Original | Odaily Planet Daily ( @OdailyChina )

Author | Fu Howe ( @vincent 31515173 )

Recently, with Trump coming to power again, the price of Bitcoin has broken through a record high. However, the corresponding development of the Bitcoin ecosystem is not optimistic. Looking back at 2023, the Bitcoin ecosystem was once the focus of the market, and various innovative projects emerged in an endless stream, attracting the attention of global investors. However, by 2024 (especially after Q2), the market heat gradually subsided, and a large number of Bitcoin ecosystem projects stagnated after issuing tokens, and even faded out of the public eye. By the beginning of 2025, the overall attention to the Bitcoin ecosystem has dropped to freezing point, and there are few discussions in the industry about Bitcoin-related technological innovations.

In such a sluggish background, how to find new breakthroughs in the Bitcoin ecosystem has become a huge challenge for practitioners. With these questions, Odaily Planet Daily had the honor to interview Kevin He, co-founder of Bitlayer. Bitlayer is the first Layer 2 based on BitVM. The team recently launched the Finality Bridge (the first Bitcoin bridge using BitVM technology) test network. During the cold winter of the Bitcoin ecosystem, Bitlayers technical team has continuously explored and broken through the boundaries of BitVM technology through technology-driven, finding new historical opportunities for the development of Bitcoin Layer 2.

The following are some wonderful insights Kevin shared during the interview, which may bring new insights to the industry.

Summary of key information:

● The Bitlayer V2 testnet is expected to be launched in Q1 2025, and the mainnet migration is scheduled to be completed in Q2 2025.

● BitVM combines the features of Optimistic Rollup and ZK Rollup to implement state verification on the Bitcoin main chain.

● Finality Bridge implements the “1-of-N” trust model, which requires only one honest participant to ensure security. It is a Bitcoin bridge that achieves “minimized trust”.

● Finality Bridge will service-oriented Bitcoin verification mechanism and promote industry collaboration and ecological sharing.

● Yield BTC integrates security, programmability and yield attributes to meet users’ new demands for BTC assets.

● Bitlayer’s ultimate goal is to build a closed business loop that realizes value creation and value release, thus becoming a profitable business. The main source of income is handling fees, and the team pays great attention to daily operations and revenue.

● Today’s industry is no longer an era where “technology is king”.

Interview Review

Odaily Planet Daily: After Bitlayer launched its mainnet in April last year, its TVL quickly exceeded $500 million, which is a very impressive performance. V2 is about to be launched. What are the highlights that can be revealed in advance? When will it be launched?

Kevin: Our roadmap is divided into three major versions: V1, V2, and V3.

● About V1: Our V1 is mainly based on the sidechain of Bitcoin. Before Bitcoin has the verification capability, only the preliminary functions can be realized through the sidechain. In April 2023, we launched the mainnet, which quickly promoted the growth of TVL, user data and on-chain transactions. The overall business operation is relatively healthy so far.

● Highlights of V2: The core goal of V2 is to evolve the network into a true Bitcoin Layer 2 (L2). This version will inherit the security of Bitcoin, and the technology can support multiple virtual machines (VMs). Currently, V2 mainly supports EVM. In the past, most Bitcoin expansion solutions could only be used for payment products, but we hope to meet users expectations for complex needs such as asset management through V2. In addition, V2 will also introduce the latest generation of Bitcoin cross-chain bridges. We have launched related products in the test network, such as https://finality.io, and users can experience the cross-chain capabilities of this product.

● About the launch time of V2:

○ The development of V2 involves multiple stages: the testnet is expected to be launched in Q1 2025 .

○ The mainnet migration is scheduled to be completed in Q2 2025. This upgrade will seamlessly transition from V1 to V2 .

There are many engineering challenges here, including the construction of the Rollup model, data migration, and the switching of chain nodes. Such migration is still rare in the industry, but we have developed a complete solution.

● About V3: Looking ahead, V3 will focus on improving the performance of the execution environment, such as reducing transaction fees, increasing speed, and shortening confirmation time. We believe that the Rollup model is very suitable for achieving performance improvements, and high performance is a very important part of Bitcoin expansion.

Odaily Planet Daily: Many second-layer networks in the Bitcoin ecosystem are slightly adjusted based on the EVM implementation method. So, how does BitVM better adapt to the characteristics of the Bitcoin network? How is it built? What are its core advantages?

Kevin: Currently, the Bitcoin Layer 2 ecosystem faces a dilemma:

1. If you focus on security, such as the Lightning Network, it is indeed very secure, but it can only handle payment applications and cannot support more complex asset management functions.

2. If you pursue programmability, such as some side chain solutions, although they support programming functions, they may be insufficient in terms of security.

The root cause of the above problems is that the Bitcoin main chain currently lacks the ability to verify the general state of the second layer. In contrast, Ethereum eventually adopted the Rollup model during the development of L2, the core of which is to verify the state transfer of L2 on the main chain. This verification can be achieved through OP Rollup or ZK Rollup. However, the Bitcoin main chain cannot currently perform this verification directly, which is a bottleneck for the development of the ecosystem.

However, since BitVM was proposed at the end of 2023, we have found that through the OP method, combined with the design characteristics of Bitcoin, state verification can be achieved on the Bitcoin main chain. This years research and development and upcoming products have also proved that our route is correct. Through BitVM, the Bitcoin main chain can verify the state transfer of L2, thus solving the dilemma of security and programmability.

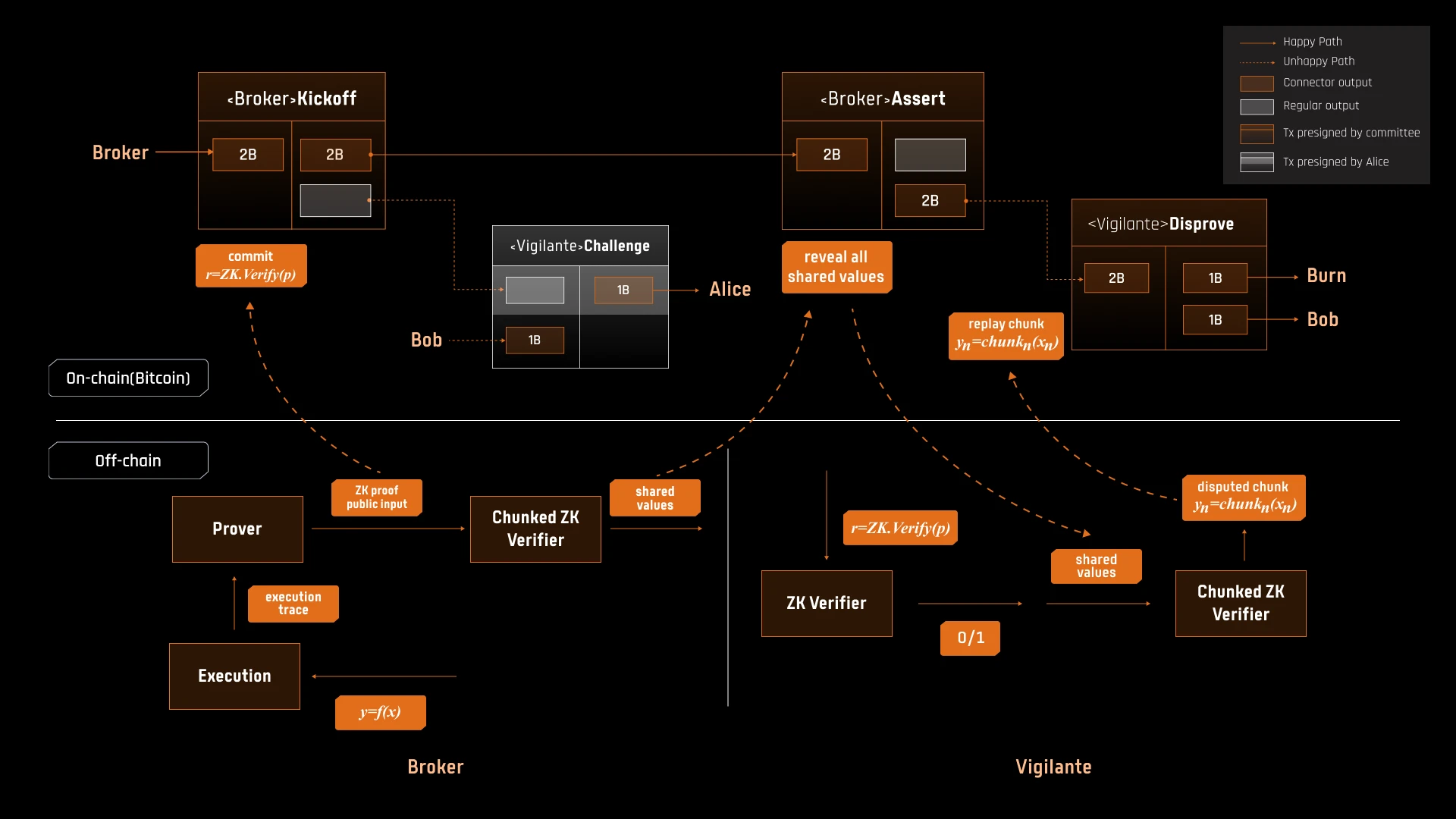

The architecture of BitVM is divided into off-chain and on-chain parts:

1. Off-chain part: including execution environment and proof environment. The users transaction is executed on the second layer and the corresponding zero-knowledge proof is generated.

2. On-chain part: Verify these proofs through the Bitcoin main chain. Currently, the Bitcoin main chain cannot directly call contracts to verify transactions in real time like Ethereum, so the commitment-challenge model is adopted: the transaction first submits a commitment and starts the challenge period.

Core Advantages

1. Balancing security and programmability : BitVM can simultaneously achieve the security accumulation and higher programmability of the Bitcoin network, supporting more complex application scenarios.

2. High performance : The Rollup model does not involve consensus protocols, so message propagation and consensus mechanisms will not become performance bottlenecks.

3. Flexible virtual machine support : BitVM, as a verification component (layer), can support the status verification of EVM and other VMs, which means that developers can directly develop applications using existing tools.

About BitVM Innovation

● BitVM combines the features of Optimistic Rollup and ZK Rollup : using OP’s framework to handle verification issues.

● After aggregating transactions, ZK proofs are generated, and then their legitimacy is verified on the main chain . This combination transplants Ethereum’s L2 verification mode to the Bitcoin network for the first time, adapting to the design features of Bitcoin.

Odaily Planet Daily: Finality Bridge is known as the trust-minimized Bitcoin bridge. What is the innovation of this technology? How does it ensure the 1:1 anchoring relationship between Bitcoin and Yield BTC tokens and guarantee security?

Kevin: Regarding the technological innovation of the Bitcoin Bridge, we can start with the generational changes in bridge technology.

The first generation of Bitcoin bridges use a centralized or MPC multi-signature approach to control assets. This approach relies on the honest behavior of most participants to ensure asset security. For example, WBTC and cbBTC, fund custody relies more on multi-signature settings or centralized solutions.

The second generation of bridge technology, such as tBTC, forms a POS network off-chain, which determines the validity of Bitcoin transactions through node consensus and signatures. The improvement of this method is the introduction of a consensus mechanism, but it still requires the majority of nodes to remain honest to ensure the operation of the system.

With BitVM and Finality Bridge, we have seen a breakthrough in trust minimization. The core of this is the implementation of the so-called 1-of-N trust model - as long as one of the multi-signature participants remains honest, the entire system can work properly. This is fundamentally different from the previous model that requires most people to be honest.

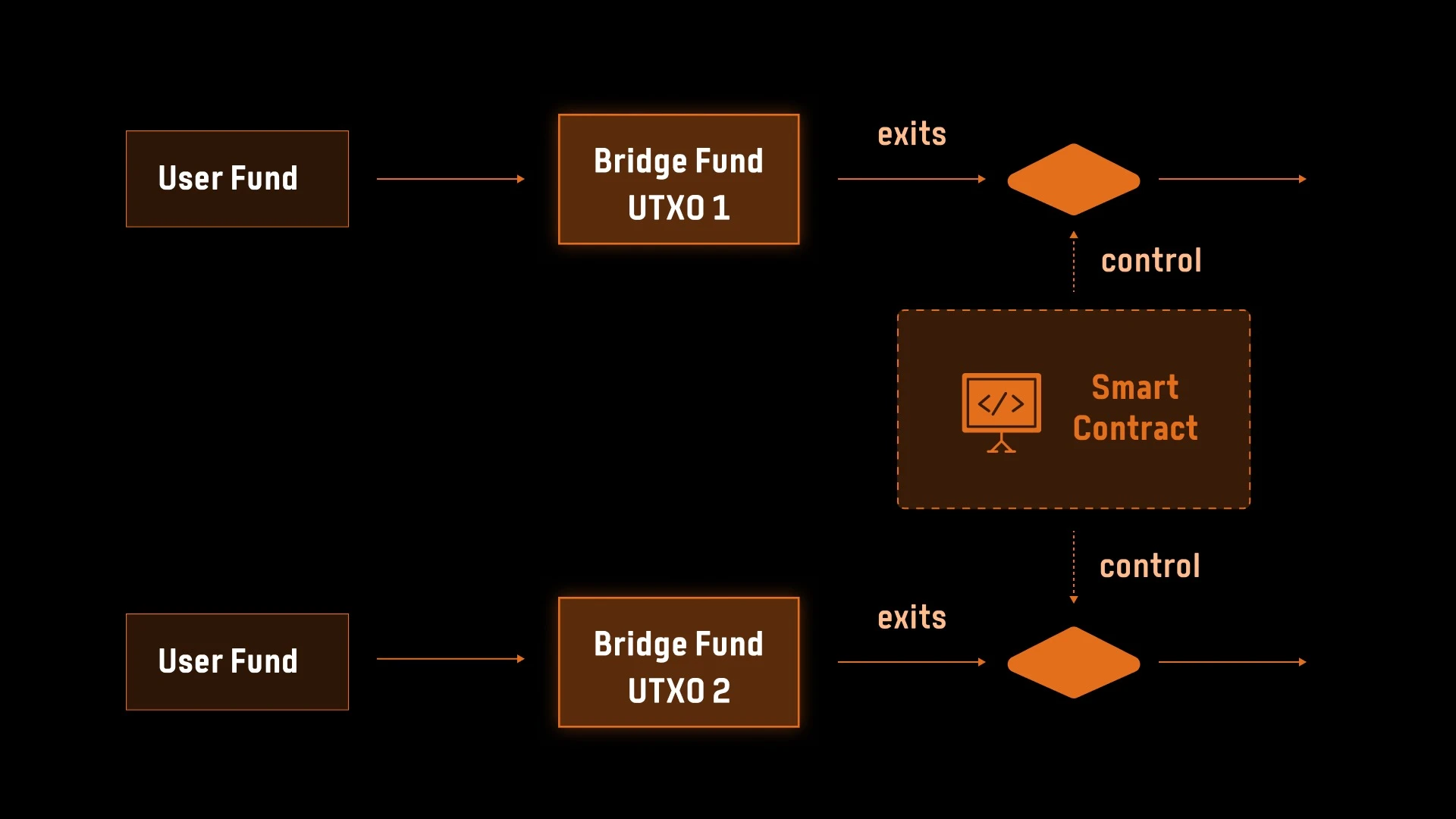

In terms of specific implementation, Finality Bridge introduces three important roles:

1. Alliance multi-signature

The users Bitcoin assets will be locked into a multi-signature address after entering the bridge. This is not a simple single signature, but a large-scale multi-signature system, and a pre-signature operation is performed at the same time to ensure that these Bitcoin assets can only flow to the designated operator address and cannot be moved by other paths. Even if there is a problem among the multi-signature members, as long as one member does not discard the private key, the destination of the funds is still safe and controllable.

2. Operator

The operator plays a key role in the whole process. When a user deposits Bitcoin into the bridge, the operator detects the deposit and generates an equivalent Yield BTC in the second-layer network and gives it to the user. When the user chooses to withdraw the funds, the operator will advance the funds to return the Bitcoin to the user and submit a reimbursement request to the chain.

3. Validator

Validators are an open, decentralized role that anyone can participate in. Their main task is to initiate challenges when violations are found and, if necessary, punish violators through on-chain interactions. Validators have an economic incentive to participate in this process, which enhances the security and decentralization of the system.

About the specific process:

● When users deposit funds, Bitcoin is locked into a multi-signature address, and the operator will create Yield BTC in the second-layer network and give it to the user.

● When a user withdraws funds, Yield BTC is destroyed on the second layer. After the operator detects the destruction message, it will advance the funds and return the equivalent amount of Bitcoin to the user. Subsequently, the operator submits a reimbursement request. If the reimbursement process is correct, it will be completed directly; if there is an error or fraud, the validator can initiate a challenge and punish the violator.

Odaily Planet Daily: Finality Bridge supports the Ethereum-compatible EVM ecosystem, and will be compatible with new public chains such as Solana in the future. In addition to the asset transfer function, what other cross-chain functions will be expanded?

Kevin: The planning of Finality Bridge goes far beyond the cross-chain asset transfer function. Its goal is to connect the needs of Bitcoin liquidity providers (including large investors, retail investors and institutions) with asset management protocols. Asset management is a broad concept that covers multiple levels. The following are the core directions for the expansion of bridge functions:

1. Multi-chain compatibility of capital flows

In addition to the currently supported Ethereum EVM ecosystem, Finality Bridge also plans to be compatible with new public chains such as Solana, and explicitly mentions the possibility of chains such as Berachain. This multi-chain compatible strategy not only expands the use scenarios of Bitcoin liquidity, but also provides more available directions for assets.

2. Openness and universality of verification functions

The core of Finality Bridge is the verification mechanism based on Bitcoin. In the future, this technology will be open sourced and packaged into an API service. This means that other protocols can inherit the security of Bitcoin without rebuilding the entire verification system, thereby greatly reducing the cost of technology development. For example, there are already institutions in the Bitcoin ecosystem that conduct security ratings on projects, and Finality Bridges verification technology can further enhance the two-way binding relationship between Bitcoin and other ecosystems.

3. Service-oriented and industry collaboration

Finality Bridge hopes to attract industry peers to use its verification system through open source technology and API services. The industry focuses on business expansion rather than repeatedly building technical infrastructure. By providing easy-to-access services, Finality Bridge hopes to achieve the goal of serving the entire industry with one set of technology and allow more protocols to directly benefit from the security of Bitcoin.

Odaily Planet Daily: Does the launch of Yield BTC mean that Bitlayer will further develop BTCFi? What are its unique advantages in scenarios such as liquidity mining, staking and lending? What are the different profit opportunities?

Kevin: We launched Yield BTC to meet the needs of users. In the current ecosystem, it is difficult to convince users to put their money in if we do not provide them with business scenarios or benefits. This is a realistic problem, so we hope to provide a solution that can respond to user needs through Yield BTC.

1. Yield BTC’s core attributes

We believe that Yield BTC is a new generation of BTC assets. Different from previous WBTC, tBTC, or other forms of BTC assets, Yield BTC integrates three core advantages:

● Security: Ensure the security of user assets and comply with the high security standards of the BTC ecosystem.

● Programmability: It can be flexibly adapted to various application scenarios, providing higher scalability for developers and protocols.

● Income attributes: Through built-in mechanisms and designs, users can obtain actual income in scenarios such as liquidity mining, staking, and lending.

2. Openness and Ecosystem Cooperation

Yield BTC is not only an asset, but also an open protocol. We hope to establish cooperation with all L1 and L2 ecosystems, including various protocols, through this protocol. We are currently actively negotiating with several well-known L1 and L2, and it is expected that specific cooperation will be implemented by February next year, including signing and going online. This openness enables Yield BTC to integrate into more ecosystems and expand its application scenarios.

3. Meet a wider range of business needs

Yield BTC is a fully programmable security asset. In theory, it can appear in any scenario that requires BTC assets, such as liquidity mining, staking, lending, and even more complex asset management needs. Compared with single-function BTC assets (such as only as payment or cross-chain tools), Yield BTC can provide a more comprehensive income option and better meet users needs for asset appreciation. Simply put, our goal is not only to provide a BTC asset, but to make Yield BTC a core asset that supports the further development of the BTCFi ecosystem. This asset can cover a wider range of scenarios and help users and protocols create more value.

Odaily Planet Daily: Bitcoin leads the market in the current market cycle, but incremental funds have not flowed significantly into other blockchain ecosystems or DeFi. How do you think BTCFi solves the problem of market demand-product mismatch?

Kevin: I will answer from three perspectives:

1. Classification of BTC asset management needs

As a BTC holder, whether an individual or an institution, there are usually four types of needs:

● Interest-generating, appreciation and value preservation : This is the most basic requirement, how to make BTC assets generate income under the premise of safety.

● Risk management : BTC spot is naturally a bullish asset, but users also need to hedge through options or contracts to manage potential risks.

● Liquidity Acquisition : Many miners or large holders do not want to sell BTC, but need short-term liquidity, such as paying electricity bills or other expenses.

● Asset diversification : Use BTC to purchase other assets to improve the diversity of the overall investment portfolio.

These needs have been partially met in off-chain or centralized scenarios, such as lending markets, options trading, etc. But we believe that the real potential lies in migrating these needs to the chain.

2. Current bottlenecks

The main bottleneck of BTCFi on the chain is the lack of a comprehensive product that can meet the requirements of security, profitability and programmability at the same time. Some existing products may perform well in one aspect, but they cannot fully cover user needs. This is exactly the problem we hope to solve through the BTCFi protocol.

In the past year, we have conducted a lot of exploration and verified some feasible business scenarios:

● On-chain options protocol : For example, our partner Jasper Vault is a typical representative of on-chain options. Compared with centralized options exchanges, it has the advantages of openness, transparency and trustlessness.

● Bitcoin Lending Protocol : The Avalon protocol we are working on is a project focused on BTC lending, which allows BTC holders to obtain more efficient liquidity.

● Stablecoin minting and trading : Minting stablecoins based on BTC over-collateralization is another very promising direction, providing users with more flexible asset allocation methods.

3. Changes in the market environment

● Changes in the market environment : There have been significant changes compared to the past. The proportion of institutional holdings has increased, and more BTC is held by institutions. These institutions are more inclined to realize interest generation or risk management through on-chain tools.

● Improvement of infrastructure : Innovations in on-chain protocols, such as stablecoins, lending markets, and options trading, make on-chain management of BTC assets more feasible.

● Diversification of coin holders’ needs : Compared with the past when BTC was only stored in cold wallets or centralized exchanges, coin holders are now more inclined to look for interest-earning opportunities and diversified investment channels.

The key to the development of BTCFi is to provide an on-chain solution that meets the comprehensive needs of coin holders. From interest generation to risk management, to liquidity acquisition and asset allocation, we hope to truly realize these needs through cooperation with more protocols. For example, by working closely with investors such as Franklin, we can not only provide investment support, but also provide more options for coin holders through financial products such as ETFs in the future.

In general, the potential of BTCFi lies in migrating mature off-chain demands to the chain, while leveraging the advantages of the chain to develop more innovative products. As the infrastructure and market environment mature further, BTCFi will become the core growth point of BTC asset management in the future.

Odaily Planet Daily: At present, the Bitcoin ecosystem continues to be sluggish, and the voices of many projects are getting lower and lower. What is the role of Bitlayer in the Bitcoin L2 ecosystem? Compared with other Bitcoin L2 projects, what is Bitlayers core competitiveness and differentiated approach?

Kevin: First of all, the short-term downturn in the Bitcoin ecosystem is normal in my opinion. As a person who is both an investor and an entrepreneur, I think the key is to return to user needs, to see whether these needs really exist, and whether we can meet these needs, and ultimately solve practical problems through products.

We chose to start Bitlayer from the beginning not to follow the market trend, but because we saw the possibility of technological breakthroughs. This is a rare opportunity, and we hope to solve some core technical problems and industry pain points in the Bitcoin ecosystem. Innovating and making breakthroughs in Bitcoin-related fields is of great significance in itself.

If it was just to catch up with the hype, I could have chosen to invest or do other things to make quick profits instead of spending time to start a project from scratch. The reason we took this path is that we firmly believe that this field has huge potential. Especially with the expansion of Bitcoin assets and market changes, the demand for Bitcoin on the chain is real. Our goal is clear, which is to move these demands to the chain, build a healthy on-chain environment, and allow more businesses and products to run on the basis of Bitcoin.

To sum it up in one sentence: We hope to promote the development of BTCFi business on the chain and make the on-chain business environment truly realized.

We have invested more than half of our resources in technology research and development. From the early days of the project to now, research and development has always been our core. After more than a year of technical accumulation, we have gradually begun to implement the research and development results, such as:

1. A new generation of cross-chain bridge : Currently available on the test network.

2. Seamless switching from V1 to V2 : We are working hard to improve the relevant functions.

3. High-frequency trading support : It is expected to be launched in the testnet environment this year.

These are our clear goals and plans. We are not only a technology-driven team, but also focus on user needs to ensure that our products truly solve practical problems.

In my opinion, the current industry is no longer an era where technology is king . User needs are more diversified. Many people enter this field not necessarily to pursue the ideal of decentralized technology, but to be able to conveniently use on-chain businesses or products. Therefore, we need to develop with a pragmatic attitude, and at the same time, in addition to technology, focus on business expansion and market adaptability.

The ultimate goal of Bitlayer is to build a closed business loop that realizes value creation and value release, thus becoming a profitable business. In this process, we must clarify the path to profitability. At present, our main revenue comes from handling fees, so we attach great importance to daily operations and revenue. We firmly believe that only by providing products that meet user needs and create value for the industry and users can the project achieve continuous value capture.