Decentralized trading, the king of trading? ——The evolution and future of on-chain trading

1. Introduction: The rise of decentralized exchanges

On January 18, 2025, two days before his inauguration, a social media message from President-elect Trump triggered the most impressive on-chain trading boom in the history of the crypto market. In just 24 hours, the market value of the token called TRUMP exceeded $24 billion, and more than 115,000 new users poured into the Solana ecosystem, equivalent to half of Arbitrum’s daily active users. This phenomenal event not only set a new record for on-chain transactions in a single day, but also revealed the huge potential of decentralized trading in a dramatic way.

As Bybit CEO Ben Zhou commented on Twitter on January 19: "Yesterday, all centralized exchanges witnessed a large amount of SOL and USDC flowing to the chain. Through DEXs such as Moonshoot and Jupiter alone, a Meme token created a market value of over US$30 billion in less than 10 hours without the participation of any CEX..." He also expressed plans to invest heavily in on-chain infrastructure construction in order to become an important entry point for users to enter web3.

These words reveal a key trend: decentralized trading has become the choice of more and more investors.

From the Margins to the Mainstream Consensus

Over the past seven years, decentralized exchanges (DEX) have gradually moved from the fringe to the mainstream. Launch platforms that simplify token issuance, such as Pump.fun, have stimulated investor interest in low-market-cap virtual assets. These assets are usually traded on DEXs first after launch. Major centralized exchanges such as Binance, Coinbase, and Kraken are slow to list new coins, often waiting for weeks or months before adding new coins in limited batches. Therefore, as people pay attention to privacy, security, and the frequency of new coin transactions, more users are entering the door of on-chain transactions.

The revolution from “CEX is king” to “on-chain trading”

In the early days of the industry, CEXs such as Binance and Coinbase dominated the market with their high liquidity and user-friendly interfaces. However, this centralized model also brought problems such as asset custody risks and lack of transparency. As technology develops, users begin to seek safer and more autonomous trading methods, which has promoted the development of DEX.

The emergence of new on-chain aggregation trading platforms

In this context, facing the new market structure, different platforms have chosen their own transformation paths, and new on-chain aggregation trading platforms have emerged.

Bitget acquired BitKeep and upgraded it to Bitget Wallet, and innovatively launched on-chain trading tools such as fast trading and smart quotes, demonstrating a strong Web3 ecological layout.

OKX Web3 Wallet launched by OKX supports multi-chain and DApp protocols and provides functions such as native cross-chain transactions, demonstrating the comprehensive transformation of traditional exchanges to Web3

Ave.ai takes another approach, providing users with comprehensive one-stop trading support by integrating data analysis of multiple blockchains, smart contract risk detection, and smart money flow monitoring.

The innovative practices of various platforms confirm the strong market demand for one-stop on-chain transaction services.

2. Evolution and advantages and disadvantages of different types of exchanges

1. Prosperity and difficulties in the CEX era

Prosperity: the pinnacle of efficiency and liquidity

CEX has dominated the cryptocurrency market in the past decade. Take Binance as an example. At its peak, it accounted for most of the global cryptocurrency trading volume, with an average daily trading volume of more than $76 billion at the end of 2024, accounting for more than 60% of the global market share. CEX has attracted a large number of users with its high efficiency, strong liquidity and fiat currency support, making it easy for novice investors to enter the market.

Dilemma: Centralization risks and lack of transparency

However, CEX also faces many challenges:

Asset custody risk: User assets are centrally stored on the platform. Once a hacker attack occurs, the loss is heavy. For example, in 2019, Binance suffered a theft of 7,000 BTC.

Lack of transparency: The internal operations of the platform are not transparent, which can easily lead to a crisis of trust.

Regulatory pressure: As global regulations become stricter, many CEXs face compliance challenges, such as FTX’s bankruptcy in 2022.

When we look at the market data at the beginning of 2025, although Binance still maintains its leading position in the industry with a daily trading volume of US$29.25 billion, the underlying logic of the market is quietly changing. In particular, the proportion of altcoin transactions on the Binance platform has climbed to 78%, an increase of 11 percentage points from May 2024. What this data reveals is that the cryptocurrency market is evolving towards a more diversified ecosystem. This transformation is not only reflected in the richness of trading varieties, but also in the innovativeness of trading methods. With the development of technology, users began to seek safer and more autonomous trading methods, which promoted the development of DEX.

2. Exploration of Traditional DEX

Innovation: The Rise of the Swap Model

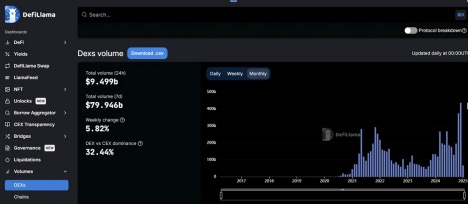

The development trajectory of decentralized trading, to some extent, reflects the maturity of the entire cryptocurrency market. Since the important node in September 2020 when CEX lost half of the on-chain trading volume for the first time, decentralized trading has shown strong development momentum. Swap mode DEX represented by Uniswap solves the problem of insufficient liquidity in the order book model through the automatic market maker (AMM) mechanism. In June 2021, Uniswap reached 80% of the market share of on-chain transactions, a phenomenon that shows that decentralized trading is gradually accepted by users. In January 2025, data from The Block and DefiLlama showed that the spot trading volume of decentralized exchanges exceeded 20% of the centralized platform trading volume for the first time in the history of cryptocurrency. Analysts believe that this may reflect people's growing interest in decentralized platforms.

Launch platforms that simplify token issuance, such as Pump.fun, have stimulated investor interest in low-market-cap virtual assets. These assets are usually traded first on DEXs after launch. Major centralized exchanges such as Binance, Coinbase, and Kraken provide web2-style access to digital assets. However, these exchanges are slow to list new coins, often waiting weeks or months before adding new coins in limited batches. Decentralized platforms such as Uniswap will continue to play an important role in cryptocurrency trading. Decentralized exchanges are more in line with the spirit of decentralization and support the launch of new tokens without restrictions. On-chain data shows that decentralized exchanges have generated nearly $10 billion in trading volume since the beginning of this year.

Market research shows that the rapid development of DEX is due to several key factors:

Users’ pursuit of asset autonomy

Smart contract technology continues to mature

The DeFi ecosystem is booming

Breakthrough in cross-chain technology

Limitations: technical bottlenecks and user barriers

However, traditional DEX also faces many challenges:

Liquidity fragmentation: assets on different chains are difficult to interoperate.

High Gas Fees: Blockchain network congestion leads to high transaction costs.

Complex user experience: For non-technical users, the operation threshold is high.

3. New species: the rise of on-chain aggregate trading platforms

The on-chain aggregate exchange combines the advantages of CEX and traditional DEX, and provides users with a new decentralized trading method by integrating multi-chain asset analysis, on-chain order placement, and user experience close to CEX level. The emergence of this new type of exchange marks a new stage of development in cryptocurrency trading.

Core features and advantages

1. Multi-chain asset integration capabilities:

Supports cross-chain asset management and transactions. Users can operate assets on multiple blockchains on a single interface.

Provide full-chain asset analysis tools to help users make smarter investment decisions

2. Experience close to CEX level:

Realize real-time order books and efficient matching mechanisms to solve liquidity problems in traditional DEX

The user interface is optimized so that non-technical users can easily get started

3. Decentralization and autonomy coexist:

Users still control their private keys, achieving true autonomy

All transactions are executed through smart contracts, without the need to trust a third party

4. Expanding spot and derivatives market share:

It not only supports spot trading, but also gradually expands to the derivatives market, such as options and leveraged products.

3. Competitiveness Analysis of On-chain Aggregate Trading Platform

1. Bitget Wallet: Global Web3 User Portal

Global market advantages:

2024 Global users exceed 60 million, annual growth rate 300%

Emerging markets: Africa grew 1,000% and Central and Eastern Europe grew 400%

Become the largest Telegram multi-chain wallet

Function integration:

Support 90 main network accesses

Connect with over 20,000 DApps

Provide fast trading and intelligent market tools

2. OKX Web3 Wallet: A one-stop DApp interaction platform

Advantages of multi-ecological coverage:

Supports over 80 blockchain networks

Connect to 1000+ DApp protocols

Providing NFT market access

Trading features:

Token Swap cross-chain transactions

Batch transfer tool support

Real-time gas fee tracking

3. Ave.ai: AI-driven one-stop trading analysis platform

Data coverage advantages:

Access to more than 60 blockchain data and connect to over 4 million crypto wallets

Supports 300+ DEX markets and 130+ networks

Provide multi-dimensional security scoring and risk detection for tokens

AI Trading Signals:

Intelligent funds flow monitoring

Whale Behavior and DEV Activity Tracking

On-chain transaction data analysis

In the current market competition landscape, Ave.ai, as a one-stop transaction analysis platform, demonstrates unique advantages:

First of all, the platform realizes seamless connection from data analysis to transaction execution. Users can complete all operations in one stop, which greatly improves efficiency. The platform supports importing existing wallets or creating new wallets, which simplifies the asset management process for users. The platform is outstanding in enabling investment decisions. By providing detailed data dashboards including fund flows, token holdings distribution, etc., and real-time monitoring of whale behavior and fund movements, it helps investors seize market opportunities.

Features of other major competitors:

Transaction function coverage: Mainstream platforms generally support 80-130 public chain networks and thousands to tens of thousands of DApps

User growth: The platforms are expanding rapidly around the world, especially in emerging markets.

Differentiated strategies: some focus on globalization, others focus on integration with Web2 services

Looking ahead, competition among on-chain aggregation trading platforms will become more intense, and user experience and data analysis capabilities will become key. As the boundaries between CeFi and DeFi become more blurred, the platform's comprehensive service capabilities will become increasingly important.

IV. Future Outlook: A New Paradigm for Decentralized Trading

1. Market evolution trend

In the next few years, DEX and CEX may form a new model of symbiotic development. The gradual participation of institutional investors in decentralized finance will further promote the development of on-chain aggregation platforms. As the industry develops, we expect to see more innovative projects emerge in the next five years to meet the changing market needs.

2. Technology development direction

At the technical level, the industry will present multi-dimensional breakthroughs. The improvement of cross-chain interoperability will break down the barriers to asset circulation and achieve a wider range of value interoperability. At the same time, the deep integration of AI technology and blockchain will bring users a more intelligent service experience. In addition, as the demand for complex financial products grows, the security of smart contracts will also be continuously optimized and strengthened.

5. Conclusion: Redefining digital asset transactions

In this massive financial revolution, on-chain aggregate trading platforms are redefining the basic paradigm of digital asset trading. From the transformation of major CEX platforms and the practice of the one-stop on-chain platform Ave.ai, we have seen the prototype of a new trading form: it retains the essential characteristics of decentralization and achieves major breakthroughs in efficiency and user experience.

Standing at the time node of 2025, we have reason to believe that with the continuous advancement of technology and the continuous maturity of the market, decentralized transactions will eventually break through the existing barriers and play a more important role in the new era of digital economy. In this transformation, those platforms that can accurately grasp the pulse of technology and deeply understand market demand will surely gain an advantage in future competition. For the entire cryptocurrency market, this may be the beginning of a new era.