2024 is a turbulent year for the cryptocurrency industry, with many major events. At the beginning of the year, the approval of the Bitcoin spot ETF injected strong momentum into the market. At the end of the year, the price of Bitcoin broke through the $100,000 mark, setting a record high. During this period, there were countless classic moments, including the Bitcoin halving, the approval of the Ethereum spot ETF, the popularity of the TON/Telegram ecosystem, the popularity of on-chain transactions, the US dollar interest rate cut, Trumps election, the revival of value investing, the popularity of new AI Agents, and the birth of DeSci, which are all worth recalling.

Bidding farewell to 2024, we stand at a new starting point and look forward to 2025 with great expectations. The interest rate cut cycle that will begin in 2025, the loose monetary policy, the friendly regulatory environment, and the positive attitude towards cryptocurrencies all indicate that 2025 is expected to usher in a violent bull market. We expect that this year, the price of Bitcoin is expected to reach a new high, hitting $200,000 per coin. At the same time, judging from the Bitcoin Dominance data in the past bull market, the current Bitcoin Dominance is maintained at around 57%, which means that the Dominance of altcoins has not yet reached a high point. We expect that in 2025, altcoins are expected to usher in a significant structural market. By then, Bitcoins Dominance may drop below 50%, or even as low as around 45%. At the same time, old cryptocurrency projects such as Ethereum, Solana, and Ripple are expected to break through historical highs. In an environment of abundant overall liquidity, whether it is Bitcoin or altcoins, including DeFi, RWA, Meme, AI-related projects and public chains, the overall market value of the entire cryptocurrency industry is very likely to break new highs.

https://coinmarketcap.com/charts/bitcoin-dominance/

Of course, as the market value and price rise sharply, we firmly believe that the cryptocurrency industry will take greater steps in technology and innovation, and deeply integrate with the policy environment and monetary trends of the new era. Whether in finance, social networking or artificial intelligence and other fields, we are more looking forward to cryptocurrency to participate more widely and contribute more to reshaping the world.

Bitcoin and its ecosystem: the ongoing journey of mining and construction

With the continuous inflow of Bitcoin ETFs, MicroStrategys crazy margin trading and only buying but not selling Bitcoin, and the Bitcoin National Strategic Reserve Plan that may be implemented during the Trump New Deal, the market prospects of Bitcoin are becoming more and more eye-catching. Its total amount is fixed and the block reward is halved again, resulting in a low inflation situation, and the monetary easing policy under the interest rate cut cycle has added momentum to it. Many factors are intertwined, indicating that Bitcoin will not only hover around the $100,000 mark in 2025, but is expected to hit a higher market value. Bitcoin is often called digital gold, and its market value ratio with gold has continued to rise in the past, from 2% to more than 10% today, and in 2024, its share will soar directly from 5% to 10%. Taking into account the above-mentioned favorable factors, it is expected that the market value ratio of Bitcoin to gold is expected to further increase to 15% to 20%. This means that the price of Bitcoin is expected to reach $150,000 to $200,000 per coin.

https://tradingdifferent.com/dashboard/bitcoin-vs-gold

https://ingoldwetrust.report/chart-gold-bitcoin-marketcap/?lang=en

Although Bitcoin itself has shown a strong influence, its ecological projects are still in the early stages of development. Among the top 100 projects in the industry by market value, only Stacks stands out, and the market value of most other Bitcoin ecological projects ranks relatively low. Currently, the market value of Bitcoin is about 2 trillion US dollars, while the total market value of its ecological projects accounts for only 0.5% to 1% of the market value of Bitcoin, that is, 10 billion to 20 billion US dollars. Such a low ratio shows that the Bitcoin ecosystem is like a treasure mountain that has not yet been fully developed, containing huge wealth potential and unlimited opportunities. We expect that with the advancement of ecological construction and the increase in resource investment, this ratio is expected to increase significantly, from the current 0.5% to 1% to 2% or even 3%. This means that the total market value of the Bitcoin ecosystem is expected to reach 50 billion to 60 billion US dollars.

Looking back at 2023, the rise of inscriptions has triggered widespread attention and enthusiasm for the Bitcoin ecosystem in the market. Then, in the first half of 2024, the Bitcoin ecosystem ushered in the first wave of significant highs. During this period, the influx of capital and development resources showed a rapid trend, and many projects emerged and went online one after another. Among them, projects such as Stacks, Merlin Chain, Bounce Bit, Solv, Babylon, UniSat / Fractal, RGB, Nervos, Bitlayer and Mezo are particularly eye-catching. They have shown their abilities in the Bitcoin ecosystem and injected strong momentum into the prosperity of the ecosystem. In addition, with the periodic arrival of the Bitcoin halving event, the block reward has gradually decreased, which has put higher requirements on the maintenance of the Bitcoin network. In order to meet this demand, miners will have to participate more actively in ecological construction to ensure the stable operation of the entire network.

Although the pace of decentralization is relatively slow, the continuous injection of capital and development resources, as well as the urgent need for network maintenance, are jointly driving the Bitcoin ecosystem forward. When the price of Bitcoin climbs to new heights, the ecosystem will inevitably need more liquidity to maintain its vitality. In the field of key technologies, OP_CAT, BitVM technology, etc. are gradually emerging, laying a solid foundation for the future development of the Bitcoin ecosystem. Looking to the future, after a construction cycle of one to two years, we have reason to believe that the construction results of this batch of projects will gradually emerge in 2025, and some key technologies of the Bitcoin network will also be expected to be truly implemented, thereby further promoting the Bitcoin ecosystem to a new stage of greater maturity, stability and prosperity.

Traditional financial encryption: fully embracing digital assets

With the rapid development of encryption technology, the traditional financial system is undergoing a profound change. Crypto assets are gradually moving from the margins to the mainstream and becoming an indispensable part of the global financial system. Although the personal IP Meme coin issued by Trump has had an impact on the price system of the industrys past currencies and projects to a certain extent, as the president of the United States, his familys every move in the field of cryptocurrency undoubtedly has a huge influence. This influence is not only reflected in the fluctuations in market sentiment, but also in the profound impact on the traditional financial system. As a new type of digital asset, Trumps Meme coin, although it has a certain degree of entertainment and speculation, the trend behind it cannot be ignored: traditional finance is accelerating to embrace digital assets, and this trend will profoundly change the landscape of the financial industry.

The US government will soon introduce clearer and more friendly cryptocurrency regulatory policies in the future, thus creating a more favorable environment for the development of digital assets. For example, the United States may accelerate the compliance process of cryptocurrency exchanges or introduce more policies to support blockchain technology innovation. As more and more traditional financial institutions and investors enter the cryptocurrency field, the correlation between the price fluctuations of digital assets and the traditional financial market is increasing. For example, the price trend of Bitcoin has shown a certain correlation with traditional assets such as US stocks. This deep integration will further promote the encryption process of the traditional financial system, making digital assets an indispensable part of the global financial system. In the future, we may see more traditional financial institutions launch their own cryptocurrency products or apply blockchain technology to existing financial businesses. With the participation of more people and the participation of more traditional financial institutions, the application of cryptocurrency in the financial field will be more extensive and in-depth. This trend will not only change the landscape of the financial industry, but also inject new vitality into the development of the global economy. The future of traditional financial encryption is full of challenges, but also full of opportunities, and all this has just begun.

AI Agent: A New Evolved Intelligent Body

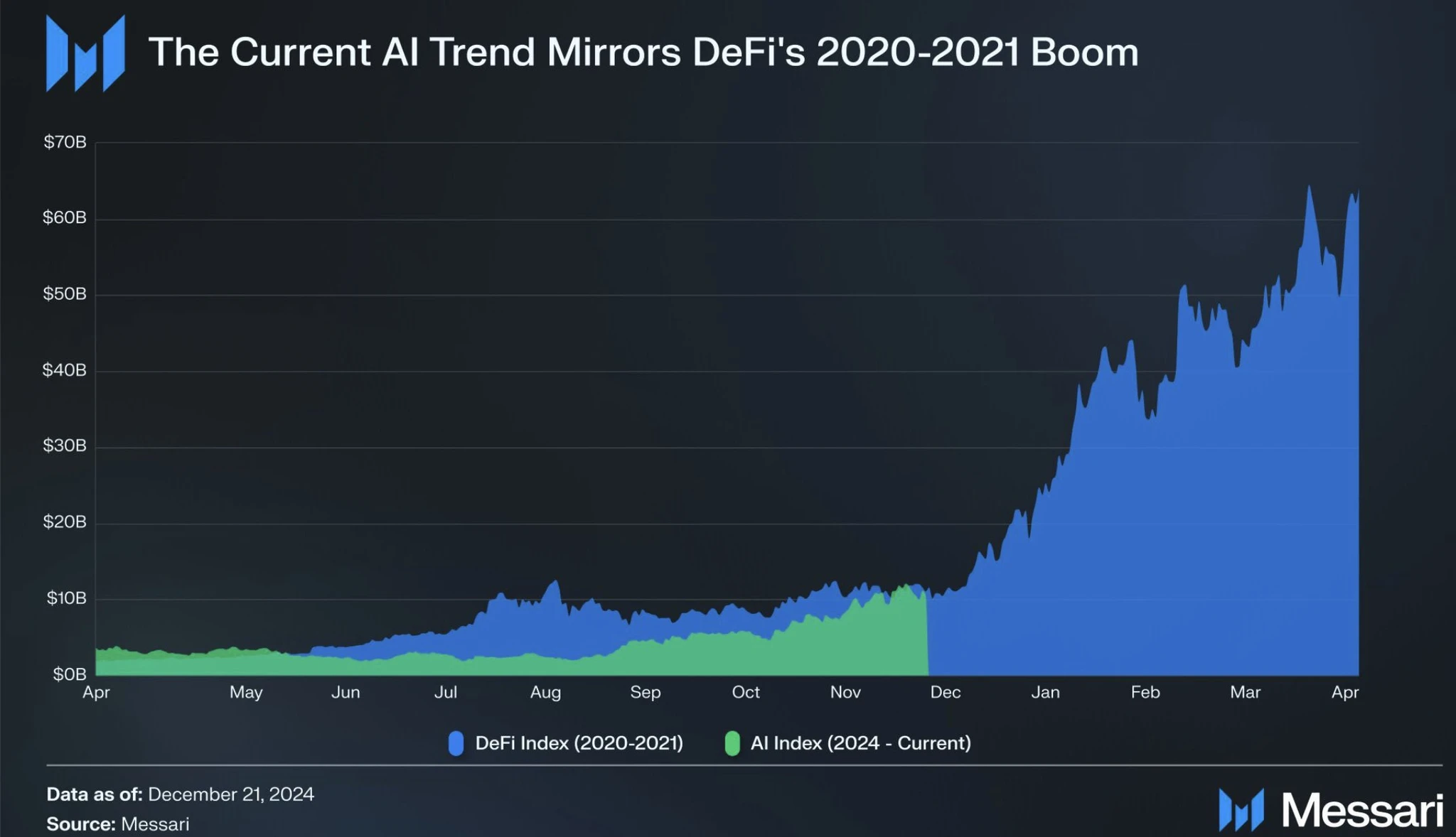

In 2025, the AI Agent sector is expected to usher in explosive growth, and its popularity may surpass the DeFi summer of 2020. Similar to the DeFi wave of that year, the development of AI Agent has also gone through a process from initial exploration to rapid rise. In the first stage, AI Agent attracted a lot of attention and capital investment with its innovative applications in automated trading, intelligent analysis and other fields. However, with the rapid heating of the market, the sector has also experienced a wash-out process, and some projects have experienced callbacks due to technical or market factors. However, the long-term development of AI Agent is still widely optimistic. In 2025, OpenAI launched a new generation of reasoning model o 3, whose powerful reasoning ability and performance close to general artificial intelligence (AGI) have injected new impetus into the development of AI Agent. The o 3 model performs well in tasks such as mathematics and programming, and can reason through private thinking chains, further improving the intelligence level of AI Agent. In addition, the application scenarios of AI Agent are constantly expanding, from DeFi to DAO governance, and it has shown great potential in optimizing transaction decisions, improving user experience and enhancing governance efficiency.

https://x.com/MessariCrypto/status/1874104196800405935

In the new cycle, AI Agent has evolved from an auxiliary tool of traditional AI models to the core driving force of the community ecology, completely transcending the limitations of a single tool attribute. Today, its development model is guided by community orientation, focusing on the growth of AI Agent itself and the construction of the ecosystem, just like building an autonomous community composed entirely of robots.

In the community-oriented model, ai16z and Virtuals are two representatives. Virtuals has built a complete AI Agent creation and token issuance platform similar to the Apple system, building a closed-loop ecosystem. ai16z focuses on open source framework and decentralized governance. The two have their own characteristics in technical architecture, token economy and market strategy, accurately meeting the needs of different users.

At present, the AI Agent market is mainly divided into two major project categories: technical support layer and scenario landing layer. The technical support layer is committed to providing underlying technology and infrastructure support for AI Agent; the scenario landing layer focuses on applying AI Agent to specific business scenarios to realize its actual value. With the gradual maturity and saturation of infrastructure, the coordinated development of infrastructure and applications will become the core theme of the next stage, pushing the field towards a period of deep integration. ArkStream pointed out that the current hot trend of AI Agent is obvious, and the FOMO sentiment has prompted all kinds of funds to pour in, trying to get a piece of the pie. This rapid expansion pattern has caused projects to emerge like mushrooms after rain, but no single project has yet exceeded 10 billion in market value. This stage can be regarded as the primary stage of the Web3 AI Agent track, and its core feature is time orientation: market participants generally have a speculative mentality and rush to enter the market as quickly as possible.

ArkStream Capital predicts that the second phase will arrive in 2025, and the market focus will shift to product quality, followed by a major reshuffle of survival of the fittest - low-quality, opportunistic projects will be quickly eliminated by mainstream funds. With the continuous iteration and upgrading of traditional AI technology, ArkStream Capital remains optimistic about the prospects of the entire track. The current popularity is enough to demonstrate its potential for development. It is expected that the first batch of AI Agent projects with a market value of over 10 billion will become an important milestone in the development of the industry in the near future. The current market value of AI Agent has entered the range of 15 billion to 20 billion US dollars, and has shown strong growth momentum in the past few months, such as an increase of more than 30% in the market value in the past week. With the continuous maturity of technology and the wide recognition of the market, AI Agent is expected to become one of the most promising sectors in 2025. Its market value is expected to continue to grow rapidly, and is expected to reach 50 billion US dollars or even higher in 2025. This growth trend is not only due to the advancement of AI technology, but also due to its wide application and implementation in many fields.

https://www.cookie.fun/

RWA and Stablecoins: A Financial Bridge with Unlimited Prospects

RWA covers a wide range of asset classes, including stablecoins, private credit, U.S. Treasuries, commodities, and stocks. Among these assets, stablecoins can be regarded as an independent track due to their uniqueness and importance. For non-stablecoin RWAs, due to the complexity of asset standardization and the imperfection of policies and regulations, the scale is relatively small. We will focus on the stablecoin field.

In the cryptocurrency market, stablecoins anchored to the US dollar have played a key role since 2018. They are not only the base currency unit for transactions, but also play the role of shadow US dollar assets, active in multiple scenarios such as transfer payments. As of December 1, 2024, the total market value of stablecoins increased to US$193 billion, a year-on-year increase of 48%. Taking the average daily transfer volume on the chain as an example, the current daily transfer volume is stable in the high range of US$25 billion to US$30 billion, and even in the market downturn, the data is not less than US$10 billion. In terms of trading volume, referring to the industry data of CoinMarketCap, the monthly trading volume in November reached US$6 trillion, which means that stablecoins account for 30% of the industrys trading volume in centralized trading volume. This proportion does not include the trading volume of stablecoins on the chain, which means that its actual proportion may be higher. In addition to the three core indicators of issuance, transaction volume and transfer volume, stablecoins also provide stable and sustainable returns by introducing stable-yield assets such as U.S. Treasury bonds as underlying assets, bringing positive externalities to the industry and further promoting the connectivity and integration of Web3 with reality.

In the stablecoin market, with the increase in market demand, various types of stablecoins have gradually emerged, including fiat-backed stablecoins, decentralized collateralized stablecoins, algorithmic stablecoins, etc. Among them, fiat-backed stablecoins have occupied most of the market and the market size is growing, but due to the continuous emergence of transaction needs in the market, decentralized stablecoins have been exploring new paths. Among them, Ethena has stood out as a leader. USDe issued by Ethena, as a synthetic dollar, has occupied a place in the DeFi field with its innovative financial solutions. USDe is characterized by the use of advanced Delta hedging strategies to maintain its peg to the US dollar, which makes it stand out among traditional stablecoins. In just over a year, the issuance scale of USDe has grown steadily, successfully withstood the test of the market downturn in Q2 and Q3, and has now jumped to third place, second only to USDT and USDC, and has entered a rapid development stage again.

ArkStream Capital believes that stablecoins play a key role in the crypto industry in crossing the bull-bear cycle, and their growth momentum is strong and will not stagnate. Whether in the field of payment or trading, various data indicators of stablecoins are expected to continue to grow. With the arrival of the bull market, the issuance scale of stablecoins will expand with the growth of the industry, and its market value is expected to double to exceed 400 billion US dollars. In this trend, decentralized stablecoins are significantly superior to traditional stablecoins with their advantages in transparency, decentralization and yield, and are expected to seize more market share. It is expected that the market share of decentralized stablecoins will increase from the current US$20 billion to more than US$60 billion, accounting for more than 15% of the entire stablecoin market in the future. As a leader in the field of decentralized stablecoins, Ethena has created a number of innovative stablecoin products such as USDtb and iUSDe around USDe. These products have further promoted the market penetration of decentralized stablecoins through cooperation with traditional financial and asset management institutions.

https://app.rwa.xyz/stablecoins

DeFi: The industry pillar for continued development and prosperity

In 2025, the DeFi track ushered in unprecedented development opportunities. With the help of the gradual relaxation of US regulatory policies, the formal influx of a large amount of funds from traditional financial institutions has significantly enhanced the liquidity of the industry. With the outburst of capital, the TVL of the DeFi sector is expected to rise rapidly, and is expected to break through the previous round of highs and head towards 200 billion US dollars, becoming a dazzling high point in the field of crypto finance. Not only that, user activities in the lending, DEX and stablecoin markets will also surge sharply, and the number of daily active addresses and daily active funds may achieve a new level of growth, thereby pushing the asset appreciation of the DeFi ecosystem to another milestone. At the same time, major exchanges have vigorously promoted the popularization of Web3 wallets, which have significantly optimized the user experience and greatly reduced the operating threshold, allowing more users to easily participate in the DeFi ecosystem.

In addition, the activity of the on-chain economy has also been greatly improved due to the on-chain activities held by many DeFi projects and exchanges. These activities not only attracted a large number of users to participate, but also further promoted the prosperity and development of the on-chain ecology. In this context, DeFi has gradually moved away from its dependence on traditional finance or exchanges and presented a new development situation. In the new era, the development of DeFi is no longer limited to traditional functions such as DEX, lending and staking. In the future, DeFi will pay more attention to new key indicators such as daily active users (DAU) and fund activity on the chain. The design of DeFi protocol products will also be closely centered around the rigid needs of users, such as security, ease of use, and optimization of user experience.

In the past, DeFi successfully attracted a large number of chain natives, and with the help of Web3 wallets, more and more users are pouring into the chain, continuously expanding the scale of chain natives. We believe that in 2025, all data indicators of the entire industry on the chain will usher in new breakthroughs. It is worth mentioning that the boundary between DeFi and CeFi is gradually blurring, and the trend of integration between the two is becoming more and more obvious. The liquidity of funds between CeFi and DeFi has increased significantly. This two-way interaction has injected more vitality into the entire financial ecosystem. At the same time, the diversified innovation of wallet products is also constantly stimulating the enthusiasm of users and injecting new impetus into the industry. It can be foreseen that in the future, DeFi will embrace a broader development space with a more open and integrated attitude.

Meme: A vivid interpretation of the attention economy

In 2024, Meme has experienced significant growth and evolution, especially in terms of total market capitalization, trading activity, theme diversity, and exchange support. From October to early December, the total market capitalization of Meme coins increased significantly, reaching a record high, and trading volume also increased significantly. The market has witnessed the emergence of a variety of new Meme coins, including AI Agent Meme (GOAT, ACT), Art BAN linked to Sothebys art auction, Squirrel PNUT related to Trump and Elon Musk, and CHILLGUY, which attracts a large number of Tiktok fans. The rise of these emerging Memes has not only injected vitality into the market and stimulated the liquidity of on-chain funds, but also attracted a large number of new investors to enter the market, contributing to the prosperity and development of the Meme and crypto industries.

Compared with emerging memes, traditional memes such as DOGE, PEPE and WIF also performed strongly in the market. In particular, PEPE and WIF successfully landed on Robinhood in November 2024, which not only highlighted the recognition of Memes by North American compliant exchanges, but also further expanded the market influence of these old Memes.

Combined with the relevant data of the Meme track in the past year, as of the end of 2023, the number of Memes in the top 500 by market value is extremely limited, mainly including a few such as DOGE, SHIB, BONK, PEPE, FLOKI and ELON, and most Memes have low market value. However, by the end of 2024, the number of Memes in the top 500 by market value has increased significantly to 48, accounting for nearly 10%, and the total market value has reached approximately US$104.7 billion, with a 24-hour trading volume of up to US$7.4 billion. All of this shows that Memes recognition and market consensus are constantly breaking through.

Especially in the fourth quarter, Meme became the focus of the cryptocurrency market and attracted a lot of attention from investors. With the return of the value investment trend in November, some funds began to divert from Meme, but some newly listed popular Memes quickly listed on mainstream exchanges such as Binance and Upbit with their good market performance and large user base. Although the lack of market relay funds caused these Memes to experience a sharp correction from their highs, ArkStream Capital believes that this correction is the perfect embodiment of the market attention economy, which means that the inflow and outflow of funds in Meme will change significantly with the fluctuation of market attention. Many Memes have rapidly grown to a market value of US$100 million or even higher in a short period of time, so it is reasonable to experience a correction and the verification of time. At the same time, some emerging sectors, such as DeSci (decentralized science), are attracting the attention of funds and resources in the form of Meme. Compared with traditional scientific research funding methods, this method is more flexible and efficient, and can quickly gather global financial support to provide timely funding guarantees for innovative and forward-looking scientific research projects. In addition, Meme, as a carrier of DeSci, can also stimulate the publics interest and participation in scientific research, create a positive scientific research atmosphere, and promote the transformation and application of scientific research results.

Most notably, the new US President Trump released a Meme token named after him (TRUMP), which undoubtedly attracted a lot of attention and capital influx from outsiders. Unlike traditional financial products, TRUMP completely bypasses centralized exchanges and relies on the power of the chain and the community to achieve a market value of tens of billions of dollars in a short period of time. This model not only sets an example for celebrities and companies to enter the cryptocurrency field, but also demonstrates the strong potential of decentralized finance. As an influential politician, any move by Trump may have a profound impact on the market. The issuance of the TRUMP token not only drives the explosive growth of the Meme track, but may also have a chain reaction on the entire cryptocurrency industry.

For this reason, ArkStream Capital believes that the prosperity of Meme in the industry is not a short-lived phenomenon. As a bridge connecting Generation Z and the Web3 world, they are expected to continue to exist and inject emotion and value into the market with their easy-to-understand and participatory characteristics. With the successful release of Trump Meme, Meme will surely achieve a deeper combination with traditional celebrities and well-known companies in the future, further expanding its influence and market potential. Therefore, ArkStream Capital is actively looking for opportunities suitable for layout in the Meme sector. Among them, special attention is paid to and layout of two types of areas: one is the portal platform that provides token information and transaction data, as well as Bot products that provide transaction convenience and strategy customization, and new Meme launch platforms such as Pump Fun. These are the core infrastructures with actual sustainable returns in the Meme field; the second is that Meme is gradually becoming a way of issuing assets that carries the concept of fairness. Many projects with actual value support are trying to use Meme to attract users. They adopt the concept of organic growth and open with a low market value. This relatively healthy growth method also reflects the active exploration and innovation of primary market projects on Meme.