The battle over public chain fees: Will Solana achieve an astonishing 30-fold growth by 2024?

Original author : 1912212.eth, Foresight News

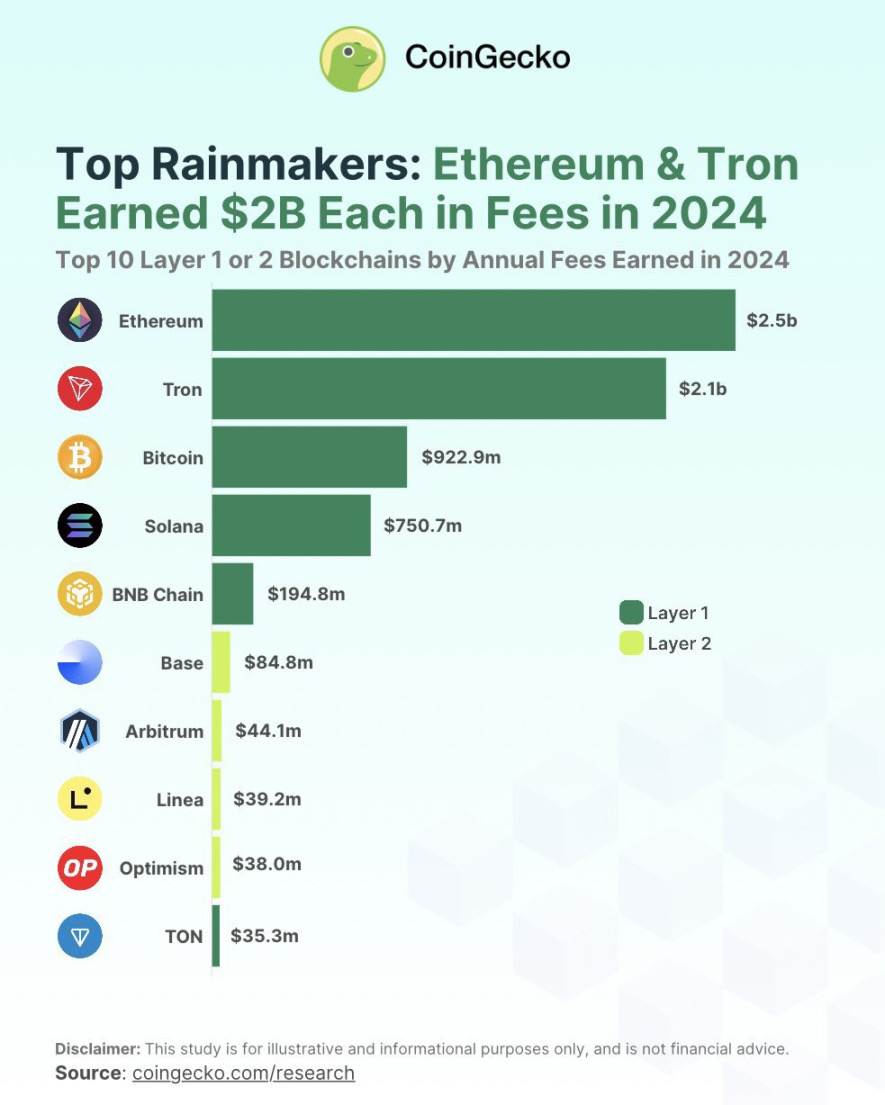

Protocol fee income is still one of the important data indicators to measure the activity, value capture and ecosystem of a chain. Recently, Coingecko announced the top 10 L1 and L2 protocol fee income rankings in 2024. Ethereum and Tron ranked first and second respectively with over 2 billion US dollars. This data is equivalent to Ethereum earning an average of 6.79 million US dollars per day, while Tron earns 5.89 million US dollars per day.

Solana’s fee income reached $700 million. The once popular TON is no longer popular, earning only $35 million in revenue last year. BNB Chain performed mediocrely, earning only nearly $200 million in revenue. Bitcoin’s fee income reached $920 million.

In terms of L2 data, Base is far ahead, taking the lead with nearly US$85 million in protocol fee income, even more than the sum of Arbitrum and OP's data.

Ethereum protocol revenue increased, but the price of the currency was lower than expected

Chain fee income usually comes from multiple aspects, such as transaction fees, smart contract execution fees, indirect income from block rewards, MEV-related income, cross-chain bridges and asset transfer fees, on-chain storage fees, destruction mechanisms, governance fees, etc.

Since the Cancun upgrade, Ethereum has significantly reduced L2 transaction costs and promoted its development, but this benefit has not had a very obvious change in revenue. It even has a taste of "sacrificing the small self to achieve the big self". Ethereum protocol revenue in 2023 was US$2.41 billion, and fee revenue in 2024 only increased by 3%. Ethereum mainly earned US$1.17 billion in the first quarter of 2024, accounting for almost half of its total fee revenue that year. Although the data shows that it is growing, given the rise of the big market and the high expectations of the market, this fee income performance is still unsatisfactory.

The weak performance of the data has a direct reflection on the price of ETH, which has fluctuated around $3,000 for most of the past year. The long-term stagnation of the price has also led to widespread dissatisfaction and doubts in the community, and Vitalik and the Ethereum Foundation under his leadership are in a deep crisis of public opinion.

The revenue performance of various Ethereum L2s is also relatively average, and Base has become one of the few new stars in Ethereum L2 that has performed relatively well. This is due to its firm grasp of the meme wave and its rapid rise. In 2024, AI concept coins represented by VIRTUAL/AIXBT and meme coins such as DEGEN emerged on the Base chain, and the wealth effect far exceeded that of Arbitrum and OP. Although there is still a big gap with Solana so far, its potential cannot be underestimated.

The second-layer protocol makes money, but it does not really feed back to Ethereum. Take Base as an example. Last year, most of the network fees became CoinBase's profits, and very little of the funds were given to the Ethereum main network. If calculated on an annualized basis, CoinBase's income from Base is close to $100 million.

The profitability of the L1 mainnet is sluggish, so it is worth questioning whether L2 can still become Ethereum’s “supersonic missile”.

Tron and Solana protocols’ single breakthrough becomes the key to their explosion

As a stablecoin public chain, Tron's protocol fee revenue increased from US$922.08 million in 2023 to US$2.15 billion in 2024. As the main pillar of contributing protocol fees, its stablecoin revenue increased from US$38.36 million in January 2023 to a high of US$342.54 million in December 2024, an increase of nearly 10 times.

Solana's fee income also performed well last year, soaring from $25.55 million in 2023 to $750.65 million in 2024, an increase of nearly 30 times, far exceeding its competitors. The main sources of fees on the Solana chain are transaction fees and priority front-running fees. The reason is self-evident. Since last year, meme coins and AI concept coins on the Solana chain have experienced a big explosion, and the exaggerated wealth effect has attracted many users to come and buy.

Take its launch platform Pump.fun as an example, its cumulative revenue has exceeded $400 million so far. Raydium, another meme liquidity infrastructure, has an annualized revenue of $363 million. In the past three months, expenses have increased by more than 370% and revenue has increased by more than 260%.

Thanks to the inscription boom in 2024, Bitcoin's annual fee income increased by 15.9%. At the same time, TON benefited from the "play and earn game" and ushered in its own highlight moment in the first half of 2024.

Conclusion

When we look back at the fee income of each year last year, it is not difficult to find that the chains with greater growth and better performance often "take advantage of the trend" and seize their own opportunities. The silence of L2, DeFi and NFT did not give Ethereum a chance to take off strongly, but the two biggest crazes of memes and AI concept coins gave Solana a godsend opportunity to shine in this cycle, and Tron benefited from the influx of stablecoin funds and its income increased significantly.

However, some crazes come and go quickly, or even never come back, which will greatly reduce the sustainability of future fee income. For example, the inscriptions in 2024 and TON ecological games have not made any progress since they fell silent. When this part of the craze income fades, how to think about the next development is the key.

Seizing the opportunity when it comes is the key, and if you are not prepared enough, you may miss the opportunity. If Solana still has frequent downtime and the user experience of wallets is extremely poor, you may not wait for your good luck. If the scalability of the Ethereum mainnet is perfectly solved as soon as possible, perhaps the meme wave may also occur on it, ushering in its own comeback.

Recommended reading: " With the wealth effect seriously lost, can Ethereum survive the "midlife crisis"? "