Original author: 1912212.eth, Foresight News

Recently, Vitalik was once again pushed to the center of the criticism stage by the community. This is not the first time that Ethereum has encountered such a crisis. From 2018 to now, Ethereum has been questioned for no less than four or five times. The most direct cause of this incident was Trumps choice to issue his own meme coin TRUMP on the Solana chain. The exaggerated increase in the meme coin once made many people who firmly grasped the opportunity become famous in one battle and retired after success.

The exaggerated wealth effect has caused many investors who missed out to sigh, and Solana and meme coins have once again become the focus of public opinion. FOMO sentiment even caused SOL to be in short supply, causing Binance to suspend withdrawals. While TRUMP is advancing rapidly, the price of SOL has soared to $295, setting a record high. The market is turbulent, Bitcoin and SOL are advancing rapidly, but Ethereum, which ranks second in market value, has never risen for ten thousand years. What happened to ETH? Why has it fallen to such a point where everyone is scorned?

New and old money no longer prefer Ethereum

Once upon a time, Ethereums grand vision of a global computing layer attracted the favor of countless tech upstarts, financial giants, and industry leaders, but now it seems to have lost its glory. Bitcoins digital gold status is as solid as a mountain, with spot ETFs approved, MicroStrategys crazy purchases, and increasing acceptance by government agencies. Even though its market value has been increasing, its increase from the bottom of $15,000 has already achieved a return of more than 6 times. BTC is still the favorite of old money such as family wealth.

On the other hand, although Ethereum competes with Bitcoin in a different way, it has remained around US$3,000 since March last year. Its performance is really disappointing in the much-anticipated altcoin season.

As of January 16, the total net inflow of Ethereum spot ETF reached 2.66 billion US dollars, but this net inflow seems to have little effect on supporting and rising the price of the currency. The price of the currency is the result of the consensus in the financial market. The long-term fluctuations have consumed a lot of faith emotions and market confidence.

On the other hand, Solana has attracted many new users with its low gas fees and the wave of meme-driven wealth creation. According to the latest data on Circle’s official website, the issuance of USDC on its Ethereum mainnet has reached 31.53 billion US dollars, while the issuance of public chain upstart Solana has soared to 7.72 billion US dollars.

L2 splits liquidity, and voices of doubt arise one after another

As early as the last cycle, the debate over L2 and L1 had already begun. In this cycle, as the Four Heavenly Kings L2 have been launched one after another, the debate over which one is better has been endless. However, at present, the voices leaning towards L1 have been generally recognized by the market.

As the L2 chain that focuses on capacity expansion, the cross-chain bridging of funds not only faces considerable problems in terms of security and timeliness, but also greatly reduces the user experience. Although each chain has its own advantages in technology, they all have the same goal, and users do not have a very obvious perception of the difference.

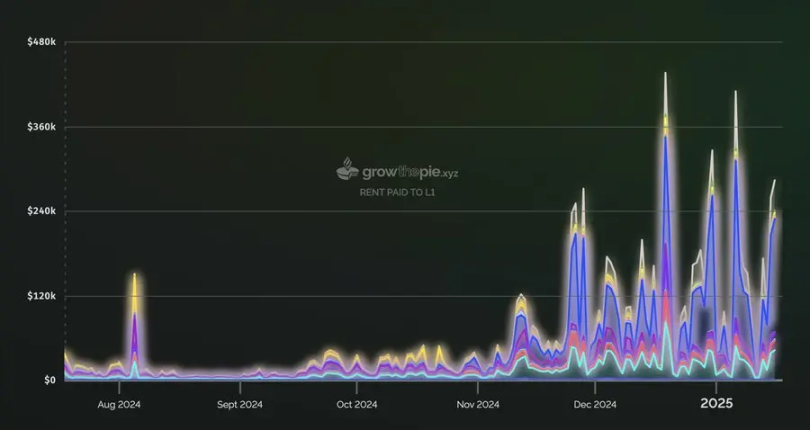

Even some project parties have repeatedly migrated between L2 chains, further splitting liquidity and user experience. In addition, each L2 has launched its own token system, which has not really fed back to Ethereum, which has also weakened the appeal of ETH. Taking Base as an example, most of the network fees last year became Coinbases profits, of which very little was given to the Ethereum mainnet, and most of it was kept by Coinbase for its own use. If calculated on an annualized basis, Coinbases revenue from Base is close to $100 million.

Kain, the founder of Synthetix and Infinex, said that if I were to run EF (Ethereum Foundation), I would definitely put pressure on L2 to use the sorter income to destroy ETH.

Since the launch of each L2, its token has performed mediocrely. Although its total TVL has exceeded US$54 billion, there has been no particularly significant growth since March last year.

Today, L2 technology is also beginning to encounter bottlenecks. The L2 chain continues to grow, and multiple L2s compete for limited Blob storage, causing fees to soar and user costs to increase. Even if the number of blobs is increased to 6 through Pectra upgrades, the problem can only be temporarily alleviated and cannot be fundamentally solved. Solutions include short-term Pectra upgrades, mid-term PeerDAS implementations, and long-term DA expansions.

In this regard, Cruve founder Michael Egorov said that it is time to abandon the L2-centric roadmap and focus on expanding L1. In addition, he bluntly stated that L2 is not a moat, but a band-aid.

The Ethereum mainnet TPS can now reach up to about 90 transactions per second, but this is far from enough. As a financial settlement layer, Ethereum now urgently needs to expand its capacity to meet the needs of massive and high-frequency data processing. However, the challenges are huge. First of all, Ethereum must ensure security and decentralization, and make complex technical adjustments and improvements to the protocol layer, such as sharding and proof of stake, etc. In addition, the issue of community consensus is also worthy of attention. The mainnet upgrade and expansion plan also needs to be widely supported and recognized by the community. If it rashly switches from L2 to L1, the position of each L2 will become quite awkward, and community division and disputes are very likely to occur.

In the short term, it remains undecided whether Ethereum’s expansion will take the path of L2 or mainnet upgrade.

DeFi and NFT Double Turbine Power Failure

As we all know, in the last bull market, the crypto industry ushered in an unprecedented crazy bull market due to the dual drive of DeFi and NFT and the macro-inflation. Ethereum, as the base currency on DeFi, has a very positive impact on the demand and popularity of ETH after DeFi ushered in explosive growth, and its price has been continuously raised under the flywheel effect.

It is worth mentioning that NFT also made great contributions to Ethereum in the last bull market. During the NFT craze, many platforms and brand NFT prices were denominated in ETH, so to buy NFT, you need to buy ETH first. The popularity of NFT has a significant impact on the expansion of ETH. It and DeFi have contributed to the glory of the crypto bull market and Ethereum.

For this reason, in the last bull market cycle, ETH’s return exceeded 50 times if calculated from the bottom.

Fast forward to this cycle, the lending and derivatives in the new DeFi protocol did not have many highlights to attract the capital frenzy. Instead, they chose to build their own chains, and value capture did not flow to Ethereum. Some DeFi protocol tokens have repeatedly reinvented the wheel and reached their peak as soon as they went online, which also dragged down the already precarious sentiment of the market. Since 2023, DeFis highlight moment only appeared in the climax of Q4 last year, and then it was submerged again in the meme and AI wave. Data shows that the current total TVL of DeFi is still lower than the peak of US$180 billion set in the previous cycle.

The explosion of NFT in the last cycle was often due to the markets consumption after making a lot of money from cryptocurrency speculation. However, nowadays, the markets capital flow is limited to three main lines: Bitcoin, on-chain memes, and AI coins. Ordinary small retail investors no longer buy the former due to price factors, and the latter two are extremely challenging for PvP levels and research capabilities. The once easy money-making cycle no longer exists.

The market is no longer rising, especially after the difficulty of making money has increased, the opportunities to make money in the market have become smaller. Some altcoin holders did not wait for the altcoin bull market, but instead ushered in a paradigm shift in their wallets. The faster you run, the more you earn and the less you lose. The slower you run, the more you are stuck.

The market has always been uninterested in DeFi and NFTs. Ethereum’s powerful turbocharger has stalled, and the price of ETH can be imagined.

Ethereum’s Wealth Effect is Gone, Solana Takes Over

This weeks market cycle is different from the past. AI and meme coins have become the dominant wealth wave. In the past cycle, ETH has made a strong wealth effect thanks to its early ICO and the subsequent emergence of DeFi protocols.

Ten years ago, Vitalik gave a speech full of codes in Silicon Valley. The entire PPT presentation was full of codes. After the speech, all the investors in the audience were excited and said that this was the future. Subsequently, Ethereum completed US$20 million in financing through ICO, setting a new record at the time. At that time, the price of one ETH was around US$0.3.

Today, the price of Ethereum is above $3,000. If you participated in the public offering at that time and held it until now, the return would be more than 10,000 times. ICO made the 2017 cycle full of hundreds or even thousands of times of returns, and the fundraising method at that time was mainly ETH. After some of them fell silent, in the 2021 cycle, the emergence of many DeFi protocols such as AAVE, COMP, SNX, UNI, etc. made market investors earn a lot of money.

Don’t underestimate the wealth effect. Whether it is the project side, the exchange, or the new listing platform, they are all racking their brains for the wealth effect. Although the market cannot make most people make money, it has at least made some people make a lot of money. This is very important because the wealth effect will be imitated, spread wildly, and attract countless latecomers.

In this cycle, the most wealth effect is no longer the so-called VC coins, but AI concept coins and MEME coins. Take MEME as an example. Apart from the old three such as DOGE/SHIB/PEPE, there is not much meme wave on the Ethereum mainnet. Even in L2, only BRETT and DEGEN on the Base chain were once popular. AIXBT and VIRTUAL have also become one of the few highlights of Base.

Memes and AI projects on Solana are springing up like mushrooms after rain. Taking the recent TRUMP as an example, Circle has issued 2.5 billion USDC on the Solana chain in 4 days since its release. Some high-level players in the Chinese community have even achieved a brilliant record of making tens of millions of dollars in profit in 4 hours, which has attracted the envy of the Twitter community.

In addition, the rise of past memes such as BONK/BOME/WIF/PENGU has injected considerable vitality into the Solana ecosystem. A group of meme super cycle theory propagandists have also cheered for it, attracting more users to the Solana ecosystem.

In terms of the AI wave, Solana also defeated Ethereum, and hot coins such as AI16Z/FARTCOIN/GOAT led the AI trend.

Solana firmly holds the market initiative in AI concept coins and meme coins. Dune data shows that its issuance launch platform Pump.fun has accumulated revenue of more than $400 million to date.

Raydium, the meme liquidity infrastructure, has an annualized revenue of $363 million and an annualized expense of more than $3 billion. In the past three months, expenses have increased by more than 370% and revenue has increased by more than 260%. The market value expense ratio is 1.1 times and the market value income ratio is 9.6 times.

Many memes and AI concept coins choose Solana instead of Ethereum and its L2, a large part of the reason is that the main network has high gas fees and slow transactions, while L2 has a vicious cycle caused by liquidity fragmentation. In the end, Solana began to expand its wealth effect with the continuous flywheel effect.

Currently, according to Solscam data, the number of active wallets remains at a high level of 6 million, an increase of nearly 6 times compared to May 2024.

The number of new accounts added daily (calculated based on multiple tokens per account) also remained at a historical high of 20 million.

Behind the crazy growth of Solana data, perhaps a single spark has already started a prairie fire.

Ethereum Foundation sells coins, team bloated

L2 is not welcomed by market investors, the dual turbos of DeFi and NFT have stalled, the wealth effect is sluggish, and many contradictions have caused the price of ETH to fluctuate. The community began to direct the contradictions at Vitalik. The once pedestal Vitalik was pulled down by everyone, and many accusations and curses were heard. The Ethereum Foundation under Vitalik’s leadership has also become the target of public criticism.

As early as in the last cycle, the Ethereum Foundation was famous for its escape indicator. In this cycle, EFs frequent selling of coins was discovered and reported by on-chain monitoring, and the community was furious. When the price of coins rises, the community may choose to ignore such selling behavior, but once the price of ETH stagnates, the selling behavior becomes a sensitive selling pressure. Vitalik explained that this was to maintain the salaries of employees and the donation behavior of the community ecology, but the community did not buy it.

The founder of Aave also expressed his views at this time. After reading the annual budget report of the Ethereum Foundation, Stani Kulechov stated that the EFEF was facing expenditure and financial problems and should immediately cut the burning rate from US$130 million to US$30 million, streamline the number of employees, form a new leadership team, and other specific suggestions.

If selling coins is just one of the reasons why retail investors vent their anger, then some people are dissatisfied with EF because it has no sense of direction and leadership.

Kyle Samani, co-founder of Multicoin Capital, an early investor in SOL, wrote today that he was excited about entering the crypto space because of Ethereum. However, he lost confidence in Ethereum after Devcon 3 in November 2017. I really cant understand why the Ethereum Foundation is so clueless. No one in the Ethereum Foundation is aware enough to promote a specific scalability plan.

In addition, Kyle added, “In the past 7 years, I feel that the Ethereum Foundation has not changed much. There is still a lack of urgency, the leadership is out of touch with the needs of core users, and there is still no clear direction.”

Eric Conner, a well-known Twitter KOL, even recently announced his withdrawal from the Ethereum community on the social platform. He once bluntly stated that the problem is that the current foundation does not report to stakeholders, is gradually falling into a quagmire and resists change. The foundation currently presents an anti-winning and competitive mentality, which has caused many community members to question whether to stay.

Under the pressure of community doubts, Vitalik had to respond that he was making major changes to his leadership structure, which had lasted for about a year. Some of these reforms have been implemented and made public, and some are still in progress. He also strongly supports contact with funds, institutions and countries, and is willing to discuss ETH from an asset perspective.

In response to the overwhelming verbal abuse, Vitalik said, If you continue to put pressure on, you are actually creating an environment that is extremely harmful to top talents. Recently, some of Ethereums best developers have sent me private messages to express their dissatisfaction with the social media environment, which is created by people like you. You are making my job more difficult. At the same time, it makes it less likely that I will have any interest in acting in accordance with your wishes.

Summarize

Ethereum is facing a serious midlife crisis, and it is not yet known what actions Vitalik will take to deal with the crisis. Fortunately, Joseph Lubin, co-founder of Ethereum and founder of Consensys, spoke out: One of Vitaliks most admirable qualities is the way he makes decisions. When problems arise, he listens to all parties, collects information, weighs the pros and cons, and makes a decision after he thinks he has considered most of the necessary data. He has listened to everyones opinions, and things are moving forward.

In addition, Joseph Lubin also said: Based on what I have seen, there will be many high-value plans disclosed soon, which will dazzle you. It is better to stay calm now and not lose your mind before the craze starts.

After experiencing many ups and downs over the years, whether the giant ship of Ethereum still has a chance to turn around remains to be seen.