After years of hesitation and anticipation, cryptocurrencies have finally reached a milestone. Trump’s new administration has continued to bring positive policy news to the market, and the president did not hesitate to leave a clear mark at the beginning of his second term.

Although the community was somewhat disappointed that Trump did not mention cryptocurrency in his inaugural speech, this was quickly made up for by a series of extremely direct and precise executive orders. The following is a brief summary of the executive orders on cryptocurrency:

Trump has set up a working group consisting of AI and cryptocurrency chief David Sacks, SEC official Hester Pierce, the Treasury Secretary and other senior members, which is considered a very pro-cryptocurrency team.

The task force is empowered to lead conversations and make regulatory policy recommendations that go beyond the federal government’s expertise.

The order aims to support the growth of digital assets, allow blockchain to be used for legitimate purposes, and require relevant agencies to maintain neutrality towards the technology in their regulation.

The working group will assess the feasibility of establishing a national digital asset reserve.

The order requires opening banking services to legitimate cryptocurrency players.

The order supports the private sector issuing dollar stablecoins, but prohibits the issuance or promotion of CBDC (central bank digital currency).

The order effectively repeals the Biden administration’s previous framework for digital assets.

Overall, this is a fairly comprehensive and impressive executive order compared to what we’ve seen in past years.

In addition, some industry details emerged shortly after the Executive Order was issued, showing significant progress in terms of institutional engagement:

The SEC overturned the controversial accounting rule SAB 121, which will allow banking institutions to begin custodying cryptocurrency assets on their balance sheets in the future. The existing rules require that cryptocurrency holdings be marked as liabilities, significantly worsening corporate debt/equity ratios and making the cost of holding cryptocurrencies too high.

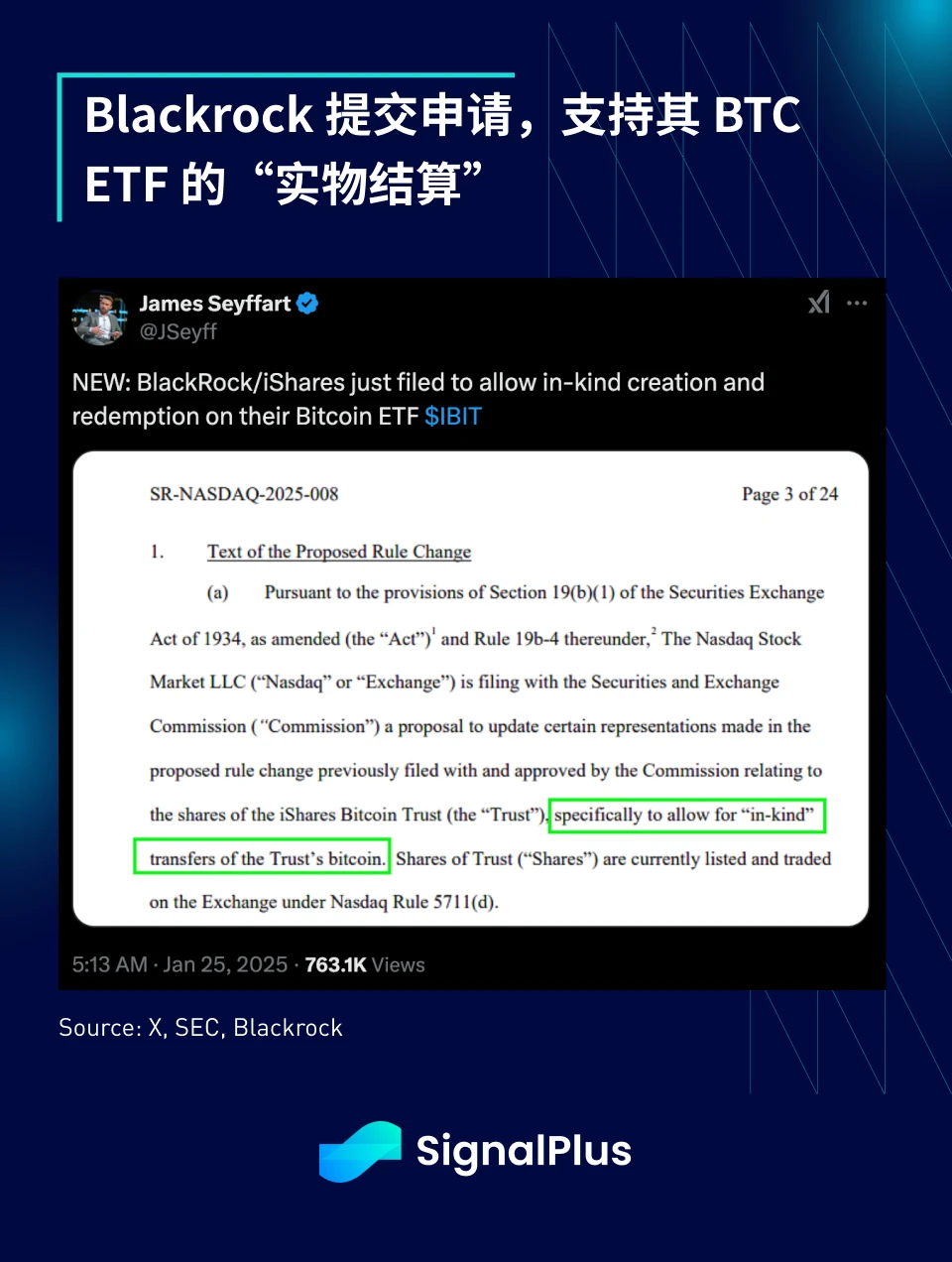

Blackrock has applied to amend its $IBIT BTC ETF filing to allow for “physical settlement,” meaning investors can choose to receive ETF returns in BTC rather than U.S. dollar fiat, suggesting that Wall Street is preparing to support BTC settlement.

In terms of blockchain applications, Elon Musk is rumored to be studying the use of blockchain technology to track government spending and efficiency, which is very DOGE style.

Over the weekend, Eric Trump “confirmed” plans to implement a 0% capital gains tax for U.S.-based cryptocurrency projects (such as XRP), while all other offshore projects will be subject to 30%.

Additionally, Senator Ted Cruz has pledged to introduce a new resolution to overturn the IRS rule requiring DeFi brokers to report gross revenue and user data, arguing that the rule undermines the spirit of decentralization and hinders cryptocurrency innovation.

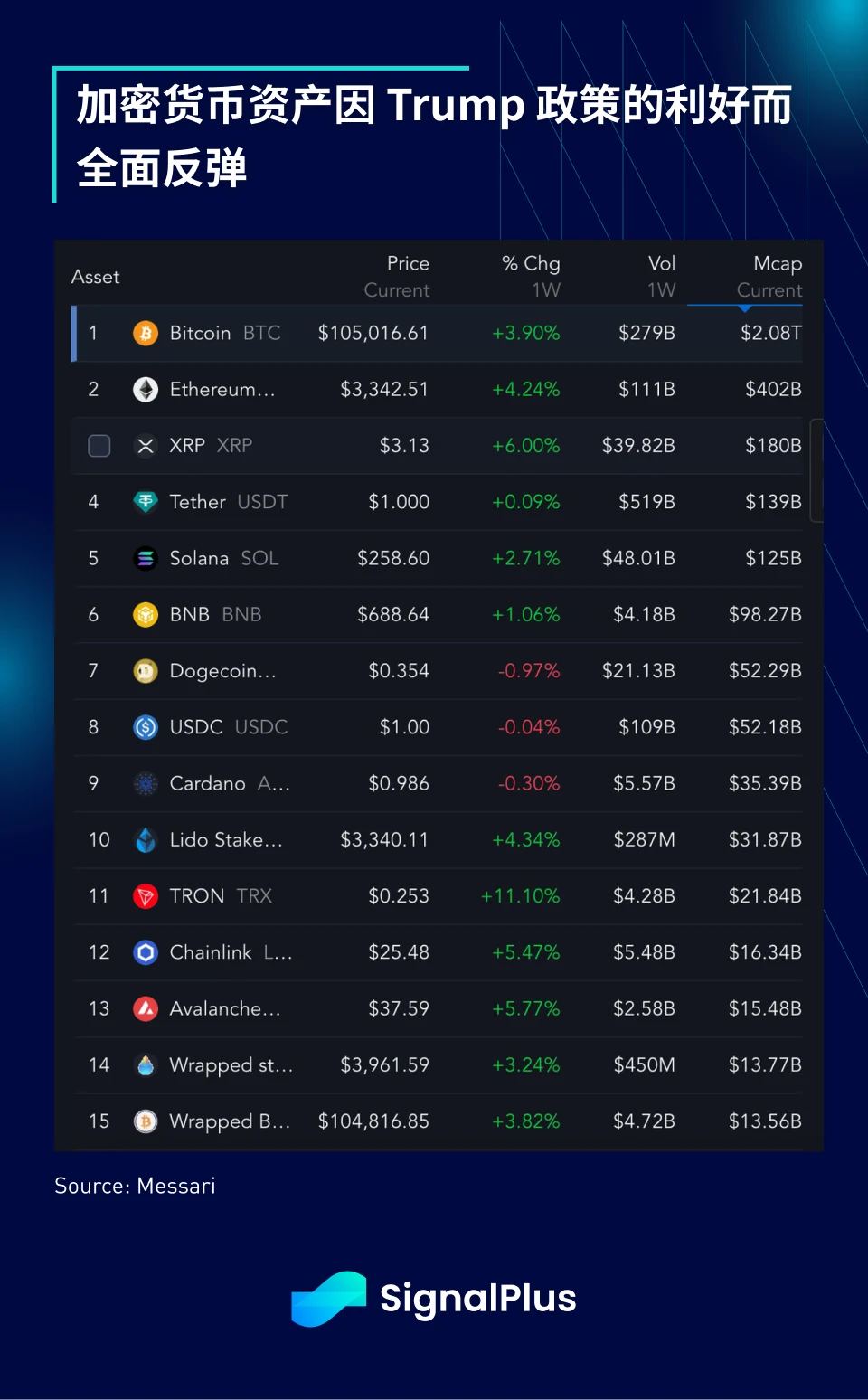

Although the market failed to hit new all-time highs, cryptocurrencies rebounded strongly from last week’s sharp decline, with BTC rising 4% and XRP rising 6% as it was considered for possible inclusion in strategic crypto asset reserves.

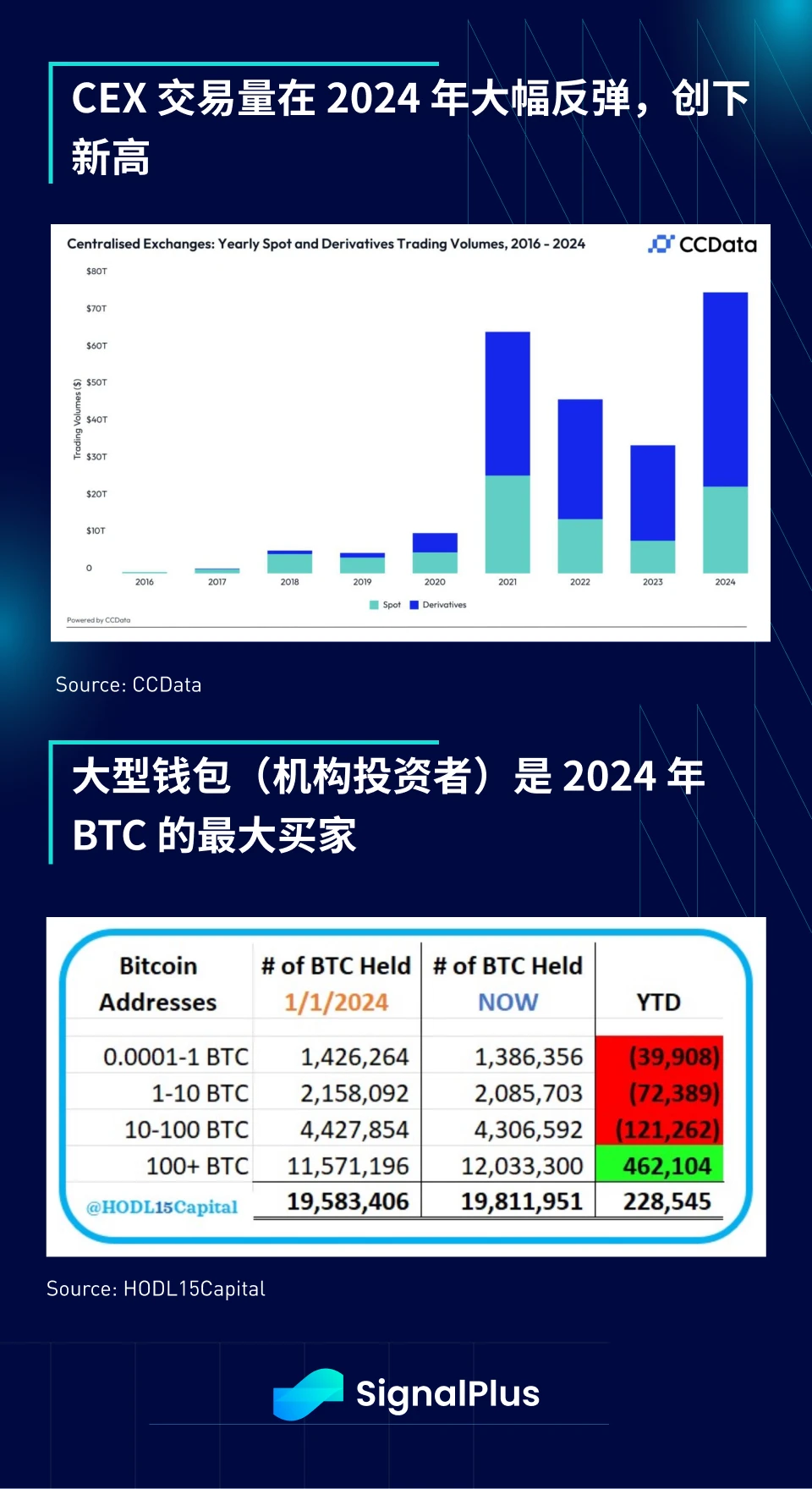

The basic data is also favorable. According to the CCData report, the spot and derivatives trading volume of centralized exchanges hit an all-time high in 2024, exceeding the peak before the FTX incident. At the same time, on-chain data shows that large wallet addresses (such as institutional investors and ETF buyers) have been net buying BTC, offsetting the selling of small addresses. This is exactly the position exchange that occurs when mainstream institutions begin to accumulate BTC. In the current political context, this is a positive signal for the continued inflow and accumulation of funds.

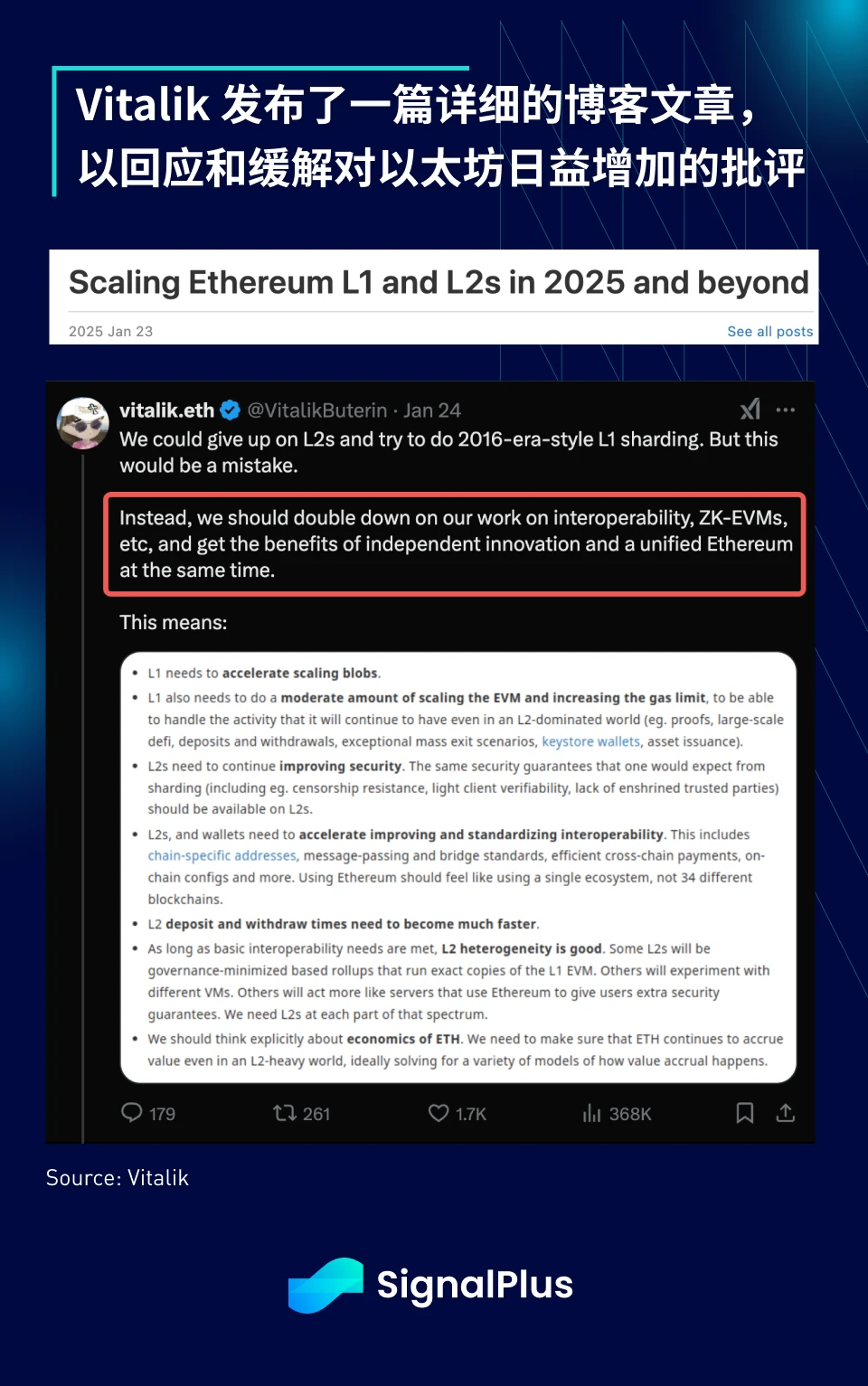

Last week, the market sentiment was so optimistic that even the troubled ETH rebounded. Vitalik released a detailed blog post responding to the communitys criticism of the way Layer 2 growth was handled. In short, he believes that Layer 2 will continue to exist, but will work hard to improve the user experience of Layer 1 to reduce excessive gas fees. Although not everyone agrees, Vitaliks detailed explanation this time is more accepted than before, at least showing that he is aware and concerned about the complaints about the current state of Ethereum. We hope that this will be the beginning of a rebound in Ethereum sentiment, especially considering its potential as a future settlement layer for financial institutions.

Back to the traditional financial macro field, President Trump’s multiple executive orders provide a lot of content worthy of in-depth analysis. He signed 26 executive orders on his first day in office, breaking all records and far exceeding the total of all previous US presidents.

In summary, here are some of the main policy priorities for Trumps new term:

Trade Policy:

“Make it in the U.S. or pay the tariffs”

Trade with China:

His attitude was milder than expected, stating that China-US relations are very good and that trade needs to be fair but not necessarily excellent.

China Tariffs:

China has already paid a lot of tariffs because of me

“I’d rather not have to use [tariffs], but this is a huge leverage point with China.”

Geopolitics:

Ukraine is ready to reach an agreement to end the war

Threatening to impose taxes and sanctions on Russia if a peace deal is not reached soon.

energy:

Hope OPEC will lower oil prices.

US energy production needs to double to “get AI to the scale [the US] wants”

Monetary Policy:

“I would call for an immediate rate cut”

There are only 3 days left until the next Fed meeting and market pricing shows little chance of a rate cut.

Macro market participants are still often confused about the markets reaction. The general trading consensus before Trumps inauguration was to be long both the US dollar and US stocks, expecting that the widespread tariff policy would push the US dollar higher, while stocks might rise if tariffs were not implemented. The final result was closer to the latter, with less stringent tariff enforcement (especially on China), which led to a general rise in risk assets and a weaker US dollar.

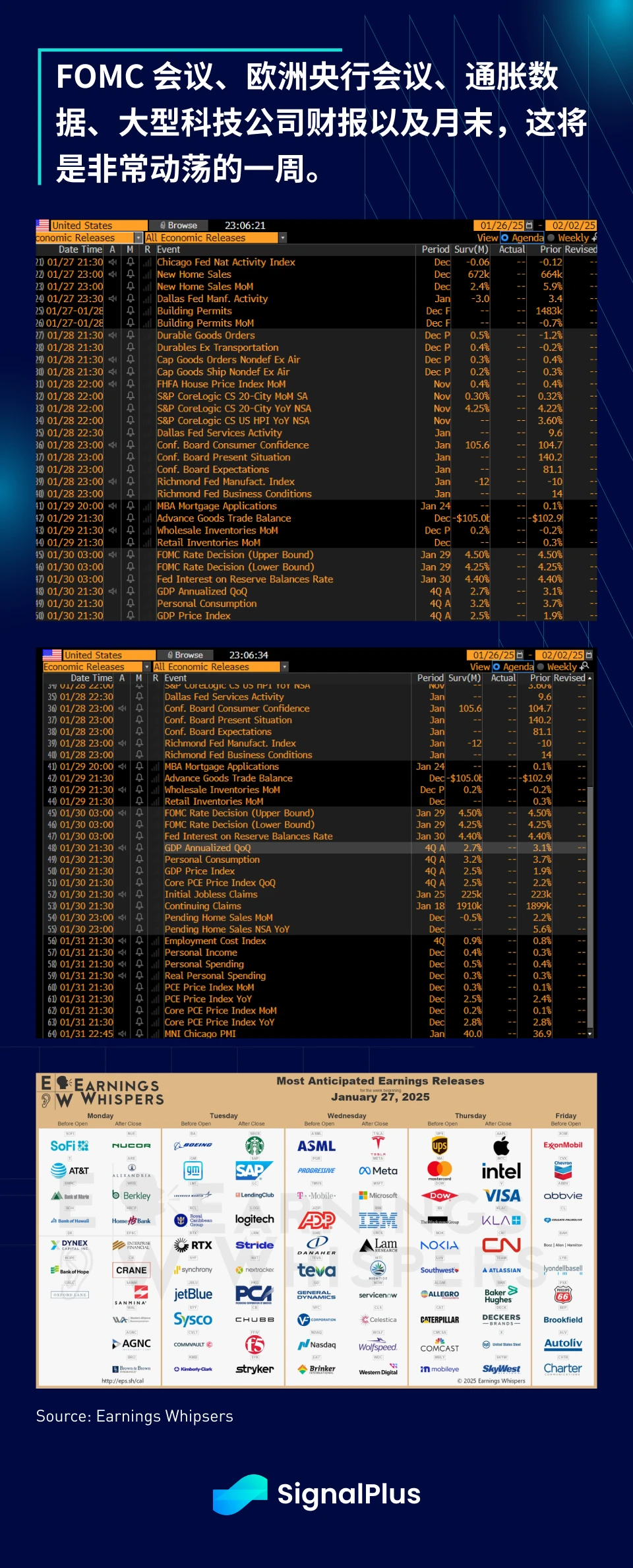

In terms of economic data, there will be many important data and schedules this week, including consumer confidence data on Tuesday, FOMC meeting on Wednesday, ECB meeting and US GDP data on Thursday, and core PCE data on Friday. In addition, this week will also usher in a series of important earnings reports, including Apple, Tesla, Microsoft, Meta, ASML, UPS, Caterpillar, Visa and Mastercard.

Considering the various blockbuster news about Trump 2.0 policy in the past week, the large number of macroeconomic schedules this week, the release of earnings reports from important technology companies, and the month-end effect, we suggest that readers wait and see what happens this week. This week is expected to be full of turbulence, noise and uncertainty, and the trading of the new year has just begun.

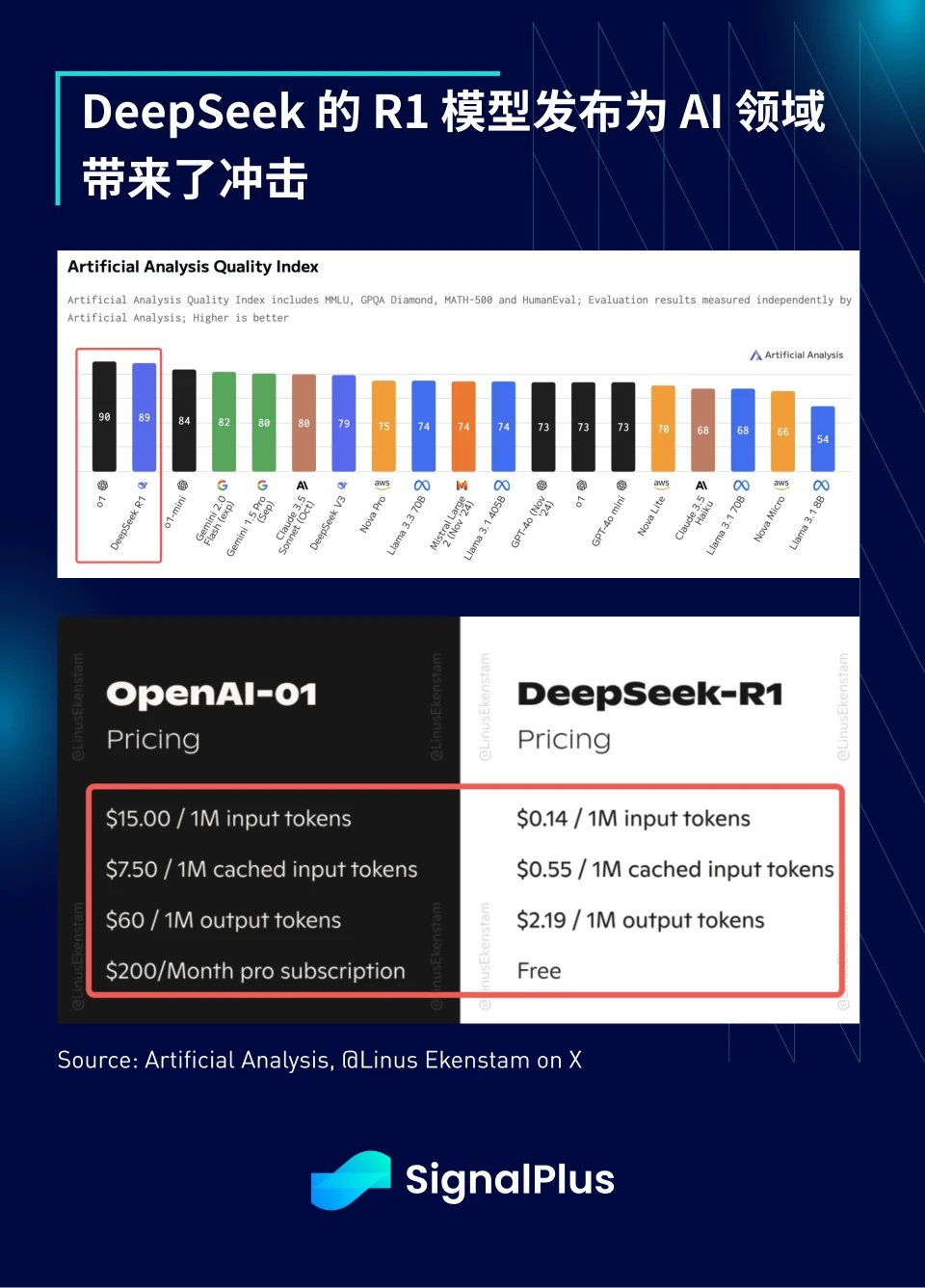

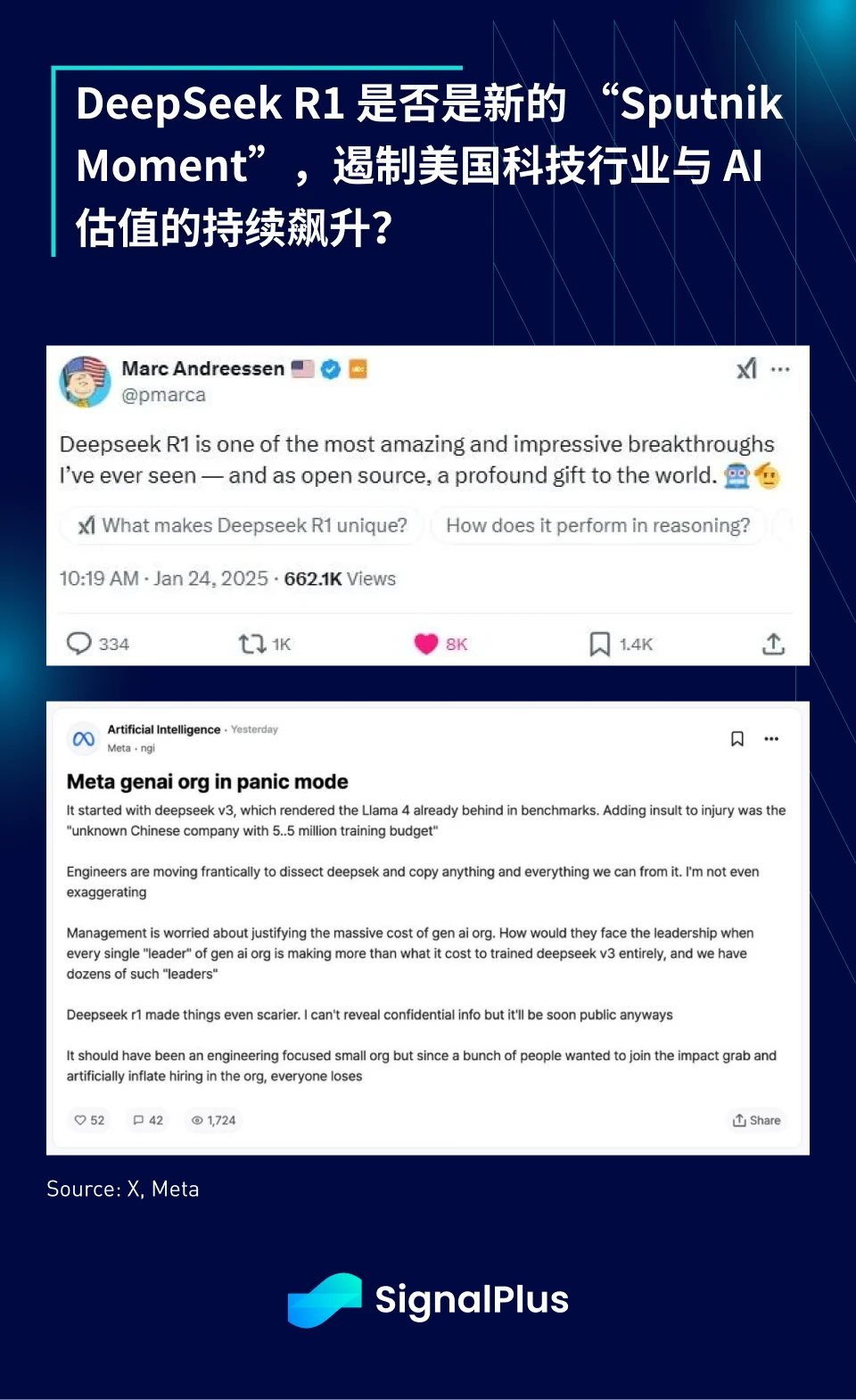

The cryptocurrency market isn’t the only sector witnessing a critical inflection point, with the near-simultaneous release of DeepSeek’s R1 and ByteDance’s Doubao 1.5 training models, generative AI (Gen-AI) may be experiencing its “Sputnik Moment.”

Despite operating on a purportedly limited budget and limited chip availability, DeepSeek’s R1 open source model has matched the performance of OpenAI’s o1 model at a fraction of the cost of running it. Prominent venture capitalists and practitioners hailed this as an incredible engineering breakthrough and a major win for open source models, coming at a time when OpenAI is announcing its $500 billion “Stargate” capital spending plan, which is in stark contrast to the previous year.

Of course, there is still a lot of uncertainty about whether AI models are becoming commoditized and what this means for high valuations and high infrastructure spending for AI companies, but more critically, is now finally the time to sell Nvidia/Nasdaq/AI VC? This is undoubtedly a trillion-dollar question that is beyond our expertise, but definitely worthy of close attention by macro investors in the future.

The SignalPlus team will suspend our market commentary next week for the Lunar New Year holiday. Thank you for your steadfast support over the past year and wish all readers good health, success, and prosperity in the Year of the Snake!

You can use the SignalPlus trading vane function at t.signalplus.com to get more real-time crypto information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com