Original author: Tulip King

Original translation: TechFlow

Alpha First

The market is generally healthy but shows signs of over-extension, and the direction of the next wave of mainstream investment is unclear.

Trumpcoin may have become the peak of the Memecoin craze - should we turn our attention to SocialFi?

Emerging hot spots: SocialFi, AI, Dinocoins, etc. are vying for market attention.

Market conditions

Despite the recent market volatility, I think the market is still healthy overall. The three core indicators of the crypto market are all very positive.

Bitcoin consolidates at high levels and shows strong performance

Bitcoin continues to consolidate near the top of the range, which indicates that market sentiment is strong rather than weak. In the current situation, about $105,000 seems to be a key price for Bitcoin. This level reflects the markets confidence in the long-term development of cryptocurrencies while avoiding the risk of excessive optimism.

Bitcoin is consolidating at high levels, showing healthy market signals.

While we didn’t get some blockbuster news—like a strategic Bitcoin Reserve (BSR) or sweeping tax incentives for crypto—the market still made some small strides. For example, Ross Ulbricht’s pardon was a low-key but important sign that the Trump administration hasn’t completely abandoned its pro-crypto policies. While regulatory clarity has been slow, the overall trend is positive.

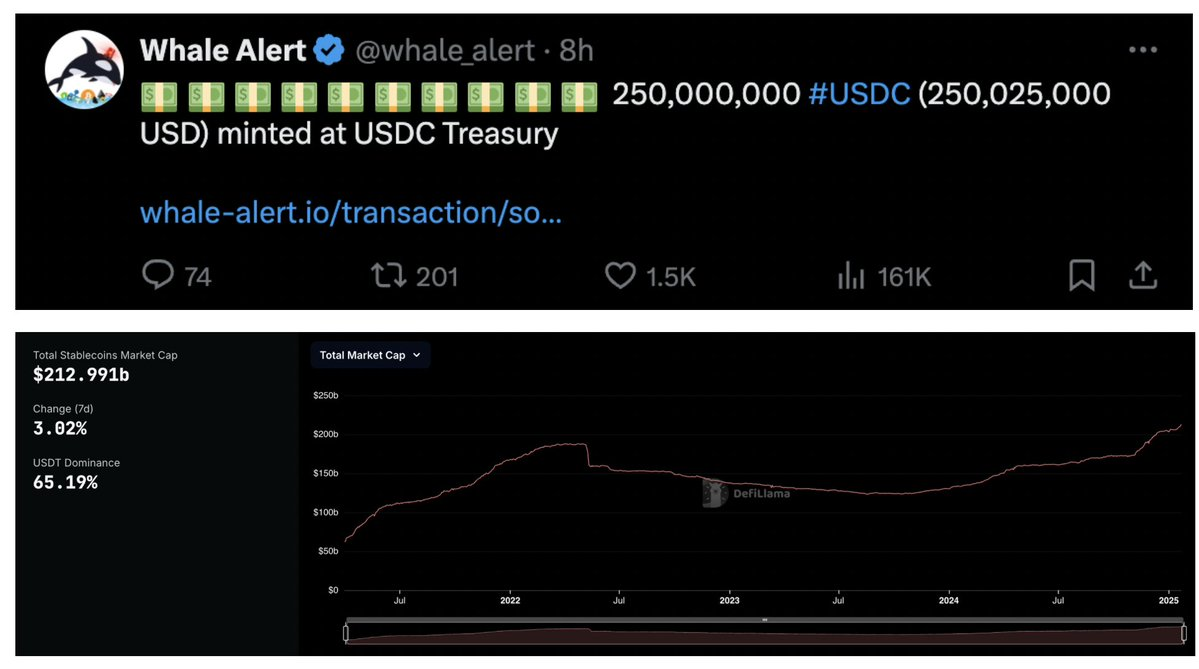

Steady growth in stablecoin supply

Another positive sign is the continued growth in stablecoin supply. Based on historical data, an increase in stablecoin supply is often a reliable precursor to increased institutional interest and market liquidity. It is worth thinking about: who is minting these stablecoins on such a large scale?

The supply of stablecoins continues to grow, sending a bullish signal.

Judging from the scale of minting, institutions are indeed entering the market. If you have doubts about this, you can check the data of @whale_alert and other on-chain monitoring tools. Although it has not yet been clearly reflected in the performance of altcoins, capital is flowing into the market.

Expansion of the total crypto market capitalization

The total market capitalization of cryptocurrencies continues to grow.

Finally, the total market capitalization of the crypto market continues to expand. This growth, combined with the strong performance of Bitcoin and the increase in the supply of stablecoins, further proves that the market is not on the verge of collapse. Instead, the market is consolidating its foundations and preparing for the next stage of growth, no matter what form this stage takes. The current market does not look like the end of the world.

Narrative risk: loss of market direction

An important reason for the lack of significant volatility in the current altcoin market is the lack of a clear narrative direction in the market. This is known as “narrative risk” – as the market loses its direction, funds may flow to the wrong investment themes, increasing risk.

Take the recent Memecoin craze. While Trump didn’t announce a strategic Bitcoin Reserve (BSR) or anything else major, he did launch a Memecoin. Melania followed suit, and there were even rumors that Barron might be involved. Traders are extremely enthusiastic about these opportunities, myself included.

However, this sudden Memecoin craze has filled the market with uncertainty, leaving more questions than answers. Is this a super cycle for Memecoin, or a top signal? Should we refocus on AI tokens? Why is XRPs price chart so strong? No one, including the market itself, seems to be able to clearly point out where to focus funds at the moment.

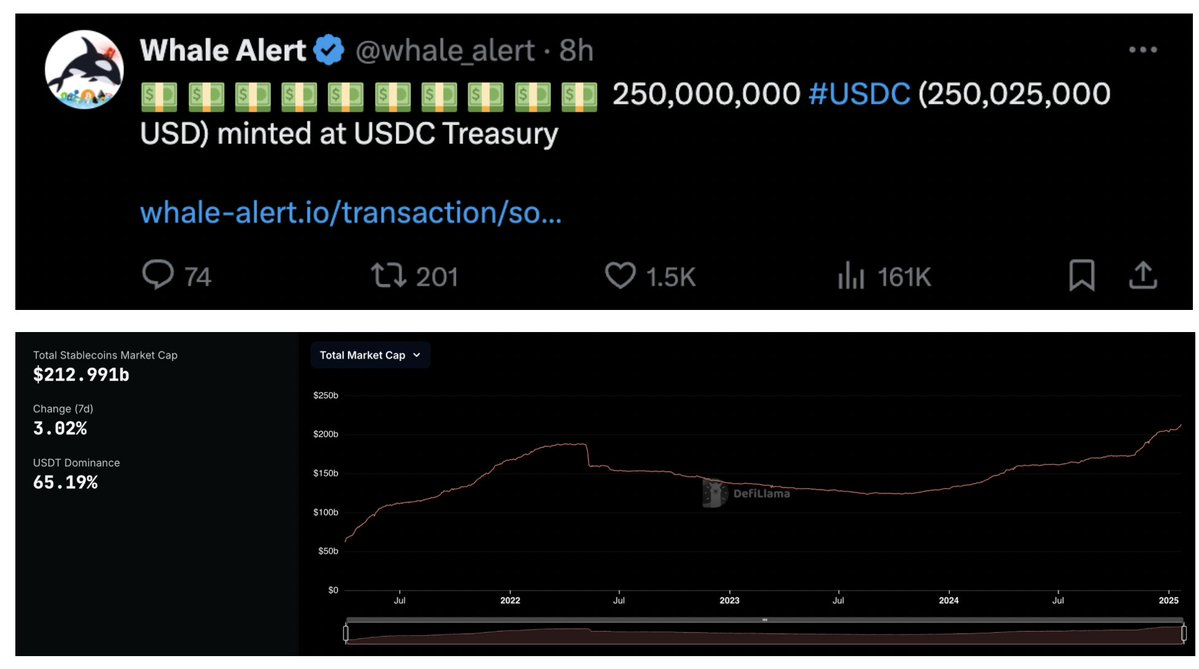

Memecoins: The craze may be coming to an end

I regret to inform you that Memecoin may have entered its last wave of trading. Trumps entry into this field has occupied an overwhelming attention and market share, and this influence is difficult to underestimate. Now the question is: who else can launch Memecoin on a similar scale? The answer is probably no one.

In Kels words, we have exhausted our attention resources.

The essence of memecoins is to convert attention into tokenized assets. They rely on capturing the publics attention and converting it into speculative capital. This model has driven the explosive growth of the memecoin market for many years. However, with Trumps entry, this model may have reached its peak. Trump is not just an ordinary celebrity or influencer, he represents the vast majority of attention on a global scale. No other figure or event can compete with his dominance in the cultural and media fields.

Therefore, Memecoin as an asset class may have reached its apex. The growth space for attention tokenization has been fully tapped. Of course, Trumpcoin may have further gains to go, and may even lead other Memecoins to a final parabolic rise. But this is more like an epilogue than a new chapter.

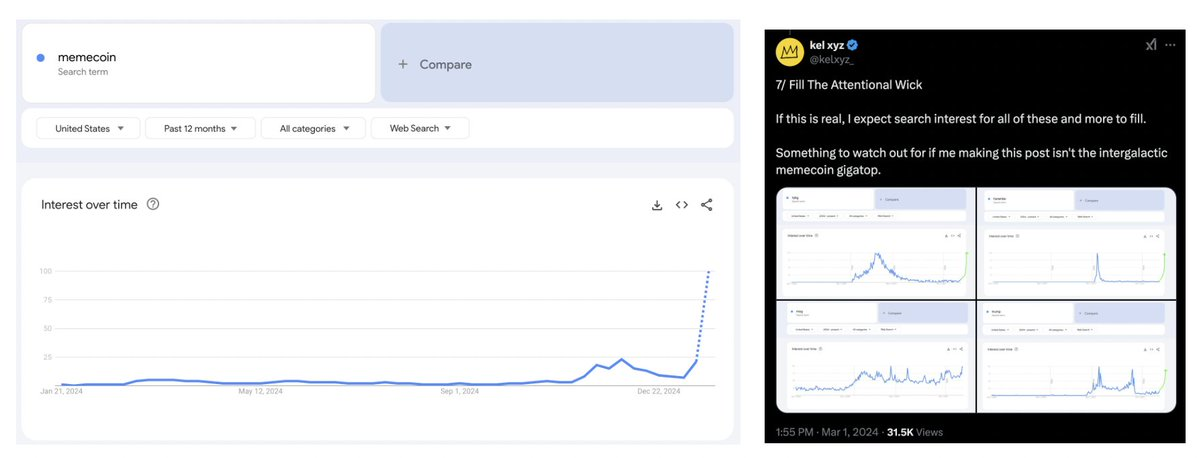

SocialFi (Clout and Yapster)

If the Memecoin narrative is to continue to grow, it needs to move to a more sustainable and scalable model. This is where SocialFis potential lies. By combining speculative enthusiasm with deeper, more personal interactions, SocialFi has the potential to continue the Memecoin story. Rather than betting on cultural phenomena or celebrity tokens, SocialFi offers an opportunity to invest in personal relationships and community dynamics. From this perspective, it is a natural evolution of the Memecoin concept - moving away from mere attention, towards more meaningful interactions and long-term value creation.

Why SocialFi is worth watching

SocialFi is a potential hotspot worth paying attention to. Successful projects in this field may combine elements of social media and online games to create a hybrid platform that is both attractive and profitable. It can be imagined that it will be a combination of social platform and online entertainment, and its potential for large-scale application cannot be underestimated.

Currently, there are two projects worth paying attention to:

Clout: Clout focuses on tokenizing social influence, allowing users with a large number of followers (10,000+) to create personal tokens. Built on Solana, it combines the monetization capabilities of Friend.tech while simplifying token issuance and integrating with decentralized exchanges such as Raydium. Clout has achieved early success, with its first token $PASTERNAK reaching a market cap of $80 million in just a few hours. With a seamless registration process for credit cards and Apple Pay, Clout significantly lowers the barrier to entry for Web2 users. However, its open structure disperses liquidity among multiple influencers, which may weaken the cohesion of the community.

Yapster: Yapster is another innovative SocialFi project that blends social media, gaming, and cryptocurrency, also built on Solana. In contrast, Yapsters approach is more centralized, rallying the community around a common goal rather than dispersing liquidity among multiple influencers. Users can participate in a daily game show, paying a 0.25 SOL entry fee to create and vote for Memes. Winning Memes can even be minted into tokens, with distribution tied to the participants scores. This model focuses on a single Meme rather than many influencers, creating a stronger and more unified flow of liquidity. Yapsters invitation-only Beta test further promotes a close-knit, engaged community. A notable example: its first token reached a market cap of $25 million in just 10 minutes, demonstrating its strong user engagement and value creation capabilities.

@yapsterxyz: Were aware that many of you are experiencing lag and other issues with the game! We are currently working around the clock to fix these issues and strive to resolve them as soon as possible. Thank you very much for your understanding and patience while experiencing the Beta test version.

Stability issues caused by excess demand are usually a bullish signal for the market.

While Clout offers many advantages to influencers in terms of scalability and operational simplicity, I prefer Yapster’s centralized mechanism and community-driven design. Its focus on converting the public’s attention into real value is more sustainable and attractive than distributing liquidity among many individuals.

Dinocoins (XRP, HBAR, XLM)

“What dies never dies, but is reborn stronger.” - George RR Martin

Dinocoins (including XRP, HBAR, and XLM) are the classic hate trade in this round of cryptocurrency cycle. This trading pattern works because it reveals the emotional bias of market participants. The markets skepticism and contempt for these assets usually means that investors are under-allocated to them, resulting in a lot of funds remaining on the sidelines. When these assets begin to rebound, investors are often forced to buy, further driving prices up.

Bitcoin and XRP price chart.

Crypto Twitter users have long viewed Dinocoins as outdated artifacts that have lost ground to newer, more appealing narratives. Yet this very disdain has created an opportunity for their unexpected resurgence.

Why should we pay attention now?

Despite their bad reputation on Twitter, Dinocoins have shown significant strength in price performance and institutional adoption. Here’s why they’re worth watching:

Institutional Recognition: These tokens have strengthened their “more formal” positioning in the cryptocurrency space, focusing on real-world use cases and partnerships. For example, Ripple’s new stablecoin RLUSD shows its efforts to integrate into mainstream finance. XRP’s partnership with Santander and HBAR’s partnership with the World Gemological Institute further demonstrate their commitment to institutional adoption.

(Not a typical XRP Army account - this is a bullish view from an excellent research team)

Regulatory Landscape: With the expectation of a friendlier regulatory environment for cryptocurrencies, these tokens are well positioned. XRP and XLM’s ISO 20022 compliance, a standard that is closely tied to compatibility with traditional financial systems, enhances their credibility. Additionally, rumors surrounding ETFs (Exchange Traded Funds) for XRP and HBAR add another layer of appeal, although Bitcoin ETFs remain the main focus of the market.

The contrast is stark: On one hand, many crypto enthusiasts turn their noses up at them; on the other, institutions may be quietly embracing these tokens. Whether you love them or hate them, Dinocoins are making moves that could redefine their role in the market. Their focus on compliance, partnerships, and real-world use cases could ultimately be a winning strategy, especially if they can win over regulators.

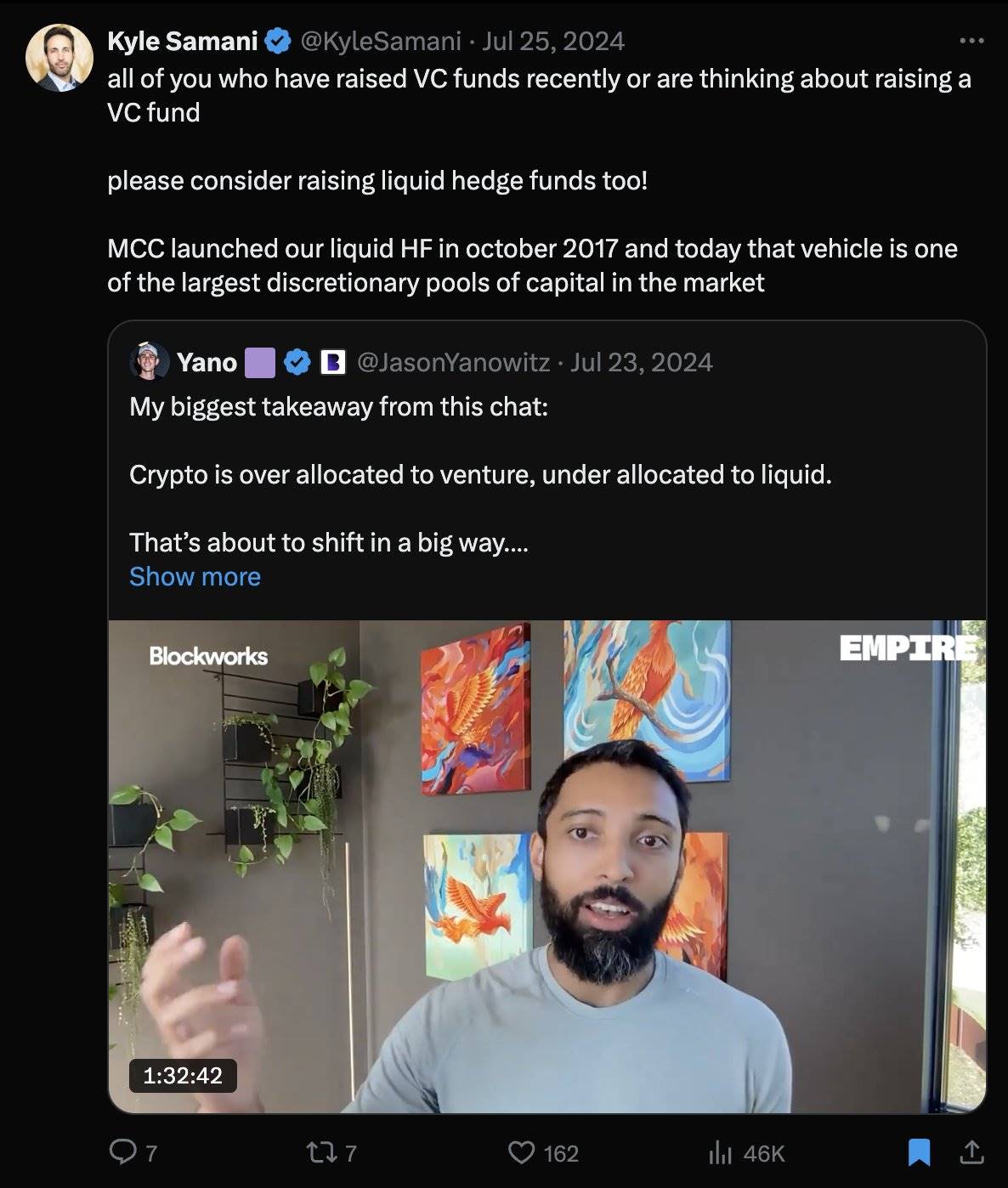

Liquid Token Operations for Hedge Funds

If you still believe in the concept of a “fair launch,” then you need to face the reality that the lifecycle of most tokens is not as democratic as it appears.

Team Developing Projects: Project teams usually develop projects with a vision of decentralized finance or infrastructure and create a token as part of the ecosystem.

VCs provide funding in exchange for locked tokens: Venture capital firms (VCs) provide funding to projects in exchange for tokens that are locked or unlocked in stages. This arrangement theoretically ties the interests of VCs to the long-term success of the project because the tokens cannot be sold immediately.

VCs sell unlocked tokens to liquidity funds over the counter: When tokens begin to unlock or release in stages, VCs usually sell these tokens to liquidity funds through over-the-counter (OTC) transactions. These liquidity funds are usually well-capitalized institutions that buy these tokens in large quantities at a discount.

Liquidity funds sell tokens when market volume is high (you are at this stage now): After acquiring these tokens, liquidity funds will try to create or take advantage of market hype. They promote narratives through platforms such as Twitter to attract market attention and increase trading volume, so that they can sell tokens at a high price under the right conditions to profit.

Actual situation

Taking Raydium as an example, its tokens appear to be mostly unlocked at this point.

Between 2021 and 2023, venture capital poured into the crypto market, especially DeFi and infrastructure projects. These investments were often made in the form of tokens that were locked or released in stages. However, with most of the tokens now unlocked, VCs need to liquidate these assets to deliver returns to their limited partners (LPs). Starting in mid-2024, many well-known VCs began calling for more liquidity. This liquidity purchases these illiquid tokens through over-the-counter (OTC) transactions, providing VCs with a market to liquidate unlocked tokens.

Instead of blaming the participants, it is better to understand the rules themselves. VCs are pushing people to raise liquidity so that they can take over their tokens through OTC methods and start distributing profits from the previous cycle to LPs.

The relationship between VCs, liquidity and the market is not out of malice, but a natural phenomenon of capital flow in the crypto ecosystem. VCs need to rely on well-funded liquidity to take their tokens, and these tokens are usually sold at low prices due to insufficient liquidity. In turn, liquidity will try to create or amplify market narratives through platforms such as Twitter to attract market attention and increase trading volume in order to sell these tokens at a high price for profit when market conditions are favorable.

The alignment of market narrative with timing.

This is not necessarily malicious behavior, I am even buying some of these tokens. But you need to know your counterparty and have a clear understanding of the life cycle of the token.

AI Agents and DeFAI

DeFAI could potentially replace many existing crypto tools. If enough functional integrations are implemented, a DeFAI router could simultaneously serve as a yield aggregator, an aggregator for decentralized exchanges (DEX) and perpetual contracts, a portfolio management tool, and more.

However, I would be wary of AI agents that claim to “help you make money.” Market dynamics mean that excess returns (alpha) will decay over time. Even so, DeFAI has the potential to provide important support to individual investors by simplifying personal trading strategies and portfolio management.

Currently, AI is at a critical development node. AI hotspots have gone through several stages: the earliest were infrastructure projects like Bittensor, followed by intelligent agent projects like AIXBT, followed by intelligent agent launch platforms (such as Virtuals) and frameworks (such as AI16Z). Today, the latest trend is around DeFAI.

An important trend is emerging

AI is undoubtedly one of the most important market hot spots in this cycle, but its long-term development direction remains unclear. The rise of DeFAI is particularly noteworthy because it does not promise magical money-making AI but focuses more on practical functions, such as simplifying the process of yield optimization, trading and portfolio management.

DeFAI is unique in that it has the potential to integrate the fragmented ecosystem of current crypto tools. Imagine a router that can seamlessly integrate multiple financial instruments, which can greatly reduce the operational friction of users. Although the idea of earning money AI agent sounds unrealistic, the advantage of DeFAI is that it helps users execute their strategies more efficiently.

Changing market trends

Like all major market hotspots, the AI space is evolving rapidly, driven by hype and experimentation. From the initial promise of AI bringing financial freedom to the actual functions provided by DeFAI today, this change reflects the markets gradual shift from fantasy to practical applications. It is foreseeable that AI will continue to be a core theme, but the ultimate winners will be those projects that can meet real needs and avoid over-promising.

The crypto market is still full of unknowns. Market hot spots change rapidly, and future winners will be those who can predict where the publics attention will flow in advance. Stay sharp and flexible, pay attention to the overall situation, and dont be confused by short-term fluctuations.