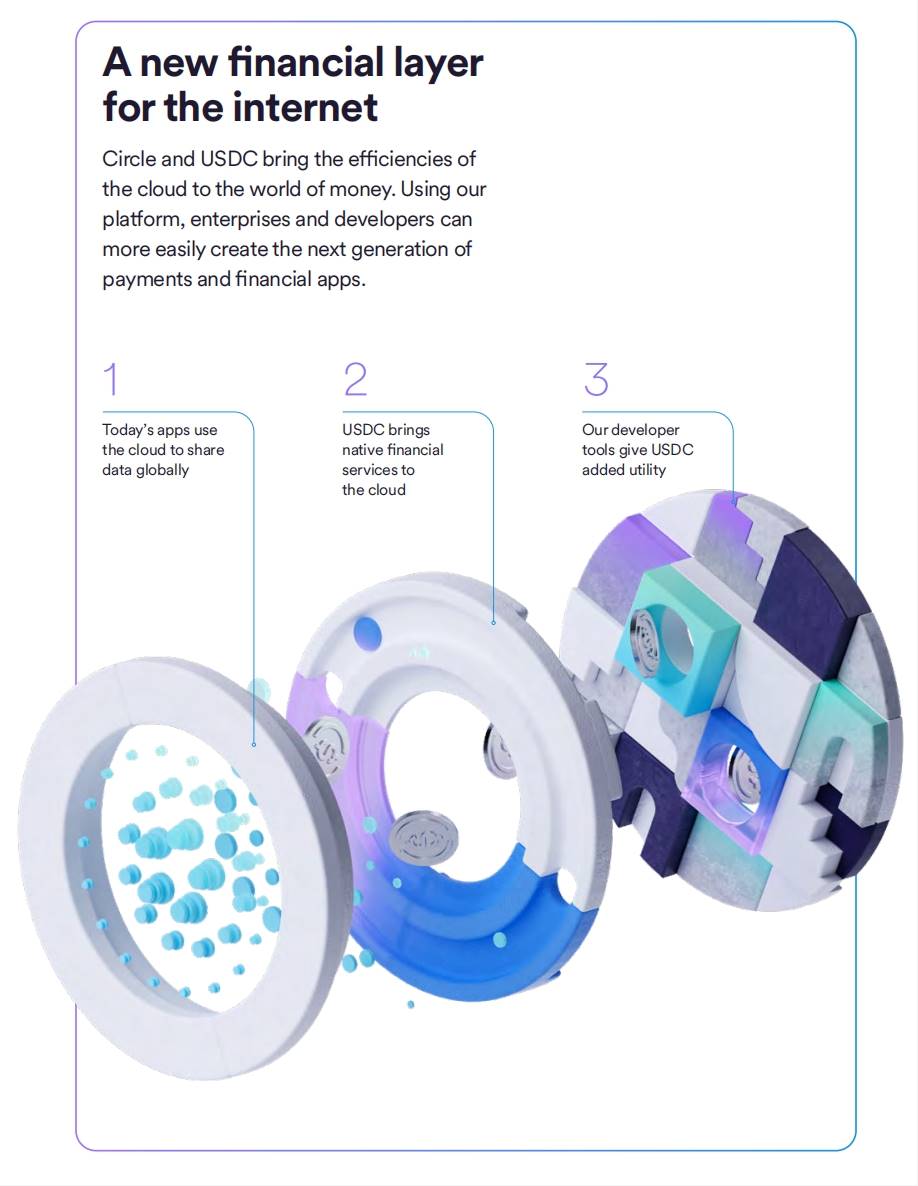

To this end, Circle designed USDC using open source standards and smart contract blockchains so that any developer can easily access the tools they need to build global, scalable digital dollar applications. This programmability and composability is a game changer: it gives USDC more powerful functionality and new application potential than traditional dollars.

Circle offers developers a range of additional services designed to make USDC easier to use for their businesses and, ultimately, their customers. This includes several types of USDC-supported wallets that businesses can embed directly into existing customer interfaces with just a few lines of code, and an expanding library of smart contract templates that remove much of the complexity of creating applications on the blockchain. Other services focus on simplifying the payment of network transaction fees, which are typically denominated in the blockchain’s native token, adding extra steps and barriers to use. Circle is now enabling the use of USDC to pay these fees.

At the same time, as a regulated financial services company, Circle puts compliance first. Developers and businesses building on the Circle platform can access tools to help ensure compliance with anti-money laundering (AML) standards through real-time transaction screening, continuous monitoring, and fulfillment of travel rule obligations. Circles new compliance engine provides developers with resources to help meet compliance needs and export safe, robust, and responsible tools to the broader digital asset ecosystem.

Over the past two decades, leading cloud service providers have solved challenges such as on-demand data storage, enabling todays Internet companies to focus less on the backend and put more resources and attention on innovation and customer experience. Similarly, Circle provides a comprehensive toolkit that can promote the development of Web3.

Web3 embeds value directly into the architecture of the Internet, allowing users to become owners of their data and other technical assets (including currency) and facilitate value exchange. In addition, Web3 can also become another new foundational layer of the Internet, providing new ways of corporate governance, value creation, and stakeholder engagement.

Just as 94% of Fortune 500 companies rely on the public cloud for business operations today, Circle expects that more and more major companies will turn to this Internet of Value in the coming years. According to some studies, more than half of Fortune 500 executives surveyed said their companies are already building on the blockchain. In addition to making it easier to launch individual applications, Circle also provides some enhancements that can turn USDC into a link that connects a wide range of services across the blockchain ecosystem. The Cross-Chain Transfer Protocol (CCTP) launched in 2023 is one such example.

One of the reasons email has become so popular around the world is that its reach is global, and SMTP enables seamless communication no matter which service users use. Similarly, CCTP facilitates interoperability of USDC between supported blockchain networks. By eliminating the long-standing friction and risk of transferring value between blockchains - because blockchains themselves cannot communicate with each other - CCTP transforms a wide range of parts of the growing blockchain ecosystem into a single interconnected network where USDC can flow easily. Although early in its life cycle, CCTP has become the primary way USDC is transferred from one blockchain to another. Since its inception, CCTP has processed more than $20 billion in USDC transfers.

4.3 Cultivating the developer ecosystem

The movement of money touches nearly every aspect of local and global commerce. Built on open protocols and programmability, USDC and Circle’s technology solutions provide any software developer with familiar tools — including APIs in standard programming languages — to create powerful applications that upgrade the legacy financial system.

Developers are already taking advantage of this new opportunity to build the Internet of Value. Crucially, this progress is happening both from the bottom up and from the top down. Entrepreneurs are using USDC and Circle’s platform to create entirely new categories of financial applications. Meanwhile, businesses are using this same infrastructure to integrate the efficiencies of USDC and blockchain into their existing operations. Every day, Circle is investing in the growth of the blockchain ecosystem and developer community.

Across the globe, Circle hosts workshops and provides other resources to make it easier for developers to get hands-on and access the power of a digital dollar. Circle helps unlock the USDC platform for developers who need to integrate enterprise-grade software into trusted applications built for the digital dollar use cases highlighted in this report.

To date, the majority of USDC developer activity has focused on deepening the connections between the blockchain ecosystem and traditional financial rails. These connections act as on- and off-ramps, making USDC more impactful for existing payment use cases. These activities support and enhance the development of a more robust on-chain economy, where the full range of financial activities connecting buyers, sellers, and merchants can occur natively on the blockchain.

The growing intersection of blockchain and AI is another area of growing interest in the USDC developer community. Although still in its early stages, there are already signs that autonomous payments using USDC may begin to open up new business models for Internet goods and create more convenient ways for people to consume. The Circle platform is ready to help developers build this future.

This on-chain economy is emerging across multiple blockchains, further underscoring the need for neutral, interoperable infrastructure — including USDC and CCTP — that removes the friction of doing business across these networks. The fact that the top six blockchains by builder interest all have native USDC availability and full CCTP integration underscores Circle’s central role in this growing ecosystem of builders and creators.

5. USDC Real-World Use Cases

USDC has the same or even greater potential uses as fiat dollars. Today, most USDC activity is oriented toward the following four categories:

5.1 Global USD Acquisition

The U.S. dollar is in high demand outside the U.S. for both business and personal use. The dollar accounts for more than 90% of cross-border trade in Latin America, 74% in the Asia-Pacific region, and 79% elsewhere outside Europe. According to the Federal Reserve, more than $1 trillion in U.S. banknotes—and more than 60% of all $100 bills—are held outside the United States.

USDC’s use outside the U.S. is largely due to these factors, as well as its greater accessibility compared to traditional bank dollars. Throughout the year, Circle has partnered with established fintechs, neobanks, and other distributors to now be able to put USDC directly into the hands of customers around the world.

5.1.1 Nubank - Latin Americas emerging bank

Nubank is the worlds largest digital banking platform outside of Asia, serving 105 million customers in Brazil, Mexico, and Colombia. The company has been leading the industry transformation by developing innovative financial products and services using data and proprietary technology. Guided by its mission to fight complexity and empower people, Nubank meets customers on their complete financial journey, promoting financial access and development through responsible lending and transparency. The company is supported by an efficient and scalable business model that combines low-cost services with growing returns. Nubanks impact has been recognized by multiple awards, including Time Magazines 100, Fast Companys Most Innovative Companies, and Forbes Worlds Best Banks.

In May 2024, Circle announced its launch in Brazil, Nubanks home market. The launch includes a partnership with Nubank, where the two companies will work together to build digital asset products that give Nubank users near-instant, low-cost, 24/7 access to USDC. In addition to using USD as a store of value, Nubank users can transfer USDC to other wallets and will increasingly use it in daily financial activities. At Nubank, 30% of crypto users hold USDC assets, 50% of new users use USDC as a stepping stone to enter the crypto world, and in 2024, the number of users holding USDC increased 10 times.

As Nubank continues to expand its reach in Latin America and beyond, USDC will be a cornerstone of our strategy to deliver innovative financial solutions to our customers. Its stability, global reach, and commitment to regulatory compliance make it an ideal partner as we build a more inclusive and accessible financial future. Thomaz Fortes, Head of Crypto

5.1.2 Lemon——Fiat Currency and Digital Currency Wallet

Lemon is a Latin American company that has become a leader in the retail digital currency market. With direct operations in Argentina, Peru, and Brazil, Lemon also works with partners to reach users in Mexico, Colombia, Uruguay, and Ecuador. Their main product is a virtual wallet that combines traditional finance with digital currencies. The integration of DeFi protocols further enhances the seamless exchange between local currencies and cryptocurrencies (including USDC), which can be earned through additional cryptocurrency income every week.

The innovative Visa Lemon card is available to Argentinian users, offering global spending and Bitcoin cashback on every purchase. Lemon and Visa have further deepened their partnership and are developing plans to expand the Lemon card throughout the region. In addition, Peruvians can interact with local payment systems using fiat or cryptocurrencies and send money via QR codes. On Lemon, users collectively hold $137 million in USDC, with new USDC users reaching 21%.

With over 3 million users in the region, the amount of USDC held by Lemon has grown 61% over the past 12 months. This reflects the growing demand for a digital dollar. This growth highlights the importance of stablecoins and our ability to provide tailored solutions that enable individuals in Latin America to manage their money freely and without barriers. Maximiliano Raimondi, CFO

5.2 Digital Asset Market

The digital asset market is gaining momentum and mainstream adoption is growing significantly in 2024. As more jurisdictions around the world enact clear regulations to govern market behavior, more digital asset exchanges are becoming compliant gateways for new users to acquire financial products with enhanced security measures and strong consumer protections.

USDC plays an increasingly important role in these markets. As the most widely used regulated stablecoin, USDC can eliminate risk for exchanges and their customers and serve as a liquid USD base layer for trading, lending, storing value, and other activities.

Based on the growing public interest, the amount of USDC held by centralized exchanges around the world has grown steadily in 2024. More institutional support for USDC trading and the launch of new products linked to USDC continue to enhance the liquidity of USDC and Bitcoin, Ethereum and other digital currency spot and leveraged product trading.

USDC also plays an important role in decentralized finance (DeFi), where institutions often place great emphasis on security and transparency. As digital asset prices rise, DeFi rebounded throughout 2024, with a total locked value (TVL) of more than $126 billion as of November 30, 2024. USDC built on DeFis historically strong usage, accounting for 69% of stablecoin trading volume in the same time frame.

As more global jurisdictions enact digital asset market regulations, the demand for regulated stablecoins will grow. This is already evident in Europe, which adopted the comprehensive MiCA framework in the summer of 2024. Traders in Europe are increasingly choosing regulated stablecoins, including USDC and EURC, which have been MiCA compliant from day one. Throughout 2024, several exchanges in the region announced delistings of non-compliant stablecoins ahead of the full compliance deadline of December 31, 2024.

Despite the lack of market structure regulation, mainstream adoption in the U.S. is also accelerating, driven in large part by the SEC’s approval of a spot Bitcoin exchange-traded fund (ETF), enabling asset managers to provide clients and customers with access to the largest digital asset by market cap. A few months later, the SEC approved a spot ETF for Ethereum. Collectively, these ETFs offer mainstream investors a highly regulated, transparent way to invest in nearly $2.5 trillion in digital assets as of November 30, 2024. To date, at least 11 U.S. institutions have launched ETFs tied to Bitcoin or Ethereum, the two largest digital assets by market cap.

While Circle is not directly used in these ETFs, its long-standing regulatory-first stance means that USDC is benefiting from the broader digital asset market trend of greater regulatory clarity and integration into the global financial system. Major traditional investment platforms in the United States and around the world continue to expand their digital product ranges, and USDC serves as a bridge between traditional and digital asset markets to serve customers.

5.2.1 Coinbase - the worlds leading compliant digital asset exchange

Coinbase provides a trusted platform that makes it easy for individuals and institutions to participate in digital assets, including trading, staking, safekeeping, spending, and fast, free global transfers. USDC plays an important role in Coinbase, accounting for a large portion of trading liquidity and collateral. In 2023, Coinbase launched Base, an Ethereum layer 2 blockchain that enables USDC transactions in less than a second and at a cost of less than a penny. This year, Base has seen significant growth in adoption, and USDC - as the leading stablecoin on Base - is a key part of this surge. In total, approximately 562 billion USDC has come to Base over the past few years. Coinbase also offers a range of other services that make it easy for more people to access and start using USDC.

Stablecoins are changing the global financial landscape by promoting greater openness and inclusion. The continued expansion of USDC circulation will enhance global economic freedom and set a new standard for an industry based on trust and transparency. We are excited to further drive innovation by advancing the development of the USDC ecosystem, its circulation and global adoption. Shan Aggarwal, VP of Corporate and Business Development

5.2.3 Chipper Cash —— Providing Convenient Financial Services to Africa

With over 6 million registered users, Chipper Cash is one of the largest fintech companies in Africa. The company enables Africans to easily send money without the hassles and fees typically associated with using other payment systems. Chipper uses USDC to enable efficient fund management around the world, optimizing and reducing cross-border settlement costs.

Chipper offers a variety of products including USD-denominated savings (for local workers who want to convert their foreign salaries into USDC), virtual Visa cards that can be funded and used locally or globally, fractional shares for investing in foreign stocks, and remittances. Chipper has 49 operating licenses around the world, including a broker-dealer license recently issued by the Securities and Exchange Commission of Ghana. Circle and Chipper are proud partners in providing trusted and accessible financial services throughout Africa and beyond.

USDC is a key settlement layer for the Chipper Cash technology platform and a growing number of partners, enabling seamless 24/7 USD transfers and facilitating broad interoperability. By using USDC on a shared ledger, we have significantly improved operational efficiency - real-time reconciliation, transparent funds tracking, and reduced transaction disputes, streamlining our internal liquidity processes. This efficiency is critical to our growth strategy and commitment to providing powerful and reliable financial services to users in Africa and beyond. Maijid Moujaled, Co-founder CEO

5.2.2 Bullish - Innovative Digital Asset Exchange

Focused on developing products and services for the institutional digital asset space, Bullish has reinvented traditional exchanges to benefit asset holders, empower traders and increase market transparency. Backed by the Groups strong capital, Bullishs centralized exchange combines a high-performance central limit order book (CLOB) with proprietary automated market-making technology to provide deep liquidity and tight spreads - all within a compliant and regulated framework. Launched in November 2021, the exchange offers services in more than 50 select jurisdictions in Asia Pacific, Europe, Africa and Latin America. Bullish is a full-reserve exchange that prioritizes compliance and protection of customer assets through strong security measures and regulatory oversight.

Bullish Exchange is operated by Bullish (GI) Limited and is regulated by the Gibraltar Financial Services Commission. Bullish launched USDC in 2021 and currently lists more than 50 USDC trading pairs in the spot and derivatives markets. Bullishs daily USDC trading volume reaches US$1.3 billion, accounting for 83% of the entire exchanges trading volume.

The introduction of strong regulatory regimes around the world is opening up the cryptocurrency market to existing diversified financial services players. USDC not only provides an efficient and secure medium of exchange, but also provides a way for institutions to confidently participate in digital assets while acting as an important mechanism for recycling risk capital. Chris Tyrer, Head of Institutional

5.2.3 dYdX — Top Decentralized Exchange

dYdX is one of the largest and most successful protocols in the decentralized finance (DeFi) space, founded by Antonio Juliano in 2017 and initially launched on the Ethereum mainnet before building a layer 2 scaling solution in 2020 with Ethereum layer 2 Starkware.

Recognizing the need for lower fees and faster speeds, dYdX began exploring alternative infrastructure and in 2023 relaunched their service on Cosmos, a highly modular ecosystem that enables services like dYdX to build and operate their own blockchains.

Every trade conducted on dYdX is settled in USDC almost instantly. Circle’s Cross-Chain Transfer Protocol (CCTP) provides users with an easy way to bring native USDC liquidity from other blockchain ecosystems to Cosmos. CCTP is a permissionless, on-chain utility that facilitates the secure transfer of USDC between blockchains through native burns and minting. CCTP allows users to easily connect their wallets and deposit USDC from Ethereum and other supported networks. Read more about Circle, dYdX, and Cosmos.

CircleThanks to the Circle team, dYdX Chain has processed over $10 billion in volume since deployment. This is a monumental feat that would not have been possible without the innovation of Cosmos native USDC and CCTP. At dYdX, we are extremely grateful to Circle for their continued innovation, and their commitment to ensuring security and reliability for their users. Antonio Juliano, Founder

5.3 Payment

Blockchain networks can provide a significant upgrade to old, fragmented traditional payment rails by replacing multiple intermediaries and siloed databases with streamlined, always-on, interoperable technology that can transfer value to anyone with an internet connection.

USDC is driving the growth of global payments, from merchant acquiring to remittances and B2B payments. USDC is well suited to the race to reduce costs and increase the flow of $150 trillion in cross-border transactions. Commercial payments in particular have already been moving toward digital alternatives, and this growth is expected to continue in the coming years. USDC can help realize the full benefits of digital payments because it is conducted over an open, shared blockchain ledger without the need for intermediaries.

This year, Circle has taken significant steps to make USDC available to capitalize on this trend in major markets around the world where demand for digital dollars is high. Businesses in the U.S., Brazil, Mexico, the European Economic Area, Singapore, and Hong Kong can now leverage Circle’s banking partnerships to pay other businesses in these markets in USDC. Payees who have accounts with Circle’s banking partners can easily convert these funds into their local currency in just minutes.

These markets are among the world’s most active global trade corridors. For example, bilateral trade between the United States and Mexico alone exceeds $800 billion per year. In Brazil, 95% of the country’s $640 billion in annual external merchandise trade is conducted in U.S. dollars. Circle expects that additional banking partnerships will continue to enhance USDC’s global liquidity and payment utility, paving the way for broader use in merchant, supplier, trade, remittances, payroll, intercompany and other payment types.

5.3.1 Worldpay - an innovative global payment service provider

Worldpay provides payment, collection and management services to businesses of all sizes. They are a global leader in financial technology with unique capabilities to support the entire business. Whether online, in-store or on mobile, Worldpay is at the heart of exceptional commerce experiences in 146 countries and 135 currencies. They help their customers be more efficient, more secure and more successful.

In 2022, Worldpay became the first global merchant acquirer to offer direct USDC settlement, enabling merchants around the world to take advantage of growing stablecoin payment volumes and provide new payment methods for customers of both crypto-native and traditional businesses. Worldpays adoption of USDC also enables businesses to develop a financial strategy that fits the preferred currency in which they conduct their business. As a result, Worldpay customers are no longer constrained by payment service providers that only offer a fiat currency ecosystem, but can take advantage of innovative crypto payment methods to directly receive, hold and transfer stablecoins in a fast and efficient manner.

As the digital asset market rebounded this year, Worldpay was well-positioned to capitalize on the uptick in retail interest. In addition to providing card-to-crypto purchases and crypto-to-card withdrawals for several major exchanges, they also offer simplified funds management through USDC settlements. Worldpay clients can receive USDC from their customers instead of fiat currency and settle these funds on weekends (outside of traditional banking hours) to help optimize working capital.

Partnering with Circle enables Worldpay to bring new innovative, scalable digital payment solutions to our merchants. Our partnership improves transaction efficiency while expanding customer access to secure on-chain transactions. USDC settlement enables our merchants to position themselves at the forefront of digital finance, where they can take advantage of the benefits of fast, efficient settlement. Looking ahead to 2025, Worldpay is excited about the opportunity to work with Circle to continue to grow the ecosystem so that more participants can take advantage of the advantages offered by stablecoins. Nabil Manji, SVP, Head of FinTech Growth Financial Partnerships

5.3.2 Mastercard - Global Card Network

Mastercard is working with businesses and governments around the world in areas such as payments to improve the lives of the billions of people it serves. For more than 60 years, Mastercard has pioneered technology that makes payments simpler, smarter and more secure. Mastercards global network drives progress in the payments ecosystem by leveraging technology to build stronger connections and bring more people into the digital economy.

Mastercard’s partnership with Circle is now in its fifth year. In 2021, Mastercard announced that it would make it easier for issuers and their crypto card partners to use USDC to settle payments resulting from transactions on the Mastercard network. The same functionality was subsequently expanded to support acquirers who want to pay merchants in USDC. Currently, millions of dollars are being settled using this solution, which is available to both issuers and acquirers. In addition, Mastercard launched a card product structure last year that allows USDC held in self-hosted wallets to be used at more than 100 million locations that accept Mastercard.

At Mastercard, we work hard to meet the needs of our consumers and clients. Clients and co-brands operating in the digital asset space prefer dealing with stablecoins, including USDC, given their business models, and we want them to be able to choose settlement mechanisms with our network. Our partnership with Circle will continue to evolve in support of our mission to make payments simpler, smarter, and more secure. Izzy Iliev-Wollitzer, SVP, Blockchain and Digital Assets. At MetaMask, we are extremely excited to be working with Mastercard and Circle. We set out to create a solution that would allow users to pay directly from their MetaMask account anywhere Mastercard is accepted, and in collaboration with these valuable partners, we achieved this goal last summer. While this is an important step toward better, faster payments services, we believe this is just the first step in a new era of financial inclusion — and we look forward to continuing to build it together. Daniel Lynch, Card Strategy Lead

5.3.3 Zodia Markets —— Promoting cross-border payments for enterprises with Standard Chartered

Zodia Markets is an institutional-first digital asset brokerage that provides a wide range of services to global clients, including OTC and on-chain foreign exchange. At Zodia Markets, $4 billion of USDC was raised throughout the year, with an average cross-border payment amount of $3.5 million per order.

Zodia Markets was founded by SC Ventures, the innovation arm of Standard Chartered Bank, and OSL Group, Asias leading digital asset firm, and supports more than 50 digital assets and more than 20 fiat currencies. The companys institutional focus and unique relationship with Standard Chartered Bank puts it at the heart of USDCs corporate cross-border payment use cases, especially in emerging markets. Clients include multinational commodity companies and other businesses seeking to accelerate growth through faster and cheaper ways to transfer dollars across borders.

Standard Chartered is a well-capitalized global bank and a major shareholder in Zodia Markets, playing a key role in the convergence of digital assets and traditional finance. With a long history and a diverse portfolio of business lines, Standard Chartered understands how to promote sustainable growth for businesses and individuals around the world. In 2023, Standard Chartered became one of the banks to hold a portion of the reserve cash backing USDC. Standard Chartered also helps people more easily access USDC in high-demand markets by facilitating local minting in Singapore. Circles partnership with Standard Chartered means Zodia Markets can mint and destroy USDC almost instantly, giving customers the opportunity to enter and exit global payment flows in minutes.

5.3.4 MoneyGram - A Global Leading Financial Technology Company

MoneyGram is one of the worlds leading financial technology companies, with an 80-year history of helping people and businesses around the world send money faster and more efficiently. Today, their services are available in more than 200 countries and territories, reaching more than 150 million consumers who have a choice of how to send money - online, in their highly acclaimed mobile app or at one of more than 440,000 locations.

MoneyGram uses USDC on the Stellar blockchain to facilitate internet-scale dollar movement, while being able to cash out in 180 countries and convert to USDC in more than 30 countries. In 2024, MoneyGram launched MoneyGram® Wallet, a non-custodial digital wallet that uses USDC to make peer-to-peer remittances easier. Their global reach and decades of expertise make their remittance approach global, not regional. MoneyGram has already connected the United States to Brazil and Mexico, and plans to enable more payment corridors under construction.

Circle At MoneyGram, we see tremendous potential in USDC’s partnership with Circle to increase the speed, transparency, and accessibility of cross-border transactions. Our goal is to empower communities around the world through greater financial inclusion. Open blockchain networks represent a critical step in the evolution of global money flows, enabling us to meet the growing expectations of our digitally savvy customers. By leveraging blockchain technology and stablecoins like USDC, MoneyGram is at the forefront of innovation, bridging traditional and digital financial ecosystems and enabling interoperability between digital assets and local currencies. Jon Lira MoneyGram Access, Head of Partnerships

5.3.5 Stripe —— American payment giant

Stripe is a technology company building financial infrastructure for the internet. Businesses of all sizes, from new startups to public companies, use Stripes software to accept payments and manage their businesses online. In 2023, Stripes business customers processed $1 trillion in total payments. Stripe is one of the most innovative companies in the world and an early adopter of crypto payments. In 2022, they began offering USDC as a payment option for the platform, and in 2024, they enabled merchants to accept stablecoin payments using USDC on the Ethereum, Solana, and Polygon blockchains.

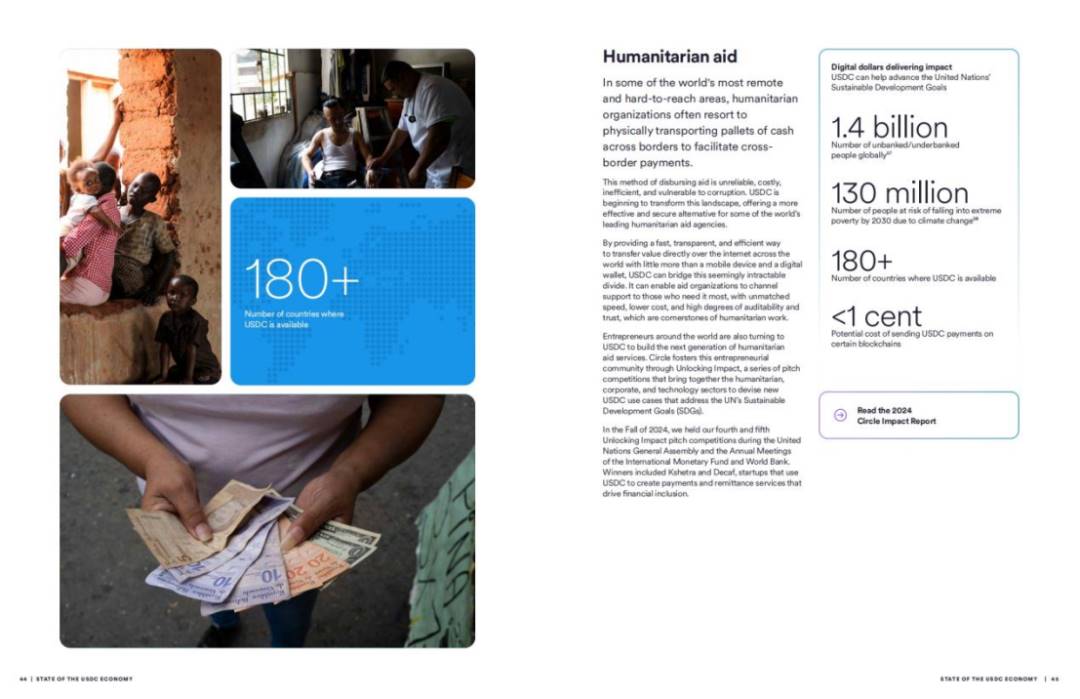

5.4 Humanitarian Assistance

Humanitarian organizations often transport cash across borders to facilitate cross-border payments in some of the most remote and hard-to-reach areas of the world.

This method of distributing aid is unreliable, costly, inefficient, and vulnerable to corruption. Currently, 1.4 billion people live in areas without banking services. It is estimated that 130 million people will fall into extreme poverty due to global warming.

USDC is beginning to change that, providing a more efficient and secure alternative to some of the world’s leading humanitarian aid agencies. USDC is able to support 180 countries with negligible transaction costs.

USDC can bridge this seemingly insurmountable gap by providing a fast, transparent, and efficient way to transfer value around the world directly over the internet, using only a mobile device and a digital wallet. It can allow aid organizations to deliver support to those who need it most with unparalleled speed, lower costs, and a high degree of auditability and trust, which are the cornerstones of humanitarian work.

Entrepreneurs around the world are also turning to USDC to build the next generation of humanitarian aid services. Circle is nurturing this entrepreneurial community through Unlocking Impact, a series of pitch competitions that brings together the humanitarian, corporate, and technology sectors to design new USDC use cases that address the United Nations’ Sustainable Development Goals (SDGs).

In the fall of 2024, Circle held the fourth and fifth Unlocking Impact pitch competitions during the United Nations General Assembly and the IMF and World Bank Annual Meetings. Winners included Kshetra and Decaf, startups using USDC to create payment and remittance services to drive financial inclusion.

5.4.1 The UN Refugee Agency

Today, more than 120 million people are forcibly displaced worldwide – a number close to the population of Japan. Yet, as persecution, conflict, violence and human rights violations increase, the outlook for those forcibly displaced grows bleak. UNHCR, the UN Refugee Agency, leads international action to protect people forced to flee their homes because of conflict and persecution. UNHCR provides life-saving assistance such as shelter, food and water, helps uphold basic human rights, and develops solutions to ensure people have a safe home where they can build a better future.

Distributing aid to displaced people is a serious challenge. They may not have access to banking services, especially in countries plagued by war and unrest. Local currencies can be unstable and difficult to use outside the country of issuance, making them less valuable to people forced to cross borders in search of safety. The risk of cash being lost or stolen is high, which is another major issue for people without a home base. As part of the Humanitarian Cash Program, UNHCR and Circle launched a program in December 2022 to distribute borderless digital dollars in the form of USDC to a group of people displaced by the war in Ukraine. The money is transferred directly to the recipients digital wallet via the Stellar blockchain, which the recipient can access almost instantly through a digital wallet on their own smartphone, with a fully integrated cash-out solution and in compliance with regulatory requirements.

The solution’s success in Ukraine has led to further expansion and implementation in other regions. In Argentina, for example, the introduction of this blockchain-based system could help safeguard the value of cash aid from the country’s high inflation and currency devaluation, significantly increasing the purchasing power and impact of aid provided to forcibly displaced people in Latin America. By leveraging blockchain technology and Circle’s USDC stablecoin, the solution improves transparency for donors and traceability for humanitarian aid recipients and stakeholders. The integration of digital wallets and direct access to the financial ecosystem makes aid accessible, even for those without traditional bank accounts.

This approach builds refugees’ resilience by sustaining their livelihoods, promoting financial and digital inclusion, and enabling them to contribute to the economies of host countries and beyond across borders. Blockchain technology can transform humanitarian aid by enabling real-time, transparent and accountable aid distribution. There is strong optimism about further leveraging blockchain and cryptocurrencies to support the most vulnerable, including those who have been forcibly displaced. Carmen Hett, Treasurer

5.4.2 Goodwall – Bridging the gap of inequality

Goodwall was founded by brothers Taha and Omar Bawa, whose parents both work for the United Nations. While traveling with their parents to refugee camps, they observed inequalities in opportunity and were determined from a young age to close this gap. By 2030, it is expected that 1 billion people will enter the workforce, 90% of whom will be in developing economies. In response, the brothers founded Goodwall, a company that acts as a powerful social community to connect this growing talent pool and help them develop the critical skills needed for future employment.

At over 2 billion people, Gen Z is the largest generation in history, yet employers and brands struggle to engage with them authentically and at scale. Goodwall provides a platform for companies like Microsoft and Accenture, as well as governments and the United Nations, to attract, engage and build a pipeline of Gen Z talent and consumers, reaching more than 100 million young people in the last 12 months.

All user actions (e.g., picking up bottles on the beach) are verified through geotagged photos and videos, and then rewarded on the platform. Goodwall chose USDC for payment because of its efficiency, cost and coverage, as well as the widespread demand for the US dollar in developing markets. In 2023, the Bawa brothers reached more than 90 million people in 170 countries. Nearly 3 million people signed up to start improving their career skills and earn USDC through environmental impact actions.

Goodwall will work with Arbitrum this fall to implement Circle’s programmable wallet, which aims to provide banking services to the unbanked and connect young people around the world to the global digital economy. Goodwall expects to issue USDC payments to more than 50,000 beneficiaries through this program over the next year.

5.4.3 Ensuro - Leveraging blockchain to support underserved insurance markets

Ensuro is an innovative insurance provider that leverages blockchain technology and smart contracts to revolutionize the insurance industry, making it more capital efficient and inclusive. Ensuros mission is to expand insurance coverage to individuals and businesses that have traditionally been overlooked by large insurance companies due to profitability constraints. The companys low fixed cost base is enabled by blockchain efficiencies, allowing it to offer insurance to underserved markets. While other insurance companies have experimented with smart contracts, they still rely on traditional payment systems that have proven to be too slow and costly.

By using USDC, Ensuro ensures that policyholders receive claim payments within minutes, which is a transformative benefit, especially for those who are financially vulnerable. Ensuro currently underwrites 170,000 policies, covering small farmers in Kenya. Through its partnership with Circle, Ensuros policy value can reach $50,000, covering a wider range of individuals and merchants.

VI. Outlook on Policy and Regulatory Trends

Last year was a breakthrough year for legal and regulatory clarity around stablecoins. At this stage in market and policy development, so-called stablecoins need to be regulated to bring this new form of digital currency into the realm of trusted financial services. Around the world, emerging stablecoin rules are effectively codifying the way Circle does business, setting clear requirements for trust, transparency, financial integrity, and other areas.

Circle Becomes First Stablecoin Issuer to Comply with Canadas New Listing Rules The proactive steps taken by Canadian securities regulators in establishing a regulatory framework for digital assets strengthen the integrity of the digital asset market while ensuring continued trust in USDC in Canadas thriving ecosystem. Dante Disparte, Chief Strategy Officer and Head of Global Policy Circle Expands Middle East Presence with ADGM Registration In December 2024, Circle reached a key milestone in its strategic expansion into the Middle East and Africa, announcing its registration with the Abu Dhabi Global Market (ADGM). The Middle East and Africa are key frontiers for advancing financial inclusion and efficiency, and registration in this tech-leading region will help drive innovative collaboration, financial inclusion and accessibility. Circle Announces New Global Headquarters in the Heart of Wall Street In September 2024, Circle unveiled plans to establish a new global corporate headquarters in the iconic One World Trade Center building in Lower Manhattan. Set to open in early 2025, the headquarters will occupy the entire 87th floor of the building and will serve as a gathering place for partners, technology experts, public leaders, employees and other global stakeholders. Were investing in New York. Were investing in America... Were honored to join New Yorks vibrant community of innovators, technologists, and financial leaders. Jeremy Allaire, Co-founder, Chairman and CEO Circle becomes the first major global stablecoin issuer to comply with EU MiCA regulations On July 1, 2024, Circle announced in Paris that it has obtained an Electronic Money Institution (EMI) license from the French financial regulator ACPR. The EMI license will enable Circle to issue USDC and EURC to the EU market in full compliance with MiCA requirements, serving more than 450 million residents and covering the worlds third largest economy. Boosted by the news, in early October 2024, EURC became the largest euro-backed stablecoin by total circulation.

Under MiCA, fiat-backed stablecoins (or e-money tokens as they are called in Europe) are treated as legal e-money, creating a level playing field for payment systems and e-money operators in the EU. Crucially, given the novel universal portability of stablecoins, Circle’s work with French and EU regulatory and policy stakeholders ensured global interchangeability of USDC and EURC in circulation in the EU. This not only provides EU market participants with a stablecoin denominated in their local currency, but also ensures that dollar-based activities in the EU are fully regulated.

Meanwhile, in the United States, long-awaited legislative progress in the House and Senate may now pass under the incoming Trump administration, which has made clear its pro-growth, pro-innovation, and pro-crypto stance. This is not a policy exercise that needs to be reinvented in the United States, as both parties have already laid out a framework for principled rules in the United States that apply not only to stablecoins but also to cryptocurrency market structure. Against this backdrop, President Trump has an opportunity to fulfill his campaign promise to establish U.S. leadership in the cryptocurrency space. By regulating stablecoins, the United States can help ensure that digital dollars become the reserve currency of the internet, just as they are the reserve currency of the world.

Other major economies are expected to follow suit by 2025, including the United Kingdom. Under Prime Minister Starmer’s government, the UK may now have the political stability to pursue long-standing regulatory interests and research into digital asset markets. Relatedly, both the UK and the US have embarked on the important work of developing national payments strategies, where regulated stablecoins offer a compelling use case for always-on money as digital savings vehicles and provide much-needed competition to entrenched payment providers.

Similarly, Brazil is expected to bring stablecoins and digital assets under the regulatory umbrella of its already impressive domestic payments environment, while Hong Kong, one of Asia’s most important financial centers, is expected to develop principled rules for stablecoins. These rules are likely to build on Japan’s concept of regulatory reciprocity while cementing Singapore’s long-standing position as Asia’s fintech hub.

As more global financial centers provide much-needed platforms for stablecoin activities within their jurisdictions, banks, asset managers, and regulators around the world are building a critical bridge from the Internet financial system to the real economy. Concerns about fierce competition are giving way to cooperation and clear goals, in which the current generation of stablecoins and blockchain-based financial services are expanding (not destroying) the reach of the real economy.

Today’s stablecoins and blockchain networks are not designed to disrupt financial services, but to expand the boundaries of innovative financial services. Dante Disparte, Chief Strategy Officer Head of Global Policy